Western Asset Managed Municipals Fund Inc., Western Asset Municipal Partners Fund Inc., Western Asset Intermediate Muni Fund Inc. Announce Results of Stockholder Votes at Special Meeting of Stockholders Relating to Proposed Mergers

August 14 2023 - 7:00AM

Business Wire

Western Asset Municipal Partners Fund Inc. (NYSE: MNP) today

announced the results of the votes cast at MNP’s re-convened

Special Meeting of Stockholders held on August 11, 2023.

Stockholders of MNP voted to approve the merger of MNP with and

into Western Asset Managed Municipals Fund Inc. (NYSE: MMU) (the

“Merger”) in accordance with the Maryland General Corporation Law

(“MGCL”). The merger of Western Asset Intermediate Muni Fund Inc.

(NYSE: SBI) with and into MMU did not receive sufficient favorable

votes from SBI stockholders at SBI’s re-convened Special Meeting of

Stockholders and was consequently not approved. SBI will continue

as its own closed-end management investment company.

Previously, on July 14, 2023, stockholders of MMU voted to

approve the Merger in accordance with the MGCL. It is currently

anticipated that the Merger will be effective in mid-to-late

October 2023, subject to all regulatory requirements and customary

closing conditions being satisfied.

Upon completion of the Merger, each share of common stock of

MNP, par value $0.001 per share, will convert into an equivalent

dollar amount (to the nearest $0.001) of full shares of common

stock of MMU, par value $0.001 per share, based on the net asset

value of each fund on the business day preceding the Merger. MMU

will not issue fractional shares to MNP stockholders. In lieu of

issuing fractional shares, MMU will pay cash to each former holder

of MNP common stock in an amount equal to the net asset value of

the fractional shares of MMU common stock that the investor would

otherwise have received in the Merger.

Prior to the closing of the Merger, MNP’s currently outstanding

Auction Rate Cumulative Preferred Stock (“ARPS”) will be redeemed

in connection with—and prior to the closing of—the Merger, pursuant

to the redemption terms outlined in the Articles Supplementary for

MNP’s ARPS. In addition, MMU’s currently outstanding ARPS will be

redeemed in connection with—and prior to the closing of—the Merger,

pursuant to the redemption terms outlined in the Articles

Supplementary for MMU’s ARPS. The redemption price per share will

be equal to the sum of the liquidation preference plus any

accumulated, but unpaid, dividends thereon for both MNP’s ARPS and

MMU’s ARPS.

With respect to the currently outstanding Variable Rate Demand

Preferred Stock (“VRDPS”) for MNP, prior to the closing of the

Merger, MMU will issue and deliver to each stockholder of MNP’s

Series 1 VRDPS newly issued shares of MMU’s VRDPS with the same

aggregate liquidation preference and terms as MNP’s Series 1 VRDPS

issued and outstanding immediately before the date of the Merger.

As the liquidation preference for the newly issued shares of MMU’s

VRDPS that will replace the MNP’s Series 1 VRDPS will be equal to

the liquidation preference of the existing MMU’s Series 1 VRDPS,

MMU will issue a corresponding number of newly issued shares of

MMU’s VRDPS so that the aggregate liquidation preference for the

replaced MNP’s Series 1 VRDPS remains the same.

MMU is a closed-end, non-diversified management investment

company. SBI and MNP are diversified, closed-end management

investment companies. MMU, SBI and MNP are each managed by Legg

Mason Partners Fund Advisor, LLC, (“LMPFA) and sub-advised by

Western Asset Management Company, LLC (“Western Asset”). Both LMPFA

and Western Asset are indirect, wholly-owned subsidiaries of

Franklin Resources, Inc.

For more information, please call Investor Relations on

1-888-777-0102, or consult the funds’ web sites www.franklintempleton.com/investments/options/closed-end-funds.

Hard copies of each fund’s complete audited financial statements

are available free of charge upon request.

THIS PRESS RELEASE IS NOT AN OFFER TO PURCHASE NOR A

SOLICITATION OF AN OFFER TO SELL SHARES OF THE FUNDS. THIS PRESS

RELEASE MAY CONTAIN STATEMENTS REGARDING PLANS AND EXPECTATIONS FOR

THE FUTURE THAT CONSTITUTE FORWARD-LOOKING STATEMENTS WITHIN THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. ALL STATEMENTS

OTHER THAN STATEMENTS OF HISTORICAL FACT ARE FORWARD-LOOKING AND

CAN BE IDENTIFIED BY THE USE OF WORDS SUCH AS “MAY,” “WILL,”

“EXPECT,” “ANTICIPATE,” “ESTIMATE,” “BELIEVE,” “CONTINUE” OR OTHER

SIMILAR WORDS. SUCH FORWARD-LOOKING STATEMENTS ARE BASED ON EACH

FUND’S CURRENT PLANS AND EXPECTATIONS, AND ARE SUBJECT TO RISKS AND

UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY

FROM THOSE DESCRIBED IN THE FORWARD-LOOKING STATEMENTS.

ADDITIONAL INFORMATION CONCERNING SUCH RISKS AND UNCERTAINTIES

IS CONTAINED IN EACH FUND’S FILINGS WITH THE SECURITIES AND

EXCHANGE COMMISSION.

About Western Asset

Western Asset is one of the world’s leading fixed-income

managers with 50 years of experience and $388.0 billion in assets

under management (AUM) as of June 30, 2023. With a focus on

long-term fundamental value investing that employs a top-down and

bottom-up approach, the firm has nine offices around the globe and

deep experience across the range of fixed-income sectors. Founded

in 1971, Western Asset has been recognized for delivering superior

levels of client service alongside its approach emphasizing team

management and intensive proprietary research, supported by robust

risk management. To learn more about Western Asset, please visit

www.westernasset.com.

Western Asset is an independent specialist investment manager of

Franklin Templeton.

About Franklin Templeton

Franklin Resources, Inc. is a global investment management

organization with subsidiaries operating as Franklin Templeton and

serving clients in over 155 countries. Franklin Templeton’s mission

is to help clients achieve better outcomes through investment

management expertise, wealth management and technology solutions.

Through its specialist investment managers, the company offers

specialization on a global scale, bringing extensive capabilities

in fixed income, equity, alternatives and multi-asset solutions.

With offices in more than 30 countries and approximately 1,300

investment professionals, the California-based company has over 75

years of investment experience and over $1.4 trillion in assets

under management as of June 30, 2023. For more information, please

visit www.franklintempleton.com.

Category: Fund Announcement

Source: Franklin Resources, Inc.

Source: Legg Mason Closed End Funds

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230814733884/en/

Media: Fund Investor Services-1-888-777-0102

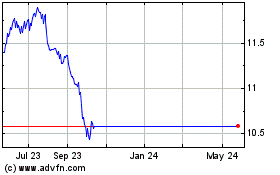

Western Asset Municipal ... (NYSE:MNP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Western Asset Municipal ... (NYSE:MNP)

Historical Stock Chart

From Dec 2023 to Dec 2024