Consolidated Highlights – Second Quarter 2024

- Revenue of $435.4 million increased 4.2% compared to the first

quarter of 2024. Revenue decreased by 20.3% (or increased by 69.3%

organically) compared to the second quarter of 2023, reflecting a

$490.0 million year-on-year foreign exchange (“FX”) headwind,

largely as a result of the 63.5% devaluation of the Nigerian Naira

(“NGN”), partially offset by $354.7 million FX resets and

escalations captured within organic growth.

- Adjusted EBITDA of $250.8 million (57.6% Adjusted EBITDA

Margin) decreased from the second quarter of 2023 by 11.9%,

reflecting a $307.2 million year-on-year FX headwind largely as a

result of the devaluation of the NGN

- Loss for the period was $124.3 million of which $169.7 million

relates to unrealized FX losses

- Cash from operations was $151.6 million

- Adjusted Levered Free Cash Flow (“ALFCF”) was $66.9

million

- Total Capex was $53.7 million

- On August 7, 2024, we reduced guidance for revenue to

$1,670-1,700 million, Adjusted EBITDA to $900-920 million and ALFCF

guidance to $250-270 million. The reduction in guidance includes

the impact from the renewal and extension of all tower contracts

with MTN Nigeria. Capital expenditure (“Total Capex”) guidance of

$330-370 million and net leverage ratio target of 3.0x-4.0x remain

unchanged.

IHS Holding Limited (NYSE: IHS) (“IHS Towers” or the “Company”),

one of the largest independent owners, operators, and developers of

shared communications infrastructure in the world by tower count,

today reported financial results for the second quarter ended June

30, 2024.

Sam Darwish, IHS Towers Chairman and Chief Executive Officer,

stated, “We’re reporting solid performance on Revenue, Adjusted

EBITDA and ALFCF, while Capex decreased meaningfully. As of this

quarter, we began putting the negative impacts of the January 2024

Naira devaluation in the rearview mirror, as we realized more of

the benefits of the FX resets in our revenue contracts and saw a

significant step-up in Adjusted EBITDA and Adjusted EBITDA margin

from the first quarter. The reduction in Capex reflects the actions

we’re taking to try to generate more cash and narrow our focus to

projects that we believe will deliver the highest returns, two of

the main goals of our ongoing strategic review.

Organic growth for the quarter was 69%. Groupwide, we added net

385 tenants and 1,566 lease amendments and built 207 towers,

including 136 in Brazil. For the remainder of the year, we expect

strong performance in our KPIs as the underlying trends driving our

business remain healthy, and the higher Adjusted EBITDA margin

continues after the dip of 1Q24 margins emanating from the January

2024 devaluation in Nigeria.

During the quarter, the average FX rate for the U.S. dollar to

the Naira was 1,392. This, compared to an average of 1,316 in 1Q24,

shows a reasonable slowdown in the rate of devaluation, and equates

to a $15 million headwind quarter-on-quarter. Whereas, when

compared to the average rate for the U.S. dollar to the Naira of

508 a year ago, it equates to a $478 million headwind, albeit

offset by $319 million from FX resets. As the Nigeria FX market

gradually stabilizes, we continue to see USD availability and more

favorable conditions to source and upstream U.S. dollars to

Group.

We’ve made progress on outstanding commercial and governance

matters. On the commercial front, in May, we extended our contract

with MTN South Africa by an additional two years, through 2034,

covering nearly 5,700 towers, and reached an agreement to unwind

our power managed services covering approximately 7,000 towers. In

June, we renewed contracts with MTN Rwanda through April 2034,

covering approximately 1,300 towers. We’re equally delighted to

have reached final resolution with MTN Nigeria. In August, we

renewed and extended all our tower contracts with them in Nigeria

through 2032, covering nearly 13,500 tenancies and approximately

23,800 lease amendments, including 1,430 of the approximately 2,500

tenancies that were due to expire in 2024 and 2025, but will now

remain with IHS Nigeria. The renewal provides what we believe is a

more sustainable split between local and foreign currency and

introduces a new diesel-linked component. This marks a significant

milestone for IHS Towers, as we have now completed the renewal of

approximately 26,000 tenancies and approximately 26,000 lease

amendments with MTN across all our African markets through the next

decade. The renewal also reaffirms our deepened relationship with

MTN, and our commitment to work together to mitigate the impacts of

global macro conditions and broaden mobile connectivity through our

critical infrastructure. We have revised our 2024 guidance to

reflect the impact of the new financial terms in the renewed

contracts with MTN Nigeria; however, our FX assumptions remain

unchanged.

In terms of governance, during our Annual General Meeting held

in June, the proposals put forward to vote on, including to amend

the Company’s articles of association, were approved by our

shareholders. The voting results mark a significant achievement for

IHS, better aligning our governance framework with that of mature

U.S. listed companies.

Lastly, regarding our strategic review, we have begun to deliver

on the goal of increasing operating profitability and substantially

reducing our Capex to increase cash flow generation, which is

reflected in our 2Q24 results and in our 2024 guidance, including

the notable step-up in Adjusted EBITDA margin for the remainder of

the year. In terms of assets review, we continue to examine our

portfolio of markets with a focus on raising proceeds with a target

of $500 million to $1 billion. Finally, regarding capital

allocation, we continue to expect that proceeds from those

initiatives will be used primarily to pay down our debt; however,

we will also consider deploying excess proceeds through share

buybacks and / or introducing a dividend policy. To be clear, these

initial targets do not rule out further initiatives to continue

increasing shareholder value, which we continue to assess in

parallel.”

RESULTS FOR THE SECOND QUARTER 2024

The table below sets forth select unaudited financial results

for the quarters ended June 30, 2024, and June 30, 2023:

Three months ended

June 30,

June 30,

Y on Y

2024

2023

Growth

$’000

$’000

%

Revenue

435,377

546,204

(20.3

)

Adjusted EBITDA(1)

250,848

284,707

*

(11.9

)

Loss for the period

(124,314

)

(1,270,326

)

*

90.2

Cash from operations

151,596

259,097

*

(41.5

)

ALFCF(1)

66,857

73,955

*

(9.6

)

(1)

Adjusted EBITDA and ALFCF are

non-IFRS financial measures. See “Use of Non-IFRS Financial

Measures” for additional information, definitions and a

reconciliation to the most comparable IFRS measures.

*

Revised to reflect an adjustment

related to the accounting treatment of foreign exchange on goods in

transit in Nigeria.

Impact of Nigerian Naira devaluation

In mid-June 2023, the Central Bank of Nigeria implemented steps

to unify the Nigerian FX market by replacing the old regime of

multiple exchange rate segments into a single Investors and

Exporters (“I&E”) window within which FX transactions would be

determined by market forces and which was subsequently renamed

NAFEM (Nigeria Autonomous Foreign Exchange Market) in October 2023.

The Group uses the USD/NGN rate published by Bloomberg for Group

reporting purposes.

As a result, the Naira devalued 37.3% between the period

immediately prior to the announcement and the month end rate as of

June 30, 2023, from ₦472.3 to $1.00 as of June 14, 2023, to ₦752.7

to $1.00 as of June 30, 2023. The Naira continued to devalue by a

further 17.4% in the second half of 2023 and closed at a rate of

₦911.7 to $1.00 as of December 31, 2023. In January 2024, there was

a further significant devaluation of 37.4% in the Naira to ₦1,455.6

to $1.00 as of January 31, 2024, and the Naira closed at a rate of

₦1,393.5 to $1.00 as of March 31, 2024.

During the second quarter of 2024, the Naira devaluation was

lower compared to the previous quarter and closed at a rate of

₦1,514.3 to $1.00 as of June 30, 2024, depreciating by 8.0% from

March 31, 2024. Due to the Naira devaluation, Revenue and segment

Adjusted EBITDA were negatively impacted by $478.1 million and

$300.3 million, respectively, in the second quarter of 2024, based

on an average rate used of ₦1,391.8 to $1.00 when compared to the

average rate of ₦508.0 to $1.00 used in the second quarter of 2023.

At the same time, there were contract resets of $319.4 million that

partially offset the negative FX impact on Revenue and fully offset

the negative FX impact on segment Adjusted EBITDA. In addition, the

Naira devaluation resulted in an impact on finance costs,

specifically related to unrealized FX losses on financing of $178.5

million in our Nigeria segment in the second quarter of 2024. This

is due to the USD denominated internal shareholder loans from Group

entities to Nigeria and USD denominated third party debt. As the

functional currency of the Nigeria businesses is NGN, these USD

balances have been revalued in NGN using the rate as of June 30,

2024, resulting in an increase in unrealized loss on FX.

Results for the three months ended June 30, 2024 versus

2023

During the second quarter of 2024, revenue was $435.4 million

compared to $546.2 million for the second quarter of 2023, a

decrease of $110.8 million, or 20.3%. Organic revenue(1) increased

by $378.6 million, or 69.3%, driven primarily by FX resets and

escalations. The increase in organic growth was more than offset by

the non-core impact of negative movements in FX rates of $490.0

million, or 89.7%, of which $478.1 million was due to the

devaluation of the NGN.

Adjusted EBITDA was $250.8 million for the second quarter of

2024, compared to $284.7 million for the second quarter of 2023.

Adjusted EBITDA margin for the second quarter of 2024 was 57.6%

(second quarter of 2023: 52.1%). The decrease in Adjusted EBITDA

reflects the decrease in revenue discussed above, partially offset

by a decrease in cost of sales. The reduction in cost of sales was

primarily driven by a decrease in tower repairs and maintenance

costs, security services costs, power generation costs, site

regulatory permit costs and staff costs of $20.6 million, $11.2

million, $8.0 million, $3.2 million and $2.4 million respectively.

The $18.8 million reduction in other cost of sales primarily

relates to the FX losses on goods in transit in Nigeria during the

second quarter of 2023.

Loss for the period was $124.3 million for the second quarter of

2024, compared to a loss of $1,270.3 million for the second quarter

of 2023. The reduced loss for the period is primarily due to a

significant decrease in finance costs of $1,089.9 million due to

the Naira devaluation discussed above and the Naira devaluation

being relatively lower during the second quarter of 2024, compared

to the second quarter of 2023, and an increase in finance income

due to unrealized net FX gains from derivative instruments of $30.6

million. These are coupled with the decrease in revenue discussed

above, partially offset by decreases in cost of sales and

administrative expenses of $90.4 million and $17.0 million,

respectively.

Cash from operations and ALFCF for the second quarter of 2024

were $151.6 million and $66.9 million, respectively, compared to

$259.1 million and $74.0 million, respectively, for the second

quarter of 2023. The decrease in cash from operations reflects a

decrease in operating income and working capital of $38.6 million

and $68.9 million, respectively. The decrease in ALFCF was

primarily due to the decreases in cash from operations discussed

above and an increase in net interest paid of $9.4 million,

partially offset by the net movement in working capital discussed

above and decreases in maintenance capital expenditure, income

taxes paid, lease payments made and revenue withholding tax of

$31.3 million, $4.1 million, $3.9 million and $2.9 million,

respectively.

(1)

Refer to “Item 2. Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” for the definition of organic revenue and additional

information.

Segment results

Revenue and Adjusted EBITDA by

segment:

Revenue and segment Adjusted EBITDA, our key profitability

measures used to assess the performance of our reportable segments,

were as follows:

Revenue

Adjusted EBITDA

Three months ended

Three months ended

June 30,

June 30,

June 30,

June 30,

2024

2023

Change

2024

2023

Change

$'000

$'000

%

$'000

$'000

%

Nigeria

269,572

364,592

(26.1

)

171,391

219,445

*

(21.9

)

SSA

108,215

123,393

(12.3

)

76,456

62,933

21.5

Latam

46,464

48,344

(3.9

)

33,279

35,330

(5.8

)

MENA

11,126

9,875

12.7

6,167

5,384

14.5

Unallocated corporate expenses(a)

—

—

—

(36,445

)

(38,385

)

5.1

Total

435,377

546,204

(20.3

)

250,848

284,707

*

(11.9

)

* Revised to reflect an

adjustment related to the accounting treatment of foreign exchange

on goods in transit in Nigeria.

(a)

Unallocated corporate expenses

primarily consist of costs associated with centralized Group

functions including Group executive, legal, finance, tax and

treasury services.

Nigeria

Revenue for our Nigeria segment decreased by $95.0 million, or

26.1%, to $269.6 million for the second quarter of 2024, compared

to $364.6 million for the second quarter of 2023. Organic revenue

increased by $383.1 million, or 105.1%, driven primarily by FX

resets and diesel prices. The decrease in revenue was primarily

driven by the non-core impact of negative movements in FX rates of

$478.1 million, or 131.1%. Year-on-year, within our Nigeria

segment, Tenants increased by 398, including 578 from Colocation

and 114 from New Sites, partially offset by 294 Churned, while

Lease Amendments increased by 2,211.

Segment Adjusted EBITDA was $171.4 million for the second

quarter of 2024, compared to $219.4 million for the second quarter

of 2023, a decrease of $48.1 million, or 21.9%. The decrease in

segment Adjusted EBITDA primarily reflects the decrease in revenue

discussed above, partially offset by a reduction in cost of sales.

This reduction in cost of sales was driven by a decrease in tower

repairs and maintenance costs of $9.7 million primarily due to the

Naira devaluation discussed above. It was also driven by a decrease

in security services costs, regulatory permits costs and staff

costs of $3.0 million, $3.0 million and $2.4 million, respectively,

solely due to the Naira devaluation discussed above, even though

the underlying local costs increased during the period. The $18.1

million reduction in other cost of sales primarily relates to the

FX losses on goods in transit in Nigeria during the second quarter

of 2023.

SSA

IHS recently concluded the agreements with MTN South Africa to

unwind the power managed services agreement and to amend the

existing Master Lease Agreement with a revised fee structure,

extended by two years through to 2034. The unwind agreement is

effective from October 1, 2023. The operational impact of the

unwind is that the IHS South African business is no longer

responsible for providing diesel or alternative power to tower

sites other than electricity costs which are fully passed through

to customers.

Revenue for our SSA segment decreased by $15.2 million, or

12.3%, to $108.2 million for the second quarter of 2024, compared

to $123.4 million for the second quarter of 2023. The decrease was

driven by an organic revenue decrease of $5.8 million, or 4.7%, and

by the non-core impact of negative movements in FX rates of $9.4

million, or 7.6%. The unwind agreement discussed above has resulted

in a one-off reduction of $14.5 million to both gross revenue and

cost of sales, reversing amounts previously recognized in the

period from October 1, 2023, to March 31, 2024. It also resulted in

an ongoing reduction in gross revenue and costs of sales which was

$8.2 million for the three months ended June 30, 2024, compared to

the three months ended June 30, 2023. Additionally, continuing

power pass through activities in South Africa are no longer

recognized on a gross basis. Year-on-year, within our SSA segment,

Tenants increased by 738, including 487 from Colocation, 199 from

New Sites and 52 from the reintegration of previously lost

tenancies more than offsetting Churn, while Lease Amendments

increased by 2,106.

Segment Adjusted EBITDA was $76.5 million for the second quarter

of 2024, compared to $62.9 million for the second quarter of 2023,

an increase of $13.5 million, or 21.5%. The increase in segment

Adjusted EBITDA primarily reflects a decrease in cost of sales of

$27.4 million driven by a decrease in tower repairs and maintenance

costs, security services costs and power generation costs of $11.3

million, $8.2 million and $7.7 million, respectively, primarily due

to the unwind agreement discussed above. This was partially offset

by the decrease in revenue discussed above. None of the updates to

gross revenue and cost of sales discussed above have a net impact

on segment Adjusted EBITDA.

Latam

Revenue for our Latam segment decreased by $1.9 million, or

3.9%, to $46.5 million for the second quarter of 2024, compared to

$48.3 million for the second quarter of 2023. The decrease in

revenue was driven by the non-core impact of negative movements in

FX rates of $2.5 million, or 5.1%, partially offset by organic

revenue growth of $0.7 million, or 1.5%, which grew despite a $5.3

million reduction in revenue from our customer Oi S.A. in Brazil as

a result of their judicial recovery proceedings. Year-on-year,

within our Latam segment, Tenants increased by 661, including 927

from New Sites and 215 from Colocation, partially offset by 424

Churned and 57 in net divestiture, primarily due to the disposal of

Peru, while Lease Amendments increased by 127.

Segment Adjusted EBITDA was $33.3 million for the second quarter

of 2024, compared to $35.3 million for the second quarter of 2023,

a decrease of $2.1 million, or 5.8%. The decrease in segment

Adjusted EBITDA primarily reflects the decrease in revenue

discussed above, and an increase in power generation costs and

tower repair and maintenance costs of $1.2 million and $0.4

million, respectively, partially offset by a decrease in site

rental costs of $1.5 million.

MENA

Revenue for our MENA segment increased by $1.3 million, or

12.7%, to $11.1 million for the second quarter of 2024, compared to

$9.9 million for the second quarter of 2023. Organic revenue

increased by $0.6 million, or 6.4%, driven primarily by New Sites

and escalations and grew inorganically in the period by $0.6

million, or 6.4%, driven primarily by the sixth stage of the Kuwait

Acquisition. Year-on-year, within our MENA segment, Tenants

increased by 138, including 109 from Tenant Acquisition and 36 from

New Sites, partially offset by 7 Churned, while Lease Amendments

increased by 14.

Segment Adjusted EBITDA was $6.2 million for the second quarter

of 2024, compared to $5.4 million for the second quarter of 2023,

an increase of $0.8 million, or 14.5%. The increase in segment

Adjusted EBITDA primarily reflects the increase in revenue

discussed above.

INVESTING ACTIVITIES

During the second quarter of 2024, capital expenditure (“Total

Capex”) was $53.7 million, compared to $201.9 million for the

second quarter of 2023. The decrease is driven by lower capital

expenditure across all our segments with Nigeria, SSA, Latam and

MENA reduced by $106.2 million, $18.8 million, $20.8 million and

$1.7 million, respectively.

The decrease in Nigeria was primarily driven by decreases of

$41.0 million related to Project Green, $27.0 million related to

maintenance capital expenditure, $20.5 million from augmentation

capital expenditure and $14.5 million for fiber business capital

expenditure. The decrease in SSA was primarily driven by decreases

of $6.6 million in refurbishment capital expenditure, $5.6 million

related to New Sites capital expenditure, $5.4 million in corporate

capital expenditure and $2.5 million in maintenance capital

expenditure. The decrease in Latam was primarily driven by

decreases of $8.4 million related to New Sites capital expenditure,

$7.5 million for fiber business capital expenditure, $2.6 million

relating to purchase of land for new or existing sites and $1.8

million in corporate capital expenditure. The decrease in MENA was

primarily driven by decreases of $0.8 million related to New Sites

capital expenditure, $0.6 million in other capital expenditure, and

$0.2 million in maintenance capital expenditure.

The total capital expenditure incurred on Project Green from

commencement until June 30, 2024, was $205.7 million, of which $0.1

million related to expenditure incurred in the second quarter of

2024.

FINANCING ACTIVITIES AND LIQUIDITY

Below is a summary of key facilities we have entered into,

repaid or amended during the second quarter of 2024. Approximate

U.S. dollar equivalent values for non-USD denominated facilities

stated below are translated from the currency of the debt at the

relevant exchange rates on June 30, 2024.

IHS Holding (2022) Bullet Term Loan Facility

In April 2024, $60.0 million in available commitments were drawn

down under the IHS Holding (2022) Bullet Term Loan Facility.

As of June 30, 2024, $430.0 million of this facility was drawn

down. The majority of the drawn proceeds have been applied towards

the prepayment of the IHS Holding (2021) Bridge Facility, the U.S.

dollar tranche of the Nigeria (2019) Term Loan and general

corporate purposes.

CIV (2023) Term Loan

In June 2024, €31.9 million (approximately $34.2 million) and

XOF 4,042.3 million (approximately $6.6 million) was drawn down

under the CIV (2023) Term Loan and the proceeds were applied

towards general corporate purposes.

As of June 30, 2024, an aggregate amount of €88.0 million

(approximately $94.3 million) and XOF 11,151.3 million

(approximately $18.2 million) has been drawn down under this

facility.

IHS Brasil - Cessão de Infraestruturas S.A. 2024

Debentures

IHS Brasil - Cessão de Infraestruturas S.A. issued debentures

for BRL 300.0 million (approximately $53.6 million), in June 2024

(as amended and/or restated from time to time, the “IHS 2024 Brasil

Debentures”). The IHS 2024 Brasil Debentures amortize, starting

from July 2026, semi-annually until maturity in July 2032.

The IHS 2024 Brasil Debentures contain customary information and

financial covenants, including but not limited to the maintenance

of specified net debt to EBITDA and interest cover ratios. They

also contain customary negative covenants and restrictions

including, but not limited to, dividends and other payments to

shareholders, intercompany loans and capital reductions.

The IHS 2024 Brasil Debentures are secured by a pledge over all

shares owned by IHS Netherlands BR B.V. in IHS Brasil – Cessão de

Infraestruturas S.A. and a pledge over the bank account where the

companies’ receivables are deposited. The IHS 2024 Brasil

Debentures have an interest rate of CDI plus 2.80% (both assuming a

252-day calculation basis) and will mature in July 2032.

The proceeds of the IHS 2024 Brasil Debentures were applied

towards general corporate purposes including working capital

purposes.

I-Systems Debentures

I-Systems issued debentures for BRL 160.0 million (approximately

$28.6 million) in June 2024 (as amended and/or restated from time

to time, the “I-Systems Debentures”). The I-Systems Debentures

amortize, starting from November 2026, semi-annually until maturity

in May 2032.

The I-Systems Debentures contain customary information and

financial covenants, including but not limited to the maintenance

of specified net debt to EBITDA. They also contain customary

negative covenants and restrictions including, but not limited to,

dividends and other payments to shareholders, intercompany loans

and capital reductions.

The I-Systems Debentures are secured by a pledge over the bank

account where the companies’ receivables are deposited. The

I-Systems Debentures have an interest rate of CDI plus 2.10% and

will mature in May 2032.

The proceeds from the issuance of the I-Systems Debentures were

applied towards, inter alia, general corporate and working capital

purposes.

Letter of Credit Facilities

As of June 30, 2024, IHS Nigeria Limited has utilized $2.2

million through funding under agreed letters of credit. These

letters mature on September 30, 2024, and their interest rates

range from 12.00% to 15.55%. These letters of credit are utilized

to fund capital and operational expenditure with suppliers.

As of June 30, 2024, INT Towers Limited has utilized $5.3

million through funding under agreed letters of credit. These

letters mature on September 30, 2024, and their interest rates

range from 12.00% to 15.75%. These letters of credit are utilized

to fund capital and operational expenditure with suppliers.

As of June 30, 2024, Global Independent Connect Limited has

utilized $0.2 million through funding under agreed letters of

credit. These letters mature on September 30, 2024, and their

interest rates range from 15.25% to 15.28%. These letters of credit

are utilized to fund capital and operational expenditure with

suppliers.

FINANCING ACTIVITIES AND LIQUIDITY AFTER REPORTING

PERIOD

Below is a summary of key facilities we have entered into,

repaid or amended after the second quarter of 2024 up to August 9,

2024.

Nigeria (2023) Term Loan and Nigeria (2023) Revolving Credit

Facility

The annual floating interest rates on the Nigeria (2023)

Revolving Credit Facility and the Nigeria (2023) Revolving Credit

Facility were subject to a cap of 24%, which was amended to 27% for

both facilities in August 2024.

IHS Kuwait Facility

IHS Kuwait Limited entered into a loan agreement originally in

April 2020 (as amended and/or restated from time to time) with a

total commitment of KWD 26.0 million (approximately $84.8 million).

As of August 9, 2024, an aggregate amount of KWD 21.8 million

(approximately $71.0 million) has been drawn down under this

facility. In August 2024, the availability period on the remaining

undrawn portion of the IHS Kuwait Facility has ended.

OTHER ACTIVITIES AFTER REPORTING PERIOD

MTN Nigeria revenue contract

On August 7, 2024, the Group entered into an agreement with MTN

Nigeria to renew and extend all the Nigerian tower Master Lease

Agreements until December 2032, covering approximately 13,500

tenancies. This includes 1,430 of approximately 2,500 MTN Nigeria

tenancies that were due to expire at the end of 2024 and in

2025.

The renewed contracts include new financial components in both

local and foreign currency, which escalate based on the respective

CPI, and a new diesel-linked component.

Full Year 2024 Outlook Guidance

The following full year 2024 guidance is based on a number of

assumptions that management believes to be reasonable and reflects

the Company’s expectations as of August 13, 2024. Actual results

may differ materially from these estimates as a result of various

factors, and the Company refers you to the cautionary language

regarding “forward-looking” statements included in this press

release when considering this information. The Company’s revised

outlook includes the impact from the renewal and extension of all

tower contracts with MTN Nigeria.

The Company’s outlook is based on the following assumptions:

- Organic revenue Y/Y growth of approximately 48% (at the

mid-point)

- Average foreign currency exchange rates to 1.00 U.S. Dollar for

January 1, 2024, through December 31, 2024, for key currencies: (a)

1,610 Nigerian Naira; (b) 5.00 Brazilian Real (c) 0.90 Euros (d)

19.00 South African Rand

- Project Green capex of approximately $10.0 million

- Build-to-suit of ~850 sites of which ~600 sites in Brazil

- Net leverage ratio target of 3.0x-4.0x

Metric

Current Range

Revenue

$1,670M-1,700M

Adjusted EBITDA (1)

$900M-920M

Adjusted Levered Free Cash Flow

(1)

$250M-270M

Total Capex

$330M-370M

(1)

Adjusted EBITDA and ALFCF are

non-IFRS financial measures. See “Use of Non-IFRS Financial

Measures” for additional information and a reconciliation to the

most comparable IFRS measures. We are unable to provide a

reconciliation of Adjusted EBITDA and ALFCF to (loss)/income and

cash from operations, respectively, for the periods presented above

without an unreasonable effort, due to the uncertainty regarding,

and the potential variability, of these costs and expenses that may

be incurred in the future, including, in the case of Adjusted

EBITDA, share-based payment expense, finance costs, and insurance

claims, and in the case of ALFCF, cash from operations, net

movement in working capital and maintenance capital expenditures,

each of which adjustments may have a significant impact on these

non-IFRS measures.

Conference Call

IHS Towers will host a conference call on August 13, 2024, at

8:30am ET to review its financial and operating results.

Supplemental materials will be available on the Company’s website,

www.ihstowers.com. The conference call can be accessed by calling

+1 646 307 1963 (U.S./Canada) or +44 20 3481 4247

(UK/International). The call ID is 9900919.

A simultaneous webcast and replay will be available in the

Investor Relations section of the Company’s website,

www.ihstowers.com, on the Earnings Materials page.

Upcoming Conferences and Events

IHS Towers management is expected to participate in the upcoming

conferences outlined below, dates noted are subject to change.

Visit www.ihstowers.com/investors/investor-presentations-events for

additional conferences information.

- Goldman Sachs EMEA Credit and Levered Finance (London) –

September 3, 2024

- Barclays Telco-Media Forum (Virtual) – September 4, 2024

- Citi Global TMT Conference (New York) – September 5, 2024

- J.P. Morgan Emerging Markets Credit Conference (London) –

September 17, 2024

- RBC Global Communications Infra Conference (Chicago) –

September 24, 2024

About IHS Towers

IHS Towers is one of the largest independent owners, operators

and developers of shared communications infrastructure in the world

by tower count and is one of the largest independent multinational

towercos solely focused on emerging markets. The Company has over

40,000 towers across its 10 markets, including Brazil, Cameroon,

Colombia, Côte d’Ivoire, Egypt, Kuwait, Nigeria, Rwanda, South

Africa and Zambia. For more information, please email:

communications@ihstowers.com or visit: www.ihstowers.com

For more information about the Company and our financial and

operating results, please also refer to the 2Q24 Supplemental

Information deck posted to our Investors Relations website at

www.ihstowers.com/investors

Cautionary statement regarding forward-looking

statements

This press release contains forward-looking statements. We

intend such forward-looking statements to be covered by relevant

safe harbor provisions for forward-looking statements (or their

equivalent) of any applicable jurisdiction, including those

contained in Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). All statements other

than statements of historical facts contained in this press release

may be forward-looking statements. In some cases, you can identify

forward-looking statements by terms such as “may,” “will,”

“should,” “expects,” “plans,” “anticipates,” “could,” “intends,”

“targets,” “projects,” “contemplates,” “believes,” “estimates,”

“forecast,” “predicts,” “potential” or “continue” or the negative

of these terms or other similar expressions. Forward-looking

statements contained in this press release include, but are not

limited to statements regarding our future results of operations

and financial position, future organic growth, anticipated results

for the fiscal year 2024, industry and business trends, business

strategy, plans (including productivity enhancements and cost

reductions, and our ability to refinance or meet our debt

obligations), market growth, position and our objectives for future

operations, including our ability to maintain relationships with

customers and continue to renew customer lease agreements or the

potential benefit of the terms of such renewals or our ability to

grow our business through acquisitions, the impact (illustrative or

otherwise) of the new agreements with MTN Nigeria (including

certain rebased fee components) on our financial results, the

impact of currency and exchange rate fluctuations (including the

devaluation of the Naira) and other economic and geopolitical

factors on our future results and operations, the outcome and

potential benefit of our strategic review, our objectives for

future operations and our participation in upcoming presentations

and events.

We have based these forward-looking statements largely on our

current expectations and projections about future events and

financial trends that we believe may affect our business, financial

condition and results of operations. Forward-looking statements

involve known and unknown risks, uncertainties and other important

factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to:

- non-performance under or termination, non-renewal or material

modification of our customer agreements;

- volatility in terms of timing for settlement of invoices or our

inability to collect amounts due under invoices;

- a reduction in the creditworthiness and financial strength of

our customers;

- the business, legal and political risks in the countries in

which we operate;

- general macroeconomic conditions in the countries in which we

operate;

- changes to existing or new tax laws, rates or fees;

- foreign exchange risks, particularly in relation to the

Nigerian Naira, and/or ability to hedge against such risks in our

commercial agreements or to access U.S. Dollars in our

markets;

- the effect of regional or global health pandemics, geopolitical

conflicts and wars, and acts of terrorism;

- our inability to successfully execute our business strategy and

operating plans, including our ability to increase the number of

Colocations and Lease Amendments on our Towers and construct New

Sites or develop business related to adjacent telecommunications

verticals (including, for example, relating to our fiber businesses

in Latin America and elsewhere) or deliver on our sustainability or

environmental, social and governance (ESG) strategy and initiatives

under anticipated costs, timelines, and complexity, such as our

Carbon Reduction Roadmap (and Project Green), including plans to

reduce diesel consumption, integrate solar panel and battery

storage solutions on tower sites and connect more sites to the

electricity grid;

- our reliance on third-party contractors or suppliers, including

failure, underperformance or inability to provide products or

services to us (in a timely manner or at all) due to sanctions

regulations, supply chain issues or for other reasons;

- our estimates and assumptions and estimated operating results

may differ materially from actual results;

- increases in operating expenses, including increased costs for

diesel;

- failure to renew or extend our ground leases, or protect our

rights to access and operate our Towers or other telecommunications

infrastructure assets;

- loss of customers;

- risks related to our indebtedness;

- changes to the network deployment plans of mobile operators in

the countries in which we operate;

- a reduction in demand for our services;

- the introduction of new technology reducing the need for tower

infrastructure and/or adjacent telecommunication verticals;

- an increase in competition in the telecommunications tower

infrastructure industry and/or adjacent telecommunication

verticals;

- our failure to integrate recent or future acquisitions;

- the identification by management of material weaknesses in our

internal control over financial reporting, which could affect our

ability to produce accurate financial statements on a timely basis

or cause us to fail to meet our future reporting obligations;

- increased costs, harm to reputation, or other adverse impacts

related to increased intention to and evolving expectations for

environmental, social and governance initiatives;

- our reliance on our senior management team and/or key

employees;

- failure to obtain required approvals and licenses for some of

our sites or businesses or comply with applicable regulations;

- inability to raise financing to fund future growth

opportunities or operating expense reduction strategies;

- environmental liability;

- inadequate insurance coverage, property loss and unforeseen

business interruption;

- compliance with or violations (or alleged violations) of laws,

regulations and sanctions, including but not limited to those

relating to telecommunications regulatory systems, tax, labor,

employment (including new minimum wage regulations), unions, health

and safety, antitrust and competition, environmental protection,

consumer protection, data privacy and protection, import/export,

foreign exchange or currency, and of anti-bribery, anti-corruption

and/or money laundering laws, sanctions and regulations;

- fluctuations in global prices for diesel or other

materials;

- disruptions in our supply of diesel or other materials;

- legal and arbitration proceedings;

- our reliance on shareholder support (including to invest in

growth opportunities) and related party transaction risks;

- risks related to the markets in which we operate, including but

not limited to local community opposition to some of our sites or

infrastructure, and the risks from our investments into emerging

and other less developed markets;

- injury, illness or death of employees, contractors or third

parties arising from health and safety incidents;

- loss or damage of assets due to security issues or civil

commotion;

- loss or damage resulting from attacks on any information

technology system or software;

- loss or damage of assets due to extreme weather events whether

or not due to climate change;

- failure to meet the requirements of accurate and timely

financial reporting and/or meet the standards of internal control

over financial reporting that support a clean certification under

the Sarbanes Oxley Act;

- risks related to our status as a foreign private issuer;

and

- the important factors discussed in the section titled “Risk

Factors” in our Annual Report on Form 20-F for the fiscal year

ended December 31, 2023.

The forward-looking statements in this press release are based

upon information available to us as of the date of this press

release, and while we believe such information forms a reasonable

basis for such statements, such information may be limited or

incomplete, and our statements should not be read to indicate that

we have conducted an exhaustive inquiry into, or review of, all

potentially available relevant information. These statements are

inherently uncertain and investors are cautioned not to unduly rely

upon these statements. You should read this press release and the

documents that we reference in this press release with the

understanding that our actual future results, performance and

achievements may be materially different from what we expect. We

qualify all of our forward-looking statements by these cautionary

statements. Additionally, we may provide information herein that is

not necessarily “material” under the federal securities laws for

SEC reporting purposes, but that is informed by various ESG

standards and frameworks (including standards for the measurement

of underlying data), and the interests of various stakeholders.

Much of this information is subject to assumptions, estimates or

third-party information that is still evolving and subject to

change. For example, we note that standards and expectations

regarding greenhouse gas (GHG) accounting and the processes for

measuring and counting GHG emissions and GHG emissions reductions

are evolving, and it is possible that our approaches both to

measuring our emissions and any reductions may be at some point,

either currently or in future, considered by certain parties to not

be in keeping with best practices. In addition, our disclosures

based on any standards may change due to revisions in framework

requirements, availability of information, changes in our business

or applicable government policies, or other factors, some of which

may be beyond our control. These forward-looking statements speak

only as of the date of this press release. Except as required by

applicable law, we do not assume, and expressly disclaim, any

obligation to publicly update or revise any forward-looking

statements contained in this press release, whether as a result of

any new information, future events or otherwise. Additionally,

references to our website and other documents contained in this

press release are provided for convenience only, and their content

is not incorporated by reference into this press release.

IHS HOLDING LIMITED

CONDENSED CONSOLIDATED

STATEMENT OF LOSS AND OTHER COMPREHENSIVE (LOSS)/INCOME

(UNAUDITED)

FOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2024 AND 2023

Three months ended

Six months ended

June 30,

June 30,

June 30,

June 30,

2024

2023*

2024

2023*

$’000

$’000

$’000

$’000

Revenue

435,377

546,204

853,121

1,148,732

Cost of sales

(206,710

)

(297,096

)

(461,000

)

(603,784

)

Administrative expenses

(83,763

)

(100,721

)

(250,459

)

(198,003

)

Net reversal of loss/(net loss allowance)

on trade receivables

2,381

(954

)

(2,179

)

(4,514

)

Other income

883

161

1,593

336

Operating income

148,168

147,594

141,076

342,767

Finance income

43,010

8,373

24,376

13,160

Finance costs

(279,156

)

(1,369,052

)

(1,812,744

)

(1,546,019

)

Loss before income tax

(87,978

)

(1,213,085

)

(1,647,292

)

(1,190,092

)

Income tax expense

(36,336

)

(57,241

)

(34,272

)

(72,459

)

Loss for the period

(124,314

)

(1,270,326

)

(1,681,564

)

(1,262,551

)

Loss attributable to:

Owners of the Company

(121,069

)

(1,266,772

)

(1,674,397

)

(1,256,191

)

Non-controlling interests

(3,245

)

(3,554

)

(7,167

)

(6,360

)

Loss for the period

(124,314

)

(1,270,326

)

(1,681,564

)

(1,262,551

)

Loss per share - basic

(0.36

)

(3.79

)

(5.03

)

(3.77

)

Loss per share - diluted

(0.36

)

(3.79

)

(5.03

)

(3.77

)

Other comprehensive

(loss)/income:

Items that may be reclassified to income

or loss

Fair value (loss)/gain through other

comprehensive income

(2

)

7

(1

)

7

Exchange differences on translation of

foreign operations

(6,994

)

585,257

1,036,525

629,449

Other comprehensive (loss)/income for

the period, net of taxes

(6,996

)

585,264

1,036,524

629,456

Total comprehensive loss for the

period

(131,310

)

(685,062

)

(645,040

)

(633,095

)

Total comprehensive loss attributable

to:

Owners of the Company

(107,091

)

(691,914

)

(610,226

)

(642,343

)

Non-controlling interests

(24,219

)

6,852

(34,814

)

9,248

Total comprehensive loss for the

period

(131,310

)

(685,062

)

(645,040

)

(633,095

)

*Revised to reflect an adjustment related

to the accounting treatment of foreign exchange on goods in transit

in Nigeria.

IHS HOLDING LIMITED

CONDENSED CONSOLIDATED

STATEMENT OF FINANCIAL POSITION (UNAUDITED)

AT JUNE 30, 2024, AND DECEMBER

31, 2023

June 30,

December 31,

2024

2023

$’000

$’000

Non-current assets

Property, plant and equipment

1,423,021

1,740,235

Right of use assets

795,000

886,909

Goodwill

442,542

619,298

Other intangible assets

804,643

933,030

Fair value through other comprehensive

income financial assets

6

13

Deferred income tax assets

60,938

63,786

Derivative financial instrument assets

12,140

1,540

Trade and other receivables

119,552

147,292

3,657,842

4,392,103

Current assets

Inventories

33,559

40,589

Income tax receivable

3,012

3,755

Derivative financial instrument assets

402

565

Trade and other receivables

399,627

607,835

Cash and cash equivalents

445,713

293,823

Assets held for sale

—

26,040

882,313

972,607

TOTAL ASSETS

4,540,155

5,364,710

Non-current liabilities

Trade and other payables

5,351

4,629

Borrowings

3,421,861

3,056,696

Lease liabilities

492,698

510,838

Provisions for other liabilities and

charges

81,011

86,131

Deferred income tax liabilities

120,984

137,106

4,121,905

3,795,400

Current liabilities

Trade and other payables

386,364

532,627

Provisions for other liabilities and

charges

172

277

Derivative financial instrument

liabilities

12,946

68,133

Income tax payable

60,507

75,612

Borrowings

157,814

454,151

Lease liabilities

90,060

91,156

707,863

1,221,956

TOTAL LIABILITIES

4,829,768

5,017,356

Stated capital

5,399,205

5,394,812

Accumulated losses

(6,967,791

)

(5,293,394

)

Other reserves

1,076,281

8,430

Equity attributable to owners of the

Company

(492,305

)

109,848

Non-controlling interest

202,692

237,506

TOTAL EQUITY

(289,613

)

347,354

TOTAL LIABILITIES AND EQUITY

4,540,155

5,364,710

IHS HOLDING LIMITED

CONDENSED CONSOLIDATED

STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

FOR THE SIX MONTHS ENDED JUNE

30, 2024 AND 2023

Attributable to owners of the

Company

Non-

Stated

Accumulated

Other

controlling

Total

capital

losses

reserves

Total

interest

equity

$’000

$’000

$’000

$’000

$’000

$’000

Balance at January 1, 2023

5,311,953

(3,317,652

)

(861,271

)

1,133,030

227,200

1,360,230

Options converted to shares

89,432

—

(89,432

)

—

—

—

Share-based payment expense

—

—

6,618

6,618

—

6,618

Other reclassifications related to

share-based payment

—

867

(1,426

)

(559

)

—

(559

)

Total transactions with owners of the

company

89,432

867

(84,240

)

6,059

—

6,059

Loss for the period*

—

(1,256,191

)

—

(1,256,191

)

(6,360

)

(1,262,551

)

Other comprehensive income*

—

—

613,848

613,848

15,608

629,456

Total comprehensive (loss)/income*

—

(1,256,191

)

613,848

(642,343

)

9,248

(633,095

)

Balance at June 30, 2023*

5,401,385

(4,572,976

)

(331,663

)

496,746

236,448

733,194

Balance at January 1, 2024

5,394,812

(5,293,394

)

8,430

109,848

237,506

347,354

Options converted to shares

4,393

—

(4,393

)

—

—

—

Share-based payment expense

—

—

8,073

8,073

—

8,073

Total transactions with owners of the

company

4,393

—

3,680

8,073

—

8,073

Loss for the period

—

(1,674,397

)

—

(1,674,397

)

(7,167

)

(1,681,564

)

Other comprehensive income/(loss)

—

—

1,064,171

1,064,171

(27,647

)

1,036,524

Total comprehensive (loss)/income

—

(1,674,397

)

1,064,171

(610,226

)

(34,814

)

(645,040

)

Balance at June 30, 2024

5,399,205

(6,967,791

)

1,076,281

(492,305

)

202,692

(289,613

)

*Revised to reflect an adjustment

related to the accounting treatment of foreign exchange on goods in

transit in Nigeria.

IHS HOLDING LIMITED

CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS (UNAUDITED)

FOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2024 AND 2023

Three months ended

Six months ended

June 30,

June 30,

June 30,

June 30,

2024

2023*

2024

2023*

$’000

$’000

$’000

$’000

Cash flows from operating

activities

Cash from operations

151,596

259,097

244,580

511,119

Income taxes paid

(15,374

)

(19,514

)

(28,516

)

(33,957

)

Payment for rent

(1,517

)

(658

)

(5,509

)

(2,943

)

Payment for tower and tower equipment

decommissioning

(20

)

(317

)

(25

)

(321

)

Net cash generated from operating

activities

134,685

238,608

210,530

473,898

Cash flow from investing

activities

Purchase of property, plant and

equipment

(60,503

)

(158,150

)

(121,534

)

(263,567

)

Payment in advance for property, plant and

equipment

(1,508

)

(34,346

)

(5,851

)

(70,148

)

Purchase of software and licenses

(1,086

)

(8,924

)

(2,729

)

(16,176

)

Net proceeds from sale of subsidiary

4,073

—

4,073

—

Proceeds from disposal of property, plant

and equipment

1,149

399

2,037

960

Insurance claims received

30

134

40

278

Interest income received

3,853

5,079

7,834

11,577

Deposit of short-term deposits

(6,358

)

(65,055

)

(36,513

)

(128,765

)

Refund of short-term deposits

1,923

3,994

204,680

20,723

Net cash (used in)/generated from

investing activities

(58,427

)

(256,869

)

52,037

(445,118

)

Cash flows from financing

activities

Bank loans and bond proceeds received (net

of transaction costs)

231,208

290,083

611,591

658,179

Bank loans and bonds repaid

(78,146

)

(153,505

)

(406,825

)

(417,850

)

Fees on loans and derivative

instruments

(3,999

)

(2,163

)

(7,254

)

(8,671

)

Interest paid

(84,630

)

(76,442

)

(165,964

)

(144,945

)

Payment for the principal of lease

liabilities

(15,468

)

(24,523

)

(32,534

)

(44,745

)

Interest paid for lease liabilities

(17,488

)

(13,174

)

(30,697

)

(25,294

)

Net gain/(loss) settled on derivative

instruments

221

472

(19,927

)

472

Net cash generated from/(used in)

financing activities

31,698

20,748

(51,610

)

17,146

Net increase in cash and cash

equivalents

107,956

2,487

210,957

45,926

Cash and cash equivalents at beginning of

period

333,203

515,589

293,823

514,078

Effect of movements in exchange rates on

cash

4,554

(85,028

)

(59,067

)

(126,956

)

Cash and cash equivalents at end of

period

445,713

433,048

445,713

433,048

*Revised to reflect an adjustment

related to the accounting treatment of foreign exchange on goods in

transit in Nigeria.

Use of Non-IFRS financial measures

Certain parts of this press release contain non-IFRS financial

measures, including Adjusted EBITDA, Adjusted EBITDA Margin and

Adjusted Levered Free Cash Flow (“ALFCF”). The non-IFRS financial

information is presented for supplemental informational purposes

only and should not be considered a substitute for financial

information presented in accordance with IFRS, and may be different

from similarly titled non-IFRS measures used by other

companies.

We define Adjusted EBITDA (including by segment) as

income/(loss) for the period, before income tax expense/(benefit),

finance costs and income, depreciation and amortization, impairment

of withholding tax receivables, impairment of goodwill, business

combination transaction costs, impairment of property, plant and

equipment, intangible assets excluding goodwill and related prepaid

land rent, reversal of provision for decommissioning costs, net

(gain)/loss on sale of assets, share-based payment

(credit)/expense, insurance claims and certain other items that

management believes are not indicative of the core performance of

our business. The most directly comparable IFRS measure to Adjusted

EBITDA is our income/(loss) for the period.

We define Adjusted EBITDA Margin as Adjusted EBITDA divided by

revenue for the applicable period, expressed as a percentage.

We believe that Adjusted EBITDA is an indicator of the operating

performance of our core business. We believe Adjusted EBITDA and

Adjusted EBITDA Margin, as defined above, are useful to investors

and are used by our management for measuring profitability and

allocating resources, because they exclude the impact of certain

items which have less bearing on our core operating performance. We

believe that utilizing Adjusted EBITDA and Adjusted EBITDA Margin

allows for a more meaningful comparison of operating fundamentals

between companies within our industry by eliminating the impact of

capital structure and taxation differences between the

companies.

Adjusted EBITDA measures are frequently used by securities

analysts, investors and other interested parties in their

evaluation of companies comparable to us, many of which present an

Adjusted EBITDA-related performance measure when reporting their

results.

Adjusted EBITDA and Adjusted EBITDA Margin are used by different

companies for differing purposes and are often calculated in ways

that reflect the circumstances of those companies. You should

exercise caution in comparing Adjusted EBITDA and Adjusted EBITDA

Margin as reported by us to Adjusted EBITDA and Adjusted EBITDA

Margin as reported by other companies. Adjusted EBITDA and Adjusted

EBITDA Margin are unaudited and have not been prepared in

accordance with IFRS.

Adjusted EBITDA and Adjusted EBITDA Margin are not measures of

performance under IFRS and you should not consider these as an

alternative to income/(loss) for the period or other financial

measures determined in accordance with IFRS.

Adjusted EBITDA and Adjusted EBITDA Margin have limitations as

analytical tools, and you should not consider them in isolation.

Some of these limitations are:

- they do not reflect interest expense, or the cash requirements

necessary to service interest or principal payments, on our

indebtedness;

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often need to be

replaced in the future and Adjusted EBITDA and Adjusted EBITDA

Margin do not reflect any cash requirements that would be required

for such replacements;

- some of the items we eliminate in calculating Adjusted EBITDA

and Adjusted EBITDA Margin reflect cash payments that have less

bearing on our core operating performance, but that impact our

operating results for the applicable period; and

- the fact that other companies in our industry may calculate

Adjusted EBITDA and Adjusted EBITDA Margin differently than we do,

which limits their usefulness as comparative measures.

Accordingly, prospective investors should not place undue

reliance on Adjusted EBITDA or Adjusted EBITDA Margin.

We define ALFCF as cash from operations, before certain items of

income or expenditure that management believes are not indicative

of the core cash flow of our business (to the extent that these

items of income and expenditure are included within cash flow from

operating activities), and after taking into account net working

capital movements, income taxes paid, withholding tax, lease and

rent payments made, net interest paid or received, business

combination transaction costs, maintenance capital expenditure and

routine corporate capital expenditure. We believe that it is

important to measure the free cash flows we have generated from

operations, after accounting for the cash cost of funding and

routine capital expenditure required to generate those cash flows.

Starting in the third quarter 2023, we replaced Recurring Levered

Free Cash Flow (“RLFCF”) with ALFCF. As a result, we have

re-presented the June 30, 2023, measure to be on a consistent basis

with the ALFCF presented for June 30, 2024. Unlike RLFCF, ALFCF

only includes the cash costs of business combination transaction

costs, other costs and other income and excludes the reversal of

movements in the net loss allowance on trade receivables and

impairment of inventory to better reflect the liquidity position in

each period. There is otherwise no change in the definition or

calculation of this metric for the periods presented as a result of

the name change.

We believe ALFCF is useful to investors because it is also used

by our management for measuring our operating cash flow, liquidity

and allocating resources. While Adjusted EBITDA provides management

with a basis for assessing its current operating performance, we

use ALFCF in order to assess the long-term, sustainable operating

liquidity of our business. ALFCF is derived through an

understanding of the funds generated from operations, taking into

account our capital structure and the taxation environment

(including withholding tax implications), as well as the impact of

non-discretionary maintenance capital expenditure and routine

corporate capital expenditure. ALFCF provides management with a

metric through which to measure the underlying cash generation of

the business by further adjusting for expenditure that are

non-discretionary in nature (such as interest paid and income taxes

paid), as well as certain cash items that impact cash from

operations in any particular period.

ALFCF and similar measures are frequently used by securities

analysts, investors and other interested parties in their

evaluation of companies comparable to us, many of which present an

ALFCF-related measure when reporting their results. Such measures

are used in the telecommunications infrastructure sector as they

are seen to be important in assessing the liquidity of a business.

We present ALFCF to provide investors with a meaningful measure for

comparing our liquidity to those of other companies, particularly

those in our industry.

ALFCF and similar measures are used by different companies for

differing purposes and are often calculated in ways that reflect

the circumstances of those companies. You should exercise caution

in comparing ALFCF as reported by us to ALFCF or similar measures

as reported by other companies. ALFCF is unaudited and has not been

prepared in accordance with IFRS.

ALFCF is not intended to replace cash from operations for the

period or any other measures of cash flow under IFRS. ALFCF has

limitations as an analytical tool, and you should not consider it

in isolation. Some of these limitations are:

- not all cash changes are reflected, for example, changes in

working capital are not included and discretionary capital

expenditure are not included;

- some of the items that we eliminate in calculating ALFCF

reflect cash payments that have less bearing on our liquidity, but

that impact our operating results for the applicable period;

- the fact that certain cash charges, such as lease payments

made, can include payments for multiple future years that are not

reflective of operating results for the applicable period, which

may result in lower lease payments for subsequent periods;

- the fact that other companies in our industry may have

different capital structures and applicable tax regimes, which

limits its usefulness as a comparative measure; and

- the fact that other companies in our industry may calculate

ALFCF differently than we do, which limits their usefulness as

comparative measures.

Accordingly, you should not place undue reliance on ALFCF.

Reconciliation from loss for the period to Adjusted EBITDA

and Adjusted EBITDA Margin

The following is a reconciliation of Adjusted EBITDA and

Adjusted EBITDA Margin to the most directly comparable IFRS

measures, which are loss and loss margin, respectively, for the

three and six months ended June 30, 2024 and 2023:

Three months ended

Six months ended

June 30,

June 30,

June 30,

June 30,

2024

2023*

2024

2023*

$'000

$'000

$'000

$'000

Loss for the period

(124,314

)

(1,270,326

)

(1,681,564

)

(1,262,551

)

Divided by total Revenue

435,377

546,204

853,121

1,148,732

Loss margin for the period

(28.6

)%

(232.6

)%

(197.1

)%

(109.9

)%

Adjustments:

Income tax expense

36,336

57,241

34,272

72,459

Finance costs(a)

279,156

1,369,052

1,812,744

1,546,019

Finance income(a)

(43,010

)

(8,373

)

(24,376

)

(13,160

)

Depreciation and amortization

87,166

116,494

174,732

235,450

Impairment of withholding tax

receivables(b)

2,756

13,349

10,972

24,604

Impairment of goodwill

—

—

87,894

—

Business combination transaction costs

148

27

380

1,486

Impairment of property, plant and

equipment, intangible assets excluding goodwill and related prepaid

land rent(c)

5,767

935

8,827

5,081

Net (gain)/loss on disposal of property,

plant and equipment

(1,919

)

168

(2,292

)

(566

)

Share-based payment expense(d)

4,885

3,628

8,066

6,917

Insurance claims(e)

(30

)

(133

)

(40

)

(278

)

Other costs(f)

3,907

2,673

6,392

4,848

Other income

—

(28

)

—

(58

)

Adjusted EBITDA

250,848

284,707

436,007

620,251

Divided by total Revenue

435,377

546,204

853,121

1,148,732

Adjusted EBITDA Margin

57.6

%

52.1

%

51.1

%

54.0

%

*Revised to reflect an adjustment

related to the accounting treatment of foreign exchange on goods in

transit in Nigeria.

(a)

Finance costs consist of interest

expense and loan facility fees on borrowings, the unwinding of the

discount on our decommissioning liability and lease liability,

realized and unrealized net FX losses arising from financing

arrangements and net realized and unrealized losses from valuations

of financial instruments. Finance income consists of interest

income from bank deposits, realized and unrealized net FX gains

arising from financing arrangements and net realized and unrealized

gains from valuations of financial instruments.

(b)

Revenue withholding tax primarily

represents amounts withheld by customers in Nigeria and paid to the

local tax authority. The amounts withheld may be recoverable

through an offset against future corporate income tax liabilities

in the relevant operating company. Revenue withholding tax

receivables are reviewed for recoverability at each reporting

period end and impaired if not forecast to be recoverable.

(c)

Represents non-cash charges

related to the impairment of property, plant and equipment,

intangible assets excluding goodwill and related prepaid land rent

on the decommissioning of sites.

(d)

Represents expense related to

share-based compensation, which vary from period to period

depending on timing of awards and changes to valuation inputs

assumptions.

(e)

Represents insurance claims

included as non-operating income.

(f)

Other costs for the three months

ended June 30, 2024, included costs related to strategic review and

one-off consulting fees related to corporate structures and

operating systems of $2.5 million and costs related to internal

reorganization of $1.3 million. Other costs for the three months

ended June 30, 2023, included one-off consulting fees related to

corporate structures and operating systems of $1.2 million and

other one-off consulting services of $1.0 million. Other costs for

the six months ended June 30, 2024, included costs related to

strategic review and one-off consulting fees related to corporate

structures and operating systems of $4.5 million and costs related

to internal reorganization of $1.8 million. Other costs for the six

months ended June 30, 2023, included one-off consulting fees

related to corporate structures and operating systems of $2.8

million, other one-off consulting services of $1.0 million, aborted

business combination transaction costs of $0.6 million and one-off

professional fees relating to financing of $0.2 million.

Reconciliation from cash from operations to ALFCF

The following is a reconciliation of ALFCF to the most directly

comparable IFRS measure, which is cash from operations, for the

three and six months June 30, 2024 and 2023:

Three months ended

Six months ended

June 30,

June 30,

June 30,

June 30,

2024

2023*

2024

2023*

$'000

$'000

$'000

$'000

Cash from operations

151,596

259,097

244,580

511,119

Adjustments:

Net movement in working capital

95,203

26,316

191,823

112,499

Income taxes paid

(15,374

)

(19,514

)

(28,516

)

(33,957

)

Withholding tax(a)

(30,631

)

(33,497

)

(44,104

)

(66,929

)

Lease and rent payments made

(34,473

)

(38,355

)

(68,740

)

(72,982

)

Net interest paid(b)

(80,777

)

(71,363

)

(158,130

)

(133,368

)

Business combination transaction costs

619

1,887

1,669

4,107

Other costs(c)

784

1,709

1,476

4,779

Maintenance capital expenditure(d)

(19,983

)

(51,261

)

(29,749

)

(95,019

)

Corporate capital expenditure(e)

(107

)

(1,064

)

(341

)

(1,554

)

ALFCF

66,857

73,955

109,968

228,695

Non-controlling interest

(1,023

)

(1,494

)

(3,722

)

(4,561

)

ALFCF excluding non-controlling

interest

65,834

72,461

106,246

224,134

*Revised to reflect an adjustment

related to the accounting treatment of foreign exchange on goods in

transit in Nigeria.

(a)

Withholding tax primarily

represents amounts withheld by customers which may be recoverable

through an offset against future corporate income tax liabilities

in the relevant operating company.

(b)

Represents the aggregate value of

interest paid and interest income received.

(c)

Other costs for the three and six

months ended June 30, 2024, primarily relate to one-off consulting

and professional fees.

(d)

We incur capital expenditure in

relation to the maintenance of our towers and fiber equipment,

which is non-discretionary in nature and required in order for us

to optimally run our portfolio and to perform in line with our

service level agreements with customers. Maintenance capital

expenditure includes the periodic repair, refurbishment and

replacement of tower, fiber equipment and power equipment at

existing sites to keep such assets in service.

(e)

Corporate capital expenditure,

which are non-discretionary in nature, consist primarily of routine

spending on information technology infrastructure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240812037799/en/

For more information, please email:

communications@ihstowers.com

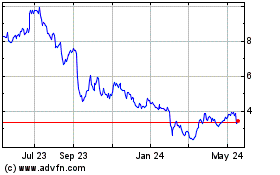

IHS (NYSE:IHS)

Historical Stock Chart

From Dec 2024 to Jan 2025

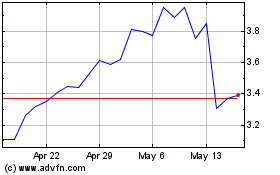

IHS (NYSE:IHS)

Historical Stock Chart

From Jan 2024 to Jan 2025