Delek Logistics Partners, LP Announces Pricing of Upsized Offering of $200 Million of Additional 8.625% Senior Notes Due 2029

August 13 2024 - 5:07PM

Business Wire

Delek Logistics Partners, LP (NYSE: DKL) (“Delek Logistics”)

announced today that it, along with Delek Logistics Finance Corp.,

a subsidiary of Delek Logistics (together with Delek Logistics, the

“Issuers”), priced an upsized offering of $200 million in aggregate

principal amount of additional 8.625% senior notes due 2029 (the

“Additional Notes”) at an offering price equal to 103.250% of their

face value, plus accrued interest from March 13, 2024. The

aggregate principal amount of the offering was increased from the

previously announced offering size of $100 million.

The Additional Notes will be issued under the same indenture as

the $650 million in aggregate principal amount of 8.625% senior

notes due 2029 issued by the Issuers on March 13, 2024 and the

additional $200 million in aggregate principal amount of 8.625%

senior notes due 2029 issued by the Issuers on April 17, 2024

(collectively, the “Existing Notes”). The Additional Notes will

form a part of the same series of notes as the Existing Notes.

The offering is expected to close on August 16, 2024, subject to

the satisfaction of customary closing conditions. Delek Logistics

intends to use the net proceeds from the offering to repay a

portion of the outstanding borrowings under its revolving credit

facility.

The Additional Notes are being offered only to persons

reasonably believed to be qualified institutional buyers in an

offering exempt from registration in reliance on Rule 144A under

the Securities Act of 1933, as amended (the “Securities Act”), and

to non-U.S. persons outside the United States in reliance on

Regulation S under the Securities Act. The Additional Notes and

related guarantees have not been registered under the Securities

Act or any state securities laws and may not be offered or sold in

the United States without registration or an applicable exemption

from the registration requirements of the Securities Act or any

applicable state securities laws.

This press release is being issued pursuant to Rule 135c under

the Securities Act, and is neither an offer to sell nor a

solicitation of an offer to buy the Additional Notes or any other

securities and shall not constitute an offer to sell or a

solicitation of an offer to buy, or a sale of, the Additional Notes

or any other securities in any jurisdiction in which such offer,

solicitation or sale is unlawful.

About Delek Logistics Partners, LP

Delek Logistics is a midstream energy master limited partnership

headquartered in Brentwood, Tennessee. Through its owned assets and

joint ventures located primarily in and around the Permian Basin,

the Delaware Basin and other select areas in the Gulf Coast region,

Delek Logistics provides gathering, pipeline, transportation, and

other services for its customers in crude oil, intermediates,

refined products, natural gas, storage, wholesale marketing,

terminalling, water disposal and recycling.

Delek US Holdings, Inc. (NYSE: DK) owns the general partner

interest as well as a majority limited partner interest in Delek

Logistics and is also a significant customer.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act and Section 21E of

the Securities Exchange Act of 1934, as amended, including

statements regarding the closing of the offering and the

anticipated use of the net proceeds therefrom. These statements may

contain words such as “possible,” “believe,” “should,” “could,”

“would,” “predict,” “plan,” “estimate,” “intend,” “may,”

“anticipate,” “will,” “if,” “expect” or similar expressions, as

well as statements in the future tense, are made as of the date

they were first issued and are based on current expectations,

estimates, forecasts and projections as well as the beliefs and

assumptions of management. Forward-looking statements are subject

to a number of risks and uncertainties, many of which involve

factors or circumstances that are beyond Delek Logistics’ control.

Delek Logistics’ actual results could differ materially from those

stated or implied in forward-looking statements due to a number of

factors, including, but not limited to, market risks and

uncertainties, including those which might affect the offering, and

the impact of any natural disasters or public health emergencies.

These and other potential risks and uncertainties that could cause

actual results to differ from the results predicted are more fully

detailed in Delek Logistics’ filings and reports with the

Securities and Exchange Commission (“SEC”), including the Annual

Report on Form 10-K for the year ended December 31, 2023, the

Quarterly Report on Form 10-Q for the quarterly period ended June

30, 2024, and other reports and filings with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813400006/en/

Investor Relations and Media/Public Affairs Contact:

investor.relations@delekus.com

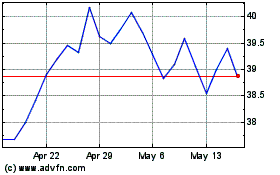

Delek Logistics Partners (NYSE:DKL)

Historical Stock Chart

From Oct 2024 to Nov 2024

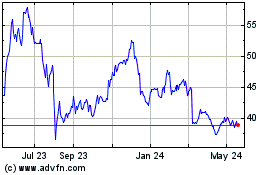

Delek Logistics Partners (NYSE:DKL)

Historical Stock Chart

From Nov 2023 to Nov 2024