Solo Brands, Inc. (NYSE: DTC) (“Solo Brands” or “the Company”)

today announced its financial results for the three and twelve

month periods ended December 31, 2023.

“I am thrilled to be leading Solo Brands. In my first two months

here I have been incredibly impressed with the strength of our core

brands, record operating cash flow and the tremendous growth

potential ahead,” said Chris Metz, CEO of Solo Brands. “I also

recognize that there is work to be done to build the

infrastructure, in terms of process, systems and talent, to support

the brands and position the company to deliver consistent growth.

Our focus in 2024 is to leverage our brands’ strengths while also

making strategic investments for the long-term.”

Fourth Quarter 2023 Highlights Compared to Fourth Quarter

2022

- Net sales of $165.3 million, down $31.9 million or 16.2%

- Net loss of $210.9 million, down $230.4 million

- Net loss per Class A common stock - basic and diluted of $2.14,

down $2.32

- Adjusted net income(1)(2) of $11.3 million, down $17.7 million

or 61.0%

- Adjusted EBITDA(1) of $14.9 million, down $23.8 million or

61.6%

- Adjusted net income per Class A common stock(1)(2) of $0.13 per

diluted share, down $0.12

Full Year 2023 Highlights Compared to Full Year 2022

- Net sales of $494.8 million, down $22.9 million or 4.4%

- Net loss of $195.3 million, down $187.7 million

- Net loss per Class A common stock - basic and diluted of $1.84,

down $1.76

- Net cash provided by operating activities of $62.4 million, up

$30.0 million or 92.7%

- Free cash flow(1) of $53.3 million, up $30.2 million or

130.3%

- Adjusted net income(1)(2) of $54.8 million, down $10.2 million

or 15.7%

- Adjusted EBITDA(1) of $70.2 million, down $17.4 million or

19.9%

- Adjusted net income per Class A common stock(1)(2) of $0.58,

down $0.03

Operating Results for the Three Months

Ended December 31, 2023

Net sales decreased to $165.3 million, or 16.2%, compared

to $197.2 million in the fourth quarter of 2022. Lower net sales

resulted, in part, from a lack of significant new product launches

in the fourth quarter of 2023 when compared to the fourth quarter

of 2022. Within our sales channels, direct-to-consumer channel

revenue declined, while wholesale sales increased, period over

period, resulting from continued growth primarily within our

strategic partnerships.

- Direct-to-consumer revenues decreased to $127.3 million, or

20.8%, compared to $160.8 million in the fourth quarter of

2022.

- Wholesale revenues increased to $38.0 million, or 4.2%,

compared to $36.5 million in the fourth quarter of 2022.

Gross profit decreased to $96.4 million, or 18.3%,

compared to $118.0 million in the fourth quarter of 2022 primarily

driven by the decrease in net sales. Gross margin decreased to

58.3%, or 150 basis points, when compared to the same period of the

prior year due to a shift in channel mix to wholesale from

direct-to-consumer as compared to the prior year period, as the

wholesale channel typically has lower gross margins compared to

that of the direct-to-consumer channel.

Selling, general and administrative expenses decreased to

$80.0 million, or 5.7%, compared to $84.7 million in the fourth

quarter of 2022. The decrease was driven by $6.7 million of lower

fixed costs, stemming from reductions in employee related expenses,

and was partially offset by a $1.9 million increase in certain

variable costs, primarily marketing expenses.

Impairment charges of $249.0 million were recorded in

2023, of which $234.8 million related to goodwill for the Company’s

Solo Stove, Oru and ISLE reporting units and $14.2 million related

to the Oru and ISLE intangible assets, as a result of the decline

in performance of these reporting units compared to previous

forecasts. No impairment charges were recorded during the fourth

quarter of 2022.

Other operating expenses increased to $1.3 million

compared to a nominal amount in the fourth quarter of 2022. The

increase was primarily driven by management transition costs and

costs related to the acquisitions in 2023, with nominal net costs

in the same period of the prior year.

Interest expense, net increased to $3.5 million, or

42.3%, compared to $2.4 million in the fourth quarter of 2022, as a

result of an increase in the weighted average interest rate on our

total debt balance, as well as a higher average debt balance when

compared to the same period of the prior year.

Net (loss) income per Class A common stock basic and

diluted per share was $(2.14) for the fourth quarter of 2023

compared to $0.18 for the fourth quarter of 2022.

Adjusted net income per Class A common stock(1)(2) was

$0.13 per diluted share for the fourth quarter of 2023 compared to

$0.25 for the fourth quarter of 2022.

Operating Results for the Twelve Months

Ended December 31, 2023

Net sales decreased to $494.8 million, or 4.4%, compared

to $517.6 million in the prior year. Lower net sales resulted, in

part, from the lack of significant new product launches in the

current year when compared to the prior year. Within our sales

channels, direct-to-consumer channel revenue declined while

wholesale sales increased, resulting from continued growth

primarily within our strategic partnerships.

- Direct-to-consumer revenues decreased to $358.1 million, or

15.4%, compared to $423.4 million in the prior year.

- Wholesale revenues increased to $136.7 million, or 45.1%,

compared to $94.2 million in the prior year.

Gross profit decreased to $302.2 million, or 5.0%,

compared to $318.2 million in the prior year primarily driven by

the decrease in net sales. Gross margin decreased to 61.1%, or 40

basis points, when compared to the same period of the prior year

driven by a shift in channel mix to wholesale as compared to the

prior year, partially offset by a decrease in freight costs.

Selling, general and administrative expenses decreased to

$249.4 million, or 3.7%, compared to $259.0 million in the prior

year. The decrease was driven by a $9.3 million decrease in

variable costs, and a $0.3 million decrease in fixed costs. The

variable cost decrease was primarily due to lower distribution

costs associated with lower net sales, as well as fair value

changes of the contingent consideration related to the acquisitions

in the current year. The fixed cost decrease was due to decreases

in employee costs as a result of reductions in equity-based

compensation, performance-based bonus expense and severance, offset

in part by an increase in rent expense as a result of the addition

of new stores and warehouse locations.

Depreciation and amortization expenses increased to $26.6

million, or 8.1%, compared to $24.6 million in the prior year. This

increase was driven by a $0.6 million increase in amortization

expenses, primarily related to increases in definite-lived

intangible assets, and a $1.4 million increase in depreciation

expenses, primarily related to acquired property and equipment,

net, for which both increases were attributable to the acquisition

activity in 2023.

Impairment charges of $249.0 million were recorded in the

fourth quarter of 2023, of which $234.8 million related to goodwill

for the Company’s Solo Stove, Oru and ISLE reporting units and

$14.2 million related to the Oru and ISLE intangible assets, as a

result of the decline in performance of these reporting units

compared to previous forecast. Impairment charges of $30.6 million

were recorded in 2022, of which $27.9 million related to goodwill

for the Company’s ISLE reporting unit and $2.7 million related to

the ISLE trademark intangible, as a result of the weakened demand

for the ISLE reporting unit’s products identified in the second

quarter of 2022.

Other operating expenses increased to $5.0 million, or

39.9%, compared to $3.6 million in the prior year, primarily due to

$2.0 million of acquisition related expenses as a result of the

acquisition activity in 2023, an increase of 222.9% compared to the

acquisition related activity included in other operating expenses

in the prior year.

Interest expense, net increased to $11.0 million, or

75.5%, compared to $6.3 million in the prior year, as a result of

an increase in the weighted average interest rate on our total debt

balance, as well as a higher average debt balance when compared to

the prior year.

Net loss per Class A common stock year to date basic and

diluted per share was $1.84 for 2023, compared to $0.08 for

2022.

Adjusted net income per Class A common stock(1)(2) year

to date basic and diluted per share was $0.58 for 2023, compared to

$0.61 for 2022.

Balance Sheet

Cash and cash equivalents were $19.8 million at December

31, 2023 compared to $23.3 million at December 31, 2022.

Inventory was $111.6 million at December 31, 2023

compared to $133.0 million at December 31, 2022. The decrease was

the result of continued focus by management to optimize inventory

turnover.

Outstanding borrowings were $60.0 million under the

Revolving Credit Facility, and $91.3 million under the Term Loan

Agreement as of December 31, 2023 compared to $20.0 million and

$96.3 million at December 31, 2022, respectively. The borrowing

capacity on the Revolving Credit Facility was $350.0 million as of

December 31, 2023, leaving $289.4 million of availability, net of

issued and outstanding letters of credit.

Full Year 2024 Outlook

Mr. Metz commented, “We continue to be incredibly excited about

the strength of our brands and believe in our long-term growth

strategy. As we focus on 2024, we see tremendous opportunity for

both channel and category expansion in our business; however, we

are mindful of the current uncertain environment and are not immune

to the pressures on consumers’ discretionary spending. Given this

backdrop, we are putting forth the following guidance for 2024:

Total revenue is expected to be between $490 million to

$510 million for 2024.

Adjusted EBITDA margin* is expected to be between 10% to

12% for 2024.

The Company’s full year 2024 guidance is based on a number of

assumptions that are subject to change, many of which are outside

the Company’s control. If actual results vary from these

assumptions, the Company’s expectations may change. There can be no

assurance that the Company will achieve these results.

* The Company has not provided a quantitative reconciliation of

forecasted adjusted EBITDA margin to forecasted GAAP net income

(loss) margin as a percent of net sales, respectively, within this

press release because the Company is unable, without making

unreasonable efforts, to calculate certain reconciling items with

confidence. With respect to GAAP net income (loss) margin, these

items include, but are not limited to, equity-based compensation

with respect to future grants and forfeitures, which could

materially affect the computation of forward-looking GAAP net

income, and are inherently uncertain and depend on various factors,

some of which are outside of the Company’s control.

(1) This release includes references to non-GAAP financial

measures. Refer to “Non-GAAP Financial Measures” later in this

release for the definitions of the non-GAAP financial measures

presented and a reconciliation of these measures to their closest

comparable GAAP measures. (2) This release reflects a change to the

presentation of the adjusted net income (loss) per Class A common

stock from previous periods in order to provide a more concise

view. Prior periods are presented on this new basis for

comparability purposes. Please see the definition of “Adjusted Net

Income (Loss) per Class A Common Stock” below for more

information.

Conference Call Details

A conference call to discuss the Company's fourth quarter and

fiscal 2023 results is scheduled for March 14, 2024, at 8:30 a.m.

ET. Investors and analysts who wish to participate in the call are

invited to dial +1 833 470 1428 (international callers, please dial

+1 929 526 1599) approximately 10 minutes prior to the start of the

call. Please reference Conference ID 878308 when prompted. A live

webcast of the conference call will be available in the investor

relations section of DTC’s website,

https://investors.solobrands.com.

A recorded replay of the call will be available shortly after

the conclusion of the call and remain available until March 21,

2024. To access the telephone replay, dial 866 813 9403

(international callers, please dial +44 204 525 0658). The access

code for the replay is 546743. A replay of the webcast will also be

available within two hours of the conclusion of the call and will

remain available on the website, https://investors.solobrands.com,

for one year.

About Solo Brands, Inc.

Solo Brands, headquartered in Grapevine, TX, develops and

produces ingenious lifestyle products that help customers create

lasting memories. Through an omni-channel distribution model that

leverages e-commerce, strategic wholesale relationships and

physical retail stores, Solo Brands offers innovative products to

consumers through six lifestyle brands – Solo Stove and TerraFlame,

known for firepits, stoves, and accessories; Chubbies, a premium

casual apparel and activewear brand; Oru Kayak, innovator of

origami folding kayaks; ISLE, maker of inflatable and hard paddle

boards and accessories; and IcyBreeze, maker of portable air

conditioning coolers.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including without limitation statements

regarding expectations of achieving long-term growth and

profitability and our anticipated GAAP and non-GAAP guidance for

the fiscal year ending December 31, 2024. In some cases, you can

identify forward-looking statements by terms such as “may,” “will,”

“should,” “expects,” “plans,” “anticipates,” “could,” “intends,”

“targets,” “projects,” “contemplates,” “believes,” “estimates,”

“forecasts,” “guidance,” “predicts,” “potential” or “continue” or

the negative of these terms or other similar expressions. These

statements are neither promises nor guarantees, and involve known

and unknown risks, uncertainties and other important factors that

may cause our actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including, but not limited to, the following: our

ability to manage our future growth effectively; our ability to

expand into additional markets; our ability to maintain and

strengthen our brand to generate and maintain ongoing demand for

our products; our ability to cost-effectively attract new customers

and retain our existing customers; our failure to maintain product

quality and product performance at an acceptable cost; the impact

of product liability and warranty claims and product recalls; the

highly competitive market in which we operate; business

interruptions resulting from geopolitical actions, natural

disasters, or pandemics; risks associated with our international

operations; problems with, or loss of, our suppliers or an

inability to obtain raw materials; and the ability of our

stockholders to influence corporate matters. These and other

important factors discussed under the caption "Risk Factors" in our

Annual Report on Form 10-K for the year ended December 31, 2023,

and any subsequent Quarterly Reports on Form 10-Q, Current Reports

on Form 8-K, or other filings we make with the Securities and

Exchange Commission could cause actual results to differ materially

from those indicated by the forward-looking statements made in this

press release. Forward-looking statements speak only as of the date

the statements are made and are based on information available to

Solo Brands at the time those statements are made and/or

management's good faith belief as of that time with respect to

future events. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable

law.

Availability of Information on Solo Brands’ Website and

Social Media Profiles

Investors and others should note that Solo Brands routinely

announces material information to investors and the marketplace

using SEC filings, press releases, public conference calls,

webcasts and the Solo Brands investors website at

https://investors.solobrands.com. We also intend to use the social

media profiles listed below as a means of disclosing information

about us to our customers, investors and the public. While not all

of the information that the Company posts to the Solo Brands

investors website or to social media profiles is of a material

nature, some information could be deemed to be material.

Accordingly, the Company encourages investors, the media, and

others interested in Solo Brands to review the information that it

shares at the “Investors” link located at the top of the page on

https://solobrands.com and to regularly follow our social media

profiles. Users may automatically receive email alerts and other

information about Solo Brands when enrolling an email address by

visiting "Investor Email Alerts" in the "Resources" section of Solo

Brands investor website at https://investors.solobrands.com.

Social Media Profiles: https://linkedin.com/company/solo-brands/

https://instagram.com/solobrands/

https://www.facebook.com/groups/368095467245044/

SOLO BRANDS, INC.

Consolidated Statements of

Operations and Comprehensive Income (Loss)

Three Months Ended December

31,

Twelve Months Ended December

31,

(In thousands, except per share

data)

2023

2022

2023

2022

Net sales

$

165,318

$

197,243

$

494,776

$

517,627

Cost of goods sold

68,899

79,277

192,624

199,452

Gross profit

96,419

117,966

302,152

318,175

Operating expenses

Selling, general & administrative

expenses

79,953

84,749

249,432

259,048

Depreciation and amortization expenses

7,014

6,398

26,593

24,592

Impairment charges

248,967

—

248,967

30,589

Other operating expenses

1,274

2

5,010

3,582

Total operating expenses

337,208

91,149

530,002

317,811

Income (loss) from operations

(240,789

)

26,817

(227,850

)

364

Non-operating (income) expense

Interest expense, net

3,462

2,433

11,004

6,271

Other non-operating (income) expense

(436

)

198

(7,297

)

712

Total non-operating (income) expense

3,026

2,631

3,707

6,983

Income (loss) before income taxes

(243,815

)

24,186

(231,557

)

(6,619

)

Income tax expense (benefit)

(32,953

)

4,678

(36,225

)

1,001

Net income (loss)

(210,862

)

19,508

(195,332

)

(7,620

)

Less: net income earned by controlling

members prior to the Reorganization Transactions

—

—

—

—

Less: net income (loss) attributable to

noncontrolling interests

(87,039

)

8,175

(83,985

)

(2,675

)

Net income (loss) attributable to Solo

Brands, Inc.

$

(123,823

)

$

11,333

$

(111,347

)

$

(4,945

)

Other comprehensive income

(loss)

Foreign currency translation, net of

tax

204

(876

)

(268

)

(827

)

Comprehensive income (loss)

(210,658

)

18,632

(195,600

)

(8,447

)

Less: other comprehensive income (loss)

attributable to noncontrolling interests

74

(338

)

(97

)

(322

)

Less: net income (loss) attributable to

noncontrolling interests

(87,039

)

8,175

(83,985

)

(2,675

)

Comprehensive income (loss)

attributable to Solo Brands, Inc.

$

(123,693

)

$

10,795

$

(111,518

)

$

(5,450

)

Net income (loss) per Class A common

stock

Basic

$

(2.14

)

$

0.18

$

(1.84

)

$

(0.08

)

Diluted

$

(2.14

)

$

0.18

$

(1.84

)

$

(0.08

)

Weighted-average Class A common stock

outstanding

Basic

57,882

63,559

60,501

63,462

Diluted

57,882

63,712

60,501

63,462

SOLO BRANDS, INC.

Consolidated Balance

Sheets

(In thousands, except par value and per

unit data)

December 31, 2023

December 31, 2022

ASSETS

Current assets

Cash and cash equivalents

$

19,842

$

23,293

Accounts receivable, net of allowance for

credit losses of $1.3 million and $1.5 million for the years ended

December 31, 2023 and 2022, respectively

42,725

26,176

Inventory

111,613

132,990

Prepaid expenses and other current

assets

21,893

12,639

Total current assets

196,073

195,098

Non-current assets

Property and equipment, net

26,159

15,166

Intangible assets, net

221,010

234,632

Goodwill

169,648

382,658

Operating lease right-of-use assets

30,788

34,259

Other non-current assets

15,640

534

Total non-current assets

463,245

667,249

Total assets

$

659,318

$

862,347

LIABILITIES AND EQUITY

Current liabilities

Accounts payable

$

21,846

$

11,783

Accrued expenses and other current

liabilities

55,155

43,377

Deferred revenue

5,310

6,848

Current portion of long-term debt

6,250

5,000

Total current liabilities

88,561

67,008

Non-current liabilities

Long-term debt, net

142,993

108,383

Deferred tax liability

17,319

82,621

Operating lease liabilities

24,648

29,133

Other non-current liabilities

13,534

205

Total non-current liabilities

198,494

220,342

Commitments and contingencies (Note

16)

Equity

Class A common stock, par value $0.001 per

share; 468,767,205 shares authorized, 57,947,711 shares issued and

outstanding; 475,000,000 authorized, 63,651,051 issued and

outstanding

58

64

Class B common stock, par value $0.001 per

share; 50,000,000 shares authorized, 33,047,780 shares issued and

outstanding; 50,000,000 shares authorized, 32,157,983 issued and

outstanding

33

32

Additional paid-in capital

357,385

358,118

Retained earnings (accumulated

deficit)

(115,458

)

5,746

Accumulated other comprehensive income

(loss)

(230

)

(499

)

Treasury stock

(526

)

(35

)

Equity attributable to the controlling

interest

241,262

363,426

Equity attributable to noncontrolling

interests

131,001

211,571

Total equity

372,263

574,997

Total liabilities and equity

$

659,318

$

862,347

SOLO BRANDS, INC.

Condensed Consolidated

Statements of Cash Flows

Year Ended December

31,

(In thousands)

2023

2022

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income (loss)

$

(195,332

)

$

(7,620

)

Adjustments to reconcile net income (loss)

to net cash (used in) provided by operating activities

Impairment charges

248,967

30,589

Depreciation and amortization

27,349

24,592

Equity-based compensation

14,717

18,598

Operating lease right-of-use assets

expense

8,373

6,889

Changes in accounts receivable

reserves

295

1,293

Amortization of debt issuance costs

860

860

Warranty provision

690

—

Equity-based compensation for

non-employees

333

—

Loss (gain) on disposal of property and

equipment

219

66

Change in fair value of contingent

consideration

(1,573

)

—

Barter credits

(7,160

)

—

Deferred income taxes

(47,040

)

(10,501

)

Changes in assets and liabilities

Inventory

28,182

(30,884

)

Accrued expenses and other current

liabilities

6,811

7,587

Accounts receivable

(16,328

)

(5,923

)

Other non-current assets and

liabilities

2,409

(542

)

Deferred revenue

(1,571

)

3,334

Operating lease ROU assets and

liabilities

(8,113

)

(5,817

)

Prepaid expenses and other current

assets

(9,222

)

(2,802

)

Accounts payable

9,557

2,676

Net cash (used in) provided by

operating activities

62,423

32,395

CASH FLOWS FROM INVESTING

ACTIVITIES:

Capital expenditures

(9,093

)

(9,241

)

Payments of contingent consideration

(9,386

)

—

Acquisitions, net of cash acquired

(34,600

)

(774

)

Net cash (used in) provided by

investing activities

(53,079

)

(10,015

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from long-term debt

70,000

45,000

Repayments of long-term debt

(35,000

)

(60,625

)

Finance lease liability principal paid

(379

)

—

Exercise of Options for Class A common

stock

39

—

Common stock repurchases

(36,957

)

—

Distributions to non-controlling

interests

(10,511

)

(8,304

)

Taxes paid related to net share settlement

of equity awards

(305

)

(35

)

Stock issued under employee stock purchase

plan

247

422

Net cash (used in) provided by

financing activities

(12,866

)

(23,542

)

Effect of exchange rate changes on

cash

71

(646

)

Net change in cash and cash

equivalents

(3,451

)

(1,808

)

Cash and cash equivalents balance,

beginning of period

23,293

25,101

Cash and cash equivalents balance, end of

period

$

19,842

$

23,293

SUPPLEMENTAL DISCLOSURES:

Cash interest paid

$

10,327

$

5,125

Cash income taxes paid

$

11,775

$

13,190

Construction in progress in accounts

payable

$

—

$

293

SUPPLEMENTAL NONCASH INVESTING AND

FINANCING DISCLOSURES:

Treasury stock retirements

$

31,164

$

—

Re-issuance of treasury stock

$

5,342

$

—

Operating lease right of use assets

obtained in exchange for lease obligations

$

3,316

$

14,797

Financing lease right of use assets

obtained in exchange for lease obligations

$

1,815

$

—

Non-GAAP Financial Measures

We report our financial results in accordance with accounting

principles generally accepted in the United States (“U.S. GAAP”);

however, management believes that certain non-GAAP financial

measures provide users of our financial information with useful

supplemental information that enables a better comparison of our

performance across periods. We use adjusted gross profit, adjusted

gross profit margin, free cash flow, adjusted net income, adjusted

net income (loss) per Class A common stock, adjusted EBITDA and

adjusted EBITDA margin non-GAAP financial measures, because we

believe they are useful indicators of our operating performance.

Our management uses these non-GAAP measures principally as measures

of our operating performance and believes that these non-GAAP

measures are useful to our investors because they are frequently

used by securities analysts, investors and other interested parties

in their evaluation of the operating performance of companies in

industries similar to ours. Our management also uses these non-GAAP

measures for planning purposes, including the preparation of our

annual operating budget and financial projections.

None of these non-GAAP measures is a measurement of financial

performance under U.S. GAAP. These non-GAAP measures should not be

considered in isolation or as a substitute for a measure of our

liquidity or operating performance prepared in accordance with U.S.

GAAP and are not indicative of net income (loss) from continuing

operations as determined under U.S. GAAP. In addition, the

exclusion of certain gains or losses in the calculation of non-GAAP

financial measures should not be construed as an inference that

these items are unusual or infrequent as they may recur in the

future, nor should it be construed that our future results will be

unaffected by unusual or non-recurring items. These non-GAAP

financial measures have limitations that should be considered

before using these measures to evaluate our liquidity or financial

performance. Some of these limitations are as follows.

These non-GAAP measures exclude certain tax payments that may

require a reduction in cash available to us; do not reflect our

cash expenditures, or future requirements, for capital expenditures

(including capitalized software developmental costs) or contractual

commitments; do not reflect changes in, or cash requirements for,

our working capital needs; do not reflect the cash requirements

necessary to service interest or principal payments on our debt;

exclude certain purchase accounting adjustments related to

acquisitions; and exclude equity-based compensation expense, which

has recently been, and will continue to be for the foreseeable

future, a significant recurring expense for our business and an

important part of our compensation strategy.

In addition, other companies may define and calculate

similarly-titled non-GAAP financial measures differently than us,

thereby limiting the usefulness of these non-GAAP financial

measures as a comparative tool. Because of these and other

limitations, you should consider our non-GAAP measures only as

supplemental to other U.S. GAAP-based financial performance

measures.

Free Cash Flow

We calculate free cash flow as net cash provided by (used in)

operating activities, reduced by capital expenditures (consisting

of purchases of property and equipment, purchases of intangible

assets and capitalization of internal use software). We believe

free cash flow is an important liquidity measure of the cash that

is available for operational expenses, investments in our business,

strategic acquisitions, and for certain other activities such as

repaying debt obligations and stock repurchases.

Adjusted Net Income (Loss)

We calculate adjusted net income as net income (loss) excluding

impairment charges and the costs that are expected to be

nonrecurring in nature and the costs that are believed by

management to be non-operating in nature and not representative of

the Company’s core operating performance, as listed below under

“Non-GAAP Adjustments”. Adjusted net income (loss) attributable to

noncontrolling interests is calculated as income (loss) before

income taxes, adjusted in the same manner as adjusted net income

noted above, adjusted for the allocable attribution to the

noncontrolling interest.

Adjusted Net Income (Loss) per Class A Common Stock

We calculate adjusted net income (loss) as adjusted net income,

as defined above, less the allocable portion of net income to the

noncontrolling interest, divided by weighted average diluted shares

or weighted average shares of Class A common stock, respectively,

as calculated under U.S. GAAP.

Beginning with the reporting of our results for the three and

twelve month periods ended December 31, 2023, adjusted net income

(loss) per Class A Common Stock removes the portion of adjusted net

income (loss) attributable to noncontrolling interests as

management believes this presentation provides investors with a

more concise view of the Company’s results. The Company intends to

present adjusted net income (loss) per Class A Common Stock on this

new basis going forward and will present prior periods on the same

basis for comparability purposes.

EBITDA

We calculate EBITDA as net income (loss) before interest

expense, income taxes, and depreciation and amortization

expenses.

Adjusted EBITDA

We calculate adjusted EBITDA as net income (loss) before

interest expense, income taxes, depreciation and amortization

expenses, impairment charges, equity-based compensation expense,

the costs that are expected to be nonrecurring in nature and the

costs that are believed by management to be non-operating in nature

and not representative of the Company’s core operating performance,

as listed below under “Non-GAAP Adjustments”.

Adjusted EBITDA Margin

We calculate adjusted EBITDA margin as adjusted EBITDA divided

by net sales.

Non-GAAP Adjustments

In addition to the costs specifically noted under the non-GAAP

metrics above, the Company believes that evaluation of its

financial performance can be enhanced by a supplemental

presentation of results that exclude nonrecurring costs and costs

believed by management to be non-operating in nature and not

representative of the Company’s core operating performance. These

costs are excluded in order to enhance consistency and

comparativeness with results in prior periods that do not include

such items and to provide a basis for evaluating operating results

in future periods.

- Amortization expense - Represents the non-cash amortization of

intangible assets related to the reorganization transactions in

2020 and the 2021 and 2023 acquisitions.

- Equity-based compensation expense - Represents the non-cash

expense related to the incentive units, restricted stock units,

options, performance stock units and employee stock purchases, with

vestings occurring over time and settled with the Company’s common

stock.

- Impairment charges - Represents intangible asset and goodwill

impairments recorded during the three months ended June 30, 2022

and the three months ended December 31, 2023.

- Tax refunds - Represents a one-time tax refund related to

COVID-19 era benefits.

- Transaction costs - Represents transaction costs primarily

related to professional service fees incurred in connection with

the secondary offering and S-3 registration statement filed in 2023

and in connection with the IPO in the comparative periods.

- Acquisition-related costs - Represents expenses that are

associated with acquisition activities, including financial

diligence and legal fees.

- Management transition costs - Represents costs primarily

related to executive transition costs for executive search fees and

related costs for the transition of certain members of

management.

- Inventory fair value write-ups - Represents the recognition of

fair market value write-ups of inventory accounted for under ASC

805 related to the 2021 and 2023 acquisitions.

- Business optimization and expansion expenses - Represents

various start-up and transition costs, including warehouse

optimization charges; costs for expansion into new international

and domestic markets; select consulting and software implementation

fees.

- Contract termination and modification fees - Includes one-time

advertising spend contract termination fees with offsetting

benefits that were fully realized by the end of 2023.

- Changes in fair value of contingent earn-out liability -

Represents the charge to mark the contingent earn-out consideration

to fair value in connection with the 2023 acquisitions.

- Tax impact of adjusting items - Represents the tax impact of

the respective adjustments for each non-GAAP financial measure

calculated at an expected statutory rate of 21.0%, adjusted to

reflect the allocation to the controlling interest.

SOLO BRANDS, INC.

Reconciliation of Non-GAAP

Financial Information to GAAP

(Unaudited) (In thousands,

except per share amounts)

The following tables reconcile the

non-GAAP financial measures to their most comparable GAAP measure

for the periods presented:

Three Months Ended December

31,

Year Ended December

31,

(dollars in thousands)

2023

2022

2023

2022

Gross profit

$

96,419

$

117,966

$

302,152

$

318,175

Inventory fair value write-up(1)

907

—

907

7,813

Adjusted gross profit

$

97,326

$

117,966

$

303,059

$

325,988

Gross profit margin

(Gross profit as a % of net sales)

58.3

%

59.8

%

61.1

%

61.5

%

Adjusted gross profit margin

(Adjusted gross profit as a % of net

sales)

58.9

%

59.8

%

61.3

%

63.0

%

Year Ended December

31,

(dollars in thousands)

2023

2022

Net cash (used in) provided by

operating activities

$

62,423

$

32,395

Capital expenditures

(9,093

)

(9,241

)

Free cash flow

$

53,330

$

23,154

Three Months Ended December

31,

Year Ended December

31,

(dollars in thousands)

2023

2022

2023

2022

Net income (loss)

$

(210,862

)

$

19,508

$

(195,332

)

$

(7,620

)

Amortization expense

6,133

5,270

22,396

21,018

Impairment charges

248,967

—

248,967

30,589

Equity-based compensation expense

21

5,385

14,787

18,598

Tax refunds

—

—

(5,121

)

—

Transaction costs

(104

)

—

1,390

1,070

Acquisition-related costs

596

515

1,957

2,186

Management transition costs

706

(216

)

1,621

1,891

Inventory fair value write-ups

907

—

907

7,813

Business optimization and expansion

expense

6

—

462

1,208

Contract termination and modification

fees

(4,317

)

—

—

—

Changes in fair value of contingent

earn-out liability

669

—

(1,573

)

—

Tax impact of adjusting items

(31,401

)

(1,460

)

(35,708

)

(11,771

)

Adjusted net income

$

11,321

$

29,002

$

54,753

$

64,982

Less: adjusted net income (loss)

attributable to noncontrolling interests

3,548

12,837

19,697

26,100

Adjusted net income (loss) attributable

to Solo Brands, Inc.

$

7,773

$

16,165

$

35,056

$

38,882

Adjusted net income per Class A common

stock

$

0.13

$

0.25

$

0.58

$

0.61

Weighted-average Class A common stock

outstanding - basic

57,882

63,559

60,501

63,462

Weighted-average Class A common stock

outstanding - diluted

57,882

63,712

60,501

63,462

Net income (loss)

$

(210,862

)

$

19,508

$

(195,332

)

$

(7,620

)

Interest expense

3,462

2,433

11,004

6,271

Income tax (benefit) expense

(32,953

)

4,678

(36,225

)

1,001

Depreciation and amortization expense

7,770

6,398

27,349

24,592

EBITDA

(232,583

)

33,017

(193,204

)

24,244

Impairment charges

248,967

—

248,967

30,589

Equity-based compensation expense

21

5,385

14,787

18,598

Tax refunds

—

—

(5,121

)

—

Transaction costs

(104

)

—

1,390

1,070

Acquisition-related costs

596

515

1,957

2,186

Management transition costs

706

(216

)

1,621

1,891

Inventory fair value write-ups

907

—

907

7,813

Business optimization and expansion

expense

6

—

462

1,208

Contract termination and modification

fees

(4,317

)

—

—

—

Changes in fair value of contingent

earn-out liability

669

—

(1,573

)

—

Adjusted EBITDA

$

14,868

$

38,701

$

70,193

$

87,599

Net income (loss) margin

(Net income (loss) as a % of net

sales)

(127.5

)%

9.9

%

(39.5

)%

(1.5

)%

Adjusted EBITDA margin

(Adjusted EBITDA as a % of net sales)

9.0

%

19.6

%

14.2

%

16.9

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240314567144/en/

Bruce Williams Investors@solobrands.com 332-242-4303

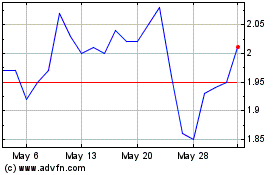

Solo Brands (NYSE:DTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Solo Brands (NYSE:DTC)

Historical Stock Chart

From Feb 2024 to Feb 2025