CONSOLIDATED HIGHLIGHTS – THIRD QUARTER 2024

- Revenue of $420.3 million declined 3.5% compared to the second

quarter of 2024 with continued growth in revenue from Colocation,

Lease Amendments and New Sites partially offsetting the initial

impact of the new financial terms in the renewed and extended

contracts with MTN Nigeria signed during this quarter. Revenue

decreased by 10.0% (or increased by 49.0% organically)

year-on-year, with foreign exchange (“FX”) resets and escalations,

captured within organic growth, helping to mitigate the impact of

the 52.0% devaluation of the Nigerian Naira (“NGN”)

- Adjusted EBITDA of $246.0 million (58.5% Adjusted EBITDA

Margin) increased 3.3% year-on-year, reflecting continued cost

control

- Loss for the period was $205.7 million of which $236.0 million

relates to unrealized FX losses

- Cash from operations was $182.4 million

- Adjusted Levered Free Cash Flow (“ALFCF”) was $87.1

million

- Total Capex was $66.5 million

- Reiterating 2024 guidance for Revenue of $1,670-1,700 million,

Adjusted EBITDA of $900-920 million, ALFCF guidance of $250-270

million, with net leverage ratio target remaining 3.0x-4.0x.

Reducing Capital expenditure (“Total Capex”) guidance to $270-300

million (from $330-370 million) driven by further capex

savings

IHS Holding Limited (NYSE: IHS) (“IHS Towers” or the “Company”),

one of the largest independent owners, operators, and developers of

shared communications infrastructure in the world by tower count,

today reported financial results for the third quarter ended

September 30, 2024.

Sam Darwish, IHS Towers Chairman and Chief Executive Officer,

stated, “We’re reporting another solid performance across our key

metrics in the third quarter, driven by healthy secular demand and

the quality of our contract structures. This led to a robust

Revenue performance despite significant FX headwinds, and the

initial impact of the new financial terms in the renewed and

extended contracts with MTN Nigeria signed during the quarter. Our

strong third quarter Adjusted EBITDA, reaching an Adjusted EBITDA

margin of 58.5%, highlights the resilience of our financial model

and our continued financial discipline. We are also pleased with

our ALFCF generation during the third quarter, driven by ongoing

capex optimization, demonstrating our focus on increased cash

generation. Based on our year to date capital allocation decisions,

and our expectation of making further capex savings, we are

revising our full year 2024 capex guidance range down to $270

million - $300 million. Given our performance year to date we also

remain confident on achieving our current 2024 Revenue, Adjusted

EBITDA and ALFCF guidance, and are trending towards the upper end

of our existing ranges. Our guidance reflects updated currency

assumptions, which resulted in a positive impact on our Nigeria

revenues, partially offset by a negative impact on our Brazil,

Zambia, Côte d’Ivoire and Cameroon revenues.

We’ve made further significant commercial progress during 2024

including within this third quarter, having recently renewed and

extended all our MTN tower MLAs and extended our Airtel Nigeria

MLA. These renewed or extended contracts with Key Customers cover

approximately 72% of our Revenue. We have lengthened our average

Tenant term to 8.1 years, increased our Contracted Revenues to

$12.3 billion, and ensured that we have no material renewals with

our largest customer, MTN, until the end of 2032. During the third

quarter specifically, we reached the significant commercial

milestone of renewing and extending all our tower contracts with

MTN Nigeria through 2032, covering nearly 13,500 tenancies and

approximately 23,800 Lease Amendments, including 1,430 of the

approximately 2,500 tenancies that were due to expire in 2024 and

2025, but will now remain with IHS Nigeria. This agreement draws a

line under a series of customer renewals.

We’ve also made significant progress on the balance sheet

strategy as we have extended our maturity profile and shifted more

of our debt into local currency, through our new approximately $439

million dual-tranche term loan, entered into recently in October

2024, proceeds of which were used to refinance our existing $430

million term loan that was due to mature in October 2025.

In Nigeria, we have seen reduced volatility of the Naira during

the quarter compared to earlier in the year, although devaluation

against the USD still remains. Importantly, we continue to see USD

availability, allowing us to source and upstream U.S. dollars to

Group, with $155 million upstreamed year to date as of November 8,

2024. The average FX rate for the U.S. dollar to the Naira was

1,601 during the third quarter, compared to an average FX rate of

1,392 during 2Q24, equating to a $36 million revenue headwind

quarter-on-quarter. This, compared to a more sizeable devaluation

year-on-year, with the average rate for the U.S. dollar to the

Naira of 768 a year ago, leading to a $265 million revenue headwind

year-on-year. Our FX resets, however, helped to ensure our reported

revenues only declined 10% year-on year, and an Adjusted EBITDA

which grew 3% over the same period.

As already highlighted, during the quarter we have continued to

deliver on numerous elements of our strategic review. Our third

quarter performance shows continued progress towards our goal of

increasing Adjusted EBITDA and substantially reducing our capex to

increase cash flow generation. The MTN Nigeria contract renewal

& extension finalizes the larger MLA renewals work. Our balance

sheet continues to improve with extended maturity and more local

currency debt. In terms of assets review, we continue to examine

our portfolio of markets and reiterate our target to raise proceeds

of $500 million to $1 billion by May 2025. Finally, regarding

capital allocation, we continue to expect that proceeds from those

initiatives will be used primarily to pay down our debt; however,

we will also consider deploying excess proceeds through share

buybacks and / or introducing a dividend policy. To be clear, these

initial targets do not rule out further initiatives to increase

shareholder value, which we continue to assess in parallel.”

Full Year 2024 Outlook Guidance

The following full year 2024 guidance is based on a number of

assumptions that management believes to be reasonable and reflects

the Company’s expectations as of November 12, 2024. Actual results

may differ materially from these estimates as a result of various

factors, and the Company refers you to the cautionary language

regarding “forward-looking” statements included in this press

release when considering this information. The Company’s revised

outlook includes the impact from the renewal and extension of all

tower contracts with MTN Nigeria.

The Company’s outlook is based on the following assumptions:

- Organic revenue Y/Y growth of approximately 48% (at the

mid-point)

- Average foreign currency exchange rates to 1.00 U.S. Dollar for

January 1, 2024, through December 31, 2024, for key currencies: (a)

1,500 Nigerian Naira; (b) 5.30 Brazilian Real (c) 0.92 Euros (d)

18.50 South African Rand

- Project Green capex of approximately $10.0 million

- Build-to-suit of ~850 sites of which ~600 sites in Brazil

- Net leverage ratio target of 3.0x-4.0x

Metric

Current Range

Previous Range

Revenue

$1,670M-1,700M

$1,670M-1,700M

Adjusted EBITDA (1)

$900M-920M

$900M-920M

Adjusted Levered Free Cash Flow (1)

$250M-270M

$250M-270M

Total Capex

$270M-300M

$330M-370M

(1) Adjusted EBITDA and ALFCF are non-IFRS

financial measures. See “Use of Non-IFRS financial measures” for

additional information and a reconciliation to the most comparable

IFRS measures. We are unable to provide a reconciliation of

Adjusted EBITDA and ALFCF to (loss)/income and cash from

operations, respectively, for the periods presented above without

an unreasonable effort, due to the uncertainty regarding, and the

potential variability, of these costs and expenses that may be

incurred in the future, including, in the case of Adjusted EBITDA,

share-based payment expense, finance costs, and insurance claims,

and in the case of ALFCF, cash from operations, net movement in

working capital and maintenance capital expenditures, each of which

adjustments may have a significant impact on these non-IFRS

measures.

RESULTS FOR THE THIRD QUARTER

2024

The table below sets forth select

unaudited financial results for the quarters ended September 30,

2024, and September, 30, 2023:

Three months ended

September 30,

September 30,

Y on Y

2024

2023 (1)

Growth

$’000

$’000

%

Revenue

420,282

467,023

(10.0

)

Adjusted EBITDA(2)

245,975

238,102

3.3

Loss for the period

(205,703

)

(268,804

)

23.5

Cash from operations

182,431

229,913

(20.7

)

ALFCF(2)

87,109

85,759

1.6

(1) Revised to reflect an adjustment

related to the accounting treatment of foreign exchange on goods in

transit in Nigeria.

(2) Adjusted EBITDA and ALFCF are non-IFRS financial measures. See

“Use of Non-IFRS financial measures” for additional information,

definitions and a reconciliation to the most comparable IFRS

measures.

Impact of Nigerian Naira

devaluation

In mid-June 2023, the Central Bank of Nigeria implemented steps

to unify the Nigerian foreign exchange market by replacing the old

regime of multiple exchange rate segments into a single Investors

and Exporters (“I&E”) window within which foreign exchange

transactions would be determined by market forces and which was

subsequently renamed NAFEM (Nigerian Autonomous Foreign Exchange

Rate Fixing Market) in October 2023. The Group uses the USD/NGN

rate published by Bloomberg for Group reporting purposes.

As a result of the steps taken by the Central Bank of Nigeria,

the Naira devalued between the period immediately prior to the

announcement and the month end rate as of June 30, 2023. The Naira

continued to devalue in the second half of 2023 and in January

2024, there was a further significant devaluation. During the

second and third quarters of 2024, the Naira has continued to

devalue but at a significantly slower rate as compared to the first

quarter of 2024.

The table below summarizes the closing and average rates per

period and related movements.

Closing Rate

Closing Rate Movement

(1)

Average Rate

Average Rate Movement

(1)

₦:$

$:₦

₦:$

$:₦

14 June 2023

472.3

—

—

—

30 June 2023

752.7

(37.3

)%

508.0

—

30 September 2023

775.6

(2.9

)%

767.7

(33.8

)%

31 December 2023

911.7

(14.9

)%

815.0

(5.8

)%

31 March 2024

1,393.5

(34.6

)%

1,315.9

(38.1

)%

30 June 2024

1,514.3

(8.0

)%

1,391.8

(5.4

)%

30 September 2024

1,669.1

(9.3

)%

1,601.0

(13.1

)%

(1) Movements presented for each period

are between that period’s rate and the preceding period rate and

are calculated as a percentage of the period’s rate.

Due to the Naira devaluation, Revenue and segment Adjusted

EBITDA were negatively impacted by $264.7 million and $172.4

million, respectively, in the third quarter of 2024, based on the

average rate used in that quarter compared to the third quarter of

2023 average rate. At the same time, there were contract resets

that partially offset the negative foreign exchange impact on

Revenue and segment Adjusted EBITDA. In addition, the Naira

devaluation resulted in an impact on finance costs, specifically

related to net unrealized foreign exchange losses on financing of

$232.1 million in our Nigeria segment in the third quarter of 2024.

This is due to the USD denominated internal shareholder loans from

Group entities to Nigeria and USD denominated third party debt. As

the functional currency of the Nigeria businesses is NGN, these USD

balances have been revalued in NGN using the rate as of September

30, 2024, resulting in an increase in unrealized loss on foreign

exchange.

Results for the three months ended September 30, 2024 versus

2023

Revenue

Revenue for the three month period ended September 30, 2024

(“third quarter”) of $420.3 million declined 10.0% year-on-year.

Organic revenue(1) increased by $229.0 million year-on-year during

the third quarter, or 49.0%, driven primarily by foreign exchange

resets and escalations in addition to continued growth in Tenants,

Lease Amendments and New Sites. This growth was partially offset by

the initial impact of the new financial terms in the renewed and

extended contracts with MTN Nigeria, signed during the third

quarter. Aggregate inorganic revenue growth was $0.1 million, which

primarily related to the sixth stage of the Kuwait Acquisition. The

increase in organic revenue was more than offset by the non-core

impact of negative movements in foreign exchange rates of $275.9

million, or 59.1%, of which $264.7 million was due to the

devaluation of the NGN.

Refer to the revenue component of the segment results section of

this discussion and analysis for further details.

For the third quarter, the net increase in Towers was 911

year-on-year, resulting in total Towers of 40,650 at the end of the

period, and primarily resulted from the addition of 1,346 New Sites

(including 210 reintegrated towers in 3Q24 from our smallest Key

Customer in Nigeria), partially offset by 350 Churned, 59 net

divestiture from Latam and 26 decommissioned. We added 1,119 net

new Tenants year-on-year (including 529 Churned Tenants in 3Q24

from our smallest Key Customer in Nigeria on which we were not

recognizing revenue), resulting in total Tenants of 60,315 and a

Colocation Rate of 1.48x at the end of the third quarter.

Year-on-year, we added 4,135 Lease Amendments, driven primarily by

5G and fiber upgrades, resulting in total Lease Amendments of

39,389 at the end of the third quarter.

(1) Refer to “Item 2. Management’s Discussion and Analysis of

Financial Condition and Results of Operations” for the definition

of organic revenue and additional information.

Adjusted EBITDA

Adjusted EBITDA for the third quarter was $246.0 million,

reaching an Adjusted EBITDA margin of 58.5%. Adjusted EBITDA

increased 3.3% year-on-year in the third quarter reflecting the

decrease in revenue discussed above, more than offset by a decrease

in cost of sales. The reduction in cost of sales was primarily

driven by a decrease in regulatory fees of $12.1 million, primarily

relating to a review of the current and historical license

obligations in the SSA segment, and a decrease in tower repairs and

maintenance costs, power generation costs, security services costs,

and staff costs of $7.4 million, $5.5 million, $4.4 million, and

$1.5 million respectively. The $11.1 million reduction in other

cost of sales primarily relates to FX losses on goods in transit in

Nigeria during the third quarter of 2023.

Loss for the period

Loss for the period in the third quarter of 2024 was $205.7

million, compared to a loss of $268.8 million for the third quarter

of 2023. This equates to a reduction of loss of $63.1 million

year-on-year, which was primarily due to a reduction in impairment

of property, plant and equipment, intangible assets excluding

goodwill and related prepaid land rent of $99.3 million primarily

driven by power equipment assets in our SSA segment being

classified as assets held for sale and remeasured at fair value

less cost to sell in the third quarter of 2023, coupled with an

increase in the net gain on the fair value of embedded options of

$24.3 million which is driven by the increase in the market value

of the Existing 2027 Senior Notes which increased the value of the

embedded call options within these notes. This was partially offset

by higher finance costs of $79.2 million driven by an increase in

the unrealized net foreign exchange losses arising from financing

as a result of the devaluation of the NGN, as well as a decrease in

revenue as discussed above.

Cash from operations

Cash from operations for the third quarter of 2024 was $182.4

million, compared to $229.9 million for the third quarter of 2023.

The decrease reflects an increased outflow in working capital of

$50.6 million (inclusive of a withholding tax receivable increase

of $20.2 million), partially offset by an increase in operating

income of $3.1 million.

ALFCF

ALFCF for the third quarter of 2024 was $87.1 million, compared

to $85.8 million for the third quarter of 2023. The increase in

ALFCF was primarily due to the increase in Adjusted EBITDA of $7.9

million and reduction in revenue withholding tax of $3.0 million,

partially offset by an increase in net interest paid of $8.6

million.

SEGMENT RESULTS

Revenue and Adjusted EBITDA by

segment

Revenue and segment Adjusted EBITDA, our key profitability

measures used to assess the performance of our reportable segments,

were as follows:

Revenue

Adjusted EBITDA

Three months ended

Three months ended

September 30,

September 30,

September 30,

September 30,

2024

2023

Change

2024

2023(1)

Change

$'000

$'000

%

$'000

$'000

%

Nigeria

242,290

271,394

(10.7

)

158,900

164,152

(3.2

)

SSA

120,139

133,481

(10.0

)

81,046

66,285

22.3

Latam

45,148

51,883

(13.0

)

33,798

38,163

(11.4

)

MENA

12,705

10,265

23.8

8,014

5,155

55.5

Unallocated corporate expenses(2)

—

—

—

(35,783

)

(35,653

)

(0.4

)

Total

420,282

467,023

(10.0

)

245,975

238,102

3.3

(1) Revised to reflect an adjustment

related to the accounting treatment of foreign exchange on goods in

transit in Nigeria.

(2) Unallocated corporate expenses primarily consist of costs

associated with centralized Group functions including Group

executive, legal, finance, tax and treasury services.

Nigeria

Third quarter revenue decreased 10.7% year-on-year to $242.3

million. Organic revenue increased by $235.6 million, or 86.8%,

driven primarily by foreign exchange resets and diesel prices, as

well as continued growth in revenue from Colocation and Lease

Amendments, partially offset by a reduction in revenues related to

the new financial terms in the renewed contracts with MTN Nigeria,

signed during the third quarter of 2024. The reported decrease in

revenue was primarily driven by the impact of negative movements in

foreign exchange rates with an average Naira rate of ₦1,601 to

$1.00 in the third quarter of 2024 compared to the average rate of

₦768 to $1.00 in the third quarter of 2023. This led to a non-core

decline of $264.7 million, or 97.5% year-on-year, a smaller decline

compared to that which we reported during the second quarter of

2024 given the third quarter of 2023 was a period impacted by the

significant devaluation of June 2023 but yet to benefit from our

contracts resetting in the fourth quarter of 2023.

During the third quarter, Tenants decreased by 279 year-on-year,

with growth of 535 from Colocation and 96 from New Sites, more than

offset by 910 Churned (which includes, for the third quarter of

2024, 529 Tenants occupied by our smallest Key Customer on which we

were not recognizing revenue), while Lease Amendments increased by

1,601 primarily due to 3G, 5G and fiber upgrades.

Segment Adjusted EBITDA for the third quarter declined 3.2%

year-on-year to $158.9 million, for a margin of 65.6%. The

year-on-year decline in segment Adjusted EBITDA for the third

quarter primarily reflects the decrease in revenue discussed above,

partially offset by a reduction in cost of sales, despite a

year-on-year increase in the cost of diesel in the third quarter of

$4.9 million. The reduction in cost of sales was primarily driven

by a decrease in tower repairs and maintenance costs of $4.4

million and security services costs ($2.0 million), due to the

movements in foreign exchange rates discussed above. The decrease

was also driven by a reduction in the USD equivalent amounts of

regulatory fees ($1.6 million) and staff costs ($1.2 million).

These are solely due to the Naira devaluation discussed above, even

though the underlying local costs increased during the period. The

$9.6 million reduction in other cost of sales, respectively,

primarily relates to the foreign exchange losses on goods in

transit in Nigeria during the third quarter.

SSA

Third quarter revenue decreased 10.0% year-on-year to $120.1

million, primarily driven by movements in organic revenue, which

decreased by $8.3 million, or 6.2%, due to factors including lower

power pass through revenues being recognized after the changes in

our agreements with MTN South Africa on the power managed services

business. These changes to power pass through revenue have no

impact on Adjusted EBITDA. Other factors impacting organic revenue

include growth in Tenants, New Sites and Lease Amendments, together

with escalations and foreign exchange resets. The overall decrease

in revenue in the third quarter was also impacted by the non-core

impact of negative movements in foreign exchange rates of $5.0

million, or 3.8%.

During the third quarter, Tenants increased by 729 year-on-year,

including 664 from Colocation, 144 from New Sites and 79 from

Churn, while Lease Amendments increased by 2,061.

Segment Adjusted EBITDA for the third quarter grew 22.3%

year-on-year to $81.0 million, for a margin of 67.5%. The

year-on-year increase in segment Adjusted EBITDA for the third

quarter primarily reflects a decrease in cost of sales of $26.7

million, driven by reduced regulatory fees ($10.5 million)

primarily relating to a review of the current and historical

license obligations, and reduced tower repairs, maintenance costs

security services costs and power generation costs of $3.0 million,

$2.9 million and $9.5 million respectively, primarily due to the

changes in our agreements with MTN South Africa discussed above.

The impact on our third quarter cost of sales from these changes

with MTN South Africa was reduced compared to the impact in the

second quarter of 2024, driven by the one-off adjustments captured

in the second quarter of 2024 relating to previous periods. This

was partially offset by the decrease in revenue during the

period.

Latam

Third quarter revenue decreased 13.0% year-on-year to $45.1

million and was primarily driven by the non-core impact of negative

movements in foreign exchange rates of $6.2 million, or 11.9%.

Organic revenue declined 0.6% in the quarter, or $0.3 million,

driven by a reduction in revenues from our customer Oi S.A. (“Oi”)

in Brazil as a result of their judicial recovery proceedings,

partially offset by continued growth in Tenants, Lease Amendments

and New Sites.

During the third quarter, Tenants increased by 657 year-on-year,

including 793 from New Sites and 236 from Colocation, partially

offset by 311 Churned and net divestiture of 61, primarily due to

the disposal of Peru, while Lease Amendments increased by 201.

Third quarter segment Adjusted EBITDA declined 11.4% to $33.8

million and primarily reflects the decrease in revenue discussed

above, as well as an increase in security services costs of $0.4

million, partially offset by a reduction in power generation costs

and site rental costs of $0.4 million and $0.3 million,

respectively.

MENA

Third quarter revenue increased 23.8% year-on-year to $12.7

million driven primarily by New Sites, Lease Amendments and

escalations. Revenues grew inorganically in the period by $0.4

million, or 3.6%, driven primarily by the sixth stage of the Kuwait

Acquisition, completed in August 2023.

During the third quarter, Tenants increased by 12 year-on-year,

including 21 from New Sites, partially offset by 9 Churned, while

Lease Amendments increased by 272.

Segment Adjusted EBITDA was $8.0 million for the third quarter,

an increase of 55.5% year-on-year. The increase in segment Adjusted

EBITDA primarily reflects the increase in revenue discussed

above.

CAPITAL EXPENDITURE

For each of our reportable segments, below

is the capital expenditure for the three month periods ended

September 30, 2024 and 2023:

Three months ended

September 30,

September 30,

Y on Y

2024

2023 (1)

Growth

$’000

$’000

%

Nigeria

(21,358

)

(30,778

)

(30.6

)

SSA

(11,307

)

(11,318

)

(0.1

)

Latam

(31,793

)

(56,999

)

(44.2

)

MENA

(771

)

(1,244

)

(38.0

)

Other

(1,231

)

(542

)

127.1

Total capital expenditure

(66,460

)

(100,881

)

(34.1

)

(1) Revised to reflect an adjustment related to the

accounting treatment of foreign exchange on goods in transit in

Nigeria.

During the third quarter of 2024, capital expenditure (“Total

Capex”) was $66.5 million, compared to $100.9 million for the third

quarter of 2023. The decrease is driven by lower capital

expenditure across our four reportable segments reflecting the

actions we are taking to improve cash generation and to narrow our

focus to projects that we expect will deliver the highest

returns.

Nigeria

The 30.6% year-on-year decrease for the third quarter was

primarily driven by decreases of $6.0 million related to Project

Green capital expenditure given the investment planned for this

project is now largely complete, $5.2 million related to fiber

business capital expenditure and $2.2 million related to

augmentation capital expenditure, partially offset by a $2.2

million increase related to maintenance capital expenditure.

SSA

The 0.1% year-on-year decrease for the third quarter was

primarily driven by decreases of $1.5 million in maintenance

capital expenditure and $1.1 million in refurbishment capital

expenditure, offset by a $2.0 million increase in augmentation

capital expenditure.

Latam

The 44.2% year-on-year decrease for the third quarter was

primarily driven by decreases related to New Sites capital

expenditure ($13.5 million), fiber business capital expenditure

($10.4 million), corporate capital expenditure ($2.4 million) and

purchase of land for new or existing sites ($1.5 million).

MENA

The 38.0% year-on-year decrease for the third quarter was

primarily due to a decrease in New Sites capital expenditure ($0.6

million) and maintenance capital expenditure ($0.2 million),

partially offset by an increase in other capital expenditure ($0.2

million) and refurbishment capital expenditure ($0.2 million).

FINANCING ACTIVITIES DURING THE THREE MONTHS ENDED SEPTEMBER

30, 2024

Nigeria (2023) Term Loan and Nigeria (2023) Revolving Credit

Facility

In August 2024, the cap of 24%, to which the floating interest

rates per annum were subject in the NGN 165.0 billion

(approximately $98.9 million) loan and the NGN 55.0 billion

(approximately $33.0 million) facility, both entered into in

January 2023, was amended to 27%.

FINANCING ACTIVITIES AFTER THE REPORTING PERIOD ENDED

SEPTEMBER 30, 2024

IHS Holding (2024) dual-tranche Bullet Term Loan

Facility

In October 2024, IHS Holding Limited entered into and drew down

on a dual-tranche $255.0 million and ZAR 3,246.0 million loan

agreement (together totaling approximately $438.6 million). This

syndicated facility is scheduled to terminate in October 2029. The

majority of the proceeds have been applied toward the repayment of

the IHS Holding (2022) Bullet Term Loan Facility. The applicable

interest rate on the dollar tranche is Term SOFR, plus a margin of

4.50% and on the ZAR tranche is JIBAR, plus a margin of 4.50%.

IHS Holding (2022) Bullet Term Loan Facility

In October 2024, the outstanding principal amount of $430.0

million under this facility was fully repaid with the proceeds from

the IHS Holding (2024) dual-tranche Bullet Term Loan Facility

described above.

OTHER ACTIVITIES AFTER REPORTING PERIOD

Nigeria withholding tax

On October 2, 2024, the Federal Government of Nigeria released

the official gazette of the “Deduction of Tax at Source

(Withholding) Regulations, 2024” setting out changes to the

withholding tax (“WHT”) regulations which impact the Group’s

Nigerian businesses. Effective from January 1, 2025, these changes

are expected to reduce the amounts of tax withheld by customers in

Nigeria with respect to colocation and telecommunication tower

services from 10% to 2%, which is anticipated to lead to an

increase in cash flow for IHS from 2025.

Nigerian WHT can be credited against corporation tax (“CIT”)

liabilities and is therefore initially recognized as an asset.

Historically, the WHT credits each quarter have exceeded the total

forecast CIT payable and the unutilized asset has been impaired.

Going forward, the Group will reassess the extent to which

previously impaired WHT credits can be recovered against future CIT

liabilities, taking account of the reduction in the WHT rate from

January 2025.

Conference Call

IHS Towers will host a conference call on November 12, 2024, at

8:30am ET to review its financial and operating results.

Supplemental materials will be available on the Company’s website,

www.ihstowers.com. The conference call can be accessed by calling

+1 646 307 1963 (U.S./Canada) or +44 20 3481 4247

(UK/International). The call ID is 5159017.

A simultaneous webcast and replay will be available in the

Investor Relations section of the Company’s website,

www.ihstowers.com, on the Earnings Materials page.

Upcoming Conferences and Events

IHS Towers management is expected to participate in the upcoming

conferences outlined below, dates noted are subject to change.

Visit www.ihstowers.com/investors/investor-presentations-events for

additional conferences information.

- UBS Global Media and Communications Conference (New York) -

December 9, 2024

About IHS Towers

IHS Towers is one of the largest independent owners, operators

and developers of shared communications infrastructure in the world

by tower count and is one of the largest independent multinational

towercos solely focused on emerging markets. The Company has over

40,000 towers across its 10 markets, including Brazil, Cameroon,

Colombia, Côte d’Ivoire, Egypt, Kuwait, Nigeria, Rwanda, South

Africa and Zambia. For more information, please email: communications@ihstowers.com or visit:

www.ihstowers.com.

For more information about the Company and our financial and

operating results, please also refer to the 3Q24 Supplemental

Information deck posted to our Investors Relations website at

www.ihstowers.com/investors.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This press release contains forward-looking statements. We

intend such forward-looking statements to be covered by relevant

safe harbor provisions for forward-looking statements (or their

equivalent) of any applicable jurisdiction, including those

contained in Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). All statements other

than statements of historical facts contained in this press release

may be forward-looking statements. In some cases, you can identify

forward-looking statements by terms such as “may,” “will,”

“should,” “expects,” “plans,” “anticipates,” “could,” “intends,”

“targets,” “projects,” “contemplates,” “believes,” “estimates,”

“forecast,” “predicts,” “potential” or “continue” or the negative

of these terms or other similar expressions. Forward-looking

statements contained in this press release include, but are not

limited to statements regarding our future results of operations

and financial position, future organic growth, anticipated results

for the fiscal year 2024, industry and business trends, business

strategy, plans (including our strategic review and related

productivity enhancements and cost reductions, as well as our

ability to refinance or meet our debt obligations), market growth,

position and our objectives for future operations, including our

ability to maintain relationships with customers and continue to

renew customer lease agreements or the potential benefit of the

terms of such renewals or our ability to grow our business through

acquisitions, the impact (illustrative or otherwise) of the new

agreements with MTN Nigeria (including certain rebased fee

components) on our financial results, the impact of currency and

exchange rate fluctuations (including the devaluation of the Naira)

and other economic and geopolitical factors on our future results

and operations, the outcome and potential benefit of our strategic

review, our objectives for future operations and our participation

in upcoming presentations and events.

We have based these forward-looking statements largely on our

current expectations and projections about future events and

financial trends that we believe may affect our business, financial

condition and results of operations. Forward-looking statements

involve known and unknown risks, uncertainties and other important

factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to:

- non-performance under or termination, non-renewal or material

modification of our customer agreements;

- volatility in terms of timing for settlement of invoices or our

inability to collect amounts due under invoices;

- a reduction in the creditworthiness and financial strength of

our customers;

- the business, legal and political risks in the countries in

which we operate;

- general macroeconomic conditions in the countries in which we

operate;

- changes to existing or new tax laws, rates or fees;

- foreign exchange risks, particularly in relation to the

Nigerian Naira, and/or ability to hedge against such risks in our

commercial agreements or to access U.S. Dollars in our

markets;

- the effect of regional or global health pandemics, geopolitical

conflicts and wars, and acts of terrorism;

- our inability to successfully execute our business strategy and

operating plans, including our ability to increase the number of

Colocations and Lease Amendments on our Towers and construct New

Sites or develop business related to adjacent telecommunications

verticals (including, for example, relating to our fiber businesses

in Latin America and elsewhere) or deliver on our sustainability or

environmental, social and governance (ESG) strategy and initiatives

under anticipated costs, timelines, and complexity, such as our

Carbon Reduction Roadmap (and Project Green), including plans to

reduce diesel consumption, integrate solar panel and battery

storage solutions on tower sites and connect more sites to the

electricity grid;

- our reliance on third-party contractors or suppliers, including

failure, underperformance or inability to provide products or

services to us (in a timely manner or at all) due to sanctions

regulations, supply chain issues or for other reasons;

- our estimates and assumptions and estimated operating results

may differ materially from actual results;

- increases in operating expenses, including increased costs for

diesel;

- failure to renew or extend our ground leases, or protect our

rights to access and operate our Towers or other telecommunications

infrastructure assets;

- loss of customers;

- risks related to our indebtedness;

- changes to the network deployment plans of mobile operators in

the countries in which we operate;

- a reduction in demand for our services;

- the introduction of new technology reducing the need for tower

infrastructure and/or adjacent telecommunication verticals;

- an increase in competition in the telecommunications tower

infrastructure industry and/or adjacent telecommunication

verticals;

- our failure to integrate recent or future acquisitions;

- the identification by management of material weaknesses in our

internal control over financial reporting, which could affect our

ability to produce accurate financial statements on a timely basis

or cause us to fail to meet our future reporting obligations;

- increased costs, harm to reputation, or other adverse impacts

related to increased intention to and evolving expectations for

environmental, social and governance initiatives;

- our reliance on our senior management team and/or key

employees;

- failure to obtain required approvals and licenses for some of

our sites or businesses or comply with applicable regulations;

- inability to raise financing to fund future growth

opportunities or operating expense reduction strategies;

- environmental liability;

- inadequate insurance coverage, property loss and unforeseen

business interruption;

- compliance with or violations (or alleged violations) of laws,

regulations and sanctions, including but not limited to those

relating to telecommunications regulatory systems, tax, labor,

employment (including new minimum wage regulations), unions, health

and safety, antitrust and competition, environmental protection,

consumer protection, data privacy and protection, import/export,

foreign exchange or currency, and of anti-bribery, anti-corruption

and/or money laundering laws, sanctions and regulations;

- fluctuations in global prices for diesel or other

materials;

- disruptions in our supply of diesel or other materials;

- legal and arbitration proceedings;

- our reliance on shareholder support (including to invest in

growth opportunities) and related party transaction risks;

- risks related to the markets in which we operate, including but

not limited to local community opposition to some of our sites or

infrastructure, and the risks from our investments into emerging

and other less developed markets;

- injury, illness or death of employees, contractors or third

parties arising from health and safety incidents;

- loss or damage of assets due to security issues or civil

commotion;

- loss or damage resulting from attacks on any information

technology system or software;

- loss or damage of assets due to extreme weather events whether

or not due to climate change;

- failure to meet the requirements of accurate and timely

financial reporting and/or meet the standards of internal control

over financial reporting that support a clean certification under

the Sarbanes Oxley Act;

- risks related to our status as a foreign private issuer;

and

- the important factors discussed in the section titled “Risk

Factors” in our Annual Report on Form 20-F for the fiscal year

ended December 31, 2023.

The forward-looking statements in this press release are based

upon information available to us as of the date of this press

release, and while we believe such information forms a reasonable

basis for such statements, such information may be limited or

incomplete, and our statements should not be read to indicate that

we have conducted an exhaustive inquiry into, or review of, all

potentially available relevant information. These statements are

inherently uncertain and investors are cautioned not to unduly rely

upon these statements. You should read this press release and the

documents that we reference in this press release with the

understanding that our actual future results, performance and

achievements may be materially different from what we expect. We

qualify all of our forward-looking statements by these cautionary

statements. Additionally, we may provide information herein that is

not necessarily “material” under the federal securities laws for

SEC reporting purposes, but that is informed by various ESG

standards and frameworks (including standards for the measurement

of underlying data), and the interests of various stakeholders.

Much of this information is subject to assumptions, estimates or

third-party information that is still evolving and subject to

change. For example, we note that standards and expectations

regarding greenhouse gas (GHG) accounting and the processes for

measuring and counting GHG emissions and GHG emissions reductions

are evolving, and it is possible that our approaches both to

measuring our emissions and any reductions may be at some point,

either currently or in future, considered by certain parties to not

be in keeping with best practices. In addition, our disclosures

based on any standards may change due to revisions in framework

requirements, availability of information, changes in our business

or applicable government policies, or other factors, some of which

may be beyond our control. These forward-looking statements speak

only as of the date of this press release. Except as required by

applicable law, we do not assume, and expressly disclaim, any

obligation to publicly update or revise any forward-looking

statements contained in this press release, whether as a result of

any new information, future events or otherwise. Additionally,

references to our website and other documents contained in this

press release are provided for convenience only, and their content

is not incorporated by reference into this press release.

CONDENSED CONSOLIDATED STATEMENT OF

LOSS AND OTHER COMPREHENSIVE INCOME (UNAUDITED)

FOR THE THREE MONTHS AND NINE MONTHS

ENDED SEPTEMBER 30, 2024, AND 2023

Three months ended

Nine months ended

September 30,

September 30,

September 30,

September 30,

2024

2023

2024

2023

$’000

$’000

$’000

$’000

Revenue

420,282

467,023

1,273,403

1,615,755

Cost of sales*

(201,745

)

(358,883

)

(662,745

)

(962,628

)

Administrative expenses

(97,099

)

(93,835

)

(347,558

)

(291,877

)

Net reversal of loss allowance/(net loss

allowance) on trade receivables

4,286

(711

)

2,107

(5,225

)

Other income

63

33

1,656

369

Operating income

125,787

13,627

266,863

356,394

Finance income

25,732

5,823

49,696

18,233

Finance costs*

(350,825

)

(271,595

)

(2,163,157

)

(1,816,864

)

Loss before income tax*

(199,306

)

(252,145

)

(1,846,598

)

(1,442,237

)

Income tax expense

(6,397

)

(16,659

)

(40,669

)

(89,118

)

Loss for the period*

(205,703

)

(268,804

)

(1,887,267

)

(1,531,355

)

Loss attributable to:

Owners of the Company*

(204,143

)

(266,830

)

(1,878,540

)

(1,523,021

)

Non‑controlling interests

(1,560

)

(1,974

)

(8,727

)

(8,334

)

Loss for the period

(205,703

)

(268,804

)

(1,887,267

)

(1,531,355

)

Loss per share ($) - basic*

(0.61

)

(0.80

)

(5.64

)

(4.57

)

Loss per share ($) - diluted*

(0.61

)

(0.80

)

(5.64

)

(4.57

)

Other comprehensive income:

Items that may be reclassified to income

or loss

Exchange differences on translation of

foreign operations*

227,539

5,346

1,264,063

634,802

Other comprehensive income for the

period, net of taxes*

227,539

5,346

1,264,063

634,802

Total comprehensive income/(loss) for

the period*

21,836

(263,458

)

(623,204

)

(896,553

)

Total comprehensive income/(loss)

attributable to:

Owners of the Company*

18,051

(254,269

)

(592,175

)

(896,612

)

Non‑controlling interests

3,785

(9,189

)

(31,029

)

59

Total comprehensive income/(loss) for

the period*

21,836

(263,458

)

(623,204

)

(896,553

)

*Revised comparative periods to reflect an

adjustment related to the accounting treatment of foreign exchange

on goods in transit in Nigeria.

CONDENSED CONSOLIDATED STATEMENT OF

FINANCIAL POSITION (UNAUDITED)

AT SEPTEMBER 30, 2024, AND DECEMBER 31,

2023

September 30,

December 31,

2024

2023

$’000

$’000

Non‑current assets

Property, plant and equipment

1,436,945

1,740,235

Right of use assets

807,033

886,909

Goodwill

441,971

619,298

Other intangible assets

809,667

933,030

Deferred income tax assets

64,508

63,786

Derivative financial instrument assets

31,170

1,540

Trade and other receivables

127,198

147,305

3,718,492

4,392,103

Current assets

Inventories

31,874

40,589

Income tax receivable

1,992

3,755

Derivative financial instrument assets

157

565

Trade and other receivables

421,218

607,835

Cash and cash equivalents

397,499

293,823

Assets held for sale

—

26,040

852,740

972,607

TOTAL ASSETS

4,571,232

5,364,710

Non‑current liabilities

Trade and other payables

5,153

4,629

Borrowings

3,354,762

3,056,696

Lease liabilities

513,484

510,838

Provisions for other liabilities and

charges

95,447

86,131

Deferred income tax liabilities

127,923

137,106

4,096,769

3,795,400

Current liabilities

Trade and other payables

400,929

532,627

Provisions for other liabilities and

charges

160

277

Derivative financial instrument

liabilities

10,537

68,133

Income tax payable

58,106

75,612

Borrowings

176,996

454,151

Lease liabilities

93,699

91,156

740,427

1,221,956

TOTAL LIABILITIES

4,837,196

5,017,356

Stated capital

5,399,635

5,394,812

Accumulated losses

(7,171,934

)

(5,293,394

)

Other reserves

1,299,858

8,430

Equity attributable to owners of the

Company

(472,441

)

109,848

Non‑controlling interest

206,477

237,506

TOTAL EQUITY

(265,964

)

347,354

TOTAL LIABILITIES AND EQUITY

5,364,710

CONDENSED CONSOLIDATED STATEMENT OF

CHANGES IN EQUITY (UNAUDITED)

FOR THE NINE MONTHS ENDED SEPTEMBER 30,

2024, AND 2023

Attributable to owners of the

Company

Non‑

Stated

Accumulated

Other

controlling

Total

capital

losses

reserves

Total

interest

equity

$’000

$’000

$’000

$’000

$’000

$’000

Balance at January 1, 2023

5,311,953

(3,317,652

)

(861,271

)

1,133,030

227,200

1,360,230

Shares repurchased and canceled through

buyback program

(10,022

)

—

—

(10,022

)

—

(10,022

)

NCI arising on business combination

—

—

—

—

1,922

1,922

Options converted to shares

89,432

—

(89,432

)

—

—

—

Share‑based payment expense

—

—

9,327

9,327

—

9,327

Other reclassifications related to

share-based payment

—

867

(1,426

)

(559

)

—

(559

)

Total transactions with owners

79,410

867

(81,531

)

(1,254

)

1,922

668

Loss for the period*

—

(1,523,021

)

—

(1,523,021

)

(8,334

)

(1,531,355

)

Other comprehensive income*

—

—

626,409

626,409

8,393

634,802

Total comprehensive (loss)/income*

—

(1,523,021

)

626,409

(896,612

)

59

(896,553

)

Balance at September 30, 2023*

5,391,363

(4,839,806

)

(316,393

)

235,164

229,181

464,345

Balance at January 1, 2024

5,394,812

(5,293,394

)

8,430

109,848

237,506

347,354

Options converted to shares

4,823

—

(4,823

)

—

—

—

Share‑based payment expense

—

—

9,886

9,886

—

9,886

Total transactions with owners

4,823

—

5,063

9,886

—

9,886

Loss for the period

—

(1,878,540

)

—

(1,878,540

)

(8,727

)

(1,887,267

)

Other comprehensive income/(loss)

—

—

1,286,365

1,286,365

(22,302

)

1,264,063

Total comprehensive (loss)/income

—

(1,878,540

)

1,286,365

(592,175

)

(31,029

)

(623,204

)

Balance at September 30, 2024

5,399,635

(7,171,934

)

1,299,858

(472,441

)

206,477

(265,964

)

*Revised to reflect an adjustment related

to the accounting treatment of foreign exchange on goods in transit

in Nigeria.

CONDENSED CONSOLIDATED STATEMENT OF

CASH FLOWS (UNAUDITED)

FOR THE THREE MONTHS AND NINE MONTHS

ENDED SEPTEMBER 30, 2024, AND 2023

Three months ended

Nine months ended

September 30,

September 30,

September 30,

September 30,

2024

2023

2024

2023

$’000

$’000

$’000

$’000

Cash flows from operating

activities

Cash from operations*

182,431

229,913

427,011

740,869

Income taxes paid

(6,575

)

(8,450

)

(35,091

)

(42,407

)

Payment for rent

(1,362

)

(1,204

)

(6,871

)

(4,147

)

Payment for tower and tower equipment

decommissioning

(27

)

(6

)

(52

)

(327

)

Net cash generated from operating

activities*

174,467

220,253

384,997

693,988

Cash flow from investing

activities

Purchase of property, plant and

equipment*

(52,175

)

(119,889

)

(173,709

)

(383,456

)

Payment in advance for property, plant and

equipment

(9,730

)

(18,772

)

(15,581

)

(88,920

)

Purchase of software and licenses

(562

)

(3,494

)

(3,291

)

(19,670

)

Consideration paid on business

combinations, net of cash acquired

—

(4,486

)

—

(4,486

)

Proceeds from sale of subsidiary, net of

cash disposed

—

—

4,073

—

Proceeds from disposal of property, plant

and equipment

12,962

508

14,999

1,468

Insurance claims received

11

32

51

310

Interest income received

5,017

5,761

12,851

17,338

Deposit of short-term deposits

(4,077

)

(59,173

)

(40,590

)

(187,938

)

Refund of short-term deposits

4,037

15,908

208,717

36,631

Net cash (used in)/generated from

investing activities*

(44,517

)

(183,605

)

7,520

(628,723

)

Cash flows from financing

activities

Shares repurchased and canceled through

buyback program

—

(5,713

)

—

(5,713

)

Bank loans and bond proceeds received and

transaction costs paid

(194

)

318,765

611,397

976,944

Bank loans and bonds repaid

(58,998

)

(226,741

)

(465,823

)

(644,591

)

Fees on loans and derivative

instruments

(2,041

)

(6,149

)

(9,295

)

(14,820

)

Interest paid

(87,037

)

(79,173

)

(253,001

)

(224,118

)

Payment for the principal of lease

liabilities

(11,929

)

(14,844

)

(44,463

)

(59,426

)

Interest paid for lease liabilities

(15,849

)

(15,405

)

(46,546

)

(40,699

)

Net (loss)/gain settled on derivative

instruments

(2,644

)

145

(22,571

)

617

Net cash used in financing

activities

(178,692

)

(29,115

)

(230,302

)

(11,806

)

Net (decrease)/increase in cash and cash

equivalents

(48,742

)

7,533

162,215

53,459

Cash and cash equivalents at beginning of

period

445,713

433,048

293,823

514,078

Effect of movements in exchange rates on

cash

528

(15,145

)

(58,539

)

(142,101

)

Cash and cash equivalents at end of

period

397,499

425,436

397,499

425,436

*Revised comparative periods to reflect an

adjustment related to the accounting treatment of foreign exchange

on goods in transit in Nigeria.

Use of Non-IFRS financial measures

Certain parts of this document contain non-IFRS financial

measures, including Adjusted EBITDA, Adjusted EBITDA Margin and

Adjusted Levered Free Cash Flow (“ALFCF”). The non-IFRS financial

information is presented for supplemental informational purposes

only and should not be considered a substitute for financial

information presented in accordance with Accounting Standards as

issued by International Accounting Standards Board (“IFRS®

Accounting Standards”), and may be different from similarly titled

non-IFRS measures used by other companies.

Adjusted EBITDA and Adjusted EBITDA Margin

We define Adjusted EBITDA (including by segment) as

income/(loss) for the period, before income tax expense/(benefit),

finance costs and income, depreciation and amortization, impairment

of withholding tax receivables, impairment of goodwill, business

combination transaction costs, impairment of property, plant and

equipment, intangible assets excluding goodwill and related prepaid

land rent, reversal of provision for decommissioning costs, net

(gain)/loss on sale of assets, share-based payment

(credit)/expense, insurance claims and certain other items that

management believes are not indicative of the core performance of

our business.

We define Adjusted EBITDA Margin as Adjusted EBITDA divided by

revenue for the applicable period, expressed as a percentage.

We believe that Adjusted EBITDA is an indicator of the operating

performance of our core business. We believe Adjusted EBITDA and

Adjusted EBITDA Margin, as defined above, are useful to investors

and are used by our management for measuring profitability and

allocating resources, because they exclude the impact of certain

items which have less bearing on our core operating performance. We

believe that utilizing Adjusted EBITDA and Adjusted EBITDA Margin

allows for a more meaningful comparison of operating fundamentals

between companies within our industry by eliminating the impact of

capital structure and taxation differences between the

companies.

Adjusted EBITDA measures are frequently used by securities

analysts, investors and other interested parties in their

evaluation of companies comparable to us, many of which present an

Adjusted EBITDA-related performance measure when reporting their

results.

Adjusted EBITDA and Adjusted EBITDA Margin are used by different

companies for differing purposes and are often calculated in ways

that reflect the circumstances of those companies. As a result,

investors should not consider these performance measures in

isolation from, or as a substitute analysis for, our results of

operations as determined in accordance with IFRS Accounting

Standards. You should exercise caution in comparing Adjusted EBITDA

and Adjusted EBITDA Margin as reported by us to Adjusted EBITDA and

Adjusted EBITDA Margin as reported by other companies. Adjusted

EBITDA and Adjusted EBITDA Margin are unaudited and have not been

prepared in accordance with IFRS Accounting Standards.

Adjusted EBITDA and Adjusted EBITDA Margin are not measures of

performance under IFRS Accounting Standards and you should not

consider these as an alternative to income/(loss) for the period or

other financial measures determined in accordance with IFRS

Accounting Standards.

Adjusted EBITDA and Adjusted EBITDA Margin have limitations as

analytical tools, and you should not consider them in isolation.

Some of these limitations are:

- they do not reflect interest expense, or the cash requirements

necessary to service interest or principal payments, on our

indebtedness;

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often need to be

replaced in the future and Adjusted EBITDA and Adjusted EBITDA

Margin do not reflect any cash requirements that would be required

for such replacements;

- some of the items we eliminate in calculating Adjusted EBITDA

and Adjusted EBITDA Margin reflect cash payments that have less

bearing on our core operating performance, but that impact our

operating results for the applicable period; and

- the fact that other companies in our industry may calculate

Adjusted EBITDA and Adjusted EBITDA Margin differently than we do,

which limits their usefulness as comparative measures.

Accordingly, prospective investors should not place undue

reliance on Adjusted EBITDA or Adjusted EBITDA Margin.

ALFCF

We define ALFCF as cash from operations, before certain items of

income or expenditure that management believes are not indicative

of the core cash flow of our business (to the extent that these

items of income and expenditure are included within cash flow from

operating activities), and after taking into account net working

capital movements, income taxes paid, withholding tax, lease and

rent payments made, net interest paid or received, business

combination transaction costs, maintenance capital expenditure and

routine corporate capital expenditure. We believe that it is

important to measure the free cash flows we have generated from

operations, after accounting for the cash cost of funding and

routine capital expenditure required to generate those cash

flows.

We believe ALFCF is useful to investors because it is also used

by our management for measuring our operating cash flow, liquidity

and allocating resources. While Adjusted EBITDA provides management

with a basis for assessing its current operating performance, we

use ALFCF in order to assess the long-term, sustainable operating

liquidity of our business. ALFCF is derived through an

understanding of the funds generated from operations, taking into

account our capital structure and the taxation environment

(including withholding tax implications), as well as the impact of

non-discretionary maintenance capital expenditure and routine

corporate capital expenditure. ALFCF provides management with a

metric through which to measure the underlying cash generation of

the business by further adjusting for expenditure that are

non-discretionary in nature (such as interest paid and income taxes

paid), as well as certain cash items that impact cash from

operations in any particular period.

ALFCF and similar measures are frequently used by securities

analysts, investors and other interested parties in their

evaluation of companies comparable to us, many of which present an

ALFCF-related measure when reporting their results. Such measures

are used in the telecommunications infrastructure sector as they

are seen to be important in assessing the liquidity of a business.

We present ALFCF to provide investors with a meaningful measure for

comparing our liquidity to those of other companies, particularly

those in our industry.

ALFCF and similar measures are used by different companies for

differing purposes and are often calculated in ways that reflect

the circumstances of those companies. You should exercise caution

in comparing ALFCF as reported by us to ALFCF or similar measures

as reported by other companies. ALFCF is unaudited and has not been

prepared in accordance with IFRS Accounting Standards.

ALFCF is not intended to replace cash from operations for the

period or any other measures of cash flow under IFRS Accounting

Standards.

ALFCF has limitations as an analytical tool, and you should not

consider it in isolation. Some of these limitations are:

- not all cash changes are reflected, for example, changes in

working capital are not included and discretionary capital

expenditure are not included;

- some of the items that we eliminate in calculating ALFCF

reflect cash payments that have less bearing on our liquidity, but

that impact our operating results for the applicable period;

- the fact that certain cash charges, such as lease payments

made, can include payments for multiple future years that are not

reflective of operating results for the applicable period, which

may result in lower lease payments for subsequent periods;

- the fact that other companies in our industry may have

different capital structures and applicable tax regimes, which

limits its usefulness as a comparative measure; and

- the fact that other companies in our industry may calculate

ALFCF differently than we do, which limits their usefulness as

comparative measures.

Accordingly, you should not place undue reliance on ALFCF.

Reconciliation from loss for the period to Adjusted EBITDA

and Adjusted EBITDA Margin

The following is a reconciliation of Adjusted EBITDA and

Adjusted EBITDA Margin to the most directly comparable IFRS

measure, which are loss and loss margins, respectively, for the

periods presented:

Three months ended

Nine months ended

September 30,

September 30,

September 30,

September 30,

2024

2023*

2024

2023*

$'000

$'000

$'000

$'000

Loss for the period

(205,703

)

(268,804

)

(1,887,267

)

(1,531,355

)

Divided by total Revenue

420,282

467,023

1,273,403

1,615,755

Loss margin for the period

(48.9

)%

(57.6

)%

(148.2

)%

(94.8

)%

Adjustments:

Income tax expense

6,397

16,659

40,669

89,118

Finance costs(a)

350,825

271,595

2,163,157

1,816,864

Finance income(a)

(25,732

)

(5,823

)

(49,696

)

(18,233

)

Depreciation and amortization

91,308

104,931

266,040

340,381

Impairment of withholding tax

receivables(b)

21,855

10,508

32,827

35,112

Impairment of goodwill

—

—

87,894

—

Business combination transaction costs

578

161

958

1,647

Impairment of property, plant and

equipment, intangible assets excluding goodwill and related prepaid

land rent(c)

4,132

103,429

12,959

108,510

Net gain on disposal of property, plant

and equipment

(1,270

)

(386

)

(3,562

)

(952

)

Share-based payment expense(d)

1,813

2,654

9,879

9,571

Insurance claims(e)

(11

)

(32

)

(51

)

(310

)

Other costs(f)

1,783

3,211

8,175

8,059

Other income

—

(1

)

—

(59

)

Adjusted EBITDA

245,975

238,102

681,982

858,353

Divided by total Revenue

420,282

467,023

1,273,403

1,615,755

Adjusted EBITDA Margin

58.5

%

51.0

%

53.6

%

53.1

%

*Revised to reflect an adjustment related

to the accounting treatment of foreign exchange on goods in transit

in Nigeria.

(a) Finance costs consist of interest

expense and loan facility fees on borrowings, the unwinding of the

discount on our decommissioning liability and lease liability,

realized and unrealized net foreign exchange losses arising from

financing arrangements and net realized and unrealized losses from

valuations of financial instruments. Finance income consists of

interest income from bank deposits, realized and unrealized net

foreign exchange gains arising from financing arrangements and net

realized and unrealized gains from valuations of financial

instruments.

(b) Revenue withholding tax primarily

represents amounts withheld by customers in Nigeria and paid to the

local tax authority. The amounts withheld may be recoverable

through an offset against future corporate income tax liabilities

in the relevant operating company. Revenue withholding tax

receivables are reviewed for recoverability at each reporting

period end and impaired if not forecast to be recoverable.

(c) Represents non-cash charges related to

the impairment of property, plant and equipment, intangible assets

excluding goodwill and related prepaid land rent on the

decommissioning of sites.

(d) Represents expenses related to

share-based compensation, which vary from period to period

depending on timing of awards and changes to valuation inputs

assumptions.

(e) Represents insurance claims included

as non-operating income.

(f) Other costs for the three months ended

September 30, 2024, included one-off consulting fees related to

corporate structures and operating systems of $0.7 million (three

months ended September 30, 2023: $1.7 million) and $5.2 million for

the nine months ended September 30, 2024 (nine months ended

September 30, 2023: $4.5 million); costs related to internal

reorganization for the three months ended September 30, 2024, of

$0.9 million (three months ended September 30, 2023: $0.6 million)

and $2.7 million for the nine months ended September 30, 2024 (nine

months ended September 30, 2023: $0.7 million); other one-off

consulting services for the three months ended September 30, 2024,

of $Nil (three months ended September 30, 2023: $0.7 million) and

$Nil for the nine months ended September 30, 2024 (nine months

ended September 30, 2023: $1.7 million); one-off professional fees

related to financing for the three months ended September 30, 2024,

of $0.1 million (three months ended September 30, 2023: $Nil) and

$0.2 million for the nine months ended September 30, 2024 (nine

months ended September 30, 2023: $0.2 million).

Reconciliation from cash from operations to ALFCF

The following is a reconciliation of ALFCF to the most directly

comparable IFRS measure, which is cash from operations, for the

three and nine months September 30, 2024 and 2023:

Three months ended

Nine months ended

September 30,

September 30,

September 30,

September 30,

2024

2023*

2024

2023*

$'000

$'000

$'000

$'000

Cash from operations

182,431

229,913

427,011

740,869

Adjustments:

Net movement in working capital

58,948

8,318

250,771

120,980

Income taxes paid

(6,575

)

(8,450

)

(35,091

)

(42,407

)

Withholding tax(a)

(20,195

)

(23,159

)

(64,299

)

(90,088

)

Lease and rent payments made

(29,140

)

(31,453

)

(97,880

)

(104,272

)

Net interest paid(b)

(82,020

)

(73,412

)

(240,150

)

(206,780

)

Business combination transaction costs

181

328

1,850

4,436

Other costs(c)

2,303

2,969

3,779

7,747

Maintenance capital expenditure(d)

(18,763

)

(19,259

)

(48,512

)

(114,278

)

Corporate capital expenditure(e)

(61

)

(36

)

(402

)

(1,590

)

ALFCF

87,109

85,759

197,077

314,617

Non-controlling interest

(6,605

)

(3,186

)

(10,327

)

(7,747

)

ALFCF excluding non-controlling

interest

80,504

82,573

186,750

306,870

*Revised to reflect an adjustment related

to the accounting treatment of foreign exchange on goods in transit

in Nigeria.

(a) Withholding tax primarily represents

amounts withheld by customers which may be recoverable through an

offset against future corporate income tax liabilities in the

relevant operating company.

(b) Represents the aggregate value of

interest paid and interest income received.

(c) Other costs for the three and nine

months ended September 30, 2024, primarily related to one-off

consulting fees.

(d) We incur capital expenditure in

relation to the maintenance of our towers and fiber equipment,

which is non-discretionary in nature and required in order for us

to optimally run our portfolio and to perform in line with our

service level agreements with customers. Maintenance capital

expenditure includes the periodic repair, refurbishment and

replacement of tower, fiber equipment and power equipment at

existing sites to keep such assets in service.

(e) Corporate capital expenditure, which

are non-discretionary in nature, consist primarily of routine

spending on information technology infrastructure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112661161/en/

communications@ihstowers.com www.ihstowers.com

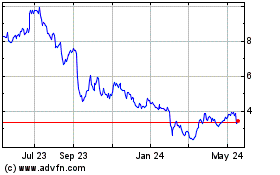

IHS (NYSE:IHS)

Historical Stock Chart

From Dec 2024 to Jan 2025

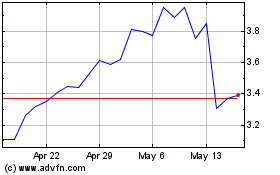

IHS (NYSE:IHS)

Historical Stock Chart

From Jan 2024 to Jan 2025