0000032604falseCommon Stock of $0.50 par value per shareEMRCHX00000326042024-02-072024-02-070000032604exch:XNYSemr:CommonStockof0.50parvaluepershareMember2024-02-072024-02-070000032604exch:XNYSemr:A0.375Notesdue2024Member2024-02-072024-02-070000032604exch:XNYSemr:A1.250Notesdue2025Member2024-02-072024-02-070000032604exch:XNYSemr:A2.000Notesdue2029Member2024-02-072024-02-070000032604emr:CommonStockof0.50parvaluepershareMemberexch:XCHI2024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): February 7, 2024

Emerson Electric Co.

-------------------------------------------------

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Missouri | 1-278 | 43-0259330 |

---------------------------------

(State or Other Jurisdiction of Incorporation) | -------------------

(Commission | ---------------------------

(I.R.S. Employer Identification Number) |

| File Number) | |

| | | | | | | | | | | |

| 8000 West Florissant Avenue | | |

| St. Louis, | Missouri | | 63136 |

------------------------------------------------

(Address of Principal Executive Offices) | | ------------------

(Zip Code) |

Registrant’s telephone number, including area code:

(314) 553-2000

------------------------------------------

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock of $0.50 par value per share | EMR | New York Stock Exchange |

| | NYSE Chicago |

| 0.375% Notes due 2024 | EMR 24 | New York Stock Exchange |

| 1.250% Notes due 2025 | EMR 25A | New York Stock Exchange |

| 2.000% Notes due 2029 | EMR 29 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

Quarterly Results Press Release

On Wednesday, February 7, 2024, a press release was issued regarding the first quarter results of Emerson Electric Co. (the “Company”). A copy of this press release is furnished with this Current Report on Form 8-K as Exhibit 99.1.

References to underlying orders in the press release refer to the Company's trailing three-month average orders growth versus the prior year, excluding currency, and significant acquisitions and divestitures.

Non-GAAP Financial Measures

The press release contains non-GAAP financial measures as such term is defined in Regulation G under the rules of the Securities and Exchange Commission. While the Company believes these non-GAAP financial measures are useful in evaluating the Company, this information should be considered as supplemental in nature and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Further, these non-GAAP financial measures may differ from similarly titled measures presented by other companies. The reasons management believes that these non-GAAP financial measures provide useful information are set forth in the Company’s most recent Form 10-K filed with the Securities and Exchange Commission and in the press release furnished with this Form 8-K.

Forward-Looking and Cautionary Statements

Statements in the press release that are not strictly historical may be “forward-looking” statements, which involve risks and uncertainties, and Emerson undertakes no obligation to update any such statements to reflect later developments. These risks and uncertainties include the scope, duration and ultimate impacts of the Russia-Ukraine and other global conflicts, as well as economic and currency conditions, market demand, pricing, protection of intellectual property, cybersecurity, tariffs, competitive and technological factors, inflation, among others, as set forth in the Company's most recent Annual Report on Form 10-K and subsequent reports filed with the SEC. The outlook contained herein represents the Company's expectations for its consolidated results, other than as noted herein.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description of Exhibits |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | EMERSON ELECTRIC CO.

(Registrant) |

| | |

| Date: | February 7, 2024 | By: | /s/ John A. Sperino |

| | | John A. Sperino Vice President and Assistant Secretary |

Emerson Reports First Quarter 2024 Results; Updates 2024 Outlook

ST. LOUIS (February 7, 2024) - Emerson (NYSE: EMR) today reported results1 for its first quarter ended December 31, 2023 and updated its full year outlook for fiscal 2024. Emerson also declared a quarterly cash dividend of $0.525 per share of common stock payable March 11, 2024 to stockholders of record on February 16, 2024.

| | | | | | | | | | | |

| (dollars in millions, except per share) | 2023 Q1 | 2024 Q1 | Change |

Underlying Orders2 | | | 4% |

| Net Sales | $3,373 | $4,117 | 22% |

Underlying Sales3 | | | 10% |

| Pretax Earnings | $422 | $139 | |

| Margin | 12.5% | 3.4% | (910) bps |

Adjusted Segment EBITA4 | $765 | $1,014 | |

| Margin | 22.7% | 24.6% | 190 bps |

| GAAP Earnings Per Share | $0.56 | $0.25 | (55)% |

Adjusted Earnings Per Share5 | $0.78 | $1.22 | 56% |

| Operating Cash Flow | $302 | $444 | 47% |

| Free Cash Flow | $243 | $367 | 51% |

Management Commentary

“Emerson's first quarter results exceeded expectations in key financial metrics including underlying sales, operating leverage and adjusted earnings per share,” said Emerson President and Chief Executive Officer Lal Karsanbhai. “Our strong start to the year, continued focus on execution, and resilient process and hybrid demand provide the confidence to update our 2024 outlook.”

Karsanbhai continued, “NI, now referred to as Test & Measurement, started the year strong delivering robust sales and margins. We have increased and accelerated our synergy plan in Test & Measurement and remain focused on creating value.”

2024 Outlook

The following tables summarize the fiscal year 2024 guidance framework. The 2024 outlook assumes approximately $500 million returned to shareholders through share repurchases and approximately $1.2 billion of dividend payments. Guidance figures are approximate. | | | | | | | | |

| 2024 Q2 | 2024 |

| Net Sales Growth | 12.5% - 14.5% | 14.5% - 17.0% |

| Underlying Sales Growth | 3.5% - 5.5% | 4.5% - 6.5% |

| Earnings Per Share | $0.68 - $0.72 | $2.80 - $2.95 |

| Amortization of Intangibles | ~$0.35 | ~$1.42 |

| Restructuring and Related Costs | ~$0.09 | ~$0.34 |

| Loss on Copeland Equity Method Investment | ~$0.06 | ~$0.20 |

| Amortization of Acquisition-related Inventory Step-up | --- | $0.38 |

| Acquisition / Divestiture Fees and Related Costs | ~$0.04 | ~$0.26 |

| Discrete Tax Benefits | --- | ($0.10) |

| Adjusted Earnings Per Share | $1.22 - $1.26 | $5.30 - $5.45 |

| Operating Cash Flow | | $3.0B - $3.1B |

| Free Cash Flow | | $2.6B - $2.7B |

1 Results are presented on a continuing operations basis.

2 Underlying orders does not include AspenTech.

3 Underlying sales excludes the impact of currency translation, and significant acquisitions and divestitures.

4 Adjusted segment EBITA represents segment earnings less restructuring and intangibles amortization expense.

5 Adjusted EPS excludes intangibles amortization expense, restructuring and related costs, the income/loss of Emerson's 40% share of Copeland, the amortization of acquisition-related inventory step-up, acquisition/divestiture fees and related costs, discrete tax benefits, an AspenTech Micromine purchase price hedge, and write-offs associated with Emerson's Russia exit.

Conference Call

Today, beginning at 8:00 a.m. Central Time / 9:00 a.m. Eastern Time, Emerson management will discuss the first quarter results during an investor conference call. Participants can access a live webcast available at www.emerson.com/investors at the time of the call. A replay of the call will be available for 90 days. Conference call slides will be posted in advance of the call on the company website.

About Emerson

Emerson (NYSE: EMR) is a global technology and software company providing innovative solutions for the world's essential industries. Through its leading automation portfolio, including its majority stake in AspenTech, Emerson helps hybrid, process and discrete manufacturers optimize operations, protect personnel, reduce emissions and achieve their sustainability goals. For more information, visit Emerson.com.

Forward-Looking and Cautionary Statements

Statements in this press release that are not strictly historical may be “forward-looking” statements, which involve risks and uncertainties, and Emerson undertakes no obligation to update any such statements to reflect later developments. These risks and uncertainties include the scope, duration and ultimate impacts of the Russia-Ukraine and other global conflicts, as well as economic and currency conditions, market demand, pricing, protection of intellectual property, cybersecurity, tariffs, competitive and technological factors, inflation, among others, as set forth in the Company's most recent Annual Report on Form 10-K and subsequent reports filed with the SEC. The outlook contained herein represents the Company's expectation for its consolidated results, other than as noted herein.

Emerson uses our Investor Relations website, www.Emerson.com/investors, as a means of disclosing information

which may be of interest or material to our investors and for complying with disclosure obligations under Regulation

FD. Accordingly, investors should monitor our Investor Relations website, in addition to following our press releases,

SEC filings, public conference calls, webcasts and social media. The information contained on, or that may be

accessed through, our website is not incorporated by reference into, and is not a part of, this document.

| | | | | |

| Investors: | Media: |

| Colleen Mettler | Joseph Sala / Greg Klassen |

| (314) 553-2197 | Joele Frank, Wilkinson Brimmer Katcher |

| (212) 355-4449 |

(tables attached)

| | | | | | | | | | | |

| | | Table 1 |

| EMERSON AND SUBSIDIARIES |

| CONSOLIDATED OPERATING RESULTS |

| (AMOUNTS IN MILLIONS EXCEPT PER SHARE, UNAUDITED) |

| | | |

| Quarter Ended Dec 31 |

| 2022 | | 2023 |

| | | |

| Net sales | $ | 3,373 | | | $ | 4,117 | |

| Cost and expenses | | | |

| Cost of sales | 1,753 | | | 2,201 | |

| SG&A expenses | 1,030 | | | 1,277 | |

| | | |

| | | |

| Other deductions, net | 120 | | | 487 | |

| Interest expense, net | 48 | | | 44 | |

Interest income from related party1 | — | | | (31) | |

| Earnings from continuing operations before income taxes | 422 | | | 139 | |

| Income taxes | 98 | | | 7 | |

| Earnings from continuing operations | 324 | | | 132 | |

| Discontinued operations, net of tax | 2,002 | | | — | |

| Net earnings | 2,326 | | | 132 | |

| Less: Noncontrolling interests in subsidiaries | (5) | | | (10) | |

| Net earnings common stockholders | $ | 2,331 | | | $ | 142 | |

| | | |

| Earnings common stockholders | | | |

| Earnings from continuing operations | $ | 329 | | | $ | 142 | |

| Discontinued operations | 2,002 | | | — | |

| Net earnings common stockholders | $ | 2,331 | | | $ | 142 | |

| | | |

| Diluted avg. shares outstanding | 586.7 | | | 573.3 | |

| | | |

| Diluted earnings per share common stockholders | | | |

| Earnings from continuing operations | $ | 0.56 | | | $ | 0.25 | |

| Discontinued operations | 3.41 | | | — | |

| Diluted earnings per common share | $ | 3.97 | | | $ | 0.25 | |

| | | |

| | | |

| Quarter Ended Dec 31 |

| 2022 | | 2023 |

| Other deductions, net | | | |

| Amortization of intangibles | $ | 118 | | | $ | 274 | |

| Restructuring costs | 10 | | | 83 | |

| | | |

| Other | (8) | | | 130 | |

| Total | $ | 120 | | | $ | 487 | |

| | | |

1 Represents interest on the Copeland note receivable |

| | | | | | | | | | | |

| | | Table 2 |

| EMERSON AND SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (DOLLARS IN MILLIONS, UNAUDITED) |

| | | |

| | | |

| Sept 30, 2023 | | Dec 31, 2023 |

| Assets | | | |

| Cash and equivalents | $ | 8,051 | | | $ | 2,076 | |

| Receivables, net | 2,518 | | | 2,759 | |

| Inventories | 2,006 | | | 2,432 | |

| Other current assets | 1,244 | | | 1,399 | |

| Total current assets | 13,819 | | | 8,666 | |

| Property, plant & equipment, net | 2,363 | | | 2,701 | |

| Goodwill | 14,480 | | | 17,983 | |

| Other intangible assets | 6,263 | | | 11,270 | |

| Copeland note receivable and equity investment | 3,255 | | | 3,253 | |

| Other | 2,566 | | | 2,640 | |

| Total assets | $ | 42,746 | | | $ | 46,513 | |

| | | |

| Liabilities and equity | | | |

| Short-term borrowings and current maturities of long-term debt | $ | 547 | | | $ | 3,227 | |

| Accounts payable | 1,275 | | | 1,234 | |

| Accrued expenses | 3,210 | | | 3,304 | |

| Total current liabilities | 5,032 | | | 7,765 | |

| Long-term debt | 7,610 | | | 7,632 | |

| Other liabilities | 3,506 | | | 4,561 | |

| Equity | | | |

| Common stockholders' equity | 20,689 | | | 20,674 | |

| Noncontrolling interests in subsidiaries | 5,909 | | | 5,881 | |

| Total equity | 26,598 | | | 26,555 | |

| Total liabilities and equity | $ | 42,746 | | | $ | 46,513 | |

| | | | | | | | | | | | | | |

| | | | Table 3 |

| EMERSON AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (DOLLARS IN MILLIONS, UNAUDITED) |

| | | | |

| Three Months Ended Dec 31 |

| | | 2022 | | 2023 |

| Operating activities | | | | |

| Net earnings | | $ | 2,326 | | | $ | 132 | |

| Earnings from discontinued operations, net of tax | | (2,002) | | — |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 260 | | 422 |

| Stock compensation | | 102 | | 74 |

| Amortization of acquisition-related inventory step-up | | — | | 231 |

| Changes in operating working capital | | (289) | | (247) |

| Other, net | | (95) | | (168) |

| Cash from continuing operations | | 302 | | 444 |

| Cash from discontinued operations | | 116 | | (29) |

| Cash provided by operating activities | | 418 | | 415 |

| | | | |

| Investing activities | | | | |

| Capital expenditures | | (59) | | (77) |

| Purchases of businesses, net of cash and equivalents acquired | | — | | (8,339) |

| Proceeds from subordinated interest | | 15 | | | — | |

| | | | |

| Other, net | | (23) | | (37) |

| Cash from continuing operations | | (67) | | (8,453) |

| Cash from discontinued operations | | 2,953 | | 1 |

| Cash provided by (used in) investing activities | | 2,886 | | (8,452) |

| | | | |

| Financing activities | | | | |

| Net increase (decrease) in short-term borrowings | | (539) | | 2,647 |

| | | | |

| | | | |

| | | | |

| Payments of long-term debt | | (9) | | — |

| Dividends paid | | (306) | | (300) |

| Purchases of common stock | | (2,000) | | (175) |

| AspenTech purchases of common stock | | — | | (72) |

| | | | |

| Other, net | | (41) | | (45) |

| | | | |

| | | | |

| Cash provided by (used in) financing activities | | (2,895) | | 2,055 |

| | | | |

| Effect of exchange rate changes on cash and equivalents | | 58 | | 7 |

| Increase (decrease) in cash and equivalents | | 467 | | (5,975) |

| Beginning cash and equivalents | | 1,804 | | 8,051 |

| Ending cash and equivalents | | $ | 2,271 | | | $ | 2,076 | |

| | | | |

| | | | | | | | | | | |

| | | Table 4 |

| EMERSON AND SUBSIDIARIES |

| SEGMENT SALES AND EARNINGS |

| (DOLLARS IN MILLIONS, UNAUDITED) |

The following tables show results for the Company's segments on an adjusted segment EBITA basis and are intended to supplement the Company's results of operations, including its segment earnings which are defined as earnings before interest and taxes. The Company defines adjusted segment and total segment EBITA as segment earnings excluding intangibles amortization expense, and restructuring and related expense. Adjusted segment and total segment EBITA, and adjusted segment and total segment EBITA margin are measures used by management and may be useful for investors to evaluate the Company's segments' operational performance.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended Dec 31 | |

| 2022 | | 2023 | | Reported | | Underlying | |

| Sales | | | | | | | | |

| Final Control | $ | 862 | | | $ | 940 | | | 9 | % | | 9 | % | |

| Measurement & Analytical | 749 | | | 947 | | | 26 | % | | 28 | % | |

| Discrete Automation | 618 | | | 613 | | | (1) | % | | (2) | % | |

| Safety & Productivity | 310 | | | 322 | | | 4 | % | | 3 | % | |

| Intelligent Devices | $ | 2,539 | | | $ | 2,822 | | | 11 | % | | 11 | % | |

| | | | | | | | |

| Control Systems & Software | 606 | | | 675 | | | 11 | % | | 11 | % | |

| Test & Measurement | — | | | 382 | | | — | % | | — | % | |

| AspenTech | 243 | | | 257 | | | 6 | % | | 6 | % | |

| Software and Control | $ | 849 | | | $ | 1,314 | | | 55 | % | | 9 | % | |

| | | | | | | | |

| Eliminations | (15) | | | (19) | | | | | | |

| Total | $ | 3,373 | | | $ | 4,117 | | | 22 | % | | 10 | % | |

| | | | | | | | | | | | | | | | | | | | |

| Sales Growth by Geography | | | | | |

| Quarter Ended Dec 31 | | | | |

| Americas | 8 | % | | | | | |

| Europe | 10 | % | | | | | |

| Asia, Middle East & Africa | 15 | % | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended Dec 31 | | Quarter Ended Dec 31 |

| 2022 | | 2023 |

| As Reported (GAAP) | | Adjusted EBITA

(Non-GAAP) | | As Reported (GAAP) | | Adjusted EBITA

(Non-GAAP) |

| Earnings | | | | | | | |

| Final Control | $ | 158 | | $ | 184 | | $ | 194 | | $ | 223 |

| Margins | 18.4 | % | | 21.4 | % | | 20.6 | % | | 23.6 | % |

| Measurement & Analytical | 175 | | 181 | | 235 | | 258 |

| Margins | 23.4 | % | | 24.1 | % | | 24.9 | % | | 27.3 | % |

| Discrete Automation | 121 | | 129 | | 97 | | 116 |

| Margins | 19.6 | % | | 21.0 | % | | 15.8 | % | | 18.9 | % |

| Safety & Productivity | 63 | | 69 | | 68 | | 74 |

| Margins | 20.4 | % | | 22.4 | % | | 21.1 | % | | 23.1 | % |

| Intelligent Devices | $ | 517 | | $ | 563 | | $ | 594 | | $ | 671 |

| Margins | 20.4 | % | | 22.2 | % | | 21.0 | % | | 23.8 | % |

| | | | | | | |

| Control Systems & Software | 107 | | 114 | | 149 | | 155 |

| Margins | 17.6 | % | | 18.7 | % | | 22.1 | % | | 23.1 | % |

| Test & Measurement | — | | | — | | | (78) | | 101 |

| Margins | — | % | | — | % | | (20.4) | % | | 26.5 | % |

| AspenTech | (33) | | 88 | | (35) | | 87 |

| Margins | (13.6) | % | | 36.6 | % | | (13.7) | % | | 33.6 | % |

| Software and Control | $ | 74 | | $ | 202 | | $ | 36 | | $ | 343 |

| Margins | 8.7 | % | | 23.8 | % | | 2.8 | % | | 26.1 | % |

| | | | | | | |

Corporate items and interest expense, net: | | | | | | | |

| Stock compensation | (102) | | | (102) | | | (74) | | | (44) | |

| Unallocated pension and postretirement costs | 45 | | | 45 | | | 31 | | | 31 | |

| Corporate and other | (64) | | | (44) | | | (399) | | | (38) | |

| | | | | | | |

| Loss on Copeland equity method investment | — | | | — | | | (36) | | | — | |

| Interest expense, net | (48) | | | — | | | (44) | | | — | |

Interest income from related party1 | — | | | — | | | 31 | | | — | |

| Pretax Earnings / Adjusted EBITA | $ | 422 | | $ | 664 | | $ | 139 | | $ | 963 |

| Margins | 12.5 | % | | 19.7 | % | | 3.4 | % | | 23.4 | % |

| | | | | | | |

| Supplemental Total Segment Earnings: | | | | | | | |

| Adjusted Total Segment EBITA | | | $ | 765 | | | | $ | 1,014 |

| Margins | | | 22.7 | % | | | | 24.6 | % |

| | | | | | | |

1 Represents interest on the Copeland note receivable. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended Dec 31 | | Quarter Ended Dec 31 | |

| 2022 | | 2023 | |

| Amortization of Intangibles1 | | Restructuring and Related Costs2 | | Amortization of Intangibles1 | | Restructuring and Related Costs2 | |

| Final Control | $ | 22 | | | $ | 4 | | | $ | 22 | | | $ | 7 | | |

| Measurement & Analytical | 5 | | 1 | | 20 | | 3 | | |

| Discrete Automation | 7 | | 1 | | 9 | | 10 | |

| Safety & Productivity | 6 | | — | | | 6 | | — | | |

| Intelligent Devices | $ | 40 | | | $ | 6 | | | $ | 57 | | | $ | 20 | | |

| | | | | | | | |

| Control Systems & Software | 6 | | 1 | | | 5 | | 1 | |

| Test & Measurement | — | | — | | | 139 | | 40 | | |

| AspenTech | 121 | | — | | | 122 | | — | | |

| Software and Control | $ | 127 | | | $ | 1 | | | $ | 266 | | | $ | 41 | | |

| | | | | | | | |

| Corporate | — | | | 8 | | — | | | 26 | 3 |

| Total | $ | 167 | | | $ | 15 | | | $ | 323 | | | $ | 87 | | |

| | | | | | | | |

1 Amortization of intangibles includes $49 and $49 reported in cost of sales for the three months ended December 31, 2022 and 2023, respectively. |

2 Restructuring and related costs includes $5 and $4 reported in cost of sales for the three months ended December 31, 2022 and 2023, respectively. |

3 Corporate restructuring of $26 for the three months ended December 31, 2023 is comprised entirely of integration-related stock compensation expense attributable to NI. |

| | | | | | | | | | | |

| | | |

| Quarter Ended Dec 31 |

| Depreciation and Amortization | 2022 | | 2023 |

| Final Control | $ | 45 | | | $ | 40 | |

| Measurement & Analytical | 30 | | | 40 | |

| Discrete Automation | 21 | | | 22 | |

| Safety & Productivity | 14 | | | 14 | |

| Intelligent Devices | 110 | | | 116 | |

| | | |

| Control Systems & Software | 21 | | | 21 | |

| Test & Measurement | — | | | 151 | |

| AspenTech | 123 | | | 123 | |

| Software and Control | 144 | | | 295 | |

| | | |

| Corporate | 6 | | | 11 | |

| Total | $ | 260 | | | $ | 422 | |

| | | | | | | | | | | |

| EMERSON AND SUBSIDIARIES |

| ADJUSTED CORPORATE AND OTHER SUPPLEMENTAL |

| (DOLLARS IN MILLIONS, UNAUDITED) |

The following table shows the Company's stock compensation and corporate and other expenses on an adjusted basis. The Company's definition of adjusted stock compensation excludes integration-related stock compensation expense. The Company's definition of adjusted corporate and other excludes corporate restructuring and related costs, first year purchase accounting related items and transaction fees, and certain gains, losses or impairments. This metric is useful for reconciling from total adjusted segment EBITA to the Company's consolidated adjusted EBITA.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Quarter Ended Dec 31 | |

| | | | | 2022 | | 2023 | |

| Stock compensation (GAAP) | | | | | $ | (102) | | | $ | (74) | | |

| Integration-related stock compensation expense | | | | | — | | 30 | 1 |

| Adjusted stock compensation (non-GAAP) | | | | | $ | (102) | | | $ | (44) | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Quarter Ended Dec 31 |

| | | | | 2022 | | 2023 |

| Corporate and other (GAAP) | | | | | $ | (64) | | | $ | (399) | |

| Corporate restructuring and related costs | | | | | 8 | | — |

| Acquisition / divestiture costs | | | | | — | | 130 | |

| Amortization of acquisition-related inventory step-up | | | | | — | | 231 | |

| Russia business exit | | | | | 47 | | | — | |

| AspenTech Micromine purchase price hedge | | | | | (35) | | | — |

| Adjusted corporate and other (non-GAAP) | | | | | $ | (44) | | | $ | (38) | |

| | | | | | | |

| 1 Integration-related stock compensation expense relates to NI and includes $26 reported as restructuring costs. |

| | | | | | | | | | | |

| | | Table 6 |

| EMERSON AND SUBSIDIARIES |

| ADJUSTED EBITA & EPS SUPPLEMENTAL |

| (AMOUNTS IN MILLIONS EXCEPT PER SHARE, UNAUDITED) |

The following tables, which show results on an adjusted EBITA basis and diluted earnings per share on an adjusted basis, are intended to supplement the Company's discussion of its results of operations herein. The Company defines adjusted EBITA as earnings excluding interest expense, net, income taxes, intangibles amortization expense, restructuring expense, first year purchase accounting related items and transaction fees, gains or losses on the Copeland equity method investment, and certain gains, losses or impairments. Adjusted earnings per share excludes intangibles amortization expense, restructuring expense, first year purchase accounting related items and transaction-related costs, gains or losses on the Copeland equity method investment, and certain gains, losses or impairments. Adjusted EBITA, adjusted EBITA margin, and adjusted earnings per share are measures used by management and may be useful for investors to evaluate the Company's operational performance.

| | | | | | | | | | | |

| Quarter Ended Dec 31 |

| 2022 | | 2023 |

| Pretax earnings | $ | 422 | | $ | 139 |

| Percent of sales | 12.5 | % | | 3.4 | % |

| Interest expense, net | 48 | | 44 |

Interest income from related party1 | — | | (31) |

| Amortization of intangibles | 167 | | 323 |

| Restructuring and related costs | 15 | | 87 |

| Acquisition/divestiture fees and related costs | — | | 134 |

| Amortization of acquisition-related inventory step-up | — | | 231 |

| Loss on Copeland equity method investment | — | | 36 |

| Russia business exit | 47 | | — |

| AspenTech Micromine purchase price hedge | (35) | | — |

| Adjusted EBITA | $ | 664 | | $ | 963 |

| Percent of sales | 19.7 | % | | 23.4 | % |

| | | |

| Quarter Ended Dec 31 |

| 2022 | | 2023 |

| GAAP earnings from continuing operations per share | $ | 0.56 | | $ | 0.25 |

| Amortization of intangibles | 0.15 | | 0.36 |

| Restructuring and related costs | 0.02 | | 0.12 |

| Acquisition/divestiture fees and related costs | — | | 0.17 |

| Amortization of acquisition-related inventory step-up | — | | 0.38 |

| Loss on Copeland equity method investment | — | | 0.04 |

| Discrete taxes | — | | (0.10) |

| Russia business exit | 0.08 | | — |

| AspenTech Micromine purchase price hedge | (0.03) | | — |

| Adjusted earnings from continuing operations per share | $ | 0.78 | | $ | 1.22 |

| Less: AspenTech contribution to adjusted earnings per share | | | (0.07) |

| Adjusted earnings per share excluding AspenTech contribution | | | $ | 1.15 |

| | | |

1 Represents interest on the Copeland note receivable |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended December 31, 2023 |

| Pretax

Earnings | | Income

Taxes | | Earnings from

Cont.

Ops. | | Non-Controlling Interests3 | | Net

Earnings

Common

Stockholders | | Diluted

Earnings

Per

Share |

| As reported (GAAP) | $ | 139 | | | $ | 7 | | | $ | 132 | | | $ | (10) | | | $ | 142 | | | $ | 0.25 | |

| Amortization of intangibles | 323 | 1 | 74 | | 249 | | 41 | | 208 | | 0.36 |

| Restructuring and related costs | 87 | 2 | 18 | | 69 | | — | | | 69 | | 0.12 |

| Acquisition/divestiture fees and related costs | 134 | | 38 | | 96 | | — | | | 96 | | 0.17 |

| Amortization of acquisition-related inventory step-up | 231 | | 14 | | 217 | | — | | | 217 | | 0.38 |

| Loss on Copeland equity method investment | 36 | | 9 | | 27 | | — | | | 27 | | 0.04 |

| Discrete taxes | — | | 57 | | (57) | | — | | | (57) | | (0.10) |

| Adjusted (non-GAAP) | $ | 950 | | | $ | 217 | | | $ | 733 | | | $ | 31 | | | $ | 702 | | | $ | 1.22 | |

| Interest expense, net | 44 | | | | | | | | | | | |

Interest income from related party4 | (31) | | | | | | | | | | |

| Adjusted EBITA (non-GAAP) | $ | 963 | | | | | | | | | | | |

| | | | | | | | | | | |

1 Amortization of intangibles includes $49 reported in cost of sales. |

2 Restructuring and related costs includes $4 reported in cost of sales. |

3 Represents the non-controlling interest in AspenTech applied to AspenTech's share of each adjustment presented herein and eliminated from Emerson's consolidated results. |

4 Represents interest on the Copeland note receivable. |

| | | | | | | | | | | |

| Table 7 |

| EMERSON AND SUBSIDIARIES |

| ASPENTECH CONTRIBUTION TO EMERSON RESULTS SUPPLEMENTAL |

| (AMOUNTS IN MILLIONS EXCEPT PER SHARE, UNAUDITED) |

The following tables reconcile the financial results of AspenTech reported to its shareholders with the amounts included in Emerson's consolidated financial results. Emerson currently owns approximately 57 percent of the common shares outstanding of AspenTech, a separately traded public company (NASDAQ: AZPN), and consolidates AspenTech in its financial results. The 43 percent non-controlling interest in AspenTech is removed from Emerson's net earnings common stockholders through the non-controlling interest line item. AspenTech is also one of Emerson's segments and its GAAP segment earnings is reconciled below to its consolidated impact to clarify that certain items are reported outside of its segment earnings within Emerson corporate, including interest income and stock compensation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended December 31, 2023 |

| Pretax

Earnings | | Income

Taxes

(Benefit) | | Earnings from

Cont.

Ops. | | Non-Controlling Interests4 | | Net

Earnings

Common

Stockholders | | Diluted

Earnings

Per

Share |

| Standalone reporting (GAAP) | $ | (37) | | 1 | $ | (15) | | | $ | (22) | | | | | | | |

| Other | (2) | | | — | | (2) | | | | | | |

| Reported in Emerson consolidation (GAAP) | (39) | | (15) | | (24) | | (10) | | | (14) | | $ | (0.02) | |

| Adjustments: | | | | | | | | | | | |

| Amortization of intangibles | 122 | | 2 | 27 |

| 95 | | | 41 | | 54 | | 0.09 |

| Adjusted (Non-GAAP) | $ | 83 | | | $ | 12 | | | $ | 71 | | | $ | 31 | | | $ | 40 | | | $ | 0.07 | |

| Interest income | (12) | 3 | | | | | | | | | |

| Stock compensation | 16 | 3 | | | | | | | | | |

| Adjusted segment EBITA (non-GAAP) | $ | 87 | | | | | | | | | | | |

| | | | | | | | | | | |

| Reconciliation to Segment EBIT |

| Pre-tax earnings | $ | (39) | | | | | | | | | | | |

| Interest income | (12) | 3 | | | | | | | | | |

| Stock compensation | 16 | 3 | | | | | | | | | |

| Segment EBIT (GAAP) | $ | (35) | | | | | | | | | | | |

| Amortization of intangibles | 122 | 2 | | | | | | | | | |

| Adjusted segment EBITA (non-GAAP) | $ | 87 | | | | | | | | | | | |

| | | | | | | | | | | |

1 Amount reflects AspenTech's pretax earnings for the three months ended December 31, 2023 as reported in its quarterly earnings release 8-K. |

2 Amortization of intangibles includes $49 reported in cost of sales. |

3 Reported in Emerson corporate line items. |

4 Represents the non-controlling interest in AspenTech applied to each adjustment presented herein and eliminated from Emerson's consolidated results. |

| | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliations of Non-GAAP Financial Measures & Other | | Table 8 |

| | | | | | | |

Reconciliations of Non-GAAP measures with the most directly comparable GAAP measure (dollars in millions, except per share amounts). See tables 4 through 7 for additional non-GAAP reconciliations. | |

| | | | | | | | | | | | | | | | | |

| 2024 Q1 Underlying Sales Change | Reported | (Favorable) / Unfavorable FX | (Acquisitions) | Divestitures | Underlying |

| Final Control | 9 | % | (1) | % | — | % | 1 | % | 9 | % |

| Measurement & Analytical | 26 | % | — | % | — | % | 2 | % | 28 | % |

| Discrete Automation | (1) | % | (1) | % | — | % | — | % | (2) | % |

| Safety & Productivity | 4 | % | (1) | % | — | % | — | % | 3 | % |

| Intelligent Devices | 11 | % | (1) | % | — | % | 1 | % | 11 | % |

| Control Systems & Software | 11 | % | (1) | % | — | % | 1 | % | 11 | % |

| Test & Measurement | — | % | — | % | — | % | — | % | — | % |

| AspenTech | 6 | % | — | % | — | % | — | % | 6 | % |

| Software and Control | 55 | % | (1) | % | (46) | % | 1 | % | 9 | % |

| Emerson | 22 | % | (1) | % | (12) | % | 1 | % | 10 | % |

| | | | | | | | |

| Underlying Growth Guidance | 2024 Q2 Guidance | 2024

Guidance |

| Reported (GAAP) | 12.5% - 14.5% | 14.5% - 17% |

| (Favorable) / Unfavorable FX | ~- pts | ~- pts |

| (Acquisitions) | ~(9) pts | (10.0) - (10.5) pts |

| Divestitures | ~- pts | ~- pts |

| Underlying (non-GAAP) | 3.5% - 5.5% | 4.5% - 6.5% |

| | | | | | | | | | | | | | | | | | | | |

| 2023 Q1 Adjusted Segment EBITA | EBIT | EBIT

Margin | Amortization

of

Intangibles | Restructuring and Related Costs | Adjusted Segment EBITA | Adjusted Segment EBITA Margin |

| Final Control | $ | 158 | | 18.4 | % | $ | 22 | | $ | 4 | | $ | 184 | | 21.4 | % |

| Measurement & Analytical | 175 | | 23.4 | % | 5 | | 1 | | 181 | | 24.1 | % |

| Discrete Automation | 121 | | 19.6 | % | 7 | | 1 | | 129 | | 21.0 | % |

| Safety & Productivity | 63 | | 20.4 | % | 6 | | — | | 69 | | 22.4 | % |

| Intelligent Devices | $ | 517 | | 20.4 | % | $ | 40 | | $ | 6 | | $ | 563 | | 22.2 | % |

| Control Systems & Software | 107 | | 17.6 | % | 6 | | 1 | | 114 | | 18.7 | % |

| Test & Measurement | — | | — | % | — | | — | | — | | — | % |

| AspenTech | (33) | | (13.6) | % | 121 | | — | | 88 | | 36.6 | % |

| Software and Control | $ | 74 | | 8.7 | % | $ | 127 | | $ | 1 | | $ | 202 | | 23.8 | % |

| | | | | | | | | | | | | | | | | | | | |

| 2024 Q1 Adjusted Segment EBITA | EBIT | EBIT

Margin | Amortization

of

Intangibles | Restructuring and Related Costs | Adjusted Segment EBITA | Adjusted Segment EBITA Margin |

| Final Control | $ | 194 | | 20.6 | % | $ | 22 | | $ | 7 | | $ | 223 | | 23.6 | % |

| Measurement & Analytical | 235 | | 24.9 | % | 20 | | 3 | | 258 | | 27.3 | % |

| Discrete Automation | 97 | | 15.8 | % | 9 | | 10 | | 116 | | 18.9 | % |

| Safety & Productivity | 68 | | 21.1 | % | 6 | | — | | 74 | | 23.1 | % |

| Intelligent Devices | $ | 594 | | 21.0 | % | $ | 57 | | $ | 20 | | $ | 671 | | 23.8 | % |

| Control Systems & Software | 149 | | 22.1 | % | 5 | | 1 | | 155 | | 23.1 | % |

| Test & Measurement | (78) | | (20.4) | % | 139 | | 40 | | 101 | | 26.5 | % |

| AspenTech | (35) | | (13.7) | % | 122 | | — | | 87 | | 33.6 | % |

| Software and Control | $ | 36 | | 2.8 | % | $ | 266 | | $ | 41 | | $ | 343 | | 26.1 | % |

| | | | | | | | | | | |

| Total Adjusted Segment EBITA | | 2023 Q1 | 2024 Q1 |

| Pretax earnings (GAAP) | | $ | 422 | $ | 139 |

| Margin | | 12.5 | % | 3.4 | % |

| Corporate items and interest expense, net | | 169 | 491 |

| Amortization of intangibles | | 167 | 323 |

| Restructuring and related costs | | 7 | 61 |

| Adjusted segment EBITA (non-GAAP) | | $ | 765 | $ | 1,014 |

| Margin | | 22.7 | % | 24.6 | % |

| | | | | | | | | | | | | | | | | | | | |

| Free Cash Flow | | 2023 Q1 | 2024 Q1 | | 2024E

($ in billions) | |

| Operating cash flow (GAAP) | | $ | 302 | | $ | 444 | | | $3.0 - $3.1 | |

| Capital expenditures | | (59) | (77) | | ~(0.4) | |

| Free cash flow (non-GAAP) | | $ | 243 | | $ | 367 | | | $2.6 - $2.7 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Note 1: Underlying sales and orders exclude the impact of currency translation and significant acquisitions and divestitures. |

| Note 2: All fiscal year 2024E figures are approximate, except where range is given. |

Cover Page

|

Feb. 07, 2024 |

| Entity Information [Line Items] |

|

| Entity Central Index Key |

0000032604

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 07, 2024

|

| Entity Registrant Name |

Emerson Electric Co.

|

| Entity Incorporation, State or Country Code |

MO

|

| Entity File Number |

1-278

|

| Entity Tax Identification Number |

43-0259330

|

| Entity Address, Address Line One |

8000 West Florissant Avenue

|

| Entity Address, City or Town |

St. Louis,

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63136

|

| City Area Code |

314

|

| Local Phone Number |

553-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| NEW YORK STOCK EXCHANGE, INC. [Member] | Common Stock of $0.50 par value per share [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock of $0.50 par value per share

|

| Trading Symbol |

EMR

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. [Member] | 0.375% Notes due 2024 [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.375% Notes due 2024

|

| Trading Symbol |

EMR 24

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. [Member] | 1.250% Notes due 2025 [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.250% Notes due 2025

|

| Trading Symbol |

EMR 25A

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. [Member] | 2.000% Notes due 2029 [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.000% Notes due 2029

|

| Trading Symbol |

EMR 29

|

| Security Exchange Name |

NYSE

|

| CHICAGO STOCK EXCHANGE, INC [Member] | Common Stock of $0.50 par value per share [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock of $0.50 par value per share

|

| Trading Symbol |

EMR

|

| Security Exchange Name |

CHX

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=emr_CommonStockof0.50parvaluepershareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=emr_A0.375Notesdue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=emr_A1.250Notesdue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=emr_A2.000Notesdue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

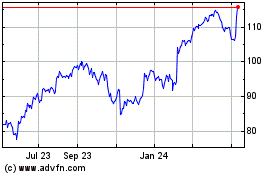

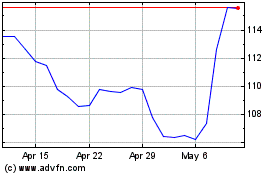

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Apr 2024 to May 2024

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From May 2023 to May 2024