UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of September,

2024

Commission File Number

001-15106

PETRÓLEO BRASILEIRO

S.A. - PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation - PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares,

28

20241-030 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

PETROBRAS ANNOUNCES OFFERING

OF U.S. DOLLAR-DENOMINATED GLOBAL NOTES AND COMMENCEMENT OF CASH TENDER OFFERS

RIO DE JANEIRO, BRAZIL – September 3, 2024 – Petróleo

Brasileiro S.A. – Petrobras (“Petrobras”) (NYSE: PBR) announces that its wholly-owned subsidiary, Petrobras

Global Finance B.V. (“PGF”), has commenced (i) an offering of a new series of U.S. dollar-denominated global notes

in the international capital markets (the “New Notes”), subject to market and other conditions (the “New

Notes Offering”), and (ii) cash tender offers to purchase any and all of certain of its outstanding U.S. dollar-denominated

notes (the “Tender Notes” and such offers, the “Tender Offers”).

New Notes Offering

The New Notes will be unsecured obligations of PGF and will be fully,

unconditionally and irrevocably guaranteed by Petrobras. PGF intends to use the net proceeds from the sale of the New Notes to purchase

Tender Notes that PGF accepts for purchase in the Tender Offers, and to use any remaining net proceeds for general corporate purposes.

Tender Offers

The Tender Offers are being made pursuant to the terms and conditions

set forth in the offer to purchase, dated September 3, 2024 (the “Offer to Purchase” and, together with the accompanying

notice of guaranteed delivery, the “Offer Documents”).

The following table sets forth the series of Tender Notes subject

to the Tender Offers, the consideration payable for each series of Tender Notes (the “Consideration”) accepted for

purchase in the Tender Offers and the acceptance priority level (the “Acceptance Priority Level”) in connection with

the Maximum Consideration Condition (as defined below):

| Title of Security |

|

CUSIP/ISIN |

|

Acceptance

Priority Level |

|

Principal Amount

Outstanding(1) |

|

|

Consideration(2) |

|

| 5.093% Global Notes Due January 2030 |

|

71647N BE8, 71647N BF5, N6945A AL1 / US71647NBE85, US71647NBF50, USN6945AAL19 |

|

1 |

|

US$ |

560,542,000 |

|

|

US$ |

991.15 |

|

| 5.600% Global Notes Due January 2031 |

|

71647NBH1 / US71647NBH17 |

|

2 |

|

US$ |

1,040,365,000 |

|

|

US$ |

998.00 |

|

| 5.500% Global Notes Due June 2051 |

|

71647NBJ7 / US71647NBJ72 |

|

3 |

|

US$ |

666,283,000 |

|

|

US$ |

849.33 |

|

| 5.625% Global Notes Due May 2043 |

|

71647NAA7 / US71647NAA72 |

|

4 |

|

US$ |

361,065,000 |

|

|

US$ |

910.30 |

|

| 6.750% Global Notes Due June 2050 |

|

71647NBG3 / US71647NBG34 |

|

5 |

|

US$ |

416,884,000 |

|

|

US$ |

980.26 |

|

| 6.900% Global Notes Due March 2049 |

|

71647NBD0 / US71647NBD03 |

|

6 |

|

US$ |

670,445,000 |

|

|

US$ |

1,000.00 |

|

| (1) | Including Notes held by Petrobras or

its affiliates. |

| (2) | Per US$1,000

principal amount of each series of Notes validly tendered and accepted for purchase. In addition,

PGF will pay accrued and unpaid interest as set forth below. |

The Tender Offers will expire at 5:00 p.m., New York City time, on

September 9, 2024, unless extended with respect to a Tender Offer (such date and time, as the same may be extended with respect to a

Tender Offer, the “Expiration Date”). Tender Notes validly tendered may be withdrawn at any time prior to 5:00 p.m.,

New York City time, on September 9, 2024, unless extended with respect to a Tender Offer, but not thereafter. The settlement date of

the Tender Offers will occur promptly following the Expiration Date, expected to be no later than four business days following the Expiration

Date, which is expected to be September 13, 2024 (the “Settlement Date”).

Holders of Tender Notes who (1) validly tender and do not validly

withdraw their Tender Notes on or prior to the Expiration Date or (2) deliver a properly completed and duly executed notice of guaranteed

delivery and other required documents pursuant to the guaranteed delivery procedures described in the Offer to Purchase on or prior to

the Expiration Date, and deliver their Tender Notes on or prior to 5:00 p.m., New York City time, on the second business day following

the Expiration Date, which is expected to be September 11, 2024 (the “Guaranteed Delivery Date”), will be eligible

to receive the applicable Consideration indicated in the table above, as well as accrued and unpaid interest from, and including, the

last interest payment date for the Tender Notes to, but not including, the Settlement Date (the “Accrued Interest”).

The Tender Offers are not contingent upon the tender of any minimum

principal amount of Tender Notes. The consummation of a Tender Offer is not conditioned on the consummation of the other Tender Offers.

Each Tender Offer is independent of the other Tender Offers, and PGF may, subject to applicable law, withdraw or modify any Tender Offer

without withdrawing or modifying other Tender Offers.

PGF will not be obligated to (i) accept for purchase any validly tendered

Tender Notes or (ii) pay any cash amounts or complete the Tender Offers, unless certain conditions are satisfied or waived prior to the

Expiration Date, including:

| - | customary conditions such as that PGF will not be obligated to consummate

the Tender Offers upon the occurrence of an event or events that would or might reasonably

be expected to prohibit, restrict or delay the consummation of the Tender Offers or materially

impair the contemplated benefits to PGF of the Tender Offers, and |

| - | the entry by PGF prior to the Expiration Date into an underwriting

agreement, on terms and conditions reasonably satisfactory to PGF, for the New Notes Offering

yielding net proceeds to PGF sufficient to fund, in addition to available cash, the Maximum

Consideration (as defined below) and Accrued Interest due to holders of Tender Notes tendered

in the Tender Offers. |

PGF will not be obligated to (i) accept for purchase any validly tendered

Tender Notes or (ii) pay any cash amounts or complete the Tender Offers, unless the New Notes Offering successfully closes and PGF receives

the net proceeds therefrom on or prior to the Settlement Date.

PGF’s obligation to accept for purchase, and to pay the applicable

Consideration for a particular series of Tender Notes validly tendered pursuant to the Tender Offers is also subject to, and conditioned

upon (the “Maximum Consideration Condition”), the aggregate Consideration for the Tender Offers, excluding the Accrued

Interest with respect to each series (the “Aggregate Consideration”), not exceeding US$1.0 billion (the “Maximum

Consideration”).

If the Maximum Consideration Condition is not satisfied with respect

to each series of Tender Notes for (i) a series of Tender Notes (the “First Non-Covered Tender Notes”) for which the

Maximum Consideration is less than the sum of (x) the Aggregate Consideration for all validly tendered First Non-Covered Tender Notes

and (y) the Aggregate Consideration for all validly tendered Tender Notes of all series, having a higher Acceptance Priority Level (with

1 being the highest Acceptance Priority Level and 6 being the lowest Acceptance Priority Level) than the First Non-Covered Tender Notes,

and (ii) all series of Tender Notes with an Acceptance Priority Level lower than the First Non-Covered Tender Notes (together with the

First Non-Covered Tender Notes, the “Non-Covered Tender Notes”), then PGF may, at any time at or prior to the Expiration

Date:

| (a) | terminate a Tender Offer with respect to one or more series of Non-Covered

Tender Notes for which the Maximum Consideration Condition has not been satisfied and promptly

return all validly tendered Tender Notes of such series, and of any series of Non-Covered

Tender Notes to the respective tendering holders; or |

| (b) | waive the Maximum Consideration Condition with respect to one or

more series of Non-Covered Tender Notes and accept all Tender Notes of such series, and of

any series of Tender Notes having a higher Acceptance Priority Level, validly tendered; or |

| (c) | if there is any series of Non-Covered Tender Notes for which: |

| 1. | the Aggregate Consideration necessary to purchase all validly tendered

Tender Notes of such series, plus |

| 2. | the Aggregate Consideration necessary to purchase all validly tendered

Tender Notes of all series having a higher Acceptance Priority Level than such series of

Tender Notes, other than any Non-Covered Tender Notes, |

are equal to, or less than, the Maximum Consideration, accept

all validly tendered Tender Notes of all series having a lower Acceptance Priority Level, until there is no series of Tender Notes with

a higher or lower Acceptance Priority Level to be considered for purchase for which the conditions set forth above are met.

It is possible that a series of Tender Notes with a particular Acceptance

Priority Level will fail to meet the conditions set forth above and therefore will not be accepted for purchase even if one or more series

with a higher or lower Acceptance Priority Level are accepted for purchase. If any series of Tender Notes is accepted for purchase under

the Tender Offers, all Tender Notes of that series that are validly tendered will be accepted for purchase.

For purposes of determining whether the Maximum Consideration Condition

is satisfied, PGF will assume that all Tender Notes tendered pursuant to the guaranteed delivery procedures described in the Offer to

Purchase will be duly delivered at or prior to the Guaranteed Delivery Date and it will not subsequently adjust the acceptance of the

Tender Notes in accordance with the Acceptance Priority Levels if any such Tender Notes are not so delivered.

PGF may, in its sole discretion, waive any one or more of the conditions

at any time, including the Maximum Consideration Condition with respect to any Tender Offer, even if the series of Tender Notes relating

to such an Tender Offer has a lower Acceptance Priority Level than other Non-Covered Tender Notes with a higher Acceptance Priority Level.

PGF expressly reserves the right, subject to applicable law, to: (i)

delay accepting the Tender Notes or extend the Expiration Date or, if the conditions to the Tender Offers are not satisfied, terminate

such Tender Offers at any time and not accept the Tender Notes; and (ii) if the conditions to the Tender Offers are not satisfied, amend

or modify at any time, the terms of the Tender Offers in any respect, including by waiving, where possible, any conditions to consummation

of the Tender Offers.

If PGF exercises any such right with respect to one or more series

of Tender Notes, it will give written notice thereof to the Depositary (as defined below) and will make a public announcement thereof

as promptly as practicable and all Tender Notes tendered pursuant to such terminated Tender Offer(s) and not accepted for payment will

be returned promptly to the tendering holders thereof. If the Maximum Consideration Condition is not satisfied with respect to a series

of Tender Notes, elections to the guaranteed delivery procedures will be promptly rejected with respect to such series.

Petrobras believes that the operation is in line with the

company’s debt management policy, maintaining its commitment to controlling debt at what it considers to be a healthy level

for companies of Petrobras’ segment and size.

# # #

PGF has engaged BofA Securities, Inc. (“BofA”),

Bradesco BBI S.A. (“Bradesco BBI”), HSBC Securities (USA) Inc. (“HSBC”), J.P. Morgan Securities

LLC (“J.P. Morgan”), Mizuho Securities USA LLC (“Mizuho”) and Morgan Stanley & Co. LLC (“Morgan

Stanley”) to act as joint bookrunners with respect to the New Notes Offering and as dealer managers with respect to the Tender

Offers (the “Dealer Managers”). Global Bondholder Services Corporation is acting as the depositary and information

agent (the “Depositary”) for the Tender Offers. In selecting the bookrunners, PGF took into consideration various

factors, including commitments to sustainability consistent with the current Strategic Plan 2024-2028.

This announcement is for informational purposes only, and does not

constitute or form part of any offer to purchase or invitation to sell or a solicitation of an offer to sell or purchase any securities.

There shall be no offer or sale of the New Notes in any jurisdiction

in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any

such jurisdiction. PGF and Petrobras have filed a registration statement, including a prospectus with the U.S. Securities and Exchange

Commission (“SEC”). Before you invest, you should read the prospectus and preliminary prospectus supplement and other

documents PGF and Petrobras have filed with the SEC for more complete information about the companies, the New Notes Offering and the

New Notes. When available, you may access these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively,

a copy of the prospectus and preliminary prospectus supplement may be obtained by contacting BofA collect at +1 (888) 294-1322, Bradesco

BBI collect at +1 (646) 432-6643, HSBC collect at +1 (212) 525-5552 or toll-free (U.S. only) at +1 (888) HSBC-4LM, J.P. Morgan collect

at +1 (212) 834 2042 / +1 (212) 834-4533 or toll-free (U.S. only) at +1 (866) 834-4666 / +1 (866) 846-2874, Mizuho collect at +1 (212)

205-7736 or toll-free (U.S. only) at +1 (866) 271-7403 and Morgan Stanley collect at +1 (212) 761-1057 or toll-free (U.S. only) at +1

(800) 624-1808.

The Tender Offers are not being made to holders of Tender Notes in

any jurisdiction in which PGF is aware that the making of the Tender Offers would not be in compliance with the laws of such jurisdiction.

In any jurisdiction in which the securities laws or blue sky laws require the Tender Offers to be made by a licensed broker or dealer,

the Tender Offers will be deemed to be made on PGF’s behalf by the Dealer Managers or one or more registered brokers or dealers

that are licensed under the laws of such jurisdiction. Any questions or requests for assistance regarding the Tender Offers may be directed

to BofA collect at +1 (646) 855-8988 or toll-free (U.S. only) at +1 (888) 292-0070, Bradesco BBI collect at +(646) 432-6643, HSBC

collect at +1 (212) 525-5552 or toll-free (U.S. only) at +1 (888) HSBC-4LM, J.P. Morgan collect at +1 (212) 834 2042 / +1 (212) 834-4533

or toll-free (U.S. only) at +1 (866) 834-4666 / +1 (866) 846-2874, Mizuho collect at +1 (212) 205-7736 or toll-free (U.S. only) at +1

(866) 271-7403 and Morgan Stanley collect at +1 (212) 761-1057 or toll-free (U.S. only) at +1 (800) 624-1808. Requests for additional

copies of the Offer Documents may be directed to Global Bondholder Services Corporation at +1 (855) 654-2014 (toll-free) or +1 (212)

430-3774. The Offer Documents can be accessed at the following link: http://www.gbsc-usa.com/Petrobras/.

Holders are advised to check with any bank, securities broker or

other intermediary through which they hold Tender Notes as to when such intermediary would need to receive instructions from such holder

in order for that holder to be able to participate in, or withdraw their instruction to participate in, a Tender Offer, before the deadlines

specified herein and in the Offer Documents.

The deadlines set by any such intermediary and the relevant clearing

systems for the submission and withdrawal of tender instructions will also be earlier than the relevant deadlines specified herein and

in the Offer Documents.

The Tender Offers are being made solely pursuant to the Offer Documents.

The Offer Documents have not been filed with, and have not been approved or reviewed by any federal or state securities commission or

regulatory authority of any country. No authority has passed upon the accuracy or adequacy of the Offer Documents or any other documents

related to the Tender Offers, and it is unlawful and may be a criminal offense to make any representation to the contrary.

The New Notes are not intended to be offered, sold or otherwise

made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“EEA”).

For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article

4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or (ii) a customer within the meaning of Directive (EU) 2016/97 (as

amended, the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined

in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Regulation (EU) 2017/1129 (as amended, the

“Prospectus Regulation”); and the expression “offer” includes the communication in any form and by any means

of sufficient information on the terms of the offer and the New Notes to be offered so as to enable an investor to decide to purchase

or subscribe the New Notes. Consequently, no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs

Regulation”) for offering or selling the New Notes or otherwise making them available to retail investors in the EEA has been prepared

and the New Notes will not be offered or sold or otherwise made available to any retail investor in the EEA.

Each person in a Member State of the EEA who acquires any New Notes

under, the offers to the public contemplated in the New Notes Offering, or to whom the New Notes are otherwise made available, will be

deemed to have represented, warranted, acknowledged and agreed to and with each underwriter and PGF that it and any person on whose behalf

it acquires New Notes is: (1) a “qualified investor” within the meaning of the Prospectus Regulation; and (2) not a “retail

investor” (as defined above).

The New Notes are not intended to be offered, sold or otherwise

made available to and should not be offered, sold or otherwise made available to any retail investor in the United Kingdom (the “United

Kingdom” or the “UK”). For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client,

as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018 (the “EUWA”); (ii) a customer within the meaning of the provisions of the Financial Services and Markets

Act 2000 (the “FSMA”) and any rules or regulations made under the FSMA to implement the Insurance Distribution Directive,

where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014

as it forms part of domestic law by virtue of the EUWA; or (iii) not a “qualified investor” as defined in Article 2 of the

Prospectus Regulation as it forms part of the domestic law by virtue of the EUWA (the “UK Prospectus Regulation”). No key

information document required by the PRIIPs Regulation as it forms part of domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”)

for offering or selling the New Notes or otherwise making them available to retail investors in the UK has been prepared and the New

Notes will not be offered or sold or otherwise made available to any retail investor in the UK.

Each person in the UK who acquires any New Notes under, the offers

to the public contemplated in the New Notes Offering, or to whom the New Notes are otherwise made available, will be deemed to have represented,

warranted, acknowledged and agreed to and with each underwriter and PGF that it and any person on whose behalf it acquires New Notes

is: (1) a "qualified investor" within the meaning of the UK Prospectus Regulation; and (2) not a "retail investor"

(as defined above).

The communication of this announcement and any other documents

or materials relating to the New Notes Offering and the Tender Offers is not being made and such documents and/or materials have not

been approved by an authorized person for the purposes of Section 21 of the Financial Services and Markets Act 2000. This announcement

and any other documents related to the New Notes Offering and the Tender Offers are for distribution only to persons who (i) have professional

experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (the “Order”), (ii) are persons falling within Article 49(2)(a) to (d) (“high net worth

companies, unincorporated associations, etc.”) of the Order, (iii) are outside the United Kingdom, (iv) are members or creditors

of certain bodies corporate as defined by or within Article 43(2) of the Order, or (v) are persons to whom an invitation or inducement

to engage in investment activity (within the meaning of section 21 of the Financial Services and Markets Act 2000) in connection with

the issue, sale or offer to purchase of any securities may otherwise lawfully be communicated or caused to be communicated (all such

persons together being referred to as “relevant persons”). This announcement and any other documents related to the New Notes

Offering and the Tender Offers are directed only at relevant persons and must not be acted on or relied on by persons who are not relevant

persons. Any investment or investment activity to which this process release and any other documents related to the New Notes Offering

and the Tender Offers are available only to relevant persons and will be engaged in only with relevant persons.

Forward-Looking Statements

This announcement contains forward-looking statements.

Forward-looking statements are information of a non-historical nature or which relate to future events and are subject to risks and uncertainties.

No assurance can be given that the transactions described herein will be consummated or as to the ultimate terms of any such transactions.

Petrobras undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information

or future events or for any other reason.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

PETRÓLEO BRASILEIRO S.A--PETROBRAS |

| |

|

|

| |

By: |

/s/ Guilherme Rajime Takahashi Saraiva |

| |

|

Name: Guilherme Rajime Takahashi Saraiva |

| |

|

Title: Attorney-in-fact |

| |

|

|

| |

By: |

/s/ Lucas Tavares de Mello |

| |

|

Name: Lucas Tavares de Mello |

| |

|

Title: Attorney-in-fact |

Date: September 3, 2024

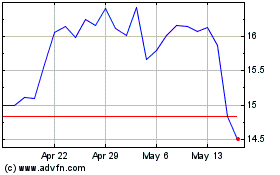

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Oct 2024 to Nov 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Nov 2023 to Nov 2024