false

0001649096

0001649096

2023-08-03

2023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 3, 2023

CLIPPER REALTY INC.

(Exact Name of Registrant as Specified in Charter)

|

Maryland

|

|

001-38010

|

|

47-4579660

|

|

(State or Other

|

|

(Commission

|

|

(IRS Employer

|

|

Jurisdiction of

|

|

File Number)

|

|

Identification No.)

|

|

Incorporation)

|

|

|

|

|

|

4611 12th Avenue, Suite 1L

Brooklyn, New York

|

|

11219

|

|

(Address of Principal Executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (718) 438-2804

Former name or former address, if changed since last report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2.):

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

CLPR

|

New York Stock Exchange

|

Item 2.02. Results of Operations and Financial Condition

On August 3, 2023, Clipper Realty Inc. issued a press release announcing its financial results for the quarterly period ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Form 8-K under Item 2.02 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific referencing in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

|

Exhibit

Number

|

|

|

Exhibit

Description

|

|

99.1

|

|

|

|

| |

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Clipper Realty Inc.

|

|

| |

(Registrant)

|

|

| |

|

|

|

| |

By:

|

/s/ David Bistricer

|

|

| |

Name:

|

David Bistricer

|

|

| |

Title:

|

Co-Chairman and Chief Executive Officer

|

|

Date: August 3, 2023

Exhibit Index

|

Exhibit

Number

|

|

|

Exhibit

Description

|

|

99.1

|

|

|

Press Release dated August 3, 2023, announcing financial results for the quarterly period ended June 30, 2023

|

Exhibit 99.1

Clipper Realty Inc. Announces Second Quarter 2023 Results

NEW YORK, August 3, 2023 /Business Wire/ -- Clipper Realty Inc. (NYSE: CLPR) (the “Company”), a leading owner and operator of multifamily residential and commercial properties in the New York metropolitan area, today announced financial and operating results for the three months ended June 30, 2023.

Highlights for the Three Months Ended June 30, 2023

| |

●

|

Record quarterly revenues of $34.5 million for the second quarter of 2023

|

| |

●

|

Quarterly income from operations of $8.0 million for the second quarter of 2023

|

| |

●

|

Record net operating income (“NOI”) of $19.2 million for the second quarter of 2023

|

| |

●

|

Quarterly net loss of $3.3 million for the second quarter of 2023

|

| |

●

|

Quarterly adjusted funds from operations (“AFFO”)1 of $5.5 million for the second quarter of 2023

|

| |

●

|

Declared a dividend of $0.095 per share for the second quarter of 2023

|

David Bistricer, Co-Chairman and Chief Executive Officer, commented,

“The second quarter of 2023 for the Company has produced record quarterly revenue and NOI and the highest AFFO in 3 years. This is the fourth straight quarter of record revenue and demonstrates the strength of the current rental market. New leases continue to rent at more than 14% over previous ones. This has resulted in record revenue for the quarter, even when we remove the revenue from our newly opened Pacific House building. In the second quarter, we recorded record revenue of $34.5 million, NOI of $19.2 million, same store leased occupancy of 99.2% and our overall collection rate remains high at 96.3%. We have also begun operations at the 1010 Pacific Street building, branded “Pacific House”, already over 77% leased. Last month we announced that Flatbush Gardens entered into a 40-year regulatory agreement with the New York City Department of Housing Preservation and Development (“HPD”) under Article 11 of the Private Housing Finance Law. This agreement will enable us to put Flatbush Gardens on an upward projection by providing us with the additional funds to invest in the property via full property tax exemptions and the opportunity to receive enhanced reimbursements for those tenants who receive governmental support. We are very excited for the future of Flatbush Gardens. We feel that our strong leasing and occupancy performance, the Article 11 transaction, our loan portfolio being over 90% fixed with no maturities until 2027 puts us in a strong position to continue executing our strategic initiatives and create long-term value.”

Financial Results

For the second quarter of 2023, revenues increased by $2.7 million, or 8.3%, to $33.7 million and $1.9 million, or 5.8% excluding revenue from Pacific House in the second quarter of 2023. This compares to revenue of $31.9 million during the second quarter of 2022. Residential revenue increased by $2.4 million, or 10.9%, and $1.6 million, or 7.3% excluding revenue from Pacific House in the second quarter of 2023 driven by higher rental rates at all our residential properties. Commercial income increased $0.2 million, or 2.3%, in the second quarter of 2023 due to new commercial leases signed during 2022.

For the second quarter of 2023, net loss was $3.3 million, or $0.10 per share or $2.6 million, or $0.05 per share excluding the net loss attributable to Pacific House operations, compared to net loss of $3.0 million, or $0.08 per share, for the second quarter of 2022. The adjusted change was primarily attributable to increased rental revenue discussed above and lower property operating costs, net of higher insurance, real estate taxes, general and administrative costs, and interest expense.

1 NOI and AFFO are non-GAAP financial measures. For a definition of these financial measures and a reconciliation of such measures to the most comparable GAAP measures, see “Reconciliation of Non-GAAP Measures” at the end of this release.

For the second quarter of 2023, AFFO was $5.5 million, or $0.13 per share, or $5.8 million or $0.14 per share excluding the impact of Pacific House, compared to $5.1 million, or $0.12 per share, for the second quarter of 2022. The adjusted increase was primarily attributable to the rental revenue discussed above and lower property operating costs, net of higher insurance, real estate taxes, general and administrative costs.

Balance Sheet

At June 30, 2023, notes payable (excluding unamortized loan costs) was $1,186.8 million, compared to $1,171.2 million at December 31, 2022. The increase was primarily due to the refinancing of the Pacific House loan in the first quarter of 2023.

Dividend

The Company today declared a second quarter dividend of $0.095 per share, the same amount as last quarter, to shareholders of record on August 15, 2023, payable August 23, 2023.

Conference Call and Supplemental Material

The Company will host a conference call on August 3, 2023, at 5:00 PM Eastern Time to discuss the second quarter 2023 results and provide a business update. The conference call can be accessed by dialing (800) 346-7359 or (973) 528-0008, conference entry code 754613. A replay of the call will be available from August 3, 2023, following the call, through August 17, 2023, by dialing (800) 332-6854 or (973) 528-0005, replay conference ID 754613. Supplemental data to this press release can be found under the “Quarterly Earnings” navigation tab on the “Investors” page of our website at www.clipperrealty.com. The Company’s filings with the Securities and Exchange Commission (the “SEC”) are filed at www.sec.gov under Clipper Realty Inc.

About Clipper Realty Inc.

Clipper Realty Inc. (NYSE: CLPR) is a self-administered and self-managed real estate company that acquires, owns, manages, operates and repositions multifamily residential and commercial properties in the New York metropolitan area, with a portfolio in Manhattan and Brooklyn. For more information on the Company, please visit www.clipperrealty.com.

Forward-Looking Statements

Various statements contained in this press release, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include estimates concerning capital projects and the success of specific properties. Our forward-looking statements are generally accompanied by words such as "estimate," "project," "predict," "believe," "expect," "intend," "anticipate," "potential," "plan" or other words that convey the uncertainty of future events or outcomes. The forward-looking statements in this press release speak only as of the date of this press release.

We disclaim any obligation to update these statements unless required by law, and we caution you not to rely on them unduly. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and most of which are difficult to predict and many of which are beyond our control and which may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. For a discussion of these and other important factors that could affect our actual results, please refer to our filings with the SEC, including the "Risk Factors" section of our Annual Report on Form 10-K for the year ended December 31, 2022, and other reports filed from time to time with the SEC.

Contact Information:

Lawrence Kreider

Chief Financial Officer

(718) 438-2804 x2231

larry@clipperrealty.com

|

Clipper Realty Inc.

|

|

Consolidated Balance Sheets

|

|

(In thousands, except for share and per share data)

|

| |

|

June 30, 2023

|

|

|

December 31, 2022

|

|

| |

|

(unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Investment in real estate

|

|

|

|

|

|

|

|

|

|

Land and improvements

|

|

$ |

571,988 |

|

|

$ |

540,859 |

|

|

Building and improvements

|

|

|

718,661 |

|

|

|

656,460 |

|

|

Tenant improvements

|

|

|

3,406 |

|

|

|

3,406 |

|

|

Furniture, fixtures and equipment

|

|

|

13,062 |

|

|

|

12,878 |

|

|

Real estate under development

|

|

|

66,361 |

|

|

|

142,287 |

|

|

Total investment in real estate

|

|

|

1,373,478 |

|

|

|

1,355,890 |

|

|

Accumulated depreciation

|

|

|

(198,825 |

) |

|

|

(184,781 |

) |

|

Investment in real estate, net

|

|

|

1,174,653 |

|

|

|

1,171,109 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

16,342 |

|

|

|

18,152 |

|

|

Restricted cash

|

|

|

14,731 |

|

|

|

12,514 |

|

|

Tenant and other receivables, net of allowance for doubtful accounts of $175 and $321, respectively

|

|

|

5,169 |

|

|

|

5,005 |

|

|

Deferred rent

|

|

|

2,546 |

|

|

|

2,573 |

|

|

Deferred costs and intangible assets, net

|

|

|

6,418 |

|

|

|

6,624 |

|

|

Prepaid expenses and other assets

|

|

|

5,960 |

|

|

|

13,654 |

|

|

TOTAL ASSETS

|

|

$ |

1,225,819 |

|

|

$ |

1,229,631 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

Notes payable, net of unamortized loan costs of $9,803 and $9,650, respectively

|

|

$ |

1,176,956 |

|

|

$ |

1,161,588 |

|

|

Accounts payable and accrued liabilities

|

|

|

15,319 |

|

|

|

17,094 |

|

|

Security deposits

|

|

|

8,660 |

|

|

|

7,940 |

|

|

Below-market leases, net

|

|

|

1 |

|

|

|

18 |

|

|

Other liabilities

|

|

|

5,353 |

|

|

|

5,812 |

|

|

TOTAL LIABILITIES

|

|

|

1,206,289 |

|

|

|

1,192,452 |

|

| |

|

|

|

|

|

|

|

|

|

Equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value; 100,000 shares authorized (including 140 shares of 12.5% Series A cumulative non-voting preferred stock), zero shares issued and outstanding

|

|

|

- |

|

|

|

- |

|

|

Common stock, $0.01 par value; 500,000,000 shares authorized, 16,063,228 shares issued and outstanding

|

|

|

160 |

|

|

|

160 |

|

|

Additional paid-in-capital

|

|

|

89,127 |

|

|

|

88,829 |

|

|

Accumulated deficit

|

|

|

(81,883 |

) |

|

|

(74,895 |

) |

|

Total stockholders' equity

|

|

|

7,404 |

|

|

|

14,094 |

|

| |

|

|

|

|

|

|

|

|

|

Non-controlling interests

|

|

|

12,126 |

|

|

|

23,085 |

|

|

TOTAL EQUITY

|

|

|

19,530 |

|

|

|

37,179 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY

|

|

$ |

1,225,819 |

|

|

$ |

1,229,631 |

|

|

Clipper Realty Inc.

|

|

Consolidated Statements of Operations

|

|

(In thousands, except per share data)

|

|

(Unaudited)

|

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential rental income

|

|

$ |

25,040 |

|

|

$ |

22,597 |

|

|

$ |

48,980 |

|

|

$ |

44,059 |

|

|

Commercial rental income

|

|

|

9,503 |

|

|

|

9,290 |

|

|

|

19,230 |

|

|

|

19,878 |

|

|

TOTAL REVENUES

|

|

|

34,543 |

|

|

|

31,887 |

|

|

|

68,210 |

|

|

|

63,937 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating expenses

|

|

|

6,782 |

|

|

|

6,928 |

|

|

|

14,881 |

|

|

|

14,467 |

|

|

Real estate taxes and insurance

|

|

|

8,700 |

|

|

|

7,886 |

|

|

|

17,236 |

|

|

|

15,817 |

|

|

General and administrative

|

|

|

3,396 |

|

|

|

3,197 |

|

|

|

6,689 |

|

|

|

6,139 |

|

|

Transaction pursuit costs

|

|

|

357 |

|

|

|

92 |

|

|

|

357 |

|

|

|

516 |

|

|

Depreciation and amortization

|

|

|

7,269 |

|

|

|

6,732 |

|

|

|

14,094 |

|

|

|

13,437 |

|

|

TOTAL OPERATING EXPENSES

|

|

|

26,504 |

|

|

|

24,835 |

|

|

|

53,257 |

|

|

|

50,376 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM OPERATIONS

|

|

|

8,039 |

|

|

|

7,052 |

|

|

|

14,953 |

|

|

|

13,561 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

(11,334 |

) |

|

|

(10,005 |

) |

|

|

(21,469 |

) |

|

|

(19,990 |

) |

|

Loss on extinguishment of debt

|

|

|

- |

|

|

|

- |

|

|

|

(3,868 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(3,295 |

) |

|

|

(2,953 |

) |

|

|

(10,384 |

) |

|

|

(6,429 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to non-controlling interests

|

|

|

2,046 |

|

|

|

1,834 |

|

|

|

6,448 |

|

|

|

3,992 |

|

|

Net loss attributable to common stockholders

|

|

$ |

(1,249 |

) |

|

$ |

(1,119 |

) |

|

$ |

(3,936 |

) |

|

$ |

(2,437 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share

|

|

$ |

(0.10 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.18 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares / OP units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares outstanding

|

|

|

16,063 |

|

|

|

16,063 |

|

|

|

16,063 |

|

|

|

16,063 |

|

|

OP units outstanding

|

|

|

26,317 |

|

|

|

26,317 |

|

|

|

26,317 |

|

|

|

26,317 |

|

|

Diluted shares outstanding

|

|

|

42,380 |

|

|

|

42,380 |

|

|

|

42,380 |

|

|

|

42,380 |

|

|

Clipper Realty Inc.

|

|

Consolidated Statements of Cash Flows

|

|

(In thousands)

|

|

(Unaudited)

|

| |

|

Six Months Ended June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(10,384 |

)

|

|

$ |

(6,429 |

)

|

| |

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

14,044 |

|

|

|

13,318 |

|

|

Amortization of deferred financing costs

|

|

|

675 |

|

|

|

626 |

|

|

Amortization of deferred costs and intangible assets

|

|

|

292 |

|

|

|

360 |

|

|

Amortization of above- and below-market leases

|

|

|

(17 |

)

|

|

|

(17 |

)

|

|

Loss on extinguishment of debt

|

|

|

3,868 |

|

|

|

- |

|

|

Deferred rent

|

|

|

27 |

|

|

|

(190 |

)

|

|

Stock-based compensation

|

|

|

1,431 |

|

|

|

1,209 |

|

|

Bad debt expense

|

|

|

(142 |

)

|

|

|

(379 |

)

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Tenant and other receivables

|

|

|

(18 |

)

|

|

|

150 |

|

|

Prepaid expenses, other assets and deferred costs

|

|

|

7,608 |

|

|

|

3,615 |

|

|

Accounts payable and accrued liabilities

|

|

|

(424 |

) |

|

|

(510 |

)

|

|

Security deposits

|

|

|

720 |

|

|

|

476 |

|

|

Other liabilities

|

|

|

(459 |

)

|

|

|

(547 |

)

|

|

Net cash provided by operating activities

|

|

|

17,221 |

|

|

|

11,682 |

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Additions to land, buildings and improvements

|

|

|

(18,915 |

)

|

|

|

(24,851 |

)

|

|

Acquisition deposit

|

|

|

- |

|

|

|

2,015 |

|

|

Cash paid in connection with acquisition of real estate

|

|

|

- |

|

|

|

(8,043 |

)

|

|

Net cash used in investing activities

|

|

|

(18,915 |

)

|

|

|

(30,879 |

)

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Payments of mortgage notes

|

|

|

(46,810 |

)

|

|

|

(1,101 |

)

|

|

Proceeds from mortgage notes

|

|

|

62,330 |

|

|

|

20,839 |

|

|

Dividends and distributions

|

|

|

(8,696 |

)

|

|

|

(8,461 |

)

|

|

Loan issuance and extinguishment costs

|

|

|

(4,723 |

)

|

|

|

(335 |

)

|

|

Net cash provided by financing activities

|

|

|

2,101 |

|

|

|

10,942 |

|

| |

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents and restricted cash

|

|

|

407 |

|

|

|

(8,255 |

)

|

|

Cash and cash equivalents and restricted cash - beginning of period

|

|

|

30,666 |

|

|

|

52,224 |

|

|

Cash and cash equivalents and restricted cash - end of period

|

|

$ |

31,073 |

|

|

$ |

43,969 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash - beginning of period:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

18,152 |

|

|

$ |

34,524 |

|

|

Restricted cash

|

|

|

12,514 |

|

|

|

17,700 |

|

|

Total cash and cash equivalents and restricted cash - beginning of period

|

|

$ |

30,666 |

|

|

$ |

52,224 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash - end of period:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

16,342 |

|

|

$ |

29,432 |

|

|

Restricted cash

|

|

|

14,731 |

|

|

|

14,537 |

|

|

Total cash and cash equivalents and restricted cash - end of period

|

|

$ |

31,073 |

|

|

$ |

43,969 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental cash flow information:

|

|

|

|

|

|

|

|

|

|

Cash paid for interest, net of capitalized interest of $3,258 and $2,309 in 2023 and 2022, respectively

|

|

$ |

21,099 |

|

|

$ |

19,423 |

|

|

Non-cash interest capitalized to real estate under development

|

|

|

27 |

|

|

|

1,118 |

|

|

Additions to investment in real estate included in accounts payable and accrued liabilities

|

|

|

3,527 |

|

|

|

7,158 |

|

Clipper Realty Inc.

Reconciliation of Non-GAAP Measures

(In thousands, except per share data)

(Unaudited)

Non-GAAP Financial Measures

We disclose and discuss funds from operations (“FFO”), adjusted funds from operations (“AFFO”), adjusted earnings before interest, income taxes, depreciation and amortization (“Adjusted EBITDA”) and net operating income (“NOI”), all of which meet the definition of “non-GAAP financial measures” set forth in Item 10(e) of Regulation S-K promulgated by the SEC.

While management and the investment community in general believe that presentation of these measures provides useful information to investors, neither FFO, AFFO, Adjusted EBITDA, nor NOI should be considered as an alternative to net income (loss) or income from operations as an indication of our performance. We believe that to understand our performance further, FFO, AFFO, Adjusted EBITDA, and NOI should be compared with our reported net income (loss) or income from operations and considered in addition to cash flows computed in accordance with GAAP, as presented in our consolidated financial statements.

Funds From Operations and Adjusted Funds From Operations

FFO is defined by the National Association of Real Estate Investment Trusts (“NAREIT”) as net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property and impairment adjustments, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Our calculation of FFO is consistent with FFO as defined by NAREIT.

AFFO is defined by us as FFO excluding amortization of identifiable intangibles incurred in property acquisitions, straight-line rent adjustments to revenue from long-term leases, amortization costs incurred in originating debt, interest rate cap mark-to-market adjustments, amortization of non-cash equity compensation, acquisition and other costs, transaction pursuit costs, loss on modification/extinguishment of debt, gain on involuntary conversion, gain on termination of lease and non-recurring litigation-related expenses, less recurring capital spending.

Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. In fact, real estate values have historically risen or fallen with market conditions. FFO is intended to be a standard supplemental measure of operating performance that excludes historical cost depreciation and valuation adjustments from net income. We consider FFO useful in evaluating potential property acquisitions and measuring operating performance. We further consider AFFO useful in determining funds available for payment of distributions. Neither FFO nor AFFO represent net income or cash flows from operations computed in accordance with GAAP. You should not consider FFO and AFFO to be alternatives to net income (loss) as reliable measures of our operating performance; nor should you consider FFO and AFFO to be alternatives to cash flows from operating, investing or financing activities (computed in accordance with GAAP) as measures of liquidity.

Neither FFO nor AFFO measure whether cash flow is sufficient to fund all of our cash needs, including loan principal amortization, capital improvements and distributions to stockholders. FFO and AFFO do not represent cash flows from operating, investing or financing activities computed in accordance with GAAP. Further, FFO and AFFO as disclosed by other REITs might not be comparable to our calculations of FFO and AFFO.

The following table sets forth a reconciliation of FFO and AFFO for the periods presented to net loss, computed in accordance with GAAP (amounts in thousands):

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

FFO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(3,295 |

) |

|

$ |

(2,953 |

) |

|

$ |

(10,384 |

) |

|

$ |

(6,429 |

) |

|

Real estate depreciation and amortization

|

|

|

7,269 |

|

|

|

6,732 |

|

|

|

14,094 |

|

|

|

13,437 |

|

|

FFO

|

|

$ |

3,974 |

|

|

$ |

3,779 |

|

|

$ |

3,710 |

|

|

$ |

7,008 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO

|

|

$ |

3,974 |

|

|

$ |

3,779 |

|

|

$ |

3,710 |

|

|

$ |

7,008 |

|

|

Amortization of real estate tax intangible

|

|

|

121 |

|

|

|

121 |

|

|

|

241 |

|

|

|

241 |

|

|

Amortization of above- and below-market leases

|

|

|

(8 |

) |

|

|

(8 |

) |

|

|

(17 |

) |

|

|

(17 |

) |

|

Straight-line rent adjustments

|

|

|

32 |

|

|

|

(1 |

) |

|

|

27 |

|

|

|

(190 |

) |

|

Amortization of debt origination costs

|

|

|

362 |

|

|

|

313 |

|

|

|

675 |

|

|

|

626 |

|

|

Amortization of LTIP awards

|

|

|

783 |

|

|

|

714 |

|

|

|

1,431 |

|

|

|

1,209 |

|

|

Transaction pursuit costs

|

|

|

357 |

|

|

|

92 |

|

|

|

357 |

|

|

|

516 |

|

|

Loss on extinguishment of debt

|

|

|

- |

|

|

|

- |

|

|

|

3,868 |

|

|

|

- |

|

|

Certain litigation-related expenses

|

|

|

- |

|

|

|

166 |

|

|

|

- |

|

|

|

253 |

|

|

Recurring capital spending

|

|

|

(129 |

) |

|

|

(89 |

) |

|

|

(324 |

) |

|

|

(138 |

) |

|

AFFO

|

|

$ |

5,492 |

|

|

$ |

5,087 |

|

|

$ |

9,968 |

|

|

$ |

9,508 |

|

|

AFFO Per Share/Unit

|

|

$ |

0.13 |

|

|

$ |

0.12 |

|

|

$ |

0.24 |

|

|

$ |

0.22 |

|

Adjusted Earnings Before Interest, Income Taxes, Depreciation and Amortization

We believe that Adjusted EBITDA is a useful measure of our operating performance. We define Adjusted EBITDA as net income (loss) before allocation to non-controlling interests, plus real estate depreciation and amortization, amortization of identifiable intangibles, straight-line rent adjustments to revenue from long-term leases, amortization of non-cash equity compensation, interest expense (net), acquisition and other costs, transaction pursuit costs, loss on modification/extinguishment of debt and non-recurring litigation-related expenses, less gain on involuntary conversion and gain on termination of lease.

We believe that this measure provides an operating perspective not immediately apparent from GAAP income from operations or net income (loss). We consider Adjusted EBITDA to be a meaningful financial measure of our core operating performance.

However, Adjusted EBITDA should only be used as an alternative measure of our financial performance. Further, other REITs may use different methodologies for calculating Adjusted EBITDA, and accordingly, our Adjusted EBITDA may not be comparable to that of other REITs.

The following table sets forth a reconciliation of Adjusted EBITDA for the periods presented to net loss, computed in accordance with GAAP (amounts in thousands):

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(3,295 |

) |

|

$ |

(2,953 |

) |

|

$ |

(10,384 |

) |

|

$ |

(6,429 |

) |

|

Real estate depreciation and amortization

|

|

|

7,269 |

|

|

|

6,732 |

|

|

|

14,094 |

|

|

|

13,437 |

|

|

Amortization of real estate tax intangible

|

|

|

121 |

|

|

|

121 |

|

|

|

241 |

|

|

|

241 |

|

|

Amortization of above- and below-market leases

|

|

|

(8 |

) |

|

|

(8 |

) |

|

|

(17 |

) |

|

|

(17 |

) |

|

Straight-line rent adjustments

|

|

|

32 |

|

|

|

(1 |

) |

|

|

27 |

|

|

|

(190 |

) |

|

Amortization of LTIP awards

|

|

|

783 |

|

|

|

714 |

|

|

|

1,431 |

|

|

|

1,209 |

|

|

Interest expense, net

|

|

|

11,334 |

|

|

|

10,005 |

|

|

|

21,469 |

|

|

|

19,990 |

|

|

Transaction pursuit costs

|

|

|

357 |

|

|

|

92 |

|

|

|

357 |

|

|

|

516 |

|

|

Loss on extinguishment of debt

|

|

|

- |

|

|

|

- |

|

|

|

3,868 |

|

|

|

- |

|

|

Certain litigation-related expenses

|

|

|

- |

|

|

|

166 |

|

|

|

- |

|

|

|

253 |

|

|

Adjusted EBITDA

|

|

$ |

16,593 |

|

|

$ |

14,868 |

|

|

$ |

31,086 |

|

|

$ |

29,010 |

|

Net Operating Income

We believe that NOI is a useful measure of our operating performance. We define NOI as income from operations plus real estate depreciation and amortization, general and administrative expenses, acquisition and other costs, transaction pursuit costs, amortization of identifiable intangibles and straight-line rent adjustments to revenue from long-term leases, less gain on termination of lease. We believe that this measure is widely recognized and provides an operating perspective not immediately apparent from GAAP income from operations or net income (loss). We use NOI to evaluate our performance because NOI allows us to evaluate the operating performance of our company by measuring the core operations of property performance and capturing trends in rental housing and property operating expenses. NOI is also a widely used metric in valuation of properties.

However, NOI should only be used as an alternative measure of our financial performance. Further, other REITs may use different methodologies for calculating NOI, and accordingly, our NOI may not be comparable to that of other REITs.

The following table sets forth a reconciliation of NOI for the periods presented to income from operations, computed in accordance with GAAP (amounts in thousands):

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

NOI

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

$ |

8,039 |

|

|

$ |

7,052 |

|

|

$ |

14,953 |

|

|

$ |

13,561 |

|

|

Real estate depreciation and amortization

|

|

|

7,269 |

|

|

|

6,732 |

|

|

|

14,094 |

|

|

|

13,437 |

|

|

General and administrative expenses

|

|

|

3,396 |

|

|

|

3,197 |

|

|

|

6,689 |

|

|

|

6,139 |

|

|

Transaction pursuit costs

|

|

|

357 |

|

|

|

92 |

|

|

|

357 |

|

|

|

516 |

|

|

Amortization of real estate tax intangible

|

|

|

121 |

|

|

|

121 |

|

|

|

241 |

|

|

|

241 |

|

|

Amortization of above- and below-market leases

|

|

|

(8 |

) |

|

|

(8 |

) |

|

|

(17 |

) |

|

|

(17 |

) |

|

Straight-line rent adjustments

|

|

|

32 |

|

|

|

(1 |

) |

|

|

27 |

|

|

|

(190 |

) |

|

NOI

|

|

$ |

19,206 |

|

|

$ |

17,185 |

|

|

$ |

36,344 |

|

|

$ |

33,687 |

|

v3.23.2

Document And Entity Information

|

Aug. 03, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CLIPPER REALTY INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 03, 2023

|

| Entity, Incorporation, State or Country Code |

MD

|

| Entity, File Number |

001-38010

|

| Entity, Tax Identification Number |

47-4579660

|

| Entity, Address, Address Line One |

4611 12th Avenue

|

| Entity, Address, Address Line Two |

Suite 1L

|

| Entity, Address, City or Town |

Brooklyn

|

| Entity, Address, State or Province |

NY

|

| Entity, Address, Postal Zip Code |

11219

|

| City Area Code |

718

|

| Local Phone Number |

438-2804

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

CLPR

|

| Security Exchange Name |

NYSE

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001649096

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

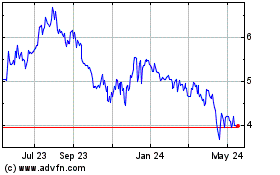

Clipper Realty (NYSE:CLPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

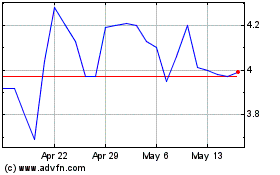

Clipper Realty (NYSE:CLPR)

Historical Stock Chart

From Jan 2024 to Jan 2025