Western Asset Investment Grade Defined Opportunity Trust Inc. Announces Tender Offer Details

August 02 2024 - 7:00AM

Business Wire

Western Asset Investment Grade Defined Opportunity Trust Inc.

(NYSE: IGI) (the “Fund”) announced today additional details

concerning its previously announced cash tender offer for up to

100% of such Fund’s outstanding shares of common stock (“Shares”)

at a price per share equal to 100% of the Fund’s net asset value

per Share on the day on which the tender offer expires (the

“Offer”). The Fund expects the Offer to commence on or about

September 3, 2024, with an expiration time of 5:00 p.m., New York

City time, on or about October 1, 2024, unless extended. To ensure

the Fund can pay proceeds for repurchased Shares promptly after the

expiration of the Offer, the Fund intends to reposition its

portfolio in an orderly manner in advance of the expiration of the

Offer.

As previously announced on June 11, 2024, stockholders approved

the proposal to convert the Fund to a perpetual fund by eliminating

the Fund’s term, which was scheduled to end at the close of

business on December 2, 2024, and eliminating the Fund’s

fundamental policy to liquidate on or about December 2, 2024.

As a result of the proposal’s approval, the following in

addition to the Offer will occur:

- If the Fund maintains at least $50 million of net assets

following the Offer, the Fund will change its name from “Western

Asset Investment Grade Defined Opportunity Trust Inc.” to “Western

Asset Investment Grade Opportunity Trust Inc.” The Fund’s ticker

symbol will remain “IGI”. The Fund’s CUSIP, 95790A101, will not

change.

- If less than $50 million of net assets remain in the Fund

following the Offer, the Offer will be cancelled and the Fund will

proceed to liquidate on or about December 2, 2024 without further

action by stockholders; and

- The Fund’s investment manager has agreed to waive 10 basis

points (0.10%) of its annual management fee (the “Fee Waiver”) for

a period of two years following the proposal’s approval. The Fee

Waiver will terminate on June 7, 2026.

The Fund has not commenced the Offer described in this release.

This announcement is not a recommendation, an offer to purchase or

a solicitation of an offer to sell shares of the Fund and the above

statements are not intended to constitute an offer to participate

in any tender offer. Information about the Offer will be provided

by future public announcements. Stockholders will be notified in

accordance with the requirements of the Securities Exchange Act of

1934, as amended, and the Investment Company Act of 1940, as

amended, either by publication or mailing or both. The Offer will

be made only by an offer to purchase, a related letter of

transmittal, and other documents to be filed with the SEC.

STOCKHOLDERS OF THE FUND SHOULD READ THE OFFER TO PURCHASE AND

TENDER OFFER STATEMENT AND RELATED EXHIBITS WHEN THOSE DOCUMENTS

ARE FILED AND BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE OFFER. These and other filed documents

will be available to investors for free both at the website of the

SEC and from the Fund. There can be no assurance that any Share

repurchase will reduce or eliminate the discount of market price

per Share to net asset value per Share for the Fund.

About the Fund

The Fund is a non-diversified, limited-term, closed-end

management investment company managed by Franklin Templeton Fund

Adviser, LLC (formerly known as Legg Mason Partners Fund Advisor,

LLC) and is sub-advised by Western Asset Management Company, LLC

(“Western Asset”), Western Asset Management Company Pte. Ltd.

(“Western Asset Singapore”), Western Asset Management Company Ltd

(“Western Asset Japan”) and Western Asset Management Company

Limited (“Western Asset London”) are the Fund’s subadvisers. FTFA,

Western Asset, Western Asset Singapore, Western Asset Japan and

Western Asset London are indirect, wholly-owned subsidiaries of

Franklin Resources, Inc.

This press release may contain statements regarding plans and

expectations for the future that constitute forward-looking

statements within the Private Securities Litigation Reform Act of

1995. Such forward-looking statements are based on the Fund’s

current plans and expectations and are subject to risks and

uncertainties that could cause actual results to differ materially

from those described in the forward-looking statements. Additional

information concerning such risks and uncertainties is contained in

the Fund’s filings with the SEC.

For more information about the Fund, please call Fund Investor

Services: 1-888-777-0102, or consult the Fund’s web site at

www.franklintempleton.com/investments/options/closed-end-funds. The

information contained on the Fund’s web site is not part of this

press release. Hard copies of the Fund’s complete audited financial

statements are available free of charge upon request.

About Franklin Templeton

Franklin Resources, Inc. is a global investment management

organization with subsidiaries operating as Franklin Templeton and

serving clients in over 150 countries. Franklin Templeton’s mission

is to help clients achieve better outcomes through investment

management expertise, wealth management and technology solutions.

Through its specialist investment managers, the company offers

specialization on a global scale, bringing extensive capabilities

in fixed income, equity, alternatives and multi-asset solutions.

With more than 1,500 investment professionals, and offices in major

financial markets around the world, the California-based company

has over 75 years of investment experience and over $1.6 trillion

in assets under management as of June 30, 2024. For more

information, please visit franklintempleton.com and follow us on

LinkedIn, X and Facebook.

Category: Fund Announcement

Source: Franklin Resources, Inc.

Source: Legg Mason Closed End Funds

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240802176950/en/

Investor Contact: Fund Investor Services 1-888-777-0102 Media

Contact: Lisa Tibbitts +1 (904) 942-4451

Lisa.Tibbitts@franklintempleton.com

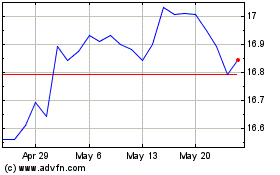

Western Asset Investment... (NYSE:IGI)

Historical Stock Chart

From Oct 2024 to Nov 2024

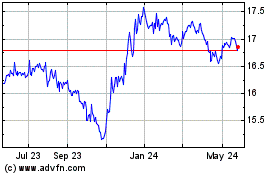

Western Asset Investment... (NYSE:IGI)

Historical Stock Chart

From Nov 2023 to Nov 2024