false000006527000000652702025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 29, 2025 |

METHODE ELECTRONICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-33731 |

36-2090085 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

8750 West Bryn Mawr Avenue |

|

Chicago, Illinois |

|

60631-3518 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (708) 867-6777 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.50 Par Value |

|

MEI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 30, 2025, Methode Electronics, Inc. (“Methode” or the “Company”) announced that Andrea J. Barry, Chief Administrative Officer and Chief Human Resources Officer of the Company, will step down from those positions effective January 31, 2025. Ms. Barry will remain an employee of the Company through May 3, 2025 (the “Separation Date”) as a special advisor to the Company’s General Counsel. In connection with her separation from the Company, the Company and Ms. Barry have entered into a Separation Agreement dated as of January 29, 2025 (the “Separation Agreement”).

Subject to the terms and conditions of the Separation Agreement, following the Separation Date, Ms. Barry will be entitled to six months of severance pay in the total amount of $283,500, less applicable withholding taxes and deductions, as well as COBRA premiums for twelve months following the separation. Under the terms of her September 2023 Retention Award Agreement (described in the Company’s Current Report on Form 8-K filed September 18, 2023), Ms. Barry will also be entitled to a cash payment of $750,000 at the time of her separation. She will remain eligible for any vesting under the Restricted Stock Unit Award Agreement dated July 25, 2024 (described in the Company’s Current Report on Form 8-K filed July 29, 2024), the 2020 Long-Term Performance-Based Award Agreement effective as of September 27, 2020 and the 2020 Long-Term Time-Based Award Agreement effective as of September 27, 2020 (each of which is described in more detail in the Company’s Proxy Statements on Schedule 14A) in accordance with the terms of the applicable agreements. The Separation Agreement includes standard releases and cooperation covenants.

The foregoing is a summary description of certain terms of the Separation Agreement and does not purport to be complete, and it is qualified in its entirety by reference to the full text of the Separation Agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1 and incorporated by reference herein.

Item 8.01 Other Events

On January 30, 2025, the Company announced the hiring of Karen Keegans as Chief Human Resources Officer, effective February 3, 2025. A copy of the press release announcing Ms. Keegans’ hiring is attached to this Current Report on Form 8-K as Exhibit 99.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Methode Electronics, Inc. |

|

|

|

|

Date: |

January 30, 2025 |

By: |

/s/ Laura Kowalchik |

|

|

|

Laura Kowalchik

Chief Financial Officer |

EXHIBIT 10.1

SEPARATION AGREEMENT AND GENERAL RELEASE

Methode Electronics, Inc. (“Methode” or “Employer”), on the one hand, and Andrea J. Barry (“Employee,” as further defined below), on the other hand, agree as follows.

1.Terms Not Defined Elsewhere in this Agreement.

a.“2024 RSU Agreement” means the Restricted Stock Unit Award Agreement between Employer and Employee effective as of July 25, 2024.

b.“Agreement” means this Separation Agreement and General Release.

c.“Employee” means Andrea J. Barry and her heirs, executors, administrators, and assigns.

d.“FY2025 Bonus” means the Annual Bonus Performance Grant Award Agreement (Fiscal 2025) effective as of September 11, 2024.

e.“Performance Award Agreement” means the 2020 Long-Term Performance-Based Award Agreement between Employer and Employee effective as of September 27, 2020.

f.“PIPA” means the Proprietary Interests Protection Agreement executed by Employee on September 20, 2024.

g.“Retention Award Agreement” means the Retention Award Agreement – Cash between Employer and Employee dated and effective as of September 13, 2023.

h.“Time-Based Award Agreement” means the 2020 Long-Term Time-Based Award Agreement between Employer and Employee effective as of September 27, 2020.

a.Employee’s last day of employment with Employer will be May 3, 2025 (the “Separation Date”). Employee’s separation shall be classified as an involuntary termination without Cause for purposes of the 2024 RSU Agreement, the Performance Award Agreement, the Retention Award Agreement, and the Time-Based Award Agreement, provided that Employee does not engage in any conduct that would constitute Cause under these agreements.

b.Effective January 31, 2025, Employee will no longer serve as Chief

Administrative Officer and Chief Human Resources Officer for Employer, and Employee will take all such actions required by Employer to effectuate her resignation from any positions she holds as a trustee for any Employer benefit plans or as an officer or director of any subsidiary of Employer. Between February 1, 2025, and the Separation Date, Employee will work remotely as a special advisor, reporting to General Counsel Kerry Vyverberg, with duties as assigned by Ms. Vyverberg that will include, but not be limited to: (1) providing all necessary support for any ongoing litigation or arbitration; and (2) assisting Employer’s new Chief Human Resources Officer with transition as well as the creation of a new LTI plan. Employee will continue to be paid her current base salary during the period until the Separation Date.

3.Delayed Effect of a Portion of this Agreement. The terms of this Agreement are effective immediately upon execution of this Agreement by both Employer and Employee, except that Paragraphs 5, 7, 9, 12.b., and 15.a. of this Agreement (the “Delayed Effective Paragraphs”) shall be effective only if: (a) Employee re-executes this Agreement on or after the Separation Date but no later than 21 days after the Separation Date; and (b) Employee does not revoke her re-execution of this Agreement (see Paragraph 19).

4.Payments Following Separation Date. On the next regularly-scheduled payroll date after the Separation Date, Employee will receive from Employer, less applicable withholding taxes: (a) payment for Employee’s accrued but unused vacation; (b) payment for Employee’s base salary earned through the Separation Date; and (c) the $750,000 Retention Award as set forth in the Retention Award Agreement. Employer will reimburse Employee’s reasonable business expenses if Employee presents proper documentation of such expenses to Employer within 30 days following the Separation Date.

5.Consideration. In consideration for Employee signing and delivering this Agreement and re-executing it on or after the Separation Date as set forth in Paragraphs 3 and 19, and subject to the condition set forth in Paragraph 11, Employer agrees to make the payments as described in sub-paragraphs a. and b. below.

a.Subject to Employee’s eligibility for and timely election of continuation coverage under COBRA, Employer will pay Employee’s COBRA premium for 12 months following the Separation Date, with such payments to commence following the expiration of the revocation period described in Paragraph 19 of this Agreement.

b.Employer will provide Employee with six months of severance pay in the total gross amount of $283,500 (the “Severance Pay”), payable as follows. The Severance Pay will be paid in Employer’s normal payroll increments over the six-month period commencing on the Separation Date, less applicable withholding taxes and deductions, beginning with the first payroll date that is at least 14 days following the expiration of the revocation period described in Paragraph 19 of this Agreement, but with the first incremental payment encompassing all incremental amounts that

would have been paid since the Separation Date had payments commenced immediately after the Separation Date.

6.No Payment Under Paragraph 5 Absent Re-execution of this Agreement on or after Separation Date; Condition Precedent to Payment. Employee understands and agrees that Employee would not receive benefits specified in Paragraph 5 above in the absence of Employee’s re-execution of this Agreement on or after the Separation Date as set forth in Paragraphs 3 and 19.

7.General Release; Claims Not Released.

a.General Release of All Claims. Employee releases, forever discharges, and covenants not to sue Methode, its current or former parent companies, subsidiaries, affiliates, predecessors, and successors, and each of their respective current or former insurers, directors, officers, managers, members, employees, agents, and assigns (collectively, “Releasees”), with respect to any and all claims, causes of action, suits, debts, sums of money, controversies, agreements, promises, damages, and demands whatsoever, including attorneys’ fees and court costs, in law or equity or before any federal, state or local administrative agency, whether known or unknown, suspected or unsuspected, which Employee has, had, or may have, based on any event occurring, or alleged to have occurred, to the date Employee re-executes this Agreement on or after the Separation Date. This release includes, but is not limited to, claims under Title VII of the Civil Rights Act of 1964, as amended, the Age Discrimination in Employment Act, the Americans with Disabilities Act, the Family and Medical Leave Act, the Occupational Safety and Health Act, the Employee Retirement Income Security Act, the Illinois Human Rights Act, and any other federal, state or local statute, law, regulation, ordinance, or order, claims for retaliatory discharge, and claims arising under common law, contract, implied contract, public policy or tort. Employee expressly waives and relinquishes all rights and benefits provided to Employee by any statute or other law that prohibits release of unspecified claims and acknowledges that this release is intended to include all claims Employee has or may have to the date Employee re-executes this Agreement on or after the Separation Date, whether Employee is aware of them or not, and that all such claims are released by this Agreement. This Agreement does not prevent Employee from filing a charge, testifying, assisting, or cooperating with the EEOC, but Employee waives any right to any relief of any kind should the EEOC pursue any claim on Employee’s behalf.

b.Claims Not Released. Notwithstanding the foregoing release of all claims, it is understood and agreed that the following claims, if any, are not released: (i) claims for unemployment compensation; (ii) claims for workers’ compensation benefits; (iii) claims for continuing health insurance coverage under COBRA; (iv) claims pertaining to vested

benefits under any retirement plan governed by the Employee Retirement Income Security Act (ERISA); (v) Employee’s rights to indemnification under Employer’s charter or bylaws; (vi) claims to enforce the terms of this Agreement; and (vi) claims that cannot be waived as a matter of law.

8.Governmental Agencies. Notwithstanding any other provision of this Agreement, Employee is not prohibited in any way from: (i) reporting possible violations of federal, state, or local law or regulations, including any possible securities law violations, to any governmental agency or entity, including but not limited to the U.S. Department of Justice, the U.S. Securities and Exchange Commission (“SEC”), the U.S. Congress, or any agency Inspector General; (ii) participating in any investigation or proceeding conducted by any federal, state, or local governmental agency or entity; (iii) making any other disclosures that are protected under the whistleblower provisions of federal, state, or local law or regulations; (iv) providing truthful testimony in response to a valid subpoena, court order, or regulatory request; (v) making truthful statements or disclosures regarding alleged unlawful employment practices; or (vi) otherwise fully participating in any federal whistleblower programs, including but not limited to any such programs managed by the SEC and/or the Occupational Safety and Health Administration. Employee further acknowledges that Employee is not required to obtain any prior authorization of Employer or any other person to make any reports or disclosures described in the preceding sentence, and Employee is not required to notify Employer or any other person that such reports or disclosures have been made. Notwithstanding any other provision of this Agreement, nothing in this Agreement limits Employee’s right to receive an award for information provided to the SEC.

9.Acknowledgments and Affirmations After Separation Date.

a.Employee affirms that from and after the Separation Date to the date of her re-execution of this Agreement (as set forth in Paragraphs 3 and 19), she has not, except as permitted by Paragraph 8, made statements about Employer or engaged in conduct that could reasonably be expected to adversely affect Employer’s reputation or business, including but not limited to discussing Employer’s business with search firms, the media, industry consultants and analysts, investors, competitors, customers, suppliers, current or former employees or directors, vendors, or any entity for whom Employee works as an employee or independent contractor.

b.Employee affirms that Employee has been paid and/or has received all compensation, wages, bonuses, commissions, and/or benefits which are due and payable as of the date Employee re-executes this Agreement on or after the Separation Date and that no further payments of any kind will be made to Employee by Employer except as set forth in this Agreement. Employee affirms that Employee has been granted any leave to which Employee was entitled under the Family and Medical Leave Act or state or local leave or disability accommodation laws.

c.Employee will remain eligible for any vesting under the 2024 RSU Agreement, the Performance Award Agreement, and the Time-Based

Award Agreement pursuant to the terms of those agreements. Employee’s rights under the Deferred Compensation Plan are unaffected by this Agreement. Employee acknowledges and agrees that, except as expressly set forth in this Agreement, she is not entitled to any further payments or benefits under: the 2024 RSU Agreement; the Performance Award Agreement; the Retention Award Agreement; the Time-Based Award Agreement; the FY 2025 Bonus; any other restricted stock awards, restricted stock unit awards, or any performance-based awards granted pursuant to Employer’s 2022 Omnibus Incentive Plan (the “Plan”) or otherwise; the Change in Control Agreement dated as of December 11, 2019, as amended; any matching bonus program; or any other bonus or equity plans, awards, programs, or agreements of any kind (collectively, all of the preceding are the “Equity/Bonus Documents”). Employee specifically acknowledges that all outstanding awards/benefits under the Equity/Bonus Documents that are not expressly designated as payable pursuant to this Agreement were not earned or vested as of the Separation Date.

d.Employee further affirms that Employee has no known workplace injuries or occupational diseases.

e.Employee affirms that as Chief Administrative Officer and Chief Human Resources Officer, she was aware of the reporting policies and procedures governing claims of discrimination, harassment, retaliation, and all other unlawful employment practices. Employee affirms that as of the Separation Date, she has not made and to her knowledge has no basis to make any allegations or claims of discrimination, harassment, retaliation, or any other unlawful employment practices against Employer.

f.Employee affirms that to her knowledge all of Employer’s decisions regarding Employee’s pay and benefits through the date of Employee’s separation of employment were not discriminatory based on age, disability, race, color, sex, religion, national origin or any other classification protected by law. Employee has reviewed and agreed that she is not entitled to any wages or compensation, other than those discussed explicitly herein.

g.Employee affirms that, in the event any attorneys or third parties have asserted or assert a hold or lien or other encumbrance upon Employee’s claims, demands, and causes of action against any of the Releasees, Employee will be responsible for paying any costs and fees associated with and otherwise satisfying that hold or lien or other encumbrance, and will hold the Releasees and their attorneys harmless for any costs or fees they incur in association with the hold or lien.

10.Limited Cooperation with Business Matters. For a period of six months following the Separation Date, Employee will reasonably cooperate with Employer in regard to the

transition of business matters handled by Employee during Employee’s employment by responding to brief calls or e-mails from Employer with questions that may arise regarding business matters she handled while employed.

11.Cooperation with Litigation. In addition to her obligations under Paragraph 10, and as a condition of Employee’s receipt of the consideration set forth in Paragraph 5 and a continuing obligation once Employer has provided all of the consideration in Paragraph 5, Employee will fully cooperate with Employer with regard to its defense to or prosecution of any actual or potential investigation, claim, charge, arbitration, or lawsuit brought against, by, or involving Employer or its subsidiaries, either formally or informally, including but not limited to any administrative agency charge, any federal court or state court lawsuit, any AAA arbitration, or any lawsuit filed or pending outside of the United States. Such cooperation will include, but not be limited to: (a) reviewing documents; (b) providing Employer and/or its attorneys with accurate and complete information; and (c) appearing at any meeting, hearing, arbitration, or trial as requested by Employer or its attorneys and, if applicable, testifying truthfully regarding matters about which Employee has personal knowledge and are not privileged. Such cooperation specifically includes, but is not limited to, appearing at any deposition, hearing, or trial pertaining any arbitration or lawsuit involving Joseph El Khoury. Employer will reimburse Employee for reasonable and customary out-of-pocket expenses that she incurs related to such cooperation consistent with Employer’s travel and expense reimbursement policies (as applicable to an officer in Employee’s former position of Chief Administrative Officer and Chief Human Resources Officer). Employer will, to the extent possible, endeavor to schedule the above cooperation activities to minimize disruption to Employee’s other personal or professional commitments. Furthermore, Employer will not require Employee to travel outside of the Chicago metropolitan area unless the nature of the matter necessitates her in-person attendance outside of the Chicago metropolitan area. To the extent that Employer believes Employee has violated the provisions of this Paragraph 11 and intends to declare that Employee’s breach constitutes a failure of a condition to payment under Paragraph 5, Employer will first provide Employee with written notice of such violation and a 10-day opportunity to cure, if such violation is subject to cure.

12.Limited Disclosure; Return of Property.

a.Employee agrees not to disclose any information regarding the existence or substance of this Agreement that is not otherwise disclosed in connection with any internal announcement or securities filings by the Company, except to Employee’s spouse, tax advisor, an attorney with whom Employee chooses to consult regarding Employee’s consideration of this Agreement, and/or to any federal, state or local government agency in accordance with Paragraph 8 or as otherwise allowed by applicable law.

b.Employee affirms that, following the Separation Date, Employee has returned all of Employer’s property, documents, and/or any confidential information in Employee’s possession or control, except as permitted by Paragraph 8. Employee also affirms that Employee is in possession of all of Employee’s property that Employee had at Employer’s premises and that Employer is not in possession of any of Employee’s property.

Employee will disclose to Employer all work-related user names and passwords.

13.PIPA. Employee acknowledges and agrees that the PIPA remains in full force and effect and reaffirms her obligations under the PIPA. Furthermore, Employee agrees, in consideration of the promises of Employer in this Agreement, that the non-solicitation provisions of Sections F and G of the PIPA shall continue for 18 months following the Separation Date (an extension of six months from the 12-month period contained in the PIPA). Employer advises Employee to consult with an attorney before signing this Agreement and agreeing to the provisions of this Paragraph 13, and Employee acknowledges that she was provided the opportunity to take at least 14 days after receipt of this Agreement from Employer before deciding whether to accept the provisions of this Paragraph 13. Employee also affirms that: (a) as of the date she first executes this Agreement as well as the date she re-executes this Agreement (as set forth in Paragraphs 3 and 19), she has not divulged any proprietary or confidential information of Employer and will continue to maintain the confidentiality of such information consistent with the PIPA and/or common law; and (b) so long as she is aware of any material non-public information concerning Employer, she shall not, directly or indirectly (i) engage in any transactions in Employer securities, (ii) recommend the purchase or sale of Employer securities, (iii) disclose material nonpublic information to any persons or entities, or (iv) assist anyone engaged in any of the foregoing activities.

14.Governing Law and Interpretation. This Agreement shall be governed and conformed in accordance with the laws of the state of Illinois, without regard to its provisions on conflicts of law. In the event of a breach of any provision of this Agreement, either party may institute an action specifically to enforce any term or terms of this Agreement and/or seek any damages for breach in the state and federal courts of Chicago, Illinois. The exclusive and sole forum for resolving disputes arising out of or related to the terms of this agreement shall be the state and federal courts of Chicago, Illinois. The parties shall submit to and accept the exclusive jurisdiction of such courts for the purpose of such suit, legal action, or proceeding. Each party irrevocably waives any objection it may have now or any time in the future to this choice of venue and jurisdiction. Should any provision of this Agreement be declared illegal or unenforceable by any court of competent jurisdiction and cannot be modified to be enforceable, excluding the general release language, such provision shall immediately become null and void, leaving the remainder of this Agreement in full force and effect.

a.Except as permitted by Paragraph 8, Employee will not make statements about Employer or engage in conduct that could reasonably be expected to adversely affect Employer’s reputation or business, including but not limited to discussing Employer’s business with search firms, the media, industry consultants and analysts, investors, competitors, customers, suppliers, current or former employees or directors, vendors, or any entity that Employee becomes employed by or does consulting work for in the future. Employee may describe her role with Employer to prospective employers, and may explain her work duties, initiatives, and accomplishments in a general way, provided she does not disclose

proprietary information or trade secrets or make statements that cast Employer in a bad light.

b.Employer will not disparage Employee in any press releases or other written public statements regarding her departure from employment with Employer, but Employer may provide all necessary and required truthful information in any disclosure required by the SEC or other governmental authority. Employer will make an internal announcement of Employer’s departure that is not inconsistent with what it is required to disclose in its 8-K filing. Employer agrees to provide Employee with a reasonable opportunity to review and comment on any internal or external announcements or 8-K filing relating to her separation prior to issuing such announcements or making such filing.

16.Nonadmission of Wrongdoing. The parties agree that neither this Agreement nor the furnishing of the consideration for this Agreement shall be deemed or construed at any time for any purpose as an admission by Releasees of wrongdoing or evidence of any liability or unlawful conduct of any kind.

17.Amendment. This Agreement may not be modified, altered, or changed except in writing and signed by both parties wherein specific reference is made to this Agreement.

18.Entire Agreement Regarding Separation Benefits. Employee understands that this Agreement fully sets forth all separation benefits Employee will receive from Employer, and it supersedes any offers or promises of termination pay, separation benefits, and the like, whether oral or written, which may have been made at any time. Employee acknowledges that Employee has not relied on any representations, promises, or agreements of any kind made to Employee in connection with Employee’s decision to accept this Agreement, except for those set forth in this Agreement.

19.Re-execution of Agreement; Revocation. The Delayed Effective Paragraphs will not take effect until eight days after Employee re-executes this Agreement following the Separation Date as set forth in Paragraph 3. Furthermore, Employee may revoke the effectiveness of the Delayed Effective Paragraphs within seven days after re-executing this Agreement and render those Paragraphs null and void. If Employee seeks to revoke the effectiveness of the Delayed Effective Paragraphs, Employee must notify Kerry Vyverberg via e-mail at kvyverberg@methode.com of Employee’s intent to revoke within seven days after re-executing this Agreement. If Employee revokes her re-execution of this Agreement as set forth above, all of the terms of the Delayed Effective Paragraphs shall be null and void.

20.Section 409A. Employer makes no representations or warranties to Employee with respect to any tax, economic, or legal consequences of this Agreement or any payments to Employee hereunder, including, without limitation, under IRS Code Section 409A, and no provision of this Agreement shall be interpreted or construed to transfer any liability for failure to comply with IRS Code Section 409A or any other applicable legal requirements from Employee to Employer or its parents or affiliates. Employee, by executing this Agreement, shall be deemed to have waived any claim against Employer or its parents or affiliates with respect to

any such tax, economic, or legal consequences. However, the payments and benefits provided under this Agreement are not intended to constitute deferred compensation that is subject to the requirements of IRS Code Section 409A. Rather, Employer intends that this Agreement and the payments and other benefits provided hereunder be exempt from the requirements of IRS Code Section 409A, pursuant to the involuntary separation pay exception described in Treas. Reg. §1.409A-1(b)(9)(iii). Notwithstanding any provision of this Agreement to the contrary, this Agreement shall be interpreted, operated, and administered in a manner consistent with such intention. Without limiting the generality of the foregoing, and notwithstanding any other provision of this Agreement to the contrary, all references herein to the termination or separation of Employee’s employment are intended to mean Employee’s “separation from service” within the meaning of IRS Code Section 409A(a)(2)(A)(i).

21.Severability. If for any reason any portion of this Agreement shall be held invalid or unenforceable, this fact shall not affect the validity or enforceability of the remaining portions of this Agreement.

22.Employee Advised to Consult an Attorney. Employee is advised to consult with an attorney before executing this Agreement and also before re-executing this Agreement on or after the Separation Date as set forth in Paragraphs 3 and 19.

23.Employee Acknowledgements. Employee acknowledges that Employee has fully read this Agreement, understands its terms, has been advised to consult with an attorney prior to signing this Agreement and prior to re-executing it, has been given 21 days to consider the release set forth in Paragraph 7 and its ramifications, has been given seven days after re-executing this Agreement to rescind the effectiveness of the Delayed Effective Paragraphs, and is entering into this Agreement knowingly and voluntarily. Employee further agrees that any modification of this Agreement, whether material or not, will not restart or change the original 21-day consideration period.

[signature page follows]

Accepted and agreed,

METHODE ELECTRONICS, INC.

DATED: January 29, 2025 By: /s/ Jon DeGaynor

Jon DeGaynor

Its Chief Executive Officer

DATED: January 27, 2025 /s/ Andrea Barry

Andrea Barry

Re-execution of Agreement by Employee on or after the Separation Date of May 3, 2025

RE-EXECUTION OF THIS DOCUMENT IS A RELEASE OF ALL CLAIMS - READ CAREFULLY BEFORE SIGNING

DATED: ___________ _______________________________

Andrea Barry

EXHIBIT 99.1

Methode Electronics Appoints Karen Keegans as

Chief Human Resources Officer

Chicago, IL – January 30, 2025 – Methode Electronics, Inc. (NYSE: MEI), a leading global supplier of custom-engineered solutions for user interface, lighting, and power distribution applications, announced today that Karen Keegans has been appointed as Chief Human Resources Officer (CHRO) effective February 3, 2025. Ms. Keegans succeeds Andrea Barry, who has served as CHRO since 2017.

Ms. Keegans joins Methode with more than 30 years of leadership experience, serving in the capacity of CHRO for several global industrial organizations, including Fortune 500 companies, such as Rockwell Automation, Pentair, and Praxair. She will be based at the company’s headquarters in Chicago, Illinois.

“We are pleased to have Karen join us as our new leader for Human Resources,” said Jon DeGaynor, President and Chief Executive Officer. “With her extensive HR experience and proven track record for helping organizations align culture and talent to business objectives, she will be a key contributor in our efforts to transform the business. She will lead critical activities such as building organizational capabilities to meet the changing needs of our end markets and the shifting of our culture to be more globally aligned and performance focused. This change, as with all of the recent organizational changes, is foundational to our efforts to return Methode to a prominent leadership position in the industry.”

Ms. Keegans said, “I am thrilled to join Methode and look forward to supporting the talent and culture needs of the organization while partnering with the teams across the globe.”

Mr. DeGaynor added, “I want to thank Andrea for her many contributions to Methode over the past eight years, particularly her leadership through a turbulent period these past two years. I and the Methode team wish her all the best in her future endeavors.”

About Karen Keegans

Karen Keegans is a seasoned HR professional whose career has spanned over 30 years, mainly with technology and industrial companies. She most recently held the position of CHRO at Suncor, an integrated energy company based in Calgary, Alberta. Over the past two decades she has held the position of CHRO at Rockwell Automation, Pentair, and Praxair. Ms. Keegans holds a B.A. degree in economics from the Western University, Canada.

About Methode Electronics, Inc.

Methode Electronics, Inc. (NYSE: MEI) is a leading global supplier of custom-engineered solutions with sales, engineering and manufacturing locations in North America, Europe, Middle East and Asia. We design, engineer, and produce mechatronic products for OEMs utilizing our broad range of technologies for user interface, lighting system, power distribution and sensor applications.

Our solutions are found in the end markets of transportation (including automotive, commercial vehicle, e-bike, aerospace, bus, and rail), cloud computing infrastructure, construction equipment, and consumer appliance. Our business is managed on a segment basis, with those segments being Automotive, Industrial, and Interface.

For Methode Electronics, Inc.

Robert K. Cherry

Vice President Investor Relations

rcherry@methode.com

708-457-4030

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

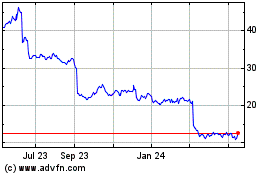

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From Dec 2024 to Jan 2025

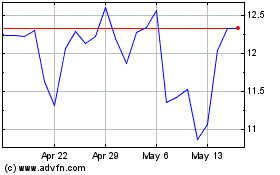

Methode Electronics (NYSE:MEI)

Historical Stock Chart

From Jan 2024 to Jan 2025