HCI Group’s 4.75% Convertible Senior Notes Due 2042 Became Convertible on January 1, 2025

January 02 2025 - 3:30PM

HCI Group, Inc. (NYSE: HCI), a

holding company with operations in homeowners insurance,

information technology services, real estate, and reinsurance, has

announced that its 4.75% Convertible Senior Notes Due 2042 became

convertible by all Holders on January 1, 2025.

The terms of the Notes provide that the Notes will become

convertible during a quarter, when the HCI closing share price for

20 trading days during the final 30 trading days of the immediately

preceding quarter was greater than 130% of the Conversion Price of

$80.54. HCI’s common shares closed at more than 130% above the

Conversion Price each day of the final 30 trading days of the

quarter ended December 31, 2024. Accordingly, the Notes became

convertible beginning January 1, 2025 and will remain convertible

at least through March 31, 2025.

All Holders who wish to convert their Notes into shares of HCI

common stock must provide a Notice of Conversion to HCI. The

requirements for such notice can be found in Section 13.02(b) of

the Indenture by and between HCI and the Bank of New York Mellon,

attached as Exhibit 4.1 to HCI’s Form 8-K filed with the Securities

and Exchange Commission on May 23, 2022. Upon a Holder’s election

to convert Notes, HCI will have the option to elect a Settlement

Method – Physical Settlement, Cash Settlement or Combination

Settlement. HCI states that for all Notices of Conversion received

on or before the close of business on March 31, 2025, HCI plans to

select Physical Settlement and settle such conversions fully in HCI

common stock, at the current conversion ratio of approximately

12.4166 shares of HCI common stock per $1,000 principal amount of

Notes.

HCI states further it is considering a full redemption of the

Notes on June 5, 2025, if the conditions for redemption are met.

The Company has the right to redeem the existing 4.75% Convertible

Notes due 2042 at any time after June 5, 2025 if the last reported

sale price of the common stock has been at least 130% of the

Conversion Price for at least 20 trading days during any 30

consecutive trading day period.

About HCI Group, Inc.HCI Group, Inc. owns

subsidiaries engaged in diverse, yet complementary business

activities, including homeowners insurance, information technology

services, insurance management, real estate, and reinsurance. HCI’s

leading insurance operation, TypTap Insurance Company, is a

technology-driven homeowners insurance company. TypTap’s operations

are powered in large part by insurance-related information

technology developed by HCI’s software subsidiary, Exzeo USA, Inc.

HCI’s largest subsidiary, Homeowners Choice Property & Casualty

Insurance Company, Inc., provides homeowners insurance primarily in

Florida. HCI’s real estate subsidiary, Greenleaf Capital, LLC, owns

and operates multiple properties in Florida, including office

buildings, retail centers and marinas.

The company's common shares trade on the New York Stock Exchange

under the ticker symbol "HCI" and are included in the Russell 2000

and S&P SmallCap 600 Index. HCI Group, Inc. regularly publishes

financial and other information in the Investor Information section

of the company’s website. For more information about HCI Group and

its subsidiaries, visit www.hcigroup.com.

Forward-Looking StatementsThis news release may

contain forward-looking statements made pursuant to the Private

Securities Litigation Reform Act of 1995. Words such as

“anticipate,” “estimate,” “expect,” “intend,” “plan,” “confident,”

“prospects,” and “project” and other similar words and expressions

are intended to signify forward-looking statements. Forward-looking

statements are not guarantees of future results and conditions but

rather are subject to various risks and uncertainties. There can be

no assurance, for example, that changes in the company’s balance

sheet and cash flow will not impact the ability or willingness of

HCI Group to elect physical delivery or to redeem the Notes. Some

of these risks and uncertainties are identified in the company’s

filings with the Securities and Exchange Commission. Should any

risks or uncertainties develop into actual events, these

developments could have material adverse effects on the company’s

business, financial condition and results of operations. HCI Group,

Inc. disclaims all obligations to update any forward-looking

statements.

Company Contact:Bill Broomall, CFA Investor

RelationsHCI Group, Inc.Tel (813) 776-1012wbroomall@typtap.com

Investor Relations Contact:Matt GloverGateway

Group, Inc. Tel 949-574-3860HCI@gatewayir.com

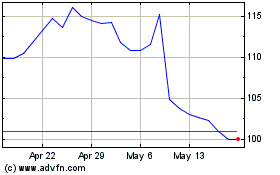

HCI (NYSE:HCI)

Historical Stock Chart

From Dec 2024 to Jan 2025

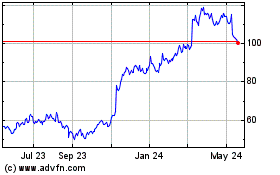

HCI (NYSE:HCI)

Historical Stock Chart

From Jan 2024 to Jan 2025