Filed Pursuant to Rule 424(b)(3)

Registration No. 333-276401

PROSPECTUS

RUBICON TECHNOLOGIES,

INC.

7,420,366 Shares

of Class A Common Stock

This prospectus relates to the

offer and resale, from time to time, by the Selling Stockholders named in this prospectus or its permitted transferee(s) (the “Selling

Stockholders”) of up to 7,420,366 shares (the “Shares”) of Class A common stock, par value $0.0001

per share (the “Class A Common Stock”), of Rubicon Technologies, Inc. (the “Company”

or “Rubicon”).

The Shares acquired by the Selling

Stockholders consist of (i) up to 2,000,000 Class A Common Stock issuable to Vellar Opportunity Fund SPV LLC – Series 2 (“Vellar”)

as payment for a $2,000,000 deferred termination fee owed to Vellar pursuant to the terms and conditions of the termination and release

agreement, dated as of November 30, 2022 (the “Vellar Termination Agreement”) by and among Vellar, the

Company, and Rubicon Technologies Holdings, LLC; (ii) 4,529,837 Class A Common Stock issued to Palantir Technologies, Inc. (“Palantir”)

pursuant to (a) Order Form No. 2 Share Issuance Agreement, dated as of June 28, 2023, by and between the Company and Palantir (“Order

Form No. 2”) and (b) Palantir Order Form – Order #4, dated as of April 1, 2023, by and between Rubicon Global,

LLC and Palantir (“Order Form No. 4”); (iii) 667,897 Class A Common Stock issued to Mizzen Capital, LP (“Mizzen”)

pursuant to the Third Amendment to Warrant and Registration Rights Agreement (the “Mizzen Warrant”), dated

as of June 7, 2023, by and between Rubicon Technologies Holdings, LLC and Mizzen; and (iv) 222,632 Class A Common Stock issued to

Star Strong Capital LLC (“Star Strong”) pursuant to the Third Amendment to Warrant and Registration Rights

Agreement (the “Star Strong Warrant”), dated as of June 7, 2023, by and between Rubicon Technologies Holdings,

LLC and Star Strong.

The Selling Stockholders may

sell any, all, or none of the securities and we do not know when or in what amount the Selling Stockholders may sell their securities

hereunder following the date of this prospectus. The Selling Stockholders may sell the securities covered by this prospectus in a number

of different ways and at varying prices. We provide more information about how the Selling Stockholders may sell their securities in

the section titled “Plan of Distribution” beginning on page 18 of this prospectus.

We are registering the offer

and sale of these securities to satisfy certain registration rights we have granted under an agreement between us and the Selling Stockholders.

We will not receive any of the proceeds from the sale of the securities by the Selling Stockholders. We will pay the expenses associated

with registering the sales by the Selling Stockholders other than any underwriting discounts and commissions, as described in more detail

in the section titled “Use of Proceeds” appearing on page 9 of this prospectus.

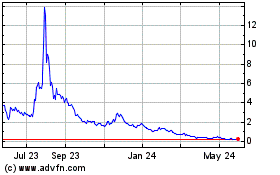

Our Class A Common Stock trades

on The New York Stock Exchange, or NYSE, under the symbol “RBT”. On January 11, 2024, the closing price of the Class A Common

Stock as reported on NYSE was $1.27 per share.

We are an “emerging

growth company” as defined in Section 2(a) of the Securities Act and are subject to reduced public company reporting requirements.

See section entitled “Risk Factors.”

INVESTING IN OUR SECURITIES

INVOLVES A HIGH DEGREE OF RISK. PLEASE CAREFULLY READ THE INFORMATION UNDER THE HEADINGS “RISK FACTORS” BEGINNING ON PAGE

6 OF THIS PROSPECTUS, ANY SIMILAR SECTION CONTAINED IN ANY APPLICABLE PROSPECTUS SUPPLEMENT, AND “ITEM 1A - RISK FACTORS”

OF OUR MOST RECENT REPORT ON FORM 10-K OR 10-Q THAT IS INCORPORATED BY REFERENCE IN THIS PROSPECTUS BEFORE YOU INVEST IN OUR SECURITIES.

Neither the SEC nor any state

securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

The date of this prospectus is January 12, 2024.

Table of Contents

You should rely only on the information provided

in this prospectus, as well as the information incorporated by reference into this prospectus and any applicable prospectus supplement.

Neither we nor the Selling Stockholders have authorized anyone to provide you with different information. Neither we nor the Selling

Stockholders are making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that

the information in this prospectus, any applicable prospectus supplement or any documents incorporated by reference is accurate as of

any date other than the date of the applicable document. Since the respective dates of this prospectus and the documents incorporated

by reference into this prospectus, our business, financial condition, results of operations and prospects may have changed.

ABOUT THIS PROSPECTUS

This prospectus is part

of a registration statement on Form S-3 that we filed with the United States Securities and Exchange Commission (the “SEC”)

using a “shelf” registration process. Under this shelf registration process, the Selling Stockholders may, from time

to time, offer and sell the securities described in this prospectus. Additionally, under the shelf process, in certain circumstances,

we may provide a prospectus supplement that will contain certain specific information about the terms of a particular offering

by the Selling Stockholders. The Selling Stockholders may use the shelf registration statement to sell up to an aggregate of 7,420,366

Class A Common Stock from time to time as described in the section entitled “Plan of Distribution.”

We will not receive any

proceeds from the sale of the Class A Common Stock to be offered by the Selling Stockholders pursuant to this prospectus. We will

pay the expenses, other than underwriting discounts and commissions, if any, associated with the sale of the Class A Common Stock

pursuant to this prospectus. To the extent required, we and the Selling Stockholders, as applicable, will deliver a prospectus

supplement or post-effective amendment with this prospectus to update the information contained in this prospectus. The prospectus

supplement or post-effective amendment may also add, update or change information included in this prospectus. You should read

both this prospectus and any applicable prospectus supplement or post-effective amendment, together with additional information

described below under the captions “Where You Can Find More Information” and “Documents Incorporated

by Reference.”

No offer of these securities

will be made in any jurisdiction where the offer is not permitted.

Unless the context indicates

otherwise, the terms “Company,” “we,” “us” and “our”

refer to Rubicon Technologies, Inc., a Delaware corporation.

TRADEMARKS

This prospectus and the

documents incorporated by reference herein contain trademarks, service marks, copyrights and trade names of other companies, which

are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, copyrights,

or trade names to imply a relationship with, or endorsement or sponsorship of us by any other companies. Solely for convenience,

our trademarks and trade names referred to in this prospectus and the documents incorporated by reference herein may appear without

the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest

extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

MARKET AND INDUSTRY DATA

This prospectus and the

documents incorporated by reference herein include industry position and industry data and forecasts that we obtained or derived

from internal company reports, independent third-party publications and other industry data. Some data are also based on good faith

estimates, which are derived from internal company analyses or review of internal company reports as well as the independent sources

referred to above.

Although we believe that

the information on which we have based these estimates of industry position and industry data are generally reliable, the accuracy

and completeness of this information is not guaranteed and we have not independently verified any of the data from third-party

sources nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to industry position are

based on market data currently available. While we are not aware of any misstatements regarding the industry data presented herein,

these estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under

the heading “Risk Factors” in this prospectus. These and other factors could cause results to differ materially

from those expressed in these publications and reports.

PROSPECTUS SUMMARY

This summary highlights

selected information and does not contain all of the information that is important to you. This summary is qualified in its entirety

by the more detailed information included in or incorporated by reference into this prospectus. Before making your investment decision

with respect to our securities, you should carefully read this entire prospectus, any applicable prospectus supplement and the

documents referred to in “Where You Can Find More Information” and “Documents Incorporated by Reference.”

Unless the context indicates

otherwise, the terms “Company,” “we,” “us” and “our” refer to Rubicon Technologies,

Inc., a Delaware corporation.

Company Overview

Founded in 2008, we are

a digital marketplace for waste and recycling and provide cloud-based waste and recycling solutions to businesses and governments.

As a digital challenger to status quo waste companies, we have developed and commercialized a proven, cutting-edge platform that

brings transparency and environmental innovation to the waste and recycling industry, enabling customers and hauling and recycling

partners to make data-driven decisions that can lead to more efficient and effective operations and yield more sustainable outcomes.

Using proprietary technology in Machine Learning, Artificial Intelligence (“AI”), computer vision, and

Industrial Internet of Things (“IoT”), for which we have secured more than 60 U.S. and international

patents, we have built an innovative digital platform aimed at modernizing the outdated, approximately $1.6 trillion global waste

and recycling industry.

Through our suite of cutting-edge

solutions, we have driven innovation in the waste and recycling industry, reimagined the customer experience, and empowered a wide

range of customers, from small businesses to Fortune 500 companies, to municipal and city agencies, to better optimize their waste

handling and recycling programs. The implementation of our solutions enables customers to find economic value in their physical

waste streams by improving business processes, reducing costs, and saving energy while helping those customers execute their sustainability

goals.

We are a leading provider

of cloud-based waste and recycling solutions for businesses, governments, and organizations worldwide. Our platform brings new

transparency to the waste and recycling industry — empowering our customers and hauling and recycling partners to make data-driven

decisions that can lead to more efficient and effective operations as well as more sustainable waste outcomes. Our platform primarily

serves three constituents – waste generator customers, hauling and recycling partners, and municipalities/governments.

We believe we have built

one of the world’s largest digital marketplaces for waste and recycling services. Underpinning this marketplace is a cutting-edge,

modular platform that powers a modern, digital experience and delivers data-driven insights and transparency for our customers

and hauling and recycling partners. We provide our waste generator customers with a digital marketplace that delivers pricing transparency,

self-service capabilities, and a seamless customer experience while helping them achieve their environmental goals. We enhance

our hauling and recycling partners’ economic opportunities by democratizing access to large, national accounts that typically

engage suppliers at the corporate level. By providing telematics-based and waste-specific solutions as well as access to group

purchasing efficiencies, we help large national accounts optimize their businesses. We help governments provide more advanced waste

and recycling services that allow them to serve their local communities more effectively by digitizing their routing and back-office

operations and using our computer vision technology to combat recycling material contamination at the source.

Over the past decade, this

value proposition has allowed us to scale our platform considerably. Our digital marketplace now services over 8,000 waste generator

customers, including numerous large, blue-chip customers such as Apple, Dollar General, Starbucks, Walmart, Chipotle, and FedEx,

which together are representative of our broader customer base. Our waste generator customers are serviced by our network of over

8,000 hauling and recycling partners across North America. We have also deployed our technology in over 100 municipalities within

the United States and operate in 20 countries. Furthermore, we have secured a robust portfolio of intellectual property, having

been awarded more than 60 patents and 15 trademarks.

Recent Developments

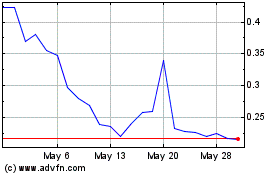

On October 16, 2023, the New

York Stock Exchange (the “NYSE”) notified the Company, and publicly announced, that the NYSE had determined to (a) commence

proceedings to delist the Company’s warrants, each warrant exercisable for one share of the Company’s Class A Common Stock,

at an exercise price of $92.00 per share, and listed to trade on the NYSE under the symbol “RBT WS” and (b) immediately suspend

trading in the warrants due to “abnormally low” trading price levels pursuant to Section 802.01D of the NYSE Listed Company

Manual. The Company did not appeal the NYSE’s determination. Trading in the Company’s Class A Common Stock was unaffected

and continued on the NYSE under the symbol “RBT.”

Corporate Information

Our principal executive

office is located at 335 Madison Avenue, 4th Floor, New York, NY 10017, and our telephone number is (844) 479.1507.

Our website is located at www.rubicon.com. The information contained on, or that may be accessed through our website, is not part

of, and is not incorporated into, this prospectus or the registration statement of which it forms a part.

Implications of Being a Smaller Reporting

Company

We are a “smaller

reporting company” meaning that the market value of our Class A Common Stock held by non-affiliates is less than $250.0 million

measured on the last business day of our second fiscal quarter or our annual revenue is less than $100.0 million during the most

recent completed fiscal year and the market value of our Class A Common Stock held by non-affiliates is less than $700.0 million

measured on the last business day of our second fiscal quarter. Accordingly, we may provide less public disclosure than larger

public companies, including the inclusion of only two years of audited financial statements and only two years of management’s

discussion and analysis of financial condition and results of operations disclosure. As a result, the information that we provide

to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

THE OFFERING

| Issuer |

|

Rubicon Technologies,

Inc. |

| |

|

|

| Shares of Class A Common Stock

that may be offered and sold from time to time by the Selling Stockholders named herein |

|

7,420,366 shares of Class

A Common Stock comprised of (i) up to 2,000,000 Class A Common Stock issuable to Vellar pursuant to the Vellar Termination

Agreement; (ii) 4,529,837 Class A Common Stock issued to Palantir pursuant to Order Form No. 2 and Order Form No. 4; (iii)

667,897 Class A Common Stock issued to Mizzen pursuant to the Mizzen Warrant; and (iv) 222,632 Class A Common Stock issued

to Star Strong pursuant to the Star Strong Warrant. |

| |

|

|

| Use of proceeds |

|

We will not receive any of

the proceeds from the sale of the Shares by the Selling Stockholders. |

| |

|

|

| Market for our Class A Common

Stock |

|

Our Class A Common Stock is currently listed on

the NYSE. |

| |

|

|

| Trading Symbol |

|

“RBT” for our

Class A Common Stock. |

| |

|

|

| Risk Factors |

|

Any investment in the securities

offered hereby is speculative and involves a high degree of risk. You should carefully read and consider the information

set forth under “Risk Factors” on page 6 of this prospectus. |

RISK FACTORS

An investment in our securities

involves a high degree of risk. You should carefully consider the risk factors incorporated by reference to our most recent Annual

Report on Form 10-K, any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained

or incorporated by reference into this prospectus as updated by our subsequent filings under the Exchange Act, and the risk factors

and other information contained in any applicable prospectus supplement and any applicable free writing prospectus before acquiring

any such securities. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered

securities. See “Where You Can Find More Information; Incorporation by Reference” in this prospectus.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus and the

documents incorporated by reference into this prospectus contain forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933, as amended, (the “Securities Act”) and Section 21E of the Securities

Exchange Act of 1934, as amended, (the “Exchange Act”). All statements contained in this prospectus,

the documents incorporated by reference herein and any applicable prospectus supplement other than statements of historical fact,

including statements regarding our future results of operations, financial position, market size and opportunity, our business

strategy and plans, the factors affecting our performance and our objectives for future operations, are forward-looking statements.

In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances,

including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words

such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,”

“estimate,” “forecast,” “project,” “continue,” “could,” “may,”

“might,” “possible,” “potential,” “predict,” “should,” “would,”

“will,” “seek,” “target,” and other similar words and expressions, but the absence of these

words does not mean that a statement is not forward-looking.

These forward-looking statements

involve a number of risks, uncertainties, or other assumptions that may cause actual results or performance to be materially different

from those expressed or implied by these forward-looking statements. You should understand that the following important factors,

in addition to those factors described elsewhere in this prospectus, could affect the future results of Rubicon Technologies, Inc.

(“Rubicon” or the “Company”) and could cause those results or other outcomes

to differ materially from those expressed or implied in such forward-looking statements, including Rubicon’s ability to:

|

● |

access,

collect and use personal data about consumers; |

|

● |

execute

its business strategy, including monetization of services provided and expansions in and into existing and new lines of business; |

|

● |

realize

the benefits expected from the business combination; |

|

● |

anticipate

the uncertainties inherent in the development of new business lines and business strategies; |

|

● |

retain and

hire necessary employees; |

|

● |

increase

brand awareness; |

|

● |

attract,

train and retain effective officers, key employees or directors; |

|

● |

upgrade

and maintain information technology systems; |

|

● |

acquire

and protect intellectual property; |

|

● |

meet future

liquidity requirements and comply with restrictive covenants related to long-term indebtedness; |

|

● |

effectively

respond to general economic and business conditions; |

|

● |

maintain

the listing of the Company’s securities on the NYSE or an inability to have its securities listed on another national

securities exchange; |

|

● |

obtain additional

capital, including use of the debt market; |

|

● |

enhance

future operating and financial results; |

|

● |

anticipate

rapid technological changes; |

|

● |

comply with

laws and regulations applicable to its business, including laws and regulations related to data privacy and insurance operations; |

|

● |

stay abreast

of modified or new laws and regulations applying to its business; |

|

● |

anticipate

the impact of, and respond to, new accounting standards; |

|

● |

anticipate

the rise in interest rates and other inflationary pressures which increase the cost of capital; |

|

● |

anticipate

the significance and timing of contractual obligations; |

|

● |

maintain

key strategic relationships with partners and distributors; |

|

● |

respond

to uncertainties associated with product and service development and market acceptance; |

|

● |

manage to

finance operations on an economically viable basis; |

|

● |

anticipate

the impact of new U.S. federal income tax law, including the impact on deferred tax assets; |

|

● |

successfully

defend litigation; |

|

● |

successfully

deploy the proceeds from its transactions; and |

|

● |

other risks

and uncertainties set forth under the section entitled “Risk Factors” beginning on page 6 of this prospectus. |

These and other factors

that could cause actual results to differ from those implied by the forward-looking statements in this prospectus are more fully

described under the heading “Risk Factors” and elsewhere in this prospectus. Forward-looking statements are

not guarantees of performance and speak only as of the date hereof. The forward-looking statements are based on the current and

reasonable expectations of Rubicon’s management but are inherently subject to uncertainties and changes in circumstances

and their potential effects and speak only as of the date of such statements. There can be no assurance that future developments

will be those that have been anticipated or that we will achieve or realize these plans, intentions or expectations.

All forward-looking statements

attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary

statements. The Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise, except as required by law.

In addition, statements

of belief and similar statements reflect the beliefs and opinions of the Company on the relevant subject. These statements are

based upon information available to the Company as of the date of this prospectus, and while the Company believes such information

forms a reasonable basis for such statements, such information may be limited or incomplete, and statements should not be read

to indicate that the Company has conducted an exhaustive inquiry into, or review of, all potentially available relevant information.

These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements.

USE OF PROCEEDS

All of the Shares offered

by the Selling Stockholders pursuant to this prospectus will be sold by the Selling Stockholders for their respective accounts.

We will not receive any of the proceeds from the sale of the Shares.

With respect to the registration

of the Shares offered by the Selling Stockholders pursuant to this prospectus, the Selling Stockholders will pay any underwriting

discounts and commissions and expenses incurred by the Selling Stockholders for brokerage, accounting, tax or legal services or

any other expenses incurred by the Selling Stockholders in disposing of the Shares. We will bear the costs, fees and expenses incurred

in effecting the registration of the Shares covered by this prospectus, including all registration and filing fees and fees and

expenses of our counsel and our independent registered public accounting firm.

DESCRIPTION OF SECURITIES

The following description

of our Class A Common Stock, Class V common stock, par value $0.0001 per share (“Class V Common Stock”

together with Class A Common Stock, the “Common Stock”), which are the only securities of the Company

registered under Section 12 of the Exchange Act, and Public Warrants (as defined below) summarizes certain information regarding

the Common Stock and the Public Warrants in our certificate of incorporation (as amended, the “Charter”),

our bylaws (the “Bylaws”) and applicable provisions of Delaware general corporate law (the “DGCL”),

and is qualified by reference to our Charter and our Bylaws, which are incorporated by reference as Exhibit 3.2 and 3.3, respectively,

to the Annual Report on Form 10-K for the fiscal year ending December 31, 2022 (our “Annual Report”).

Authorized and Outstanding Stock

The Charter authorizes

the issuance of 975,000,000 shares of common stock, consisting of (i) 690,000,000 shares of Class A Common Stock, par value $0.0001

per share, (ii) 275,000,000 shares of Class V Common Stock, par value $0.0001 per share, and (ii) 10,000,000 shares of preferred

stock, par value $0.0001 per share.

Common Stock

The Charter authorizes two

classes of common stock, Class A Common Stock and Class V Common Stock, each with a par value of $0.0001. As of January 11, 2024, there

were 42,389,738 shares of Class A Common Stock issued and outstanding and 4,425,388 shares of Class V Common Stock issued and outstanding.

Pursuant to the Eighth

Amended and Restated Limited Liability Company Agreement of Rubicon Technologies, LLC (the “A&R LLCA”),

Class B Units are exchangeable into an equivalent number of Class A Common Stock, subject to certain limitations and adjustments,

at the election of the holder thereof or pursuant to a mandatory redemption at the election of Rubicon (as managing member of Rubicon

Technologies, LLC (“Holdings LLC”)). Upon the exchange of any Class B Units, Rubicon will retire an equivalent

number of shares of Class V Common Stock held by such holder of exchanged Class B Units.

Preferred Stock

The Charter provides that

up to 10,000,000 shares of preferred stock may be issued from time to time in one or more series. The Board of Directors (“Board”)

is authorized to fix the voting rights, if any, designations, powers, preferences and relative, participating, optional, special

and other rights, if any, and any qualifications, limitations and restrictions thereof, applicable to the shares of each series.

The Board is able, without stockholder approval, to issue preferred stock with voting and other rights that could adversely affect

the voting power and other rights of the holders of the Class A Common Stock and Class V Common Stock and could have anti-takeover

effects. The ability of the Board to issue preferred stock without stockholder approval could have the effect of delaying, deferring,

or preventing a change of control of us or the removal of existing management. We have no preferred stock outstanding at the date

hereof. Although we do not currently intend to issue any shares of preferred stock, we cannot assure you that we will not do so

in the future.

Dividends and Other Distributions

Under the Charter, holders

of Class A Common Stock are entitled to receive ratable dividends, if any, as may be declared from time-to-time by our Board out

of legally available assets or funds. There are no current plans to pay cash dividends on Class A Common Stock for the foreseeable

future. In the event of our liquidation, dissolution or winding-up, the holders of our Class A Common stock will be entitled to

share ratably in all assets remaining after payment of or provision for any liabilities, subject to prior distribution rights of

preferred stock, if any, then outstanding. Class V Common Stock has no economic rights and shares of Class V Common Stock are not

entitled to receive any assets upon dissolution, liquidation or winding up of Rubicon, nor can such shares participate in any dividends

or distributions of Rubicon.

We are a holding company

with no material assets other than our interest in Holdings LLC. We intend to cause Holdings LLC to make distributions to holders

of Class A Units and Class B Units in amounts such that the total cash distribution from Holdings LLC to the holders are sufficient

to enable each holder to pay all applicable taxes on taxable income allocable to such holder and other obligations under the Tax

Receivable Agreement, dated August 15, 2022 (the “Tax Receivable Agreement”), by and among Rubicon,

Holdings LLC, the TRA Representative (as defined therein), and certain former equity holders of Rubicon, as well as any cash dividends

declared by us.

The A&R LLCA generally

provides that pro rata cash tax distributions will be made to holders of Class A Units and Class B Units (including Rubicon) at

certain assumed tax rates. We anticipate that the distributions we will receive from Holdings LLC may, in certain periods, exceed

our actual tax liabilities and obligations to make payments under the Tax Receivable Agreement. The Board, in its sole discretion,

will make any determination from time to time with respect to the use of any such excess cash so accumulated, which may include,

among other uses, to pay dividends on the Class A Common Stock. We will have no obligation to distribute such cash (or other available

cash other than any declared dividend) to stockholders. We also expect, if necessary, to undertake ameliorative actions, which

may include pro rata or non-pro rata reclassifications, combinations, subdivisions or adjustments of outstanding Class A Units

pursuant to the A&R LLCA, to maintain one-for-one parity between Class A Units held by us and shares of Class A Common Stock.

Voting Power

Except as otherwise required

by law or as otherwise provided in any certificate of designation for any series of preferred stock, under the Charter, the holders

of Class A Common Stock and Class V Common Stock possess all voting power for the election of our directors and all other matters

requiring stockholder action and are entitled to one vote per share on matters to be voted on by stockholders. Holders of Class

A Common Stock and Class V Common Stock shall at all times vote together as one class on all matters submitted to a vote of the

holders of Class A Common Stock and Class V Common Stock under the Charter. Under the Charter, directors are elected by a plurality

voting standard, whereby each of our stockholders may not give more than one vote per share towards any one director nominee. There

are no cumulative voting rights.

Preemptive or Other Rights

The Charter does not provide

for any preemptive or other similar rights.

Limitations on Liability and Indemnification

of Officers and Directors

The Charter and Bylaws

limit the liability of our directors and provide for the indemnification of our current and former officers and directors, in each

case, to the fullest extent permitted by Delaware law.

We have entered into agreements

with our officers and directors to provide contractual indemnification in addition to the indemnification provided for in our Charter

and Bylaws. The Charter and Bylaws also permit us to secure insurance on behalf of any officer, director or employee for any liability

arising out of his or her actions.

In connection with the

closing of the business combination, Rubicon (formerly named Founder SPAC) purchased a tail policy with respect to liability coverage

for the benefit of former Founder SPAC officers and directors. We will maintain such tail policy for a period of no less than six

(6) years following the closing of the business combination.

These provisions may discourage

stockholders from bringing a lawsuit against our directors for breach of their fiduciary duty. These provisions also may have the

effect of reducing the likelihood of derivative litigation against officers and directors, even though such an action, if successful,

might otherwise benefit us and our stockholders. Furthermore, a stockholder’s investment may be adversely affected to the

extent we pay the costs of settlement and damage awards against officers and directors pursuant to these indemnification provisions.

We believe that these provisions,

the directors’ and officers’ liability insurance and the indemnity agreements are necessary to attract and retain talented

and experienced officers and directors.

Exclusive Forum

The Charter provides that,

unless Rubicon selects or consents in writing to the selection of an alternative forum, to the fullest extent permitted by the

applicable law: (a) the sole and exclusive forum for any complaint asserting any internal corporate claims, to the fullest extent

permitted by law, and subject to applicable jurisdictional requirements, shall be the Court of Chancery of the State of Delaware

(or, if the Court of Chancery does not have, or declines to accept, jurisdiction, another state court or a federal court located

within the State of Delaware); and (b) the sole and exclusive forum for any complaint asserting a cause of action arising under

the Securities Act, to the fullest extent permitted by law, shall be the federal district courts of the United States of America.

For purposes of the foregoing, “internal corporate claims” means claims, including claims in the right of Rubicon that

are based upon a violation of a duty by a current or former director, officer, employee, or stockholder in such capacity, or as

to which the DGCL confers jurisdiction upon the Court of Chancery. Any person or entity purchasing or otherwise acquiring any interest

in any shares of Class A Common Stock or Class V Common Stock will be deemed to have notice of and consented to the provisions

of this provision.

Certain Anti-Takeover Provisions of Delaware

Law; Rubicon’s Certificate of Incorporation and Bylaws

The Charter and Bylaws

contain, and the DGCL contains, provisions, as summarized in the following paragraphs, that are intended to enhance the likelihood

of continuity and stability in the composition of the Board. These provisions are intended to avoid costly takeover battles, reduce

our vulnerability to a hostile change of control and enhance the Board’s ability to maximize stockholder value in connection

with any unsolicited offer to acquire Rubicon. However, these provisions may have an anti-takeover effect and may delay, deter

or prevent a merger or acquisition of Rubicon by means of a tender offer, a proxy contest or other takeover attempt that a stockholder

might consider in its best interest, including those attempts that might result in a premium over the prevailing market price for

the shares of Class A Common Stock held by stockholders.

Delaware Law

Rubicon is governed by

the provisions of Section 203 of the DGCL. Section 203 generally prohibits a publicly held Delaware corporation from

engaging in a “business combination” with any “interested stockholder” for a period of three years after

the date of the transaction in which the person became an interested stockholder, unless (with certain exceptions) the business

combination or the transaction in which the person became an interested stockholder is approved in a prescribed manner. Generally,

a “business combination” includes a merger, asset or stock sale, or other transaction resulting in a financial benefit

to the interested stockholder. Generally, an “interested stockholder” is a person who, together with affiliates and

associates, owns (or within three years prior to the determination of interested stockholder status, did own) 15% or more of a

corporation’s voting stock. These provisions may have the effect of delaying, deferring, or preventing changes in control

of Rubicon not approved in advance by the Board.

Special Meetings

The Charter provides that

special meetings of the stockholders may be called only by or at the direction of the Board, the Chairman of the Board, or the

Chief Executive Officer. The Bylaws prohibit the conduct of any business at a special meeting other than as specified in the notice

for such special meeting. These provisions may have the effect of deferring, delaying, or discouraging hostile takeovers or changes

in control or management of our Company.

Advance Notice of Director Nominations

and New Business

The Bylaws state that in

order for a stockholder to propose nominations of candidates to be elected as directors or any other proper business to be considered

by stockholders at the annual meeting, such stockholder must, among other things, provide notice thereof in writing to the secretary

at the principal executive offices of Rubicon within the time periods set forth in the Bylaws. Such notice must contain, among

other things, certain information about the stockholder giving the notice (and the beneficial owner, if any, on whose behalf the

nomination or proposal is made) and certain information about any nominee or other proposed business. Stockholder proposals of

business other than director nominations cannot be submitted in connection with special meetings of stockholders.

The Bylaws allow the presiding

officer at a meeting of stockholders to adopt rules and regulations for the conduct of meetings which may have the effect of precluding

the conduct of certain business at a meeting if such rules and regulations are not followed. These provisions may also defer, delay,

or discourage a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors

or otherwise attempting to influence or obtain control of our company.

Supermajority Voting for Amendments to

Our Governing Documents

Certain amendments to the

Charter require the affirmative vote of at least 66⅔% of the voting power of all shares of our common stock then outstanding.

The Charter provides that the Board is expressly authorized to adopt, amend, or repeal the Bylaws and that our stockholders may

amend certain provision of the Bylaws only with the approval of at least 66⅔% of the voting power of all shares of our common

stock then outstanding. These provisions make it more difficult for stockholders to change the Charter or Bylaws and may, therefore,

defer, delay, or discourage a potential acquirer from conducting a solicitation of proxies to amend the Charter or Bylaws or otherwise

attempting to influence or obtain control of our company.

No Cumulative Voting

The DGCL provides that

a stockholder’s right to vote cumulatively in the election of directors does not exist unless the Charter specifically provides

otherwise. The Charter does not provide for cumulative voting. The prohibition on cumulative voting has the effect of making it

more difficult for stockholders to change the composition of the Board.

Classified Board of Directors

The Charter provides that

the Board is divided into three classes of directors, with the classes to be as nearly equal in number as possible, designated

Class I, Class II and Class III. The terms of Class I, Class II and Class III directors end at our 2023, 2024 and 2025 annual meetings

of stockholders, respectively. As of June 8, 2023, the Class I director nominees were re-elected for a three-year term expiring

at Rubicon’s 2026 annual meeting.

Directors of each class

the term of which shall then expire shall be elected to hold office for a three-year term. The classification of directors has

the effect of making it more difficult for stockholders to change the composition of our Board and require a longer time period

to do so. The Charter provides that the number of directors will be fixed from time to time exclusively pursuant to a resolution

adopted by the Board. The classification of directors has the effect of making it more difficult for stockholders to change the

composition of our Board. As a result, in most circumstances, a person can gain control of the Board only by successfully engaging

in a proxy contest at two or more meetings of stockholders at which directors are elected.

Removal of Directors; Vacancies

The Charter and Bylaws

provide that, so long as the Board is classified, directors may be removed only for cause and only upon the affirmative vote of

holders of at least 66⅔% of the voting power of all the then outstanding shares of common stock entitled to vote generally

in the election of directors, voting together as a single class. Therefore, because stockholders cannot call a special meeting

of stockholders, as discussed above, stockholders may only submit a stockholder proposal for the purpose of removing a director

at an annual meeting. The Charter and Bylaws provide that vacancies and newly created directorships resulting from any increase

in the authorized number of directors shall be filled only by a majority of the directors then in office or by a sole remaining

director. Therefore, while stockholders may remove a director, stockholders are not able to elect new directors to fill any resulting

vacancies that may be created as a result of such removal.

Stockholder Action by Written Consent

The DGCL permits any action

required to be taken at any annual or special meeting of the stockholders to be taken without a meeting, without prior notice and

without a vote if a consent in writing, setting forth the action so taken, is signed by the holders of outstanding stock having

not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares

of stock entitled to vote thereon were present and voted, unless the Charter provides otherwise. The Charter and Bylaws preclude

stockholder action by written consent. This prohibition, combined with the fact stockholders cannot call a special meeting, as

discussed above, means that stockholders are limited in the manner in which they can bring proposals and nominations for stockholder

consideration, making it more difficult to effect change in our governing documents and the Board.

Warrants

As of January 11, 2024, there

were 30,016,851 warrants outstanding (“Warrants”), consisting of 15,812,476 public warrants (the “Public

Warrants”) and 14,204,375 private warrants (the “Private Warrants”). Each whole Warrant originally

entitled the registered holder to purchase one share of Class A Common Stock at a price of $11.50 per share, subject to adjustment as

set forth in the Warrant Agreement. On September 26, 2023, the Company effected a reverse stock split with a 1:8 ratio (the “Reverse

Stock Split”). Subsequent to the Reverse Stock Split, the exercise price for each Warrant was adjusted to $92.00 per share.

A Warrant does not entitle

the registered holder thereof to any of the rights of a stockholder of Rubicon, including, without limitation, the right to receive

dividends or any voting rights, until such Warrant is exercised for shares of Class A Common Stock. Rubicon will at all times reserve

and keep available a sufficient number of authorized but unissued shares of Class A Common Stock to permit the exercise in full

of all outstanding Warrants.

Warrant Exercise

The Warrants became exercisable

on September 14, 2022 (30 days after the consummation of the Business Combination) and will expire at 5:00 p.m., New York

City time on August 15, 2027 (the fifth anniversary of the completion of the Business Combination) or earlier upon redemption

or liquidation.

The Warrants may be exercised

on or before the expiration date upon surrender of the warrant certificate at the office of the warrant agent, with the subscription

form duly executed, and by paying in full the exercise price and all applicable taxes due for the number of Warrants being exercised.

No fractional shares will be issued upon exercise of the Warrants. If, by reason of any adjustment made pursuant to the Warrant

Agreement, a holder would be entitled, upon the exercise of a Warrant, to receive a fractional interest in a share, we will, upon

such exercise, round up to the nearest whole number of shares of Class A Common Stock to be issued to the Warrant holder.

No Warrant will be exercisable

for cash, and we will not be obligated to issue Class A Common Stock upon exercise of a Warrant unless the shares of Class A Common

Stock issuable upon exercise of such Warrant have been registered, qualified, or deemed to be exempt under the securities laws

of the state of residence of the registered holder of the Warrant. In the event that the foregoing condition is not met, the holder

of such Warrant will not be entitled to exercise such Warrant for cash and such Warrant may have no value and expire worthless.

Notwithstanding the foregoing, in no event will we be required to net cash settle any Warrant.

A holder of a Warrant may

notify us in writing in the event it elects to be subject to a requirement that such holder will not have the right to exercise

such Warrant, to the extent that after giving effect to such exercise, such person (together with such person’s affiliates),

to the warrant agent’s actual knowledge, would beneficially own in excess of 9.8% (the “maximum percentage”)

of the shares of Class A Common Stock outstanding immediately after giving effect to such exercise. The holder of a Warrant may

by written notice increase or decrease the maximum percentage applicable to such holder, on the terms and subject to the conditions

set forth in the Warrant Agreement.

Redemption

Rubicon may, at its option,

redeem not less than all of the outstanding Warrants at any time during the exercise period, at a price of $0.01 per Warrant:

|

● |

upon not

less than 30 days’ prior written notice of redemption to each Warrant holder, |

|

● |

provided

that the last reported sale price of the Class A Common Stock equals or exceeds $144.00 per share (as adjusted for the Reverse

Stock Split) on each of 20 trading days within a 30 trading day period commencing after the Warrants become exercisable and

ending on the third trading day prior to the notice of redemption to Warrant holders, and |

|

● |

provided

that there is an effective registration statement with respect to the Class A Common Stock underlying such Warrants, and

a current prospectus relating thereto, available throughout the 30-day redemption or Rubicon has elected to require the exercise

of the Warrants on a “cashless basis.” |

In accordance with the

Warrant Agreement, in the event that we elect to redeem the outstanding Warrants as set forth above, we will fix a date for the

redemption (the “Redemption Date”). Notice of redemption will be mailed by first class mail, postage

prepaid, not less than 30 days prior to the Redemption Date to the registered holders of the Warrants to be redeemed at their last

addresses as they appear on the registration books. Any notice mailed in the manner provided above will be conclusively presumed

to have been duly given whether or not the registered holder received such notice.

The Warrants may be exercised

for cash at any time after notice of redemption is given by Rubicon and prior to the Redemption Date. On and after the Redemption

Date, the record holder of the Warrants will have no further rights, except to receive the redemption price for such holder’s

Warrants upon surrender thereof.

If we call the Warrants

for redemption as described above, our management will have the option to require all holders that wish to exercise Warrants to

do so on a “cashless basis.” In such event, each holder would pay the exercise price by surrendering the Warrants for

that number of shares of Class A Common Stock equal to the quotient obtained by dividing (x) the product of the number of shares

of Class A Common Stock underlying the Warrants, multiplied by the difference between the exercise price of the Warrants and the

“fair market value” by (y) the fair market value. The “fair market value” shall mean the volume-weighted

average trading price of the Class A Common Stock for the 10 trading days immediately following the date on which the notice of

redemption is sent to the Warrant holders.

Private Warrants

The Private Warrants are

identical to the Public Warrants in all material respects, except that (i) the Private Warrants issued to Jefferies LLC will not

be exercisable more than five years after October 19, 2021 in accordance with FINRA Rule 5110(g)(8), and (ii) the Private

Warrants held by Sponsor and certain insiders of Founder are subject to certain additional transfer restrictions set forth in the

Sponsor Agreement.

Our Transfer Agent and Warrant Agent

The transfer agent for

our Common Stock and warrant agent for our Warrants is Continental Stock Transfer & Trust Company, 1 State Street, New York,

New York 10004.

Listing of Securities

Our Class A Common Stock

are listed on NYSE under the symbol “RBT”.

SELLING STOCKHOLDERS

This prospectus relates

to the offer and resale from time to time by the Selling Stockholders of up to 7,420,366 shares of our Class A Common Stock.

The Selling Stockholders

may from time to time offer and sell any or all of the Shares set forth below pursuant to this prospectus. When we refer to the

“Selling Stockholders” in this prospectus, we mean the persons listed in the table below, and the pledgee(s),

donee(s), transferee(s), assignee(s), successor(s) and others who later come to hold any of the Selling Stockholders’ interest

in our securities after the date of this prospectus.

The table below sets forth,

as of the date of this prospectus, the name of the Selling Stockholders for which we are registering the Shares for resale to the

public, and the aggregate principal amount that such Selling Stockholders may offer pursuant to this prospectus.

In calculating the percentage

of Class A Common Stock owned by the Selling Stockholders, we treated as outstanding the number of shares of Class A Common Stock

issuable upon exercise of the Selling Stockholders’ warrants, if any, but did not assume exercise of any other Selling Stockholders’

warrants.

We cannot advise you as

to whether the Selling Stockholders will in fact sell any or all of such shares of Class A Common Stock. In addition, the Selling

Stockholders may sell, transfer or otherwise dispose of, at any time and from time to time, the Shares in transactions exempt from

the registration requirements of the Securities Act after the date of this prospectus, subject to applicable law.

Selling Stockholders information

for each additional Selling Stockholder, if any, will be set forth by prospectus supplement to the extent required prior to the

time of any offer or sale of such Selling Stockholders’ securities pursuant to this prospectus. Any prospectus supplement

may add, update, substitute, or change the information contained in this prospectus, including the identity of each Selling Stockholder

and the number of shares of Class A Common Stock and Warrants registered on its behalf. The Selling Stockholders are not making

any representation that any securities covered by this prospectus will be offered for sale. The Selling Stockholders reserve the

right to accept or reject, in whole or in part, any proposed sale of the securities. See “Plan of Distribution.”

For purposes of the table below, we assume that all of the securities covered by this prospectus will be sold.

We have determined beneficial

ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for

any other purpose. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting

and sole investment power with respect to all securities that they beneficially own, subject to community property laws where applicable.

Except as described in the footnotes to the following table, none of the persons named in the table has held any position or office

or had any other material relationship with us or our affiliates during the three years prior to the date of this prospectus. The

inclusion of any shares of Class A Common Stock in these table does not constitute an admission of beneficial ownership for the

person named below.

We have based percentage ownership

of our Class A Common Stock prior to this offering on 42,389,738 shares of Class A Common Stock issued and outstanding as of January 11,

2024.

Unless otherwise indicated,

the address of each beneficial owner listed in the table below is c/o Rubicon Technologies, Inc., 335 Madison Avenue, 4th

Floor, New York, NY 10017.

| | |

Shares of

Class A Common Stock

Beneficially Owned | | |

Shares of

Class A Common Stock

Registered | | |

Shares of

Class A Common Stock

Beneficially Owned

After Sale of All Shares of

Common Stock Offered | |

| Selling Stockholders | |

Shares | | |

Percentage(2) | | |

Hereby | | |

Shares | | |

Percentage | |

| Vellar Opportunity Fund SPV LLC – Series 2(1) | |

| 2,000,000 | | |

| 4.7 | % | |

| 2,000,000 | | |

| - | | |

| - | |

| Palantir Technologies, Inc.(3) | |

| 5,480,837 | | |

| 12.9 | % | |

| 4,529,837 | | |

| 951,000 | | |

| 2.5 | % |

| Mizzen Capital, LP(4) | |

| 1,118,696 | | |

| 2.6 | % | |

| 667,897 | | |

| 450,799 | | |

| 1.1 | % |

| Star Strong Capital LLC(5) | |

| 372,898 | | |

| * | | |

| 222,632 | | |

| 150,266 | | |

| * | |

| * | Represents beneficial

ownership of less than 1%. |

|

(1) |

Represents

2,000,000 shares of Class A Common Stock consisting of up to 2,000,000 Shares issuable to Vellar as payment for $2,000,000

deferred termination fee owed to Vellar pursuant to the terms and conditions of the Vellar Termination Agreement. The business

address of Vellar is c/o Andrew Davilman, 3 Columbus Circle, 24th Floor, New York, NY 10019. |

|

(2) |

The percentage

of beneficial ownership is calculated based on 42,389,738 shares of Class A Common Stock outstanding as of January 11, 2024.

Unless otherwise indicated, we believe that all persons named in the table have sole voting and investment power with respect

to all shares of Class A Common Stock beneficially owned by them. |

|

(3) |

Represents 5,480,837 shares of Class A Common Stock beneficially owned by Palantir as of January 11, 2024. These shares consist of (a) 4,529,837 shares of Class A Common Stock registered herein and of which (i) 4,049,067 shares of Class A Common Stock were issued to Palantir pursuant to Order Form No. 2, (ii) 480,770 shares of Class A Common Stock were issued to Palantir pursuant to Order Form No. 4; and (b) 951,000 shares of Class A Common Stock of which (i) 888,673 shares of Class A Common Stock were previously issued to Palantir pursuant to Order Form No. 2 and (ii) 62,327 shares of Class A Common Stock were previously issued to Palantir pursuant to Order Form No. 3, dated as of March 30, 2023, by and between Palantir and Rubicon Global, LLC. The business address of Palantir is 1200 17th Street, Floor 15, Denver, CO 80202. |

|

(4) |

Represents 1,118,696 shares of Class A Common Stock beneficially owned by Mizzen as of January 11, 2024. These shares consist of (i) 667,897 shares of Class A Common Stock issued to Mizzen pursuant to the Mizzen Warrant and registered herein, and (ii) 450,799 shares of Class A Common Stock issued to Mizzen pursuant to the Common Stock Purchase Warrant, dated as of December 22, 2021 (as amended on November 18, 2022, March 22, 2023 and June 7, 2023). The business address of Mizzen Capital, LPC is 488 Madison Avenue, 18th Floor, New York, NY 10022. |

|

(5) |

Represents 372,898 shares of Class A Common Stock beneficially owned by Star Strong as of January 11, 2024. These shares consist of (i) 222,632 shares of Class A Common Stock issued to Star Strong pursuant to the Star Strong Warrant, and (ii) 150,266 shares of Class A Common Stock issued to Star Strong pursuant to the Common Stock Purchase Warrant, dated as of December 22, 2021 (as amended on November 18, 2022, March 22, 2023 and June 7, 2023). The business address of Star Strong Capital LLC is 470 James Street, Suite 104, New Haven, CT 06513. |

PLAN OF DISTRIBUTION

We are registering the possible

resale by the Selling Stockholders of up to 7,420,366 shares of Class A Common Stock.

We will not receive any of the

proceeds from the sale of the securities by the Selling Stockholders. The aggregate proceeds to the Selling Stockholders will be the

purchase price of the securities less any discounts and commissions borne by the Selling Stockholders.

The Selling Stockholders will

pay any underwriting discounts and commissions and expenses incurred by the Selling Stockholders for brokerage, accounting, tax or legal

services or any other expenses incurred by the Selling Stockholders in disposing of the securities. We will bear all other costs, fees

and expenses incurred in effecting the registration of the securities covered by this prospectus, including, without limitation, all

registration and filing fees, NYSE listing fees and fees and expenses of our counsel and our independent registered public accountants.

The securities beneficially owned

by the Selling Stockholders covered by this prospectus may be offered and sold from time to time by the Selling Stockholders. The Selling

Stockholders will act independently of us in making decisions with respect to the timing, manner and size of each sale. Such sales may

be made on one or more exchanges or in the over-the-counter market or otherwise, at prices and under terms then prevailing or at prices

related to the then current market price or in negotiated transactions. The Selling Stockholders reserve the right to accept and, together

with its respective agents, to reject, any proposed purchase of securities to be made directly or through agents. The Selling Stockholders

and any of their permitted transferees may sell their securities offered by this prospectus on any stock exchange, market or trading

facility on which the securities are traded or in private transactions. If underwriters are used in the sale, such underwriters will

acquire the shares for their own account. These sales may be at a fixed price or varying prices, which may be changed, or at market prices

prevailing at the time of sale, at prices relating to prevailing market prices or at negotiated prices. The securities may be offered

to the public through underwriting syndicates represented by managing underwriters or by underwriters without a syndicate. The obligations

of the underwriters to purchase the securities will be subject to certain conditions. The underwriters will be obligated to purchase

all the securities offered if any of the securities are purchased.

Subject to the limitations set

forth in any applicable registration rights agreement, the Selling Stockholders may use any one or more of the following methods when

selling the securities offered by this prospectus:

|

● |

purchases by a broker-dealer

as principal and resale by such broker-dealer for its own account pursuant to this prospectus; |

|

● |

ordinary brokerage

transactions and transactions in which the broker solicits purchasers; |

|

● |

block trades in

which the broker-dealer so engaged will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

|

● |

an over-the-counter

distribution in accordance with the rules of the NYSE; |

|

● |

through trading

plans entered into by a Selling Stockholder pursuant to Rule 10b5-1 under the Exchange Act that are in place at the time of

an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their

securities on the basis of parameters described in such trading plans; |

|

● |

through one or more

underwritten offerings on a firm commitment or best efforts basis; |

|

● |

settlement of short

sales entered into after the date of this prospectus; |

|

● |

agreements with

broker-dealers to sell a specified number of the securities at a stipulated price per share or warrant; |

|

● |

in “at the

market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the

time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange

or sales made through a market maker other than on an exchange or other similar offerings through sales agents; |

|

● |

directly to purchasers,

including through a specific bidding, auction or other process or in privately negotiated transactions; |

|

● |

through the writing

or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

|

● |

through a combination

of any of the above methods of sale; or |

|

● |

any other method

permitted pursuant to applicable law. |

In addition, a Selling Stockholder

that is an entity may elect to make a pro rata in-kind distribution of securities to its members, partners or stockholders pursuant to

the registration statement of which this prospectus is a part by delivering a prospectus with a plan of distribution. Such members, partners

or stockholders would thereby receive freely tradeable securities pursuant to the distribution through a registration statement. To the

extent a distributee is an affiliate of ours (or to the extent otherwise required by law), we may file a prospectus supplement in order

to permit the distributees to use the prospectus to resell the securities acquired in the distribution.

There can be no assurance that

the Selling Stockholders will sell all or any of the securities offered by this prospectus. In addition, the Selling Stockholders may

also sell securities under Rule 144 under the Securities Act, if available, or in other transactions exempt from registration, rather

than under this prospectus. The Selling Stockholders have the sole and absolute discretion not to accept any purchase offer or make any

sale of securities if they deem the purchase price to be unsatisfactory at any particular time.

The Selling Stockholders also

may transfer the securities in other circumstances, in which case the transferees, pledgees or other successors-in-interest will be the

selling beneficial owners for purposes of this prospectus. Upon being notified by a Selling Stockholder that a donee, pledgee, transferee,

other successor-in-interest intends to sell our securities, we will, to the extent required, promptly file a supplement to this prospectus

to name specifically such person as a Selling Stockholder.

With respect to a particular

offering of the securities held by the Selling Stockholders, to the extent required, an accompanying prospectus supplement or, if appropriate,

a post-effective amendment to the registration statement of which this prospectus is part, will be prepared and will set forth the following

information:

|

● |

the specific securities

to be offered and sold; |

|

● |

the names of the

Selling Stockholders; |

|

● |

the respective purchase

prices and public offering prices, the proceeds to be received from the sale, if any, and other material terms of the offering; |

|

● |

settlement of short

sales entered into after the date of this prospectus; |

|

● |

the names of any

participating agents, broker-dealers or underwriters; and |

|

● |

any applicable commissions,

discounts, concessions and other items constituting compensation from the Selling Stockholders. |

In connection with distributions

of the securities or otherwise, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions.

In connection with such transactions, broker-dealers or other financial institutions may engage in short sales of the securities in the

course of hedging the positions they assume with Selling Stockholders. The Selling Stockholders may also sell the securities short and

redeliver the securities to close out such short positions. The Selling Stockholders may also enter into option or other transactions

with broker-dealers or other financial institutions which require the delivery to such broker-dealer or other financial institution of

securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this

prospectus (as supplemented or amended to reflect such transaction). The Selling Stockholders may also pledge securities to a broker-dealer

or other financial institution, and, upon a default, such broker-dealer or other financial institution, may effect sales of the pledged

securities pursuant to this prospectus (as supplemented or amended to reflect such transaction).

In order to facilitate the offering

of the securities, any underwriters or agents, as the case may be, involved in the offering of such securities may engage in transactions

that stabilize, maintain or otherwise affect the price of our securities. Specifically, the underwriters or agents, as the case may be,

may over allot in connection with the offering, creating a short position in our securities for their own account. In addition, to cover

overallotments or to stabilize the price of our securities, the underwriters or agents, as the case may be, may bid for, and purchase,

such securities in the open market. Finally, in any offering of securities through a syndicate of underwriters, the underwriting syndicate

may reclaim selling concessions allotted to an underwriter or a broker-dealer for distributing such securities in the offering if the

syndicate repurchases previously distributed securities in transactions to cover syndicate short positions, in stabilization transactions

or otherwise. Any of these activities may stabilize or maintain the market price of the securities above independent market levels. The

underwriters or agents, as the case may be, are not required to engage in these activities, and may end any of these activities at any

time.

The Selling Stockholders may

solicit offers to purchase the securities directly from, and it may sell such securities directly to, institutional investors or others.

In this case, no underwriters or agents would be involved. The terms of any of those sales, including the terms of any bidding or auction

process, if utilized, will be described in the applicable prospectus supplement.

It is possible that one or more

underwriters may make a market in our securities, but such underwriters will not be obligated to do so and may discontinue any market

making at any time without notice. We cannot give any assurance as to the liquidity of the trading market for our securities. Our Class

A Common Stock is currently listed on NYSE under the symbol “RBT.”

The Selling Stockholders may

authorize underwriters, broker-dealers or agents to solicit offers by certain purchasers to purchase the securities at the public offering

price set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified

date in the future. The contracts will be subject only to those conditions set forth in the prospectus supplement, and the prospectus

supplement will set forth any commissions we or the Selling Stockholders pay for solicitation of these contracts.

The Selling Stockholders may

enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately

negotiated transactions. If the applicable prospectus supplement indicates, in connection with those derivatives, the third parties may

sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the

third party may use securities pledged by the Selling Stockholders or borrowed from the Selling Stockholders or others to settle those

sales or to close out any related open borrowings of stock, and may use securities received from the Selling Stockholders in settlement

of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter

and will be identified in the applicable prospectus supplement (or a post-effective amendment). In addition, the Selling Stockholders

may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell the securities short using

this prospectus. Such financial institution or other third party may transfer its economic short position to investors in our securities

or in connection with a concurrent offering of other securities.

In effecting sales, broker-dealers

or agents engaged by the Selling Stockholders may arrange for other broker-dealers to participate. Broker-dealers or agents may receive

commissions, discounts or concessions from the Selling Stockholders in amounts to be negotiated immediately prior to the sale.

In compliance with the guidelines

of the Financial Industry Regulatory Authority (“FINRA”), the aggregate maximum discount, commission, fees

or other items constituting underwriting compensation to be received by any FINRA member or independent broker-dealer will not exceed

8% of the gross proceeds of any offering pursuant to this prospectus and any applicable prospectus supplement.

If at the time of any offering

made under this prospectus a member of FINRA participating in the offering has a “conflict of interest” as defined in FINRA

Rule 5121 (“Rule 5121”), that offering will be conducted in accordance with the relevant provisions

of Rule 5121.

To our knowledge, there are currently

no plans, arrangements or understandings between any of the Selling Stockholders and any broker-dealer or agent regarding the sale of

the securities by any of the Selling Stockholders. Upon our notification by a Selling Stockholder that any material arrangement has been

entered into with an underwriter or broker-dealer for the sale of securities through a block trade, special offering, exchange distribution,

secondary distribution or a purchase by an underwriter or broker-dealer, we will file, if required by applicable law or regulation, a

supplement to this prospectus pursuant to Rule 424(b) under the Securities Act disclosing certain material information relating

to such underwriter or broker-dealer and such offering.

Underwriters, broker-dealers

or agents may facilitate the marketing of an offering online directly or through one of their affiliates. In those cases, prospective

investors may view offering terms and a prospectus online and, depending upon the particular underwriter, broker-dealer or agent, place

orders online or through their financial advisors.

In offering the securities covered

by this prospectus, the Selling Stockholders and any underwriters, broker-dealers or agents who execute sales for the Selling Stockholders

may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. Any discounts,

commissions, concessions or profit they earn on any resale of those securities may be underwriting discounts and commissions under the

Securities Act.

The underwriters, broker-dealers

and agents may engage in transactions with us or the Selling Stockholders, or perform services for us or the Selling Stockholders, in

the ordinary course of business.

In order to comply with the securities

laws of certain states, if applicable, the securities must be sold in such jurisdictions only through registered or licensed brokers

or dealers. In addition, in certain states the securities may not be sold unless they have been registered or qualified for sale in the

applicable state or an exemption from the registration or qualification requirement is available and is complied with.

The Selling Stockholders and

any other persons participating in the sale or distribution of the securities will be subject to applicable provisions of the Securities

Act and the Exchange Act, and the rules and regulations thereunder, including, without limitation, Regulation M. These provisions may

restrict certain activities of, and limit the timing of purchases and sales of any of the securities by, the Selling Stockholders or

any other person, which limitations may affect the marketability of the shares of the securities.

We will make copies of this prospectus

available to the Selling Stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Selling

Stockholders may indemnify any agent, broker-dealer or underwriter that participates in transactions involving the sale of the securities

against certain liabilities, including liabilities arising under the Securities Act.

We have agreed to indemnify the

Selling Stockholders against certain liabilities, including certain liabilities under the Securities Act, the Exchange Act or other federal

or state law. Agents, broker-dealers and underwriters may be entitled to indemnification by us and the Selling Stockholders against certain

civil liabilities, including liabilities under the Securities Act, or to contribution with respect to payments which the agents, broker-dealers

or underwriters may be required to make in respect thereof.

LEGAL MATTERS

The validity of the securities

offered by this prospectus have been passed upon us by Winston & Strawn LLP, Houston, Texas.

EXPERTS

The consolidated financial statements

of Rubicon Technologies, Inc. as of and for the years ended December 31, 2022 and 2021, incorporated by reference herein, have been

audited by Cherry Bekaert LLP, an independent registered public accounting firm, as stated in their report incorporated by reference

herein, and are so incorporated upon the report of such firm given upon their authority as experts in accountings and auditing.