Rubicon completes transformative transaction to accelerate

journey to profitability

Rubicon Technologies, Inc. (“Rubicon” or the “Company”) (NYSE:

RBT), a leading provider of technology solutions for waste and

recycling generators, today reported financial and operational

results for the first quarter of 2024.

First Quarter 2024 Financial Highlights Including

Discontinued Operations

- Revenue was $166.1 million, a decrease of $15.0 million or 8.3%

compared to $181.1 million in the first quarter of 2023.

- Gross Profit was $10.1 million, an increase of $0.8 million or

8.2% compared to $9.3 million in the first quarter of 2023.

- Adjusted Gross Profit was $17.1 million, an increase of $1.0

million or 5.9% compared to $16.1 million in the first quarter of

2023.

- Gross Profit Margin was 6.1%, an increase of 93 bps compared to

5.2% in the first quarter of 2023.

- Adjusted Gross Profit Margin was 10.3%, an increase of 138 bps

compared to 8.9% in the first quarter of 2023.

- Net Loss was $(17.2) million, a decrease of $7.7 million or

81.5% compared to $(9.5) million in the first quarter of 2023.

- Adjusted EBITDA was $(11.0) million, an improvement of $2.9

million or 20.9% compared to $(14.0) million in the first quarter

of 2023.

Operational and Business Highlights

- On May 7, 2024 the Company announced that it had sold its fleet

technology business and issued convertible preferred stock in

Rubicon to Rodina Capital, a private investment firm based in

Florida, in a sale with a total transaction value of $94.2 million,

which includes up-front cash of $61.7 million and an earnout

consideration of $12.5 million that could become payable in 2024.

The Company also issued $20.0 million of convertible preferred

stock to Rodina Capital.

- Rubicon participated in a competitive evaluation and won a

significant contract with a new customer in the grocery sector at

the beginning of the second quarter. Providing waste and recycling

services to over 500 stores across the United States and Canada,

this is a valuable contract for Rubicon, with strong potential for

incremental growth opportunities along the way. This customer is

already experiencing the full benefits of Rubicon’s platform for

scalable waste and recycling services, which supports their efforts

to reduce environmental impact while providing exceptional value

and service to their own customers. As a leader in sustainability

with multiple waste streams, this customer’s needs and values align

with what Rubicon does best, reducing costs and increasing

diversion rates. Rubicon has achieved both with other grocery

customers, and we look forward to driving similar results with this

new relationship.

Sale of Fleet Technology Business Unit

On May 7, 2024, Rubicon announced that the Company has sold its

fleet technology business unit and issued convertible preferred

stock in Rubicon to Rodina Capital, a private investment firm based

in Florida, in a sale with a total transaction value of $94.2

million, which includes up-front cash of $61.7 million and an

earnout consideration of $12.5 million that could become payable in

2024, along with a $20.0 million issuance of convertible preferred

stock.

These transactions are transformational for the Company,

ensuring Rubicon’s long-term viability, improving its balance sheet

by reducing debts and providing additional liquidity to enable the

Company to quickly achieve its business objectives, accelerate its

journey to profitability, and continue growing its core business.

Importantly, it marks a return to Rubicon’s core principles, a

business centered on a customer-focused approach that has been

instrumental in the Company’s growth from the outset. This

strategic move underscores Rubicon’s dedication to the

RUBICONConnect™ product, which serves commercial waste generators

from small to medium-sized businesses to Fortune 500 companies.

Many of the Company’s commercial customers are looking to Rubicon

to help them achieve sustainability goals with tailored zero waste

and circular economy solutions, including through the Company’s

recently launched Technical Advisory Services (TAS). This sale and

the new capital will be dedicated to improving services and

strengthening Rubicon’s longstanding relationship with more than

8,000 vendor and hauler partners, 90 percent of which are small,

independent businesses.

“We are pleased to report our results for the first quarter,

demonstrating our continued momentum through year-over-year

Adjusted EBITDA improvement on our path to profitability. This

performance is a testament to the dedication and hard work of our

team, as well as the trust and support of our customers,” said Phil

Rodoni, Chief Executive Officer of Rubicon. “The recent sale of the

fleet technology business unit aligns with our strategic vision to

lead our industry by innovating and investing in sustainable

practices that meet the evolving needs of both our hauler network

and customer base. We are excited to leverage this newfound

financial agility to drive growth, enhance our competitive edge,

and deliver exceptional value to our shareholders and customers

alike.”

Webcast Information

The Rubicon Technologies, Inc. management team will host a

conference call to discuss its first quarter 2024 financial results

this afternoon, Monday, May 20, 2024, at 5:00 p.m. ET. The call can

be accessed via telephone by dialing (929) 203-2112, or toll free

at (888) 660-6863, and referencing Rubicon Technologies, Inc. A

live webcast of the conference will also be available on the Events

and Presentations page on the Investor Relations section of

Rubicon’s website

(https://investors.rubicon.com/events-presentations/default.aspx).

Please log in to the webcast or dial in to the call at least 10

minutes prior to the start of the event.

About Rubicon

Rubicon builds AI-enabled technology products and provides

expert sustainability solutions to waste generators and material

processors to help them understand, manage, and reduce waste. As a

mission-driven company, Rubicon helps its customers improve

operational efficiency, unlock economic value, and deliver better

environmental outcomes. To learn more, visit rubicon.com.

Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures,”

including Adjusted Gross Profit, Adjusted Gross Profit Margin and

Adjusted EBITDA, which are supplemental financial measures that are

not calculated or presented in accordance with generally accepted

accounting principles (GAAP). Such non-GAAP financial measures

should not be considered superior to, as a substitute for or

alternative to, and should be considered in conjunction with, the

GAAP financial measures presented in this press release. The

non-GAAP financial measures in this press release may differ from

similarly titled measures used by other companies. Definitions of

these non-GAAP financial measures, including explanations of the

ways in which Rubicon’s management uses these non-GAAP measures to

evaluate its business, the substantive reasons why Rubicon’s

management believes that these non-GAAP measures provide useful

information to investors and limitations associated with the use of

these non-GAAP measures, are included under “Use of Non-GAAP

Financial Measures” after the tables below. In addition,

reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures are included under

“Reconciliations of Non-GAAP Financial Measures” after the tables

below.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995 and within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

All statements, other than statements of present or historical fact

included in this press release, are forward-looking statements.

When used in this press release, the words “could,” “should,”

“will,” “may,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” the negative of such terms and other similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain such

identifying words. Such forward-looking statements are subject to

risks, uncertainties, and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements. These forward-looking statements

are based upon current expectations, estimates, projections, and

assumptions that, while considered reasonable by Rubicon and its

management, are inherently uncertain; factors that may cause actual

results to differ materially from current expectations include, but

are not limited to: 1) the outcome of any legal proceedings that

may be instituted against Rubicon or others following the closing

of the business combination; 2) Rubicon’s ability to continue to

meet the New York Stock Exchange’s listing standards; 3) changes in

applicable laws or regulations; 4) the possibility that Rubicon may

be adversely affected by other economic, business and/or

competitive factors; 5) Rubicon’s execution of anticipated

operational efficiency initiatives, cost reduction measures and

financing arrangements; and 6) other risks and uncertainties set

forth in the sections entitled “Risk Factors” and “Cautionary Note

Regarding Forward-Looking Statements” in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023 (filed

March 28, 2024 with the Securities and Exchange Commission (the

“SEC”)), Registration Statement on Form S-3, as amended, filed with

the SEC, and other documents Rubicon has filed with the SEC.

Although Rubicon believes the expectations reflected in the

forward-looking statements are reasonable, nothing in this press

release should be regarded as a representation by any person that

the forward-looking statements set forth herein will be achieved or

that any of the contemplated results of such forward looking

statements will be achieved. There may be additional risks that

Rubicon presently does not know of or that Rubicon currently

believes are immaterial that could also cause actual results to

differ from those contained in the forward-looking statements, many

of which are beyond Rubicon’s control. You should not place undue

reliance on forward-looking statements, which speak only as of the

date they are made. Rubicon does not undertake, and expressly

disclaims, any duty to update these forward-looking statements,

except as otherwise required by applicable law.

RUBICON TECHNOLOGIES, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) (in thousands, except per share data)

Three Months Ended

March 31,

2024

2023

Revenue:

Service

$

147,252

$

164,324

Recyclable commodity

15,810

14,733

Total revenue

163,062

179,057

Costs and Expenses:

Cost of revenue (exclusive of amortization

and depreciation):

Service

140,347

157,514

Recyclable commodity

14,055

13,187

Total cost of revenue (exclusive of

amortization and depreciation)

154,402

170,701

Sales and marketing

1,688

2,445

Product development

6,625

7,441

General and administrative

13,086

18,188

Gain on settlement of incentive

compensation

-

(18,622

)

Amortization and depreciation

931

1,113

Total Costs and Expenses

176,732

181,266

Loss from Operations

(13,670

)

(2,209

)

Other Income (Expense):

Interest earned

32

1

Gain (loss) on change in fair value of

warrant liabilities

10,577

(55

)

Gain on change in fair value of earnout

liabilities

111

4,820

Loss on change in fair value of

derivatives

(1,299

)

(2,198

)

Gain on service fee settlements in

connection with the Mergers

-

632

Loss on extinguishment of debt

obligations

-

(2,103

)

Interest expense

(10,750

)

(7,176

)

Related party interest expense

(522

)

(593

)

Other expense

(951

)

(421

)

Total other income (expense)

(2,802

)

(7,093

)

Loss from continuing operations before

income taxes

(16,472

)

(9,302

)

Income tax expense

12

16

Net loss from continuing operations

(16,484

)

(9,318

)

Discontinued operations:

Loss from discontinued operations before

income taxes

(669

)

(133

)

Income tax expense

-

-

Net loss from discontinued operations

(669

)

(133

)

Net loss

$

(17,153

)

$

(9,451

)

Net loss from continuing operations

attributable to noncontrolling interests

(1,437

)

(6,234

)

Net loss from continuing operations

attributable to Class A common stockholders

$

(15,047

)

$

(3,084

)

Net loss from discontinued operations

attributable to noncontrolling interests

(45

)

(88

)

Net loss from discontinued operations

attributable to Class A common stockholders

$

(624

)

$

(45

)

Net loss from continuing operations per

Class A Common share – basic and diluted

$

(0.33

)

$

(0.41

)

Net loss from discontinued operations per

Class A Common share – basic and diluted

$

(0.01

)

$

(0.01

)

Weighted average shares outstanding –

basic and diluted

46,068,599

7,427,116

Use of Non-GAAP Financial

Measures

Adjusted Gross Profit and Adjusted Gross Profit

Margin

Adjusted Gross Profit and Adjusted Gross Profit Margin are

considered non-GAAP financial measures under the rules of the U.S.

Securities and Exchange Commission (the “SEC”) because they

exclude, respectively, certain amounts included in Gross Profit and

Gross Profit Margin calculated in accordance with GAAP.

Specifically, the Company calculates Adjusted Gross Profit by

adding back amortization and depreciation for revenue generating

activities and platform support costs to GAAP Gross Profit, the

most comparable GAAP measure. Adjusted Gross Profit Margin is

calculated as Adjusted Gross Profit divided by total GAAP revenue.

Rubicon believes presenting Adjusted Gross Profit and Adjusted

Gross Profit Margin is useful to investors because they show the

progress in scaling Rubicon’s digital platform by quantifying the

markup and margin Rubicon charges its customers that are

incremental to its marketplace vendor costs. These measures

demonstrate this progress because changes in these measures are

driven primarily by Rubicon’s ability to optimize services for its

customers, improve its hauling and recycling partners’ efficiency

and achieve economies of scale on both sides of the marketplace.

Rubicon’s management team uses these non-GAAP measures as one of

the means to evaluate the profitability of Rubicon’s customer

accounts, exclusive of certain costs that are generally fixed in

nature, and to assess how successful Rubicon is in achieving its

pricing strategies. However, it is important to note that other

companies, including companies in our industry, may calculate and

use these measures differently or not at all, which may reduce

their usefulness as a comparative measure. Further, these measures

should not be read in isolation from or without reference to our

results prepared in accordance with GAAP.

Adjusted EBITDA

Adjusted EBITDA is considered a non-GAAP financial measure under

the rules of the SEC because it excludes certain amounts included

in net loss calculated in accordance with GAAP. Specifically, the

Company calculates Adjusted EBITDA by GAAP net loss adjusted to

exclude interest expense and income, income tax expense and

benefit, amortization and depreciation, gain or loss on

extinguishment of debt obligations, equity-based compensation, gain

or loss on change in fair value of warrant liabilities, gain or

loss on change in fair value of earn-out liabilities, gain or loss

on change in fair value of derivatives, executive severance

charges, gain or loss on settlement of the management rollover

bonuses, gain or loss on service fee settlements in connection with

the Mergers, other non-operating income and expenses, and unique

non-recurring income and expenses.

The Company has included Adjusted EBITDA because it is a key

measure used by Rubicon’s management team to evaluate its operating

performance, generate future operating plans, and make strategic

decisions, including those relating to operating expenses. Further,

the Company believes Adjusted EBITDA is helpful in highlighting

trends in Rubicon’s operating results because it allows for more

consistent comparisons of financial performance between periods by

excluding gains and losses that are non-operational in nature or

outside the control of management, as well as items that may differ

significantly depending on long-term strategic decisions regarding

capital structure, the tax jurisdictions in which Rubicon operates

and capital investments. Adjusted EBITDA is also often used by

analysts, investors and other interested parties in evaluating and

comparing Rubicon’s results to other companies within the industry.

Accordingly, the Company believes that Adjusted EBITDA provides

useful information to investors and others in understanding and

evaluating its operating results in the same manner as Rubicon’s

management team and board of directors.

Adjusted EBITDA has limitations as an analytical tool, and it

should not be considered in isolation or as a substitute for

analysis of net loss or other results as reported under GAAP. Some

of these limitations are:

- Adjusted EBITDA does not reflect the Company’s cash

expenditures, future requirements for capital expenditures, or

contractual commitments;

- Adjusted EBITDA does not reflect changes in, or cash

requirements for, the Company’s working capital needs;

- Adjusted EBITDA does not reflect the Company’s tax expense or

the cash requirements to pay taxes;

- although amortization and depreciation are non-cash charges,

the assets being amortized and depreciated will often have to be

replaced in the future and Adjusted EBITDA does not reflect any

cash requirements for such replacements;

- Adjusted EBITDA should not be construed as an inference that

the Company’s future results will be unaffected by unusual or

non-recurring items for which the Company may make adjustments in

historical periods; and

- other companies in the industry may calculate Adjusted EBITDA

differently than the Company does, limiting its usefulness as a

comparative measure.

Reconciliations of Non-GAAP Financial Measures

The following reconciliations of the non-GAAP financial measures

include both continuing and discontinued operations.

Adjusted Gross Profit and Adjusted Gross Profit

Margin

The following table presents reconciliations of Adjusted Gross

Profit and Adjusted Gross Margin to the most directly comparable

GAAP financial measures for each of the periods indicated.

Three Months Ended

March 31,

2024

2023

(in thousands, except

percentages)

Total revenue

$

166,075

$

181,098

Less: total cost of revenue (exclusive of

amortization and depreciation)

155,402

171,188

Less: amortization and depreciation for

revenue generating activities

573

574

Gross profit

$

10,100

$

9,336

Gross profit margin

6.1

%

5.2

%

Gross profit

$

10,100

$

9,336

Add: amortization and depreciation for

revenue generating activities

573

574

Add: platform support costs(1)

6,430

6,236

Adjusted gross profit

$

17,103

$

16,146

Adjusted gross profit margin

10.3

%

8.9

%

Amortization and depreciation for revenue

generating activities

$

573

$

574

Amortization and depreciation for sales,

marketing, general and administrative activities

640

787

Total amortization and depreciation

$

1,213

$

1,361

Platform support costs(1)

$

6,430

$

6,236

Marketplace vendor costs(2)

148,972

164,952

Total cost of revenue (exclusive of

amortization and depreciation)

$

155,402

$

171,188

(1)

We define platform support costs as costs

to operate our revenue generating platforms that do not directly

correlate with volume of sales transactions procured through our

digital marketplace. Such costs include employee costs, data costs,

platform hosting costs and other overhead costs.

(2)

We define marketplace vendor costs as

direct costs charged by our hauling and recycling partners for

services procured through our digital marketplace.

Adjusted EBITDA

The following table presents reconciliations of Adjusted EBITDA

to the most directly comparable GAAP financial measure for each of

the periods indicated.

Three Months Ended

March 31,

2024

2023

(in thousands, except

percentages)

Total revenue

$

166,075

$

181,098

Net loss

$

(17,153

)

$

(9,451

)

Adjustments:

Interest expense

10,750

7,176

Related party interest expense

522

593

Interest earned

(111

)

(1

)

Income tax expense

12

16

Amortization and depreciation

1,213

1,361

Loss on extinguishment of debt

obligations

-

2,103

Equity-based compensation

563

9,302

(Gain) loss on change in fair value of

warrant liabilities

(10,577

)

55

Gain on change in fair value of earn-out

liabilities

(32

)

(4,820

)

Loss on change in fair value of

derivatives

1,299

2,198

Executive severance charges

1,532

4,553

Gain on settlement of Management Rollover

Bonuses

-

(26,826

)

Gain on service fee settlements in

connection with the Mergers

-

(632

)

Other expenses(3)

951

421

Adjusted EBITDA

$

(11,031

)

$

(13,952

)

Net loss as a percentage of total

revenue

(10.3

)%

(5.2

)%

Adjusted EBITDA as a percentage of total

revenue

(6.6

)%

(7.7

)%

(3)

Other expenses primarily consist of

foreign currency exchange gains and losses, taxes, penalties, fees

for certain financing arrangements and gains and losses on sale of

property and equipment.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240520384814/en/

Investor Contact: Alexandra Clark

Director of Finance & Investor Relations

alexandra.clark@rubicon.com

Media Contact: Benjamin Spall Sr.

Manager, Corporate Communications benjamin.spall@rubicon.com

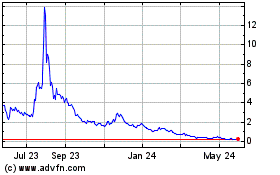

Rubicon Technologies (NYSE:RBT)

Historical Stock Chart

From Dec 2024 to Jan 2025

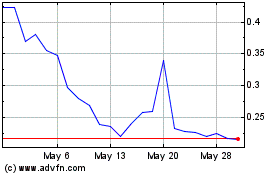

Rubicon Technologies (NYSE:RBT)

Historical Stock Chart

From Jan 2024 to Jan 2025