- INDIA: Airtel Payments Bank Customers can soon direct

Western Union money transfer into their bank accounts 24/7, via

their app

- AFRICA: Airtel Money mobile wallet users in 14 countries

will be able to route any money transfer received, into their

wallets, and senders worldwide will be able to push funds directly

to an Airtel Money mobile wallet in real-time

Western Union, a global leader in cross-border, cross-currency

money movement and payments, and Bharti Airtel Limited, a leading

global telecommunications company with operations in 18 countries

across Asia and Africa, today announced an unprecedented milestone

in global money movement across the world’s significant emerging

markets. The two industry leaders have come together to launch

real-time payments soon into millions of Airtel Payments Bank

accounts in India and Mobile Wallets across 14 countries in

Africa.

This key milestone follows the conclusion of new flagship

collaborations with two leading subsidiaries of India’s largest

integrated telecom - Bharti Airtel, namely Airtel Payments Bank,

India’s first payments bank with millions of customers and over

500K banking points across the country and Airtel Africa plc Africa

(LSE: AAF; NSE: AIRTELAFRI) (“Airtel Africa” or “Group”), a leading

provider of telecommunications and mobile money services with a

presence in 14 countries in Africa.

Western Union’s collaboration with Airtel Payments Bank in India

will offer another channel for real-time cross-border money

movement into India, the world’s largest remittance-receiving

country, according to the World Bank. Airtel Payments Bank

customers can soon direct a Western Union money transfer into their

bank accounts 24/7 via their app in real-time. Global senders can

use Western Union’s digital services in 75 countries plus

territories, or the walk-in Agent network across more than 200

countries and territories.

The collaboration with Airtel Africa will enable more than 15

million Airtel Money mobile wallet users in Nigeria, Uganda, Gabon,

Tanzania, Zambia, DRC, Malawi, Madagascar, Kenya, Congo, Niger,

Tchad, Rwanda and Seychelles to simply route any money transfer

received from across the world into their wallets. It will also

allow senders around the world to push funds directly to an Airtel

Money mobile wallet in real-time and store value or pay for goods

and services. Service launch is expected in the course of 2020.

“The future of money transfer is about customer choice –

allowing them to move money whenever, however and wherever they

want. Our platform cuts through the complexities of cross-border

money movement and payments so millions of customers can access

their funds in real-time and in a manner that suits their local

infrastructure and preferences,” said Western Union President and

CEO, Hikmet Ersek, speaking from the World Economic Forum Annual

Meeting, Davos, Switzerland.

"Our platform offers multiple channel choice for our customers

and the customers of our partners including Banks, FIs, Telecom and

Fintech players. We applaud Airtel for their global vision of

anticipating and leading change in the global digital landscape,”

Ersek said.

At the World Economic Forum

Annual Meeting, Davos, Switzerland, Hikmet Ersek will join Sunil

Bharti Mittal, Chairman of Bharti Airtel, along with Singapore

Prime Minister Lee Hsien Loong and South Africa's Minister of

International Relations and Cooperation Grace Naledi Mandisa Pandor

as part of a panel “Leading a New Multilateralism”, which focuses

on how emerging markets – including India and Africa – are changing

the nature of multilateralism.

BHARTI AIRTEL

“Collaborating with Western

Union on these two flagship initiatives in both India and Africa

reflects Bharti Airtel’s keen commitment to transform the quality

of lives of millions of people across emerging and developing

markets, providing connectivity and digital empowerment. We are

delighted to contribute to the development of a sound and inclusive

payments ecosystem in emerging markets to spur financial inclusion

and economic growth,” said Sunil Bharti Mittal, Chairman, Bharti

Airtel.

AIRTEL PAYMENTS BANK

“We are delighted to collaborate with Western Union to add

inbound global remittances to our portfolio of digitally enabled

financial services. Our technology platforms and deep distribution

reach allows customers to access a range of financial services in a

convenient fashion. We will continue to bring to market innovative

solutions that simplify basic financial services and empower every

Indian,” said Anubrata Biswas, MD & CEO, Airtel Payments

Bank.

AIRTEL MONEY AFRICA

Raghunath Mandava, CEO of Airtel Africa, said, “We are very

excited to partner with Western Union to offer Airtel Money

customers better access to one of the world's largest money

transfer organisations. International remittances into Africa are a

lifeline to some of our customers. This partnership will give our

customers the convenience and security of directly receiving and

sending remittances from their Airtel mobile money wallets. They

will now be automatically credited and debited via their Airtel

mobile money wallets on their phone and can immediately access the

funds to pay bills or merchants and transfer funds to family and

friends or convert to cash from the widespread Airtel Money agents,

kiosks and branches.”

This tie up with Western Union adds to other tie ups that Airtel

Africa has already put in place to help customers get inflows from

across the world.

The announcement marks further expansion of Western Union’s

unique ability to partner with a growing base of national and

international tech leaders by leveraging its core assets –

including global settlement capabilities, network, compliance and

technology systems – to enable international cross-border transfers

with customer facing innovation.

Airtel Payments Bank in India and Airtel Africa adds to a host

of other partners offering receiver-directed Western Union money

transfers: eSewa in Nepal, Gcash in the Philippines, mVola in

Madagascar and Tigo in El Salvador and Guatemala. Receiver-directed

money transfer services are on the rise with flexible linkages

offered by mobile apps and wallets. It offers receiving customers

the choice of a preferred payout method based on convenience.

Western Union has more than 40 banking and payment partnerships

in over 100 countries. This robust network of relationships helps

accelerate money movement between institutions and provides

reliable connections for deposits to billions of customer accounts

and digital wallets.

INDUSTRY DATA

INDIA: Reserve Bank of India (RBI) recently shared their

National Strategy for Financial Inclusion (NSFI) for the period

2019-2024. The report states that digital infrastructure in the

country needs to be expanded and adoption and acceptance for

digital payments and bringing people into the fold of formal

financial system must be encouraged. Another objective of the

strategy is for every village to have access to a formal financial

service provider within a reasonable distance of 5 KM radius. The

customers may be onboarded through an easy and hassle-free digital

process and processes should be geared towards a less-paper

ecosystem.

GSMA projects that in 2025, there will be 623 million unique

mobile subscribers, 483 million mobile internet users and

penetration of smartphones will reach 66%. Sub-Saharan Africa

remains a hotbed for mobile money services. By the end of 2018,

there were 395.7 million registered mobile money accounts in the

region, representing nearly half of total global mobile money

accounts. The region is now served by more than 130 live mobile

money services, many of them led by mobile operators, and a network

of more than 1.4 million active agents.

WU-G

About Western Union

The Western Union Company (NYSE: WU) is a global leader in

cross-border, cross-currency money movement and payments. Our

omnichannel platform connects the digital and physical worlds and

makes it possible for consumers and businesses to send and receive

money and make payments with speed, ease, and reliability. As of

September 30, 2019, our network included over 550,000 retail agent

locations offering our branded services in more than 200 countries

and territories, with the capability to send money to billions of

accounts. Additionally, westernunion.com, our fastest growing

channel in 2018, is available in 75 countries, plus additional

territories, to move money around the world. With our global reach,

Western Union moves money for better, connecting family, friends

and businesses to enable financial inclusion and support economic

growth. For more information, visit www.westernunion.com.

About Bharti Airtel

Bharti Airtel Limited is a leading global telecommunications

company with operations in 18 countries across Asia and Africa.

Headquartered in New Delhi, India, the company ranks amongst the

top 3 mobile service providers globally in terms of subscribers. In

India, the company's product offerings include 2G, 3G and 4G

wireless services, mobile commerce, fixed line services, high speed

home broadband, DTH, enterprise services including national &

international long-distance services to carriers. In the rest of

the geographies, it offers 2G, 3G, 4G wireless services and mobile

commerce. Bharti Airtel had over 411 million customers across its

operations at the end of June 2019. To know more please visit,

www.airtel.com

About Airtel Africa

Airtel Africa (LSE: AAF; NSE: AIRTELAFRI) is a leading provider

of telecommunications and mobile money services, with a presence in

14 countries in Africa, primarily in East, Central and West Africa.

Airtel Africa offers an integrated suite of telecommunications

solutions to its subscribers, including mobile voice and data

services as well as mobile money services both nationally and

internationally. The Group aims to continue providing a simple and

intuitive customer experience through streamlined customer

journeys.

About Airtel Payments Bank

Airtel Payments Bank, India’s first payments bank that launched

in January 2017, now boasts of over 40 million+ customers and over

500K banking points across the country. In addition to having a

presence in all 29 states of India, Airtel Payments Bank also has

an app for Android and iOS users to make banking easier for its

rural and urban customers. Facilitating transactions worth INR 500

billion annually, it is focused on contributing to the government’s

vision of Digital India and Financial Inclusion by taking digital

banking services to the doorstep of every Indian, even in the

remotest of rural areas.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200122005356/en/

Media contact: Western Union Global Communications and

Social Channels Pia De Lima; Pia.DeLima@westernunion.com

Western Union Asia-Pacific Karen Santos;

Karen.Santos2@westernunion.com

Western Union Middle East and Africa Mohamed El Khalouki;

Mohamed.ElKhalouki@wu.com

Airtel Payments Bank Tanya Sachdev;

a_tanya.sachdev@airtelbank.com

Airtel Africa Kevin Soady, Kekst CNC: +44 20 3755 1600

Michael Okwiri : Michael.Okwiri@africa.airtel.com

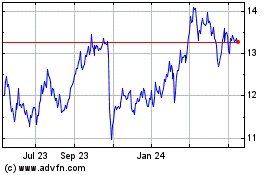

Western Union (NYSE:WU)

Historical Stock Chart

From Oct 2024 to Nov 2024

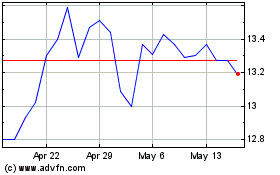

Western Union (NYSE:WU)

Historical Stock Chart

From Nov 2023 to Nov 2024