Kosmos Energy Ltd. (the “Offeror”, “Kosmos”, or the “Company”)

(NYSE/LSE:KOS) announced the early tender results of its previously

announced series of tender offers (each a “Tender Offer” and,

collectively, the “Tender Offers”) to purchase for cash up to (i)

$400,000,000 aggregate principal amount (the “2026 Notes Cap”) of

the Offeror’s outstanding 7.125% Senior Notes due 2026 (the “2026

Notes”) and (ii) up to $100,000,000 aggregate principal amount (the

“2027/2028 Notes Cap”) of the Offeror’s outstanding 7.750% Senior

Notes due 2027 (the “2027 Notes”) and its 7.500% Senior Notes due

2028 (the “2028 Notes” and, together with the 2026 Notes and the

2027 Notes, the “Notes”), subject, in the case of the 2027 Notes,

to an additional sub-cap of $50,000,000 aggregate principal amount

(the “2027 Notes Sub-Cap”). The Tender Offers are being made

pursuant to the terms and conditions set forth in the Offer to

Purchase, dated September 9, 2024 (the “Offer to Purchase”), which

is available on the transaction website:

https://projects.sodali.com/kosmos, subject to eligibility

confirmation and registration. The Company refers investors to the

Offer to Purchase for the complete terms and conditions of the

Tender Offers.

As of 5:00 p.m., New York City time, on September 20, 2024 (such

date and time, the “Early Tender Time”), according to information

provided to Sodali & Co., the tender and information agent for

the Tender Offers, the aggregate principal amount of each series of

Notes listed in the table below has been validly tendered and not

validly withdrawn in each Tender Offer. Withdrawal rights for the

Notes expired at 5:00 p.m., New York City time, on the Early Tender

Time.

The following table sets forth certain terms of the Tender

Offers and the results of the Early Tender Settlement:

Title of Security

CUSIP/ISIN Number

Outstanding Principal

Amount

2026 Notes Priority of

Acceptance

Total Consideration(1)

Principal Amount Tendered at

Early Tender Time

Aggregate Principal Amount

Accepted for Purchase

7.125% Senior Notes due 2026

issued by Kosmos Energy Ltd. (the “2026 Notes”)

Rule 144A: 500688AC0 /

US500688AC04 Regulation S: U5007TAA3 / USU5007TAA35

$650,000,000

Tenders specifying a valid 2026

Notes Acceptance Code (as described in the Offer to Purchase) were

eligible to receive priority of acceptance in the Tender Offer

(such 2026 Notes, the “Priority 2026 Notes”)

$1,000.00

$523,736,000

$400,000,000

Title of Security

CUSIP/ISIN Number

Outstanding Principal

Amount

Acceptance Priority

Level

Total Consideration(1)

Principal Amount Tendered at

Early Tender Time

Aggregate Principal Amount

Accepted for Purchase

7.750% Senior Notes due 2027

issued by Kosmos Energy Ltd. (the “2027 Notes”)

Rule 144A:

500688AF3 / US500688AF35

Regulation S:

U5007TAD7 / USU5007TAD73

$400,000,000

1

$997.50

$246,445,000

$50,000,000

7.500% Senior Notes due 2028

issued by Kosmos Energy Ltd. (the “2028 Notes”)

Rule 144A:

500688AD8 / US500688AD86

Regulation S:

U5007TAB1 / USU5007TAB18

$450,000,000

2

$982.50

$247,471,000

$49,726,000(2)

(1)

Per $1,000 principal amount of

Notes tendered prior to the Early Tender Time. Includes the Early

Tender Payment (as defined in the Offer to Purchase) but does not

include accrued and unpaid interest on the Notes, which will also

be payable as described below.

(2)

Due to the application of

adjustments related to minimum denominations with respect to

tenders of the 2028 Notes, the aggregate principal amount of 2028

Notes accepted for purchase, when combined with the aggregate

principal amount of 2027 Notes accepted for purchase, is below the

2027/2028 Notes Cap. However, because the aggregate principal

amount of 2028 Notes tendered was greater than the 2027/2028 Notes

Cap (when combined with the aggregate principal amount of 2027

Notes accepted for purchase), the Offeror will not accept

additional 2028 Notes for purchase following the Early Tender

Time.

All conditions were satisfied or waived by the Company at the

Early Tender Time. The Company has elected to exercise its right to

make payment for Notes that were validly tendered at or prior to

the Early Tender Time and that are accepted for purchase on

September 24, 2024 (the “Early Settlement Date”).

As the aggregate principal amount of 2026 Notes validly tendered

and not validly withdrawn at or prior to the Early Tender Time

exceeded the 2026 Notes Cap, no 2026 Notes tendered after the Early

Tender Time will be accepted for purchase. All Priority 2026 Notes

validly tendered and not validly withdrawn, and which were eligible

for priority of acceptance under the terms of the Tender Offer,

will be accepted for purchase without proration. The 2026 Notes

validly tendered and not validly withdrawn without an Acceptance

Code that will be accepted for purchase will be subject to a

proration factor of 46.2980%, with further adjustments as necessary

to account for the minimum denominations applicable to the 2026

Notes.

As the aggregate principal amount of 2027 Notes validly tendered

and not validly withdrawn exceeded the 2027 Notes Sub-Cap, and the

aggregate principal amount of 2028 Notes validly tendered and not

validly withdrawn prior to the Early Tender Time, when combined

with a principal amount of 2027 Notes equal to the 2027 Notes

Sub-Cap, exceeded the 2027/2028 Notes Cap, (i) no 2027 Notes or

2028 Notes tendered after the Early Tender Time will be accepted

for purchase, and (ii) each of the 2027 Notes and 2028 Notes

accepted for purchase will be subject to proration. The 2027 Notes

accepted for purchase will be subject to a proration factor of

23.7779%, and the 2028 Notes accepted for purchase will be subject

to a proration factor of 24.9990%, in each case with further

adjustments as necessary to account for the minimum denominations

applicable to the 2027 Notes and 2028 Notes.

Notes tendered and not purchased on the Early Settlement Date

will be returned to holders promptly after the Early Settlement

Date. The consideration to be paid for the Notes validly tendered

and not validly withdrawn at or prior to the Early Tender Time per

$1,000 principal amount of such Notes validly tendered and accepted

for purchase pursuant to the applicable Tender Offer is the amount

set forth in the table above under the heading “Total

Consideration.” The amounts set forth in the table above under

“Total Consideration” already include the early tender payment for

the Notes accepted for purchase. All holders of Notes accepted for

purchase will also receive accrued interest from, and including,

the most recent applicable interest payment date preceding the

Early Settlement Date to, but not including, the Early Settlement

Date, if and when such Notes are accepted for payment.

Information Relating to the Tender Offers

The complete terms and conditions of the Tender Offers are set

forth in the Offer to Purchase. Investors with questions regarding

the terms and conditions of the Tender Offers may contact Merrill

Lynch International at +44 20 7996 5420 or by email to

DG.LM-EMEA@bofa.com.

Sodali & Co. is the tender and information agent for the

Tender Offers. Any questions regarding procedures for tendering

Notes may be directed to Sodali & Co at Hong Kong: +852 2319

4130, London: +44 20 4513 6933, Stamford: +1 203 658 9457 or by

email to kosmos@investor.sodali.com.

This press release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, or the

solicitation of tenders with respect to, the Notes. No offer,

solicitation, purchase or sale will be made in any jurisdiction in

which such an offer, solicitation or sale would be unlawful. The

Tender Offers are being made solely pursuant to the Offer to

Purchase made available to holders of the Notes. None of the

Company or its affiliates, their respective boards of directors,

the dealer manager, the tender and information agent or the trustee

with respect to any series of Notes is making any recommendation as

to whether or not holders should tender or refrain from tendering

all or any portion of their Notes in response to the Tender Offers.

Holders are urged to evaluate carefully all information in the

Offer to Purchase, consult their own investment and tax advisors

and make their own decisions whether to tender Notes in the Tender

Offers, and, if so, the principal amount of Notes to tender.

About Kosmos Energy

Kosmos is a full-cycle, deepwater, independent oil and gas

exploration and production company focused along the offshore

Atlantic Margins. Our key assets include production offshore Ghana,

Equatorial Guinea and the U.S. Gulf of Mexico, as well as

world-class gas projects offshore Mauritania and Senegal. We also

pursue a proven basin exploration program in Equatorial Guinea and

the U.S. Gulf of Mexico. Kosmos is listed on the NYSE and LSE and

is traded under the ticker symbol KOS. Kosmos is engaged in a

single line of business, which is the exploration, development, and

production of oil and natural gas. Substantially all of our

long-lived assets and all of our product sales are related to

operations in four geographic areas: Ghana, Equatorial Guinea,

Mauritania/Senegal and the U.S. Gulf of Mexico.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act and Section 21E of

the Securities Exchange Act of 1934, as amended. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that Kosmos

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Kosmos’ estimates and

forward-looking statements are mainly based on its current

expectations and estimates of future events and trends, which

affect or may affect its businesses and operations. Although Kosmos

believes that these estimates and forward-looking statements are

based upon reasonable assumptions, they are subject to several

risks and uncertainties and are made in light of information

currently available to Kosmos. When used in this press release, the

words “anticipate,” “believe,” “intend,” “expect,” “plan,” “will,”

“may,” “potential” or other similar words are intended to identify

forward-looking statements. Such statements are subject to a number

of assumptions, risks and uncertainties, many of which are beyond

the control of Kosmos, which may cause actual results to differ

materially from those implied or expressed by the forward-looking

statements. Further information on such assumptions, risks and

uncertainties is available in Kosmos’ Securities and Exchange

Commission filings. Kosmos undertakes no obligation and does not

intend to update or correct these forward-looking statements to

reflect events or circumstances occurring after the date of this

press release, except as required by applicable law. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

All forward-looking statements are qualified in their entirety by

this cautionary statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240923337767/en/

Investor Relations Jamie Buckland +44 (0) 203 954 2831

jbuckland@kosmosenergy.com or Media Relations Thomas

Golembeski +1-214-445-9674 tgolembeski@kosmosenergy.com

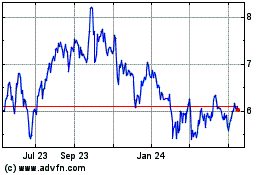

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Dec 2024 to Jan 2025

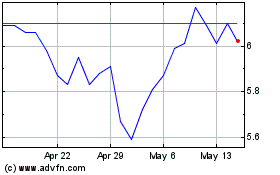

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Jan 2024 to Jan 2025