Rubicon makes significant progress toward profitability and

positive Adjusted EBITDA.

Rubicon Technologies, Inc. (“Rubicon” or the “Company”) (NYSE:

RBT), a leading provider of technology solutions for waste,

recycling, and fleet operations, today reported financial and

operational results for the fourth quarter and full year of

2023.

Fourth Quarter 2023 Financial Highlights

- Revenue was $170.7 million, an increase of $4.7 million or 2.8%

compared to $166.0 million in the fourth quarter of 2022.

- Gross Profit was $13.2 million, an increase of $6.5 million or

95.4% compared to $6.8 million in the fourth quarter of 2022.

- Adjusted Gross Profit was $18.3 million, an increase of $4.9

million or 36.5% compared to $13.4 million in the fourth quarter of

2022.

- Gross Profit Margin was 7.7%, an increase of 367 bps compared

to 4.1% in the fourth quarter of 2022.

- Adjusted Gross Profit Margin was 10.7%, an increase of 264 bps

compared to 8.1% in the fourth quarter of 2022.

- Net Loss was $(15.1) million, an improvement of $2.9 million or

16.1% compared to $(18.0) million in the fourth quarter of

2022.

- Adjusted EBITDA was $(0.4) million, an improvement of $17.1

million or 97.5% compared to $(17.6) million in the fourth quarter

of 2022.

Full Year 2023 Financial Highlights

- Revenue was $697.6 million, an increase of $22.2 million or

3.3% compared to $675.4 million for the full year 2022.

- Gross Profit was $47.7 million, an increase of $22.7 million or

90.6% compared to $25.0 million for the full year 2022.

- Adjusted Gross Profit was $72.2 million, an increase of $18.9

million or 35.5% compared to $53.3 million for the full year

2022.

- Gross Profit Margin was 6.8%, an increase of 313 bps compared

to 3.7% for the full year 2022.

- Adjusted Gross Profit Margin was 10.4%, an increase of 246 bps

compared to 7.9% for the full year 2022.

- Net Loss was $(77.6) million, an improvement of $204.2 million

or 72.5% compared to $(281.8) million for the full year 2022.

- Adjusted EBITDA was $(33.0) million, an improvement of $41.3

million or 55.6% compared to $(74.3) million for the full year

2022.

Operational and Business Highlights

- RUBICONConnect™ added prestigious clients such as Neiman Marcus

and Vail Properties while extending contracts with Gap, Inc.,

Goodyear Tires, and Americold. In 2024, the focus remains on

enhancing relationships with existing customers and expanding the

client base by providing better environmental and financial

outcomes for customers.

- The Company’s second-annual Next Summit showcased cutting-edge

technological developments. Recent innovations include a billing

module for streamlined invoicing and AI-driven features to combat

illegal waste disposal, ensuring operational efficiency. The

third-annual Next Summit will take place in New York City in June

2024, bringing together fleet and commercial partners to facilitate

collaboration between waste, recycling, and sustainability

experts.

- Rubicon demonstrated its commitment to sustainability through

the launch of Technical Advisory Services, empowering customers to

achieve sustainability goals with tailored solutions and strategic

partnerships.

Fourth Quarter 2023 Review

Revenue was $170.7 million, an increase of $4.7 million or 2.8%

compared to $166.0 million in the fourth quarter of 2022, mainly

driven by business expansion with existing customers.

Gross Profit was $13.2 million, an increase of $6.5 million or

95.4% compared to $6.8 million in the fourth quarter of 2022,

driven by the optimization of the portfolio and margin

improvement.

Adjusted Gross Profit was $18.3 million, an increase of $4.9

million or 36.5% compared to $13.4 million in the fourth quarter of

2022, driven by additional higher margin business with existing

customers which also drove AGP margin expansion of over 260 bps to

10.7% from 8.1%.

Net Loss was $(15.1) million, an improvement of $2.9 million or

16.1% compared to $(18.0) million in the fourth quarter of

2022.

Adjusted EBITDA was $(0.4) million, an improvement of $17.1

million or 97.5% compared to $(17.6) million in the fourth quarter

of 2022.

Full Year 2023 Review

Revenue was $697.6 million, an increase of $22.2 million or 3.3%

compared to $675.4 million for the full year 2022 which is

predominately due to service expansion and volume increases in the

RUBICONConnect business.

Gross Profit was $47.7 million, an increase of $22.7 million or

90.6% compared to $25.0 million for the full year 2022, driven by

the optimization of the portfolio and margin improvement.

Adjusted Gross Profit was $72.2 million, an increase of $18.9

million or 35.5% compared to $53.3 million for the full year 2022,

driven by additional higher margin business with existing customers

which also drove AGP margin expansion of over 245 bps to 10.4% from

7.9%.

Net Loss was $(77.6) million, an improvement of $204.2 million

or 72.5% compared to $(281.8) million for the full year 2022.

Adjusted EBITDA was $(33.0) million, an improvement of $41.3

million or 55.6% compared to $(74.3) million for the full year

2022.

Webcast Information

The Rubicon Technologies, Inc. management team will host a

conference call to discuss its fourth quarter and full year 2023

financial results this afternoon, Thursday, March 7, 2024, at 5:00

p.m. ET. The call can be accessed via telephone by dialing (929)

203-2112, or toll free at (888) 660-6863, and referencing Rubicon

Technologies, Inc. A live webcast of the conference will also be

available on the Events and Presentations page on the Investor

Relations section of Rubicon’s website

(https://investors.rubicon.com/events-presentations/default.aspx).

Please log in to the webcast or dial in to the call at least 10

minutes prior to the start of the event.

About Rubicon

Rubicon builds AI-enabled technology products and provides

expert sustainability solutions to waste generators, fleet

operators, and material processors to help them understand, manage,

and reduce waste. As a mission-driven company, Rubicon helps its

customers improve operational efficiency, unlock economic value,

and deliver better environmental outcomes. To learn more, visit

rubicon.com.

Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures,”

including Adjusted Gross Profit, Adjusted Gross Profit Margin and

Adjusted EBITDA, which are supplemental financial measures that are

not calculated or presented in accordance with generally accepted

accounting principles (GAAP). Such non-GAAP financial measures

should not be considered superior to, as a substitute for or

alternative to, and should be considered in conjunction with, the

GAAP financial measures presented in this press release. The

non-GAAP financial measures in this press release may differ from

similarly titled measures used by other companies. Definitions of

these non-GAAP financial measures, including explanations of the

ways in which Rubicon’s management uses these non-GAAP measures to

evaluate its business, the substantive reasons why Rubicon’s

management believes that these non-GAAP measures provide useful

information to investors and limitations associated with the use of

these non-GAAP measures, are included under “Use of Non-GAAP

Financial Measures” after the tables below. In addition,

reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures are included under

“Reconciliations of Non-GAAP Financial Measures” after the tables

below.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995 and within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

All statements, other than statements of present or historical fact

included in this press release, are forward-looking statements.

When used in this press release, the words “could,” “should,”

“will,” “may,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” the negative of such terms and other similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain such

identifying words. Such forward-looking statements are subject to

risks, uncertainties, and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements. These forward-looking statements

are based upon current expectations, estimates, projections, and

assumptions that, while considered reasonable by Rubicon and its

management, are inherently uncertain; factors that may cause actual

results to differ materially from current expectations include, but

are not limited to: 1) the outcome of any legal proceedings that

may be instituted against Rubicon or others following the closing

of the business combination; 2) Rubicon’s ability to continue to

meet the New York Stock Exchange’s listing standards following the

consummation of the business combination; 3) the ability to

recognize the anticipated benefits of the business combination,

which may be affected by, among other things, the ability of the

combined company to grow and manage growth profitably, maintain

relationships with customers and suppliers and retain its

management and key employees; 4) continued costs related to the

business combination; 5) changes in applicable laws or regulations;

6) the possibility that Rubicon may be adversely affected by other

economic, business and/or competitive factors, including the

continued impacts of the COVID-19 pandemic, geopolitical conflicts,

such as the conflict between Israel and Hamas or Russia and

Ukraine, the effects of inflation and potential recessionary

conditions; 7) Rubicon’s execution of anticipated operational

efficiency initiatives, cost reduction measures and financing

arrangements; and 8) other risks and uncertainties set forth in the

sections entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in the Company’s Annual Report on Form

10-K, Registration Statement on Form S-1, as amended, filed with

the U.S. Securities and Exchange Commission (the “SEC”), and other

documents Rubicon has filed with the SEC. Although Rubicon believes

the expectations reflected in the forward-looking statements are

reasonable, nothing in this press release should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward looking statements will be achieved. There

may be additional risks that Rubicon presently does not know of or

that Rubicon currently believes are immaterial that could also

cause actual results to differ from those contained in the

forward-looking statements, many of which are beyond Rubicon’s

control. You should not place undue reliance on forward-looking

statements, which speak only as of the date they are made. Rubicon

does not undertake, and expressly disclaims, any duty to update

these forward-looking statements, except as otherwise required by

applicable law.

RUBICON TECHNOLOGIES, INC AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS (UNAUDITED)

(in thousands, except per share

data)

Three Months Ended

Year Ended

December 31,

December 31,

2023

2022

2023

2022

Revenue:

Service

$

158,511

$

152,054

$

644,636

$

589,810

Recyclable commodity

12,152

13,938

52,946

85,578

Total revenue

170,663

165,992

697,582

675,388

Costs and Expenses:

Cost of revenue (exclusive of amortization

and depreciation):

Service

145,727

146,368

600,940

569,750

Recyclable commodity

11,264

12,227

46,691

78,083

Total cost of revenue (exclusive of

amortization and depreciation)

156,991

158,595

647,631

647,833

Sales and marketing

2,805

2,841

11,729

16,177

Product development

6,020

9,114

29,645

37,450

General and administrative

7,068

8,973

52,950

221,493

Gain on settlement of incentive

compensation

(420

)

-

(19,042

)

-

Amortization and depreciation

1,204

1,392

5,186

5,723

Total Costs and Expenses

173,668

180,915

728,099

928,676

Loss from Operations

(3,005

)

(14,923

)

(30,517

)

(253,288

)

Other Income (Expense):

Interest earned

46

1

57

2

(Loss) gain on change in fair value of

warrant liabilities

(864

)

(1,340

)

2,021

(1,777

)

Gain on change in fair value of earn-out

liabilities

18

1,400

5,458

68,500

(Loss) gain on change in fair value of

derivatives

(519

)

4,279

(4,297

)

(72,641

)

Excess fair value over the consideration

received for SAFE

-

-

-

(800

)

Excess fair value over the consideration

received for pre-funded warrant

-

(14,000

)

-

(14,000

)

Gain on services fee settlements in

connection with the Mergers

-

12,126

6,996

12,126

Loss on extinguishment of debt

obligations

-

-

(18,234

)

-

Interest expense

(9,758

)

(4,600

)

(34,232

)

(16,863

)

Related party interest expense

(508

)

-

(2,215

)

-

Other expense

(600

)

(960

)

(2,619

)

(2,954

)

Total Other Income (Expense)

(12,185

)

(3,094

)

(47,065

)

(28,407

)

Loss Before Income Taxes

(15,190

)

(18,017

)

(77,582

)

(281,695

)

Income tax (benefit) expense

(52

)

16

(3

)

76

Net Loss

(15,138

)

(18,033

)

(77,579

)

(281,771

)

Net loss attributable to Holdings LLC

unitholders prior to the Mergers

-

-

-

(228,997

)

Net loss attributable to noncontrolling

interests

(2,179

)

(5,688

)

(20,635

)

(22,621

)

Net Loss Attributable to Class A Common

Stockholders

$

(12,959

)

$

(12,345

)

$

(56,944

)

$

(30,153

)

Net loss per Class A Common share – basic

and diluted

$

(0.34

)

$

(1.98

)

$

(2.50

)

$

(4.84

)

Weighted average shares outstanding –

basic and diluted

37,667,417

6,235,675

22,797,555

6,235,675

RUBICON TECHNOLOGIES, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(in thousands)

2023

2022

ASSETS

Current Assets:

Cash and cash equivalents

$

18,695

$

10,079

Accounts receivable, net

66,977

65,923

Contract assets, net

76,621

55,184

Prepaid expenses

13,305

10,466

Other current assets

3,790

2,109

Related-party notes receivable

-

7,020

Total Current Assets

179,388

150,781

Property and equipment, net

1,425

2,644

Operating lease right-of-use assets

567

2,827

Other noncurrent assets

2,114

4,764

Goodwill

32,132

32,132

Intangible assets, net

7,661

10,881

Total Assets

$

223,287

$

204,029

LIABILITIES AND STOCKHOLDERS’ (DEFICIT)

EQUITY

Current Liabilities:

Accounts payable

$

65,465

$

75,113

Line of credit

71,121

51,823

Accrued expenses

77,001

108,002

Contract liabilities

7,359

5,888

Operating lease liabilities, current

725

1,880

Warrant liabilities

26,493

20,890

Derivative liabilities

9,375

-

Debt obligations, net of deferred debt

charges

-

3,771

Total Current Liabilities

$

257,539

$

267,367

Long-Term Liabilities:

Deferred income taxes

197

217

Operating lease liabilities,

noncurrent

-

1,826

Debt obligations, net of deferred debt

charges

81,001

69,458

Related-party debt obligations, net of

deferred debt charges

16,302

10,597

Derivative liabilities

3,683

826

Earn-out liabilities

142

5,600

Other long-term liabilities

3,395

2,590

Total Long-Term Liabilities

104,720

91,114

Total Liabilities

362,259

358,481

Commitments and Contingencies (Note

19)

Stockholders’ (Deficit) Equity:

Common stock – Class A, par value of

$0.0001 per share, 690,000,000 shares authorized, 39,643,584 and

6,985,869 shares issued and outstanding as of December 31, 2023 and

December 31, 2022

4

1

Common stock – Class V, par value of

$0.0001 per share, 275,000,000 shares authorized, 4,425,388 and

14,432,992 shares issued and outstanding as of December 31, 2023

and December 31, 2022

-

1

Preferred stock – par value of $0.0001 per

share, 10,000,000 shares authorized, 0 issued and outstanding as of

December 31, 2023 and December 31, 2022

-

-

Additional paid-in capital

127,716

34,659

Accumulated deficit

(394,804

)

(337,860

)

Total stockholders’ deficit attributable

to Rubicon Technologies, Inc.

(267,084

)

(303,199

)

Noncontrolling interests

128,112

148,747

Total Stockholders’ Deficit

(138,972

)

(154,452

)

Total Liabilities and Stockholders’

(Deficit) Equity

$

223,287

$

204,029

RUBICON TECHNOLOGIES, INC AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS (UNAUDITED)

(in thousands)

2023

2022

Cash flows from operating

activities:

Net loss

$

(77,579

)

$

(281,771

)

Adjustments to reconcile net loss to net

cash flows from operating activities:

Loss on disposal of property and

equipment

805

44

Gain on lease agreement amendment

(220

)

-

Amortization and depreciation

5,186

5,723

Amortization of deferred debt charges

9,722

3,490

Amortization of related party deferred

debt charges

708

-

Paid-in-kind interest capitalized to

principal of debt obligations

7,692

-

Paid-in-kind interest capitalized to

principal of related-party debt obligations

1,396

30

Bad debt reserve

2,250

(2,631

)

(Gain) loss on change in fair value of

warrant liabilities

(2,021

)

1,777

Loss on change in fair value of

derivatives

4,297

72,641

Gain on change in fair value of earn-out

liabilities

(5,458

)

(68,500

)

Loss on extinguishment of debt

obligations

18,234

-

Excess fair value over the consideration

received for SAFE

-

800

Excess fair value over the consideration

received for pre-funded warrant

-

14,000

Loss on SEPA commitment fee settled in

Class A Common Stock

-

892

Equity-based compensation

15,023

94,204

Phantom unit expense

-

6,783

Settlement of accrued incentive

compensation

(27,246

)

-

Service fees settled in common stock

10,613

-

Gain on service fee settlement in

connection with the Mergers

(6,996

)

(12,126

)

Deferred income taxes

(20

)

39

Change in operating assets and

liabilities:

Accounts receivable

(3,304

)

(20,632

)

Contract assets

(21,437

)

1,800

Prepaid expenses

(611

)

(4,421

)

Other current assets

(1,765

)

(472

)

Operating right-of-use assets

1,094

1,093

Other noncurrent assets

(64

)

(180

)

Accounts payable

(9,649

)

27,582

Accrued expenses

10,366

29,030

Contract liabilities

1,471

1,285

Operating lease liabilities

(1,595

)

(1,739

)

Other liabilities

2,219

223

Net cash flows from operating

activities

(66,889

)

(131,036

)

Cash flows from investing

activities:

Property and equipment purchases

(816

)

(1,406

)

Forward purchase option derivative

purchase

-

(68,715

)

Settlement of forward purchase option

derivative

-

(6,000

)

Net cash flows from investing

activities

(816

)

(76,121

)

Cash flows from financing

activities:

Net (repayments) borrowings on Revolving

Credit Facility

(51,823

)

21,907

Net borrowings on June 2023 Revolving

Credit Facility

71,121

-

Proceeds from debt obligations

86,226

7,000

Repayments of debt obligations

(53,500

)

(6,000

)

Proceeds from related party debt

obligations

14,520

3,510

Financing costs paid

(13,891

)

(4,021

)

Proceeds from issuance of common stock

24,767

-

Proceeds from SAFE

-

8,000

Proceeds from pre-funded warrant

-

6,000

Payments for loan commitment asset

-

(1,447

)

Proceeds from the Mergers

-

196,778

Equity issuance costs paid

(32

)

(25,108

)

RSUs withheld to pay taxes

(1,067

)

-

Net cash flows from financing

activities

76,321

206,619

Net change in cash and cash

equivalents

8,616

(538

)

Cash, beginning of year

10,079

10,617

Cash, end of year

$

18,695

$

10,079

Supplemental disclosure of cash flow

information:

Cash paid for interest

$

14,645

$

12,234

Supplemental disclosures of non-cash

investing and financing activities:

Exchange of warrant liabilities for common

stock

$

4,585

$

3,311

Conversion of SAFE for Class B Units

$

-

$

8,000

Establishment of earn-out liabilities

$

-

$

74,100

Equity issuance costs accrued but not

paid

$

-

$

13,433

Equity issuance costs settled with common

stock

$

7,069

$

17,000

Equity issuance costs waived

$

6,364

$

-

Fair value of warrants issued as deferred

debt charges

$

1,682

$

430

Fair value of derivatives issued as

deferred debt charges

$

12,739

$

-

Fair value of warrants issued as loan

commitment asset

$

-

$

615

Conversions of debt obligations to common

stock

$

17,000

$

-

Conversions of related-party debt

obligations to common stock

$

3,080

$

-

Loan commitment asset reclassed to

deferred debt charges

$

2,062

$

-

Use of Non-GAAP Financial

Measures

Adjusted Gross Profit and Adjusted Gross Profit

Margin

Adjusted Gross Profit and Adjusted Gross Profit Margin are

considered non-GAAP financial measures under the rules of the U.S.

Securities and Exchange Commission (the “SEC”) because they

exclude, respectively, certain amounts included in Gross Profit and

Gross Profit Margin calculated in accordance with GAAP.

Specifically, the Company calculates Adjusted Gross Profit by

adding back amortization and depreciation for revenue generating

activities and platform support costs to GAAP Gross Profit, the

most comparable GAAP measure. Adjusted Gross Profit Margin is

calculated as Adjusted Gross Profit divided by total GAAP revenue.

Rubicon believes presenting Adjusted Gross Profit and Adjusted

Gross Profit Margin is useful to investors because they show the

progress in scaling Rubicon’s digital platform by quantifying the

markup and margin Rubicon charges its customers that are

incremental to its marketplace vendor costs. These measures

demonstrate this progress because changes in these measures are

driven primarily by Rubicon’s ability to optimize services for its

customers, improve its hauling and recycling partners’ efficiency

and achieve economies of scale on both sides of the marketplace.

Rubicon’s management team uses these non-GAAP measures as one of

the means to evaluate the profitability of Rubicon’s customer

accounts, exclusive of certain costs that are generally fixed in

nature, and to assess how successful Rubicon is in achieving its

pricing strategies. However, it is important to note that other

companies, including companies in our industry, may calculate and

use these measures differently or not at all, which may reduce

their usefulness as a comparative measure. Further, these measures

should not be read in isolation from or without reference to our

results prepared in accordance with GAAP.

Adjusted EBITDA

Adjusted EBITDA is considered a non-GAAP financial measure under

the rules of the SEC because it excludes certain amounts included

in net loss calculated in accordance with GAAP. Specifically, the

Company calculates Adjusted EBITDA by GAAP net loss adjusted to

exclude interest expense and income, income tax expense and

benefit, amortization and depreciation, gain or loss on

extinguishment of debt obligations, equity-based compensation,

phantom unit expense, gain or loss on change in fair value of

warrant liabilities, gain or loss on change in fair value of

earn-out liabilities, gain or loss on change in fair value of

derivatives, executive severance charges, gain or loss on

settlement of the management rollover bonuses, excess fair value

over the consideration received for SAFE, excess fair value over

the consideration received for pre-funded warrant, gain or loss on

service fee settlements in connection with the Mergers, other

non-operating income and expenses, and unique non-recurring income

and expenses.

The Company has included Adjusted EBITDA because it is a key

measure used by Rubicon’s management team to evaluate its operating

performance, generate future operating plans, and make strategic

decisions, including those relating to operating expenses. Further,

the Company believes Adjusted EBITDA is helpful in highlighting

trends in Rubicon’s operating results because it allows for more

consistent comparisons of financial performance between periods by

excluding gains and losses that are non-operational in nature or

outside the control of management, as well as items that may differ

significantly depending on long-term strategic decisions regarding

capital structure, the tax jurisdictions in which Rubicon operates

and capital investments. Adjusted EBITDA is also often used by

analysts, investors and other interested parties in evaluating and

comparing Rubicon’s results to other companies within the industry.

Accordingly, the Company believes that Adjusted EBITDA provides

useful information to investors and others in understanding and

evaluating its operating results in the same manner as Rubicon’s

management team and board of directors.

Adjusted EBITDA has limitations as an analytical tool, and it

should not be considered in isolation or as a substitute for

analysis of net loss or other results as reported under GAAP. Some

of these limitations are:

●

Adjusted EBITDA does not reflect the

Company’s cash expenditures, future requirements for capital

expenditures, or contractual commitments;

●

Adjusted EBITDA does not reflect changes

in, or cash requirements for, the Company’s working capital

needs;

●

Adjusted EBITDA does not reflect the

Company’s tax expense or the cash requirements to pay taxes;

●

although amortization and depreciation are

non-cash charges, the assets being amortized and depreciated will

often have to be replaced in the future and Adjusted EBITDA does

not reflect any cash requirements for such replacements;

●

Adjusted EBITDA should not be construed as

an inference that the Company’s future results will be unaffected

by unusual or non-recurring items for which the Company may make

adjustments in historical periods; and

●

other companies in the industry may

calculate Adjusted EBITDA differently than the Company does,

limiting its usefulness as a comparative measure.

Reconciliations of Non-GAAP Financial Measures

Adjusted Gross Profit and Adjusted Gross Profit

Margin

The following table presents reconciliations of Adjusted Gross

Profit and Adjusted Gross Margin to the most directly comparable

GAAP financial measures for each of the periods indicated.

Three Months Ended

Year Ended

December 31,

December 31,

2023

2022

2023

2022

(in thousands, except

percentages)

Total revenue

$

170,663

$

165,992

$

697,582

$

675,388

Less: total cost of revenue (exclusive of

amortization and depreciation)

156,991

158,595

647,631

647,833

Less: amortization and depreciation for

revenue generating activities

452

631

2,246

2,520

Gross profit

$

13,220

$

6,766

$

47,705

$

25,035

Gross profit margin

7.7

%

4.1

%

6.8

%

3.7

%

Gross profit

$

13,220

$

6,766

$

47,705

$

25,035

Add: amortization and depreciation for

revenue generating activities

452

631

2,246

2,520

Add: platform support costs(1)

4,620

6,005

22,281

25,766

Adjusted gross profit

$

18,292

$

13,402

$

72,232

$

53,321

Adjusted gross profit margin

10.7

%

8.1

%

10.4

%

7.9

%

Amortization and depreciation for revenue

generating activities

$

452

$

631

$

2,246

$

2,520

Amortization and depreciation for sales,

marketing, general and administrative activities

752

761

2,940

3,203

Total amortization and depreciation

$

1,204

$

1,392

$

5,186

$

5,723

Platform support costs(1)

$

4,620

$

6,005

$

22,281

$

25,766

Marketplace vendor costs(2)

152,371

152,590

625,350

622,067

Total cost of revenue (exclusive of

amortization and depreciation)

$

156,991

$

158,595

$

647,631

$

647,833

(1)

Platform support costs are defined as

costs to operate the Company’s revenue generating platforms that do

not directly correlate with volume of sales transactions procured

through Rubicon’s digital marketplace. Such costs include employee

costs, data costs, platform hosting costs and other overhead

costs.

(2)

Marketplace vendor costs are defined as

direct costs charged by the Company’s hauling and recycling

partners for services procured through Rubicon’s digital

marketplace.

Adjusted EBITDA

The following table presents reconciliations of Adjusted EBITDA

to the most directly comparable GAAP financial measure for each of

the periods indicated.

Three Months Ended

Year Ended

December 31,

December 31,

2023

2022

2023

2022

(in thousands)

Net loss

$

(15,138

)

$

(18,033

)

$

(77,579

)

$

(281,771

)

Adjustments:

Interest expense

9,758

4,600

34,232

16,863

Related party interest expense

508

-

2,215

-

Interest earned

(46

)

(1

)

(57

)

(2

)

Income tax (benefit) expense

(52

)

16

(3

)

76

Amortization and depreciation

1,204

1,392

5,186

5,723

Loss on extinguishment of debt

obligations

-

-

18,234

-

Equity-based compensation

1,784

5,659

15,023

94,204

Phantom unit expense

-

-

-

6,783

Deferred compensation expense

-

(1,250

)

-

-

Loss (gain) on change in fair value of

warrant liabilities

864

1,340

(2,021

)

1,777

Gain on change in fair value of earn-out

liabilities

(18

)

(1,400

)

(5,458

)

(68,500

)

Loss (gain) on change in fair value of

derivatives

519

(4,279

)

4,297

72,641

Executive severance charges

-

1,952

4,553

1,952

Gain on settlement of Management Rollover

Bonuses

(420

)

(10,415

)

(27,246

)

(10,415

)

Excess fair value over the consideration

received for SAFE

-

-

-

800

Excess fair value over the consideration

received for pre-funded warrant

-

14,000

-

14,000

Gain on service fee settlements in

connection with the Mergers

-

(12,126

)

(6,996

)

(12,126

)

Nonrecurring merger transaction

expenses(3)

-

-

-

80,712

Other expenses(4)

600

960

2,619

2,954

Adjusted EBITDA

$

(437

)

$

(17,585

)

$

(33,001

)

$

(74,329

)

(3)

Nonrecurring merger transaction expenses

primarily consist of management bonus payments and related accruals

in connection with the Mergers.

(4)

Other expenses primarily consist of

foreign currency exchange gains and losses, taxes, penalties, fees

for certain financing arrangements, and gains and losses on sale of

property and equipment.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240307889741/en/

Investor Contact: Alexandra Clark Director of Finance

& Investor Relations alexandra.clark@rubicon.com

Media Contact: Benjamin Spall Sr. Manager, Corporate

Communications benjamin.spall@rubicon.com

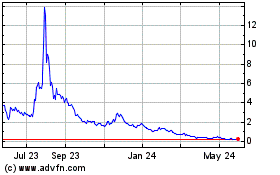

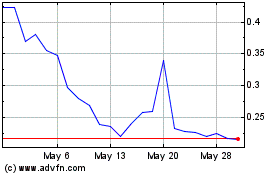

Rubicon Technologies (NYSE:RBT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rubicon Technologies (NYSE:RBT)

Historical Stock Chart

From Dec 2023 to Dec 2024