Clip Money Inc. (TSX-V: CLIP) (OTCQB: CLPMF) (“

Clip

Money” or the

“Company”), a company that

operates a multi-bank self-service deposit system for businesses,

is pleased to announce the closing of a non-brokered private

placement of 28,596,826 common shares in the capital of the Company

(the “

Common Shares ”) at a price of CDN$0.23 per

Common Share (the “

Equity Price”) for gross

proceeds of approximately US$4,900,000 (the “

Equity

Financing”). Separately, Clip is also pleased to announce

the closing of a non-brokered private placement of secured

convertible notes (each a “

Convertible Note”) of

the Company for gross proceeds in the principal amount of

US$6,132,271 (inclusive of US$1,032,271 subscribed for by an

existing arm’s length investor (the “

Secondary

Investor”), as described further below) (the

“

Convertible Notes Financing”, together with the

Equity Financing, the “

Financings”). Cardtronics,

Inc. (“

Cardtronics”), a wholly-owned subsidiary of

NCR Corporation (NYSE:NCR), subscribed for the entire Equity

Financing and US$5,100,000 of the Convertible Note Financing, for a

combined US$10,000,000 investment in the Company.

Alongside the Financings, the Company and NCR

have established a long-term, firmware exclusive, commercial

collaboration that will combine Clip Money's pioneering business

cash deposit solution with NCR’s cardless cash deposit API and cash

in network.

Clip Money is the only multi-bank cash deposit

network in North America focused on businesses and driven by APIs,

enabling any business to make cash deposits into their bank account

of choice through Clip Money’s network without integration at the

bank itself. NCR will enable Clip Money deposit services at its

premier cash in network with more than 2,500 operating sites across

30 states serving more than 70 of the largest population centers

across the United States, complementing the current ClipDrop

network of nearly approximately 400 locations. The expanded network

will provide a large portion of U.S. business convenient access to

Clip Money’s services allowing businesses to manage cash more

efficiently regardless of the branch presence of their bank or

credit union of choice.

“This partnership with NCR seamlessly

complements Clip Money's existing deposit network, which is

primarily situated within shopping malls and prominent big box

retailers. NCR’s global market presence will provide Clip Money

with an immediate growth platform within North America, as well as

the potential to explore international market opportunities that

require business deposit transformation.”

Joseph Arrage, Chief Executive

Officer

Each Convertible Note issued under the

Convertible Notes Financing will be due and payable on the date

that is 60 months from the date hereof (the “Maturity

Date”) and will accrue simple interest at a rate of 8% per

annum, payable at the Maturity Date. The Convertible Notes will be

convertible into Common Shares at any time, in whole or in part, on

or prior to the Maturity Date at the option of the holder, based on

the principal amount of the Convertible Notes being converted

divided by a conversion price of CDN$0.26 per Common Share. No

accrued interest shall be paid on any part of the Convertible Notes

that is converted into Common Shares. The Convertible Notes issued

to Cardtronics and the Secondary Investor are secured by a first

and second lien security interest, respectively, in all of the

assets of the Company.

Upon closing of the Financings, Cardtronics

became a Control Person of the Company (as such term is defined in

the policies of the TSX Venture Exchange (the

“TSXV”)). In accordance with the policies of the

TSXV, the Company obtained disinterested shareholder approval in

respect of the creation of a new Control Person by written consent

of a majority of the shareholders of the Company. No bonuses,

finders’ fees, or commissions were paid by the Company in

connection with the Financings.

All securities to be issued in connection with

the Equity Financing and the Convertible Notes Financing are

subject to a statutory hold period of four months plus a day from

the date hereof in accordance with applicable securities

legislation in Canada.

The Company intends to use the net proceeds from

the Financings for general corporate and working capital purposes,

and to repay the entire CDN$670,505 bridge loan made by certain

executives of the Company, plus all accrued interest, that was

publicly announced by the Company on August 15, 2023.

The Company has also entered into an investor

rights agreement with Cardtronics (the “Investor Rights

Agreement”) providing for, among other things, a board

nomination right, pre-emptive rights, a right to match in respect

of certain acquisition offers and standstill and lock-up

restrictions. Additional information regarding the Investor Rights

Agreement will be included in a material change report to be filed

by the Company on www.sedar.com.

An unsecured convertible note of the Company

(the “Unsecured Note”) with a principal amount of

US$1,000,000 (“Principal Amount”)

issued in connection with the Company’s unsecured convertible note

financing publicly announced by the Company on June 14, 2023 was

redeemed by the Company in exchange for a cash payment to the

Secondary Investor equal to 105% of the Principal Amount plus

accrued and unpaid interest (the “Secondary Investor

Transaction”). Proceeds from the Secondary Investor

Transaction in the amount of US$1,032,271 were subsequently used by

the Secondary Investor to subscribe for new a Convertible Note

under the Convertible Note Financing. The Clip Money board of

directors has determined that the Secondary Investor Transaction is

in the best interests of the Company.

This press release is only a summary of certain

principal terms of the Financings and the Investor Rights Agreement

and is qualified in its entirety by reference to the more detailed

information contained in the material change report of the Company,

as well as the Company’s other filings on www.sedarplus.ca.

EARLY WARNING DISCLOSURE REGARDING

CARDTRONICS

This disclosure is being provided pursuant to

Multilateral Instrument 62-104 Take-Over Bids and Issuer Bids and

National Instruments 62-103 The Early Warning System and Related

Take-Over Bid and Insider Reporting Issues.

Prior to the closing of the Financings,

Cardtronics did not own or control, directly or indirectly, any

securities of the Company. On closing of the Financings,

Cardtronics acquired ownership or control, directly or indirectly,

over an aggregate of 28,596,826 Common Shares at a price of

CDN$0.23 and a Convertible Note in the principal amount of

CDN$6,845,730, representing approximately 27.31% of the issued and

outstanding Common Shares on a non-diluted basis and representing

approximately 41.91% of the issued and outstanding Common Shares on

a partially-diluted basis assuming the full conversion of the

Convertible Note.

The Common Shares and Convertible Note were

acquired by Cardtronics for investment purposes. The Acquiror will

evaluate its investment in the Company from time to time and may,

based on such evaluation, market conditions and other

circumstances, increase or decrease its shareholdings through

market transactions, private agreements, or otherwise, subject to

and in accordance with the terms of the Investor Rights Agreement

(as defined above).

A copy of Cardtronics’ report relating to the

Financings will be available on the Company’s SEDAR+ profile at

www.sedarplus.ca or may be obtained from Cardtronics at

scott.sykes@ncr.com.

The address of Cardtronics is 864 Spring Street

Northwest, Atlanta, Georgia 30308 U.S.A.

About Clip Money Inc.

Clip Money operates a multi-bank self-service

deposit system for businesses through its ClipDrop Boxes and ATMs

that provides businesses with the capability of making deposits

outside of their bank branch. Deposits can be made at top retailers

and shopping malls rather than having to go to a local bank branch

or using a cash pickup service. Clips conveniently located

ClipDrops or Clip enabled ATMs serve as cash deposit locations,

facilitating next business day credit into a business account. Clip

combines functional hardware, an intuitive user app and an

innovative cloud-based transaction engine that efficiently

processes business banking transactions. Clip Money offers a

cost-effective and convenient solution for business banking

deposits across major markets in Canada and the United States. For

more information about the Company,

visit www.clipmoney.com.

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

For further information, please contact:

Joseph ArrageChief Executive Officertel:

844-593-2547

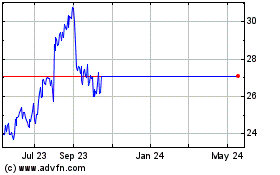

NCR (NYSE:NCR)

Historical Stock Chart

From Jan 2025 to Feb 2025

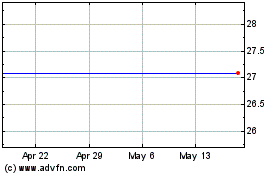

NCR (NYSE:NCR)

Historical Stock Chart

From Feb 2024 to Feb 2025