Voya survey reveals half of caregivers say responsibilities impact ability to save for retirement

October 15 2024 - 9:05AM

Business Wire

Findings show employers have an opportunity to retain

caregivers with broader workplace benefits and savings

resources

Voya Financial, Inc. (NYSE: VOYA) released new findings from a

consumer research survey uncovering that almost half of caregivers

(49%) report their responsibilities have had a severe or major

impact on their ability to prepare for their retirement. More than

half of caregivers also noted caregiver responsibilities impacting

their ability to prepare for emergencies and unexpected expenses

(52%), mental well-being (52%) and healthcare costs (51%). Notably,

when looking at a combined group of Asian, Hispanic and Black

Americans, 28% reported that their caregiver responsibilities will

have a severe or major impact on their ability to save for

retirement, compared to 19% of white Americans.

“Caregiving comes with significant emotional challenges, and the

financial strains are often a concern. In fact, Voya’s research

found that 27% of caregivers changed jobs to provide care. However,

employers can play a critical role when it comes to supporting

caregivers in the workplace,” said Carole Mendoza, VP, benefits at

Voya Financial. “Employers that prioritize traditional workplace

benefits coupled with specific caregiver resources have an

opportunity to create an environment that can foster employee

loyalty, reduce turnover and enhance overall productivity. However,

it’s important to ensure employees are aware of and understand all

the benefits and resources available to them, particularly

employees in diverse communities.”

Caregiving impact on financial life

Voya’s research also found caregiving responsibilities severely

or majorly affect several other aspects of their finances,

including a home purchase (40%), mortgage and rent payments (38%),

having a child and childcare costs (35%), and college expenses or

student loans for themselves or their dependents (30%). And, among

those who are already caregivers, Asian, Hispanic and Black

Americans also report higher impacts on mental wellness (66% vs.

43%), healthcare costs (64% vs. 44%) and buying a home (52% vs.

31%), compared to white caregivers.

Interestingly, Voya’s findings also show employed Americans are

more likely to stay with their employers if the company provides

access to health spending and savings accounts (51%), voluntary

benefit offerings, such as critical illness, hospital indemnity,

disability income, accident insurance (51%), and comprehensive

caregiver planning resources (36%) — all which can have a

significant impact on those with disabilities and their caregivers,

who often face financial challenges connected to their dual

responsibilities at home and work.

Another notable finding: More than half (53%) of caregivers

agree or strongly agree they are likely to use caregiver resources

and support offered through employers, including educational

articles, checklists and planning document templates.

“Employers have an opportunity to demonstrate a commitment to an

inclusive and supportive workplace for caregivers and all

employees,” Mendoza added. “Offering comprehensive benefits that

include support for caregivers can also be a significant factor in

attracting and retaining talent, along with promoting higher job

satisfaction and overall well-being. Benefits, such as health

savings accounts, flexible spending accounts, legal insurance,

disability and long-term care insurance, and targeted planning and

education resources for the disabilities community continue to be

an untapped caregiver-retention tool for many employers.”

Those with disabilities and their caregivers can find more

resources and information at voyacares.com. As an industry leader

focused on the delivery of benefits, savings and investment

solutions to and through the workplace, Voya is committed to

delivering on its mission to make a secure financial future

possible for all — one person, one family, one institution at a

time.

About the study

These are the results of an Ipsos survey in partnership with

Voya Consumer Insights and Research conducted Aug. 8–9, 2024, on

the Ipsos eNation omnibus online platform among 1,005 adults aged

18+ in the U.S., featuring 164 caregivers (117 White, 39

Asian/Hispanic/Black[Net], 8 other). Sample sizes are consistent

wave to wave. The sample can be taken as representative of the

general adult U.S. population age 18 or older. The data is weighted

so that the sample composition best reflects the demographic

profile of the adult population according to the most recent census

data. Where results do not sum to 100 or the “difference” appears

to be +/ 1 more/less than the actual, this may be due to rounding,

multiple responses or the exclusion of “don't knows” or not stated

responses. The precision of Ipsos online polls is calculated using

a credibility interval with a poll of 1,000 accurate to +/ 3.5

percentage points. For more information on the Ipsos use of

credibility intervals, please visit the Ipsos website

(Ipsos.com).

About Voya Financial®

Voya Financial, Inc. (NYSE: VOYA) is a leading health, wealth

and investment company with approximately 9,000 employees who are

focused on achieving Voya’s aspirational vision: Clearing your path

to financial confidence and a more fulfilling life. Through

products, solutions and technologies, Voya helps its 15.2 million

individual, workplace and institutional clients become well

planned, well invested and well protected. Benefitfocus, a Voya

company and a leading benefits administration provider, extends the

reach of Voya’s workplace benefits and savings offerings by

engaging directly with more than 12 million employees in the U.S.

Certified as a “Great Place to Work” by the Great Place to Work®

Institute, Voya is purpose-driven and committed to conducting

business in a way that is economically, ethically, socially and

environmentally responsible. Voya has earned recognition as: one of

the World’s Most Ethical Companies® by Ethisphere; a member of the

Bloomberg Gender-Equality Index; and a “Best Place to Work for

Disability Inclusion” on the Disability Equality Index. For more

information, visit voya.com. Follow Voya Financial on Facebook,

LinkedIn, and Instagram.

VOYA-EB

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241015955342/en/

Media: Natasha D. Smith Voya Financial (212) 309-8200

Natasha.Smith@voya.com

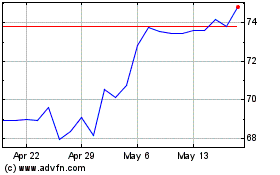

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Jan 2025 to Feb 2025

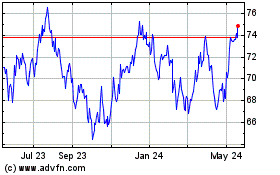

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Feb 2024 to Feb 2025