Global Unit Case Volume Grew 2% for the Quarter

and 1% for the Full Year

Net Revenues Grew 6% for the Quarter and 3% for

the Full Year; Organic Revenues (Non-GAAP) Grew 14% for the Quarter

and 12% for the Full Year

Operating Income Grew 19% for the Quarter and

Declined 12% for the Full Year; Comparable Currency Neutral

Operating Income (Non-GAAP) Grew 22% for the Quarter and 16% for

the Full Year

Fourth Quarter EPS Grew 12% to $0.51;

Comparable EPS (Non-GAAP) Grew 12% to $0.55; Full Year EPS Declined

Slightly to $2.46; Comparable EPS (Non-GAAP) Grew 7% to $2.88

Cash Flow from Operations was $6.8 Billion for

the Full Year, Down 41%; Free Cash Flow (Non-GAAP) was $4.7 Billion

for the Full Year, Down 51%; Free Cash Flow Excluding the IRS Tax

Litigation Deposit (Non-GAAP) was $10.8 Billion for the Full Year,

Up 11%

Company Provides 2025 Financial Outlook

The Coca-Cola Company today reported fourth quarter and full

year 2024 results. “Our all-weather strategy is working, and we

continue to demonstrate our ability to lead through dynamic

external environments,” said James Quincey, Chairman and CEO of The

Coca-Cola Company. “Our global scale, coupled with local-market

expertise and the unwavering dedication of our people and our

system, uniquely position us to capture the vast opportunities

ahead.”

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250211158506/en/

Highlights

Quarterly/Full Year Performance

- Revenues: For the quarter, net revenues increased 6% to

$11.5 billion, and organic revenues (non-GAAP) grew 14%, driven by

9% growth in price/mix and a 5% increase in concentrate sales.

Concentrate sales were 3 points ahead of unit case volume,

primarily driven by two additional days and the timing of

concentrate shipments. For the full year, net revenues grew 3% to

$47.1 billion, and organic revenues (non-GAAP) grew 12%, driven by

11% growth in price/mix and 2% growth in concentrate sales.

Concentrate sales were 1 point ahead of unit case volume, primarily

due to the timing of concentrate shipments.

- Operating margin: For the quarter, operating margin was

23.5% versus 21.0% in the prior year, while comparable operating

margin (non-GAAP) was 24.0% versus 23.1% in the prior year. For the

full year, operating margin was 21.2% versus 24.7% in the prior

year, while comparable operating margin (non-GAAP) was 30.0% versus

29.1% in the prior year. For both the quarter and the full year,

operating margin performance included items impacting

comparability, as well as currency headwinds. Full year operating

margin included a charge of $3.1 billion related to the

remeasurement of the contingent consideration liability to fair

value in conjunction with the acquisition of fairlife, LLC

(“fairlife”) in 2020. For both the quarter and the full year,

comparable operating margin (non-GAAP) expansion was primarily

driven by strong organic revenue (non-GAAP) growth and the impact

of refranchising bottling operations, partially offset by higher

input costs, higher operating expenses and currency headwinds.

- Earnings per share: For the quarter, EPS grew 12% to

$0.51, while comparable EPS (non-GAAP) grew 12% to $0.55. EPS

performance included the impact of a 1-point currency headwind,

while comparable EPS (non-GAAP) performance included the impact of

an 11-point currency headwind. For the full year, EPS declined

slightly to $2.46, while comparable EPS (non-GAAP) grew 7% to

$2.88. EPS and comparable EPS (non-GAAP) performance both included

the impact of a 9-point currency headwind.

- Market share: For both the quarter and the full year,

the company gained value share in total nonalcoholic ready-to-drink

(“NARTD”) beverages.

- Cash flow: For the full year, cash flow from operations

and free cash flow (non-GAAP) were $6.8 billion and $4.7 billion,

respectively. Both decreased versus the prior year, primarily due

to a $6.0 billion deposit made to the U.S. Internal Revenue Service

(“IRS”) related to ongoing tax litigation (“IRS tax litigation

deposit”). Free cash flow excluding the IRS tax litigation deposit

(non-GAAP) was $10.8 billion, an increase of $1.0 billion versus

the prior year, largely due to strong business performance and

working capital benefits, partially offset by higher other tax

payments and higher capital expenditures.

Company Updates

- Offering a brand portfolio across compelling package

offerings: The company, in close alignment with its bottling

partners, continues to exemplify leadership in revenue growth

management (“RGM”) by offering relevant global and local brands in

a variety of packages at the right price points to meet consumer

needs. Returnable glass bottles offer a unique competitive

advantage, having an expansive footprint for the company across

more than 110 countries and, in 2024, added 1.6 billion unit cases

to total company volume performance, with a growth rate that

outpaced total company volume growth. Returnable glass bottles are

important to the company’s RGM capabilities, serving as both an

affordable and premium package that can be tailored to local market

needs. In developed markets across Western Europe, the bottle is a

key premium package in away-from-home channels. In certain

developing and emerging markets, returnable glass bottles are an

affordable offering that enables the company to recruit consumers

and develop the commercial beverage industry. In 2018, the company

launched a universal returnable glass bottle in Latin America,

aimed at further reducing input costs, increasing collectability

and expanding beverage offerings. The universal bottle has quickly

expanded to markets around the world, including Germany, South

Africa and Vietnam, with more opportunities ahead.

- Stepping up key execution levers to drive recruitment:

The company’s global franchise system is increasing outlet coverage

and accelerating the placement of cold-drink equipment across local

markets to drive consumer recruitment and long-term balanced

revenue growth. In 2024, the Coca-Cola system increased

availability by adding more than 250,000 net new outlets and nearly

600,000 new coolers. Increasing cold-drink equipment is critical to

drive transactions and expand the consumer base, as coolers are one

of the strongest enablers for transaction growth, especially in

traditional trade channels where approximately 90% of NARTD

beverages are served cold. These actions contributed to the company

growing volume and gaining value share for both the quarter and the

full year.

Operating Review – Three

Months Ended December 31, 2024

Revenues and

Volume

Percent Change

Concentrate Sales1

Price/Mix

Currency Impact

Acquisitions, Divestitures and

Structural Changes, Net

Reported Net Revenues

Organic Revenues2

Unit Case Volume3

Consolidated

5

9

(3)

(5)

6

14

2

Europe, Middle East & Africa

6

11

(11)

0

6

17

0

Latin America

3

23

(15)

0

10

25

2

North America

4

12

0

0

16

15

1

Asia Pacific

6

(5)

8

0

9

1

6

Global Ventures4

10

(7)

2

0

5

3

3

Bottling Investments

4

2

0

(30)

(23)

7

(26)

Operating Income and

EPS

Percent Change

Reported Operating Income

Items Impacting Comparability

Currency Impact

Comparable Currency Neutral

Operating Income2

Consolidated

19

11

(14)

22

Europe, Middle East & Africa

2

7

(20)

14

Latin America

24

1

(24)

46

North America

29

3

0

26

Asia Pacific

24

35

(5)

(6)

Global Ventures

14

4

1

9

Bottling Investments

8

7

4

(3)

Percent Change

Reported EPS

Items Impacting Comparability

Currency Impact

Comparable Currency Neutral

EPS2

Consolidated

12

(1)

(11)

23

Note: Certain rows may not add due to

rounding.

1 For Bottling Investments, this

represents the percent change in net revenues attributable to the

increase (decrease) in unit case volume computed based on total

sales (rather than average daily sales) in each of the

corresponding periods after considering the impact of structural

changes, if any.

2 Organic revenues, comparable currency

neutral operating income and comparable currency neutral EPS are

non-GAAP financial measures. Refer to the Reconciliation of GAAP

and Non-GAAP Financial Measures section.

3 Unit case volume is computed based on

average daily sales.

4 Due to the combination of multiple

business models in the Global Ventures operating segment, the

composition of concentrate sales and price/mix may fluctuate

materially from period to period. Therefore, the company places

greater focus on revenue growth as the best indicator of underlying

performance of the Global Ventures operating segment.

Operating Review – Year Ended

December 31, 2024

Revenues and

Volume

Percent Change

Concentrate Sales1

Price/Mix

Currency Impact

Acquisitions, Divestitures and

Structural Changes, Net

Reported Net Revenues

Organic Revenues2

Unit Case Volume

Consolidated

2

11

(5)

(4)

3

12

1

Europe, Middle East & Africa

(1)

17

(16)

0

1

16

0

Latin America

3

21

(14)

0

11

25

3

North America

1

10

0

0

11

11

0

Asia Pacific

2

2

(3)

0

2

4

1

Global Ventures3

4

(3)

2

0

2

1

2

Bottling Investments

5

5

(2)

(28)

(21)

9

(23)

Operating Income and

EPS

Percent Change

Reported Operating Income

Items Impacting Comparability

Currency Impact

Comparable Currency Neutral

Operating Income2

Consolidated

(12)

(17)

(11)

16

Europe, Middle East & Africa

(2)

1

(16)

14

Latin America

10

(2)

(18)

31

North America

(2)

(16)

0

14

Asia Pacific

5

6

(6)

5

Global Ventures

9

1

1

8

Bottling Investments

(14)

1

(1)

(15)

Percent Change

Reported EPS

Items Impacting Comparability

Currency Impact

Comparable Currency Neutral

EPS2

Consolidated

0

(8)

(9)

17

Note: Certain rows may not add due to

rounding.

1 For Bottling Investments, this

represents the percent change in net revenues attributable to the

increase (decrease) in unit case volume after considering the

impact of structural changes, if any.

2 Organic revenues, comparable currency

neutral operating income and comparable currency neutral EPS are

non-GAAP financial measures. Refer to the Reconciliation of GAAP

and Non-GAAP Financial Measures section.

3 Due to the combination of multiple

business models in the Global Ventures operating segment, the

composition of concentrate sales and price/mix may fluctuate

materially from period to period. Therefore, the company places

greater focus on revenue growth as the best indicator of underlying

performance of the Global Ventures operating segment

In addition to the data in the preceding tables, operating

results included the following:

Consolidated

- Unit case volume grew 2% for the quarter, led by China, Brazil

and the United States. For the full year, unit case volume grew 1%,

led by Brazil, India and Mexico.

Unit case volume performance included the following:

- Sparkling soft drinks grew 2% for both the quarter and the full

year. For the quarter, performance was driven by growth across all

geographic operating segments and, for the full year, growth was

driven by Latin America, Asia Pacific and North America. Trademark

Coca-Cola grew 2% for both the quarter and the full year, driven by

growth in Latin America, Asia Pacific and North America. Coca-Cola

Zero Sugar grew 13% for the quarter and 9% for the full year, both

driven by growth across all geographic operating segments.

Sparkling flavors grew 2% for the quarter and 1% for the full year,

both primarily driven by growth in Asia Pacific and North

America.

- Juice, value-added dairy and plant-based beverages declined 1%

for the quarter and were even for the full year, as growth in North

America was offset by declines in Europe, Middle East and

Africa.

- Water, sports, coffee and tea grew 2% for the quarter and

declined 1% for the full year. Water grew 2% for the quarter and

declined 2% for the full year. For the quarter, water performance

was primarily driven by growth in Europe, Middle East and Africa,

Latin America and Asia Pacific and, for the full year, growth in

Latin America and Europe, Middle East and Africa was more than

offset by a decline in Asia Pacific. Sports drinks declined 2% for

the quarter and 1% for the full year as growth in Europe, Middle

East and Africa was more than offset by declines in North America

and Asia Pacific. Coffee declined 1% for the quarter and 3% for the

full year, primarily due to the performance of Costa® coffee in the

United Kingdom. Tea grew 5% for the quarter and 4% for the full

year. For the quarter, growth was driven by all geographic

operating segments and, for the full year, growth was driven

primarily by Asia Pacific and Europe, Middle East and Africa.

- Price/mix grew 9% for the quarter and 11% for the full year.

For the quarter, approximately 4 points were driven by pricing from

markets experiencing intense inflation, with the remainder driven

by pricing actions in the marketplace and favorable mix.

Concentrate sales were 3 points ahead of unit case volume,

primarily due to two additional days and the timing of concentrate

shipments. For the full year, approximately 5 points were driven by

pricing from markets experiencing intense inflation, with the

remainder driven by pricing actions in the marketplace and

favorable mix. Concentrate sales were 1 point ahead of unit case

volume, primarily due to the timing of concentrate shipments.

- Operating income grew 19% for the quarter and declined 12% for

the full year, which included items impacting comparability and

currency headwinds. Comparable currency neutral operating income

(non-GAAP) grew 22% for the quarter and 16% for the full year. For

the quarter, comparable currency neutral operating income

(non-GAAP) performance was driven by organic revenue (non-GAAP)

growth across all operating segments, partially offset by higher

input costs and operating expenses. For the full year, performance

was driven by organic revenue (non-GAAP) growth across all

operating segments, partially offset by an increase in marketing

investments, higher input costs and higher operating expenses.

Europe, Middle East &

Africa

- Unit case volume was even for the quarter as growth in water,

sports, coffee and tea and sparkling flavors was offset by a

decline in juice, value-added dairy and plant-based beverages.

- Price/mix grew 11% for the quarter, primarily driven by pricing

from markets experiencing intense inflation as well as pricing

actions across operating units, partially offset by unfavorable

mix. For the quarter, concentrate sales were 6 points ahead of unit

case volume, primarily due to the timing of concentrate shipments

and two additional days.

- Operating income grew 2% for the quarter, which included items

impacting comparability and a 13-point currency headwind.

Comparable currency neutral operating income (non-GAAP) grew 14%

for the quarter, primarily driven by strong organic revenue

(non-GAAP) growth, partially offset by higher input costs and

marketing investments.

- For the full year, the company gained value share in total

NARTD beverages, led by share gains in Nigeria, Romania and

France.

Latin America

- Unit case volume grew 2% for the quarter, primarily driven by

growth in Trademark Coca-Cola.

- Price/mix grew 23% for the quarter. More than half of the

growth was driven by the impact of inflationary pricing in

Argentina, with the remainder driven by favorable mix and pricing

actions in the marketplace. For the quarter, concentrate sales were

1 point ahead of unit case volume, primarily due to two additional

days, partially offset by the timing of concentrate shipments.

- Operating income increased 24% for the quarter, which included

items impacting comparability and an 18-point currency headwind.

Comparable currency neutral operating income (non-GAAP) grew 46%

for the quarter, primarily driven by strong organic revenue

(non-GAAP) growth and marketing efficiencies, partially offset by

higher operating expenses.

- For the full year, the company gained value share in total

NARTD beverages, led by share gains in Colombia, Brazil and

Mexico.

North America

- Unit case volume grew 1% for the quarter, primarily driven by

growth in sparkling flavors, juice, value-added dairy and

plant-based beverages, and Trademark Coca-Cola.

- Price/mix grew 12% for the quarter, driven by pricing actions

in the marketplace and favorable mix. For the quarter, concentrate

sales were 3 points ahead of unit case volume, primarily due to two

additional days and the timing of concentrate shipments.

- Operating income grew 29% for the quarter, which included items

impacting comparability and a 2-point currency tailwind. Comparable

currency neutral operating income (non-GAAP) grew 26% for the

quarter, primarily driven by strong organic revenue (non-GAAP)

growth, partially offset by higher input costs and marketing

investments.

- For the full year, the company gained value share in total

NARTD beverages, driven by share gains in Trademark Coca-Cola and

juice, value-added dairy and plant-based beverages.

Asia Pacific

- Unit case volume grew 6% for the quarter, primarily driven by

growth in Trademark Coca-Cola and sparkling flavors.

- Price/mix declined 5% for the quarter, driven by unfavorable

mix, partially offset by pricing actions in the marketplace. For

the quarter, concentrate sales were in line with unit case

volume.

- Operating income grew 24% for the quarter, which included items

impacting comparability and a 31-point currency tailwind.

Comparable currency neutral operating income (non-GAAP) declined 6%

for the quarter, as organic revenue (non-GAAP) growth was more than

offset by higher input costs and an increase in marketing

investments.

- For the full year, total NARTD beverages value share for the

company was even, as growth in the Philippines, South Korea and

Japan was offset by declines in Indonesia and Bangladesh.

Global Ventures

- Net revenues grew 5% and organic revenues (non-GAAP) grew 3%

for the quarter, primarily driven by product mix.

- Operating income grew 14% for the quarter, which included items

impacting comparability and a 1-point currency tailwind. Comparable

currency neutral operating income (non-GAAP) grew 9% for the

quarter, driven by product mix.

Bottling Investments

- Unit case volume declined 26% for the quarter, largely due to

the impact of refranchising bottling operations.

- Price/mix grew 2% for the quarter, driven by pricing actions

across markets.

- Operating income grew 8% for the quarter, which included items

impacting comparability, a 5-point currency tailwind and the impact

of refranchising bottling operations. Comparable currency neutral

operating income (non-GAAP) declined 3% for the quarter.

Capital Allocation

Update

- Reinvesting in the business: The company continued to

invest in its various lines of business and spent $2.1 billion on

capital expenditures in 2024, an increase of 11% versus the prior

year.

- Continuing to grow the dividend: The company paid

dividends totaling $8.4 billion during 2024. The company has

increased its dividend in each of the last 62 years.

- M&A initiatives: In 2024, the company did not make

any significant acquisitions. The company continues to evaluate

inorganic growth opportunities through brands and capabilities. In

2024, with respect to divestitures, the company made progress

towards refranchising company-owned bottling operations.

- Share repurchases: In 2024, the company issued $0.7

billion of shares in connection with the exercise of stock options

by employees and purchased $1.8 billion of shares. Consequently,

net share repurchases (non-GAAP) were $1.1 billion. The company’s

remaining share repurchase authorization is approximately $4.9

billion.

Outlook

The 2025 outlook information provided below includes

forward-looking non-GAAP financial measures, which management uses

in measuring performance. The company is not able to reconcile full

year 2025 projected organic revenues (non-GAAP) to full year 2025

projected reported net revenues, full year 2025 projected

comparable net revenues (non-GAAP) to full year 2025 projected

reported net revenues, full year 2025 projected underlying

effective tax rate (non-GAAP) to full year 2025 projected reported

effective tax rate, full year 2025 projected comparable currency

neutral EPS (non-GAAP) to full year 2025 projected reported EPS, or

full year 2025 projected comparable EPS (non-GAAP) to full year

2025 projected reported EPS without unreasonable efforts because it

is not possible to predict with a reasonable degree of certainty

the exact timing and exact impact of acquisitions, divestitures and

structural changes throughout 2025; the exact timing and exact

amount of items impacting comparability throughout 2025; and the

exact impact of fluctuations in foreign currency exchange rates

throughout 2025. The unavailable information could have a

significant impact on the company’s full year 2025 reported

financial results.

Full Year 2025

The company expects to deliver organic revenue (non-GAAP) growth

of 5% to 6%.

For comparable net revenues (non-GAAP), the company expects a 3%

to 4% currency headwind based on the current rates and including

the impact of hedged positions, in addition to a slight headwind

from acquisitions, divestitures and structural changes.

The company’s underlying effective tax rate (non-GAAP) is

estimated to be 20.8% versus 18.6% in 2024. This includes the

impact of several countries enacting the global minimum tax

regulations and does not include the impact of ongoing tax

litigation with the IRS, if the company were not to prevail.

The company expects to deliver comparable currency neutral EPS

(non-GAAP) growth of 8% to 10%.

The company expects comparable EPS (non-GAAP) growth of 2% to

3%, versus $2.88 in 2024.

Comparable EPS (non-GAAP) percentage growth is expected to

include a 6% to 7% currency headwind based on the current rates and

including the impact of hedged positions, in addition to a slight

headwind from acquisitions, divestitures and structural

changes.

The company expects to generate free cash flow excluding the

fairlife contingent consideration payment (non-GAAP) of

approximately $9.5 billion. This consists of cash flow from

operations excluding the fairlife contingent consideration payment

(non-GAAP) of approximately $11.7 billion, less capital

expenditures of approximately $2.2 billion.

First Quarter 2025

Considerations

Comparable net revenues (non-GAAP) are expected to include a 3%

to 4% currency headwind based on the current rates and including

the impact of hedged positions, in addition to a 2% to 3% headwind

from acquisitions, divestitures and structural changes.

Comparable EPS (non-GAAP) percentage growth is expected to

include a 5% to 6% currency headwind based on the current rates and

including the impact of hedged positions, in addition to a 2% to 3%

headwind from acquisitions, divestitures and structural

changes.

The first quarter has two fewer days compared to first quarter

2024.

Notes

- All references to growth rate percentages and share compare the

results of the period to those of the prior year comparable period,

unless otherwise noted.

- All references to volume and volume percentage changes indicate

unit case volume, unless otherwise noted. All volume percentage

changes are computed based on average daily sales in the fourth

quarter, unless otherwise noted, and are computed on a reported

basis for the full year. “Unit case” means a unit of measurement

equal to 192 U.S. fluid ounces of finished beverage (24 eight-ounce

servings), with the exception of unit case equivalents for Costa

non-ready-to-drink beverage products which are primarily measured

in number of transactions. “Unit case volume” means the number of

unit cases (or unit case equivalents) of company beverages directly

or indirectly sold by the company and its bottling partners to

customers or consumers.

- “Concentrate sales” represents the amount of concentrates,

syrups, beverage bases, source waters and powders/minerals (in all

instances expressed in unit case equivalents) sold by, or used in

finished beverages sold by, the company to its bottling partners or

other customers. For Costa non-ready-to-drink beverage products,

“concentrate sales” represents the amount of beverages, primarily

measured in number of transactions (in all instances expressed in

unit case equivalents) sold by the company to customers or

consumers. In the reconciliation of reported net revenues,

“concentrate sales” represents the percent change in net revenues

attributable to the increase (decrease) in concentrate sales volume

for the geographic operating segments and the Global Ventures

operating segment after considering the impact of structural

changes, if any. For the Bottling Investments operating segment for

the fourth quarter, this represents the percent change in net

revenues attributable to the increase (decrease) in unit case

volume computed based on total sales (rather than average daily

sales) in each of the corresponding periods after considering the

impact of structural changes, if any. For the Bottling Investments

operating segment for the full year, this represents the percent

change in net revenues attributable to the increase (decrease) in

unit case volume after considering the impact of structural

changes, if any. The Bottling Investments operating segment

reflects unit case volume growth for consolidated bottlers

only.

- “Price/mix” represents the change in net operating revenues

caused by factors such as price changes, the mix of products and

packages sold, and the mix of channels and geographic territories

where the sales occurred.

- First quarter 2024 financial results were impacted by one less

day as compared to first quarter 2023, and fourth quarter 2024

financial results were impacted by two additional days as compared

to fourth quarter 2023. Unit case volume results for the quarters

are not impacted by the variances in days due to the average daily

sales computation referenced above.

Conference Call

The company is hosting a conference call with investors and

analysts to discuss fourth quarter and full year 2024 operating

results today, Feb. 11, 2025, at 8:30 a.m. ET. The company invites

participants to listen to a live webcast of the conference call on

the company’s website, http://www.coca-colacompany.com, in the

“Investors” section. An audio replay in downloadable digital format

and a transcript of the call will be available on the website

within 24 hours following the call. Further, the “Investors”

section of the website includes certain supplemental information

and a reconciliation of non-GAAP financial measures to the

company’s results as reported under GAAP, which may be used during

the call when discussing financial results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211158506/en/

Investors and Analysts: Robin

Halpern,

koinvestorrelations@coca-cola.com

Media: Scott Leith,

sleith@coca-cola.com

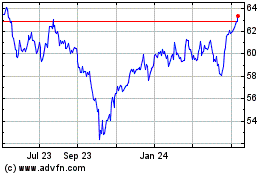

Coca Cola (NYSE:KO)

Historical Stock Chart

From Jan 2025 to Feb 2025

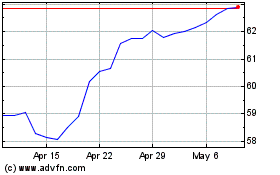

Coca Cola (NYSE:KO)

Historical Stock Chart

From Feb 2024 to Feb 2025