Company provides initial outlook for Q1 and FY

2025

Nu Skin Enterprises Inc. (NYSE: NUS) today announced fourth

quarter and full-year 2024 results above its latest revenue

guidance.

Executive Summary Q4 2024 vs. Prior-year

Quarter

Revenue

$445.6 million; (8.8)%

- (4.1)% FX impact or $(20.1) million

- Rhyz revenue $83.1 million; 27.7%

Earnings Per Share

(EPS)

$(0.73) or $0.38 excluding restructuring

and other charges, compared to $0.15 or $0.37 excluding

restructuring and other charges

Customers

831,972; (15)%

Paid Affiliates

144,874; (13)% or (12)% excluding an

adjustment to eligibility requirements

Sales Leaders

36,912; (16)%

Executive Summary 2024 vs. 2023

Revenue:

$1.73 billion; (12.0)%

- (3.8)% FX impact or $(76.1) million

- Rhyz revenue $286.6 million; 32.3%

Earnings Per Share

(EPS):

$(2.95) or $0.84 excluding restructuring

and other charges, compared to $0.17 or $1.85 excluding inventory

write-off and other charges

“We were pleased to beat our fourth quarter revenue guidance,

generate sequential revenue growth and exceed our adjusted earnings

as we materially completed our restructuring plan," said Ryan

Napierski, Nu Skin president and CEO. “As we look ahead to 2025, we

anticipate improving business trends and a return to year-over-year

growth in several of our markets but also anticipate continued

economic challenges and poor consumer sentiment, particularly in

Greater China and South Korea.

“This year we will focus on strengthening our core Nu Skin

business with the continued rollout of our enhanced sales

performance compensation plan in several markets as well as

accelerating growth in developing markets including Latin America,”

continued Napierski. “We are also excited for Prysm iO™, an

exclusive intelligent wellness device that will provide consumers

with the nutritional insights needed to look, live and feel better.

We anticipate the introduction later this year of this breakthrough

technology will infuse energy and future growth for the nutrition

side of the business. Also, we were pleased with the strategic

transaction of Mavely for $250 million, which strengthened our

balance sheet and underscored the value of Rhyz to incubate and

scale meaningful business, as we continue to invest in and advance

our Rhyz segments.”

Q4 2024 Year-over-year Operating Results

Revenue

$445.6 million compared to $488.6

million

- (4.1)% FX impact or $(20.1) million

- Rhyz revenue $83.1 million; 27.7%

Gross Margin

62.7% or 71.4% excluding inventory

write-off compared to 72.1%

- Nu Skin business was 67.5% or 76.6% excluding inventory

write-off compared to 77.4%

Selling Expenses

37.1% compared to 37.1%

- Nu Skin business was 40.3% compared to 40.8%

G&A Expenses

27.1% compared to 29.7%

Operating Margin

(11.9)% or 7.7% excluding restructuring

and other charges compared to 3.3% or 6.4% excluding restructuring

and other charges

Interest Expense

$5.9 million compared to $7.4 million

Other Income

$1.1 million compared to $0.6 million

Income Tax Rate

37.5% or 36.6% excluding restructuring and

other charges compared to 21.9% or 24.9% excluding restructuring

and other charges

EPS

$(0.73) or $0.38 excluding restructuring

and other charges compared to $0.15 or $0.37 excluding

restructuring and other charges

Stockholder Value

Dividend Payments

$3.0 million

Stock Repurchases

$0.0 million

- $162.4 million remaining in authorization

Q1 and Full-year 2025 Outlook

Q1 2025 Revenue

$345 to $365 million; (17)% to (13)%

- Approximately (3)% FX impact

Q1 2025 EPS

$2.65 to $2.75 or $0.10 to $0.20 excluding

the gain from the Mavely transaction

2025 Revenue

$1.48 to $1.62 billion; (15)% to (6)% or

(11)% to (3)% excluding Mavely revenue in 2024

- Approximately (3)% FX impact

2025 EPS

$3.45 to $3.85 or $0.90 to $1.30 excluding

the gain from the Mavely transaction

“We are encouraged by our recent progress in strengthening our

business by driving sequential growth in our core Nu Skin business,

improving operational efficiencies and delivering strong cash

flow,” said James D. Thomas, chief financial officer. “As we look

ahead to 2025, our annual revenue guidance is $1.48 to $1.62

billion, with an approximate 3% foreign currency headwind. We

anticipate reported EPS of $3.45 to $3.85 and growth in our

adjusted EPS, which we estimate to be $0.90 to $1.30, excluding the

gain from the sale of Mavely. For the first quarter, which is

typically our lowest quarter due to seasonality of our business, we

project revenue of $345 to $365 million. This assumes a negative

foreign currency impact of approximately 3%, with reported earnings

per share of $2.65 to $2.75 or $0.10 to $0.20, excluding the gain

from the sale of Mavely. As we’ve executed on our restructuring

plan and improved our cost structure, we are better positioned to

execute our strategy and drive earnings growth in 2025.”

Conference Call

The Nu Skin Enterprises management team will host a conference

call with the investment community today at 5 p.m. (ET). Those

wishing to access the webcast, as well as the financial information

presented during the call, can visit the Investor Relations page on

the company's website at ir.nuskin.com. A replay of the webcast

will be available on the same page through Feb. 27, 2025.

About Nu Skin Enterprises Inc.

The Nu Skin Enterprises Inc. (NYSE: NUS) family of companies

includes Nu Skin and Rhyz Inc. Nu Skin is an integrated beauty and

wellness company, powered by a dynamic affiliate opportunity

platform, which operates in nearly 50 markets worldwide. Backed by

40 years of scientific research, the company’s products help people

look, feel and live their best with brands including Nu Skin®

personal care, Pharmanex® nutrition and ageLOC® anti-aging, which

includes an award-winning line of beauty device systems. Formed in

2018, Rhyz is a synergistic ecosystem of consumer, technology and

manufacturing companies focused on innovation within the beauty,

wellness and lifestyle categories.

Important Information Regarding Forward-Looking

Statements: This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, that represent the company’s current

expectations and beliefs. All statements other than statements of

historical fact are “forward-looking statements” for purposes of

federal and state securities laws and include, but are not limited

to, statements of management’s expectations regarding the macro

environment, business trends, the company’s performance, growth and

growth opportunities, investments, initiatives, rollout of the

enhanced sales performance compensation plan, new product

introductions, and performance of our Rhyz segments; projections

regarding revenue, expenses, tax rates, earnings per share, foreign

currency fluctuations, uses of cash and other financial items;

statements of belief; and statements of assumptions underlying any

of the foregoing. In some cases, you can identify these statements

by forward-looking words such as “believe,” “expect,” “anticipate,”

“accelerate,” “vision,” “continue,” “outlook,” “guidance,”

“improve,” “will,” “would,” “could,” “may,” “might,” the negative

of these words and other similar words.

The forward-looking statements and related assumptions involve

risks and uncertainties that could cause actual results and

outcomes to differ materially from any forward-looking statements

or views expressed herein. These risks and uncertainties include,

but are not limited to, the following:

- any failure of current or planned initiatives or products to

generate interest among the company’s sales force and customers and

generate sponsoring and selling activities on a sustained

basis;

- risk that direct selling laws and regulations in any of the

company’s markets, including the United States and Mainland China,

may be modified, interpreted or enforced in a manner that results

in negative changes to the company’s business model or negatively

impacts its revenue, sales force or business, including through the

interruption of sales activities, loss of licenses, increased

scrutiny of sales force actions, imposition of fines, or any other

adverse actions or events;

- economic conditions and events globally;

- competitive pressures in the company’s markets;

- risk that epidemics and related disruptions, or other crises

could negatively impact our business;

- adverse publicity related to the company’s business, products,

industry or any legal actions or complaints by the company’s sales

force or others;

- political, legal, tax and regulatory uncertainties, including

trade policies, associated with operating in Mainland China and

other international markets;

- uncertainty regarding meeting restrictions and other government

scrutiny in Mainland China, as well as negative media and consumer

sentiment in Mainland China on our business operations and

results;

- risk of foreign-currency fluctuations and the currency

translation impact on the company’s business associated with these

fluctuations;

- uncertainties regarding the future financial performance of the

businesses the company has acquired;

- risks related to accurately predicting, delivering or

maintaining sufficient quantities of products to support planned

initiatives or launch strategies, and increased risk of inventory

write-offs if the company over-forecasts demand for a product or

changes its planned initiatives or launch strategies;

- regulatory risks associated with the company’s products, which

could require the company to modify its claims or inhibit its

ability to import or continue selling a product in a market if the

product is determined to be a medical device or if the company is

unable to register the product in a timely manner under applicable

regulatory requirements; and

- the company’s future tax-planning initiatives, any prospective

or retrospective increases in duties or tariffs on the company’s

products imported into the company’s markets outside of the United

States, and any adverse results of tax audits or unfavorable

changes to tax laws in the company’s various markets.

The company’s financial performance and the forward-looking

statements contained herein are further qualified by a detailed

discussion of associated risks set forth in the documents filed by

the company with the Securities and Exchange Commission. The

forward-looking statements set forth the company’s beliefs as of

the date that such information was first provided, and the company

assumes no duty to update the forward-looking statements contained

in this release to reflect any change except as required by

law.

Non-GAAP Financial Measures: Constant-currency revenue

change is a non-GAAP financial measure that removes the impact of

fluctuations in foreign-currency exchange rates, thereby

facilitating period-to-period comparisons of the company’s

performance. It is calculated by translating the current period’s

revenue at the same average exchange rates in effect during the

applicable prior-year period and then comparing that amount to the

prior-year period’s revenue. The company believes that

constant-currency revenue change is useful to investors, lenders

and analysts because such information enables them to gauge the

impact of foreign-currency fluctuations on the company’s revenue

from period to period.

Earnings per share, gross margin, operating margin and income

tax rate, each excluding inventory write-off charges, restructuring

charges, the gain from the Mavely sale, and/or other charges, as

well as revenue growth rate excluding Mavely 2024 revenue, also are

non-GAAP financial measures.

- Inventory write-off charges and restructuring charges are not

part of the ongoing operations of our underlying business;

- Mavely revenue is no longer included in our operations

following our sale of this business on January 2, 2025; and

- the gain from the Mavely sale, legal accrual, and non-recurring

foreign tax charge that have been excluded in the non-GAAP

financial measures are not typical for our ongoing operations.

The company believes that these non-GAAP financial measures are

useful to investors, lenders and analysts because removing the

impact of these items facilitates period-to-period comparisons of

the company’s performance. Please see the reconciliations of these

items to our earnings per share, gross margin, operating margin,

income tax rate and revenue growth rate calculated under GAAP,

below.

The following table sets forth revenue for the three-month

periods ended December 31, 2024, and 2023 for each of our

reportable segments (U.S. dollars in thousands):

Three Months Ended

December 31,

Constant-Currency

2024

2023

Change

Change

Nu Skin

Americas

$

85,356

$

97,753

(12.7)%

3.8%

Southeast Asia/Pacific

64,925

66,889

(2.9)%

(3.4)%

Mainland China

56,438

71,516

(21.1)%

(21.2)%

Japan

47,512

50,966

(6.8)%

(3.8)%

Europe & Africa

42,600

47,892

(11.0)%

(10.1)%

South Korea

33,423

48,380

(30.9)%

(26.7)%

Hong Kong/ Taiwan

32,549

41,209

(21.0)%

(20.0)%

Other

(354)

(1,066)

66.8%

67.0%

Total Nu Skin

362,449

423,539

(14.4)%

(9.7)%

Rhyz

Manufacturing

47,882

50,363

(4.9)%

(4.9)%

Rhyz Other

35,221

14,738

139.0%

139.0%

Total Rhyz

83,103

65,101

27.7%

27.7%

Total

$

445,552

$

488,640

(8.8)%

(4.7)%

The following table sets forth revenue for the years ended

December 31, 2024, and 2023 for each of our reportable segments

(U.S. dollars in thousands):

Year Ended

December 31,

Constant-Currency

2024

2023

Change

Change

Nu Skin

Americas

$

322,516

$

398,222

(19.0)%

(8.2)%

Southeast Asia/Pacific

244,846

267,206

(8.4)%

(6.4)%

Mainland China

235,235

298,079

(21.1)%

(19.7)%

Japan

181,557

207,833

(12.6)%

(5.9)%

Europe & Africa

164,164

192,352

(14.7)%

(14.6)%

South Korea

163,706

236,099

(30.7)%

(27.7)%

Hong Kong/ Taiwan

130,610

153,589

(15.0)%

(13.3)%

Other

2,832

(858)

430.1%

430.3%

Total Nu Skin

1,445,466

1,752,522

(17.5)%

(13.2)%

Rhyz

Manufacturing

201,430

181,395

11.0%

11.0%

Rhyz Other

85,188

35,214

141.9%

141.9%

Total Rhyz

286,618

216,609

32.3%

32.3%

Total

$

1,732,084

$

1,969,131

(12.0)%

(8.2)%

The following table provides information concerning the number

of Customers, Paid Affiliates and Sales Leaders in our core Nu Skin

business for the three-month periods ended December 31, 2024, and

2023:

Three Months Ended

December 31,

2024

2023

Change

Customers

Americas

227,556

231,183

(2)%

Southeast Asia/Pacific

82,956

106,471

(22)%

Mainland China

150,731

207,276

(27)%

Japan

110,069

113,670

(3)%

Europe & Africa

133,306

163,178

(18)%

South Korea

81,301

103,151

(21)%

Hong Kong/Taiwan

46,053

52,110

(12)%

Total Customers

831,972

977,039

(15)%

Paid Affiliates

Americas

28,361

31,910

(11)%

Southeast Asia/Pacific(1)

26,310

34,404

(24)%

Mainland China

22,125

25,889

(15)%

Japan

22,318

22,417

—

Europe & Africa

16,860

18,888

(11)%

South Korea(1)

17,939

22,166

(19)%

Hong Kong/Taiwan

10,961

11,212

(2)%

Total Paid Affiliates

144,874

166,886

(13)%

Sales Leaders

Americas

6,778

7,126

(5)%

Southeast Asia/Pacific

5,288

6,418

(18)%

Mainland China

8,969

11,296

(21)%

Japan

6,780

7,086

(4)%

Europe & Africa

3,343

3,968

(16)%

South Korea

3,343

5,249

(36)%

Hong Kong/Taiwan

2,411

2,916

(17)%

Total Sales Leaders

36,912

44,059

(16)%

(1) The December 31, 2024, number is affected by a change in

eligibility requirements for receiving certain rewards within our

compensation structure, to more narrowly focus on those affiliates

who are actively building a consumer base. We plan to implement

these changes in additional segments over the next several

quarters. We estimate the change in eligibility requirements

resulted in a reduction of approximately 1 thousand for Southeast

Asia/Pacific and South Korea.

- “Customers” are persons who have purchased directly from the

Company during the three months ended as of the date indicated. Our

Customer numbers include members of our sales force who made such a

purchase, including Paid Affiliates and those who qualify as Sales

Leaders, but they do not include consumers who purchase directly

from members of our sales force.

- “Paid Affiliates” are any Brand Affiliates, as well as members

of our sales force in Mainland China, who earned sales compensation

during the three-month period. In all of our markets besides

Mainland China, we refer to members of our independent sales force

as “Brand Affiliates” because their primary role is to promote our

brand and products through their personal social networks.

- “Sales Leaders” are the three-month average of our monthly

Brand Affiliates, as well as sales employees and independent

marketers in Mainland China, who achieved certain qualification

requirements as of the end of each month of the quarter.

NU SKIN ENTERPRISES,

INC.

Consolidated Statements of

Income (Unaudited)

(U.S. dollars in thousands,

except per share amounts)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

Revenue

$

445,552

$

488,640

$

1,732,084

$

1,969,131

Cost of sales

166,405

136,215

550,233

611,850

Gross profit

279,147

352,425

1,181,851

1,357,281

Operating expenses:

Selling expenses

165,422

181,326

652,039

742,365

General and administrative expenses

120,930

145,033

479,037

546,858

Restructuring and impairment expenses

45,876

10,003

202,360

19,790

Total operating expenses

332,228

336,362

1,333,436

1,309,013

Operating income (loss)

(53,081)

16,063

(151,585)

48,268

Interest expense

5,864

7,368

26,409

25,560

Other income, net

1,143

633

2,943

3,870

Income (loss) before provision for income

taxes

(57,802)

9,328

(175,051)

26,578

Provision (benefit) for income taxes

(21,697)

2,046

(28,457)

17,983

Net income (loss)

$

(36,105)

$

7,282

$

(146,594)

$

8,595

Net income (loss) per share:

Basic

$

(0.73)

$

0.15

$

(2.95)

$

0.17

Diluted

$

(0.73)

$

0.15

$

(2.95)

$

0.17

Weighted-average common shares outstanding

(000s):

Basic

49,712

49,411

49,662

49,711

Diluted

49,712

49,479

49,662

49,860

NU SKIN ENTERPRISES,

INC.

Consolidated Balance Sheets

(Unaudited)

(U.S. dollars in thousands)

December 31,

2024

2023

ASSETS

Current assets

Cash and cash equivalents

$

186,883

$

256,057

Current investments

11,111

11,759

Accounts receivable, net

50,784

58,695

Inventories, net

190,242

279,978

Prepaid expenses and other

72,643

81,066

Current assets held for sale

26,936

14,316

Total current assets

538,599

701,871

Property and equipment, net

379,595

432,965

Operating lease right-of-use assets

72,605

90,107

Goodwill

83,625

218,166

Other intangible assets, net

74,278

95,260

Other assets

298,008

247,606

Long-term assets held for sale

22,204

22,651

Total assets

$

1,468,914

$

1,808,626

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities

Accounts payable

$

34,880

$

43,113

Accrued expenses

217,808

253,702

Current portion of long-term debt

30,000

25,000

Current liabilities held for sale

13,919

7,056

Total current liabilities

296,607

328,871

Operating lease liabilities

58,439

70,943

Long-term debt

363,613

478,040

Other liabilities

97,475

106,641

Long-term liabilities held for sale

1,325

2,163

Total liabilities

817,459

986,658

Commitments and contingencies

Stockholders’ equity

Class A common stock – 500 million shares

authorized, $0.001 par value, 90.6 million shares issued

91

91

Additional paid-in capital

627,787

621,853

Treasury stock, at cost – 40.8 million and

41.1 million shares

(1,563,614)

(1,570,440)

Accumulated other comprehensive loss

(124,758)

(100,006)

Retained earnings

1,711,949

1,870,470

Total stockholders’ equity

651,455

821,968

Total liabilities and stockholders’

equity

$

1,468,914

$

1,808,626

NU SKIN ENTERPRISES, INC.

Reconciliation of Gross Margin Excluding Impact of Inventory

Write-off to GAAP Gross Margin (in thousands, except for

percentages)

Three months ended December

31,

Year ended December

31,

2024

2023

2024

2023

Gross Profit

$

279,147

$

352,425

$

1,181,851

$

1,357,281

Impact of inventory write-off

38,765

-

38,765

65,728

Adjusted Gross Profit

$

317,912

$

352,425

$

1,220,616

$

1,423,009

Gross Margin

62.7%

72.1%

68.2%

68.9%

Gross Margin, excluding inventory

write-off impact

71.4%

72.1%

70.5%

72.3%

Revenue

$

445,552

$

488,640

$

1,732,084

$

1,969,131

NU SKIN ENTERPRISES, INC.

Reconciliation of Core Nu Skin Business Gross Margin Excluding

Impact of Inventory Write-off to GAAP Gross Margin (in

thousands, except for percentages)

Three months ended December

31,

2024

2023

Gross Profit

$

244,754

$

327,786

Impact of inventory write-off

32,704

-

Adjusted Gross Profit

$

277,458

$

327,786

Gross Margin

67.5%

77.4%

Gross Margin, excluding inventory

write-off impact

76.6%

77.4%

Revenue

$

362,449

$

423,539

NU SKIN ENTERPRISES, INC.

Reconciliation of Operating Margin Excluding Impact of Certain

Charges to GAAP Operating Margin (in thousands, except for

percentages)

Three months ended December

31,

Year ended December

31,

2024

2023

2024

2023

Operating Income

$

(53,081)

$

16,063

$

(151,585)

$

48,268

Impact of inventory write-off

38,765

-

38,765

65,728

Impact of restructuring and impairment

45,876

10,003

202,360

19,790

Impact of other charges(1)

2,940

5,260

2,940

5,260

Adjusted operating income

$

34,500

$

31,326

$

92,480

$

139,046

Operating margin

(11.9)%

3.3%

(8.8)%

2.5%

Operating margin, excluding impact of

restructuring and other charges

7.7%

6.4%

5.3%

7.1%

Revenue

$

445,552

$

488,640

$

1,732,084

$

1,969,131

(1) Other charges for the fourth quarter and full year 2024

consist of transaction-related expenses incurred related to the

sale of Mavely. Other charges for the fourth quarter and full year

2023 consist of a legal contingency ($3.0 million) and a

non-recurring foreign tax charge ($2.3 million).

NU SKIN ENTERPRISES, INC.

Reconciliation of Effective Tax Rate Excluding Impact of Certain

Charges to GAAP Effective Tax Rate (in thousands, except for

percentages)

Three months ended December

31,

Year ended December

31,

2024

2023

2024

2023

Provision (benefit) for income taxes

$

(21,697)

$

2,046

$

(28,457)

$

17,983

Impact of restructuring on provision for

income taxes

32,604

4,081

55,674

7,324

Provision for income taxes, excluding

impact of restructuring

$

10,907

$

6,127

$

27,217

$

25,307

Income (loss) before provision for income

taxes

(57,802)

9,328

(175,051)

26,578

Impact of inventory write-off

38,765

-

38,765

65,728

Impact of restructuring and impairment

45,876

10,003

202,360

19,790

Impact of other charges(1)

2,940

5,260

2,940

5,260

Income before provision for income taxes,

excluding impact of restructuring and other charges

$

29,779

$

24,591

$

69,014

$

117,356

Effective tax rate

37.5%

21.9%

16.3%

67.7%

Effective tax rate, excluding impact of

restructuring and other charges

36.6%

24.9%

39.4%

21.6%

(1) Other charges for the fourth quarter and full year 2024

consist of transaction-related expenses incurred related to the

sale of Mavely. Other charges for the fourth quarter and full year

2023 consist of a legal contingency ($3.0 million) and a

non-recurring foreign tax charge ($2.3 million).

NU SKIN ENTERPRISES, INC.

Reconciliation of Earnings Per Share Excluding Impact of Certain

Charges to GAAP Earnings Per Share (in thousands, except for

per share amounts)

Three months ended December

31,

Year ended December

31,

2024

2023

2024

2023

Net income

$

(36,105)

$

7,282

$

(146,594)

$

8,595

Impact of Inventory Write-off:

Inventory write-off

38,765

-

38,765

65,728

Tax impact

(14,643)

-

(14,643)

(4,866)

Impact of restructuring and impairment

expense:

Restructuring and impairment

45,876

10,003

202,360

19,790

Tax impact

(17,329)

(3,088)

(40,399)

(1,465)

Impact of other charges(1)

Impact of other charges

2,940

5,260

2,940

5,260

Tax impact

(632)

(993)

(632)

(993)

Adjusted net income

$

18,872

$

18,464

$

41,797

$

92,049

Diluted earnings per share

$

(0.73)

$

0.15

$

(2.95)

$

0.17

Diluted earnings per share, excluding

impact of restructuring and other charges

$

0.38

$

0.37

$

0.84

$

1.85

Weighted-average common shares outstanding

(000)

49,712

49,479

49,662

49,860

(1) Other charges for the fourth quarter and full year 2024

consist of transaction-related expenses incurred related to the

sale of Mavely. Other charges for the fourth quarter and full year

2023 consist of a legal contingency ($3.0 million) and a

non-recurring foreign tax charge ($2.3 million).

NU SKIN ENTERPRISES, INC.

Reconciliation of Earnings Per Share Excluding Impact of Mavely

Sale to GAAP Earnings Per Share

Three months ended March 31,

2025

Year ended December 31,

2025

Low end

High end

Low end

High end

Earnings Per Share

$

2.65

$

2.75

$

3.45

$

3.85

Impact of Mavely Sale:

Pre-tax Mavely sale gain

(3.40)

(3.40)

(3.40)

(3.40)

Tax impact

0.85

0.85

0.85

0.85

Adjusted EPS

$

0.10

$

0.20

$

0.90

$

1.30

NU SKIN ENTERPRISES, INC.

Reconciliation of Revenue Growth Rates Excluding Mavely 2024

Revenue to GAAP Revenue Growth Rates

(in thousands, except for

percentages)

Three months ended March 31,

2025

Year ended December 31,

2025

Low end

High end

Low end

High end

2024 Revenue

$

417,306

$

417,306

$

1,732,084

$

1,732,084

Less: Mavely 2024 Revenue

6,970

6,970

69,620

69,620

2024 Revenue, excluding Mavely

$

410,336

$

410,336

$

1,662,464

$

1,662,464

Revenue Growth Rate

(17)%

(13)%

(15)%

(6)%

Revenue Growth Rate, excluding Mavely 2024

Revenue

(16)%

(11)%

(11)%

(3)%

2025 Forecasted Revenue

$

345,000

$

365,000

$

1,480,000

$

1,620,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213536488/en/

Media: media@nuskin.com, (801) 345-6397 Investors:

investorrelations@nuskin.com, (801) 345-3577

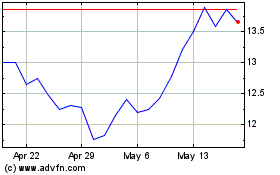

Nu Skin Enterprises (NYSE:NUS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Nu Skin Enterprises (NYSE:NUS)

Historical Stock Chart

From Feb 2024 to Feb 2025