0001895262false00018952622024-07-312024-07-310001895262us-gaap:CommonStockMember2024-07-312024-07-310001895262ne:Tranche1WarrantsMember2024-07-312024-07-310001895262ne:Tranche2WarrantsMember2024-07-312024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

FORM 8-K

__________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): July 31, 2024

__________________________________________

NOBLE CORPORATION plc

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| England and Wales | | 001-41520 | | 98-1644664 |

| (State or other jurisdiction of incorporation) | | (Commission file number) | | (I.R.S. employer identification no.) |

| | | | | | | | | | | | | | |

| | | | |

| 13135 Dairy Ashford, | Suite 800, | Sugar Land, | Texas | 77478 |

| (Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: 281 276-6100

__________________________________________

| | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions |

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| A Ordinary Shares, par value $0.00001 per share | NE | New York Stock Exchange |

| Tranche 1 Warrants of Noble Corporation plc | NE WS | New York Stock Exchange |

| Tranche 2 Warrants of Noble Corporation plc | NE WSA | New York Stock Exchange |

| | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

Emerging growth company ☐

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

| | |

| Item 2.02. Results of Operations and Financial Condition. |

On July 31, 2024, Noble Corporation plc (the “Company”) issued a press release announcing its condensed consolidated financial results for the quarter ended June 30, 2024. A copy of such press release is included as Exhibit 99.1 and will be published in the “Investors” section on the Company’s website at www.noblecorp.com. |

Pursuant to the rules and regulations of the Securities and Exchange Commission, the press release is being furnished and shall not be deemed to be “filed” under the Securities Exchange Act of 1934. |

|

| Item 7.01. Regulation FD Disclosure. |

On August 1, 2024, the President and Chief Executive Officer of Noble Corporation plc (NYSE: NE), Robert W. Eifler, together with other executive officers, plan to announce Noble Corporation plc's earnings for the quarter ended June 30, 2024, via teleconference, which will be open to the public and broadcast live over the internet. A copy of the slide presentation used in connection with the teleconference is attached as Exhibit 99.2 and is incorporated by reference into this item. Pursuant to the rules and regulations of the Securities and Exchange Commission, the slide presentation is being furnished and shall not be deemed to be “filed” under the Securities Exchange Act of 1934. |

| | | | | |

Item 9.01. Financial Statements and Exhibits. |

| (d) Exhibits |

| |

| EXHIBIT | |

| NUMBER | DESCRIPTION |

| Exhibit 99.1 | |

| Exhibit 99.2 | |

| Exhibit 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

| | |

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | NOBLE CORPORATION plc | |

| | | | | | | |

| Date: | July 31, 2024 | | | | By: | | /s/ Robert W. Eifler | |

| | | | | | | Robert W. Eifler | |

| | | | | | | President and Chief Executive Officer | |

| | | | | | | | |

NOBLE CORPORATION PLC ANNOUNCES SECOND QUARTER 2024 RESULTS

•Announced acquisition of Diamond Offshore Drilling, Inc. (“Diamond”), bolstering a leading position in deepwater; transaction expected to close by Q1 2025.

•Q2 Net Income of $195 million, Diluted Earnings Per Share of $1.34, Adjusted EBITDA of $271 million, net cash provided by operating activities of $107 million, and Free Cash Flow of $(26) million.

•As previously announced, Q3 dividend increased to $0.50 per share, establishing the current highest dividend payout in U.S. oilfield services sector.

•Guidance for Full Year 2024 Adjusted EBITDA narrowed to $950-$1,000 million (from $925-$1,025 million).

SUGAR LAND, TEXAS, July 31, 2024 - Noble Corporation plc (NYSE: NE, CSE: NOBLE, “Noble”, or the “Company”) today reported second quarter 2024 results.

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| (in millions, except per share amounts) | | June 30, 2024 | | June 30, 2023 | | March 31,

2024 |

| Total Revenue | | $ | 693 | | | $ | 639 | | | $ | 637 | |

| Contract Drilling Services Revenue | | 661 | | | 606 | | | 612 | |

| Net Income (Loss) | | 195 | | | 66 | | | 95 | |

| Adjusted EBITDA* | | 271 | | | 188 | | | 183 | |

| Adjusted Net Income (Loss)* | | 105 | | | 56 | | | 66 | |

| Basic Earnings (Loss) Per Share | | 1.37 | | | 0.48 | | | 0.67 | |

| Diluted Earnings (Loss) Per Share | | 1.34 | | | 0.45 | | | 0.66 | |

| Adjusted Diluted Earnings (Loss) Per Share* | | 0.72 | | | 0.38 | | | 0.45 | |

| | | | | | |

| * A Non-GAAP supporting schedule is included with the statements and schedules attached to this press release. |

Robert W. Eifler, President and Chief Executive Officer of Noble Corporation plc, stated “Our second quarter results reflect a strong earnings improvement driven by key contract startups, resulting in a 48% sequential improvement in Adjusted EBITDA. To that end, the 25% increase to our quarterly dividend to $0.50 per share in Q3 further demonstrates Noble’s return of capital commitment. We are extremely excited to be progressing toward closing the highly accretive acquisition of Diamond, which represents a critical milestone in our First Choice journey through the formation of an industry leading deepwater fleet and a strong free cash generation and return of capital platform.”

Second Quarter Results

Contract drilling services revenue for the second quarter of 2024 totaled $661 million compared to $612 million in the first quarter of 2024, with the sequential increase driven by increased utilization. Marketed fleet utilization was 78% in the three months ended June 30, 2024, compared to 72% in the previous quarter. Contract drilling services costs for the second quarter of 2024 were $336 million, down from $390 million the first quarter of 2024, with lower contract preparation and mobilization expenses. Net income increased to $195 million in the second quarter of 2024, up from $95 million in the first quarter of 2024, and Adjusted EBITDA increased to $271 million in the second quarter of 2024, up from $183 million in the first quarter of 2024. Net cash provided by

operating activities in the second quarter of 2024 was $107 million, net capital expenditures were $133 million, and free cash flow (non-GAAP) was $(26) million driven by a significant working capital build.

Balance Sheet and Capital Allocation

The Company's balance sheet as of June 30, 2024, reflected total debt principal value of $635 million and cash (and cash equivalents) of $163 million. On June 10, 2024, Noble’s Board of Directors approved an interim quarterly cash dividend on our ordinary shares of $0.50 per share for the third quarter of 2024. This dividend is in addition to the $0.40 per share dividend previously announced which was paid on June 27, 2024, to shareholders of record at close of business on June 6, 2024. The $0.50 dividend is expected to be paid on September 26, 2024, to shareholders of record at close of business on September 12, 2024. The Company intends to continue to pay dividends on a quarterly basis, and the third quarter dividend represents $2.00 on an annualized basis. Future quarterly dividends and other shareholder returns will be subject to, amongst other things, approval by the Board of Directors and may be modified as market conditions dictate. The removal of certain restrictions pursuant to the merger agreement with Diamond has provided Noble the flexibility to execute under its previously approved share repurchase program following the conclusion of the Diamond shareholder vote currently scheduled for August 27th, and subject to laws and regulations.

Operating Highlights and Backlog

Noble's marketed fleet of sixteen floaters was 78% contracted through the second quarter, compared with 76% in the prior quarter. Industry leading edge dayrates for tier-1 drillships remain firm in the high $400,000s to low $500,000s per day range, excluding discounted rates for longer term duration fixtures. Contract fixtures for lower specification sixth generation floaters have been limited, resulting in continued white space for these units and bifurcated dayrate expectations for tier-1 rigs and lower specification rigs in 2024 and 2025.

Utilization of Noble's thirteen marketed jackups improved to 77% in the second quarter, up from 67% utilization during the prior quarter. Leading edge harsh environment jackup dayrates are in the mid $200,000s per day in Norway and $130,000 to $150,000 per day in other North Sea. The Northern Europe jackup market is characterized by moderately improving demand visibility in Norway for 2025, contrasted with a more cautious near term outlook in the southern North Sea arising from policy and permitting uncertainty in the U.K.

Subsequent to last quarter’s earnings press release, new contracts for Noble’s fleet with total contract value of approximately $275 million (including mobilization payments) include the following:

•Noble Stanley Lafosse received an extension from Murphy by the exercise of five option wells in the Gulf of Mexico, an additional scope of $177 million based on an estimated one year duration extending into February 2026.

•Noble Innovator received an extension from BP in the UK North Sea by exercise of priced options for an estimated duration of approximately 8 months at a dayrate of $155,000.

•Noble Resolve has been awarded a contract from Central European Petroleum for one well with estimated duration of 45 days offshore Poland at a dayrate of $140,000 plus mobilization and demobilization which is expected to commence in September 2024. The rig was also awarded a contract from an undisclosed operator in Spain for a 13-well P&A scope valued at approximately $40 million (including mobilization and demobilization) that is expected to commence in Q2 2025 for an estimated 170 days.

•Noble Resilient was awarded a one-well intervention contract from Harbour Energy with an estimated 30-70 day duration commencing in July 2024.

•Noble Regina Allen received an extension from TotalEnergies by the exercise of two priced option wells at $150,000 per day in Argentina with estimated duration of 60 days.

Noble's backlog as of July 31, 2024, stands at $4.2 billion.

Outlook

For the full year 2024, Noble is updating its guidance as follows: Total revenue increases and narrows to a range of $2,650 to $2,750 million (previously $2,550 to $2,700 million) with the increase primarily driven by higher reimbursable revenue and revenue from ancillary services; Adjusted EBITDA narrows to a range of $950 to

$1,000 million (previously $925 to $1,025 million), and capital additions (net of reimbursements) remains the same with a range of $400 to $440 million.

Commenting on Noble’s outlook, Mr. Eifler stated, “Deepwater fundamentals remain firm, and key indicators continue to support meaningful additional growth over the course of this cycle. Although demand has been flat over the past twelve months and appears likely to remain approximately flat into mid 2025, we expect several sizeable development programs will drive another leg of growth from late 2025 and 2026. Notwithstanding this expected moderated EBITDA trajectory throughout this transition period with continuing white space impacts, Noble has now reached a free cash flow inflection point, and we intend to continue to drive shareholder value by directing essentially all free cash flow to dividends and share repurchases.”

Noble’s outlook does not include any impact of its pending acquisition of Diamond.

Due to the forward-looking nature of Adjusted EBITDA, management cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measure. Accordingly, the Company is unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measure to the most directly comparable forward-looking GAAP financial measure without unreasonable effort. The unavailable information could have a significant effect on Noble’s full year 2024 GAAP financial results.

Conference Call

Noble will host a conference call related to its second quarter 2024 results on Thursday, August 1st, 2024, at 8:00 a.m. U.S. Central Time. Interested parties may dial +1 800-715-9871 and refer to conference ID 31391 approximately 15 minutes prior to the scheduled start time. Additionally, a live webcast link will be available on the Investor Relations section of the Company’s website. A webcast replay will be accessible for a limited time following the call.

For additional information, visit www.noblecorp.com or email investors@noblecorp.com.

Contact Noble Corporation plc

Ian Macpherson

Vice President - Investor Relations

+1 713-239-6019

imacpherson@noblecorp.com

About Noble Corporation plc

Noble is a leading offshore drilling contractor for the oil and gas industry. The Company owns and operates one of the most modern, versatile, and technically advanced fleets in the offshore drilling industry. Noble and its predecessors have been engaged in the contract drilling of oil and gas wells since 1921. Noble performs, through its subsidiaries, contract drilling services with a fleet of offshore drilling units focused largely on ultra-deepwater and high specification jackup drilling opportunities in both established and emerging regions worldwide. Additional information on Noble is available at www.noblecorp.com.

Dividend Details

Dividends payable to Noble shareholders will generally be paid in U.S. dollars (USD). However, holders of shares in the form of share entitlements admitted to trading on NASDAQ Copenhagen will receive an equivalent dividend payment in Danish krone (DKK) as determined by the exchange rate on a specified date. The holders of such share entitlements bear the risk of fluctuations in USD and DKK exchange rates.

Forward-looking Statements

This communication includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, as amended. All statements other than statements of historical facts included in this communication are forward looking statements, including those regarding future guidance, including revenue, adjusted EBITDA, the offshore drilling market and demand fundamentals, realization and timing of integration synergies, costs, the benefits or results of acquisitions or dispositions such as the acquisition of Diamond Offshore Drilling, Inc. (the “Diamond Transaction”) free cash flow expectations, capital expenditure, capital additions, capital allocation expectations including planned dividends and share

repurchases, contract backlog, rig demand, expected future contracts, anticipated contract start dates, major project schedules, dayrates and duration, fleet condition and utilization, realization and timing of insurance recoverables and 2024 financial guidance. Forward-looking statements involve risks, uncertainties and assumptions, and actual results may differ materially from any future results expressed or implied by such forward-looking statements. When used in this communication, or in the documents incorporated by reference, the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “guidance,” “intend,” “may,” “might,” “on track,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would,” “achieve,” “shall,” “target,” “will” and similar expressions are intended to be among the statements that identify forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we cannot assure you that such expectations will prove to be correct. These forward-looking statements speak only as of the date of this communication and we undertake no obligation to revise or update any forward-looking statement for any reason, except as required by law. Risks and uncertainties include, but are not limited to, those detailed in Noble’s most recent Annual Report on Form 10-K, Quarterly Reports Form 10-Q and other filings with the U.S. Securities and Exchange Commission, including, but not limited to, risks related to the recently announced Diamond Transaction, including the risk that the transaction will not be completed on the timeline or terms currently contemplated, the risk that the benefits of the transaction may not be fully realized or may take longer to realize than expected, the risk that the costs of the acquisition will be significant and the risk that management attention will be diverted to transaction-related issues. We cannot control such risk factors and other uncertainties, and in many cases, we cannot predict the risks and uncertainties that could cause our actual results to differ materially from those indicated by the forward-looking statements. You should consider these risks and uncertainties when you are evaluating us. With respect to our capital allocation policy, distributions to shareholders in the form of either dividends or share buybacks are subject to the Board of Directors’ assessment of factors such as business development, growth strategy, current leverage and financing needs. There can be no assurance that a dividend or buyback program will be declared or continued.

NOBLE CORPORATION plc AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Operating revenues | | | | | | | | |

| Contract drilling services | | $ | 660,710 | | | $ | 606,180 | | | $ | 1,273,135 | | | $ | 1,181,470 | |

| Reimbursables and other | | 32,134 | | | 32,355 | | | 56,793 | | | 67,119 | |

| | 692,844 | | | 638,535 | | | 1,329,928 | | | 1,248,589 | |

| Operating costs and expenses | | | | | | | | |

| Contract drilling services | | 335,854 | | | 362,533 | | | 725,721 | | | 724,322 | |

| Reimbursables | | 23,331 | | | 24,796 | | | 41,011 | | | 50,802 | |

| Depreciation and amortization | | 90,770 | | | 71,324 | | | 177,468 | | | 141,266 | |

| General and administrative | | 39,669 | | | 32,352 | | | 65,630 | | | 62,389 | |

| Merger and integration costs | | 10,618 | | | 22,452 | | | 19,949 | | | 34,083 | |

(Gain) loss on sale of operating assets, net | | (17,357) | | | — | | | (17,357) | | | — | |

| Hurricane losses and (recoveries), net | | — | | | 15,934 | | | — | | | 19,478 | |

| | 482,885 | | | 529,391 | | | 1,012,422 | | | 1,032,340 | |

| Operating income (loss) | | 209,959 | | | 109,144 | | | 317,506 | | | 216,249 | |

| Other income (expense) | | | | | | | | |

| Interest expense, net of amounts capitalized | | (11,996) | | | (14,662) | | | (29,540) | | | (31,534) | |

| | | | | | | | |

| Gain (loss) on extinguishment of debt, net | | — | | | (26,397) | | | — | | | (26,397) | |

| Interest income and other, net | | (8,183) | | | (2,940) | | | (12,918) | | | (914) | |

| Income (loss) before income taxes | | 189,780 | | | 65,145 | | | 275,048 | | | 157,404 | |

| Income tax benefit (provision) | | 5,228 | | | 671 | | | 15,441 | | | 16,475 | |

| Net income (loss) | | $ | 195,008 | | | $ | 65,816 | | | $ | 290,489 | | | $ | 173,879 | |

| Per share data | | | | | | | | |

| Basic: | | | | | | | | |

| Net income (loss) | | $ | 1.37 | | | $ | 0.48 | | | $ | 2.04 | | | $ | 1.27 | |

| Diluted: | | | | | | | | |

| Net income (loss) | | $ | 1.34 | | | $ | 0.45 | | | $ | 1.99 | | | $ | 1.19 | |

NOBLE CORPORATION plc AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 162,852 | | | $ | 360,794 | |

| Accounts receivable, net | | 637,034 | | | 548,844 | |

| Prepaid expenses and other current assets | | 186,979 | | | 152,110 | |

| Total current assets | | 986,865 | | | 1,061,748 | |

| Intangible assets | | 4,356 | | | 10,128 | |

| Property and equipment, at cost | | 4,853,998 | | | 4,591,936 | |

| Accumulated depreciation | | (640,185) | | | (467,600) | |

| Property and equipment, net | | 4,213,813 | | | 4,124,336 | |

| | | | |

| Other assets | | 382,100 | | | 311,225 | |

| Total assets | | $ | 5,587,134 | | | $ | 5,507,437 | |

| LIABILITIES AND EQUITY | | | | |

| Current liabilities | | | | |

| | | | |

| Accounts payable | | $ | 340,161 | | | $ | 395,165 | |

| Accrued payroll and related costs | | 68,179 | | | 97,313 | |

| Other current liabilities | | 228,658 | | | 149,202 | |

| Total current liabilities | | 636,998 | | | 641,680 | |

| Long-term debt | | 622,051 | | | 586,203 | |

| Other liabilities | | 340,842 | | | 307,451 | |

| Noncurrent contract liabilities | | 2,241 | | | 50,863 | |

| Total liabilities | | 1,602,132 | | | 1,586,197 | |

| Commitments and contingencies | | | | |

| Total shareholders’ equity | | 3,985,002 | | | 3,921,240 | |

| Total liabilities and equity | | $ | 5,587,134 | | | $ | 5,507,437 | |

NOBLE CORPORATION plc AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net income (loss) | $ | 290,489 | | | $ | 173,879 | |

| Adjustments to reconcile net income (loss) to net cash flow from operating activities: | | | |

| Depreciation and amortization | 177,468 | | | 141,266 | |

| Amortization of intangible assets and contract liabilities, net | (42,850) | | | (84,737) | |

| | | |

| (Gain) loss on extinguishment of debt, net | — | | | 26,397 | |

| (Gain) loss on sale of operating assets, net | (17,357) | | | — | |

Changes in components of working capital and other operating activities | (172,270) | | | (108,725) | |

| Net cash provided by (used in) operating activities | 235,480 | | | 148,080 | |

| Cash flows from investing activities | | | |

| Capital expenditures | (307,651) | | | (169,530) | |

Proceeds from insurance claims | 8,528 | | | — | |

| Proceeds from disposal of assets, net | (690) | | | — | |

| Net cash provided by (used in) investing activities | (299,813) | | | (169,530) | |

| Cash flows from financing activities | | | |

| Issuance of debt | — | | | 600,000 | |

| Borrowings on credit facilities | 35,000 | | | — | |

| | | |

| Repayments of debt | — | | | (673,411) | |

| Debt extinguishment costs | — | | | (25,697) | |

| Debt issuance costs | — | | | (24,914) | |

| Warrants exercised | 282 | | | 102 | |

| Share repurchases | — | | | (70,000) | |

| Dividend payments | (116,581) | | | — | |

| Taxes withheld on employee stock transactions | (53,627) | | | (8,355) | |

| Net cash provided by (used in) financing activities | (134,926) | | | (202,275) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | (199,259) | | | (223,725) | |

| Cash, cash equivalents and restricted cash, beginning of period | 367,745 | | | 485,707 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 168,486 | | | $ | 261,982 | |

NOBLE CORPORATION plc AND SUBSIDIARIES

OPERATIONAL INFORMATION

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Average Rig Utilization (1) |

| Three Months Ended | | Three Months Ended | | Three Months Ended |

| June 30, 2024 | | March 31, 2024 | | June 30, 2023 |

| Floaters | 70 | % | | 64 | % | | 76 | % |

| Jackups | 77 | % | | 67 | % | | 62 | % |

| Total | 73 | % | | 65 | % | | 70 | % |

| | | | | |

| | | | | |

| Operating Days |

| Three Months Ended | | Three Months Ended | | Three Months Ended |

| June 30, 2024 | | March 31, 2024 | | June 30, 2023 |

| Floaters | 1,138 | | | 1,101 | | | 1,305 | |

| Jackups | 914 | | | 794 | | | 786 | |

| Total | 2,052 | | | 1,895 | | | 2,091 | |

| | | | | |

| | | | | |

| Average Dayrates |

| Three Months Ended | | Three Months Ended | | Three Months Ended |

| June 30, 2024 | | March 31, 2024 | | June 30, 2023 |

| Floaters | $ | 435,677 | | | $ | 433,608 | | | $ | 363,167 | |

| Jackups | 155,585 | | | 144,187 | | | 128,885 | |

| Total | $ | 310,962 | | | $ | 312,502 | | | $ | 275,066 | |

(1) Average Rig Utilization statistics include all marketed and cold stacked rigs.

NOBLE CORPORATION plc AND SUBSIDIARIES

CALCULATION OF BASIC AND DILUTED NET INCOME/(LOSS) PER SHARE

(In thousands, except per share amounts)

(Unaudited)

The following tables presents the computation of basic and diluted income (loss) per share:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Numerator: | | | | | | | | |

| | | | | | | | |

| Net income (loss) | | $ | 195,008 | | | $ | 65,816 | | | $ | 290,489 | | | $ | 173,879 | |

| | | | | | | | |

| | | | | | | | |

| Denominator: | | | | | | | | |

| Weighted average shares outstanding - basic | | 142,854 | | | 138,058 | | | 142,404 | | | 136,502 | |

| Dilutive effect of share-based awards | | 1,559 | | | 3,242 | | | 1,559 | | | 3,242 | |

| Dilutive effect of warrants | | 1,647 | | | 5,692 | | | 1,651 | | | 6,810 | |

| Weighted average shares outstanding - diluted | | 146,060 | | | 146,992 | | | 145,614 | | | 146,554 | |

| Per share data | | | | | | | | |

| Basic: | | | | | | | | |

| Net income (loss) | | $ | 1.37 | | | $ | 0.48 | | | $ | 2.04 | | | $ | 1.27 | |

| Diluted: | | | | | | | | |

| Net income (loss) | | $ | 1.34 | | | $ | 0.45 | | | $ | 1.99 | | | $ | 1.19 | |

NOBLE CORPORATION plc AND SUBSIDIARIES

NON-GAAP MEASURES AND RECONCILIATION

Certain non-GAAP measures and corresponding reconciliations to GAAP financial measures for the Company have been provided for meaningful comparisons between current results and prior operating periods. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are not normally included or excluded in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles.

The Company defines “Adjusted EBITDA” as net income (loss) adjusted for interest expense, net of amounts capitalized; interest income and other, net; income tax benefit (provision); and depreciation and amortization expense, as well as, if applicable, gain (loss) on extinguishment of debt, net; losses on economic impairments; amortization of intangible assets and contract liabilities, net; restructuring and similar charges; costs related to mergers and integrations; and certain other infrequent operational events. We believe that the Adjusted EBITDA measure provides greater transparency of our core operating performance. We prepare Adjusted Net Income (Loss) by eliminating from Net Income (Loss) the impact of a number of non-recurring items we do not consider indicative of our on-going performance. We prepare Adjusted Diluted Earnings (Loss) per Share by eliminating from Diluted Earnings per Share the impact of a number of non-recurring items we do not consider indicative of our on-going performance. Similar to Adjusted EBITDA, we believe these measures help identify underlying trends that could otherwise be masked by the effect of the non-recurring items we exclude in the measure.

The Company also discloses free cash flow as a non-GAAP liquidity measure. Free cash flow is calculated as Net cash provided by (used in) operating activities less cash paid for capital expenditures. We believe Free Cash Flow is useful to investors because it measures our ability to generate or use cash. Once business needs and obligations are met, this cash can be used to reinvest in the company for future growth or to return to shareholders through dividend payments or share repurchases. We may have certain obligations such as non-discretionary debt service that are not deducted from the measure. Such business needs, obligations, and other non-discretionary expenditures that are not deducted from Free Cash Flow would reduce cash available for other uses including return of capital.

We believe that these non-GAAP financial measures provide useful information about our financial performance, enhance the overall understanding of our past performance and future prospects, and allow for greater transparency with respect to key metrics used by our management team for financial and operational decision-making. We are presenting these non-GAAP financial measures to assist investors in seeing our financial performance through the eyes of management, and because we believe that these measures provide an additional tool for investors to use in comparing our core financial performance over multiple periods with other companies in our industry.

These non-GAAP adjusted measures should be considered in addition to, and not as a substitute for, or superior to, contract drilling revenue, contract drilling costs, contract drilling margin, average daily revenue, operating income, cash flows from operations, or other measures of financial performance prepared in accordance with GAAP. Please see the following non-GAAP Financial Measures and Reconciliations for a complete description of the adjustments.

NOBLE CORPORATION plc AND SUBSIDIARIES

NON-GAAP MEASURES AND RECONCILIATION

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Adjusted EBITDA | | |

| | Three Months Ended June 30, | | Three Months Ended |

| | 2024 | | 2023 | | March 31, 2024 |

| Net income (loss) | | $ | 195,008 | | | $ | 65,816 | | | $ | 95,481 | |

| Income tax (benefit) provision | | (5,228) | | | (671) | | | (10,213) | |

| Interest expense, net of amounts capitalized | | 11,996 | | | 14,662 | | | 17,544 | |

| Interest income and other, net | | 8,183 | | | 2,940 | | | 4,735 | |

| Depreciation and amortization | | 90,770 | | | 71,324 | | | 86,698 | |

Amortization of intangible assets and contract liabilities, net | | (22,497) | | | (31,009) | | | (20,353) | |

| | | | | | |

| (Gain) loss on extinguishment of debt, net | | — | | | 26,397 | | | — | |

| | | | | | |

| Merger and integration costs | | 10,618 | | | 22,452 | | | 9,331 | |

(Gain) loss on sale of operating assets, net | | (17,357) | | | — | | | — | |

| Hurricane losses and (recoveries), net | | — | | | 15,934 | | | — | |

| Adjusted EBITDA | | $ | 271,493 | | | $ | 187,845 | | | $ | 183,223 | |

| | | | | | | | | | | | | | | | | | | | |

Reconciliation of Income Tax Benefit (Provision) | | | | |

| | Three Months Ended June 30, | | Three Months Ended |

| | 2024 | | 2023 | | March 31, 2024 |

| Income tax benefit (provision) | | $ | 5,228 | | | $ | 671 | | | $ | 10,213 | |

| Adjustments | | | | | | |

Amortization of intangible assets and contract liabilities, net | | 101 | | | 3,747 | | | 58 | |

| | | | | | |

Gain (loss) on sale of operating assets, net | | 2,500 | | | — | | | — | |

| | | | | | |

| Discrete tax items | | (63,067) | | | (47,601) | | | (18,528) | |

| Total Adjustments | | (60,466) | | | (43,854) | | | (18,470) | |

| Adjusted income tax benefit (provision) | | $ | (55,238) | | | $ | (43,183) | | | $ | (8,257) | |

NOBLE CORPORATION plc AND SUBSIDIARIES

NON-GAAP MEASURES AND RECONCILIATION

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Income (Loss) | | | | | | |

| | Three Months Ended June 30, | | Three Months Ended |

| | 2024 | | 2023 | | March 31, 2024 |

| Net income (loss) | | $ | 195,008 | | | $ | 65,816 | | | $ | 95,481 | |

| Adjustments | | | | | | |

| Amortization of intangible assets and contract liabilities, net | | (22,396) | | | (27,262) | | | (20,295) | |

| | | | | | |

| | | | | | |

| | | | | | |

| Merger and integration costs | | 10,618 | | | 22,452 | | | 9,331 | |

(Gain) loss on sale of operating assets, net | | (14,857) | | | — | | | — | |

| Hurricane losses and (recoveries), net | | — | | | 15,934 | | | — | |

| (Gain) loss on extinguishment of debt, net | | — | | | 26,397 | | | — | |

| Discrete tax items | | (63,067) | | | (47,601) | | | (18,528) | |

| Total Adjustments | | (89,702) | | | (10,080) | | | (29,492) | |

| Adjusted net income (loss) | | $ | 105,306 | | | $ | 55,736 | | | $ | 65,989 | |

| | | | | | |

| Reconciliation of Diluted EPS | | | | | | |

| | Three Months Ended June 30, | | Three Months Ended |

| | 2024 | | 2023 | | March 31, 2024 |

| Unadjusted diluted EPS | | $ | 1.34 | | | $ | 0.45 | | | $ | 0.66 | |

| Adjustments | | | | | | |

| Amortization of intangible assets and contract liabilities, net | | (0.15) | | | (0.19) | | | (0.14) | |

| | | | | | |

| | | | | | |

| | | | | | |

| Merger and integration costs | | 0.06 | | | 0.15 | | | 0.06 | |

(Gain) loss on sale of operating assets, net | | (0.10) | | | — | | | — | |

| Hurricane losses and (recoveries), net | | — | | | 0.11 | | | — | |

| (Gain) loss on extinguishment of debt, net | | — | | | 0.18 | | | — | |

| Discrete tax items | | (0.43) | | | (0.32) | | | (0.13) | |

| Total Adjustments | | (0.62) | | | (0.07) | | | (0.21) | |

| Adjusted diluted EPS | | $ | 0.72 | | | $ | 0.38 | | | $ | 0.45 | |

| | | | | | |

| Reconciliation of Free Cash Flow | | | | | | |

| | Three Months Ended June 30, | | Three Months Ended |

| | 2024 | | 2023 | | March 31, 2024 |

| Net cash provided by (used in) operating activities | | $ | 106,791 | | | $ | 211,160 | | | $ | 128,689 | |

| Capital expenditures, net of proceeds from insurance claims | | (132,513) | | | (106,796) | | | (166,610) | |

| Free cash flow | | $ | (25,722) | | | $ | 104,364 | | | $ | (37,921) | |

Noble Corporation plc Second Quarter 2024 Earnings Conference Call August 1, 2024

Disclaimer Forward-Looking Statements This communication includes “forward-looking statements” about Noble Corporation plc ("Noble" or the "Company") within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, as amended. All statements other than statements of historical facts included in this communication are forward looking statements, including those regarding future guidance, including revenue, adjusted EBITDA, the offshore drilling market and demand fundamentals, realization and timing of integration synergies, costs, the benefits or results of acquisitions or dispositions such as the acquisition of Diamond Offshore Drilling, Inc. (the “Diamond Transaction”), free cash flow expectations, capital expenditures, capital additions, capital allocation expectations, including planned dividends and share repurchases, contract backlog, rig demand, expected future contracts, anticipated contract start dates, major project schedules, dayrates and duration, any asset sales, access to capital, fleet condition and utilization, and 2024 financial guidance. Forward-looking statements involve risks, uncertainties and assumptions, and actual results may differ materially from any future results expressed or implied by such forward-looking statements. When used in this communication, or in the documents incorporated by reference, the words “guidance,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “on track,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would,” “achieve,” “shall,” “target,” “will” and similar expressions are intended to be among the statements that identify forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we cannot assure you that such expectations will prove to be correct. These forward-looking statements speak only as of the date of this communication and we undertake no obligation to revise or update any forward-looking statement for any reason, except as required by law. Risks and uncertainties include, but are not limited to, those detailed in Noble’s most recent Annual Report on Form 10-K, Quarterly Reports Form 10-Q and other filings with the U.S. Securities and Exchange Commission, including, but not limited to, risks related to the recently announced Diamond Transaction, including the risk that the transaction will not be completed on the timeline or terms currently contemplated, the risk that the benefits of the transaction may not be fully realized or may take longer to realize than expected, the risk that the costs of the acquisition will be significant and the risk that management attention will be diverted to transaction-related issues. We cannot control such risk factors and other uncertainties, and in many cases, we cannot predict the risks and uncertainties that could cause our actual results to differ materially from those indicated by the forward-looking statements. You should consider these risks and uncertainties when you are evaluating us. With respect to our capital allocation policy, distributions to shareholders in the form of either dividends or share buybacks are subject to the Board of Directors’ assessment of factors such as business development, growth strategy, current leverage and financing needs. There can be no assurance that a dividend or buyback program will be declared or continued. Non-GAAP Measures This presentation includes certain financial measures that we use to describe the Company's performance that are not in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). The non-GAAP information presented herein provides investors with additional useful information but should not be considered in isolation or as substitutes for the related GAAP measures. Moreover, other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. The Company defines "Adjusted EBITDA" as net income adjusted for interest expense, net of amounts capitalized; interest income and other, net; income tax benefit (provision); and depreciation and amortization expense, as well as, if applicable, gain (loss) on extinguishment of debt, net; losses on economic impairments; restructuring and similar charges; costs related to mergers and integrations; and certain other infrequent operational events. We believe that the Adjusted EBITDA measure provides greater transparency of our core operating performance. The Company defines net debt as indebtedness minus cash and cash equivalents; free cash flow as cash flow from operations minus capital expenditures; adjusted EBITDA margin as adjusted EBITDA divided by total revenues; and leverage as net debt divided by annualized adjusted EBITDA from the most recently reported quarter. The Company defines net capital expenditures as capital expenditures net of reimbursements and insurance proceeds, and we define Capital Additions as additions to property and equipment. Additionally, due to the forward-looking nature of Adjusted EBITDA, management cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measure. Accordingly, the company is unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measure to the most directly comparable forward-looking GAAP financial measure without unreasonable effort. 2

Summary Quarterly Dividend Increased to $0.50 for Q3 2024 Approximately $470M of capital returned to shareholders cumulatively Q4 2022 – Q3 2024 Approximately $275M in New Contracts Since Last Quarter Stanley Lafosse, Innovator, Resolve, Regina Allen 2024 Outlook: Adjusted EBITDA Guidance Narrowed Midpoint $975M Adj EBITDA unchanged; new range reflects 52-54% weighting to H2 Q2 Adjusted EBITDA of $271M, Free Cash Flow of ($26M) 48% sequential EBITDA increase driven by key contract startups 3 Acquisition of Diamond Offshore Bolsters Deepwater Leadership Position Significantly accretive to FCF per share, on track to close by Q1 2025

Second Quarter Financial Highlights Adjusted EBITDA $271M $183M Net capital expenditures $133M $167M Free cash flow ($26M) ($38)M Net debt $459M $374M Backlog $4.2B $4.4B Liquidity $656M $739M Adjusted EBITDA margin 39% 29% Leverage 0.4x 0.5x 4 Prior quarter figures for Q1 2024 shown below

Current Backlog Stands at $4.2 Billion 2024 2025 2026 2027 Floaters Jackups 76% 48% 12%26% Percentage of available days committed1 Backlog ($B) and Contract Coverage 1) Committed days on total marketed fleet, excluding cold stacked rigs, per 7/31/2024 fleet status 5 1.0 1.7 1.1 0.5

Deepwater Fleet Overview 2024 2025 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 DRILLSHIPS Noble Tom Madden (7g dual BOP) Noble Globetrotter I (6g) Noble Sam Croft (7g dual BOP) Noble Globetrotter II (6g) Pacific Meltem (7g dual BOP) – cold stacked Pacific Scirocco (6g) – cold stacked Noble Don Taylor (7g dual BOP) SEMISUBMERSIBLES Noble Bob Douglas (7g dual BOP) Noble Deliverer (6g) Noble Developer (6g) Noble Faye Kozack (7g dual BOP) Noble Valiant (7g dual BOP) Noble Discoverer (6g) Noble Viking (7g) Noble Venturer (7g dual BOP) Noble Voyager (7g dual BOP) Noble Stanley Lafosse (7g dual BOP) Noble Gerry de Souza (6g dual BOP) Firm contracts, excluding options, per 7/31/24 fleet status Recent Highlights • Stanley Lafosse: five additional wells option exercised (~1 year) with Murphy in the Gulf of Mexico, expected to commence in Feb 2025, includes an additional option for a further five wells 6

Jackup Fleet Overview 2024 2025 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 ULTRA HARSH ENVIRONMENT Noble Innovator (CJ70) Noble Integrator (CJ70) Noble Interceptor (CJ70) Noble Reacher (CJ50) Noble Resilient (CJ50) Noble Resolute (CJ50) Noble Resolve (CJ50) Noble Highlander (JU-2000E) HARSH ENVIRONMENT Noble Tom Prosser (JU-3000N) Noble Mick O’Brien (JU-3000N) Noble Regina Allen (JU-3000N) Noble Invincible (CJ70) Noble Intrepid (CJ70) Firm contracts, excluding options, per 7/31/24 fleet status Recent Highlights • Innovator: exercise of priced options with BP in the UK North Sea for an estimated duration of approximately 8 months • Regina Allen: exercise of two priced option wells (~60 days) with TotalEnergies in Argentina • Resilient: one well (~40 days) with Harbour in the United Kingdom, commenced in June 2024 • Resolve: one well (~45 days) with Central European Petroleum in Poland, expected to commence in September 2024; next, thirteen well P&A campaign (~170 days) with an undisclosed operator in Spain, expected to commence in Q2 2025 7

Financial Overview ($ millions) Quarter End 6/30/2024 Quarter End 3/31/2024 Revenue 693 637 Adjusted EBITDA 271 183 margin % 39% 29% Net Income 195 95 Diluted EPS 1.34 0.66 Cash flow from operations 107 129 Cash paid for capital expenditures 133 167 Free cash flow (26) (38) Net debt 1 459 374 Leverage 2 0.4x 0.5x Liquidity 3 655 739 1) Net debt defined as total indebtedness minus cash and cash equivalents. 2) Leverage ratio defined as net debt divided by annualized Adjusted EBITDA for the period. 3) 6/30/24 liquidity includes $163 million cash and cash equivalents plus $492 million RCF availability net of Letters of Credit outstanding Non-GAAP to GAAP reconciliations provided on page 10. 8

2024 Guidance Update Revenue 2,650 - 2,750 2,550 - 2,700 Adjusted EBITDA 950 – 1,000 925 – 1,025 Capital Addit ions, net of reimbursements 400 – 440 400 - 440 $ millions 9 Denotes prior guidance

Appendix: Reconciliation to GAAP Measures Reconciliation of Adjusted EBITDA Three Months Ended June 30, Three Months Ended 2024 2023 March 31, 2024 Net income (loss) $ 195,008 $ 65,816 $ 95,481 Income tax (benefit) provision (5,228) (671) (10,213) Interest expense, net of amounts capitalized 11,996 14,662 17,544 Interest income and other, net 8,183 2,940 4,735 Depreciation and amortization 90,770 71,324 86,698 Amortization of intangible assets and contract liabilities, net (22,497) (31,009) (20,353) (Gain) loss on extinguishment of debt, net — 26,397 — Merger and integration costs 10,618 22,452 9,331 (Gain) loss on sale of operating assets, net (17,357) — — Hurricane losses and (recoveries), net — 15,934 — Adjusted EBITDA $ 271,493 $ 187,845 $ 183,223 Total revenue $ 692,844 $ 638,535 $ 637,084 Adjusted EBITDA margin 39 % 29 % 29 % Reconciliation of Free Cash Flow Three Months Ended June 30, Three Months Ended 2024 2023 March 31, 2024 Net cash provided by (used in) operating activities $ 106,791 $ 211,160 $ 128,689 Capital expenditures, net of proceeds from insurance claims (132,513) (106,796) (166,610) Free cash flow $ (25,722) $ 104,364 $ (37,921) Reconciliation of Net Debt June 30, 2024 December 31, 2023 Long-term debt $ 622,051 $ 586,203 Cash and cash equivalents 162,852 360,794 Net Debt $ 459,199 $ 225,409

v3.24.2

Cover

|

Jul. 31, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 31, 2024

|

| Entity Registrant Name |

NOBLE CORPORATION plc

|

| Entity Central Index Key |

0001895262

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity File Number |

001-41520

|

| Entity Tax Identification Number |

98-1644664

|

| Entity Address, Address Line One |

13135 Dairy Ashford,

|

| Entity Address, Address Line Two |

Suite 800,

|

| Entity Address, City or Town |

Sugar Land,

|

| Entity Address, Country |

TX

|

| Entity Address, Postal Zip Code |

77478

|

| City Area Code |

281

|

| Local Phone Number |

276-6100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

A Ordinary Shares, par value $0.00001 per share

|

| Trading Symbol |

NE

|

| Security Exchange Name |

NYSE

|

| Tranche 2 Warrants |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Tranche 2 Warrants of Noble Corporation plc

|

| Trading Symbol |

NE WSA

|

| Security Exchange Name |

NYSE

|

| Tranche 1 Warrants |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Tranche 1 Warrants of Noble Corporation plc

|

| Trading Symbol |

NE WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ne_Tranche2WarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ne_Tranche1WarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

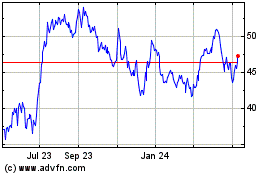

Noble (NYSE:NE)

Historical Stock Chart

From Oct 2024 to Nov 2024

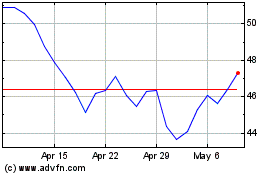

Noble (NYSE:NE)

Historical Stock Chart

From Nov 2023 to Nov 2024