As costs of health care rise, survey also reveals 51% of

Americans believe health care costs have a direct impact on ability

to save for retirement

Voya Financial, Inc. (NYSE: VOYA) announced today findings from

a consumer research survey highlighting new workplace benefits and

savings perspectives heading into the 2024 open enrollment season.

Among the findings, Voya’s research indicates a shift in employee

priorities as nearly three-quarters (72%) of employed Americans

strongly or somewhat agree they would take a job with a slightly

lower salary for better health care and medical coverage, including

lower premiums and out-of-pocket costs. This sentiment is felt even

higher among millennials (80%) compared to Generation Z (60%),

Generation X (69%) and baby boomers (72%).

“The consistent trend of rising health care costs, coupled with

the fact that these needs are anticipated to increase as one ages,

is having a tangible effect on individuals,” said Nate Black, VP,

Health Solutions Product at Voya Financial. “Our research also

revealed more than half of employed Americans strongly or somewhat

agree they would take a lower salary for employer contributions to

health savings and spending accounts (59%), and better access to

voluntary benefit offerings such as critical illness, hospital

indemnity, disability income and accident insurance (54%). As a

result, this data highlights that priorities are shifting regarding

individuals’ broader health care needs, particularly when it comes

to support from their employer. With open enrollment nearing,

employers have a critical role to play helping their workforce

leverage and maximize the full spectrum of their workplace benefits

and savings offerings.”

Health care costs can impact ability to save for

retirement

Voya’s research also found more than half (51%) of employed

Americans say health care costs have a severe or major impact on

their ability to save for retirement. The good news, however, is

that many employers today recognize this challenge and continue to

provide their workforce with solutions that can support one’s

health and wealth needs.

What’s more, employees equally recognize the value of solutions

through the workforce as Voya’s research also found over half of

working Americans would be more likely to stay with their current

employer if provided access to health spending and savings accounts

(51%), voluntary benefit offerings (51%) and mental health benefits

and resources (54%).

“While it’s encouraging to see employees’ interest in these

solutions as we approach open enrollment, now is the time for

employers to help their workforce understand the true value these

employer-offered resources can provide — which can make a

difference in retirement readiness,” said Christin Kuretich, VP,

Supplemental Products at Voya Financial. “Many individuals may not

realize that voluntary benefits, for example, can also help lessen

the financial impact of a covered event such as an illness or

accident and can potentially reduce the need to tap into a

retirement account for any out-of-pocket medical or other expenses.

With that in mind, these benefits can be tailored to meet

individual needs.”

Utilize digital guidance support

As managing one’s holistic savings picture remains top of mind,

interestingly, Voya’s research has also shown that three-quarters

(75%) of working Americans strongly or somewhat agree they are

interested in receiving support to maximize their workplace

benefits dollars across their retirement savings, health savings

accounts (HSAs), health care insurance and voluntary benefits at

work.

One area of growing support is in the form of innovative digital

guidance tools — which continue to emerge as a valuable resource,

with goals that include simplifying processes, saving time and

fostering informed decision-making. Encouragingly, individuals are

interested in this type of guidance as Voya’s research also found

half of employed Americans are more likely to stay with their

current employer if offered access to digital tools and advice to

help them make retirement plan and workplace-benefit-related

decisions.

“Personalized digital guidance experiences, designed to help

employees make more-informed decisions with a synchronized view of

their whole financial life, are becoming increasingly important to

be able to support the evolving needs of individuals and their

households,” added Kuretich. “This is crucial not only during open

enrollment but also year-round to educate employees on their

benefits, ensuring they are fully equipped to leverage their

workplace benefits and savings effectively.”

Voya continues to support both employers and employees to help

gain more holistic views into their workplace benefits and savings

through its myVoyage personalized financial-guidance and connected

workplace-benefits digital platform. As a result, Voya’s customers

who use myVoyage are 50% more likely to choose a less-expensive

health plan option and 50% more likely to elect to save funds in an

HSA, when eligible, while increasing their retirement savings

rates.1 The myVoyage solution continues to evolve with ongoing

enhancements happening throughout 2024.

As an industry leader focused on the delivery of benefits,

savings and investment solutions to and through the workplace, Voya

is committed to delivering on its mission to make a secure

financial future possible for all — one person, one family, one

institution at a time.

All data, unless noted otherwise, based on the results of a Voya

Financial Consumer Insights & Research survey conducted Aug.

8-9, 2024, on the Ipsos eNation omnibus online platform among 1,005

adults aged 18+ in the U.S., featuring 440 Americans working full

time or part time.

1. Voya Financial internal data as of Dec. 31, 2023.

About Voya Financial®

Voya Financial, Inc. (NYSE: VOYA), is a leading health, wealth

and investment company with approximately 9,000 employees who are

focused on achieving Voya’s aspirational vision: “Clearing your

path to financial confidence and a more fulfilling life.” Through

products, solutions and technologies, Voya helps its 15.2 million

individual, workplace and institutional clients become well

planned, well invested and well protected. Benefitfocus, a Voya

company and a leading benefits administration provider, extends the

reach of Voya’s workplace benefits and savings offerings by

engaging directly with over 12 million employees in the U.S.

Certified as a “Great Place to Work” by the Great Place to Work®

Institute, Voya is purpose-driven and committed to conducting

business in a way that is economically, ethically, socially and

environmentally responsible. Voya has earned recognition as: one of

the World’s Most Ethical Companies® by Ethisphere; a member of the

Bloomberg Gender-Equality Index; and a “Best Place to Work for

Disability Inclusion” on the Disability Equality Index. For more

information, visit voya.com. Follow Voya Financial on Facebook,

Instagram, and LinkedIn.

Voya Financial and its affiliated companies (collectively,

“Voya”) are making available to you the Personalized Enrollment

Guidance tool offered by SAVVI Financial LLC (“SAVVI”). Voya has a

financial ownership interest in and business relationships with

SAVVI that create an incentive for Voya to promote SAVVI’s products

and services and for SAVVI to promote Voya’s products and services.

Please access and read SAVVI’s Firm Brochure, which is available at

this link: https://www.savvifi.com/legal/form-adv. It contains

general information about SAVVI’s business, including conflicts of

interest.

The Personalized Enrollment Guidance tool provides information

and options for you to consider in making healthcare, health

savings, emergency savings, and retirement savings choices. Those

choices are solely up to you to make. Personalized Enrollment

Guidance is not intended to serve as financial advice. None of

SAVVI, Voya, nor WEX Health acts in a fiduciary capacity in

providing Personalized Enrollment Guidance or other services to

you; any such fiduciary capacity is explicitly disclaimed.

Products and services offered through the Voya® family of

companies.

Insurance is issued by ReliaStar Life Insurance Company

(Minneapolis, MN) and ReliaStar Life Insurance Company of New York

(Woodbury, NY). Within the State of New York, only ReliaStar Life

Insurance Company of New York is admitted, and its products issued.

Both are members of the Voya® family of companies. Voya Employee

Benefits is a division of both companies. Form numbers, product

availability and specific provisions may vary by state.

VOYA-EB

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240917168817/en/

Media Contact: Olivia Valente Voya Financial (203)

528-5284 Olivia.Valente@voya.com

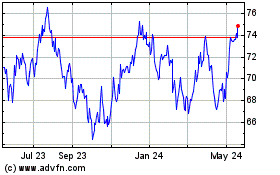

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Oct 2024 to Nov 2024

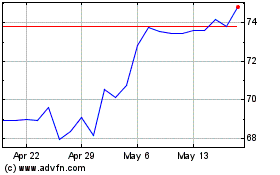

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Nov 2023 to Nov 2024