Majority of working Americans select same health plan from prior year during benefits open enrollment, Voya survey finds

October 30 2024 - 8:00AM

Business Wire

New Voya research details employee decision-making when it

comes to workplace benefits enrollment, leaving opportunity for

greater employer engagement

Voya Financial, Inc. (NYSE: VOYA) announced today findings from

a new consumer research survey detailing decision-making behaviors

driven by working Americans during the annual workplace enrollment

period. The results of Voya’s research reveal an overwhelming

majority (91%) of working Americans “strongly agree” or “agree”

that when it comes to selecting their health or medical plan each

year during benefits open enrollment, they typically select the

same plan from the prior year.1

Heading into open enrollment season, Voya’s research sought to

further understand how employees are engaging with their benefits

and the decision-making involved in their annual enrollment

selection. While the research shows that inertia plays a role for

employees in making benefits changes, having the tendency to select

the benefits they enrolled in previously, Voya’s data also showed

nearly half (49%) of benefits-eligible employed Americans spend

less than 20 minutes reviewing information related to their

workplace benefits during their employer’s open enrollment period.2

The good news is 79% of employees “strongly agree” or “agree” they

will spend more time reviewing their employee benefits options and

coverage than they did during the last enrollment period.1

“The workplace annual enrollment period is the one time of year

employees can review and engage with their employer’s holistic

benefits package, which should not be taken lightly,” said Nate

Black, VP, Health Solutions Product Development at Voya Financial.

“While it’s encouraging that most employees will be spending more

time reviewing their options this year, now is also the time for

employers to be engaging and communicating with their workforce

about the value of the solutions they offer.”

“High Deductible” naming could create decision-making

bias

When it comes to overall health plan selection, two of the most

common plans employers offer are the Preferred Provider

Organization (PPO) and the High-Deductible Health Plan (HDHP),

where a PPO will typically offer a lower deductible with higher

premiums and a HDHP offering higher deductibles with lower

premiums. While HDHPs are often paired with a tax-advantaged health

savings account (HSA), which enables the accountholder to

contribute pre-tax funds to use toward eligible health care

expenses, the “high deductible” name of the plan has proven to

create biases for individuals who may not fully understand the

plan’s benefits. According to Voya’s research, working Americans

are almost three times more likely to choose a PPO over a HDHP when

the plans are labeled their branded names of “Traditional PPO”

(74%) and “High-Deductible Health Plan” (26%). However, when plan

names are unbranded, removing “high deductible” from the plan name,

the preference gap narrows considerably: 52% chose the unbranded

PPO, and 48% chose the unbranded HDHP.1

“It’s clear that employees’ decisions can be driven by

underlying, non-financial factors like inherent biases against

HDHPs, their own inertia around decision-making and an aversion to

high deductibles,” added Black. “As employees make several quick

decisions during annual enrollment, further education and guidance

around the benefits and solutions offered through the workplace is

critical. Helping employees overcome these obstacles can enable

them to make the best decisions and choices for them and their

family — and potentially help create improved financial outcomes

for employees and employers alike.”

Voya’s research also uncovered only 3% of working Americans

understand the full benefits of an HSA, which is only slightly

higher among HSA owners at 4%.1 This data underscores the notion

that employees may be lacking an ability to build strategies to

increase health care savings, cover medical and living expenses in

retirement, or to use their account as an investment vehicle once

the account balance reaches a certain threshold. Specifically, less

than half of respondents were aware HSAs can be used to:

- Pay for health care expenses in retirement (47%);

- Provide tax advantages (47%);

- Roll money over from year to year (43%); and

- Be used as an investment vehicle (29%).1

As an industry leader focused on the delivery of benefits,

savings and investment solutions to and through the workplace, Voya

is committed to delivering on its mission to make a secure

financial future possible for all — one person, one family, one

institution at a time.

- Voya Financial Consumer Insights & Research survey

conducted Sept. 27 – Oct. 7, 2024, among 345 adults aged 18+

Americans, working either full time or part time, who have primary

or shared household responsibility for making financial and

health/medical plan decisions, are benefit eligible for

employer-sponsored retirement and health plans, and currently

enrolled.

- Voya Financial Consumer Insights & Research survey

conducted Sept. 25-27, 2024, among 2,201 Americans aged 18+,

featuring 513 benefits-eligible working Americans.

About Voya Financial®

Voya Financial, Inc. (NYSE: VOYA) is a leading health, wealth

and investment company with approximately 9,000 employees who are

focused on achieving Voya’s aspirational vision: “Clearing your

path to financial confidence and a more fulfilling life.” Through

products, solutions and technologies, Voya helps its 15.2 million

individual, workplace and institutional clients become well

planned, well invested and well protected. Benefitfocus, a Voya

company and a leading benefits administration provider, extends the

reach of Voya’s workplace benefits and savings offerings by

engaging directly with more than 12 million employees in the U.S.

Certified as a “Great Place to Work” by the Great Place to Work ®

Institute, Voya is purpose-driven and committed to conducting

business in a way that is economically, ethically, socially and

environmentally responsible. Voya has earned recognition as: one of

the World’s Most Ethical Companies ® by Ethisphere; a member of the

Bloomberg Gender-Equality Index; and a “Best Place to Work for

Disability Inclusion” on the Disability Equality Index. For more

information, visit voya.com. Follow Voya Financial on Facebook,

Instagram and LinkedIn.

VOYA-EB

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030506200/en/

Media Contact: Laura Maulucci Voya Financial (508)

353-6913 Laura.Maulucci@voya.com

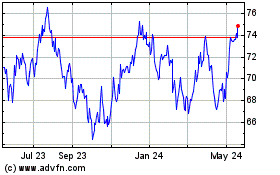

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Jan 2025 to Feb 2025

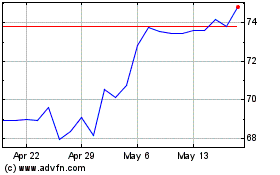

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Feb 2024 to Feb 2025