UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

SECURITIES EXCHANGE

ACT OF 1934

For the month of September,

2024

(Commission File

No. 001-34429),

PAMPA ENERGIA S.A.

(PAMPA ENERGY INC.)

Argentina

(Jurisdiction of

incorporation or organization)

Maipú 1

C1084ABA

City of Buenos Aires

Argentina

(Address of principal

executive offices)

(Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ___X___ Form 40-F ______

(Indicate

by check mark whether the registrant by furnishing the

information contained in this form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

Yes ______ No ___X___

(If "Yes"

is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82- .)

This Form 6-K

for Pampa Energía S.A. (“Pampa” or the “Company”) contains:

Exhibit

1: PAMPA ENERGÍA S.A. ANNOUNCES THE EXPIRATION AND TENDER RESULTS FOR ITS CASH TENDER OFFER FOR ANY AND ALL OF ITS OUTSTANDING SERIES

1 7.500% NOTES DUE 2027

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: September 5, 2024

| Pampa Energía S.A. |

| |

|

|

| |

|

|

| By: |

/s/ Gustavo Mariani

|

|

| |

Name: Gustavo Mariani

Title: Chief Executive Officer |

|

FORWARD-LOOKING

STATEMENTS

This press release may contain

forward-looking statements. These statements are statements that are not historical facts, and are based on management's current

view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates",

"believes", "estimates", "expects", "plans" and similar expressions, as they relate to

the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends,

the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations

and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee

that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including

general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors

could cause actual results to differ materially from current expectations.

PAMPA ENERGÍA S.A.

ANNOUNCES THE EXPIRATION AND TENDER RESULTS FOR ITS CASH TENDER OFFER FOR ANY AND ALL OF ITS OUTSTANDING SERIES 1 7.500% NOTES DUE 2027

BUENOS AIRES, ARGENTINA (September 5, 2024) — Pampa Energía

S.A. (“Pampa,” the “Company”

or “we”) today announced the expiration and tender results of the previously-announced offer by the Company to purchase for

cash (the “Offer”) from each registered holder (each, a “Holder” and, collectively, the “Holders”)

any and all of its outstanding Series 1 7.500% Notes due 2027 (the “Notes”) issued by the Company under the indenture dated

as of January 24, 2017 (the “Indenture”).

The Offer expired at 8:00 a.m., New York City time, on September 5,

2024 (such date and time, the “Expiration Time”). The Offer was made by the Company pursuant to the offer to purchase dated

August 26, 2024 (the “Offer to Purchase”) and the related guaranteed delivery instruction (the “Notice of Guaranteed

Delivery,” and together with the Offer to Purchase, the “Offer Documents”). The principal purpose of the Offer was to

purchase for cash any and all of the outstanding Notes. The Company intends to finance the purchase of the Notes with the proceeds of

the offering of a concurrent issuance of new notes made in reliance on one or more exemptions from the registration requirements of the

U.S. Securities Act of 1933, as amended.

The Company has been advised that, as of the Expiration Time, U.S.$396,816,000

in aggregate principal amount of Notes, or approximately 52.91% of the Notes outstanding, have been validly tendered and not validly withdrawn

pursuant to the Offer.

Additionally, Guaranteed Delivery instructions were submitted for

U.S.$630,000 in aggregate principal amount of Notes, or approximately 0.08% of the Notes outstanding, as of the Expiration Time. In order

to be eligible to participate in the Offer, holders of Notes reflected in such Guaranteed Delivery instructions received by the Company

prior to the Expiration Time must validly tender such Notes pursuant to the Guaranteed Delivery Procedures (as defined in the Offer Documents)

by 5:00 p.m., New York City time on September 9, 2024, unless extended by the Company.

The Company has accepted for purchase all of the Notes validly tendered

in the Offer and not validly withdrawn on or prior to the Expiration Time. Notes accepted for purchase, including Notes tendered pursuant

to Guaranteed Delivery Procedures, will be paid in full by the Company on September 10, 2024 (the “Settlement Date”).

The final principal amount of Notes that will be purchased by the

Company on the Settlement Date is subject to change based on deliveries of Notes pursuant to the Guaranteed Delivery Procedures. A press

release announcing the final results of the Offer is expected to be issued on or promptly after the Settlement Date.

The Notes and other information relating to the Offer are listed in

the table below:

|

Notes |

CUSIP / ISIN /

Common Code Numbers |

Outstanding Principal

Amount |

Offer Consideration(2)

(3) |

| Series 1 7.500% Notes due 2027 |

697660 AA6/ US697660AA69 / 155564636

P7464E AA4/ USP7464EAA49 / 155566132 |

U.S.$ 750,000,000(1) |

U.S.$1,000 |

| (1) | Including U.S.$153 million principal amount of Notes which are held by a third party lender of the Company

as security for such financing. |

| (2) | Per U.S.$1,000 principal amount of Notes validly tendered and accepted for purchase. The Offer Consideration

does not include accrued interest. |

| (3) | Holders will also receive accrued interest from and including the last interest payment date for the

Notes up to but not including the Settlement Date. |

Holders who had validly tendered

and not withdrawn their Notes at or before the Expiration Time are entitled to receive U.S.$1,000 per U.S.$1,000 principal amount

of the Notes tendered (the “Offer Consideration”), on the Settlement Date. In addition,

Holders whose Notes were purchased in the Offer will receive accrued and unpaid interest from and including the last interest payment

date for the Notes up to but not including the Settlement Date. For the avoidance of doubt, accrued interest will cease to accrue on the

Settlement Date for all Notes accepted in the Offer, including those tendered by the Guaranteed Delivery Procedures.

The obligation of the Company to pay for Notes validly tendered pursuant

to the Offer, or Notes with respect to which a properly completed Notice of Guaranteed Delivery was delivered at or prior to the Expiration

Time, is subject to, and conditioned upon, the satisfaction or waiver of certain conditions as set forth in the Offer Documents, in the

sole discretion of the Company. The terms and conditions of the Offer are described in the Offer Documents previously distributed to the

Holders.

The Company has retained Citigroup Global Markets Inc., Deutsche Bank

Securities Inc., J.P. Morgan Securities LLC and Santander US Capital Markets LLC to serve as the dealer managers for the Offer, and Banco

Santander Argentina S.A. and Banco de Galicia y Buenos Aires S.A.U. to act as local information agents in Argentina. Questions regarding

the Offer may be directed to Citigroup Global Markets Inc. at (212) 723-6106 (collect) or (800) 558-3785 (toll-free), Deutsche Bank Securities

Inc. at (212) 250-2955 (collect) or (866) 627-0391 (toll-free) , J.P. Morgan Securities LLC at (212) 834-7279 (collect) or at (866) 846-2874

(toll-free) and/or to Santander US Capital Markets LLC at (212) 350-0660 (collect) or at (855) 404-3636 (toll-free). Requests for documents

may be directed to Morrow Sodali International LLC (trading as Sodali & Co), the information and tender agent for the Offer, by e-mail

at pampa@investor.sodali.com, or by telephone in Stamford at +1 203 658 9457 or in London at +44 20 4513 6933.

Documents relating to

the Offer, including the Offer to Purchase and guaranteed delivery instruction, are also available at https://projects.sodali.com/pampa.

None of the Company, the dealer managers, the local information agents

or the information agent and tender agent make any recommendations as to whether Holders should tender their Notes pursuant to the Offer,

and no one has been authorized by any of them to make such recommendations. Holders must make their own decisions as to whether to tender

their Notes, and, if so, the principal amount of Notes to tender.

This press release is for informational purposes only and is not a

recommendation and is not an offer to sell or a solicitation of an offer to buy any security. The Offer is being made solely pursuant

to the Offer Documents.

The Offer does not constitute, and may not be used in connection with,

an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not permitted by law or in which the person

making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation.

2

In any jurisdiction where the securities, blue sky or other laws require

tender offers to be made by a licensed broker or dealer and in which the dealer managers, or any affiliates thereof, are so licensed,

the Offer will be deemed to have been made by any such dealer managers, or such affiliates, on behalf of the Company.

Forward Looking Statements

This press release contains forward-looking statements within the

meaning of the United States Private Securities Litigation Reform Act of 1995, as amended. Actual results may differ materially from those

reflected in the forward-looking statements. We undertake no obligation to update any forward-looking statement or other information contained

in this press release to reflect events or circumstances occurring after the date of this press release or to reflect the occurrence of

unanticipated events or circumstances, including, without limitation, changes in our business or acquisition strategy or planned capital

expenditures, or to reflect the occurrence of unanticipated events.

About Pampa

Pampa is an Argentine leading independent energy company, participating

in the electricity and gas businesses. We and our subsidiaries, joint ventures and affiliates are engaged in the generation and transmission

of electricity, exploration, production, commercialization and transportation of oil and gas, and production of petrochemical products.

Our shares are traded on the New York Stock Exchange and the Bolsas y Mercados Argentinos S.A.

For further information, see our website www.pampa.com or contact:

Investor Relations

Phone: +54-11-4344-6000

Email: investor@pampa.com

3

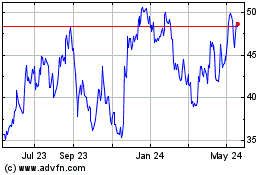

Pampa Energia (NYSE:PAM)

Historical Stock Chart

From Dec 2024 to Jan 2025

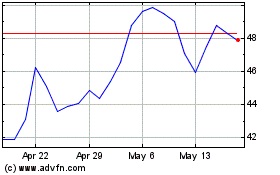

Pampa Energia (NYSE:PAM)

Historical Stock Chart

From Jan 2024 to Jan 2025