UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

February 18, 2025

Date of Report (Date of earliest event reported)

___________________________________

Redwire Corporation

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-39733 (Commission File Number) | 88-1818410 (I.R.S. Employer Identification Number) |

8226 Philips Highway, Suite 101 Jacksonville, Florida 32256 |

(Address of principal executive offices and zip code) |

(650) 701-7722 |

(Registrant's telephone number, including area code) |

__________________________________Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | RDW | New York Stock Exchange |

| Warrants, each to purchase one share of Common Stock | RDW WS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 - Regulation FD Disclosures

On February 18, 2025, Redwire Corporation (the “Company” or “Redwire”), distributed videos of Space Investors Daily and New York Stock Exchange ("NYSE") interviews of Redwire's Chairman, Chief Executive Officer and President, Peter Cannito, on X, Facebook and Linked-In. The transcript of such interviews are filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information set forth in Item 7.01 of this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific references in such a filing.

Item 9.01 - Financial Statements and Exhibits

(d) The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 99.1 | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Additional Information and Where to Find It

Redwire will file with the SEC a proxy statement relating to a special meeting of Redwire’s stockholders (the “proxy statement”). STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT REDWIRE, EDGE AUTONOMY, THE TRANSACTION AND RELATED MATTERS. Stockholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the parties through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the parties on investor relations section of Redwire’s website at redwirespace.com.

Participants in the Solicitation

Redwire and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Redwire in respect of the proposed business combination contemplated by the proxy statement. Information regarding the persons who are, under the rules of the SEC, participants in the solicitation of the stockholders of Redwire, respectively, in connection with the proposed business combination, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement when it is filed with the SEC. Information regarding Redwire’s directors and executive officers is contained in Redwire’s Annual Report on Form 10-K for the year ended December 31, 2023 and its Proxy Statement on Schedule 14A, dated April 22, 2024, which are filed with the SEC.

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed business combination or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Forward-Looking Statements

Readers are cautioned that the statements contained in this communication regarding expectations of our performance or other matters that may affect our or the combined company’s business, results of operations, or financial condition are “forward-looking statements” as defined by the “safe harbor” provisions in the Private Securities Litigation Reform Act of 1995. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included or incorporated in this communication, including statements regarding our or the combined company’s strategy, financial projections, including the prospective financial information provided in this communication, financial position, funding for continued operations, cash reserves, liquidity, projected costs, plans, projects, awards and contracts, and objectives of management, the entry into the potential business combination, the expected benefits from the proposed business combination, the expected performance of the combined company, the expectations regarding financing the proposed business combination, among others, are forward-looking statements. Words such as “expect,” “anticipate,” “should,” “believe,” “target,” “continued,” “project,” “plan,” “opportunity,” “estimate,” “potential,” “predict,” “demonstrates,” “may,” “will,” “could,” “intend,” “shall,” “possible,” “forecast,” “trends,” “contemplate,” “would,” “approximately,” “likely,” “outlook,” “schedule,” “pipeline,” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements, but the absence of these words does not mean that a statement is not forward looking. These forward-looking statements are not guarantees of future performance, conditions or results. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control.

These factors and circumstances include, but are not limited to: (1) risks associated with the continued economic uncertainty, including high inflation, supply chain challenges, labor shortages, increased labor costs, high interest rates, foreign currency exchange volatility, concerns of economic slowdown or recession and reduced spending or suspension of investment in new or enhanced projects; (2) the failure of financial institutions or transactional counterparties; (3) Redwire’s limited operating history and history of losses to date as well as the limited operating history of Edge Autonomy and the relatively novel nature of the drone industry; (4) the inability to successfully integrate recently completed and future acquisitions, including the proposed business combination with Edge Autonomy, as well as the failure to realize the anticipated benefits of the transaction or to realize estimated projected combined company results; (5) the development and continued refinement of many of Redwire’s and the combined company’s proprietary technologies, products and service offerings; (6) competition with new or existing companies; (7) the possibility that Redwire’s expectations and assumptions relating to future results and projections with respect to Redwire or Edge Autonomy may prove incorrect; (8) adverse publicity stemming from any incident or perceived risk involving Redwire, Edge Autonomy, the combined company, or their competitors; (9) unsatisfactory performance of our and the combined company’s products resulting from challenges in the space environment, extreme space weather events, the environments in which drones operate, including in combat or other areas where hostilities may occur, or otherwise; (10) the emerging nature of the market for in-space infrastructure services and the market for drones and related services; (11) inability to realize benefits from new offerings or the application of our or the combined company’s technologies; (12) the inability to convert orders in backlog into revenue; (13) our and the combined company’s dependence on U.S. and foreign government contracts, which are only partially funded and subject to immediate termination, or which may be influenced by the level of military activities and related spending such as in or with respect to the war in Ukraine; (14) the fact that we are and the combined company will be subject to stringent economic sanctions, and trade control laws and regulations; (15) the need for substantial additional funding to finance our and the combined company’s operations, which may not be available when needed, on acceptable terms or at all; (16) the dilution of existing holders of our common stock that will result from the issuance of additional shares of common stock as consideration for the acquisition of Edge Autonomy, as well as the issuance of common stock in any offering that may be undertaken in connection with such acquisition; (17) the fact that the issuance and sale of shares of our Series A Convertible Preferred Stock has reduced the relative voting power of holders of our common stock and diluted the ownership of holders of our capital stock; (18) the ability to achieve the conditions to cause, or timing of, any mandatory conversion of the Series A Convertible Preferred stock into common stock; (19) the fact that AE Industrial Partners and Bain Capital have significant influence over us, which could limit your ability to influence the outcome of key transactions; (20) provisions in our Certificate of Designation with respect to our Series A Convertible Preferred Stock may delay or prevent our acquisition by a third party, which could also reduce the market price of our capital stock; (21) the fact that our Series A Convertible Preferred Stock has rights, preferences and privileges that are not held by, and are preferential to, the rights of holders of our other outstanding capital stock; (22) the possibility of sales of a substantial amount of our common stock by our current stockholders, as well as the equity owners of Edge Autonomy following consummation of the transaction, which sales could cause the price of our common stock and warrants to fall; (23) the impact of the issuance of additional shares of Series A Convertible Preferred Stock as pay in kind dividends on the price and market for our common stock; (24) the volatility of the trading price of our common stock and warrants; (25) risks related to short sellers of our common stock; (26) Redwire’s or the combined company’s inability to report our financial condition or results of operations accurately or timely as a result of identified material weaknesses in internal control over financial reporting, as well as the possible need to expand or improve Edge Autonomy’s financial reporting systems and controls; (27) the possibility that the closing conditions under the merger agreement necessary to consummate the merger between Redwire and Edge Autonomy will not be satisfied; (28) the effect of any announcement or pendency of the proposed business combination on Redwire’s or Edge Autonomy’s business relationships, operating results and business generally; (29) risks that the proposed business combination disrupts current plans and operations of Redwire or Edge Autonomy; (30) the ability of Redwire or the combined company to raise financing in connection with

the proposed business combination or to finance its operations in the future; (31) the impact of any increase in the combined company’s indebtedness incurred to fund working capital or other corporate needs, including the repayment of Edge Autonomy's outstanding indebtedness and transaction expenses incurred to acquire Edge Autonomy, as well as debt covenants that may limit the combined company’s activities, flexibility or ability to take advantage of business opportunities, and the effect of debt service on the availability of cash to fund investment in the business; (32) the ability to implement business plans, forecasts and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities; (33) costs related to the transaction; and (34) other risks and uncertainties described in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and those indicated from time to time in other documents filed or to be filed with the SEC by Redwire. The forward-looking statements contained in this communication are based on our current expectations and beliefs concerning future developments and their potential effects on us. If underlying assumptions to forward-looking statements prove inaccurate, or if known or unknown risks or uncertainties materialize, actual results could vary materially from those anticipated, estimated, or projected. The forward-looking statements contained in this communication are made as of the date of this communication, and Redwire disclaims any intention or obligation, other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Persons reading this communication are cautioned not to place undue reliance on forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 18, 2025

| | | | | |

| Redwire Corporation |

| |

By: | /s/ Jonathan Baliff |

Name: | Jonathan Baliff |

Title: | Chief Financial Officer and Director |

On February 18, 2025, Redwire Corporation distributed videos of Space Investors Daily and New York Stock Exchange (“NYSE”) interviews with Redwire's Chairman, Chief Executive Officer and President, Peter Cannito, including the broadcasted and full interviews by publishing posts on each of the media platforms; X, Facebook and Linked-In. Below includes the posts published on each aforementioned media platform and transcripts of the interviews.

Space Investors Daily Live on X Interview

January 29, 2025

Presenters

Marc-André Ranger, Space Investors Daily

Peter Cannito, Redwire President, CEO & Chairman

Marc-André Ranger

Alright welcome everyone, please thumbs up if you can hear me fine. Can you guys hear me well? Alright so I think everyone should hear me OK. Perfect. So today we dive into the world of space infrastructure and innovation with Peter Cannito the CEO of Redwire Space. Peter, thanks for joining us today.

Peter Cannito

It's my honor, thanks for having me.

Marc-André Ranger

It actually really means a lot that someone as important and busy as you are take the time to speak with retail investors we're really glad to have you today.

Peter Cannito

I'm glad to be here and you know we've been looking for an opportunity to engage more with our retail investors. It's such an important group and we're honored that you're having us and really excited that you gave us this opportunity.

Marc-André Ranger

Perfect thank you. So small housekeeping item before we start: if for some reason you cannot hear me or Pete just leave and come back it usually fixes the problem. Also, although this is a one-on-one conversation today you can

still participate by adding comments or your insights by clicking on the bubble to the bottom right of your screen. So Pete ready to get into it?

Peter Cannito

I am, fire away.

Marc-André Ranger

Awesome. So Redwire’s quickly become a key player in the space industry with a diverse portfolio of technologies and services. For our listeners who are just getting to know Redwire, could you provide an overview of your core business segments and the type of solutions you offer?

Peter Cannito

Sure. Well, at its heart Redwire started out as a space infrastructure company and we've been going through a bit of an evolution. As the market evolves, we of course try to evolve with it. In the very beginning we were really focused on a picks and shovel strategy of providing what we call the fundamental building blocks of space. These are those key subsystems and components that every space mission needs regardless of what they're trying to achieve - things like power, avionics, sensors, structures and things like that. And that was the very beginning portion of our building kind of a foundation of a space infrastructure company.

Over time we started to evolve and throughout 2024 on many of the earnings calls I talked about our 4 main strategies of protecting the core, scaling production, moving up the value chain and venture optionality. And although we started with those fundamental building blocks of space, in 2024 we very successfully have moved up the value chain and added a number of different space platforms to our portfolio to include a number of both LEO and GEO and VLEO platforms - all of them named after sharks. So now we are kind of, in addition to just providing those fundamental building blocks, we're adding these platforms.

And of course we have this aspect of our business that we call venture optionality which may not be driving a lot of revenue, although it has been profitable, but it is these next generation capabilities around biotech that are small now but have the potential to be major breakthroughs and drive significant revenue in the future. That's things like our PIL-BOX pharmaceutical in space capability or things like 3D printing bio on orbit.

Marc-André Ranger

So talking about these acquisitions, partnerships can you highlight some recent developments and how they fit into Redwire’s overall growth strategy? I'm thinking Hera Systems, Edge Autonomy and others.

Peter Cannito

Sure well the most recent two was Hera in Q3 and then the recent signing of the Edge Autonomy deal and those were really fundamental to that third principle of growth that I mentioned called moving up the value chain and Hera brought a number of really exciting space-based platforms and then Edge Autonomy once we close will bring, will actually expand our platform strategy beyond space into what we call a multi-domain platform strategy.

So those two acquisitions in particular were about you know really that moving up the value chain fundamental growth principle and this positions Redwire in two ways: #1 as a space platform provider we can now go after full missions which enables us to scale more rapidly because those tend to be larger, higher value revenue drivers. And then additionally with ultimately adding Edge Autonomy platforms into the portfolio we can not only go for those single platform missions, but that systems-of-systems type missions that includes both the airborne and the space domain collaborating, and we feel like that gives us a real strategic competitive advantage to contract for a multi-domain mission from a single organization that is vertically integrated across both space and airborne platforms.

Marc-André Ranger

Can you tell us more about how these acquisitions are financed and should investors anticipate further capital raise to fuel this strategy?

Peter Cannito

Sure. Well, Hera we did off the balance sheet and so we got a really good value there which is core to our M&A strategy and finding great value, accretive M&A targets. For Edge we have a lot of different tools in our toolkit. We have the ability to raise both equity and debt or combination of both and so you know we're always looking at the lowest cost of capital, quite frankly, and putting it together a finance package that optimizes our balance sheet over time.

Marc-André Ranger

Alright I was talking with other investors and we're saying how we compare you to the Berkshire Hathaway of space and there's - you buy or you raise at let's say and we were talking about the recent AST SpaceMobile $400 million convert and you can raise that at 4 or 5% and you can grow that with great opportunities in the market it doesn't seem so bad as news. And some of these retail investors are often scared about capital raise so I think that that was a great way to see it also.

Peter Cannito

Yeah, that that's a really key insight, right? You know I grew up reading Benjamin Graham's The Intelligent Investor and securities analysis and if you're doing capital raises to invest in a technology that may or may not be successful that's very different than the idea of using capital raises to buy increase accretive investments or accretive companies where you're using that, you know, classic Warren Buffett where you can get something at a lower either revenue or EBITDA multiple than you're currently trading at - where yes, some additional equity was issued but it was done in a way to buy an asset that is actually bringing additional revenue and EBITDA profitability to the table so that the sum of the whole is greater than the sum of the two parts. It's a great way and, as you pointed out from Berkshire Hathaway, a well proven way to create enterprise value over time.

Marc-André Ranger

Awesome. So the space sector is increasingly competitive. We've seen more established players and new entrants kind of fighting for opportunities. What would you say are Redwire’s keys strengths and differentiators in this market?

Peter Cannito

Yeah, well one of them is quite frankly is the resiliency associated with the portfolio effect of having such a diverse group of products, right? So I like to say that it's very early days in space. It's an emerging market and the market is evolving rapidly. There were things quite frankly that when we first started out we thought were going to be the next big technology that didn't totally play out and I think everybody's seeing that kind of dynamic in the marketplace, where certain companies that might have had a singular focus, the market didn't go in the direction that they had anticipated. It ended up having potentially catastrophic issues. Our resiliency associated with our diversity has been strong. It's allowed us to be to be able to pivot into what’s working. Now some of that has to do with the fact that we were always focused on those fundamental core technologies of space, so selling the picks and shovels if you will added a bit of resiliency as well. But I do believe that idea that we have of many paths to victory associated with the different technologies that we're developing right now has been a critical differentiator for us. And again, the agility, the flexibility and the resiliency that comes with having that portfolio effect.

The other one is I think we're differentiated in the sense that are really focused on financial discipline. We spend a lot of time focusing on being free cash flow and you know here at Redwire we're constantly balancing between having what we call impact of a new groundbreaking technology that's just you know amazing and exciting, with maintaining financial discipline to ensure that we're not getting too far over our skis in terms of our spending profile. Because at the end of the day you know our focus is on being a profitable company and for that for us we think from an investment perspective that puts us as a investable asset with a certain class of investors and really a company positioned to be a certain type of player in the market for those that are looking at space companies with large.

Marc-André Ranger

I really like that. It's easy to forget that often your latest acquisition’s been accretive to Redwire right, it's a company that makes all already makes a lot of money, there's really good synergies and so you don't seem to just be going after the next hot thing you're actually going after companies that are making money and significantly.

Peter Cannito

That's right - like you mentioned Berkshire Hathaway, Warren Buffett. We're value investors, we're looking for companies that have a strategic differentiation as well as a synergy associated with our business but we're also looking for profitable companies at a good value.

Marc-André Ranger

So now let's turn our attention to very low earth orbit or VLEO. We're seeing a surge of interest lately in this orbit; we've heard SpaceX, we've heard that China is also trying to do something in there. What's driving this trend and what unique advantages does VLEO offer for commercial activities?

Peter Cannito

Yeah well, at the end of the day probably the most fundamental benefit that you get from very low earth orbit is that it's closer to the ground, so you can either get higher resolution if you're talking about earth imaging than you can from space or you can get the same resolution with less expensive optics, right? So you get to choose. You can either go for a higher performance or you can go for the same performance at a lower cost when you're comparing it to LEO.

There's also other advantages associated with the orbital debris. VLEO is kind of a self-cleaning orbit they call it because you're so close to the earth atmosphere that basically once your mission is complete, you'll be dragged down rather quickly and it'll burn up in the atmosphere so there isn't that this issue of persistent space debris that develops over time.

And lastly, I think there's a lot of interest because again it's another orbit, so you have resiliency in your overall space architecture. This is particularly important to national security customers when they look at the idea of if there was some sort of disruption in GEO or LEO you know having as many of our capabilities across as many orbits as possible gives you greater resiliency.

Marc-André Ranger

And so with those advantages in mind what are some of the most promising commercial applications you foresee in VLEO and how are you, Redwire, strategically positioning to capitalize on it?

Peter Cannito

Well right now we're basically focusing on the technology and the evolution of the technology primarily with a focus on national security but we believe because of that trade that I articulated in terms of either having better resolution or the same resolution at a more affordable cost that when you look at those companies out there that are building commercial constellations that are focused on earth observation, they're going to look longer term at VLEO as a new opportunity to enhance their earth observation architecture or constellations to get better performance over time.

Marc-André Ranger

Can you explain how this translate into the real world? I like to have a mental image and when I see VLEO of course like everyone else I see those satellites closer to Earth maybe spinning like faster but what does it do like can you give us a mental image of VLEO and how it can help basically national security or others?

Peter Cannito

Yeah well so once you have this new orbit if you will and really what it is as a matter of fact I got a question one time about when was it that we started thinking about Edge Autonomy as an acquisition and the way I answered it

was really around when we started looking at VLEO as an investment and people started calling it an orbital drone. And then all of a sudden the kind of a light bulb went off that that from a mission perspective, and earth observation is the easiest one to imagine in terms of real world application, it really doesn't matter to the end user the positioning of a platform that's doing earth observation and whether it's in space or in the air they're just trying to get the most amount of pixels they can for the lowest amount of cost. So when all of a sudden they started calling our VLEO SaberSat platform an orbital drone it occurred to us that it's really arbitrary in that context the difference between airborne assets and space-based assets. And that's why we came up with what I articulated in our investor presentation right after the announcement this idea of having platforms from the surface of the Earth all the way to the surface of the moon and the coverage and have all those different platforms working together. So, in that context you know VLEO is just adding to what I believe is a hybrid architecture of platforms that bring different performance characteristics to any mission. So whether you're talking about earth observation for commercial reasons or whether you're talking about it earth observation for national security reasons VLEO gives you performance characteristics you can't get in the other orbits that are very complementary, right? To include, it's because now VLEO is bridging the gap between airborne UASs and space you really fill out - we believe Redwire as part of this strategy is really filling out - that that full earth observation architecture if that makes sense.

Marc-André Ranger

Yeah, absolutely. I really see it as in the middle between your Edge Autonomy acquisition and the higher ups orbit like the GEO or Hera Systems and that really enables a whole chain going from like you said from the Earth to the moon which is amazing to think about. So you’re currently working on these initiatives on two continents right you're working with ESA and DARPA here in the US from what I understand.

Peter Cannito

That's right and in Europe we have the Skimsat program that is an ESA program that leverages our Phantom platform so we have one VLEO platform focused on US National Security and another one for Europe.

Marc-André Ranger

Great and what would be the next milestone or what can investors look for with the development of this great technology?

Peter Cannito

Well, the next big milestone is going to be ultimately a launch, right? So getting these things up and flying and proving out what a great capability it's going to be.

Marc-André Ranger

I really can't wait, awesome. So shifting gears to microgravity research you've developed a fascinating facility called the PIL-BOX. Can you explain the concept behind PIL-BOX and the types of microgravity research it enables?

Peter Cannito

Yes, so what PIL-BOX does is it is a payload essentially, that when it goes up in microgravity grows crystals, what we call seed crystals, of a variety of different compounds that can then be used on earth to use crystallography essentially to understand the size and shape of molecules not only associated with pharmaceuticals, or though that's one of the most promising aspects, but really any process that uses molecules associated with chemistry or what have you that needs a really high fidelity model of those molecules, right? So but at the end of the day what PIL-BOX is doing is it's just a way to grow crystals which is a process that's already done here on earth except for when you do it in microgravity, gravity has on earth an impact on the crystal growth so you get more variability and it might not and a decrease in accuracy based on the findings that that we have had to-date.

So what we've been able to do with PIL-BOX is select different compounds, take them up into space and then PIL-BOX grows crystals using those compounds that tend to be bigger and more accurate and then we can bring those down to Earth where they function really as a template, if you will, for understanding those compounds in a better way than using crystals on Earth. So the use case we like to talk about I think that resonates the most is this idea that

the form of a compound in pharmaceuticals drives the function. Sometimes you could have a very promising drug that has a side effect but you don't completely understand why that side effect is occurring and with better models of the molecules associated or the proteins associated in these pharmaceuticals, you can have a higher level understanding of what is potentially causing those side effects and then come up with ways to mitigate them.

Marc-André Ranger

So PIL-BOX is currently the infrastructure is in the ISS, right, so how does it compare to other microgravity research platform like let's say Varda in term of accessibility or even research capabilities?

Peter Cannito

Sure. Well so PIL-BOX is a capability that can function anywhere where there's the right environment for microgravity, right? So currently we're on the ISS because that's the most proven, available microgravity platform out there but we're really platform agnostic. As a matter of fact, I believe Varda is more focused on the platform than it is on the payload capability. For us, if the Varda platform created the right environment and was up there for the right period of time as example with the right level of microgravity, PIL-BOX could probably function on the Varda platform although I don't know a lot about that platform so that's more just an example theoretically, that it's really a platform agnostic strategy.

So whether you know the future for microgravity research platforms is the ISS or something that Axiom puts up or Vast or Sierra Space or Blue Origin or Varda or the Europeans have a number of capabilities that they're contemplating putting up there, to Redwire and PIL-BOX it doesn't matter. We want to be on all those platforms and I think that's an important aspect of it. Because I think one of the things that people sometimes will refer to us as an orbital outfitter in terms of our microgravity platforms and one of the things that folks have to realize is that commercial space stations are great, they're exciting but they have to do something useful for them to ultimately be of value and that's where Redwire, not only with PIL-BOX but with all of our microgravity development capabilities, and we've done stuff associated with microprocessors and more efficient materials for chip development, we've done 3D printing on orbit both for our polymers, ceramics, super alloys and, of course, 3D printing bio capabilities like the meniscus we printed and the heart cells we printed. These are all things that we someday envision there will be these space platforms up there commercial or otherwise of varying types that will all have Redwire hardware on them if that makes sense?

Marc-André Ranger

Yeah absolutely love to hear it especially the platform agnostic part. Makes me think yesterday I think SpaceX and Vast announced microgravity research initiative they're opening up spot so we would love to see PIL-BOX aboard a Dragon at some point in the future.

Peter Cannito

Yeah we did announce a couple months back our partnership with Vast so we're certainly talking to those guys and I think it's a really a symbiotic relationship between them being ultimately a space landlord and us being a space tenant with our microgravity capabilities.

Marc-André Ranger

Really, really sounds amazing so you touched a bit on the real-world application you touched on your 3D printing organs, meniscus, heart tissue. So what would you say are the best application across these industries of microgravity research?

Peter Cannito

Well currently although we're taking an all-of-the-above strategy, currently the PIL-BOX and the development of seed crystals for pharmaceutical or otherwise applications seems to be the furthest along right now. I think that's the one that we feel has the highest level of commercial potential in the nearest term.

Marc-André Ranger

And when we think about commercialization of these research both for PIL-BOX and others, what's your strategy in both monetizing and attracting new partners? I think you're already working with big ones like Eli Lilly, Bristol-Myers. So are those initiatives, how will those initiatives make money and how do you plan on attracting more partners?

Peter Cannito

It's a good question. So probably the easiest way to think about it, and this is why we refer to it as venture optionality, is that right now and previously the model has been mostly people paying us to develop the payloads to run experiments right? And so one of the things that is a very Redwire approach to this kind of emerging tech is we do make revenue and make money on getting paid to make these payloads right so a lot of people ask me well how come you don't have these really big capital investments where you're you know spending all sorts of money to you know develop this stuff out and the reason is because here to date we've been we've been paid revenue to build these payloads while maintaining the critical intellectual property associated with them. Longer term, we're exploring lots of different ways that now that we've started flying some of our own compounds, how we can leverage the intellectual property that that comes with having a basically a seed crystal that that belongs to Redwire and what we can do with that.

So one of the things we've talked about publicly though is this idea from my perspective is I hope for a day one day where people aren't even talking about the fact that the seed crystals were essentially built in space. The fact of the matter is wherever they were built it's just a better seed crystal and that drives you know additional business opportunities. Because like I said this is a process that already occurs terrestrially; we are just doing it in space to take advantage of the unique characteristics of microgravity that leads to larger and better more well-formed crystals. But it's still early days and that's why we like to call it venture optionality, because I think we're exploring lots of different partnerships and looking for the potential different ways to monetize this.

Marc-André Ranger

I love it. I love all these free options on your stock and honestly it's just amazing. Redwire stock comes with all these free options in my mind. Anyway so shifting gear to future outlooks and maybe looking ahead a bit: what do you see are some of the most significant trends and challenges that you see shaping the future of the space industry as a whole and how do you see Redwire preparing for them?

Peter Cannito

Well the good news is there's a lot of demand signal out there and I'm really excited about a lot of different trends out there that are driving demand. One of probably the biggest is this idea of space as a warfighting domain. Space is more important to national security than ever before and we definitely have near peer competition going on in the space domain and as a result you see things like the establishment of the Space Force and increasing budgets and the investment of space for a national security perspective. Of course at Redwire we're looking at where that's going to lead to as you start looking at multi-domain. You know at the end of the day space has to be useful, right? There's a lot of really exciting things that happen in terms of going to space, you know you see rockets take off and having an ISS and having satellites and all that other kind of stuff. But at Redwire we're very pragmatic and we think about the fact that for space to be really a healthy long-term investment it has to be as useful as possible so we're trying to focus on that but looking at the multi-domain aspect of where space adds to national security by supplementing things like command and control or communications of airborne assets it's a trend that we're obviously leaning into. We also are super excited about space exploration. Of course we're involved in the Artemis program and are excited about returning to the moon. There is a lot of talk obviously too about potentially going to Mars. The nice thing about Redwire is when you provide the fundamental building blocks of space both those missions create a lot of opportunities for us. One of the areas that we're leaning into is obviously space power. The ROSA is a really important capability that's currently powering the ISS and we had announcements earlier in programs like VSAT where we're partnered with Astrobotic to put power systems on the moon. We also announced a program called Mason that does microwave sintering in order to essentially build landing pads on the moon. And of course, like everybody else we're looking at Mars and the opportunities that that creates as well. So if you put you know I talked about national security and space as a warfighting domain but then you put that other what I think is a really

renewed public enthusiasm for space exploration as another current trend, that's really exciting for us. And then the last one I would probably add to that would be this idea of space commercialization and the future of commercial space stations both from an infrastructure perspective, because we feel that since we already provide the power system for solar arrays, roll out solar arrays, on the ISS that that makes us a good candidate for providing similar infrastructure to emerging commercial space stations, but also as I mentioned being the orbital outfitter that put those useful technologies into these future space stations that are going to create things that we haven't even thought of yet for the benefit of earth - whether it be in material science or pharmaceutical or bio research or what have you.

Marc-André Ranger

Now we're really talking, you bring me into that Star Trek future I so hope to see in the near future.

Peter Cannito

We certainly have a lot of Star Trek fans here at Redwire.

Marc-André Ranger

So what's your aspirations then for Redwire we talked about all of this but where do you see the company being in let's say 5 or 10 years and what key milestone do you hope to achieve in term of growth, innovation, impact?

Peter Cannito

Where our goal is to be in it for the long term, right? We're a long-term focused company that is continuously balancing high-impact products, high-impact technologies that are going to be revolutionary in the future but balancing that with fiscal discipline so that we can stay in the game perpetually, right? So and build that resiliency so we know that regardless of what direction space goes in we're firm believers that it's going to be exciting and that there's a lot of growth there and it's an incredible emerging market to be in and so we want to make sure that we have the balance sheet, the free cash flow, the profitability, to have what I would call a really exciting sustainable growth at higher than average rates.

Marc-André Ranger

Right on. I hope to be able to transfer my shares to my kids one day. And then being able to continue and look forward to the stars just like we are right now. So any final thoughts as we as we close today and any key takeaways you'd like to leave our listeners with?

Peter Cannito

No not that we haven't articulated other than I think just trying to help everybody understand how we're positioning ourselves and it's not the only strategy obviously out there and you know we always like to say that when space wins, Redwire wins and we're really honored and privileged to be part of what we think is a robust space community. And so we're going to keep on doing what we're doing and hopefully what we've demonstrated we do well - things like investing in breakthrough technologies, focusing on our platform strategy, continuing to do accretive M&A and you know everything that you've seen in the last three years our goal is to just kind of stick to our strategy that so far has served us well and keep doing what we're doing and growing out what I just think is an extraordinary platform led by an incredible management team with just a world class employee base both in the US and internationally.

Marc-André Ranger

Well, we're really lucky to have leaders like you that take some of their valuable time to show up and explain these sometimes hard to grasp concept in really easy to understand and narrative. So once again thank you so much Pete for sharing your valuable time and insights with us today. It's been just crazy enlightening and very amazing conversation I really enjoyed it so for our listeners today you want to learn more about Redwire Space and their groundbreaking work don't hesitate to visit their website and follow them on X. A quick reminder everyone that today's conversation is recorded so if you missed part of it you can always come back listen to the whole thing also feel free to use the recording for your own content if you feel that it can add value to others - sharing is caring that's

what we're all about here learning together. So that's all the time we have today. Thanks a lot and thank you one last time thank you very much Peter for coming in and being part of that conversation today.

Peter Cannito

Thank you to you it's been a pleasure I really enjoyed our time and thanks to all the Redwire shareholders out there we appreciate you and have a good week.

Marc-André Ranger

You too sir. Thank you very much bye now.

NYSE TV Taking Stock Interview

February 6, 2025

Presenters

Trinity Chavez, NYSE TV

Peter Cannito, Redwire President, CEO & Chairman

Trinity Chavez

Redwire’s making a bold move acquiring Edge Autonomy to become a leader in multi-domain autonomous technology. This deal combines Redwire’s space platforms with Edge’s airborne systems creating an end-to-end defense solution powered by AI. Joining me now to talk more about this is the CEO of Redwire on this episode of Taking Stock.

Now Pete, thank you so much for joining us today.

Peter Cannito

Thank you, it’s great to be here. Thank you for having me.

Trinity Chavez

And congratulations on this news announcements. Tell us more about it and what drove the decision to acquire Edge Autonomy and how this acquisition transforms Redwire into a leader in the multi-domain sector.

Peter Cannito

Many of the people who have been tracking Redwire know, but for those who haven’t been, last April we announced a Very Low Earth Orbit satellite program that we were developing that people started referring to as an orbital drone. And it was very interesting because Redwire has traditionally been a space infrastructure company with a variety of different spacecraft platforms in various orbits in space such as Low Earth Orbit, Medium Earth Orbit, and Geosynchronous Earth Orbit and when we started moving into what’s called Very Low Earth Orbit or VLEO, and people started to referring to our spacecraft as an orbital drone it really occurred to us that in many cases from the defense tech part of our business, it was very arbitrary this idea of offering these platform solutions in space versus airborne solutions. So when we came across Edge Autonomy, we realized that by adding a company like Edge Autonomy we would then become a multi-domain defense tech company that really spanned from the surface of the Earth all the way to the surface of the moon in our offering of these let’s call them, above-Earth platforms. And that was very unique and positioning in the marketplace that we haven’t come across yet. So we thought of it as a really highly differentiated strategic competitive advantage that we could build by doing this M&A.

Trinity Chavez

And how does combining Redwire’s space platforms with Edge Autonomy’s airborne technology position the company to better serve national security customers?

Peter Cannito

The national security strategy has been migrating towards a concept that they call Joint All-Domain warfighting. They have a program concept called Joint All-Domain Command and Control and the idea is that when you’re developing a national security strategy, you don’t want to have stovepipes between the different domains of air, sea, land, space, and cyber for instance. So you’re really looking to have a multi-domain or all-domain capability and by vertically integrating airborne platforms within a agile middle market company like Redwire that already has space-based platforms, you now have the potential for fully-integrated, vertically-integrated multi-domain platforms where spacecraft or satellites can be operating through connectivity with airborne systems, like Edge Autonomy’s UAS systems, to collaborate in this autonomous way to get better coverage of the battlefield.

Trinity Chavez

And as you mentioned with this acquisition Redwire now spans to space, air, and defense systems; so what advantages does this end-to-end capability provide to the warfighter and defense agencies?

Peter Cannito

Yeah, so if you think about each platform brings a unique benefit to the fight. Space-based platforms are what some will refer to as the ultimate high ground, right? Because you have a very high, wide-area view of Earth and by extension of the battlefield. However, when you move into space, you give up certain performance parameters, like for instance, resolution. Whereas the closer you are to Earth, your imaging has higher resolution and therefore higher accuracy. One example of how combining them into an integrated system is you can use spacecraft to surveil a very wide area, and then if they detect something, communicate potentially with a uncrewed airborne system to move into that area where the detection occurred for a higher-resolution image of what’s happening on the ground. And that’s just one example; there are other examples that have to do with where satellites can provide longer communications range for airborne systems because they have the ability to communicate over the horizon using space assets instead of a direct communications link. So there are a number of different dynamic missions that are enhanced when these two domains in a multi-domain construct are collaborating.

Trinity Chavez

And you mentioned that making your platforms smarter with AI is really a part of your business strategy, but how will AI play a role in connecting autonomous drones with spacecraft to provide real-time, actionable data?

Peter Cannito

Well, that real-time part is really the key, isn’t it? What it allows AI to do is to take workload off the operator so these autonomous platforms can take care of a lot of the different operational aspects of the mission, reserving the operator with their task loads for those really high-order analysis-type areas that you want your analysts to really work on. So what it does, for instance, I mentioned this idea of a spacecraft with a wide area field of view having a detection queuing perhaps an airborne asset that can get a better look through a higher-fidelity electro-optic camera system. That could all be automated with artificial intelligence such as different computer vision technologies; so it is about reducing operator workload but also using algorithms to get higher-fidelity data.

Trinity Chavez

Well, thank you so much Pete for all of those great insights. It was a pleasure speaking with you and having you on Taking Stock today.

Peter Cannito

Thank you for having me.

Additional Information and Where to Find It

The definitive agreement entered into in connection with the proposed business combination described herein and a summary of material terms of the transaction will be provided in a Current Report on Form 8-K or Schedule 14A to be filed with the Securities and Exchange Commission (the “SEC”). Redwire will file with the SEC a proxy statement relating to a special meeting of Redwire’s stockholders (the “proxy statement”). STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT REDWIRE, EDGE AUTONOMY, THE TRANSACTION AND RELATED MATTERS. Stockholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the parties through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the parties on investor relations section of Redwire’s website at redwirespace.com.

Participants in the Solicitation

Redwire and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Redwire in respect of the proposed business combination contemplated by the proxy statement. Information regarding the persons who are, under the rules of the SEC, participants in the solicitation of the stockholders of Redwire, respectively, in connection with the proposed business combination, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement when it is filed with the SEC. Information regarding Redwire’s directors and executive officers is contained in Redwire’s Annual Report on Form 10-K for the year ended December 31, 2023 and its Proxy Statement on Schedule 14A, dated April 22, 2024, which are filed with the SEC.

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed business combination or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Forward-Looking Statements

Readers are cautioned that the statements contained in this communication regarding expectations of our performance or other matters that may affect our or the combined company’s business, results of operations, or financial condition are “forward-looking statements” as defined by the “safe harbor” provisions in the Private Securities Litigation Reform Act of 1995. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included or incorporated in this communication, including statements regarding our or the combined company’s strategy, financial projections, including the prospective financial information provided in this communication, financial position, funding for continued operations, cash reserves, liquidity, projected costs, plans, projects, awards and contracts, and objectives of management, the entry into the potential business combination, the expected benefits from the proposed business combination, the expected performance of the combined company, the expectations regarding financing the proposed business combination, among others, are forward-looking statements. Words such as “expect,” “anticipate,” “should,” “believe,” “target,” “continued,” “project,” “plan,” “opportunity,” “estimate,” “potential,” “predict,” “demonstrates,” “may,” “will,” “could,” “intend,” “shall,” “possible,” “forecast,” “trends,” “contemplate,” “would,” “approximately,” “likely,” “outlook,” “schedule,” “pipeline,” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements, but the absence of these words does not mean that a statement is not forward looking. These forward-looking statements are not guarantees of future performance, conditions or results. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control.

These factors and circumstances include, but are not limited to: (1) risks associated with the continued economic uncertainty, including high inflation, supply chain challenges, labor shortages, increased labor costs, high interest rates, foreign currency exchange volatility, concerns of economic slowdown or recession and reduced spending or suspension of investment in new or enhanced projects; (2) the failure of financial institutions or transactional counterparties; (3) Redwire’s limited operating history and history of losses to date as well as the limited operating history of Edge Autonomy and the relatively novel nature of the drone industry; (4) the inability to successfully integrate recently completed and future acquisitions, including the proposed business combination with Edge Autonomy, as well as the failure to realize the anticipated benefits of the transaction or to realize estimated projected combined company results; (5) the development and continued refinement of many of Redwire’s and the combined company’s proprietary technologies, products and service offerings; (6) competition with new or existing companies; (7) the possibility that Redwire’s expectations and assumptions relating to future results and projections with respect to Redwire or Edge Autonomy may prove incorrect; (8) adverse publicity stemming from any incident or perceived risk involving Redwire, Edge Autonomy, the combined company, or their competitors; (9) unsatisfactory performance of our and the combined company’s products resulting from challenges in the space environment, extreme space weather events, the environments in which drones operate, including in combat or other areas where hostilities may occur, or otherwise; (10) the emerging nature of the market for in-space infrastructure services and the market for drones and related services; (11) inability to realize benefits from new offerings or the application of our or the combined company’s technologies; (12) the inability to convert orders in backlog into revenue; (13) our and the combined company’s dependence on U.S. and foreign government contracts, which are only partially funded and subject to immediate termination, or which may be influenced by the level of military activities and related spending such as in or with respect to the war in Ukraine; (14) the fact that we are and the combined company will be subject to stringent economic sanctions, and trade control laws and regulations; (15) the need for substantial additional funding to finance our and the combined company’s operations, which may not be available when needed, on acceptable terms or at all; (16) the dilution of existing holders of our common stock that will result from the issuance of additional shares of common stock as consideration for the acquisition of Edge Autonomy, as well as the issuance of common stock in any offering that may be undertaken in connection with such acquisition; (17) the fact that the issuance and sale of shares of our Series A Convertible Preferred Stock has reduced the relative voting power of holders of our common stock and diluted the ownership of holders of our capital stock; (18) the ability to achieve the conditions to cause, or timing of, any mandatory conversion of the Series A Convertible Preferred stock into common stock; (19) the fact that AE Industrial Partners and Bain Capital have significant influence over us, which could limit your ability to influence the outcome of key transactions; (20) provisions in our Certificate of Designation with respect to our Series A Convertible Preferred Stock may delay or prevent our acquisition by a third party, which could also reduce the market price of our capital stock; (21) the fact that our Series A Convertible Preferred Stock has rights, preferences and privileges that are not held by, and are preferential to, the rights of holders of our other outstanding capital stock; (22) the possibility of sales of a substantial amount of our common stock by our current stockholders, as well as the equity owners of Edge Autonomy following consummation of the transaction, which sales could cause the price of our common stock and warrants to fall; (23) the impact of the issuance of additional shares of Series A Convertible Preferred Stock as pay in kind dividends on the price and market for our common stock; (24) the volatility of the trading price of our common stock and warrants; (25) risks related to short sellers of our common stock; (26) Redwire’s or the combined company’s inability to report our financial condition or results of operations accurately or timely as a result of identified material weaknesses in internal control over financial reporting, as well as the possible need to expand or improve Edge Autonomy’s financial reporting systems and controls; (27) the possibility that the closing conditions under the merger agreement necessary to consummate the merger between Redwire and Edge Autonomy will not be satisfied; (28) the effect of any announcement or pendency of the proposed business combination on Redwire’s or Edge Autonomy’s business relationships, operating results and business generally; (29) risks that the proposed business combination disrupts current plans and operations of Redwire or Edge Autonomy; (30) the ability of Redwire or the combined company to raise financing in connection with the proposed business combination or to finance its operations in the future; (31) the impact of any increase in the combined company’s indebtedness incurred to fund working capital or other corporate needs, including the repayment of Edge Autonomy’s outstanding indebtedness and transaction expenses incurred to acquire Edge Autonomy, as well as debt covenants that may limit the combined company’s activities, flexibility or ability to take advantage of business opportunities, and the effect of debt service on the availability of cash to fund investment in the business; (32) the ability to implement business

plans, forecasts and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities; (33) costs related to the transaction; and (34) other risks and uncertainties described in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and those indicated from time to time in other documents filed or to be filed with the SEC by Redwire. The forward-looking statements contained in this communication are based on our current expectations and beliefs concerning future developments and their potential effects on us. If underlying assumptions to forward-looking statements prove inaccurate, or if known or unknown risks or uncertainties materialize, actual results could vary materially from those anticipated, estimated, or projected. The forward-looking statements contained in this communication are made as of the date of this communication, and Redwire disclaims any intention or obligation, other than imposed by law, to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Persons reading this communication are cautioned not to place undue reliance on forward-looking statements.

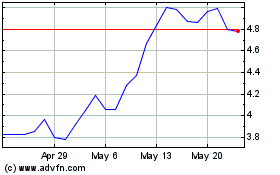

Redwire (NYSE:RDW)

Historical Stock Chart

From Jan 2025 to Feb 2025

Redwire (NYSE:RDW)

Historical Stock Chart

From Feb 2024 to Feb 2025