Shareholders vote in favour of Transactions

to materially reduce Cazoo’s indebtedness

Transactions significantly reduce Cazoo’s

indebtedness from $630 million to $200 million

Deleveraged capital structure will provide

financial flexibility to support future growth

Cazoo Group Ltd (NYSE: CZOO) (“Cazoo” or “the Company”), the UK

online used car retailer, which makes buying and selling a car as

simple as ordering any other product online, announces that,

following its Extraordinary General Meeting (“EGM”), held today at

3:00 p.m. GMT, all resolutions submitted for shareholder approval

were overwhelmingly approved. The final results of the voting at

the EGM will be available shortly at Cazoo’s Investor Relations

site, investors.cazoo.co.uk.

Alex Chesterman, Founder & Executive Chairman of Cazoo,

commented, “Shareholder approval for the Transactions at

today’s EGM, together with consent received previously from 100% of

holders of our Convertible Notes, signals strong ongoing support

for Cazoo’s business model and strategy. The Transactions will

significantly reduce Cazoo’s indebtedness from $630 million to $200

million and enhance our financial flexibility. We can now leverage

the meaningful progress delivered since the beginning of the year

to achieve better unit economics and lower costs. An improved

capital structure is expected to support further growth along with

facilitating progress on various strategic options. We expect the

Transactions to complete within the next few weeks.”

The EGM was called to approve a series of transactions (the

“Transactions”) aimed at improving the Company’s capital structure,

decreasing the total amount of outstanding indebtedness and

creating a platform for future profitability. In accordance with

the transaction support agreement (the “Transaction Support

Agreement”), dated as of September 20, 2023, as amended, by and

among the Company, the holders of the Company’s 2.00% convertible

senior notes due 2027 (the “Convertible Notes”), and certain

holders of our Class A ordinary shares, par value $0.002 per share

(the “Class A ordinary shares”) who hold more than 33% of the

Company’s outstanding Class A ordinary shares, the Transactions

consist of: (a) the exchange of the Convertible Notes for $200

million aggregate principal amount of our senior secured notes due

2027 and Class A ordinary shares that will represent 92% of our

outstanding Class A ordinary shares immediately after giving effect

to the exchange offer (such exchange for the Convertible Notes, the

“Exchange Offer”), (b) the issuance of three tranches of warrants

to the existing holders of all of our outstanding Class A ordinary

shares, and (c) the replacement of our board of directors with a

new seven-person board of directors on or after the closing date of

the Transactions.

As of November 17, 2023 the Company secured agreements from the

holders of 100% of its Convertible Notes to participate in the

Company’s Exchange Offer. The Company’s Exchange Offer, which will

expire on December 4, 2023, is being made upon the terms and

subject to the conditions set forth in the Exchange Offer

Memorandum filed with the Securities and Exchange Commission

(“SEC”) on November 3, 2023 (as amended or supplemented from time

to time, the “Offering Memorandum”).

In addition to seeking approval of the Transactions, the EGM was

also called to approve a reverse stock split in which holders of

100 Class A ordinary shares will receive one (1) new Class A

ordinary share, an increase to our authorized share capital and

amendments to Cazoo’s amended and restated articles of

association.

About Cazoo - www.cazoo.co.uk

Our mission is to transform the car buying and selling

experience across the UK by providing better selection, value,

transparency, convenience and peace of mind. Our aim is to make

buying or selling a car no different to ordering any other product

online, where consumers can simply and seamlessly buy, sell or

finance a car entirely online for delivery or collection in as

little as 72 hours.

Important Additional Information

This communication is not an offer to purchase nor a

solicitation of an offer to sell any securities. The Company’s

contemplated debt Exchange Offer has commenced. In connection with

the commencement of the Exchange Offer, the Company has filed with

the SEC a tender offer statement on Schedule TO. The Exchange Offer

is being made only pursuant to the offer to purchase and related

tender offer documents filed as part of the Schedule TO with the

SEC. You are strongly advised to read the tender offer statement

(including an offer to purchase and related tender offer documents)

that were filed by the Company with the SEC on November 3, 2023,

because it contains important information, including the terms and

conditions of the Exchange Offer. These documents are available at

no charge on the SEC’s website at www.sec.gov. These documents may

also be obtained free of charge from Cazoo by requesting them by

mail at 41 Chalton Street, London NW1 1JD, United Kingdom.

No Offer

This communication does not constitute an offer to sell or

exchange, or the solicitation of an offer to buy or exchange any

securities, or a solicitation of any vote or approval, nor shall

there be any sale of securities in any jurisdiction in which such

offer, solicitation, sale or exchange would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of section 10 of the

Securities Act of 1933, as amended, or an exemption therefrom.

Forward-Looking Statements

This communication contains “forward-looking statements”. The

expectations, estimates, and projections of the business of Cazoo

may differ from its actual results and, consequently, you should

not rely on forward-looking statements as predictions of future

events. These forward-looking statements generally are identified

by the words “believe,” “project,” “expect,” “anticipate,”

“estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,”

“may,” “should,” “will,” “would,” “will be,” “will continue,” “will

likely result,” and similar expressions. Forward-looking statements

are predictions, projections and other statements about future

events that are based on current expectations and assumptions and,

as a result, are subject to risks and uncertainties. Many factors

could cause actual future events to differ materially from the

forward-looking statements in this press release, including but not

limited to: (1) the implementation of and expected benefits from

our business realignment plan, the wind-down of operations in

mainland Europe, the five-year plan (which extends the revised 2023

plan to 2027), and other cost-saving initiatives; (2) reaching and

maintaining profitability in the future; (3) global inflation and

cost increases for labor, fuel, materials and services; (4)

geopolitical and macroeconomic conditions and their impact on

prices for goods and services and on consumer discretionary

spending; (5) having access to suitable and sufficient vehicle

inventory for resale to customers and reconditioning and selling

inventory expeditiously and efficiently; (6) availability of credit

for vehicle and other financing and the affordability of interest

rates; (7) increasing Cazoo’s service offerings and price

optimization; (8) effectively promoting Cazoo’s brand and

increasing brand awareness; (9) expanding Cazoo’s product offerings

and introducing additional products and services; (10) enhancing

future operating and financial results; (11) achieving our

long-term growth goals; (12) acquiring and integrating other

companies; (13) acquiring and protecting intellectual property;

(14) attracting, training and retaining key personnel; (15)

complying with laws and regulations applicable to Cazoo’s business;

(16) our inability to consummate the Transactions contemplated by

the Transaction Support Agreement as scheduled or at all; (17) the

volatility of the trading price of our Class A Shares, which may

increase as a result of the issuance of Class A ordinary shares and

warrants pursuant to the Transaction Support Agreement; (18) the

Company’s ability to regain compliance with the continued listing

standards of the NYSE as set forth in Sections 802.01B and 802.01C

of the NYSE Listed Company Manual within the applicable cure

period; (19) the Company’s ability to continue to comply with

applicable listing standards of the NYSE; and (20) other risks and

uncertainties set forth in the sections entitled “Risk Factors” and

“Cautionary Note Regarding Forward-Looking Statements” in the

Annual Report on Form 20-F filed with the SEC by Cazoo Group Ltd on

March 30, 2023 and in subsequent filings with the SEC. The

foregoing list of factors is not exhaustive. You should carefully

consider the foregoing factors and the disclosure included in other

documents filed by Cazoo from time to time with the SEC. These

filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements, and Cazoo assumes no obligation and does not intend to

update or revise these forward-looking statements, whether as a

result of new information, future events, or otherwise. Cazoo gives

no assurance that it will achieve its expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231121286714/en/

Investor Relations: Cazoo: Anna Gavrilova, Head of

Investor Relations, investors@cazoo.co.uk ICR: cazoo@icrinc.com

Media: Cazoo: Peter Bancroft, Interim Communications

Director, press@cazoo.co.uk Brunswick: Simone Selzer +44 20 7404

5959 / cazoo@brunswickgroup.com

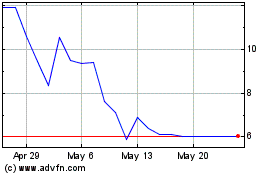

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Jan 2024 to Jan 2025