ICE Announces Record Environmental Market Trading in 2024

January 24 2025 - 7:00AM

Business Wire

Equivalent to over $1 Trillion in Notional

Value for the Fourth Consecutive Year

Intercontinental Exchange, Inc. (NYSE:ICE), a leading global

provider of technology and data, today announced that a record

number of environmental contracts traded on ICE in 2024, equivalent

to over $1 trillion in notional value for the fourth consecutive

year.

A record 20.4 million environmental futures and options

contracts traded on ICE in 2024, up approximately 40%

year-over-year (y/y) along with record average daily volume and

participation.

ICE’s EU Carbon Allowance (EUA) futures and options, which

represents the world’s most liquid carbon derivatives market, and

U.K. Carbon Allowance (UKA) futures and options each reached record

participation in 2024 and physically delivered carbon allowances

worth $40 billion.

Across ICE’s North American environmental markets, a record 5.6

million futures and options traded in 2024, with a record $12.3

billion physically delivered. ICE’s California Carbon Allowance

(CCA) market hit record traded volume in 2024 of 3.9 million

contracts, up 68% y/y.

“For the last twenty years, ICE has worked to create a truly

interconnected global network of energy and environmental markets

to allow customers to meet their emissions obligations and

environmental price risk on a single platform,” said Gordon

Bennett, Managing Director, Utility Markets at ICE. “At ICE we are

working hard to develop scalable carbon credit markets, including

CORSIA, the first global market-based carbon credit program

targeted at reducing emissions from international aviation.”

Reflecting how many carbon markets are expanding their scope and

coverage, the European Union has created a new emissions trading

scheme named ETS 2 to cover carbon dioxide emissions from fuel

combustion in buildings and road transport. To help the market

manage carbon price risk in these new sectors, ICE plans to launch

EUA 2 futures on May 6, 2025, subject to regulatory approval.

Since launch, 166 billion carbon allowances, 6 billion carbon

credits, 588 million renewable energy certificates, and the

equivalent of 21.2 billion Renewable Identification Numbers (RINs)

have traded across ICE’s global environmental portfolio.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune

500 company that designs, builds and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges

– including the New York Stock Exchange – and clearing

houses help people invest, raise capital and manage risk. We

offer some of the world’s largest markets to trade and clear energy

and environmental products. Our fixed income, data services

and execution capabilities provide information, analytics and

platforms that help our customers streamline processes and

capitalize on opportunities. At ICE Mortgage Technology, we

are transforming U.S. housing finance, from initial consumer

engagement through loan production, closing, registration and the

long-term servicing relationship. Together, ICE transforms,

streamlines and automates industries to connect our customers to

opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for

certain products covered by the EU Packaged Retail and

Insurance-based Investment Products Regulation can be accessed on

the relevant exchange website under the heading “Key Information

Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 – Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

Category: EXCHANGES

ICE-CORP

Source: Intercontinental Exchange

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250124458141/en/

ICE Media: Jess Tatham jess.tatham@ice.com +44

7377 947136

ICE Investor: Katia Gonzalez

katia.gonzalez@ice.com (678) 981-3882

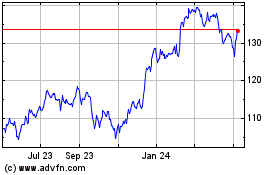

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Feb 2024 to Feb 2025