As filed with the Securities and Exchange Commission

on December 23, 2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NatWest

Group plc

(Exact Name of Registrant as Specified in Its Charter)

United Kingdom

(State or Other Jurisdiction of Incorporation or Organization)

Not Applicable

(I.R.S. Employer Identification No.)

250 Bishopsgate, London, EC2M 4AA

United Kingdom

+44 (0) 207 085 5143

(Address and Telephone Number of Registrant’s Principal Executive Offices)

CT Corporation System

28 Liberty St.

New York, NY 10005

United States

(212) 590-9070

(Name, Address and Telephone Number of Agent for Service)

Please send copies of all

communications to:

Reuven B. Young

Davis Polk & Wardwell London LLP

5 Aldermanbury Square

London EC2V 7HR

England

Tel. No.: 011-44-20-7418-1300 |

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following

box. x

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

PROSPECTUS

NATWEST GROUP plc

DEBT SECURITIES

DOLLAR PREFERENCE SHARES

CONTINGENT CONVERTIBLE SECURITIES

ORDINARY SHARES

RIGHTS TO SUBSCRIBE FOR ORDINARY SHARES

AMERICAN DEPOSITARY SHARES

By this prospectus we may offer from time to time,

together or separately, debt securities, including senior debt securities and subordinated debt securities, dollar preference shares (directly

or in the form of American depositary shares), contingent convertible securities, ordinary shares (directly or in the form of American

depositary shares) and rights to subscribe for ordinary shares (directly or in the form of American depositary shares). Our ordinary shares

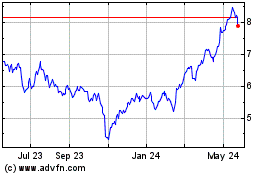

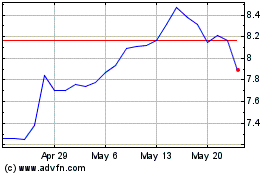

are listed on the London Stock Exchange under the symbol “NWG”. Our American depositary shares, or ADSs, each representing

two ordinary shares (or a right to receive two ordinary shares), are listed on the New York Stock Exchange under the symbol “NWG”.

We will provide the specific terms of these securities,

and the manner in which they will be offered, in one or more supplements to this prospectus. Any supplement may also add, update or change

information contained, or incorporated by reference, into this prospectus.

You should carefully read this prospectus and

the applicable prospectus supplement, together with the additional information described under the headings “Where You Can Find

More Information” and “Incorporation of Documents by Reference”, before investing in our securities. The amount and

price of the offered securities will be determined at the time of the offering. We may sell these securities to or through underwriters,

and also to other purchasers or through agents. The names of the underwriters will be set forth in the accompanying prospectus supplement.

Investing in our securities involves risks

that are described in the “Risk Factors” section beginning on page 2.

The debt securities and the contingent convertible

securities may be subject to the exercise of the U.K. bail-in power by the relevant U.K. resolution authority as described herein and

in the applicable prospectus supplement for such debt securities or contingent convertible securities.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined that this prospectus is truthful or

complete. Any representation to the contrary is a criminal offense.

This prospectus may not be used to sell securities

unless it is accompanied by a prospectus supplement.

The date of this prospectus is

December 23, 2024.

TABLE OF CONTENTS

Page

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

on Form F-3 that we filed with the Securities and Exchange Commission (“SEC”) using a “shelf” registration process.

Under this shelf registration process, we may from time to time sell any combination of the securities described in this prospectus in

one or more offerings in one or more foreign currencies or currency units.

This prospectus provides you with a general description

of the debt securities, dollar preference shares, contingent convertible securities, ordinary shares, rights to subscribe for ordinary

shares and the American depositary shares, which we will refer to collectively as the “securities”. Each time we sell securities,

we will provide a prospectus supplement that will contain, among others, specific information about the terms of that offering and the

risks relating to that offering. The prospectus supplement will provide information regarding certain tax consequences of the purchase,

ownership and disposition of the offered securities. The prospectus supplement may also add to, update or change information contained

in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should

rely on the information in that prospectus supplement. We will file each prospectus supplement with the SEC. You should read both this

prospectus and the applicable prospectus supplement, together with the additional information described under the headings “Where

You Can Find More Information” and “Incorporation of Documents by Reference”.

The registration statement containing this prospectus,

including exhibits to the registration statement, provides additional information about us and the securities we may offer under this

prospectus. The registration statement can be read at the SEC’s offices or obtained from the SEC’s website mentioned under

the heading “Where You Can Find More Information”.

Certain Terms

In this prospectus, the terms “we”,

“our” and “us” means NatWest Group plc and the term “NatWest Group” means NatWest Group plc and its

subsidiaries.

NatWest Group plc publishes its consolidated financial

statements in pounds sterling (“£” or “sterling”), the lawful currency of the United Kingdom. In this prospectus

and any prospectus supplement, references to “dollars” and “$” are to United States dollars.

USE OF PROCEEDS

Unless we have disclosed a specific plan in the

accompanying prospectus supplement, we will use the net proceeds from the sale of the securities we may offer by this prospectus for general

corporate purposes. NatWest Group has raised capital in various markets from time to time and we expect to continue to raise capital in

such markets and at such times as we consider appropriate.

NATWEST GROUP PLC

NatWest Group plc is a public limited company

incorporated in Scotland with registration number SC045551. NatWest Group plc was incorporated under Scots law on March 25, 1968. NatWest

Group plc is the holding company of a large banking and financial services group. Headquartered in Edinburgh, NatWest Group plc operates

primarily in the United Kingdom through a network of branches, local banks and non-bank subsidiaries. NatWest Group’s main operating

companies include National Westminster Bank Plc, NatWest Markets Plc, The Royal Bank of Scotland plc and Coutts & Co. NatWest Group

has a diversified customer base and provides a wide range of products and services to personal, commercial and large corporate and institutional

customers. At September 30, 2024, His Majesty’s Treasury’s (“HM Treasury”) percentage of total voting rights held

in NatWest Group plc was 16.92%.

NatWest Group plc’s registered office is

36 St Andrew Square, Edinburgh EH2 2YB, Scotland and its principal place of business is 250 Bishopsgate, London, EC2M 4AA, United Kingdom,

telephone +44 (0) 207 085 5143.

You can find a more detailed description of NatWest

Group’s business in our annual report on Form 20-F for the year ended December 31, 2023, filed with the SEC on February 23, 2024

(the “2023 Annual Report”), which is incorporated by reference in this prospectus, or similar subsequent filings incorporated by

reference in this prospectus.

RISK

FACTORS

Investing

in the securities offered using this prospectus involves risk. You should consider carefully the risks described below, together with

the risks described in the documents incorporated by reference into this prospectus and any risk factors included in the prospectus supplement,

before you decide to buy our securities. If any of these risks actually occur, our business, financial condition and results of operations

could suffer, and the trading price and liquidity of the securities offered using this prospectus could decline, in which case you may

lose all or part of your investment.

Additional

risks, if any, specific to a potential offering of class of securities issued under this prospectus will be set out in the applicable

prospectus supplement. Terms relating to debt securities or contingent convertible securities used but not defined in these risk factors

have the meaning ascribed thereto in the relevant indenture in respect of these securities.

Risks relating to NatWest Group plc and NatWest Group

For a description of the risks associated with

NatWest Group plc and NatWest Group, including certain risks associated with investments in NatWest Group plc’s securities, please

refer to the “Risk Factors” section in our 2023 Annual Report and the “NatWest Group plc Summary Risk Factors”

section in our interim report on Form 6-K for the six months ended June 30, 2024, filed with the SEC on July 26, 2024 (the “H1 Interim

Report”), which are incorporated by reference in this prospectus or similar sections in subsequent filings incorporated by reference

in this prospectus.

Risks relating to NatWest Group plc’s Shares Generally

NatWest Group plc’s shares (including

ordinary shares, dollar preference shares and rights to receive ordinary shares) and American depositary shares may experience volatility

which will negatively affect your investment.

In recent years major stock markets have experienced

varying degrees of price and trading volume fluctuations. These fluctuations have sometimes been, and may again be, unrelated or disproportionate

to the operating performance of the relevant companies. There could be significant fluctuations in the price of our shares and ADSs, even

if our operating results meet the expectations of the investment community. In addition, the following factors, among others, could cause

the market price of our shares and ADSs to fluctuate significantly:

| · | announcements by NatWest Group or its competitors relating to operating results, earnings, acquisitions or joint ventures, capital

commitments or spending; |

| · | changes in financial estimates or investment recommendations by securities analysts; |

| · | changes in market valuations of other peer banks; |

| · | changes in interest rates; |

| · | adverse economic performance or recession in the countries or markets in which we operate; or |

| · | disruptions in trading on major stock markets. |

As a result of these and other factors, you

may be unable to sell your shares and ADSs at or above the price you purchased at due to fluctuations in the market price.

You may be unable to recover in civil

proceedings for U.S. securities laws violations.

NatWest Group plc is incorporated under the

laws of Scotland. Substantially all of our directors and officers, and the experts named in this prospectus, reside outside the United

States, principally in the United Kingdom. All or a substantial portion of our assets, and the assets of such persons, are located outside

the United States. Therefore, you may not be able to effect service of process within the United States upon us or these persons so that

you may

enforce judgments of U.S. courts against us

or these persons based on the civil liability provisions of the U.S. federal securities laws.

Risks relating to the Debt Securities and Contingent Convertible

Securities Generally

The debt securities and contingent

convertible securities contain very limited Defaults and Events of Default provisions, and the remedies available thereunder are limited.

The debt securities and contingent convertible

securities contain very limited Defaults and Events of Default provisions, and the remedies available thereunder are limited. The sole

remedy available to the Trustee against the Issuer in case of a “Default”, being the failure to pay principal or interest

on the debt securities or contingent convertible securities when it otherwise becomes due and payable (following the expiration of a specified

grace period), is that the Trustee may commence a proceeding for our winding up and/or prove in our winding up. The Trustee may not, however,

upon the occurrence of a Default, declare the principal amount of any outstanding debt securities or contingent convertible securities

due and payable. While holders of the debt securities or contingent convertible securities will similarly not be able to accelerate a

repayment of the principal amount of the debt securities or contingent convertible securities upon the occurrence of a Default, such holders

shall have the right to sue for any payments that are due but unpaid.

An Event of Default will only occur if an order

is made for our winding up which is not successfully appealed within 30 days or upon a valid adoption by our shareholders of an effective

resolution for our winding up (in each case other than under or in connection with a scheme of amalgamation or reconstruction not involving

bankruptcy or insolvency). On the occurrence of such an Event of Default, the Trustee and the holders of the debt securities or contingent

convertible securities have only limited enforcement remedies. If such an Event of Default with respect to the debt securities or contingent

convertible securities occurs and is continuing, the Trustee or the holders of at least 25% in aggregate principal amount of the outstanding

debt securities or contingent convertible securities may declare the principal amount of, and any accrued but unpaid interest on, the

debt securities or contingent convertible securities to be due and payable immediately.

Prior to the occurrence of an Event of Default,

the debt securities and contingent convertible securities are subject to bail-in in the event the U.K. bail-in power is exercised. As

a result, during such time as the Trustee is seeking to cause our winding up, your claims in such winding up could be reduced to zero.

The Banking Act confers substantial powers

on relevant UK authorities designed to enable them to take a range of actions in relation to UK banks or investment firms and certain

of their affiliates in the event a bank or investment firm in the same group is considered to be failing or likely to fail. The exercise

of any of these actions in relation to NatWest Group plc or any entity within NatWest Group could materially adversely affect the value

of the debt securities and contingent convertible securities.

Under the Banking Act, substantial powers are

granted to the Bank of England (or, in certain circumstances, HM Treasury), in consultation with the Prudential Regulation Authority (“PRA”),

the Financial Conduct Authority and HM Treasury, as appropriate as part of a special resolution regime (the “SRR”). These

powers enable the relevant UK authority to implement resolution measures with respect to a UK bank or investment firm and certain of its

affiliates (including, for example, NatWest Group plc) (each a “relevant entity”) in circumstances in which the relevant UK

authority is satisfied that the resolution conditions are met. Under the applicable regulatory framework and pursuant to guidance issued

by the Bank of England, governmental financial support, if any is provided, would only be used as a last resort measure where a serious

threat to financial stability cannot be avoided by other measures (such as the stabilization options described below, including the UK

bail-in power) and subject to the limitations set out in the Banking Act.

The Banking Act grants broad powers to the relevant

UK authorities and the application of such powers, or any suggestion of such application, could have a material adverse effect on the

value or trading liquidity of the debt securities and contingent convertible securities or the rights of holders under the debt securities

and contingent convertible securities and could lead to holders of the debt securities and contingent convertible securities losing some

or all of the value of their investment in the debt securities and contingent convertible securities. These powers include the ability

to (i) modify or cancel contractual arrangements to which an entity in resolution is party, in certain circumstances; (ii) suspend or

override the enforcement provisions or termination rights that might be invoked by counterparties facing an entity in resolution, as a

result of the exercise of the resolution powers; and (iii)

disapply or modify laws in the UK (with possible retrospective effect)

to enable the powers under the Banking Act to be used effectively.

The exercise of the stabilization options or other

powers conferred on the relevant UK authority under the Banking Act with respect to us, or any suggestion of any such exercise, could

have a material adverse effect on the value or trading liquidity of the debt securities and contingent convertible securities or your

rights under the debt securities and contingent convertible securities and could lead to holders of the debt securities and contingent

convertible securities losing some or all of the value of their investment in the debt securities and contingent convertible securities.

Additional Risks Relating to Subordinated Debt

Securities Generally

NatWest Group’s obligations

under the subordinated debt securities are subordinated

The

obligations of NatWest Group plc under the subordinated debt securities will be unsecured and subordinated and will rank junior in priority

of payment to the current and future claims of NatWest Group plc’s creditors, other than claims in respect of any liability that

ranks, or is expressed to rank, junior to or pari passu with

the subordinated debt securities. We expect from time to time to incur additional indebtedness or other obligations that will constitute

senior indebtedness, and the indenture governing the subordinated debt securities does not contain any provisions restricting our ability

to incur senior indebtedness or the amount thereof. Although the subordinated debt securities may pay a higher rate of interest than comparable

notes which are not so subordinated, there is a risk that an investor in such subordinated debt securities will lose all or some of its

investment if NatWest Group plc becomes insolvent since the assets of NatWest Group plc would be available to pay such amounts only after

all the senior creditors of NatWest Group have been paid in full.

On

December 19, 2018, the Banks and Building Societies (Priorities on Insolvency) Order 2018 (the “Order”), came into effect.

The Order implements certain amendments to the BRRD in the U.K. as regards the ranking of unsecured debt instruments in insolvency hierarchy.

Specifically, the Order inserts a new section in the U.K. Insolvency Act 1986 as may be amended from time to time (including, without

limitation, by the Order) (the “Insolvency Act”) that splits a financial institution’s non-preferential debts into classes,

and provides that ordinary non-preferential debts will rank ahead of secondary non-preferential debts and tertiary non-preferential debts.

The subordinated debt securities would constitute tertiary non-preferential debts under the Insolvency Act, and therefore both ordinary

and secondary non-preferential debts would continue to rank ahead of claims in respect of the subordinated debt securities. Although the

Order was subsequently repealed by the Financial Services and Markets Act 2023, the relevant amendments to the Insolvency Act remain in

force.

Additional Risks Relating to the Contingent

Convertible Securities Generally

The contingent convertible securities are

complex financial instruments that involve a high degree of risk and may not be a suitable investment for all investors.

The contingent convertible

securities are complex financial instruments that involve a high degree of risk. As a result, an investment in the contingent convertible

securities will involve certain increased risks compared to other categories of securities. Each potential investor of the contingent

convertible securities must determine the suitability (either alone or with the help of a financial adviser) of that investment in light

of its own circumstances. In particular, each potential investor should:

| (i) | have sufficient knowledge and experience to make a meaningful evaluation of the contingent convertible

securities, the merits and risks of investing in the contingent convertible securities and the information contained or incorporated by

reference in this prospectus supplement or any applicable supplement to this prospectus supplement; |

| (ii) | have access to, and knowledge of, appropriate analytical tools to evaluate, in the context of its particular

financial situation, an investment in the contingent convertible securities and the impact such investment will have on its overall investment

portfolio; |

| (iii) | have sufficient financial resources and liquidity to bear all of the risks of an investment in the contingent

convertible securities, including where the currency for principal or interest payments, i.e., US dollars, is different from the currency

in which such potential investor’s financial activities are principally denominated |

| | and the possibility that the entire principal

amount of the contingent convertible securities could be lost, including following the exercise by the relevant UK resolution authority

of any resolution powers; |

| (iv) | understand thoroughly the terms of the contingent convertible securities, such as the provisions governing

cancellation of interest, and be familiar with the behaviour of any relevant indices and financial markets and the resolution regime applicable

to NatWest Group, including the possibility that the contingent convertible securities may become subject to write-down or conversion

if the resolution powers or UK bail in powers are exercised; |

| (v) | be able to evaluate (either alone or with the help of a financial adviser) possible scenarios for economic,

interest rate and other factors that may affect its investment and its ability to bear the applicable risks; and |

| (vi) | understand the accounting, legal, regulatory and tax implications of a purchase, and the holding and disposal

of an interest in the contingent convertible securities. |

Sophisticated investors generally

do not purchase complex financial instruments that bear a high degree of risk as stand-alone investments. They purchase such financial

instruments as a way to enhance yield with an understood, measured, appropriate addition of risk to their overall portfolios. A potential

investor should not invest in the contingent convertible securities unless it has the knowledge and expertise (either alone or with a

financial advisor) to evaluate how the contingent convertible securities will perform under changing conditions and the impact this investment

will have on the potential investor’s overall investment portfolio. Prior to making an investment decision, potential investors

should consider carefully, in light of their own financial circumstances and investment objectives, all the information contained in this

prospectus supplement and the base prospectus or incorporated by reference herein.

The contingent convertible securities have no scheduled

maturity and no fixed redemption date and you do not have the right to cause the contingent convertible securities to be redeemed or otherwise

accelerate the repayment of the principal amount of the contingent convertible securities except in very limited circumstances.

The contingent convertible securities are perpetual

securities and have no fixed maturity date or fixed redemption date and holders and beneficial owners of the contingent convertible securities

may not request any redemption of the contingent convertible securities at any time. Although under certain circumstances we may redeem

the contingent convertible securities, we are under no obligation to do so and you have no right to call for their redemption.

There is no right of acceleration in the case

of any non-payment of principal of, or interest on, the contingent convertible securities or in the case of a failure by us to perform

any other covenant under the contingent convertible securities or under the indenture governing the contingent convertible securities.

Accordingly, we are not required to make any repayment of the principal amount of Notes at any time or under any circumstances other than

in certain situations.

DESCRIPTION OF

DEBT SECURITIES

The following is a summary of the general terms

that will apply to any senior debt securities and subordinated debt securities that may be offered by NatWest Group plc. Consequently,

when we refer to “debt securities” in this prospectus, we mean the senior debt securities and the subordinated debt securities

that may be issued by NatWest Group plc. The term “debt securities” does not include the “contingent convertible securities”

described under “Description of Contingent Convertible Securities”.

Each time that we issue debt securities, we

will file a prospectus supplement with the SEC, which you should read carefully. The prospectus supplement will summarize specific terms

of your security and may contain additional terms of those debt securities to those described in this

prospectus or terms that differ from those described in this prospectus. The terms presented here, together with the terms contained in

the prospectus supplement, will be a description of the material terms of the debt securities, but if there is any inconsistency between

the terms presented here and those in the prospectus supplement, those in the prospectus supplement will apply and will replace those

presented here. Therefore, the statements we make below in this section may not apply to your debt security. You should also read the indentures under

which we will issue the debt securities, which we have filed with the SEC as exhibits to the registration statement of which this prospectus

is a part.

Senior debt securities will be issued by NatWest

Group plc under the senior debt indenture as supplemented by supplemental indentures as required. Subordinated debt securities will be

issued by NatWest Group plc under the subordinated debt indenture as supplemented by supplemental indentures as required. Each indenture

is a contract between us and The Bank of New York Mellon, as trustee. None of the indentures limit our ability to incur additional indebtedness,

including additional senior indebtedness.

The summary below does not describe every aspect

of the indentures or the debt securities and is subject to and qualified in its entirety by reference to all the provisions of the indentures.

General

The debt securities are not deposits and are not

insured or guaranteed by the U.S. Federal Deposit Insurance Corporation or any other government agency of the United States or the United

Kingdom.

The indentures do not limit the amount of debt

securities that we may issue. We may issue debt securities in one or more series. The relevant prospectus supplement for any particular

series of debt securities will describe the terms of the offered debt securities, including some or all of the following terms:

| · | whether they are senior debt securities or subordinated debt securities; |

| · | with respect to the subordinated debt securities, whether the payment of interest can be deferred, whether the payment of principal

can be deferred, the subordination terms, the redemption terms and the events of default applicable to each series of the subordinated

debt securities; |

| · | their specific designation, authorized denomination and aggregate principal amount; |

| · | the price or prices at which they will be issued; |

| · | whether such debt securities will be dated debt securities with a specified maturity date or undated debt securities with no specified

maturity date; |

| · | the annual interest rate or rates, or how to calculate the interest rate or rates; |

| · | the date or dates from which interest, if any, will accrue or the method, if any, by which such date or dates will be determined; |

| · | the times and places at which any interest payments are payable; |

| · | the terms of any mandatory or optional redemption, including the amount of any premium; |

| · | any modifications or additions to the events of default with respect to the debt securities offered; |

| · | any provisions relating to conversion or exchange for other securities issued by us; |

| · | the currency or currencies in which they are denominated and in which we will make any payments; |

| · | any index used to determine the amount of any payments on the debt securities; |

| · | any restrictions that apply to the offer, sale and delivery of the debt securities and the exchange of debt securities of one form

for debt securities of another form; |

| · | whether and under what circumstances, if other than those described in this prospectus, we will pay additional amounts on the debt

securities following certain developments with respect to withholding tax or information reporting laws and whether, and on what terms,

if other than those described in this prospectus, we may redeem the debt securities following those developments; |

| · | the terms of any mandatory or optional exchange; and |

| · | any listing on a securities exchange. |

In addition, the prospectus supplement will describe

the material U.S. federal and U.K. tax considerations that apply to any particular series of debt securities.

Debt securities may bear interest at a fixed rate,

a floating rate or a combination thereof. We will sell any subordinated debt securities that bear no interest, or that bear interest at

a rate that at the time of issuance is below the prevailing market rate, at a discount to their stated principal amount.

Holders of debt securities shall have no voting

rights except those described under the heading “ –Modification and Waiver” below.

If we issue senior debt securities designed

to count towards the EU minimum requirements for own funds and eligible liabilities framework, the terms (including the events of default

and redemption options) of those securities in particular may differ from those described in this prospectus and will be set out in the

relevant prospectus supplement.

If we issue subordinated debt securities that

qualify as Tier 2 capital or other capital for regulatory purposes, the payment, subordination, redemption, events of default and other

terms may vary from those described in this prospectus and will be set forth in the relevant prospectus supplement.

Payments

We will make any payments of interest and principal,

on any particular series of debt securities on the dates and, in the case of payments of interest, at the rate or rates, that we set out

in, or that are determined by the method of calculation described in, the relevant prospectus supplement.

Subordinated Debt Securities

Unless the relevant prospectus supplement provides

otherwise, if we do not make a payment on a series of subordinated debt securities on any payment date, our obligation to make such payment

shall be deferred and such failure to make a payment does not create a default under the applicable subordinated debt indenture. The relevant

prospectus supplement will set forth the terms on which the payment of interest and principal on the subordinated debt securities can

be deferred and any other terms relating to payments on subordinated debt securities.

Subordination

Senior Debt Securities

Unless the relevant prospectus supplement provides

otherwise, senior debt securities constitute our direct, unconditional, unsecured and unsubordinated obligations ranking pari passu, without

any preference among themselves, with all of our other outstanding unsecured and unsubordinated obligations, present and future, except

such obligations as are preferred by operation of law.

Subordinated Debt Securities

If we issue subordinated debt securities, the

applicable prospectus supplement relating to the subordinated debt securities will include a description of the subordination provisions

that apply to the subordinated debt securities.

Unless the relevant prospectus supplement provides

otherwise, in a winding-up or qualifying administration, all payments on any series of subordinated debt securities will be subordinate

to, and subject in right of payment to the prior payment in full of, all claims of all of our creditors other than claims in respect of

any liability that is, or is expressed to be, subordinated, whether only in the event of a winding-up,

qualifying administration or otherwise, to the claims of all or any of our creditors, in the manner provided in the applicable subordinated

debt indenture.

General

As a consequence of these subordination provisions,

if winding-up proceedings or a qualifying administration should occur, each holder of subordinated debt securities may recover less ratably

than the holders of our unsubordinated liabilities (including holders of senior debt securities). If, in any winding-up or qualifying

administration, the amount payable on any series of debt securities and any claims ranking equally with that series are not paid in full,

those debt securities and other claims ranking equally will share ratably in any distribution of our assets in a winding-up or a qualifying

administration in proportion to the respective amounts to which they are entitled. If any holder is entitled to any recovery with respect

to the debt securities in any winding-up, liquidation or qualifying administration, the holder might not be entitled in those proceedings

to a recovery in U.S. dollars and might be entitled only to a recovery in pounds sterling or any other lawful currency of the United Kingdom.

In addition, because NatWest Group plc is a holding

company, its rights to participate in the assets of any subsidiary as a shareholder if such subsidiary is liquidated will be subject to

the prior claims of such subsidiary’s creditors.

Additional Amounts

All amounts to be paid by us on any series of

debt securities will be paid without deduction or withholding for, or on account of, any and all present and future income, stamp and

other taxes, levies, imposts, duties, charges, fees, deductions or withholdings now or hereafter imposed, levied, collected, withheld

or assessed by or on behalf of the United Kingdom or any political subdivision or any authority thereof or therein having the power to

tax (the “U.K. Taxing Jurisdiction”), unless such deduction or withholding is required by law.

Unless otherwise specified in the relevant prospectus

supplement, if deduction or withholding of any such taxes, levies, imposts, duties, charges, fees, deductions or withholdings shall at

any time be required by the U.K. Taxing Jurisdiction, we will pay such additional amounts with respect to the principal of, premium, if

any, and interest, if any, on any series of debt securities (“Additional Amounts”) as may be necessary in order that the net

amounts paid to the holders of the debt securities of the particular series, after such deduction or withholding, shall equal the amounts

of such payments which would have been payable in respect of such debt securities had no such deduction or withholding been required;

provided, however, that the foregoing will not apply to any such tax, levy, impost, duty, charge, fee, deduction or withholding that would

not have been payable or due but for the fact that:

(i) the holder or the beneficial owner of the

debt security is a domiciliary, national or resident of, or engaging in business or maintaining a permanent establishment or physically

present in, the U.K. Taxing Jurisdiction or otherwise has some connection with the U.K. Taxing Jurisdiction other than the mere holding

or ownership of a debt security, or the collection of the payment on any debt security of the relevant series,

(ii) except in the case of a winding-up of us

in the United Kingdom, the relevant debt security is presented (where presentation is required) for payment in the United Kingdom,

(iii) the relevant debt security is presented

(where presentation is required) for payment more than 30 days after the date payment became due or was provided for, whichever is later,

except to the extent that the holder would have been entitled to such Additional Amount on presenting (where presentation is required)

the debt security for payment at the close of such 30 day period,

(iv) the holder or the beneficial owner of the

relevant debt security or the payment on such debt security failed to comply with a request by us or our liquidator or other authorized

person addressed to the holder (x) to provide information concerning the nationality, residence or identity of the holder or such beneficial

owner or (y) to make any declaration or other similar claim to satisfy any requirement, which in the case of (x) or (y), is required or

imposed by a statute, treaty, regulation or administrative practice of the U.K. Taxing Jurisdiction as a precondition to exemption or

relief from all or part of such deduction or withholding,

(v) the withholding or deduction is required to

be made pursuant to Sections 1471 through 1474 of the U.S. Internal Revenue Code of 1986, as amended, any agreement with the U.S. Treasury

entered into with respect thereto, any U.S. Treasury regulation issued thereunder or any other official interpretations or guidance issued

with respect thereto; any intergovernmental agreement entered into with

respect thereto, or any law, regulation, or other official interpretation or guidance promulgated pursuant to such an intergovernmental

agreement, or

(vi) any combination of subclauses (i) through

(v) above,

nor shall Additional Amounts be paid with respect to a payment on the

debt security to any holder who is a fiduciary or partnership or person other than the sole beneficial owner of such payment to the extent

such payment would be required by the laws of the U.K. Taxing Jurisdiction to be included in the income for tax purposes of a beneficiary

or settlor with respect to such fiduciary or a member of such partnership or a beneficial owner who would not have been entitled to such

Additional Amounts, had it been the holder.

As used in this “Additional Amounts”

section, the term “payment” means, in the context of senior debt securities and subordinated debt securities, payments of

principal of, premium, if any, and interest, if any, on such securities. Whenever in this prospectus or any prospectus supplement there

is mentioned, in the context of senior debt securities or subordinated debt securities, the payment of the principal, premium, if any,

or interest, if any, on, or in respect of, any such security of any series, such mention shall be deemed to include mention of the payment

of Additional Amounts provided for in this “Additional Amounts” section to the extent that, in such context, Additional Amounts

are, were or would be payable in respect thereof pursuant to the provisions of this section and as if express mention of the payment of

Additional Amounts (if applicable) were made in any provisions hereof where such express mention is not made.

Redemption

Unless the relevant prospectus supplement provides

otherwise, we will have the option to redeem the debt securities of any series as a whole upon (i) not less than 15 business days, and

not more than 30 calendar days’ notice in respect of the senior debt securities, or (ii) not less than 15 days, and not more than

30 days’ notice in respect of our subordinated debt securities, to each holder of debt securities, on any payment date, at a redemption

price equal to 100% of their principal amount together with any accrued but unpaid payments of interest, if any (including any deferred

amounts in the case of subordinated debt securities), to the redemption date, or, in the case of discount securities, their accreted face

amount, together with any accrued interest, if, at any time, we determine that as a result of a change in or amendment to the laws or

regulations of a U.K. Taxing Jurisdiction, including any treaty to which it is a party, or a change in an official application or interpretation

of those laws or regulations, including a decision of any court or tribunal, which becomes effective on or after the date specified in

the terms of the debt securities:

| · | in making any payments on the particular series of debt securities, we have paid or will or would on the next payment date be required

to pay Additional Amounts; |

| · | payments on the next payment date in respect of any of the series of debt securities would be treated as “distributions”

within the meaning of Section 1000 of the Corporation Tax Act 2010 of the United Kingdom (or any statutory modification or re-enactment

thereof for the time being); or |

| · | on the next payment date we would not be entitled to claim a deduction in respect of the payments in computing our U.K. taxation liabilities,

or the value of the deduction to us would be materially reduced. |

In each case we shall be required, before we give a notice of redemption, to deliver to the trustee a written legal opinion of independent English counsel of

recognized standing, selected by us, in a form satisfactory to the trustee confirming that we are entitled to exercise our right of redemption.

The relevant prospectus supplement will specify

whether or not we may redeem the debt securities of any series, in whole or in part, at our option, including any conditions to our right

to exercise such option, in any other circumstances and, if so, the prices and any premium at which and the dates on which we may do so.

Any notice of redemption of debt securities of any series will state, among other items:

| · | the amount of debt securities to be redeemed if less than all of the series is to be redeemed; |

| · | that, and subject to what conditions, the redemption price will become due and payable on the redemption date and that payments will

cease to accrue on such date; |

| · | the place or places at which each holder may obtain payment of the redemption price; and |

| · | the CUSIP, Common Code and/or ISIN number or numbers, if any, with respect to debt securities |

In the case of a partial redemption, the trustee

shall select the debt securities to be redeemed in any manner which it deems fair and appropriate.

We or any of our subsidiaries may at any time

and from time to time purchase debt securities of any series in the open market or by tender or by private agreement, if applicable law

allows and if, in the case of the subordinated debt securities, certain other conditions which may be specified in the applicable prospectus

supplement are satisfied. Any debt securities of any series that we purchase beneficially for our own account, other than in connection

with dealing in securities, will be treated as cancelled and will no longer be issued and outstanding.

Under existing U.K. PRA requirements, we may not

make any redemption or repurchase of certain debt securities beneficially for our own account unless, among other things, we give prior

notice to the PRA and, in certain circumstances, it grants permission, in each case to the extent required at the relevant time and in

the relevant circumstances. The PRA may impose conditions on any redemption or repurchase all of which will be set out in the prospectus

supplement and supplemental indenture with respect to any series of debt securities.

Modification and Waiver

We and the trustee may make certain modifications

and amendments of the applicable indenture with respect to any series of debt securities without the consent of the holders of the debt

securities. We may make other modifications and amendments with the consent of the holder or holders of not less than a majority in aggregate

outstanding principal amount of the debt securities of the series outstanding under the indenture that are affected by the modification

or amendment, voting as one class. However, we may not make any modification or amendment without the consent of the holder of each debt

security affected that would:

| · | change the stated maturity of the principal amount of any debt security; |

| · | reduce the principal amount of, the interest rates of, or any premium payable upon the redemption of, any debt security; |

| · | change our (or any successor’s) obligation to pay Additional Amounts; |

| · | change the currency of payment; |

| · | impair the right to institute suit for the enforcement of any payment due and payable; |

| · | reduce the percentage in aggregate principal amount of outstanding debt securities of the series necessary to modify or amend the

indenture or to waive compliance with certain provisions of the relevant indenture and any Senior Debt Security Event of Default, Subordinated

Debt Security Event of Default or Subordinated Debt Security Default (as such terms are defined below and described in the relevant prospectus

supplement); |

| · | modify the subordination provisions or the terms of our obligations in respect of the due and punctual payment of the amounts due

and payable on the debt securities in a manner adverse to the holders; or |

| · | modify the above requirements. |

In addition, variations in the terms and conditions

of debt securities of any series, including modifications relating to subordination, redemption, a Senior Debt Security Event of Default,

Subordinated Debt Security Event of Default or Subordinated Debt Security Default (as those terms are defined under the heading “Event

of Default and Defaults; Limitations of Remedies” below), as described in the relevant prospectus supplement, may require the non-objection

from, or consent of, the PRA or its successor.

Events of Default and Defaults; Limitation of Remedies

Senior Debt Security Event of Default

Unless the relevant prospectus supplement provides

otherwise, a “Senior Debt Security Event of Default” with respect to any series of senior debt securities shall result if:

| · | we do not pay any principal or interest on any senior debt securities of that series within 14 days from the due date for payment

and the principal or interest has not been duly paid within a further 14 days following written notice from the trustee or from holders

of 25% in outstanding principal amount of the senior debt securities of that series to us requiring the payment to be made. It shall not,

however, be a Senior Debt Security Event of Default if during the 14 days after the notice, we satisfy the trustee that such sums were

not paid in order to comply with a law, regulation or order of any court of competent jurisdiction. Where there is doubt as to the validity

or applicability of any such law, regulation or order, it shall not be a Senior Debt Security Event of Default if we act on the advice

given to us during the 14 day period by independent legal advisers approved by the trustee; or |

| · | we breach any covenant or warranty of the senior debt indenture (other than as stated above with respect to payments when due) and

that breach has not been remedied within 60 days of receipt of a written notice from the trustee certifying that in its opinion the breach

is materially prejudicial to the interests of the holders of the senior debt securities of that series and requiring the breach to be

remedied or from holders of at least 25% in outstanding principal amount of the senior debt securities of that series requiring the breach

to be remedied; or |

| · | either a court of competent jurisdiction issues an order which is not successfully appealed within 30 days, or an effective shareholders’

resolution is validly adopted, for our winding-up (other than under or in connection with a scheme of reconstruction, merger or amalgamation

not involving bankruptcy or insolvency). |

If a Senior Debt Security Event of Default occurs

and is continuing, the trustee or the holders of at least 25% in outstanding principal amount of the senior debt securities of that series

may at their discretion declare the senior debt securities of that series to be due and repayable immediately (and the senior debt securities

of that series shall thereby become due and repayable) at their outstanding principal amount (or at such other repayment amount as may

be specified in or determined in accordance with the relevant prospectus supplement) together with accrued interest, if any, as provided

in the prospectus supplement. The trustee may at its discretion and without further notice institute such proceedings as it may think

suitable, against us to enforce payment. Subject to the indenture provisions for the indemnification of the trustee and the securities

administrator, as the case may be, the holder(s) of a majority in aggregate principal amount of the outstanding senior debt securities

of any series shall have the right to direct the time, method and place of conducting any proceeding in the name or and on the behalf

of the trustee for any remedy available to the trustee or exercising any trust or power conferred on the trustee with respect to the series.

However, this direction must not be in conflict with any rule of law or the senior debt indenture, and must not be unjustly prejudicial

to the holder(s) of any senior debt securities of that series not taking part in the direction, and determined by the trustee. The trustee

may also take any other action consistent with the direction that it deems proper.

Notwithstanding any contrary provisions, nothing

shall impair the right of a holder, absent the holder’s consent, to sue for any payments due but unpaid with respect to the senior

debt securities.

Unless the relevant prospectus supplement provides

otherwise, by accepting a senior debt security, each holder will be deemed to have waived any right of set-off, counterclaim or combination

of accounts with respect to the senior debt securities or the applicable indenture that they might otherwise have against us, whether

before or during our winding-up.

Subordinated Debt Securities Event of Default

Unless the relevant prospectus supplement provides

otherwise, a “Subordinated Debt Security Event of Default” with respect to any series of subordinated debt securities shall

result if either a court of competent jurisdiction issues an order which is not successfully appealed within 30 days, or an effective

shareholders’ resolution is validly adopted, for our winding-up (other than under or in connection with a scheme of amalgamation

or reconstruction not involving our bankruptcy or insolvency).

If a Subordinated Debt Security Event of Default

occurs and is continuing, the trustee or the holders of at least 25% in aggregate principal amount of the outstanding subordinated debt

securities of each series may declare to be due and payable immediately in accordance with the terms of the applicable indenture the principal

amount of, and any accrued but unpaid payments (or, in the case of discount securities, the accreted face amount, together with any accrued

interest), including any deferred interest. However, after this declaration but before the trustee obtains a judgment or decree for payment

of money due, the holder or holders of a majority in aggregate principal amount of the outstanding subordinated debt securities of the

series may rescind the declaration of accelerations and its consequences, but only if all Subordinated Debt Security Events of Default

have been remedied or waived and all payments due, other than those due as a result of acceleration, have been made.

Subordinated Debt Securities Defaults

In addition to Subordinated Debt Security Events

of Default, the subordinated debt indenture also separately provides for “Subordinated Debt Security Defaults”. The relevant

prospectus supplement with respect to any series of subordinated debt securities shall set out what events, if any, shall be considered

Subordinated Debt Security Defaults. The indenture permits the issuance of subordinated debt securities in one or more series and whether

a Subordinated Debt Security Default has occurred is determined on a series-by-series basis.

Unless the relevant prospectus supplement provides

otherwise, if a Subordinated Debt Security Default occurs and is continuing, the trustee may commence a proceeding in Scotland (but not

elsewhere) for our winding-up, but the trustee may not declare the principal amount of any outstanding subordinated debt security due

and payable. The relevant prospectus supplement will set forth further actions provided in the subordinated debt securities indenture

relating to the rights of holders in connection with the occurrence of a Subordinated Debt Security Default, if any, that may be taken

by the trustee upon the occurrence of a Subordinated Debt Security Default.

Unless the relevant prospectus supplement provides

otherwise, by accepting a subordinated debt security each holder and the trustee will be deemed to have waived any right of set-off, counterclaim

or combination of accounts with respect to the subordinated debt securities or the indenture (or between our obligations under or in respect

of any subordinated debt security and any liability owed by a holder or the trustee to us) that they might otherwise have against us,

whether before or during our winding-up.

Events of Default and Defaults - General

The holder or holders of not less than a majority

in aggregate principal amount of the outstanding debt securities of any series may waive any past Senior Debt Security Event of Default,

Subordinated Debt Security Event of Default or Subordinated Debt Security Default with respect to the series, except a Senior Debt Security

Event of Default, Subordinated Debt Security Event of Default or Subordinated Debt Security Default, in respect of the payment of interest,

if any, or principal of (or premium, if any) or payments on any debt security or a covenant or provision of the applicable indenture which

cannot be modified or amended without the consent of each holder of debt securities of such series.

Subject to exceptions, the trustee may, without

the consent of the holders, waive or authorize a Senior Debt Security Event of Default if, in the opinion of the trustee, the Senior Debt

Security Event of Default would not be materially prejudicial to the interests of the holders.

Subject to the provisions of the applicable indenture

relating to the duties of the trustee, if a Senior Debt Security Event of Default, Subordinated Debt Security Event of Default or Subordinated

Debt Security Default occurs and is continuing with respect to the debt securities of any series, the trustee will be under no obligation

to any holder or holders of the debt securities of the series, unless they have offered reasonable indemnity to the trustee. Subject to

the indenture provisions for the indemnification of the trustee, the holder or holders of a majority in aggregate principal amount of

the outstanding debt securities of any series shall have the right to direct the time, method and place of conducting any proceeding for

any remedy available to the trustee or exercising any trust or power conferred on the trustee with respect to the series, if the direction

is not in conflict with any rule of law or with the applicable indenture and the trustee does not determine that the action would be unjustly

prejudicial to the holder or holders of any debt securities of any series not taking part in that direction. The trustee may take any

other action that it deems proper which is not inconsistent with that direction.

The indentures provide that the trustee will,

within 90 days after the occurrence of a Senior Debt Security Event of Default, Subordinated Debt Security Event of Default or Subordinated

Debt Security Default with respect to the

debt securities of any series, give to each holder of the debt securities

of the affected series notice of the Senior Debt Security Event of Default, Subordinated Debt Security Event of Default or Subordinated

Debt Security Default known to it, unless the Senior Debt Security Event of Default, Subordinated Debt Security Event of Default or Subordinated

Debt Security Default has been cured or waived. However, the trustee shall be protected in withholding notice if it determines in good

faith that withholding notice is in the interest of the holders.

We are required to furnish to the trustee annually

a statement as to our compliance with all conditions and covenants under the indenture.

Consolidation, Merger and Sale of Assets; Assumption

We may, without the consent of the holders of

any of the debt securities, consolidate with, merge into or transfer or lease our assets substantially as an entirety to any person, provided

that any successor corporation formed by any consolidation or amalgamation, or any transferee or lessee of our assets, is a company organized

under the laws of any part of the United Kingdom that assumes, by a supplemental indenture, our obligations on the debt securities and

under the applicable indenture, and we procure the delivery of a customary officer’s certificate and legal opinion providing that

the conditions precedent to the transaction have been complied with.

Subject to applicable law and regulation, any

of our wholly-owned subsidiaries may assume our obligations under the debt securities of any series without the consent of any holder,

provided that certain conditions are satisfied, including that under certain indentures we unconditionally guarantee the obligations of

the subsidiary under the debt securities of that series. If we do and the other relevant conditions for such assumption are satisfied,

all of our direct obligations under the debt securities of the series and the applicable indenture shall immediately be discharged. Any

Additional Amounts under the debt securities of the series will be payable in respect of taxes imposed by the jurisdiction in which the

assuming subsidiary is incorporated, subject to exceptions equivalent to those that apply to any obligation to pay Additional Amounts

in respect of taxes imposed by the U.K. Taxing Jurisdiction, rather than taxes imposed by the U.K. Taxing Jurisdiction. The subsidiary

that assumes our obligations will also be entitled to redeem the debt securities of the relevant series in the circumstances described

in “–Redemption” above with respect to any change or amendment to, or change in the application or official interpretation

of, the laws or regulations (including any treaty) of the assuming subsidiary’s jurisdiction of incorporation which occurs after

the date of the assumption.

An assumption of our obligations under the

debt securities of any series might be deemed for U.S. federal income tax purposes to be an exchange of those debt securities for new

debt securities by each beneficial owner, resulting in a recognition of taxable gain or loss for U.S. federal income tax purposes and

possibly certain other adverse tax consequences. You should consult your tax advisor regarding the U.S. federal, state and local income

tax consequences of an assumption.

Governing Law

The debt securities and the indentures will be

governed by and construed in accordance with the laws of the State of New York, except that, as the indentures specify, the subordination

provisions and the waiver of the right to set-off by the holders and by the Trustee acting on behalf of the holders of each series of

subordinated debt securities will be governed by and construed in accordance with the laws of Scotland.

Notices

All notices to holders of registered debt securities

shall be validly given if in writing and mailed, first-class postage prepaid, to them at their respective addresses in the register maintained

by the trustee.

Until such time as any definitive securities are

issued, there may, so long as any global securities in registered form representing the debt securities are held in their entirety on

behalf of DTC, be substituted for such notice by first-class mail the delivery of the relevant notice to DTC for communication by them

to the holders of the debt securities, in accordance with DTC’s applicable procedures. Neither the failure to give any notice to

a particular holder, nor any defect in a notice given to a particular holder, will affect the sufficiency of any notice given to another

holder.

Notices to be given by any holders of the debt

securities to the trustee shall be in writing to the trustee at its corporate trust office. While any of the debt securities are represented

by a global securities in registered form, such notice may be given by any holder to the trustee through DTC in such manner as DTC may

approve for this purpose.

The Trustees and Securities Administrator

The Bank of New York Mellon, acting through its

London Branch, 160 Queen Victoria Street, London EC4V 4LA, is the trustee under the indentures with respect to the debt securities. The

trustee shall have and be subject to all the duties and responsibilities specified with respect to an indenture trustee under the Trust

Indenture Act of 1939 (the “TIA”). Subject to the provisions of the TIA, the trustees are under no obligation to exercise

any of the powers vested in them by the indentures at the request of any holder of notes, unless offered reasonable indemnity by the holder

against the costs, expense and liabilities which might be incurred thereby. We and certain of our subsidiaries maintain deposit accounts

and conduct other banking transactions with The Bank of New York Mellon in the ordinary course of our business. The Bank of New York Mellon

is also the book-entry depositary and paying agent with respect to our debt securities. The Bank of New York Mellon is the depositary

with respect to the ADSs representing certain of our preference shares.

Consent to Service of Process

We irrevocably designate CT Corporation System

as our authorized agent for service of process in any legal action or proceeding arising out of or relating to the indentures or any debt

securities brought in any federal or state court in The City of New York, New York and we irrevocably submit to the jurisdiction of those

courts.

DESCRIPTION OF

DOLLAR PREFERENCE SHARES

The following is a summary of the general terms

of the dollar preference shares of any series. Each time that we issue dollar preference shares, we will file a prospectus supplement

with the SEC, which you should read carefully. The prospectus supplement will designate the terms of the dollar preference shares of the

particular series, which are set out in the resolutions establishing the series that our board of directors or an authorized committee

thereof (referred to in this section as the board of directors) adopt. These terms may amend, supplement or be different from those summarized

below, and if so the applicable prospectus supplement will state that, and the description of the dollar preference shares of that series

contained in the prospectus supplement will apply. You should also read our Articles of Association, which we have filed with the SEC

as an exhibit to the registration statement of which this prospectus is a part. You should read the summary of the general terms of the

ADR deposit agreement under which Dollar Preference Share American Depositary Receipts (“Dollar Preference Share ADRs”) evidencing

American Depositary Shares (“Dollar Preference Share ADSs”) that may represent dollar preference shares may be issued, under

the heading “Description of Dollar Preference Share American Depositary Shares”.

If we issue dollar preference shares that qualify

as capital for regulatory purposes, the terms of such dollar preference shares may vary from those described in this prospectus and will

be set forth in the relevant prospectus supplement.

The summary below does not describe every aspect

of the dollar preference shares of any series and is subject to and qualified in its entirety by reference to all the provisions of the

resolutions establishing the series, our Articles of Association and the ADR deposit agreement.

General

Under our Articles of Association, our board of

directors is authorized to provide for the issuance of dollar preference shares, in one or more series, with the dividend rights, liquidation

value per share, redemption provisions, voting rights and other rights, preferences, privileges, limitations and restrictions that are

set forth in resolutions providing for their issue adopted by our board of directors. Our board of directors may only provide for the

issuance of dollar preference shares of any series if a resolution of our shareholders has authorized the allotment of shares.

The dollar preference shares of any series will

have the dividend rights, rights upon liquidation, redemption provisions and voting rights described below, unless the relevant prospectus

supplement provides otherwise. You should read the prospectus supplement for the specific terms of any series, including:

| · | the number of shares offered, the number of shares offered in the form of Dollar Preference Share ADSs and the number of dollar preference

shares represented by each Dollar Preference Share ADS; |

| · | the public offering price of the series; |

| · | the liquidation value per share of that series; |

| · | the dividend rate, or the method of calculating it; |

| · | the place where we will pay dividends; |

| · | the dates on which dividends will be payable; |

| · | the circumstances under which dividends may not be payable; |

| · | the restrictions applicable to the sale and delivery of the dollar preference shares; |

| · | whether and under what circumstances we will pay additional amounts on the dollar preference shares in the event of certain developments

with respect to withholding tax or information reporting laws; |

| · | any redemption, conversion or exchange provisions; |

| · | any listing on a securities exchange; and |

| · | any other rights, preferences, privileges, limitations and restrictions relating to the series. |

The prospectus supplement will also describe material

U.S. and U.K. tax considerations that apply to any particular series of dollar preference shares.

The dollar preference shares of any series will

rank junior as to dividends to any cumulative preference shares, equally as to dividends with any other non-cumulative preference shares,

any exchange preference shares and any sterling preference shares, equally as to repayment of capital on a winding-up or liquidation with

any other non-cumulative preference shares, any exchange preference shares, any sterling preference shares and any cumulative preference

shares and, unless the resolutions of our board of directors establishing any series of dollar preference shares specify otherwise and

the related prospectus supplement so states, will rank equally in all respects with the dollar preference shares of each other series

and any other of our shares which are expressed to rank equally with them. The preferential rights to dividends of the holders of the

cumulative preference shares are cumulative whereas the preferential rights to dividends of the holders of any series of dollar preference

shares, any series of exchange preference shares, any euro preference shares, and any sterling preference shares will be or are non-cumulative.

Holders of dollar preference shares will have no pre-emptive rights.

The dollar preference shares will rank in priority

to our ordinary shares as regards the right to receive dividends and rights to repayment of capital if we are wound up or liquidated,

whether or not voluntarily.

There are no restrictions under our Articles of

Association or under Scots law as currently in effect that limit the right of non-resident or foreign owners, as such, to acquire dollar

preference shares of any series freely or, when entitled to vote dollar preference shares of a particular series, to vote those dollar

preference shares. There are currently no English or Scots laws, decrees, or regulations that would prevent the remittance of dividends

or other payments on the dollar preference shares of any series to non-resident holders.

Dividends

Non-cumulative preferential dividends on each

series of dollar preference shares will be payable at the rate or rates and on the dates set out in the relevant prospectus supplement

and will accrue from their date of issue.

Pursuant to our Articles of Association, our board

of directors may resolve prior to the issue and allotment of any series of dollar preference shares that full dividends on such series

of dollar preference shares in respect of a particular dividend payment date will not be declared and paid if,

(i) in its sole and absolute discretion, the board of directors resolves prior to the relevant dividend payment date that such dividend

(or part thereof) shall not be paid or (ii) in the opinion of the board of directors, payment of a dividend would breach or cause a breach

of the capital adequacy requirements of the PRA that apply at that time to us and/or any of our subsidiaries, or subject to the next following

paragraph, our distributable profits, after the payment in full, or the setting aside of a sum to provide for the payment in full, of

all dividends stated to be payable on or before the relevant dividend payment date on the cumulative preference shares (and any arrears

of dividends thereon), are insufficient to cover the payment in full of dividends on that series of dollar preference shares and dividends

on any of our other preference shares stated to be payable on the same date as the dividends on that series and ranking equally as to

dividends with the dollar preference shares of that series. The U.K. Companies Act 2006 defines “distributable profits” as,

in general terms, and subject to adjustment, accumulated realized profits less accumulated realized losses.

Unless the applicable prospectus supplement states

otherwise, if dividends are to be paid but our distributable profits are, in the opinion of the board of directors, insufficient to enable

payment in full of dividends on any series of dollar preference shares on any dividend payment date and also the payment in full of all

other dividends stated to be payable on such date on any other non-cumulative preference shares and any of our other share capital expressed

to rank pari passu therewith as regards participation in profits, after payment in full, or the setting aside of a sum to cover

the payment in full, of all dividends stated to be payable on or before such date on any cumulative preference share, then the board of

directors shall (subject always to sub-clauses (i) and (ii) of the preceding paragraph) declare and pay dividends to the extent of the

available distributable profits, (if any) on a pro rata basis so that (subject as aforesaid) the amount of dividends declared per share

on the dollar preference shares of the series and the dividends stated to be payable on such date on any other non-cumulative preference

shares and any of our other share capital expressed to rank pari passu therewith as regards distribution of profits will bear to

each other the same ratio that accrued dividends per share on the dollar preference shares of the series and other non-cumulative preference

shares, and any of our other share capital expressed to rank pari passu therewith as regards participation in profits, bear to

each other.

Dividends on the cumulative preference shares,

including any arrears, are payable in priority to any dividends on any series of dollar preference shares, and as a result, we may not

pay any dividend on any series of dollar preference shares unless we have declared and paid in full dividends on the cumulative preference

shares, including any arrears.

If we have not declared and paid in full the dividend

stated to be payable on any series of dollar preference shares on the most recent dividend payment date, or if we have not set aside a

sum to provide for payment in full, in either case for the reasons set out in sub-clause (ii) of the second paragraph of this section,

we may not declare or pay any dividends upon any of our other share capital (other than the cumulative preference shares) and we may not

set aside any sum to pay such dividends, unless, on the date of declaration, we set aside an amount equal to the dividend for the then-current

dividend period payable on that series of dollar preference shares to provide for the payment in full of the dividend on that series of

dollar preference shares on the next dividend payment date. If we have not declared and paid in full any dividend payable on any series

of dollar preference shares on any dividend payment date, or if we have not set aside a sum to provide for payment in full, in either

case for the reasons set out in sub-clause (ii) of the second paragraph of this section, we may not redeem, purchase or otherwise acquire