Board and Committee Operations

Board, Committee and Individual Director Evaluations

Our Board assesses annually its effectiveness and that of its Committees. All Directors complete an evaluation form for the Board and for each Committee on which they serve. These forms include numerical ratings for certain key metrics, as well as the opportunity for written comments. The comments provide key insights into the areas Directors believe the Board can improve or in which its performance is strong. The evaluation results are reported to the full Board, and each Committee is provided with its Committee evaluation results. The Governance and Nominating Committee oversees the process. Evaluation topics include number and length of meetings, topics covered and materials provided, Committee structure and activities, Board composition, including any comments on other members of the Board and their expertise, succession planning, Director participation and interaction with management and promotion of ethical behavior. Our Board discusses the results of each annual evaluation and, as appropriate, implements enhancements and other modifications identified during the evaluation.

Also as part of the annual self-assessment process, the Chair of the Board meets with each Director individually to solicit peer-to-peer evaluations. The one-on-one meetings between the Board Chair and other members of the Board is an important mechanism to obtain and share feedback among the Board members. During these one-on-one meetings, the Board Chair solicits feedback on the Board’s function, each Board member’s self-assessment of their function on the Board, and their assessment of their fellow Board members’ function on the Board. Upon completion of the meetings, the Chair then meets with each Director individually to provide feedback on their performance that was obtained in the peer-to-peer evaluation sessions.

Corporate Governance and Nominating Committee

Nomination Process

The Governance and Nominating Committee is primarily responsible for identifying and evaluating director candidates and for recommending re-nomination of incumbent directors. The Committee, which consists entirely of independent directors under applicable SEC rules and NYSE listing standards, regularly reviews the appropriate size and composition of the Board and anticipates vacancies and required expertise. The Committee reviews potential nominees from several sources, including Directors, management, shareholders or others. The Committee is also authorized to retain search firms to identify potential director candidates, as well as other external advisors, including for purposes of performing background reviews of potential candidates. The Committee retained Spencer Stuart in fiscal 2023 to assist in identifying and evaluating potential candidates. Ms. Gonçalves was recommended by this third-party search firm and Mr. McKelvey was recommended by the Company’s Chief Executive Officer. Ms. Gonçalves and Mr. McKelvey are standing for election to the Board for the first time.

In evaluating potential nominees, the Committee considers the knowledge, reputation, experience, integrity and judgment of the candidates, their contribution to the diversity of backgrounds, experience and skills on the Board and their ability to devote sufficient time and effort to their duties as Directors. The Board considers the following experience particularly relevant: global business, technology, innovation or cybersecurity, business development, large company CEO or COO, financial leadership or expertise, corporate governance, operational leadership, industry, end-markets and growth areas, as well as experience on the boards of other major organizations. The Company’s Corporate Governance Principles and Practices set forth the minimum qualifications for nominees. Candidates are interviewed multiple times by the Chair of the Board, the CEO, the Chair of the Governance and Nominating Committee and other members of the Board to ensure that candidates not only possess the requisites skills and characteristics, but also the personality, leadership traits, work ethic, and independence of thought to effectively contribute as a member of the Board. The best candidates are then recommended by the Committee to the Board.

To ensure that the Board continues to evolve and be refreshed in a manner that serves the Company’s changing business and strategic needs, before recommending for re-nomination a slate of incumbent directors for an additional term, the Committee also evaluates whether incumbent directors possess the requisite skills and perspective, both individually and collectively. This evaluation is based primarily on the results of the periodic review the Committee performs of the requisite skills and characteristics of Board members, as well as the composition of the Board as a whole, the results of the Board’s annual evaluation, and the results of the individual Director evaluations.

The Board’s policy is to seek qualified candidates. In evaluating candidates, the Committee will consider diversity criteria such as race, ethnicity, gender, cultural background, national origin, religion, disability, age or sexual orientation. The Board seeks to maintain a balance of perspectives, qualities and skills on the Board to obtain a diversity of viewpoints to better understand the technical, economic, political and social environments in which the Company operates. The Board is committed to using refreshment opportunities to strengthen its cognitive diversity. To accomplish this, existing Board members and outside agencies are required to recommend candidates to further these objectives. The Board’s success on these objectives is measured by the range of viewpoints represented on the Board.

The Committee will consider candidates recommended by shareholders if required biographical information is properly submitted as described in “Other Matters – Future Shareholder Proposals and Nominations” on page 81. Properly submitted shareholder recommendations are sent to the Committee and will receive the same consideration as others identified to the Committee.

The Company’s Bylaws permit shareholders to nominate Directors at an annual meeting of shareholders or at a special meeting at which Directors are to be elected. The procedures for making such nominations are discussed in “Other Matters – Future Shareholder Proposals and Nominations” beginning on page 81.

|

|

|

| 22 |

|

PROXY STATEMENT FOR EMERSON 2024 ANNUAL MEETING OF SHAREHOLDERS |

Proxy Item No. 4: Vote to Approve the Emerson Electric 2024 Equity Incentive Plan

and the time or times at which, awards will be granted and the number of shares to be subject to an award, establish or waive any rules, and make any other determination in administering the Plan, including, but not limited to, determining the timing of when any termination of employment occurs for purposes of the Plan. The Committee’s decisions will be final and conclusive. To the extent permitted by applicable laws and regulations and guidelines of the New York Stock Exchange, or any other stock exchange or quotation system on which the shares of the Company’s common stock are then principally listed or quoted, the Committee may delegate to a sub-committee of the Committee or one or more officers of the Company, including the CEO, any or all of their respective authority and responsibility to administer the Plan; provided that the Committee may not delegate such authority with respect to employees of the Company who are subject to the reporting requirements of Section 16(a) of the Exchange Act to one or more officers of the Company.

Performance Shares. The Committee may establish one or more performance programs in which shares may be awarded as performance shares. Performance shares represent the right to receive payment (as described below) to the extent specified performance objectives are achieved during the applicable performance period. Performance periods may overlap.

The Committee may make awards to participants in any one or more of the performance programs. During a performance period, the Committee may, in its discretion, award performance shares to new participants in the performance program, or, in cases of significant promotion or additional responsibility, to any one or more existing participants in the performance program, subject to the maximum number of shares under the plan. Awards of performance shares may be conditioned on the participant’s continued employment by the Company or a subsidiary or affiliate over the performance period or in any other manner the Committee may determine.

Target levels. The Committee will establish a target performance objective or objectives for an award at the beginning of the applicable performance period, which need not be the same for all participants. At the time it establishes the performance targets the Committee will establish the formula or other methodology for determining the performance shares that will be earned based on the level of achievement of the performance target or targets, including setting any minimum or maximum payouts for any target objective in any performance period. The Committee may not make any payout greater than the amount earned under the established formula or methodology. The Committee may, in its discretion and when determined to be in the best interests of the Company, reduce the amount paid pursuant to an earned award.

Payout. Prior to making a performance share payment following expiration of the performance period, the Committee will certify in writing the level of achievement of the applicable performance objective(s) and the amount of payments to be made to each participant. Performance will be measured against the performance targets, and the Committee will determine what portion of a performance shares award is earned based on the established methodology, up to the stated maximum limit. A participant will receive an amount equal to the fair market value of one share of common stock for each performance share earned. Fair market value means the closing price of the Company’s common stock as reported on the New York Stock Exchange or such other stock exchange or quotation system on which the shares of the Company’s common stock are then principally listed or quoted; provided, however, that the Committee may adopt any criterion for the determination of such fair market value as it may determine to be appropriate.

The Committee may also establish additional vesting conditions for payment. Payment may be made in shares of common stock and cash or in any combination as determined by the Committee. Payment timing is intended to comply with Section 409A of the IRC. The Committee may, in its discretion, require or permit participants to defer payment under rules it may establish.

Performance Measures. Performance objectives may be based upon, without limitation, one or more of the following criteria, or such other criteria as the Committee may determine: sales, profit, operating profit, earnings before interest and taxes (EBIT), adjusted EBIT, earnings before interest, taxes, and amortization (EBITA), adjusted EBITA, earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted EBITDA, pre-tax earnings, earnings, net earnings, any related margins, earnings per share (EPS), adjusted EPS, asset management, cash flow, operating cash flow, free cash flow, free cash flow conversion, days sales outstanding, days payables outstanding, inventory turnover, return on total capital, return on equity, total shareholder return, relative total shareholder return, share price, acquisition and divestiture performance, development and achievement of strategic business objectives, customer satisfaction, new product introductions and performance, cost reductions, manufacturing efficiency, delivery lead time performance, research and development achievements, market share, working capital, geographic expansion, non-cash equity based compensation expense, human resources management, and development and achievement of ESG goals and objectives (including, without limitation, goals regarding diversity, equity and inclusion and the reduction in greenhouse gas emissions).

The performance objectives may include or exclude specified items of an unusual, non-recurring or extraordinary nature including, without limitation, acquisitions or dispositions, changes in accounting methods, changes in inventory methods, changes in corporate taxation, unusual accounting gains and losses, changes in financial accounting standards, or other extraordinary events causing dilution of or diminution in the Company’s financial results, all as the Committee may deem necessary or desirable to accomplish the purposes of the performance program.

Conditions to Payment. Unless otherwise determined by the Committee, in order to receive payment of performance shares a participant must have been continuously employed by the Company or a subsidiary or affiliate from the date of the award through the expiration of the performance period, and must remain employed with the Company or a subsidiary or affiliate, except for approved leaves of absence, on the payment date. However, in the event of retirement at age 60, a participant would receive a pro-rated amount, determined by the Committee, based on the level of achievement of the performance objectives determined at the end of the performance period. Moreover, the Committee has the discretion to allow a participant whose employment is terminated due to death, disability or otherwise, to receive a pro-rata or other payment (or no payment), subject to the level of achievement of the performance objectives at the end of the performance period.

|

|

|

| 66 |

|

PROXY STATEMENT FOR EMERSON 2024 ANNUAL MEETING OF SHAREHOLDERS |

Proxy Item No. 4: Vote to Approve the Emerson Electric 2024 Equity Incentive Plan

Restricted Shares and RSUs. The Committee may also grant restricted shares or restricted stock units (RSUs), which are subject to a restriction period but not subject to performance programs or performance objectives. An award of restricted shares is an award of actual shares of common stock subject to restrictions and forfeiture. An RSU represents the right to receive one share of common stock, subject to restrictions and forfeiture.

Restricted stock and RSUs will be forfeited if the holder resigns or is discharged from the employ of the Company or a subsidiary or affiliate during the restriction period specified by the Committee. Restricted stock and RSUs may also be forfeited on such other terms and conditions as the Committee may specify. The Committee in its discretion may waive any term and condition of any such award and reduce the restriction period.

Stock Options and SARs. The Committee may also grant stock options and SARs. Options may be in the form of “incentive stock options”, or “ISOs”, under Section 422 of the Code, provided, however, that in no event will more than 16,000,000 shares be available for granting incentive stock options under the Plan. The fair market value of incentive stock options which first become exercisable by any optionee during any calendar year is subject to additional limitation under the Plan and Code, currently $100,000. In addition, the Committee may grant to an optionee an alternative SAR for all or any part of the number of shares covered by the optionee’s options. The Committee may later grant to the holder of options that are not incentive stock options an alternative SAR covering all or a portion of such shares, provided, however, that the aggregate amount of shares covered under an alternative SAR held by an option holder may not exceed the total number of shares covered by such holder’s unexercised options.

Option Prices. The purchase price under each option may not be less than 100% of the fair market value of the common stock at the time of grant.

Payment of Option Prices. The purchase price under each option is to be paid in cash, common stock, or in a combination thereof. The optionee may facilitate the payment of the exercise price through a third-party broker in lieu of directly paying the option price in cash.

Payment of SAR award amount. A SAR is to be paid in cash, common stock, or in a combination thereof. The SAR award amount is the excess of the fair market value of the Company’s common stock on the date of exercise over the fair market value of the Company’s common stock on the date the SAR was granted, multiplied by the number of shares as to which the SAR is exercised.

Term. Generally, stock options and SARs will be exercisable at such times as the Committee approves. The term of each stock option and SAR will be not more than 10 years from the date of granting thereof or such shorter period as is prescribed in the award agreement.

Non-Transferability. Options and SARs generally are not transferable with limited exceptions for estate planning.

Other Share-Based Awards. Subject to the terms of the 2024 Plan, the Committee may grant other share-based awards to participants. Other share-based awards are awards denominated or payable in, valued in whole or in part by reference to, or otherwise based on, shares of common stock and payable in shares of common stock or cash. The Committee will determine all terms and conditions of any other share-based award, including but not limited to, the time or times at which such awards will be made, and the number of shares to be granted pursuant to such awards or to which such award relates; provided that any such award that provides for purchase rights will be priced at 100% of fair market value on the date of grant of the award.

Dividends and Dividend Equivalents; Clawback. The Committee may authorize the payment of cash dividend equivalents on awards of performance shares or restricted stock units, or on a portion thereof, provided that such dividends are subject to clawback if paid on shares in excess of the total shares ultimately earned, vested or payable under the applicable award. Unless otherwise determined by the Committee, restricted shares will be entitled to receive cash dividends when paid on the Company’s shares of the Company’s common stock; provided that such dividends are subject to clawback if paid on shares in excess of the total shares ultimately earned, vested or payable under the applicable award. In no event will dividends or dividend equivalents be payable on awards of stock options or stock appreciation rights.

No Repricing of Stock Options or Stock Appreciation Rights. Except in connection with an adjustment involving a change in capitalization or other corporate transaction or event as provided for in the Plan, none of the following may occur without prior shareholder approval:

| |

• |

|

amendment or adjustment of the Plan or any award to reduce the exercise price of any outstanding stock option or stock appreciation right; |

| |

• |

|

cancellation of outstanding stock options or stock appreciation rights in exchange for stock options or stock appreciation rights with a lower exercise price, or any other equity or non-equity plan award; or |

| |

• |

|

repurchase by the Company of any stock option or stock appreciation right which has an exercise price less than the then current fair market value of the Company’s common stock. |

Double Trigger Change of Control. If a “double trigger event” occurs with respect to an award in connection with a change of control, then holders of such awards will hold such awards fully vested, and, to the extent applicable, will be entitled to payout, assuming, with respect to awards subject to performance objectives for which the performance period has not been completed at the time of the change of control, that the specified performance periods had elapsed and the performance objectives relating thereto had been fully achieved (at the highest level provided in the award, whether target, or maximum, as applicable) free of any conditions, to the extent consistent with Code Section 409A.

|

|

|

| PROXY STATEMENT FOR EMERSON 2024 ANNUAL MEETING OF SHAREHOLDERS |

|

67 |

Other Matters

Director Nominees for Inclusion in Proxy Statement (Proxy Access)

In August 2017, the Board amended the Bylaws to permit a holder (or a group of not more than 20 holders) of at least 3% of our outstanding common stock continuously for at least three years to nominate and include in our proxy materials director nominees constituting up to the greater of two individuals or 20% of the Board, provided that the nominating holder(s) and the nominee(s) satisfy the requirements specified in the Bylaws, including providing the Company with advance notice of the nomination. Notice of director nominees submitted under these Bylaw provisions must be delivered to and received by the Secretary of the Company, whose address is 8000 West Florissant Avenue, St. Louis, Missouri 63136, no sooner than July 11, 2024, and no later than August 10, 2024, to be considered timely for purposes of the Company’s 2025 Annual Meeting.

To utilize proxy access, among other things, the electing shareholder and proposed nominee must comply with the detailed requirements set forth in our Bylaws, including the provision of the proposing shareholder information, various other required information, representations, undertakings, agreements and other requirements as set forth in the Bylaws and as required by law.

In each case the notice must be given to the Secretary of the Company, whose address is 8000 West Florissant Avenue, St. Louis, Missouri 63136. Any shareholder desiring a copy of the Company’s Bylaws will be furnished one without charge upon written request to the Secretary. A copy of the Bylaws is available on the Company’s website at www.Emerson.com, Company, Investors, Corporate Governance, Bylaws.

Universal Proxy Rules

In addition to satisfying the foregoing requirements, including the timing and other requirements, under the Bylaws summarized above under “—Proposals and Nominations Not for Inclusion in Proxy Statement,” to comply with the universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than the Company’s nominees for the 2025 Annual Meeting must also provide notice to Secretary of the Company, whose address is 8000 West Florissant Avenue, St. Louis, Missouri 63136, that sets forth all information required by Rule 14a-19 under the Exchange Act no later than December 8, 2024 (or, if the 2025 Annual Meeting is called for a date that is not within 30 calendar days of the anniversary of the date of the 2024 Annual Meeting, then notice must be provided by the later of 60 calendar days prior to the date of the 2025 Annual Meeting or by the close of business on the tenth calendar day following the day on which public announcement of the date of the 2025 Annual Meeting is first made). A shareholder seeking to utilize the universal proxy rules must comply with those rules and must also comply with our Bylaws, including the obligation to provide timely notice (not less than 90 nor more than 120 days before the meeting) as described above under “—Proposals and Nominations Not for Inclusion in Proxy Statement.”

Communications with the Company and Obtaining Emerson Documents

Shareholders and other interested persons may contact the Independent Chair of the Board or any of our Directors in writing c/o Emerson Electric Co., 8000 West Florissant Avenue, St. Louis, Missouri 63136, Attn: Secretary. All such letters will be forwarded promptly to the Independent Chair of the Board or relevant Director.

The Company’s Corporate Governance Principles and Practices and the charters of all Board committees are available on the Company’s website at www.Emerson.com, Company, Investors, Corporate Governance. The foregoing documents are available in print to shareholders upon written request delivered to Emerson Electric Co., 8000 West Florissant Avenue, St. Louis, Missouri 63136, Attn: Secretary.

Additional Filings

The Company’s Forms 10-K, 10-Q, 8-K and all amendments to those reports are available without charge through the Company’s website on the internet as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. They may be accessed as follows: www.Emerson.com, Company, Investors, SEC filings. Information on our website does not constitute part of this proxy statement.

Householding of Proxies

The SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for annual reports, proxy statements and notices of internet availability of proxy materials with respect to two or more shareholders sharing the same address by delivering a single annual report, proxy statement and/or a notice of internet availability of proxy materials addressed to those shareholders. This process, which is commonly referred to as “householding,” can provide extra convenience for shareholders and cost savings for companies. The Company and some brokers household annual reports, proxy materials and notices of internet availability of proxy materials, delivering a single annual report, proxy statement and/or notice of internet availability of proxy materials to multiple shareholders sharing an address unless contrary instructions have been received from the affected shareholders.

Once you have received notice from your broker or the Company that your broker or the Company will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no

|

|

|

| 82 |

|

PROXY STATEMENT FOR EMERSON 2024 ANNUAL MEETING OF SHAREHOLDERS |

Appendix C

Emerson Electric Co. 2024 Equity Incentive Plan

Emerson Electric Co.

2024 Equity Incentive Plan

1. Purpose. The purpose of the 2024 Equity Incentive Plan (the “Plan”) of Emerson Electric Co. (“Emerson” or the “Company”), is to provide the Company the ability to attract and retain talented individuals to serve as officers and employees of the Company through competitive market-based compensation practices. As an integral component of our compensation practices, the Plan encourages Participant equity ownership which provides a strong financial incentive for Participants to strive to meet the Company’s business and strategic objectives that drive shareholder value.

2. Definitions. As used in the Plan, the following words and phrases will have the meanings specified below, unless the context clearly indicates otherwise:

(a) “1933 Act” means the Securities Act of 1933, as amended, and all regulations, guidance and other interpretative authority issued thereunder.

(b) “1934 Act” means the Securities Exchange Act of 1934, as amended, and all regulations, guidance and other interpretative authority issued thereunder.

(c) “Acquisition Award” means Awards granted under the Plan through the settlement, assumption or substitution of outstanding Awards, or through obligations to grant future Awards, in connection with the Company acquiring another entity.

(d) “Award” means a grant of Performance Shares, Restricted Shares, Restricted Stock Units, Options, SARs, and Other Share-Based Awards in accordance with the terms of the Plan.

(e) “Board” means the Board of Directors of the Company.

(f) “CEO” means the Chief Executive Officer of the Company.

(g) “Change of Control” of the Company shall mean:

(i) the purchase or acquisition by any person, entity or group of persons, within the meaning of Section 13(d) or 14(d) of the 1934 Act (excluding, for this purpose, the Company or its subsidiaries or any employee benefit plan of the Company or its subsidiaries), of beneficial ownership (within the meaning of Rule 13d-3 under the 1934 Act) of 20% or more of either the then-outstanding Shares or the combined voting power of Emerson’s then-outstanding voting securities entitled to vote in the election of directors;

(ii) the consummation of (A) any reorganization, merger, consolidation or similar transaction involving Emerson, other than a reorganization, merger, consolidation or similar transaction in which the Company’s shareholders immediately prior to such transaction own more than 50% of the combined voting power entitled to vote in the election of directors of the surviving corporation, (B) any sale, lease, exchange or other transfer (in one transaction or a series of related transactions) of all or substantially all of the assets of Emerson, or (C) the liquidation or dissolution of Emerson; or

(iii) individuals who, as of the date hereof, constitute the Board (the “Incumbent Board”) ceasing for any reason to constitute at least a majority of the Board, provided that any person who becomes a director subsequent to the date hereof whose election, or nomination for election by the Company’s shareholders, was approved by a vote of at least a majority of the directors then comprising the Incumbent Board (other than an individual whose initial assumption of office is in connection with an actual or threatened election contest relating to the election of directors of the Company) shall be, for purposes of this section, considered as though such person were a member of the Incumbent Board.

To the extent required to avoid the adverse tax consequences under Section 409A of the Code, a Change of Control shall be deemed to occur only to the extent it also meets the requirements for a change in control event for purposes of Section 409A of the Code.

(h) “Code” means the Internal Revenue Code of 1986, as amended.

(i) “Committee” means the Compensation Committee of the Board or such other committee of the Board as may be authorized from time to time by the Board.

(j) “Common Stock” means Common Stock, $0.50 par value per share, of the Company.

(k) “Company” means Emerson Electric Co., a Missouri corporation.

|

|

|

|

|

| |

C-1 |

|

|

PROXY STATEMENT FOR EMERSON 2024 ANNUAL MEETING OF SHAREHOLDERS |

Appendix C

(l) “Double Trigger Event” shall be deemed to occur with respect to an Award if (X) following such Change of Control, the Participant is involuntarily terminated other than for cause or (Y) within two years following such Change of Control, the Participant terminates in one of the following circumstances, which are not remedied by the Company or its successor within 30 days after its receipt of a written notice from the Participant describing the applicable circumstances (which notice must be provided by the Participant within 90 days after the Participant’s knowledge of the applicable circumstances): (a) the Participant’s compensation, title, duties or responsibilities are substantially reduced or adversely affected, or (b) the Participant is required to relocate by more than 50 miles the location at which the Participant must provide services as a condition to continued employment, in each case, without written consent; provided that in each case, the Participant must actually terminate employment within 30 days following the Company’s 30 day cure period specified herein.

(m) “Fair Market Value” means, as of any date, the closing price of the Company’s Common Stock as reported on the New York Stock Exchange or such other stock exchange or quotation system on which the Shares are then principally listed or quoted; provided, however, that the Committee may adopt any criterion for the determination of such fair market value as it may determine to be appropriate.

(n) “Full Value Award” means any Award that is settled in Shares other than: (a) an Option, (b) a SAR or (c) any other Award for which the Participant pays the intrinsic value existing as of the date of grant (whether directly or by forgoing a right to receive a payment from the Company or any subsidiary).

(o) “Participant” means any eligible individual approved to receive an Award pursuant to Section 4.

(p) “Performance Objectives” means any objectives that the Committee establishes with respect to an Award, which may be based upon, without limitation, one or more of the following criteria, or such other criteria as the Committee may determine: sales, profit, operating profit, earnings before interest and taxes (EBIT), adjusted EBIT, earnings before interest, taxes, and amortization (EBITA), adjusted EBITA, earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted EBITDA, pre-tax earnings, earnings, net earnings, any related margins, earnings per share (EPS), adjusted EPS, asset management, cash flow, operating cash flow, free cash flow, free cash flow conversion, days sales outstanding, days payables outstanding, inventory turnover, return on total capital, return on equity, total shareholder return, relative total shareholder return, share price, acquisition and divestiture performance, development and achievement of strategic business objectives, customer satisfaction, new product introductions and performance, cost reductions, manufacturing efficiency, delivery lead time performance, research and development achievements, market share, working capital, geographic expansion, non-cash equity based compensation expense, human resources management, and development and achievement of ESG goals and objectives (including, without limitation, goals regarding diversity, equity and inclusion and the reduction in greenhouse gas emissions).

The Performance Objectives may include or exclude specified items of an unusual, non-recurring or extraordinary nature including, without limitation, acquisitions or dispositions, changes in accounting methods, changes in inventory methods, changes in corporate taxation, unusual accounting gains and losses, changes in financial accounting standards, or other extraordinary events causing dilution of or diminution in the Company’s financial results, all as the Committee may deem necessary or desirable to accomplish the purposes of the performance program.

(q) “Other Share-Based Awards” means the Awards described in Section 9.

(r) “Performance Shares” means the right to receive payment (as determined by the Committee) if one or more specified Performance Objectives are achieved.

(s) “Plan” means the 2024 Equity Incentive Plan of Emerson Electric Co.

(t) “Restricted Shares” are an Award of Shares subject to restrictions and forfeiture.

(u) “Restricted Stock Unit” represents the right to receive one Share on the terms and conditions set forth herein.

(v) “SAR” means a stock appreciation right.

(w) “SAR Award Amount” means (i) the excess of the Fair Market Value of one Share on the date of exercise over (A) the Fair Market Value on the date the SAR was granted or (B) in the case of an alternative SAR, the per share Option price for the Option in respect of which the alternative SAR was granted multiplied by (ii) the number of Shares as to which the SAR is exercised.

(x) “Shares” means shares of Common Stock.

(y) “Incentive Stock Option” means an Option to purchase Shares which meets the requirements of Section 422 of the Code, or any successor provision, and which is intended by the Committee to constitute an Incentive Stock Option.

(z) “Nonqualified Stock Option” means an Option that is not an Incentive Stock Option.

(aa) “Option” means the right to purchase Shares at a stated price for a specified period of time.

|

|

|

| PROXY STATEMENT FOR EMERSON 2024 ANNUAL MEETING OF SHAREHOLDERS |

|

C-2 |

Appendix C

9. Other Share-Based Awards. Subject to the terms of this Plan, the Committee may grant to Participants other types of Awards not described in Sections 6, 7 and 8, which shall be denominated or payable in, valued in whole or in part by reference to, or otherwise based on, Shares, either alone or in addition to or in conjunction with other Awards, and payable in Shares or cash. Without limitation, such Other Share-Based Award may include the issuance of (a) unrestricted Shares, which may be awarded in lieu of cash compensation to which a Participant is otherwise entitled, in exchange for cancellation of a compensation right (except as prohibited by Section 13(h)), as a bonus, upon the attainment of Performance Goals or otherwise or (b) rights to acquire Shares from the Company. The Committee shall determine all terms and conditions of any Other Share-Based Award, including but not limited to, the time or times at which such Awards shall be made, and the number of Shares to be granted pursuant to such Awards or to which such Award shall relate; provided that any Other Share-Based Award that provides for purchase rights shall be priced at 100% of Fair Market Value on the date of grant of the Award; and provided further that the date of grant cannot be prior to the date the Committee takes action to approve the Award.

10. Change of Control. With respect to a Participant, to the extent the Participant has in effect an Award agreement, or employment, retention, change of control, severance or similar agreement, or is covered by a change of control, severance or similar plan or policy that specifically provides for the treatment of an Award upon a Change of Control (or upon certain terminations of employment or service following a Change of Control), then such provisions shall control over the remainder of the provisions of this Section 10. In all other cases, the following provisions of this Section 10 shall apply.

(a) If a Double Trigger Event occurs with respect to an Award in connection with a Change of Control, Participants then holding such Awards shall hold such Awards fully vested, and, to the extent applicable, be entitled to receive a payout, assuming, with respect to Awards subject to Performance Objectives for which the performance period has not been completed at the time of the Change of Control, that the specified performance periods had elapsed and the Performance Objectives relating thereto had been fully achieved (at the highest level provided in the Award, whether target, or maximum, as applicable) free of any conditions, to the extent consistent with Code Section 409A.

(b) If holders of Performance Shares are entitled to payment pursuant to Section 10(a) in respect of a Double Trigger Event, then the required payment shall be made in cash. Any payment pursuant to this Section 10 will be made at the time and manner specified herein, in the applicable Award or as otherwise provided under a deferral election.

(c) The Committee shall have discretion to determine whether Awards are being appropriately assumed or substituted in connection with a Change of Control. Without limiting the generality of the foregoing, the Committee shall have the authority to determine that Awards granted under the Plan are being appropriately assumed or substituted if the terms of such Awards remain substantially the same except that (i) following the Change of Control each such Award shall become entitled to the consideration received by the holder of one share of Common Stock pursuant to such Change of Control, or, (ii) if such consideration does not consist solely of shares of the acquirer’s common stock, each Award becomes entitled to an amount of the acquirer’s common stock equal in fair value to the consideration received by the holder of one share of Common Stock in such Change of Control.

(d) The Committee shall have authority to devise procedures allowing for such assumption or such payment or any other procedures the Committee determines to be appropriate to administer the Awards in connection with a Change of Control.

(e) If the Committee determines that Awards granted under the Plan are being appropriately assumed by, or equivalent awards are being substituted by, the acquirer, then no waiver or consent shall be required of any Participant to make effective, nor may any such Participant object to, such assumption or substitution by the acquirer.

(f) In addition, in the event of a Change of Control, if the Committee determines that Awards are not being appropriately assumed by the acquirer or an equivalent award substituted by the acquirer or where the Committee determines that cash or cash equivalents are the sole or primary form of consideration to be received by the shareholders of the Company in connection with the Change of Control), the Committee may cancel any outstanding Awards and pay to the holders thereof, in cash or stock, or any combination thereof, the value of such Awards based upon the price per share of Common Stock received or to be received by other shareholders of the Company in the event, to the extent consistent with Section 409A of the Code. In the case of any Option or SAR with an exercise price (or the Fair Market Value on the date the SAR was granted in the case of a SAR) that equals or exceeds the price paid for a share of Common Stock in connection with the Change in Control, the Committee may cancel the Option or SAR without the payment of consideration therefor.

11. Adjustments for Changes in Common Stock and Certain Other Events. In the event of stock dividends, extraordinary cash dividends, recapitalizations, mergers, consolidations, stock splits, spin-offs, split-offs, split-ups, combinations, spin-outs, reverse stock splits or similar matters affecting outstanding Shares during the term of the Plan, appropriate revision shall be made (i) the aggregate number and class of Shares available under the Plan and the individual limits set forth in Section 5(d), (ii) in the applicable Performance Objectives of performance programs, (iii) for the adjustment in the number and class of Shares subject to each outstanding Option or SAR, the Option prices and SAR exercise amounts, and (iv) in the number and kind of shares of common stock or other consideration awarded to reflect the effect of such stock dividend, extraordinary cash dividend, recapitalization, merger, consolidation, stock split, spin-off, split-off, split-up, combination, exchange of shares, spin-out, reverse stock split or similar matter on the interests of the Participants in the Plan. In the event the Company, a subsidiary or an affiliate, enters into a transaction described in Section 424(a) of the Code with any other corporation, the Committee may grant Options or SARs to employees or former employees of such corporation in substitution of Options or SARs previously granted to them upon such terms and conditions as shall be necessary to qualify such grant as a substitution described in Section 424(a) of the Code.

|

|

|

|

|

| |

C-7 |

|

|

PROXY STATEMENT FOR EMERSON 2024 ANNUAL MEETING OF SHAREHOLDERS |

Appendix C

12. Non-Assignability. Rights under the Plan and in respect of Shares issued or delivered under the Plan are not transferable and may not be assigned or pledged by any Participant at any time, and no recognition shall be required to be given by the Company to any attempted assignment of any rights hereunder or of any attempted assignment of the Shares. This non-assignability shall not apply to any Shares delivered to Participants hereunder after such Shares shall be fully vested in the holder thereof, except the transfer or resale of Shares may be restricted by applicable securities laws, including by reason of the 1933 Act as set forth in Section 13(a) hereof.

13. Additional Provisions Applicable to Awards.

(a) Payments in Common Stock. Shares delivered to Participants hereunder in satisfaction of Awards so delivered after the release of any conditions applicable thereto may nonetheless thereafter be restricted stock under the Securities Act of 1933, as amended (the “1933 Act”), and the certificates for such Shares may have a legend imprinted thereon restricting the resale, hypothecation or further transfer of said Shares except in a registered offering or pursuant to an available exemption from registration.

(b) No Rights as Shareholder. The grant of an Award to a Participant in the Plan shall create no rights in such Participant as a shareholder of the Company until such time and to the extent that the Participant is delivered Shares pursuant to such Participant’s Award; provided that holders of Restricted Shares granted hereunder shall have such rights as are expressly provided for herein and in the terms of the Award.

(c) Form of Awards. The Committee may establish one or more forms of Award certificates or agreements which set forth terms or conditions of Awards, including confidentiality, noncompetition, nonsolicitation or other restrictive covenants or other provisions.

(d) Time of Award. An Award under the Plan shall be deemed to be made on the date on which the Committee, by formal action of its members duly recorded in the records thereof makes an Award, provided that such Award is evidenced by a written notice, certificate or agreement executed on behalf of the Company within a reasonable time after the date of such action. Notwithstanding the foregoing, the Committee may require as a condition to the effectiveness of any Award that an Award agreement with respect to such Award be executed on behalf of the Company and/or by the Participant to whom the Award evidenced thereby shall have been granted and such executed Award agreement be delivered to the Company.

(e) Compliance with Applicable Law. Notwithstanding any other provision of this Plan, the Company shall have no obligation to grant any Award or issue any Shares under the Plan or make any other distribution of benefits under this Plan unless, in the opinion of the Company, such grant, issuance, delivery or distribution would comply with all applicable laws (including, without limitation, the registration and other requirements of the 1933 Act or the laws of any state or foreign jurisdiction) and the applicable requirements of any securities exchange or similar entity.

The Company shall be under no obligation to any Participant to register for offering or resale, or to qualify for exemption under the 1933 Act, or to register or qualify under the laws of any state or foreign jurisdiction, any Common Stock, security or interest in a security paid or issued under, or created by, the Plan, or to continue in effect any such registrations or qualifications if made. The Company may issue certificates for Shares delivered pursuant to Awards with such legends and subject to such restrictions on transfer and stop-transfer instructions as counsel for the Company deems necessary or desirable for compliance by the Company with federal, state and foreign securities laws. The Company may also require such other action or agreement by the Participants as may from time to time be necessary to comply with applicable securities laws.

To the extent the Plan or any instrument evidencing an Award provides for issuance of stock certificates to reflect the issuance of Shares, the issuance may be effected on a noncertificated basis, to the extent not prohibited by applicable law or the applicable rules of any stock exchange.

(f) Minimum Vesting Period. Except for Acquisition Awards, all Awards granted under the Plan that may be settled in Shares must have a minimum vesting period of one (1) year from the date of grant, provided that such minimum vesting period will not apply to Awards with respect to up to five percent (5%) of the number of shares covered by the Plan, provided, however, that the foregoing does not prohibit the Committee from granting Awards that contain rights to accelerated vesting on termination of employment, retirement, death or disability or otherwise accelerate vesting.

(g) Dividends and Dividend Equivalents.

(i) The Committee may authorize the payment of an amount equal to cash dividends on Awards of Performance Shares or Restricted Stock Units, or on a portion thereof, awarded to Participants in the Plan; provided that, if the Committee determines that all or any portion of any such Award is not earned, vested or payable, then any dividend equivalents paid on Shares in excess of the total Shares ultimately earned, vested or payable under the applicable Award will be subject to recovery, deduction and clawback by the Company, including, but not limited to, through reduction of any payout of any Award. Unless otherwise determined by the Committee, Restricted Shares shall be entitled to receive cash dividends when paid on the Shares; provided that, if the Committee determines that all or any portion of any such Award is not earned, vested or payable, then any dividends paid on Shares in excess of the total Shares ultimately earned, vested or payable under the applicable Award may be subject to recovery, deduction and clawback by the Company, including, but not limited to, through reduction of any payout of any Award.

(ii) In no event shall the Plan or any Award agreement hereunder provide that dividend equivalents or any similar cash payments be made with respect to any Options or SARs granted under the Plan.

|

|

|

| PROXY STATEMENT FOR EMERSON 2024 ANNUAL MEETING OF SHAREHOLDERS |

|

C-8 |

Appendix C

(h) Prohibition on Repricing. Without prior shareholder approval, in no event (other than as provided under Section 11) shall (i) the Plan or any Award agreement hereunder be amended or adjusted to reduce the exercise price of any outstanding Option or SAR, (ii) outstanding Options or SARS be canceled in exchange for either (x) Options or SARs with a lower exercise price or (y) any other equity or non-equity plan award, or (iii) the Company repurchase any Option or SAR which has an exercise price less than the then current fair market value of the Common Stock.

(i) Withholding. The Committee may require the Company to withhold from any payment due to a Participant (under this Plan or otherwise) any amount necessary to satisfy income tax withholding requirements in respect of any payment due under this Plan; and for this purpose may withhold cash and the Shares deliverable in respect of any Award. Alternatively, the Committee may require the Participant to pay to the Company such cash amount or additional cash amount as may be necessary to satisfy withholding requirements in which case such Participant shall be entitled to receive delivery of all Shares due hereunder. Upon vesting of any Award, the Company may withhold sufficient Shares to satisfy its withholding obligations for federal, state, local income and other taxes regardless of jurisdiction on such payment, or may withhold cash from any amounts otherwise payable with respect to the Award. Notwithstanding the foregoing, for any Award under the Plan, in the case of a Participant who is subject to Section 16 of the 1934 Act, the Company shall, as required by applicable law, withhold sufficient Shares to satisfy the Company’s obligation to withhold for federal, state and other taxes regardless of jurisdiction, provided that prior to such withholding, the Committee may approve in advance an alternative method of withholding.

(j) Fractional Shares. No fractional Shares shall be issued under the Plan, and the Committee shall determine the treatment of any fractional Shares that would otherwise be payable in connection with any Award.

14. Miscellaneous.

(a) Amendments. The Committee shall have the authority to make amendments and revisions of this Plan, provided that no amendments or revisions of the Plan shall be made without the consent of the shareholders of the Company if such amendment or revision would increase the aggregate number of Shares which may be granted or securities which may be issued under the Plan or which would, by applicable law or rule, require such approval.

(b) No Right of Continued Service. No Participant in the Plan shall have any right as a Participant in the Plan to continue in the employ of the Company or of any of its subsidiaries for any period of time, or any right to a continuation of such Participant’s present or any other rate of compensation; and such rights and powers as the Company now has or which it may have in the future to dismiss or discharge any Participant from employment or to change the assignments of any Participant are expressly reserved to the Company.

(c) Relationship to Other Benefits. No payment under the Plan will be taken into account in determining any benefits under any pension, retirement, savings, profit sharing, group insurance, welfare or other benefit plan of the Company or any subsidiary, except as expressly provided in writing in such other plan or an agreement thereunder.

(d) Term of Plan; Approval by Shareholders. The term of the Plan shall become effective on the date of its approval by the shareholders of the Company. The Plan shall terminate ten (10) years after such date of shareholder approval or earlier if the Board, in its discretion, elects to terminate the Plan. Awards outstanding at the time of any Plan termination will continue in full force and effect and will not be affected thereby.

(e) Separability of Provisions. With respect to Participants subject to Section 16 of the 1934 Act, this Plan and transactions hereunder are intended to comply with all applicable provisions of Rule 16b-3 or its successors. To the extent that any provision of the Plan or action of the Committee fails to so comply, it shall be deemed null and void to the extent permitted by law and deemed advisable by the Committee.

(f) Governing Law. To the extent that Federal law does not otherwise control, the Plan shall be governed by and construed in accordance with the laws of the State of Missouri, without regard to the conflict of laws rules thereof.

(g) Clawback. Notwithstanding any other provisions of this Plan, any Award under this Plan shall be subject to such deductions, clawback, recoupment or recovery as may be required to be made (x) pursuant to any applicable policy adopted by the Company which provides for such deduction, clawback, recoupment or recovery, as currently effective or subsequently amended, or (y) to the extent required pursuant to any currently effective or subsequently adopted law, government regulation or stock exchange listing requirement. Any Award under this Plan shall be conditioned upon the Participant’s compliance with all practices and policies under the Company’s Ethics and Compliance Program, including the Company’s Code of Conduct and Code of Ethics, and that a Participant’s actions will reflect the Company’s Core Value of Integrity. Any violation of the Company’s Ethics and Compliance Program may result in the forfeiture of any Award under this Plan or the repayment of any amounts paid under any Award under this Plan.

(h) Data Privacy. As a condition for receiving any Award, each Participant explicitly and unambiguously consents to the collection, use and transfer, in electronic or other form, of personal data as described in this Section by and among the Company and its subsidiaries and affiliates exclusively for implementing, administering and managing the Participant’s participation in the Plan. The Company and its subsidiaries and affiliates may hold certain personal information about a Participant, including the Participant’s name, address and telephone number; birthdate; social security, insurance number or other identification number; salary; nationality; job title(s); any Shares held in the Company or its subsidiaries and affiliates; and Award details (the “Data”), to

|

|

|

|

|

| |

C-9 |

|

|

PROXY STATEMENT FOR EMERSON 2024 ANNUAL MEETING OF SHAREHOLDERS |

Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Sep. 30, 2023 |

Sep. 30, 2022 |

Sep. 30, 2021 |

| Pay vs Performance Disclosure |

|

|

|

| Pay vs Performance Disclosure, Table |

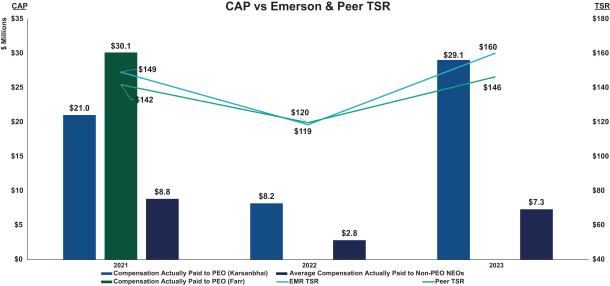

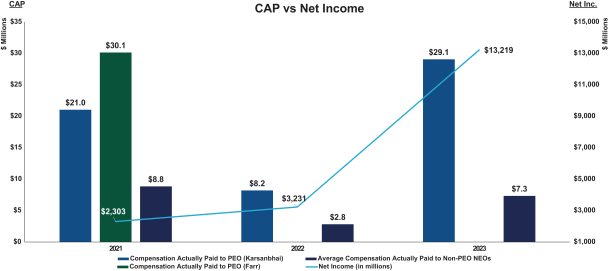

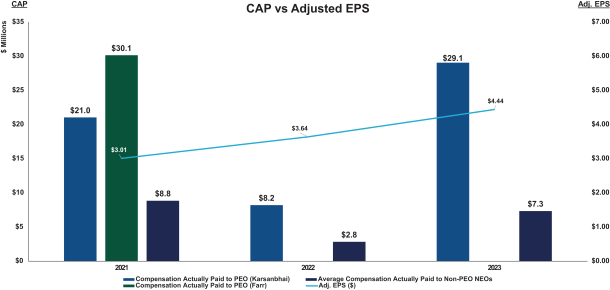

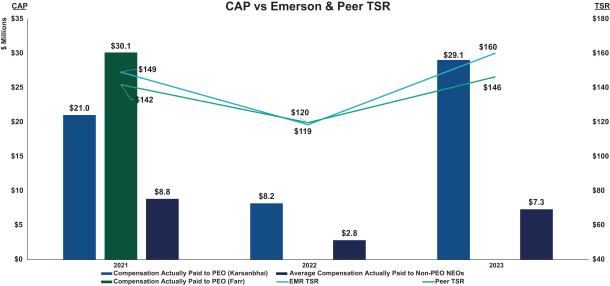

As required by Item 402(v) of Regulation S-K, the following table and accompanying narrative sets forth information concerning the compensation of our NEOs for each of the last three fiscal years and our financial performance for each such year in accordance with the SEC’s pay versus performance (“PVP”) disclosure rules. Under the PVP rules, the SEC has developed a new definition of pay, referred to as compensation actually paid (“CAP”), which is compared here to certain performance measures defined by the SEC. The Committee does not use CAP as a basis for making compensation decisions, nor does it use the performance measures defined by the SEC for the PVP table to measure performance for incentive plan purposes. Refer to “Compensation Discussion and Analysis” above for details on how we align pay with performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary

Compensation

Table Total for

PEO(1) |

|

Summary

Compensation

Table Total for

PEO(1) |

|

Compensation

Actually Paid

to PEO(1)(2)

(Karsanbhai) |

|

Compensation

Actually Paid

to PEO(1)(2)

(Farr) |

|

Average

Summary

Compensation

Table Total for

non-PEO

Named

Executive

Officers(1) |

|

Average

Compensation

Actually Paid

to non-PEO

NEOs (1)(2) |

|

Value of Initial

Fixed $100

Investment

Based On: |

|

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

$ |

18,317,194 |

|

|

|

|

N/A |

|

|

|

$ |

29,057,107 |

|

|

|

|

N/A |

|

|

|

$ |

4,795,129 |

|

|

|

$ |

7,335,684 |

|

|

|

|

160.11 |

|

|

|

|

146.36 |

|

|

|

$ |

13,219 |

|

|

|

$ |

4.44 |

|

| |

|

|

|

|

|

|

|

|

|

|

2022 |

|

|

$ |

15,178,106 |

|

|

|

|

N/A |

|

|

|

$ |

8,202,846 |

|

|

|

|

N/A |

|

|

|

$ |

5,294,490 |

|

|

|

$ |

2,830,506 |

|

|

|

|

118.57 |

|

|

|

|

114.23 |

|

|

|

$ |

3,231 |

|

|

|

$ |

3.64 |

|

| |

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

$ |

15,806,036 |

|

|

|

$ |

15,066,763 |

|

|

|

$ |

21,037,695 |

|

|

|

$ |

30,144,401 |

|

|

|

$ |

5,524,580 |

|

|

|

$ |

8,847,430 |

|

|

|

|

149.12 |

|

|

|

|

134.55 |

|

|

|

$ |

2,303 |

|

|

|

$ |

3.01 |

|

| (1) |

The principal executive officer (“PEO”) and the non-PEO NEOs for each fiscal year are as follows: 2023 – PEO: S. L. Karsanbhai; NEOs: M. J. Baughman, R. R. Krishnan, S. Y. Bosco, M. H. Train and F. J. Dellaquila; 2022 – PEO: S. L. Karsanbhai; NEOs: F. J. Dellaquila, R. R. Krishnan, M. J. Bulanda and S. Y. Bosco; 2021 – PEOs: S. L. Karsanbhai and D. N. Farr; NEOs: F. J. Dellaquila, R. R. Krishnan, M. J. Bulanda, J. P. Froedge, and M. H. Train. |

| (2) |

In determining the “compensation actually paid” to our NEOs, we are required to make various adjustments to amounts that have been previously reported in the Summary Compensation Table (“SCT”) in previous years, as the SEC’s required valuation methods for this disclosure differ from those required in the SCT. The table below provides the adjustments to the SCT total compensation made to arrive at the compensation actually paid for the PEO and the average for Non-PEO NEOs. The amounts below for performance shares assume that the targeted award is earned, with actual amounts used for the year in which the award vests. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

SCT Total Compensation |

|

$ |

18,317,194 |

|

|

$ |

4,795,129 |

|

|

|

|

|

|

$ |

15,178,106 |

|

|

$ |

5,294,490 |

|

|

|

|

|

|

$ |

15,806,036 |

|

|

$ |

15,066,763 |

|

|

$ |

5,524,580 |

|

| |

|

|

|

|

|

|

|

|

|

Less: Stock Awards column in the SCT |

|

$ |

(12,912,123 |

) |

|

$ |

(2,271,575 |

) |

|

|

|

|

|

$ |

(11,060,131 |

) |

|

$ |

(3,015,166 |

) |

|

|

|

|

|

$ |

(12,651,359 |

) |

|

$ |

(11,599,962 |

) |

|

$ |

(3,920,122 |

) |

| |

|

|

|

|

|

|

|

|

|

Less: Change in the Pension Value column of SCT |

|

$ |

(11,000 |

) |

|

$ |

(308,200 |

) |

|

|

|

|

|

$ |

— |

|

|

$ |

(494,250 |

) |

|

|

|

|

|

$ |

(16,000 |

) |

|

$ |

— |

|

|

$ |

(171,200 |

) |

| |

|

|

|

|

|

|

|

|

|

Add: Fair value of unvested stock awards granted in FY, determined at FYE (a) |

|

$ |

14,327,521 |

|

|

$ |

2,548,659 |

|

|

|

|

|

|

$ |

8,038,447 |

|

|

$ |

2,191,408 |

|

|

|

|

|

|

$ |

15,000,973 |

|

|

$ |

15,729,328 |

|

|

$ |

4,955,598 |

|

| |

|

|

|

|

|

|

|

|

|

Change in fair value of outstanding and unvested stock awards granted in prior FYs from prior FYE to applicable FYE (b) |

|

$ |

4,325,440 |

|

|

$ |

787,787 |

|

|

|

|

|

|

$ |

(3,760,581 |

) |

|

$ |

(1,059,805 |

) |

|

|

|

|

|

$ |

1,553,550 |

|

|

$ |

4,512,346 |

|

|

$ |

1,494,446 |

|

| |

|

|

|

|

|

|

|

|

|

Change in fair value of stock awards granted during prior FYs that vested during the applicable FY, based on change in fair value from prior FY end to vesting date(c) |

|

$ |

4,246,211 |

|

|

$ |

1,468,230 |

|

|

|

|

|

|

$ |

(568,314 |

) |

|

$ |

(466,769 |

) |

|

|

|

|

|

$ |

990,662 |

|

|

$ |

4,861,164 |

|

|

$ |

647,294 |

|

| |

|

|

|

|

|

|

|

|

|

Add: Dividends paid during applicable FY prior to vesting date (to the extent not otherwise included) (d) |

|

$ |

763,865 |

|

|

$ |

232,224 |

|

|

|

|

|

|

$ |

375,318 |

|

|

$ |

223,617 |

|

|

|

|

|

|

$ |

353,833 |

|

|

$ |

992,846 |

|

|

$ |

231,933 |

|

| |

|

|

|

|

|

|

|

|

|

Add: Service cost for pension plans(e) |

|

$ |

— |

|

|

$ |

83,430 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

156,982 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

581,917 |

|

|

$ |

84,902 |

|

| |

|

|

|

|

|

|

|

|

|

Add: Prior service cost for pension plans (f) |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

Compensation Actually Paid |

|

$ |

29,057,107 |

|

|

$ |

7,335,684 |

|

|

|

|

|

|

$ |

8,202,846 |

|

|

$ |

2,830,506 |

|

|

|

|

|

|

$ |

21,037,695 |

|

|

$ |

30,144,401 |

|

|

$ |

8,847,430 |

|

|

(a) |

For each fiscal year includes performance share awards granted that year. For fiscal 2021 and fiscal 2022, also includes restricted stock awards granted that year. Amounts are computed in accordance with FASB ASC Topic 718 and do not correspond to the actual value that will be realized. |

|

(b) |

For each fiscal year includes change in fair value for performance share awards, restricted stock awards and RSU awards granted in prior fiscal years that remain outstanding and unvested at the end of that year. |

|

(c) |

For each fiscal year includes change in fair value for performance shares awards earned for the performance period ending on September 30 of that fiscal year and restricted stock that vested that year, as of the vesting date. |

|

(d) |

Includes the value of dividends on restricted stock and dividend equivalents on performance shares for each fiscal year prior to the vesting date. |

|

(e) |

Includes for each fiscal year, the service cost calculated as the actuarial present value of each NEO’s benefit under pension plans attributable to services rendered during the covered fiscal year. |

|

(f) |

Includes for each fiscal year, the prior service cost, calculated as the entire cost of benefits granted (or credit for benefits reduced) in a plan amendment (or initiation) during the covered fiscal year that are attributed by the benefit formula to services rendered in periods prior to the amendment (or initiation). |

| (3) |

For each fiscal year, includes the cumulative TSR of the Company since September 30, 2020 and the S&P 500 Capital Goods Ind e x calculated in a manner consistent with our stock performance graph in our Annual Report to Shareholders, assuming $100 invested on September 30, 2020 in stock or index, including reinvestment of dividends. |

| (4) |

For each fiscal year, consists of net earnings as disclosed in our annual financial statements, which includes the impact of discontinued operations. In 2023, this impact included the significant gains from the sale of the Company’s majority interest in its Climate Technologies business and the sale of its InSinkErator business. Earnings from continuing operations for each year were: 2023-$2,152, 2022-$1,886 and 2021-$1,414. |

| (5) |

Adjusted EPS is calculated as described in Appendix D, GAAP to Non-GAAP Reconciliations. |

|

|

|

| Company Selected Measure Name |

Adjusted EPS

|

|

|

| Named Executive Officers, Footnote |

| (1) |

The principal executive officer (“PEO”) and the non-PEO NEOs for each fiscal year are as follows: 2023 – PEO: S. L. Karsanbhai; NEOs: M. J. Baughman, R. R. Krishnan, S. Y. Bosco, M. H. Train and F. J. Dellaquila; 2022 – PEO: S. L. Karsanbhai; NEOs: F. J. Dellaquila, R. R. Krishnan, M. J. Bulanda and S. Y. Bosco; 2021 – PEOs: S. L. Karsanbhai and D. N. Farr; NEOs: F. J. Dellaquila, R. R. Krishnan, M. J. Bulanda, J. P. Froedge, and M. H. Train. |

|

|

|

| Peer Group Issuers, Footnote |

| (3) |

For each fiscal year, includes the cumulative TSR of the Company since September 30, 2020 and the S&P 500 Capital Goods Ind e x calculated in a manner consistent with our stock performance graph in our Annual Report to Shareholders, assuming $100 invested on September 30, 2020 in stock or index, including reinvestment of dividends. |

|

|

|

| PEO Total Compensation Amount |

$ 18,317,194

|

$ 15,178,106

|

$ 15,066,763

|

| PEO Actually Paid Compensation Amount |

$ 29,057,107

|

8,202,846

|

|

| Adjustment To PEO Compensation, Footnote |

| (2) |

In determining the “compensation actually paid” to our NEOs, we are required to make various adjustments to amounts that have been previously reported in the Summary Compensation Table (“SCT”) in previous years, as the SEC’s required valuation methods for this disclosure differ from those required in the SCT. The table below provides the adjustments to the SCT total compensation made to arrive at the compensation actually paid for the PEO and the average for Non-PEO NEOs. The amounts below for performance shares assume that the targeted award is earned, with actual amounts used for the year in which the award vests. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

SCT Total Compensation |

|

$ |

18,317,194 |

|

|

$ |

4,795,129 |

|

|

|

|

|

|

$ |

15,178,106 |

|

|

$ |

5,294,490 |

|

|

|

|

|

|

$ |

15,806,036 |

|

|

$ |

15,066,763 |

|

|

$ |

5,524,580 |

|

| |

|

|

|

|

|

|

|

|

|

Less: Stock Awards column in the SCT |

|

$ |

(12,912,123 |

) |

|

$ |

(2,271,575 |

) |

|

|

|

|

|

$ |

(11,060,131 |

) |

|

$ |

(3,015,166 |

) |

|

|

|

|

|

$ |

(12,651,359 |

) |

|

$ |

(11,599,962 |

) |

|

$ |

(3,920,122 |

) |

| |

|

|

|

|

|

|

|

|

|

Less: Change in the Pension Value column of SCT |

|

$ |

(11,000 |

) |

|

$ |

(308,200 |

) |

|

|

|

|

|

$ |

— |

|

|

$ |

(494,250 |

) |

|

|

|

|

|

$ |

(16,000 |

) |

|

$ |

— |

|

|

$ |

(171,200 |

) |

| |

|

|

|

|

|

|

|

|

|

Add: Fair value of unvested stock awards granted in FY, determined at FYE (a) |

|

$ |

14,327,521 |

|

|

$ |

2,548,659 |

|

|

|

|

|

|

$ |

8,038,447 |

|

|

$ |

2,191,408 |

|

|

|

|

|

|

$ |

15,000,973 |

|

|

$ |

15,729,328 |

|

|

$ |

4,955,598 |

|

| |

|

|

|

|

|

|

|

|

|

Change in fair value of outstanding and unvested stock awards granted in prior FYs from prior FYE to applicable FYE (b) |

|

$ |

4,325,440 |

|

|

$ |

787,787 |

|

|

|

|

|

|

$ |

(3,760,581 |

) |

|

$ |

(1,059,805 |

) |

|

|

|

|

|

$ |

1,553,550 |

|

|

$ |

4,512,346 |

|

|

$ |

1,494,446 |

|

| |

|

|

|

|

|

|

|

|

|

Change in fair value of stock awards granted during prior FYs that vested during the applicable FY, based on change in fair value from prior FY end to vesting date(c) |

|

$ |

4,246,211 |

|

|

$ |

1,468,230 |

|

|

|

|

|

|

$ |

(568,314 |

) |

|

$ |

(466,769 |

) |

|

|

|

|

|

$ |

990,662 |

|

|

$ |

4,861,164 |

|

|

$ |

647,294 |

|

| |

|

|

|

|

|

|

|

|

|

Add: Dividends paid during applicable FY prior to vesting date (to the extent not otherwise included) (d) |

|

$ |

763,865 |

|

|

$ |

232,224 |

|

|

|

|

|

|

$ |

375,318 |

|

|

$ |

223,617 |

|

|

|

|

|

|

$ |

353,833 |

|

|

$ |

992,846 |

|

|

$ |

231,933 |

|

| |

|

|

|

|

|

|

|

|

|

Add: Service cost for pension plans(e) |

|

$ |

— |

|

|

$ |

83,430 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

156,982 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

581,917 |

|

|

$ |

84,902 |

|

| |

|

|

|

|

|

|

|

|

|

Add: Prior service cost for pension plans (f) |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

Compensation Actually Paid |

|

$ |

29,057,107 |

|

|

$ |

7,335,684 |

|

|

|

|

|

|

$ |

8,202,846 |

|

|

$ |

2,830,506 |

|

|

|

|

|

|

$ |

21,037,695 |

|

|

$ |

30,144,401 |

|

|

$ |

8,847,430 |

|

|

(a) |

For each fiscal year includes performance share awards granted that year. For fiscal 2021 and fiscal 2022, also includes restricted stock awards granted that year. Amounts are computed in accordance with FASB ASC Topic 718 and do not correspond to the actual value that will be realized. |

|

(b) |

For each fiscal year includes change in fair value for performance share awards, restricted stock awards and RSU awards granted in prior fiscal years that remain outstanding and unvested at the end of that year. |

|

(c) |

For each fiscal year includes change in fair value for performance shares awards earned for the performance period ending on September 30 of that fiscal year and restricted stock that vested that year, as of the vesting date. |

|

(d) |

Includes the value of dividends on restricted stock and dividend equivalents on performance shares for each fiscal year prior to the vesting date. |

|

(e) |