Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

May 13 2021 - 7:58AM

Edgar (US Regulatory)

EATON VANCE TAX-MANAGED GLOBAL DIVERSIFIED EQUITY

INCOME FUND

Supplement to Prospectus dated February 19, 2021

The following changes are effective July 1, 2021:

The following replaces the corresponding disclosure under “The

Adviser” in “Management of the Fund” in the Prospectus:

Eaton Vance acts as the Fund’s investment adviser under an Investment

Advisory Agreement (the “Advisory Agreement”). The Adviser’s principal office is located at Two International Place,

Boston, MA 02110. Eaton Vance and its predecessor organizations have been managing assets since 1924 and managing mutual funds since 1931.

As of December 31, 2020, Eaton Vance and its affiliates managed approximately $583.1 billion of fund and separate account assets on behalf

of clients, including approximately $154.9 billion in equity assets. Eaton Vance is a wholly-owned subsidiary of Eaton Vance Corp., a

publicly-held holding company, which through its subsidiaries and affiliates engages primarily in investment management, administration

and marketing activities.

On October 8, 2020, Morgan Stanley and Eaton Vance Corp. (“EVC”)

announced that they had entered into a definitive agreement under which Morgan Stanley will acquire EVC (the “Transaction”).

The Fund’s investment adviser is a wholly-owned subsidiary of EVC and would become an indirect wholly-owned subsidiary of Morgan

Stanley as a result of the acquisition. The acquisition is subject to the completion or waiver of customary closing conditions, and is

expected to close in the second quarter of 2021.

Pursuant to the 1940 Act, consummation of the Transaction may be deemed

to result in the automatic termination of the Fund’s investment advisory agreement with its investment adviser. On November 10,

2020, the Fund's Board approved a new investment advisory agreement. The new investment advisory agreement was approved by Fund shareholders

at a joint special meeting of shareholders held on January 22, 2021, and would take effect upon consummation of the transaction.

Under the general supervision of the Fund’s Board, Eaton Vance

is responsible for managing the Fund’s overall investment program. Eaton Vance also is responsible for providing the Sub-Adviser

with research support and supervising the performance of the Sub-Adviser. The Adviser will furnish to the Fund investment advice and office

facilities, equipment and personnel for servicing the investments of the Fund. The Adviser will compensate all Trustees and officers of

the Fund who are members of the Adviser’s organization and who render investment services to the Fund, and will also compensate

all other Adviser personnel who provide research and investment services to the Fund. In return for these services, facilities and payments,

the Fund has agreed to pay the Adviser an investment advisory fee, payable on a monthly basis, at an annual rate of 1.00% of the average

daily gross assets of the Fund up to and including $1.5 billion, 0.98% of the average daily gross assets of the Fund over $1.5 billion

up to and including $3 billion, 0.96% of the average daily gross assets of the Fund over $3 billion up to and including $5 billion, and

0.94% of the average daily gross assets of the Fund over $5 billion. Gross assets of the Fund means total assets of the Fund, including

any form of investment leverage that the Fund utilizes, minus all accrued expenses incurred in the normal course of operations, but not

excluding any liabilities or obligations attributable to any future investment leverage obtained through (i) indebtedness of any type

(including, without limitation, borrowing through a credit facility/commercial paper program or the issuance of debt securities), (ii)

the issuance of preferred shares or other similar preference securities, (iii) the reinvestment of collateral received for securities

loaned in accordance with the Fund’s investment objectives and policies and/or (iv) any other means. During periods in which the

Fund is using leverage, the fees paid to Eaton Vance for investment advisory services will be higher than if the Fund did not use leverage

because the fees paid will be calculated on the basis of the Fund’s gross assets, including proceeds from borrowings and from the

issuance of preferred shares (if applicable). Under the Sub-Advisory Agreement between Eaton Vance and EVAIL, Eaton Vance (and not the

Fund) pays EVAIL a portion of the advisory fee for sub-advisory services provided to the Fund. The Fund is responsible for all expenses

not expressly stated by another party (such as the expenses required to be paid pursuant to an agreement with the investment adviser or

administrator).

EATON VANCE TAX-MANAGED GLOBAL DIVERSIFIED EQUITY

INCOME FUND

Supplement to Statement of Additional Information

dated February 19, 2021

The following changes are effective July 1, 2021:

The following replaces the tables under “Portfolio Managers.”

in “Investment Advisory and Other Services”:

|

|

Number of

All Accounts

|

Total Assets of

All Accounts

|

Number of Accounts

Paying a Performance Fee

|

Total Assets of Accounts

Paying a Performance Fee

|

|

Christopher M. Dyer(1)

|

|

|

|

|

|

Registered Investment Companies

|

9

|

$ 6,455.2

|

0

|

$ 0

|

|

Other Pooled Investment Vehicles

|

0

|

$ 0

|

0

|

$ 0

|

|

Other Accounts

|

2

|

$ 5.4

|

0

|

$ 0

|

|

|

(1)

|

This portfolio manager serves as portfolio manager of one or more registered investment companies that invests or may invest in one

or more underlying registered investment companies in the Eaton Vance family of funds or other pooled investment vehicles sponsored by

Eaton Vance. The underlying investment companies may be managed by this portfolio manager or another portfolio manager.

|

The following table shows the dollar range of shares of the Fund beneficially

owned by the portfolio manager as of the Fund’s most recent fiscal year ended October 31, 2020 and in the Eaton Vance Family of

Funds as of December 31, 2020.

|

Portfolio Managers

|

Dollar Range of Equity Securities

Beneficially Owned in the Fund

|

Aggregate Dollar Range of Equity

Securities Beneficially Owned

in all Registered Funds in

the Eaton Vance Family of Funds

|

|

Christopher M. Dyer

|

None

|

$1 – $10,000

|

May 13, 2021

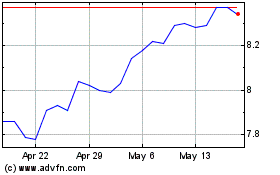

Eaton Vance Tax Managed ... (NYSE:EXG)

Historical Stock Chart

From Oct 2024 to Nov 2024

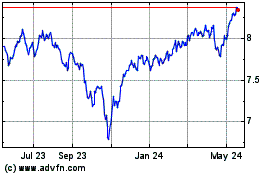

Eaton Vance Tax Managed ... (NYSE:EXG)

Historical Stock Chart

From Nov 2023 to Nov 2024