March US Retail Sales Showing Unexpected Strength

April 07 2011 - 7:32AM

Dow Jones News

U.S. consumers spent March on the move, allowing many retailers

to deliver solid sales numbers that suggest resilience in the face

of challenges from a later Easter, poor weather and higher gasoline

prices.

Early reports from companies including warehouse club Costco

Wholesale Corp. (COST), Victoria's Secret operator Limited Brands

Inc. (LTD), and teen retailer Zumiez Inc. (ZUMZ) show considerably

better gains than expected at stores open a year or more.

Others, including Hot Topic Inc. (HOTT), Stage Stores Inc. (SSI)

and apparel retailer Cato Corp. (CATO) posted drops in same-store

sales from a year earlier, but the declines were less than analysts

projected.

"I wouldn't necessarily say the performances we're seeing for

March was remarkable, because expectations were so low," said John

Long, retail strategist at Kurt Salmon. "It will take April and the

Easter holiday to really gauge what's going on, especially on the

apparel side."

Wet Seal Inc. (WTSLA), a young women's retailer, reported a 4.7%

gain in same-store sales compared with expectations for a 1.7%

drop. Chief Executive Susan McGalla said the company estimated

same-store sales would have increased at a high single-digit

percentage without the effect of a later Easter, but that April

would benefit as a result.

The month did see robust growth in employment, with non-farm

payrolls showing the addition of 216,000 positions, spurring hopes

for a sustained employment recovery. The stock market also

continues rising, a plus especially for higher-end shoppers.

Costco, which posted a 13% rise in same-store sales when

analysts were projecting a 7.4% gain, continued to benefit from

higher gasoline prices at the pumps at its clubs, favorable foreign

exchange rates and the continued economic recovery in California,

where the company has a significant presence.

Costco's international operations showed continued growth, with

foreign sales rising 17% for the month, while U.S. sales increased

11%. Costco said its Tamasakai, Japan, warehouse, closed for

repairs from earthquake damage, is expected to reopen before the

end of the year.

While many other big players are still to be heard from,

including Target Corp. (TGT), Macy's Inc. (M) and Saks Inc. (SKS),

it is looking like retailers will beat expectations as a group.

The 25 retailers tracked by Thomson Reuters are expected to post

a 0.7% drop in same-store sales for last month, with much of the

reservations for a stronger showing the result of Easter being its

latest since 1943. The calendar shift pushed buying into April. The

March showing is expected to be followed by 7.5% gain in April. As

a result of the April momentum, sales for the two months are

expected to show 3.4% growth, which Thomson Reuters considers

healthy buying.

Easter fell on April 4 last year and is three weeks later this

year on April 24.

And consumers are expected to buy. U.S. retail spending on

Easter related merchandise, for everything from cookware to

clothing, is expected to average $131.04 a person this year, up 11%

from a year ago, the National Retail Federation said. The figure is

based on a poll of consumers. The increase suggests momentum and is

"a good sign leading into the much busier and important months to

come," said Matthew Shay, the trade group's president.

Retailers in coming months will look to back-to-school and

Christmas holiday buying to the lion's share of their annual sales.

They are also facing increasing cost pressures from rising cotton

and labor prices and will have to see what kind of price increases

shoppers will absorb.

-By Karen Talley, Dow Jones Newswires; 212-416-2196;

karen.talley@dowjones.com

-Ian Thompson contributed to this story.

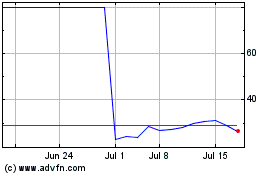

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

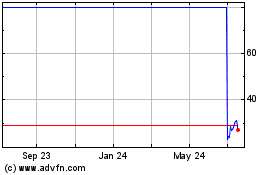

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024