In the first bullet under Financial Highlights, the figure for

Adjusted Net Income Q4´22 has been corrected to $113.8 million.

The updated release reads:

NU HOLDINGS LTD. REPORTS FOURTH QUARTER AND

FULL YEAR 2022 FINANCIAL RESULTS

Nu Holdings Ltd. (NYSE: NU | B3: NUBR33), (“Nu” or the

“Company”), one of the world’s largest digital financial services

platforms, released today its Fourth Quarter & Full Year 2022

financial results. Financial results are expressed in U.S. dollars

and are presented in accordance with International Financial

Reporting Standards (IFRS). The full earnings release has been made

available on the Company’s Investor Relations website at

www.investors.nu, as well as the details of the Earnings Conference

Call Nu will hold today at 5:00pm Eastern time/7:00pm Brasília

time.

“Nu posted record results this quarter, with growth across all

metrics and a meaningful increase in profits. Net Income grew to

over $58 million in Q4’22 at holding level, excluding the one-time

non-cash effects of the CSA termination announced last November. We

reached a total of 75 million customers in Brazil, Mexico and

Colombia, increasing engagement, cross-sell and up-sell –all to

consolidate Nu’s position as Brazil’s fifth largest financial

institution in terms of active customers. In Brazil specifically,

we saw net income grow to $138 million in the last quarter, with an

annualized ROE of 35% – among the highest in the industry,

providing evidence for the profit potential of our business model.

Despite the macroeconomic challenges of 2022, Nu was able to beat

every key metric: maintained accelerated growth, gained share in

products and markets, kept delinquency in check through superior

credit underwriting, and improved operating leverage,” says David

Vélez, founder and CEO.

Q4’22 & Full Year´22 Results Snapshot

Below are Q4’22 and FY’22 performance highlights of Nu Holdings

Ltd.:

Operating Highlights:

- Customer growth: Nu added 4.2 million customers in Q4’22

and 20.7 million in 2022, closing the year with a total of 74.6

million customers globally. This represents a 38% growth

year-over-year (YoY), which solidifies Nu's position as Brazil’s

fifth largest financial institution and Latin America's sixth

largest, both by number of active customers.

- Engagement and activity rates: Monthly Average Revenue

per Active Customer (ARPAC) increased to $8.2, expanding 37% YoY on

a FX neutral basis (FXN)1. This expansion is motivated by the

increase of primary banking relationship with customers, the

maturation of customers cohorts, and the rollout of new products

that foster further cross-sell as well as growing transaction and

purchase volumes (up-sell). Activity rate2 hit yet another

historical mark at 82%. Nu has become the primary banking

relationship for over 58% of the monthly active customers that have

been with Nu for over a year.

- Low-cost operating platform: Consistently stable

throughout the quarters, Monthly Average Cost to Serve Per Active

Customer at year-end was at $0.9, reflecting Nu’s focus on

operating efficiency while delivering a sustained expansion of its

ecosystem at scale. The company’s efficiency ratio, which reflects

Nu’s operating leverage, has improved consistently throughout the

past four consecutive quarters to reach an all-time low at 47.4%,

already comparable with incumbent levels in the region and yet with

far more potential as the company continues to expand with one of

the lowest cost to acquire in the incumbent and fintech

industry.

- Asset Quality: Remained within expectations with 15-90

NPL ratio dropping 50 points-base in Q4´22 to 3.7%, while 90+NPL

reached 5.2%. The improvement in early delinquency indicator is

explained firstly by better credit performance from Nu’s loan

portfolio in response to management actions adopted in Q2, and

usual positive seasonality in Q4. Nu continues to outperform the

industry on a like-for-like basis, across different income bands,

and with an even more pronounced comparative advantage for the

lower income bands.

Financial Highlights:

- Net & Adjusted Income: Nu reported a Net Income of

$58 million for Q4´22, delivering its second consecutive quarter of

profit, excluding the one-time non-cash effect of the CSA

termination announced in November 2022, which amounts to $355.6

million. Regarding Adjusted Net Income3 the company reported $113.8

million in Q4´22. In Brazil specifically, Net Income grew to $138

million in the last quarter with an annualized ROE of 35%, one of

the highest in the industry.

- Revenue: Nu posted $1.45 billion in revenues for Q4’22

and $4.8 billion for FY´22, an all time record high with a 168%

annual expansion YoY FXN. This comes as a result of the compounding

effect of customer growth and higher levels of customer

monetization in Brazil, which alone responded for $4.5 billion of

2022 total revenues.

- Gross Profit: Nu’s Q4’22 gross profit expanded 137% to

$578.3 million, while annual gross profit increased 126% YoY FX to

a record of $1.66 billion. Gross profit margin expanded

significantly to 40% for the quarter and 35% for the year,

reinforcing Nu’s operational leverage capacity, effectiveness in

adequately pricing credit and adapting fundings costs according to

macro circumstances.

- Capital: Nu strengthened its position as one of the best

capitalized players in the region with its adjusted capital

reaching $3.8 billion.

- Liquidity: Nu maintains significant excess liquidity

with a loan-to-deposit ratio of 25%. On December 31st, 2022, Nu had

an interest-earning portfolio of $4 billion, while total deposits

were four times this amount at $15.8 billion.

Business highlights:

- Performance and Growth in Brazil: With the consolidation

of operations in the country, Brazil accounted for 93% ($4.5

billion) of total revenues in 2022, while Net Income grew to $185

million, from a $20 million loss in 2021. Adjusted Net Income grew

to $282 million, from $50 million in 2021. Nu ended 2022 as

Brazil's fifth largest financial institution in numbers of active

customers and Latin America's sixth largest one. In terms of total

customers, Nu expanded its Brazilian customer base to 70.9 million,

which represents 44% of the country’s adult population. These

results highlight not only the success achieved so far in the

Brazilian market, but the potential lying ahead as the company

continues to escalate its business and drive further client

engagement. Credit card purchase volume increased 54% for Q4’22 and

73% for the Full Year YoY FXN, to US$ 23.8 billion and $81.0

billion, respectively. Nu holds 12% of the local credit card market

share in terms of purchase volume.

- International Expansion: In Mexico, its second largest

market, Nu’s customer base exceeded 3.2 million at the end of 2022,

reporting a 129% growth. As per the last available data from August

2022, Nu's market share in terms of new cards issued in the country

approached 29%, while share in terms of purchase volumes for credit

cards already achieved 5%. In Colombia, Nu delivered its strongest

growth in relative terms by reaching 565,000 customers and now

accounting for 38% of the new credit cards in the market, as per

latest available information.

- Multi-Product Platform: Nu keeps delivering at launching

and expanding its products portfolio with credit cards, NuAccounts

and Personal loans reaching approximately 34 million, 54 million

and 5 million active customers, respectively. NuInvest reached 7

million active customers, likely positioning itself as the largest

digital investments platform in Latin America. NuCripto grew to 1.3

million active customers since its full rollout in July 2022, and

the base of SMEs customers expanded 79% YoY to 2.5 million at the

end of 2022. Insurance ended 2022 with more than 962 thousand

active policies.

Footnotes

1 FX neutral measures were calculated to present what such

measures in preceding periods/years would have been had exchange

rates remained stable from these preceding periods/years until the

date of the Company’s more recent financial information. 2 Activity

rate is defined as monthly active customers divided by the total

number of customers as of a specific date. 3 Adjusted Net Income

(Loss) is a non-IFRS measure calculated using Net Income adjusted

for expenses related to Nu's share-based compensation as well as

the tax effects related to these items, among others. For more

information, please see “Non-IFRS Financial Measures and

Reconciliations – Adjusted Net Income Reconciliation".

CONFERENCE EARNINGS CALL

DETAILS

Nu will hold a Conference Earnings Call

today at 5:00pm Eastern time/7:00pm Brasília time with simultaneous

translation in Portuguese and English.

To pre-register for this call, please

click here

A replay of the webcast will be made

available after the call on the Investor Relations page: click

here.

Note on forward-looking statements and non-IFRS financial

measures

This release speaks at the date hereof and the Company is under

no obligation to update or keep current the information contained

in this release. Any information expressed herein is subject to

change without notice. Any market or other third-party data

included in this release has been obtained by the Company from

third party sources. While the Company has compiled and extracted

the market data, it can provide no assurances of the accuracy and

completeness of such information and takes no responsibility for

such data.

This release contains forward-looking statements. All statements

other than statements of historical fact contained in this release

may be forward-looking statements and include, but are not limited

to, statements regarding the Company’s intent, belief or current

expectations. These forward-looking statements are subject to risks

and uncertainties, and may include, among others, financial

forecasts and estimates based on assumptions or statements

regarding plans, objectives and expectations. Although the Company

believes that these estimates and forward-looking statements are

based upon reasonable assumptions, they are subject to several

risks and uncertainties and are made in light of information

currently available, and actual results may differ materially from

those expressed or implied in the forward-looking statements due to

various factors, including those risks and uncertainties included

under the captions “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” in our

prospectus dated December 8, 2021 filed with the Securities,

Exchange Commission pursuant to Rule 424(b) under the Securities

Act of 1933, as amended, and in our Annual Report on Form 20-F for

the year ended December 31, 2021, which was filed with the

Securities and Exchange Commission on April 20, 2022 and the

Reference Form filed with the Brazilian Securities and Exchange

Commission also on April 20, 2022. The Company, its advisers and

each of their respective directors, officers and employees disclaim

any obligation to update the Company’s view of such risks and

uncertainties or to publicly announce the result of any revision to

the forward-looking statements made herein, except where it would

be required to do so under applicable law. The forward-looking

statements can be identified, in certain cases, through the use of

words such as “believe,” “may,” “might,” “can,” “could,” “is

designed to,” “will,” “aim,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “forecast”, “plan”, “predict”, “potential”,

“aspiration,” “should,” “purpose,” “belief,” and similar, or

variations of, or the negative of such words and expressions.

The financial information in this document includes forecasts,

projections and other predictive statements that represent the

Company’s assumptions and expectations in light of currently

available information. These forecasts, projections and other

predictive statements are based on the Company’s expectations and

are subject to variables and uncertainties. The Company’s actual

performance results may differ. Consequently, no guarantee is

presented or implied as to the accuracy of specific forecasts,

projections or predictive statements contained herein, and undue

reliance should not be placed on the forward-looking statements in

this press release, which are inherently uncertain.

In addition to IFRS financials, this release includes certain

summarized, non-audited or non-IFRS financial information. These

summarized, non-audited or non-IFRS financial measures are in

addition to, and not a substitute for or superior to, measures of

financial performance prepared in accordance with IFRS. References

in this presentation to “R$” refer to the Brazilian real, the

official currency of Brazil.

About Nu

Nu is one of the world’s largest digital financial services

platforms, serving around 75 million customers across Brazil,

Mexico and Colombia. As one of the leading technology companies in

the world, Nu leverages proprietary technologies and innovative

business practices to create new financial solutions and

experiences for individuals and SMEs that are simple, intuitive,

convenient, low-cost, empowering and human. Guided by a mission to

fight complexity and empower people, Nu is fostering the access to

financial services across Latin America, connecting profit and

purpose to create value for its stakeholders and have a positive

impact on the communities it serves. For more information, please

visit www.nubank.com.br

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230214005795/en/

Investors Relations Jorg Friedemann

investors@nubank.com.br

Media Relations Leila Suwwan press@nubank.com.br

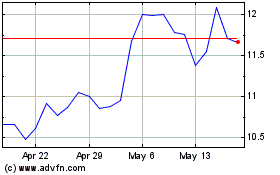

Nu (NYSE:NU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nu (NYSE:NU)

Historical Stock Chart

From Jan 2024 to Jan 2025