false

0001337619

0001337619

2024-09-16

2024-09-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 16, 2024

Envestnet, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-34835 |

|

20-1409613 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1000 Chesterbrook Boulevard, Suite 250

Berwyn,

Pennsylvania 19312

(Address of principal executive offices, including

zip code)

(312) 827-2800

(Registrant’s telephone number, including

area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, Par Value $0.005 Per Share |

|

ENV |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item

8.01. Other Events.

On August 23, 2024, Envestnet,

Inc., a Delaware corporation (“Envestnet” or the “Company”), filed a definitive proxy statement on Schedule 14A

(the “Proxy Statement”) with the Securities and Exchange Commission (“SEC”) in connection with the Agreement and

Plan of Merger, dated as of July 11, 2024 (as it may be amended from time to time, the “Merger Agreement”), by and among

BCPE Pequod Buyer, Inc. (“Parent”), BCPE Pequod Merger Sub, Inc., a direct, wholly owned subsidiary of Parent (“Merger

Sub”), and Envestnet, pursuant to which Merger Sub will merge with and into Envestnet (the “Merger”), with Envestnet

surviving the Merger and becoming a wholly owned subsidiary of Parent. The special meeting of the Company’s stockholders to act

on the proposal to adopt the Merger Agreement and certain other proposals, in each case as disclosed in the Proxy Statement, will be held

virtually on Tuesday, September 24, 2024, at 10:00 a.m., Eastern Time.

Since the announcement of

the Merger, several purported stockholders of the Company have sent demand letters generally alleging that the preliminary proxy statement

the Company filed on August 12, 2024 and/or the Proxy Statement omitted information that rendered it false and misleading or otherwise

had disclosure deficiencies in violation of federal securities laws. Additional purported stockholders of the Company have sent demands

pursuant to Section 220 of the Delaware General Corporation Law seeking inspection of certain Company books and records. In addition,

on September 5, 2024 and September 6, 2024, respectively, two separate complaints with nearly identical claims were filed by purported

stockholders in the Supreme Court of the State of New York, County of New York against the Company

and its directors (i) under the caption Eric Miller v. Envestnet, Inc., et al., Case

No. 654622/2024 (the “Miller Complaint”) and (ii) under the caption Kevin Turner v. Envestnet, Inc., et al.,

Case No. 654641/2024 (the “Turner Complaint,” together with the Miller Complaint, the “Complaints”). The

Complaints allege that the Proxy Statement omitted certain purportedly material information regarding, among other things, the

background of the Merger, the Company’s financial projections, and Morgan Stanley & Co., LLC’s (“Morgan Stanley”)

financial analyses in violation of New York common law. The Complaints seek, among other things,

an injunction enjoining consummation of the Merger or, in the event that the Merger is consummated, damages resulting from the alleged

violations.

The

Company denies the allegations in the Complaints and the demand letters, denies that any violation of law has occurred and believes that

the claims asserted in the Complaints are wholly without merit. The Company believes that the Proxy Statement disclosed all material information

required to be disclosed and denies that any of the supplemental disclosures are in any way material or are otherwise required to be disclosed.

However, solely to minimize any expense and distraction, and to avoid the uncertainty, of any litigation, and without admitting any

liability or wrongdoing whatsoever, the Company has determined to voluntarily supplement certain disclosures in the Proxy Statement by

providing the additional information presented below in this Current Report on Form 8-K. Nothing in this Current Report on Form 8-K shall

be deemed an admission of the merit, necessity or materiality of any supplemental disclosures under any applicable laws. To the contrary,

the Company specifically denies that any further disclosure of any kind was or is material or required.

Supplemental Disclosures

to the Proxy Statement

The

additional disclosures (the “supplemental disclosures”) in this Current Report on Form 8-K supplement the disclosures contained

in the Proxy Statement and should be reviewed in conjunction with the disclosures contained in the Proxy Statement, which in turn should

be carefully read in its entirety. To the extent information set forth in the supplemental disclosures differs from or updates information

contained in the Proxy Statement, the information in this Current Report on Form 8-K shall supersede the applicable information contained

in the Proxy Statement. All page references are to the Proxy Statement, and capitalized terms used but not otherwise defined herein have

the meanings ascribed to such terms in the Proxy Statement. For clarity, new text within restated paragraphs from the Proxy Statement

is highlighted with bold, underlined text and deleted text within restated paragraphs from

the Proxy Statement is highlighted with strikethrough text.

The section of the

Proxy Statement entitled “The Merger—Background of the Merger” is amended and supplemented as follows:

| 1. | The following supplemental disclosure is added as a new paragraph after the second full paragraph

beginning on page 38 of the Proxy Statement: |

Following

the Board’s April 3, 2024 meeting and continuing through to the signing of the Merger Agreement, representatives from Bain and the

Company had various, informal discussions regarding the possibility of a strategic transaction involving the Company and Bain, including

among other things discussions relating to the March Bain Proposal and Bain’s subsequent proposals (which proposals are described

below).

| 2. | The following supplemental disclosure is added as a new paragraph before the first full paragraph on page 41 of the Proxy Statement: |

Following

receipt of the April Financial Sponsor A Proposal and continuing until June 21, 2024, representatives of the Company and Financial Sponsor

A had various, informal discussions regarding the possibility of a strategic transaction involving

the Company and Financial Sponsor A, including among other things discussions relating to the April Financial Sponsor A Proposal

and Financial Sponsor A’s subsequent proposal (which proposal is described below). Additionally, following receipt of the April

Strategic Party A Proposal and continuing until June 24, 2024, representatives of the Company and Strategic Party A had various,

informal discussions regarding the possibility of a strategic transaction involving the Company and Strategic Party A, including

among other things discussions relating to the April Strategic Party A Proposal and Strategic Party A’s subsequent proposals (which

proposals are described below).

| 3. | The following supplemental disclosure is added as a new paragraph after the third full paragraph

beginning on page 42 of the Proxy Statement: |

Each non-disclosure

agreement entered into between the Company, on the one hand, and Bain, Financial Sponsor A and Strategic Party A, on the other hand, in

connection with the Transaction, contains customary standstill provisions for the benefit of the Company and does not contain “don't

ask, don't waive" provisions.

| 4. | The following supplemental disclosure is added as a new paragraph before the last full paragraph

beginning on page 43 of the Proxy Statement: |

On or about

May 24, 2024, Bain informed the Company that, subject to customary non-disclosure agreements, Bain intended to discuss with Company stockholders

BlackRock and Fidelity whether they would be interested in a potential rollover of their equity investments in the Company in connection

with Bain’s potential acquisition of the Company. The Company was thereafter not involved with the discussions between Bain,

BlackRock and Fidelity.

| 5. | The following supplemental disclosure is added as a new paragraph before the last full paragraph

beginning on page 49 of the Proxy Statement: |

On July 11,

2024, BlackRock and Bain executed a support and rollover agreement. Further, on July 11, 2024, Fidelity and Bain also executed a support

and rollover agreement. For more information, please see the section entitled “The Merger—Financing of the Transactions—Support

and Rollover Agreements” beginning on page 82 of the Proxy Statement.

The section of the

Proxy Statement entitled “The Merger—Opinion of Morgan Stanley” is amended and supplemented as follows:

| 1. | The following supplemental disclosure replaces in its entirety the second full paragraph of the

section entitled “Summary of Financial Analyses of Morgan Stanley” beginning on page 58 of the Proxy Statement: |

In performing the financial analyses

summarized below and in arriving at its opinion, at the direction of the Board, Morgan Stanley utilized and relied upon the Management

Projections and the Street Projections (as set forth below), each of which were approved by management of Envestnet and

the Board for Morgan Stanley’s use in connection with its financial analyses and which are described below. In addition, Morgan

Stanley utilized and relied upon the number of issued and outstanding shares of Envestnet provided by management of Envestnet. For further

information regarding the Management Projections, see the section entitled “The Merger—Projections” beginning

on page 66 of this Proxy Statement.

| Street Projections (amount in millions) | |

FY 2024E | | |

FY 2025E | |

| Gross Revenue | |

$ | 1,370 | | |

$ | 1,503 | |

| Adjusted EBITDA | |

$ | 307 | | |

$ | 343 | |

| Capital Expenditures and Capitalized Software | |

$ | (99 | ) | |

$ | (106 | ) |

| 2. | The following supplemental disclosure replaces in its entirety the fifth full paragraph of the section entitled “Public

Trading Comparables Analysis” beginning on page 59 of the Proxy Statement: |

Based on the estimated number of fully

diluted shares of Envestnet, as of July 8, 2024, as provided by Envestnet management and calculated using the treasury stock method (which,

when referenced herein, equals approximately 57 million shares of Envestnet Common Stock comprised of 55 million basic shares outstanding

and the impact of approximately two million dilutive securities), Morgan Stanley calculated the following ranges of the implied

per share values of Envestnet Common Stock, each rounded to the nearest $0.25.

| 3. | The following supplemental disclosure replaces in its entirety the second full paragraph of the section entitled “Discounted

Equity Value Analysis” beginning on page 61 of the Proxy Statement: |

To calculate these discounted fully diluted

equity values, Morgan Stanley utilized estimated pro forma Adj. EBITDA of Envestnet for 2026 under the May Projections with D&A

Adjustment and No Initiatives Adjustment, which included the pro forma adjustments to reflect the potential sale of the D&A

Business and associated reduction in corporate expenses following such disposition as directed by Envestnet management, as described in

the section entitled “The Merger—Projections” beginning on page 66 of this Proxy Statement. Based upon the application

of its professional judgment and experience, Morgan Stanley applied a range of AV to next 12 months’ (referred to as “NTM”)

Adj. EBITDA (based on such multiples for the comparable companies in the public trading comparables analysis discussed above) to Envestnet’s

estimated pro forma Adj. EBITDA for 2026 of $377 million in order to reach a future-implied fully diluted AV of Envestnet

as of December 31, 2025. Morgan Stanley applied an AV to NTM Adj. EBITDA multiple range of 11.0x to 13.0x, to generate the undiscounted

implied future fully diluted AV as of December 31, 2025. Morgan Stanley then calculated the undiscounted implied future fully diluted

equity value as of December 31, 2025. In doing so, Morgan Stanley deducted estimated net debt (which took into account both

the estimated net proceeds from the potential sale of the D&A Business, as provided by Envestnet management,

and the value of minority investments (using the equity method or the cost method) as of June 30, 2024 of $108 million,

in each case as provided by Envestnet management). Based on the estimated number of fully diluted shares of Envestnet,

as of July 8, 2024, as provided by Envestnet management and calculated using the treasury stock method (which, when referenced

herein, equals approximately 57 million shares of Envestnet Common Stock comprised of 55 million basic shares outstanding and the impact

of approximately two million dilutive securities), Morgan Stanley calculated the undiscounted implied future fully diluted equity

value per share as of December 31, 2025.

| 4. | The following supplemental disclosure replaces in its entirety the first full paragraph of the section entitled “Equity

Research Analysts’ Price Targets” beginning on page 63 of the Proxy Statement: |

For reference purposes only, Morgan Stanley

reviewed the price targets for shares of Envestnet Common Stock prepared and published by seven equity research analysts as of July 9,

2024 (as set forth below) and noted the range, each rounded to the nearest $0.25, was $56.00 per share to $78.00 per share.

These forward price targets generally reflected each analyst’s estimate of the 12-month future public market trading price of shares

of Envestnet Common Stock. Morgan Stanley then discounted such price targets to present value, for a one-year discount period, using a

discount rate of 12.6% for Envestnet, to arrive at a range of $49.75 per share to $69.25 per share. The 12.6% discount rate was selected

by Morgan Stanley based on Envestnet’s estimated cost of equity, estimated using the capital asset pricing model method and utilizing

a six percent (6%) market risk premium, a risk-free rate of 4.3% based on the 10-year U.S. Treasury yield as of July 9, 2024, and a 1.38

predicted beta based on the U.S. long-term predicted beta as of April 15, 2024 (which was the day immediately prior to the release of

the April Press Report).

| Analyst | |

Price Target | |

| Analyst A | |

$ | 78 | |

| Analyst B | |

$ | 72 | |

| Analyst C | |

$ | 66 | |

| Analyst D | |

$ | 64 | |

| Analyst E | |

$ | 59 | |

| Analyst F | |

$ | 57 | |

| Analyst G | |

$ | 56 | |

The section of the

Proxy Statement entitled “The Merger—Legal Proceedings Regarding the Merger” is amended and supplemented as follows:

| 1. | The following supplemental disclosures replace in their entirety the last two paragraphs beginning

on page 87 of the Proxy Statement: |

As of the date of this Proxy

Statement, tThe Company has received demand letters from purported Company stockholders alleging deficiencies and/or

omissions in the preliminary proxy statement the Company filed on August 12, 2024 and/or the Proxy Statement. The demand

letters seek additional disclosures to remedy these purported deficiencies. Additional purported Company stockholders sent demands

pursuant to Section 220 of the DGCL seeking inspection of certain Company books and records. In addition, two separate complaints were

filed by purported stockholders in the Supreme Court of the State of New York: Eric

Miller v. Envestnet, Inc., et al., Case No. 654622/2024, was filed on September 5, 2024; and

Kevin Turner v. Envestnet, Inc., et al., Case No. 654641/2024, was filed on September

6, 2024. Each complaint alleges that the Proxy Statement omitted certain purportedly material information in violation of New York common

law and asserts claims for negligence and negligent misrepresentation and concealment against the Company and its directors. The

complaints seek, among other things, an order enjoining consummation of the proposed Merger or, in the event that the proposed Merger

is consummated, an unspecified amount of damages resulting from the alleged violations of the Company’s directors. The

Company believes that denies the allegations in these the complaints and the demand

letters, denies that any violation of law has occurred and believes that the claims asserted in the complaints are wholly

without merit.

Potential plaintiffs

may file additional lawsuits or send additional demand letters in connection with the Merger. The outcome of any future

litigation is uncertain. Such litigation, if not resolved, could prevent or delay consummation of the Merger and result in substantial

costs to Envestnet, including any costs associated with the indemnification of directors and officers. One of the conditions to the consummation

of the Merger is that there shall not be any order restraining, enjoining or otherwise preventing the consummation of the Merger issued

by any governmental entity having jurisdiction over any of Envestnet, Parent or Merger Sub that remains in effect at the time of the Closing.

Therefore, if a plaintiff were successful in obtaining an injunction prohibiting the consummation of the Merger on the agreed-upon terms,

then such injunction may prevent the Merger from being consummated, or from being consummated within the expected time frame.

-END OF SUPPLEMENT TO PROXY STATEMENT-

Cautionary Statement Regarding

Forward-Looking Statements

This communication contains,

and the Company’s other filings and communications may contain, forward-looking statements. All statements other than statements

of historical fact are forward-looking statements. Forward-looking statements give the Company’s current expectations relating to

the Company’s financial condition, results of operations, plans, objectives, future performance and business including, without

limitation, statements regarding the Merger and related transactions, the expected closing of the Merger and the timing thereof, and as

to the financing commitments. You can identify forward-looking statements by the fact that they do not relate strictly to historical or

current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,”

“plan,” “intend,” “believe,” “may,” “will,” “should,” “can

have,” “likely” and other words and terms of similar meaning. These forward-looking statements are based on management’s

beliefs, as well as assumptions made by, and information currently available to, the Company.

Because such statements are

based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially

from those projected and are subject to a number of known and unknown risks and uncertainties, including: (i) the risk that the Merger

may not be completed on the anticipated terms in a timely manner or at all, which may adversely affect the Company’s business and

the price of the Company’s common stock; (ii) the failure to satisfy any of the conditions to the consummation of the Merger, including

the receipt of certain regulatory approvals and the approval of the Company’s stockholders; (iii) the occurrence of any event, change

or other circumstance or condition that could give rise to the termination of the agreement, including in circumstances requiring the

Company to pay a termination fee; (iv) the effect of the announcement or pendency of the Merger on the Company’s business relationships,

operating results and business generally; (v) risks that the Merger disrupts the Company’s current plans and operations (including

the ability of certain customers to terminate or amend contracts upon a change of control); (vi) the Company’s ability to retain,

hire and integrate skilled personnel including the Company’s senior management team and maintain relationships with key business

partners and customers, and others with whom it does business, in light of the Merger; (vii) risks related to diverting management’s

attention from the Company’s ongoing business operations; (viii) unexpected costs, charges or expenses resulting from the Merger;

(ix) the ability to obtain the necessary financing arrangements set forth in the commitment letters received in connection with the Merger;

(x) potential litigation relating to the Merger that could be instituted against the parties to the agreement or their respective directors,

managers or officers, or the effects of any outcomes related thereto; (xi) the impact of adverse general and industry-specific economic

and market conditions; (xii) certain restrictions during the pendency of the Merger that may impact the Company’s ability to pursue

certain business opportunities or strategic transactions; (xiii) uncertainty as to timing of completion of the Merger; (xiv) risks that

the benefits of the Merger are not realized when and as expected; (xv) legislative, regulatory and economic developments; (xvi) those

risks and uncertainties set forth under the headings “Forward-Looking Statements” and “Risk Factors” in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC, as

such risk factors may be amended, supplemented or superseded from time to time by other reports filed by the Company with the SEC from

time to time, which are available via the SEC’s website at www.sec.gov; and (xvii)

those risks that are described in the Proxy Statement filed with the SEC on August 23, 2024 and available from the sources indicated below.

The Company cautions you that

the important factors referenced above may not contain all the factors that are important to you. These

risks, as well as other risks associated with the Merger, are more fully discussed in the Proxy Statement filed with the SEC on August

23, 2024 in connection with the Merger. There can be no assurance that the Merger will be completed, or if it is completed, that

it will close within the anticipated time period. These factors should not be construed as exhaustive and should be read in conjunction

with the other forward-looking statements. The forward-looking statements included in this communication are made only as of the

date hereof. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise, except as otherwise required by law. If one or more of these or other risks or uncertainties materialize,

or if our underlying assumptions prove to be incorrect, our actual results may vary materially from what we may have expressed or implied

by these forward-looking statements. We caution that you should not place significant weight on any of our forward-looking statements.

You should specifically consider the factors identified in this communication that could cause actual results to differ. Furthermore,

new risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect the Company.

Additional Information and

Where to Find It

This communication is being

made in connection with the Merger. In connection with the Merger, the Company has filed certain documents regarding the Merger with

the SEC, including the Proxy Statement on August 23, 2024. The Proxy Statement has been mailed to stockholders of the Company. This communication

does not constitute an offer to sell or the solicitation of an offer to buy any securities. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION,

STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT FILED WITH THE SEC (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER

RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION

ABOUT THE MERGER. Stockholders will be able to obtain, free of charge, copies of such documents filed by the Company when filed with

the SEC in connection with the Merger at the SEC’s website (http://www.sec.gov). In addition, the Company’s stockholders

will be able to obtain, free of charge, copies of such documents filed by the Company when filed with the SEC at the Company’s

website (https://investor.envestnet.com/). Alternatively, these documents, when available, can be obtained free of charge from the Company

upon written request to the Company at 1000 Chesterbrook Boulevard, Suite 250, Berwyn, Pennsylvania,

19312.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

Envestnet, Inc. |

| |

|

|

| Date: September 16, 2024 |

By: |

/s/ James L. Fox |

|

Name: |

James L. Fox |

|

Title: |

Interim Chief Executive Officer |

6

v3.24.3

Cover

|

Sep. 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 16, 2024

|

| Entity File Number |

001-34835

|

| Entity Registrant Name |

Envestnet, Inc.

|

| Entity Central Index Key |

0001337619

|

| Entity Tax Identification Number |

20-1409613

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1000 Chesterbrook Boulevard

|

| Entity Address, Address Line Two |

Suite 250

|

| Entity Address, City or Town |

Berwyn

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19312

|

| City Area Code |

(312)

|

| Local Phone Number |

827-2800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.005 Per Share

|

| Trading Symbol |

ENV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

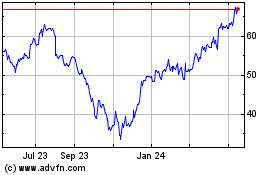

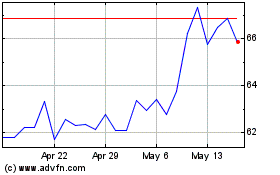

Envestnet (NYSE:ENV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Envestnet (NYSE:ENV)

Historical Stock Chart

From Nov 2023 to Nov 2024