false

0001672013

0001672013

2024-12-17

2024-12-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported)

December 17, 2024

| Acushnet

Holdings Corp. |

| (Exact name of registrant

as specified in its charter) |

| Delaware |

001-37935 |

45-2644353 |

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| |

|

|

| 333 Bridge Street |

Fairhaven, Massachusetts |

02719 |

(Address of principal executive

offices) |

|

(Zip Code) |

(800) 225-8500

(Registrant’s Telephone

Number, Including Area Code)

Not Applicable

(Former Name or Former Address,

if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock - $0.001 par value per share |

|

GOLF |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On December 17, 2024, in connection with

its existing $1.0 billion share repurchase authorization, Acushnet Holdings Corp. (the “Company”) entered into an agreement

with Magnus Holdings Co., Ltd. (“Magnus”) pursuant to which the Company will purchase up to an aggregate of $62.5 million

of shares of its common stock from Magnus on a share-for-share basis as the Company repurchases shares in the open market or privately

negotiated transactions. The price payable to Magnus for the Company’s shares will be the average price of the shares purchased

in the open market or privately negotiated transactions over the period of time from January 2, 2025 (in the case of the first such pricing

period) to the first “determination date” and, in the case of any subsequent such pricing period, from the most recent preceding

determination date to the next determination date. The “determination date” will be (i) commencing January 2, 2025, the date

on which the Company purchases an aggregate of $62.5 million of shares, (ii) any date otherwise mutually agreed between the Company and

Magnus, and (iii) June 30, 2025, if the Company has not already purchased the $62.5 million shares of common stock. The obligations of

the Company to purchase the shares and Magnus to sell the shares following each determination date are conditioned upon no event occurring

since the date of the agreement that, either individually or in the aggregate, has had a material adverse effect on the business or financial

condition of the Company as of each closing. The foregoing summary does not purport to be complete and is qualified in its entirety by

reference to the copy of the agreement filed as Exhibit 10.1 to this Current Report on Form 8-K. For more information on Magnus’

relationship to the Company, please refer to the Company’s Definitive Proxy Statement filed on April 19, 2024.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ACUSHNET HOLDINGS CORP. |

| |

|

| |

By: |

/s/ Sean Sullivan |

| |

Name: |

Sean Sullivan |

| |

Title: |

Executive Vice President, Chief Financial Officer |

Date: December 17, 2024

Exhibit 10.1

STOCK REPURCHASE AGREEMENT

THIS STOCK REPURCHASE AGREEMENT (this “Agreement”)

is entered into as of December 17, 2024 by and between Acushnet Holdings Corp. (the “Company”) and Magnus Holdings Co., Ltd.

(the “Seller”).

BACKGROUND

A.

As of the date hereof, Seller owns 31,412,966 shares of the Company’s common stock (the “Common Stock”), and

has agreed to transfer a portion of those shares to the Company on the terms and conditions set forth in this Agreement;

B.

The Seller desires to sell, and the Company desires to repurchase, a portion of the shares of Common Stock held by the Seller at

the price and upon the terms and conditions provided in this Agreement (the “Repurchase”);

C.

The board of directors of the Company (the “Board”) has authorized a program to repurchase shares of Common Stock,

from time to time in the open market, in privately negotiated transactions or in a combination thereof (the “Share Repurchase Program”);

D.

On February 15, 2024, the Board authorized the Company to repurchase up to an additional $300 million of Common Stock, bringing

the total Share Repurchase Program authorization up to an aggregate of $1 billion;

E.

The Board formed a special committee of the Board (the “Board Committee”) comprised solely of independent directors

to determine whether or not to authorize and to negotiate the terms of the Repurchase; and

F.

The Board Committee has approved the Repurchase and related transactions that may be required in connection with the Repurchase.

THEREFORE, in consideration of the mutual covenants

herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the undersigned hereby

agree as follows:

AGREEMENT

1. Repurchase.

(a)

Subject to the satisfaction of the conditions and to the terms set forth in paragraph 1(b) below, the Seller hereby agrees to transfer,

assign, sell, convey and deliver to the Company 100% of its right, title, and interest in and to the applicable Sale Number (as defined

below) of shares of Common Stock (the “Repurchase Shares”) at each Closing (as defined below). The “Sale Number”

shall mean the number of shares of Common Stock acquired by the Company during the Pricing Period (as defined below) as of the applicable

Determination Date (as defined below) under the Share Repurchase Program through open market purchases or privately negotiated transactions

from shareholders other than Seller (such shares are referred to as the “Public Shares”), rounded down to the nearest whole

share. The “Pricing Period” shall be the period from January 2, 2025 through the applicable Determination Date in the case

of the first Determination Date or the period from the most recent preceding Determination Date to the applicable Determination Date otherwise.

A “Determination Date” shall be (i) the date that the Company has paid, commencing January 2, 2025, an aggregate of $62,500,000

to repurchase shares of Common Stock under the Share Repurchase Program through open market purchases or privately negotiated transactions,

(ii) any date earlier than the Determination Date contemplated by clause (i) as the parties hereto mutually agree, provided that any such

mutual agreement may be reached only during an open trading window under the Company’s insider trading policy, as such are determined

by the Company from time to time, and (iii) June 30, 2025 but (in the case of this clause (iii)) only if the Determination Date contemplated

by clause (i) has not occurred prior to June 30, 2025. The per share purchase price for each Repurchase Share shall be equal to the average

per share price paid by the Company during the applicable Pricing Period for the Public Shares (the “Weighted Average Per Share

Purchase Price” and the Weighted Average Per Share Purchase Price multiplied by the applicable Sale Number is the “Aggregate

Purchase Price”). On or promptly following each Determination Date (and in any event no later than the second business day following

such Determination Date), the Company shall notify the Seller, in writing (email being sufficient), of the applicable Sale Number of Repurchase

Shares, the applicable Weighted Average Per Share Purchase Price and the applicable Aggregate Purchase Price, together with related calculations

(including details of the corresponding purchases of Public Shares). At each Closing (as defined below), subject to the satisfaction of

the conditions and to the terms set forth in paragraph 1(b), Seller agrees to transfer, assign, sell, convey and deliver the applicable

Sale Number of Repurchase Shares to the Company, and the Company hereby agrees to purchase such Repurchase Shares from Seller at the applicable

Weighted Average Per Share Purchase Price. The Company and the Seller shall execute a cross-receipt in mutually agreeable form at each

Closing.

(b)

The obligations of the Company to purchase the Repurchase Shares and the Seller to sell the Repurchase Shares at each Closing shall

be subject to no event occurring since the date of this Agreement as of such Closing that, either individually or in the aggregate, has

had a material adverse effect on the business or financial condition of the Company.

(c)

It is the intent of the Seller and the Company that the transactions provided for herein comply with the requirements of Rule 10b5-1(c)(1)(i)(B)

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and this Agreement shall be interpreted to comply

with the requirements thereof.

(d)

Each closing of the sale of the applicable Sale Number of Repurchase Shares (each, a “Closing”) shall take place at

10:00 a.m. (New York time) fifteen (15) days after the Company notifies Seller that a Determination Date has occurred (or, if such day

is not a business day, the next business day following such 15-day period), at the offices of the Company in Fairhaven, Massachusetts,

unless otherwise agreed by the Company and the Seller; provided, that, in the case of any Determination Date that occurs on or prior to

June 30, 2025, Closing shall take place on July 10, 2025 unless otherwise agreed by the Company and Seller. At the Closing, the Seller

shall deliver to the Company or as instructed by the Company duly executed stock powers relating to the applicable Sale Number of Repurchase

Shares together with certificates representing the applicable Sale Number of Repurchase Shares (if applicable), and the Company shall

deliver to the Seller the applicable Aggregate Purchase Price for such Repurchase Shares by wire transfer of immediately available funds

pursuant to wire instructions previously provided by the Seller to the Company. When used in this Agreement, “business day”

shall mean any day other than a Saturday, Sunday or other day on which commercial banks are closed in New York, New York.

(e)

The parties shall cooperate and provide each other reasonable opportunity to review and comment on public disclosure of the transactions

contemplated hereby; provided, that neither party shall be prohibited under this Agreement from disclosing matters that it determines

are necessary or appropriate to comply with its obligations under applicable law.

2. Company

Representations. In connection with the transactions contemplated hereby, the Company represents and warrants to the Seller that:

(a)

The Company is a corporation duly organized and existing under the laws of the State of Delaware. The Company has the requisite

corporate power and authority to execute, deliver and perform its obligations under this Agreement and to consummate the transactions

contemplated hereby.

(b)

This Agreement has been duly authorized, executed and delivered by the Company and constitutes a valid and binding agreement of

the Company enforceable in accordance with its terms, except to the extent that enforcement thereof may be limited by bankruptcy, insolvency,

reorganization or other laws affecting enforcement of creditors’ rights or by general equitable principles.

(c)

The compliance by the Company with this Agreement and the consummation of the transactions herein contemplated will not (i) conflict

with or result in a breach or violation of any of the terms or provisions of, or constitute a default under any indenture, mortgage, deed

of trust, loan agreement or other agreement or instrument to which the Company or any of its subsidiaries is a party or by which the Company

or any of its subsidiaries is bound or to which any of the property or assets of the Company or any of its subsidiaries is subject, (ii)

violate any provision of the certificate of incorporation or by-laws, or other organizational documents, as applicable, of the Company

or its subsidiaries or (iii) violate any statute or any order, rule or regulation of any court or governmental agency or body having jurisdiction

over the Company or any of its Subsidiaries or any of their properties; except, in the case of clauses (i) and (iii), as would not impair

in any material respect the consummation of the Company’s obligations hereunder or reasonably be expected to have a material adverse

effect on the financial position, stockholders’ equity or results of operations of the Company and its subsidiaries, taken as a

whole, in the case of each such clause, after giving effect to any consents, approvals, authorizations, orders, registrations, qualifications,

waivers and amendments as will have been obtained or made as of the date of this Agreement; and no consent, approval, authorization, order,

registration or qualification of or with any such court or governmental agency or body is required for the execution, delivery and performance

by the Company of its obligations under this Agreement, including the consummation by the Company of the transactions contemplated by

this Agreement, except where the failure to obtain or make any such consent, approval, authorization, order, registration or qualification

would not impair in any material respect the consummation of the Company’s obligations hereunder or reasonably be expected to have

a material adverse effect on the financial position, stockholders’ equity or results of operations of the Company and its subsidiaries,

taken as a whole.

(d)

As of the date hereof, the Company is not aware of any material, nonpublic information about the Company or its securities and

it is entering into this Agreement in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b5-1 of the Exchange

Act.

3. Representations

of the Seller. In connection with the transactions contemplated hereby, the Seller represents and warrants to the Company that:

(a)

Seller is duly organized and existing under the laws of its state of organization.

(b)

All consents, approvals, authorizations and orders necessary for the execution and delivery by Seller of this Agreement and for

the sale and delivery of the Repurchase Shares to be sold by Seller hereunder, have been obtained; and Seller has full right, power and

authority to enter into this Agreement and to sell, assign, transfer and deliver the Repurchase Shares to be sold by Seller hereunder,

except for such consents, approvals, authorizations and orders as would not impair in any material respect the consummation of the Seller’s

obligations hereunder.

(c)

This Agreement has been duly authorized, executed and delivered by Seller and constitutes a valid and binding agreement of Seller,

enforceable in accordance with its terms, except to the extent that enforcement thereof may be limited by bankruptcy, insolvency, reorganization

or other laws affecting enforcement of creditors’ rights or by general equitable principles.

(d)

The sale of the Repurchase Shares to be sold by Seller hereunder and the compliance by such Seller with all of the provisions of

this Agreement and the consummation of the transactions contemplated herein (i) will not conflict with or result in a breach or violation

of any of the terms or provisions of, or constitute a default under, any indenture, mortgage, deed of trust, loan agreement or other agreement

or instrument to which Seller is a party or by which Seller is bound or to which any of the property or assets of Seller is subject, (ii)

nor will such action violate any of the provisions of (x) any organizational or similar documents pursuant to which Seller was formed

or (y) any statute or any order, rule or regulation of any court or governmental agency or body having jurisdiction over Seller or the

property of such Seller; except in the case of clause (i) or clause (ii)(y), for such conflicts, breaches, violations or defaults as would

not impair in any material respect the consummation of Seller’s obligations hereunder.

(e)

As of the date hereof and immediately prior to the delivery of the Repurchase Shares to the Company at each Closing, such Seller

owns the Repurchase Shares or a security entitlement in respect thereof, and holds, or will hold, such Repurchase Shares free and clear

of all liens, encumbrances, equities or claims; and, upon delivery of such Repurchase Shares (including by delivery of security certificates

duly indorsed or crediting to a securities account of the Company) and payment therefor pursuant hereto, assuming that the Company has

no notice of any adverse claims within the meaning of Section 8-105 of the New York Uniform Commercial Code as in effect in the State

of New York from time to time (the “UCC”), the Company will acquire its interest in the Repurchase Shares purchased by the

Company that are physically delivered to the Company free of adverse claims (within the meaning of Section 8-105 of the UCC) or, in the

case of crediting to a securities account of the Company, will acquire a security entitlement (within the meaning of Section 8-102(a)(17)

of the UCC) to such Repurchase Shares purchased by the Company, and no action (whether framed in conversion, replevin, constructive trust,

equitable lien or other theory) based on an adverse claim (within the meaning of Section 8-105 of the UCC) to such security entitlement

may be asserted against the Company.

(f)

Seller (either alone or together with its advisors) has such knowledge and experience in financial or business matters that it

is capable of evaluating the merits and risks of the Repurchase. Seller has had the opportunity to ask questions and receive answers concerning

the terms and conditions of the Repurchase and the Repurchase Shares and has had full access to such other information concerning the

Repurchase Shares and the Company as it has requested. Seller has received all information that it believes is necessary or appropriate

in connection with the Repurchase. Seller is an informed and sophisticated party and has engaged, to the extent such Seller deems appropriate,

expert advisors experienced in the evaluation of transactions of the type contemplated hereby. Seller acknowledges that Seller has not

relied upon any express or implied representations or warranties of any nature made by or on behalf of the Company, whether or not any

such representations, warranties or statements were made in writing or orally, except as expressly set forth for the benefit of Seller

in this Agreement.

(g)

As of the date hereof, the Seller is not aware of any material, nonpublic information about the Company or its securities and it

is entering into this Agreement in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b5-1 of the Exchange

Act.

4. Termination.

This Agreement may be terminated at any time upon written notice by either party to the other specifying an effective termination date

that is no earlier than 30 business days following the delivery of such notice. On any termination pursuant to this Section 4, the effective

termination date specified in such written notice will constitute a Determination Date under this Agreement and the parties will remain

obligated to purchase and sell the applicable Sale Number of Shares for the Pricing Period ending on such Determination Date as provided

in Section 1. No termination of this Agreement shall relieve either party of (i) any obligations with respect to any purchase and sale

of Repurchase Shares with respect to any Determination Date occurring on or prior to such effective termination date or (ii) any liability

for any breach of this Agreement prior to such effective termination date.

5. Notices.

All notices, demands or other communications to be given or delivered under or by reason of the provisions of this Agreement will be in

writing and will be deemed to have been given when delivered personally, mailed by certified or registered mail, return receipt requested

and postage prepaid, or sent via a nationally recognized overnight courier, or sent via email to the recipient (unless the sender receives

an automated message that the email has not been delivered). Such notices, demands and other communications will be sent to the address

indicated below:

To the Company:

Acushnet Holdings Corp.

333 Bridge Street

Fairhaven, Massachusetts 02719

United States of America

Attention: Roland Giroux

Tel No.:

Email Address:

and to the Seller:

Magnus Holdings Co., Ltd.

35, Bomun-ro, Seongbuk-gu, Seoul, Korea 10F, 02873

Republic of Korea

Attention: Ho Yeon Lee

Tel No.:

Email Address:

or such other address or to the attention of such other person as the

recipient party shall have specified by prior written notice to the sending party.

6. Miscellaneous.

(a)

Survival of Representations and Warranties. All representations and warranties contained herein or made in writing by any

party in connection herewith shall survive the execution and delivery of this Agreement and the consummation of the transactions contemplated

hereby.

(b)

Severability. Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective

and valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal, or unenforceable in any respect

under any applicable law or rule in any jurisdiction, such invalidity, illegality, or unenforceability will not affect any other provision

or any other jurisdiction, but this Agreement will be reformed, construed, and enforced in such jurisdiction as if such invalid, illegal,

or unenforceable provision had never been contained herein.

(c)

Complete Agreement. This Agreement and any other agreements ancillary thereto and executed and delivered on the date hereof

embody the complete agreement and understanding between the parties and supersede and preempt any prior understandings, agreements, or

representations by or among the parties, written or oral, which may have related to the subject matter hereof in any way.

(d)

Counterparts. This Agreement may be executed in separate counterparts, each of which is deemed to be an original and all

of which taken together constitute one and the same agreement.

(e)

Assignment; Successors and Assigns. Neither this Agreement nor any of the rights, interests or obligations hereunder shall

be assigned, in whole or in part, by either of the parties without the prior written consent of the other party. Subject to the preceding

sentence, this Agreement shall bind and inure to the benefit of and be enforceable by the Seller and the Company and their respective

successors and permitted assigns. Any purported assignment not permitted under this paragraph shall be null and void.

(f)

No Third Party Beneficiaries or Other Rights. This Agreement is for the sole benefit of the parties and their successors

and permitted assigns and nothing herein express or implied shall give or shall be construed to confer any legal or equitable rights or

remedies to any person other than the parties to this Agreement and such successors and permitted assigns.

(g)

Governing Law; Jurisdiction. The Agreement and all disputes arising out of or related to this agreement (whether in contract,

tort or otherwise) will be governed by and construed in accordance with the laws of the State of New York. EACH OF THE PARTIES TO THIS

AGREEMENT IRREVOCABLY WAIVES ANY AND ALL RIGHTS TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATED TO THIS AGREEMENT.

Each of the parties (i) irrevocably submits to the personal jurisdiction of any state or federal court sitting in the State of New York,

County of New York, as well as to the jurisdiction of all courts to which an appeal may be taken from such courts, in any suit, action

or proceeding relating to or arising out of, under or in connection with this Agreement, (ii) agrees that all claims in respect of such

suit, action or proceeding, whether arising under contract, tort or otherwise, shall be brought, heard and determined exclusively in such

courts, (iii) agrees that it shall not attempt to deny or defeat such personal jurisdiction by motion or other request for leave from

such courts, and (iv) agrees not to bring any action or proceeding relating to or arising out of, under or in connection with this Agreement

in any other court, tribunal, forum or proceeding. Each of the parties waives any defense of inconvenient forum to the maintenance of

any action or proceeding brought in accordance with this paragraph. Each of the parties agrees that service of any process, summons, notice

or document by U.S. registered mail to its address set forth herein shall be effective service of process for any action, suit or proceeding

brought against it in accordance with this paragraph, provided that nothing in the foregoing sentence shall affect the right of any party

to serve legal process in any other manner permitted by law.

(h)

Mutuality of Drafting. The parties have participated jointly in the negotiation and drafting of this Agreement. In the event

an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as jointly drafted by the parties, and

no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any provision of the Agreement.

(i)

Remedies. The parties hereto agree and acknowledge that money damages will not be an adequate remedy for any breach of the

provisions of this Agreement, that any breach of the provisions of this Agreement shall cause the other parties irreparable harm, and

that any party may in its sole discretion apply to any court of law or equity of competent jurisdiction (without posting any bond or deposit)

for specific performance or other injunctive relief in order to enforce, or prevent any violations of, the provisions of this Agreement.

(j)

Amendment and Waiver. The provisions of this Agreement may be amended, modified or waived only with the prior written consent

of the Seller and the Company. No waiver of any of the provisions of this Agreement shall be deemed or shall constitute a waiver of any

other provisions of this Agreement, nor shall any waiver constitute a continuing waiver. Moreover, no failure by any party to insist upon

strict performance of any of the provisions of this Agreement or to exercise any right or remedy arising out of a breach thereof shall

constitute a waiver of any other provisions or any other breaches of this Agreement.

(k)

Further Assurances. Each of the Company and the Seller shall execute and deliver such additional documents and instruments

and shall take such further action as may be necessary or appropriate to effectuate fully the provisions of this Agreement.

(l)

Expenses. Each of the Company and the Seller shall bear its own expenses in connection with the drafting, negotiation,

execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

[Signatures appear on following page.]

IN WITNESS WHEREOF, each of the parties has executed this Stock Repurchase

Agreement as the date first written above by duly authorized representatives.

COMPANY:

| ACUSHNET HOLDINGS CORP. |

|

| |

|

| By: |

/s/ Sean Sullivan |

|

| Name: |

Sean Sullivan |

|

| Title: |

Executive Vice President, Chief Financial Officer |

|

SELLER:

| MAGNUS HOLDINGS CO., LTD. |

|

| |

|

| By: |

/s/ Ho Yeon Lee |

|

| Name: |

Ho Yeon Lee |

|

| Title: |

Chief Executive Officer |

|

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

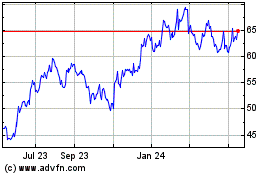

Acushnet (NYSE:GOLF)

Historical Stock Chart

From Nov 2024 to Dec 2024

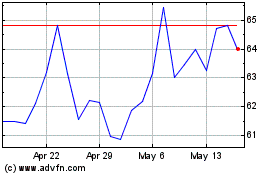

Acushnet (NYSE:GOLF)

Historical Stock Chart

From Dec 2023 to Dec 2024