Delta to Boost Capacity on Overseas Uptick -- WSJ

April 11 2019 - 2:02AM

Dow Jones News

By Doug Cameron

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 11, 2019).

Delta Air Lines Inc. plans to trim domestic flying growth in the

second half of the year but will add capacity overall as business

on overseas routes to Europe and Asia improves.

The nation's third-largest carrier by traffic said Wednesday

that it plans to boost capacity by 3% to 4% this year compared with

2019. That is a percentage point higher than guidance the carrier

offered in December, though trimming of domestic flying growth

helped allay investor fears that carriers are adding too much

capacity and depressing leisure fares.

Trans-Atlantic flights have been a source of weakness for U.S.

carriers in recent months, but Delta expects its closely watched

unit revenue in the market to return to growth during the

summer.

The improvement has been led by corporate and premium traffic, a

segment coveted by JetBlue Airways Group Inc., which analysts

expect to unveil plans as soon as Wednesday to launch its first

European flights within the next two years, according to people

familiar with the situation.

JetBlue declined to comment. Delta last week said it had plans

to launch additional services to Europe from Boston and New York,

two of JetBlue's main bases.

"We will see what the supply-and-demand balance is but we've had

a very good couple of years in the trans-Atlantic and we expect

that to continue," said Delta Chief Executive Ed Bastian on an

investor call.

Mr. Bastian said Delta continued to pursue a small, potential

investment in Alitalia, the state-owned flag carrier that is part

of its SkyTeam global alliance.

His comments came as Delta reported quarterly profit at the top

end of analysts' expectations, reset after an investor update last

week, and second-quarter guidance was also in line, lifted in part

by the benefit of a new credit-card deal with American Express Co.

Delta's shares were up 1.5% in midday trading Wednesday.

JetBlue on Wednesday said it expects to report that revenue per

available seat mile fell about 3.1% in the first quarter. Delta

said its unit revenue rose 2.4% in the first quarter.

Adjusted net income for Atlanta-based Delta totaled $639

million, or 96 cents a share, compared with $529 million, or 75

cents a share, a year earlier, ahead of the 90 cents a share

analysts estimated, according to a FactSet poll.

Virgin Atlantic Airways Ltd., the U.K.-based carrier in which

Delta has a 49% stake, on Wednesday delivered a GBP38.9 million

($50.9 million) loss in 2018 compared with a loss of GBP65.5

million the year earlier. Virgin last year agreed to pursue tighter

cooperation with Delta and Air France-KLM SA, another Virgin

Atlantic stakeholder. That deal awaits regulatory clearance.

--Kimberly Chin and Robert Wall contributed to this article.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

April 11, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

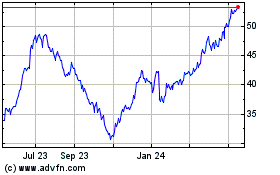

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

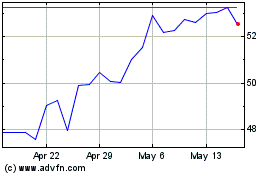

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Jul 2023 to Jul 2024