false000116330200011633022024-10-312024-10-310001163302exch:XNYS2024-10-312024-10-310001163302exch:XCHI2024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 31, 2024

United States Steel Corporation

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| | | | |

Delaware | | 1-16811 | | 25-1897152 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| |

600 Grant Street,

Pittsburgh, PA 15219-2800

(Address of Principal Executive Offices, and Zip Code)

(412) 433-1121

Registrant’s Telephone Number, Including Area Code

____________________________________________

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

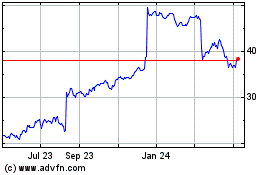

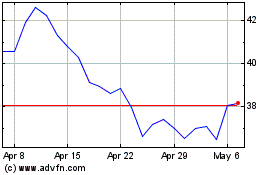

Common Stock | X | New York Stock Exchange |

Common Stock | X | Chicago Stock Exchange |

| | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 2.02. Results of Operations and Financial Condition

On October 31, 2024, United States Steel Corporation (the “Corporation”) issued a press release announcing its financial results for the third quarter 2024. Also on October 31, 2024, the Corporation posted to its website a presentation related to the Corporation’s financial results for the third quarter 2024.

In accordance with General Instruction B.2 of Form 8-K, the information contained in this Item 2.02, the press release and the presentation are being furnished under Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information and exhibits be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The full text of the press release, together with related unaudited financial information and statistics, is furnished herewith as Exhibit 99.1. The earnings presentation is furnished with this current report on Form 8-K as Exhibit 99.2.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits:

| | | | | |

| Exhibit No. | Description |

| |

| Press release, dated October 31, 2024, titled “United States Steel Corporation Reports Third Quarter 2024 Results” together with related unaudited financial information and statistics. |

| |

| Third Quarter 2024 Earnings Presentation. |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

UNITED STATES STEEL CORPORATION

| | | | | |

| By | /s/ Manpreet S. Grewal |

| Manpreet S. Grewal |

| Vice President, Controller & Chief Accounting Officer |

Dated: October 31, 2024

| | | | | | | | | | | | | | | | | |

| |

CONTACTS:

Corporate Communications T - (412) 433-1300 E - media@uss.com | Emily Chieng Investor Relations Officer T - (412) 618-9554 E - ecchieng@uss.com |

|

NEWS RELEASE |

FOR IMMEDIATE RELEASE:

United States Steel Corporation Reports Third Quarter 2024 Results

•Third quarter 2024 net earnings of $119 million, or $0.48 per diluted share.

•Third quarter 2024 adjusted net earnings of $140 million, or $0.56 per diluted share.

•Third quarter 2024 adjusted EBITDA of $319 million.

PITTSBURGH, October 31, 2024 – United States Steel Corporation (NYSE: X) reported third quarter 2024 net earnings of $119 million, or $0.48 per diluted share. Adjusted net earnings was $140 million, or $0.56 per diluted share. This compares to third quarter 2023 net earnings of $299 million, or $1.20 per diluted share. Adjusted net earnings for the third quarter 2023 was $350 million, or $1.40 per diluted share.

Commenting on the Company’s third quarter performance, U. S. Steel President and Chief Executive Officer, David B. Burritt said, “Third quarter adjusted EBITDA of $319 million demonstrated resilience in our business model despite the weaker average selling prices experienced across our operating segments. The North American Flat-Rolled segment continued to benefit from a strong commercial strategy that leveraged a diverse product mix and a purposeful increase in contracted volumes across the end markets we serve. Our Mini Mill segment, which was impacted by softening market pricing, delivered 11% EBITDA margins when adjusting for $40 million in one-time start-up costs for strategic projects. USSE earnings benefited from a one-time favorable adjustment related to CO2 allocations, which offset pressures from a challenging demand environment in Europe. Tubular earnings were weaker in the third quarter, as expected, reflecting lower benchmark prices.”

Commenting on the Company’s strategic initiatives, Burritt continued, “We are very pleased to announce that we achieved first coil at Big River 2 (“BR2”), with the Big River team expecting to begin shipments to customers during the fourth quarter. We are excited to highlight photos of BR2 in the investor presentation posted today on our website. Congratulations to the Big River team on safely delivering over $4 billion of growth capital investments, including the non-grain oriented (“NGO”) electrical steel line and the dual Galvalume® / Galvanized coating line. Coupled with our enhanced commercial strategy and recent investments

©2024 U. S. Steel. All Rights Reserved www.ussteel.com United States Steel Corporation

made in the North American Flat Rolled segment, we look forward to building upon our more resilient earnings with increasing free cash flow.”

Commenting on the Company’s transaction with Nippon Steel Corporation, Burritt noted, “We continue to work towards closing by year-end. Importantly, in September, the Board of Arbitration ruled in favor of U. S. Steel under our basic labor agreement. We are also pleased to see additional commitments from Nippon Steel, which will build upon the existing benefits including the transfer of technologies and further innovations from Nippon Steel's $500 million annual R&D spending, to further strengthen the merits of the transaction. We look forward to delivering these benefits to all of our stakeholders, especially to our hardworking men and women in the Mon Valley and Gary plants, where Nippon Steel has committed to invest at least $1.3 billion, increasing the total capital commitment to at least $2.7 billion."

Q4 2024 Outlook

We expect fourth quarter adjusted EBITDA in the range of $225 million and $275 million. Our North American Flat-Rolled segment results should decrease slightly, driven largely by lower lagging average selling price expectations for the quarter. We expect an improvement in Mini Mill segment results, even after accounting for $25 million of related start-up and one-time construction costs at BR2, reflecting an expected improvement in average selling prices. In Europe, results are expected to be lower given the absence of the positive CO2 allocations and weak underlying demand and pricing conditions. Our Tubular segment results should be largely consistent with the third quarter.

| | | | | | | | | | | | | | |

| Earnings Highlights | | |

| Three Months Ended September 30, | Nine Months Ended September 30, |

| (Dollars in millions, except per share amounts) | 2024 | 2023 | 2024 | 2023 |

| Net Sales | $ | 3,853 | | $ | 4,431 | | $ | 12,131 | | $ | 13,909 | |

| Segment earnings (loss) before interest and income taxes | | | | |

| Flat-Rolled | $ | 106 | | $ | 225 | | $ | 323 | | $ | 449 | |

| Mini Mill | (28) | | 42 | | 99 | | 186 | |

| U. S. Steel Europe | 7 | | (13) | | 13 | | 25 | |

| Tubular | (4) | | 87 | | 82 | | 476 | |

| Other | 3 | | 7 | | (3) | | (2) | |

| Total segment earnings before interest and income taxes | $ | 84 | | $ | 348 | | $ | 514 | | $ | 1,134 | |

| Other items not allocated to segments | (36) | | (71) | | (131) | | (104) | |

| Earnings before interest and income taxes | $ | 48 | | $ | 277 | | $ | 383 | | $ | 1,030 | |

| Net interest and other financial benefits | (61) | | (64) | | (174) | | (182) | |

| Income tax (benefit) expense | (10) | | 42 | | 84 | | 237 | |

| Net earnings | $ | 119 | | $ | 299 | | $ | 473 | | $ | 975 | |

| Earnings per diluted share | $ | 0.48 | | $ | 1.20 | | $ | 1.88 | | $ | 3.86 | |

| | | | |

Adjusted net earnings (a) | $ | 140 | | $ | 350 | | $ | 557 | | $ | 1,028 | |

Adjusted net earnings per diluted share (a) | $ | 0.56 | | $ | 1.40 | | $ | 2.21 | | $ | 4.07 | |

Adjusted earnings before interest, income taxes, depreciation and amortization (EBITDA) (a) | $ | 319 | | $ | 578 | | $ | 1,176 | | $ | 1,809 | |

(a) Please refer to the non-GAAP Financial Measures section of this document for the reconciliation of these amounts. |

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

| | | | | | | | | | | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| PRELIMINARY SUPPLEMENTAL STATISTICS (Unaudited) |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | 2023 | | 2024 | 2023 |

| OPERATING STATISTICS | | | | | |

Average realized price: ($/net ton unless otherwise noted) (a) | | | | | |

| Flat-Rolled | 993 | | 1,036 | | | 1,030 | | 1,045 | |

| Mini Mill | 800 | | 901 | | | 880 | | 898 | |

| U. S. Steel Europe | 802 | | 852 | | | 818 | | 910 | |

| U. S. Steel Europe (€/net ton) | 730 | | 783 | | | 753 | | 840 | |

| Tubular | 1,805 | | 2,927 | | | 2,062 | | 3,422 | |

| | | | | | |

Steel shipments (thousands of net tons): (a) | | | | | |

| Flat-Rolled | 1,905 | | 2,159 | | | 5,999 | | 6,672 | |

| Mini Mill | 602 | | 561 | | | 1,732 | | 1,807 | |

| U. S. Steel Europe | 899 | | 958 | | | 2,846 | | 2,875 | |

| Tubular | 110 | | 104 | | | 333 | | 346 | |

| Total steel shipments | 3,516 | | 3,782 | | | 10,910 | | 11,700 | |

| | | | | | |

| Intersegment steel (unless otherwise noted) shipments (thousands of net tons): | | | | | |

| Mini Mill to Flat-Rolled | 84 | | 145 | | | 288 | | 370 | |

| Flat-Rolled to Mini Mill | 2 | | 2 | | | 3 | | 2 | |

| Flat-Rolled to Mini Mill (pig iron) | 83 | | 95 | | | 248 | | 210 | |

| | | | | | |

| Flat-Rolled to USSE (coal) | — | | 174 | | | 258 | | 632 | |

| | | | | | |

| Raw steel production (thousands of net tons): | | | | | |

| Flat-Rolled | 2,107 | | 2,390 | | | 6,290 | | 7,312 | |

| Mini Mill | 732 | | 693 | | | 2,174 | | 2,201 | |

| U. S. Steel Europe | 970 | | 990 | | | 3,029 | | 3,295 | |

| Tubular | 159 | | 111 | | | 422 | | 411 | |

| | | | | | |

Raw steel capability utilization: (b) | | | | | |

| Flat-Rolled | 63 | % | 72 | % | | 63 | % | 74 | % |

| Mini Mill | 88 | % | 83 | % | | 88 | % | 89 | % |

| U. S. Steel Europe | 77 | % | 79 | % | | 81 | % | 88 | % |

| Tubular | 70 | % | 49 | % | | 62 | % | 61 | % |

| | | | | | |

CAPITAL EXPENDITURES (dollars in millions) | | | | | |

| Flat-Rolled | 114 | | 132 | | | 378 | | 375 | |

| Mini Mill | 364 | | 423 | | | 1,302 | | 1,474 | |

| U. S. Steel Europe | 27 | | 24 | | | 82 | | 66 | |

| Tubular | 6 | | 7 | | | 20 | | 24 | |

| Other Businesses | — | | — | | | — | | — | |

| Total | $ | 511 | | $ | 586 | | | $ | 1,782 | | $ | 1,939 | |

(a) Excludes intersegment shipments. |

(b) Based on annual raw steel production capability of 13.2 million net tons for Flat-Rolled, 3.3 million net tons for Mini Mill, 5.0 million net tons for U. S. Steel Europe and 0.9 million net tons for Tubular. |

|

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

| | | | | | | | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| CONDENSED STATEMENT OF OPERATIONS (Unaudited) |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (Dollars in millions, except per share amounts) | 2024 | 2023 | | 2024 | 2023 |

| Net Sales | $ | 3,853 | | $ | 4,431 | | | $ | 12,131 | | $ | 13,909 | |

| | | | | |

| Operating expenses (income): | | | | | |

| Cost of sales | 3,448 | | 3,838 | | | 10,742 | | 11,952 | |

| Selling, general and administrative expenses | 104 | | 118 | | | 328 | | 320 | |

| Depreciation, depletion and amortization | 235 | | 230 | | | 662 | | 675 | |

| Earnings from investees | (17) | | (51) | | | (76) | | (76) | |

| Asset impairment charges | — | | — | | | 19 | | 4 | |

| Restructuring and other charges | 5 | | 18 | | | 11 | | 21 | |

| Other losses (gains), net | 30 | | 1 | | | 62 | | (17) | |

| Total operating expenses | 3,805 | | 4,154 | | | 11,748 | | 12,879 | |

| | | | | |

| Earnings before interest and income taxes | 48 | | 277 | | | 383 | | 1,030 | |

| Net interest and other financial benefits | (61) | | (64) | | | (174) | | (182) | |

| | | | | |

| Earnings before income taxes | 109 | | 341 | | | 557 | | 1,212 | |

| Income tax (benefit) expense | (10) | | 42 | | | 84 | | 237 | |

| | | | | |

| Net earnings | 119 | | 299 | | | 473 | | 975 | |

| Less: Net earnings attributable to noncontrolling interests | — | | — | | | — | | — | |

| Net earnings attributable to United States Steel Corporation | $ | 119 | | $ | 299 | | | $ | 473 | | $ | 975 | |

| | | | | |

| COMMON STOCK DATA: | | | | | |

| Net earnings per share attributable to United States Steel Corporation Stockholders | | | | | |

| Basic | $ | 0.53 | | $ | 1.34 | | | $ | 2.10 | | $ | 4.33 | |

| Diluted | $ | 0.48 | | $ | 1.20 | | | $ | 1.88 | | $ | 3.86 | |

| Weighted average shares, in thousands | | | | | |

| Basic | 225,095 | | 223,109 | | | 224,697 | | 225,311 | |

| Diluted | 254,060 | | 253,070 | | | 254,124 | | 255,080 | |

| Dividends paid per common share | $ | 0.05 | | $ | 0.05 | | | $ | 0.15 | | $ | 0.15 | |

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

| | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| CONDENSED CASH FLOW STATEMENT (Unaudited) |

| | Nine Months Ended September 30, | Nine Months Ended September 30, |

| (Dollars in millions) | 2024 | 2023 |

| Increase (decrease) in cash, cash equivalents and restricted cash |

| Operating activities: | | |

| Net earnings | $ | 473 | | $ | 975 | |

| Depreciation, depletion and amortization | 662 | | 675 | |

| Asset impairment charges | 19 | | 4 | |

| Restructuring and other charges | 11 | | 21 | |

| Pensions and other postretirement benefits | (99) | | (124) | |

| Active employee benefit investments | 51 | | 20 | |

| Deferred income taxes | 141 | | 275 | |

| Working capital changes | (204) | | 227 | |

| Income taxes receivable/payable | (127) | | (86) | |

| Other operating activities | (216) | | (276) | |

| Net cash provided by operating activities | 711 | | 1,711 | |

| | | |

| Investing activities: | | |

| Capital expenditures | (1,782) | | (1,939) | |

| Proceeds from sale of assets | 3 | | 4 | |

| Other investing activities | (5) | | — | |

| Net cash used in investing activities | (1,784) | | (1,935) | |

| | | |

| Financing activities: | | |

| Issuance of long-term debt, net of financing costs | — | | 241 | |

| Repayment of long-term debt | (46) | | (69) | |

| Common stock repurchased | — | | (175) | |

| Other financing activities | (58) | | (50) | |

| Net cash used in financing activities | (104) | | (53) | |

| | | |

| Effect of exchange rate changes on cash | 4 | | (3) | |

| | | |

| Net decrease in cash, cash equivalents and restricted cash | (1,173) | | (280) | |

| Cash, cash equivalents and restricted cash at beginning of year | 2,988 | | 3,539 | |

| | | |

| Cash, cash equivalents and restricted cash at end of period | $ | 1,815 | | $ | 3,259 | |

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

| | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| CONDENSED BALANCE SHEET (Unaudited) |

| | September 30, | December 31, |

| (Dollars in millions) | 2024 | 2023 |

| Cash and cash equivalents | $ | 1,773 | | $ | 2,948 | |

| Receivables, net | 1,649 | | 1,548 | |

| Inventories | 2,039 | | 2,128 | |

| Other current assets | 305 | | 319 | |

| Total current assets | 5,766 | | 6,943 | |

| | | |

| Operating lease assets | 82 | | 109 | |

| Property, plant and equipment, net | 11,665 | | 10,393 | |

| Investments and long-term receivables, net | 830 | | 761 | |

| Intangibles, net | 421 | | 436 | |

| Goodwill | 920 | | 920 | |

| Other noncurrent assets | 949 | | 889 | |

| Total assets | $ | 20,633 | | $ | 20,451 | |

| | | |

| Accounts payable and other accrued liabilities | 2,745 | | 3,028 | |

| Payroll and benefits payable | 321 | | 442 | |

| Short-term debt and current maturities of long-term debt | 163 | | 142 | |

| Other current liabilities | 223 | | 336 | |

| Total current liabilities | 3,452 | | 3,948 | |

| | | |

| Noncurrent operating lease liabilities | 51 | | 73 | |

| Long-term debt, less unamortized discount and debt issuance costs | 4,068 | | 4,080 | |

| Employee benefits | 124 | | 126 | |

| Deferred income tax liabilities | 732 | | 587 | |

| Other long-term liabilities | 535 | | 497 | |

| United States Steel Corporation stockholders' equity | 11,578 | | 11,047 | |

| Noncontrolling interests | 93 | | 93 | |

| Total liabilities and stockholders' equity | $ | 20,633 | | $ | 20,451 | |

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| NON-GAAP FINANCIAL MEASURES |

| RECONCILIATION OF ADJUSTED NET EARNINGS |

| | Three Months Ended September 30, | Nine Months Ended September 30, |

| (Dollars in millions) | 2024 | 2023 | 2024 | 2023 |

| Net earnings and diluted net earnings per share attributable to United States Steel Corporation, as reported | $ | 119 | | $ | 0.48 | | $ | 299 | | $ | 1.20 | | $ | 473 | | $ | 1.88 | | $ | 975 | | $ | 3.86 | |

| Restructuring and other charges | 5 | | | 18 | | | 11 | | | 21 | | |

| Stock-based compensation expense | 10 | | | 14 | | | 37 | | | 37 | | |

| Asset impairment charges | — | | | — | | | 19 | | | 4 | | |

| VEBA asset surplus adjustment | (9) | | | (6) | | | (21) | | | (36) | | |

| Environmental remediation charges | 1 | | | 9 | | | 4 | | | 11 | | |

| Strategic alternatives review process costs | 18 | | | 16 | | | 59 | | | 16 | | |

| Granite City idling costs | — | | | 14 | | | — | | | 14 | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other charges, net | 2 | | | 1 | | | 1 | | | 2 | | |

| Adjusted pre-tax net earnings to United States Steel Corporation | 146 | | | 365 | | | 583 | | | 1,044 | | |

| Tax impact of adjusted items (a) | (6) | | | (15) | | | (26) | | | (16) | | |

| Adjusted net earnings and diluted net earnings per share attributable to United States Steel Corporation | $ | 140 | | $ | 0.56 | | $ | 350 | | $ | 1.40 | | $ | 557 | | $ | 2.21 | | $ | 1,028 | | $ | 4.07 | |

| Weighted average diluted ordinary shares outstanding, in millions | 254.1 | | | 253.1 | | | 254.1 | | | 255.1 | | |

(a) The tax impact of adjusted items for both the three and nine months ended September 30, 2024, and 2023 were calculated using a blended tax rate of 24%. |

| | | | | | | | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| NON-GAAP FINANCIAL MEASURES |

| RECONCILIATION OF ADJUSTED EBITDA |

| | Three Months Ended September 30, | Nine Months Ended September 30, |

| (Dollars in millions) | 2024 | 2023 | 2024 | 2023 |

| Reconciliation to Adjusted EBITDA | | | | |

| Net earnings attributable to United States Steel Corporation | $ | 119 | | $ | 299 | | $ | 473 | | 975 | |

| Income tax (benefit) expense | (10) | | 42 | | 84 | | 237 | |

| Net interest and other financial benefits | (61) | | (64) | | (174) | | (182) | |

| Depreciation, depletion and amortization expense | 235 | | 230 | | 662 | | 675 | |

| EBITDA | 283 | | 507 | | 1,045 | | 1,705 | |

| Restructuring and other charges | 5 | | 18 | | 11 | | 21 | |

| Stock-based compensation expense | 10 | | 14 | | 37 | | 37 | |

| Asset impairment charges | — | | — | | 19 | | 4 | |

| Environmental remediation charges | 1 | | 9 | | 4 | | 11 | |

| Strategic alternatives review process costs | 18 | | 16 | | 59 | | 16 | |

| Granite City idling costs | — | | 14 | | — | | 14 | |

| | | | | |

| | | | | |

| Other charges, net | 2 | | — | | 1 | | 1 | |

| Adjusted EBITDA | $ | 319 | | $ | 578 | | $ | 1,176 | | $ | 1,809 | |

| Net earnings margin (a) | 3.1 | % | 6.7 | % | 3.9 | % | 7.0 | % |

| Adjusted EBITDA margin (a) | 8.3 | % | 13.0 | % | 9.7 | % | 13.0 | % |

(a) The net earnings and adjusted EBITDA margins represent net earnings or adjusted EBITDA divided by net sales. |

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

| | | | | | | | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| NON-GAAP FINANCIAL MEASURES |

| RECONCILIATION OF PAST TWELVE MONTHS OF FREE AND INVESTABLE CASH FLOW |

| 4th | 1st | 2nd | 3rd | |

| Quarter | Quarter | Quarter | Quarter | Total of the |

| (Dollars in millions) | 2023 | 2024 | 2024 | 2024 | Four Quarters |

| Net cash provided (used) by operating activities | $ | 389 | | $ | (28) | | $ | 474 | | $ | 265 | | $ | 1,100 | |

| Net cash used in investing activities | (633) | | (645) | | (630) | | (509) | | (2,417) | |

| Free cash flow | (244) | | (673) | | (156) | | (244) | | (1,317) | |

| Strategic capital expenditures | 425 | | 468 | | 468 | | 346 | | 1,707 | |

| Investable free cash flow | $ | 181 | | $ | (205) | | $ | 312 | | $ | 102 | | $ | 390 | |

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

We present adjusted net earnings, adjusted net earnings per diluted share, earnings before interest, income taxes, depreciation and amortization (EBITDA), adjusted EBITDA and adjusted EBITDA margin, which are non-GAAP measures, as additional measurements to enhance the understanding of our operating performance. We believe that EBITDA, considered along with net earnings, is a relevant indicator of trends relating to our operating performance and provides management and investors with additional information for comparison of our operating results to the operating results of other companies.

Adjusted net earnings and adjusted net earnings per diluted share are non-GAAP measures that exclude the effects of items that include: restructuring and other charges, stock-based compensation expense, asset impairment charges, VEBA asset surplus adjustment, environmental remediation charges, strategic alternatives review process costs, Granite City idling costs, tax impact of adjusted items and other charges, net (Adjustment Items). Adjusted EBITDA and adjusted EBITDA margins are also non-GAAP measures that exclude the effects of certain Adjustment Items. We present adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA and adjusted EBITDA margin to enhance the understanding of our ongoing operating performance and established trends affecting our core operations by excluding the effects of events that can obscure underlying trends. U. S. Steel's management considers adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, and adjusted EBITDA margin as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, and adjusted EBITDA margin useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, and adjusted EBITDA margin provides insight into management’s view and assessment of the Company’s ongoing operating performance because management does not consider the Adjustment Items when evaluating the Company’s financial performance. Adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, and adjusted EBITDA margin should not be considered a substitute for net earnings, earnings per diluted share or other financial measures as computed in accordance with U.S. GAAP and are not necessarily comparable to similarly titled measures used by other companies.

We also present free cash flow, a non-GAAP measure of cash generated from operations after any investing activity and investable free cash flow, a non-GAAP measure of cash generated from operations after any investing activity adjusted for strategic capital expenditures. We believe that free cash flow and investable free cash flow provide further insight into the Company's overall utilization of cash. A condensed consolidated statement of operations (unaudited), condensed consolidated cash flow statement (unaudited), condensed consolidated balance sheet (unaudited) and preliminary supplemental statistics (unaudited) for U. S. Steel are attached.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This release contains information regarding the Company and Nippon Steel Corporation ("NSC") that may constitute “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, that are subject to risks and uncertainties. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,” “may” and similar expressions or by using future dates in connection with any discussion of, among other things, statements expressing general views about future operating or financial results, operating or financial performance, trends, events or developments that we expect or anticipate will occur in the future, anticipated cost savings, potential capital and operational cash improvements and changes in the global economic environment, the construction or operation of new or existing facilities or capabilities, statements regarding our greenhouse gas emissions reduction goals, as well as statements regarding the proposed transaction between the Company and NSC, including the timing of the completion of the transaction. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements include all statements that are not historical facts, but instead represent only the Company’s beliefs regarding

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

future goals, plans and expectations about our prospects for the future and other events, many of which, by their nature, are inherently uncertain and outside of the Company’s or NSC’s control. It is possible that the Company’s or NSC’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management of the Company believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. In addition, forward looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company’s or NSC's historical experience and our present expectations or projections. Risks and uncertainties include without limitation: the ability of the parties to consummate the proposed transaction on a timely basis or at all; the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement and plan of merger relating to the proposed transaction (the “Merger Agreement”); the risk that the parties to the Merger Agreement may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business opportunities or strategic transactions; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the Company’s common stock; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating to the proposed transaction; the risk that the proposed transaction and its announcement could have an adverse effect on the ability of the Company or NSC to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, stockholders and other business relationships and on its operating results and business generally; and the risk the pending proposed transaction could distract management of the Company. The Company directs readers to its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 and Form 10-K for the year ended December 31, 2023, and the other documents it files with the SEC for other risks associated with the Company’s future performance. These documents contain and identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements. All information in this report is as of the date above. The Company does not undertake any duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations whether as a result of new information, future events or otherwise, except as required by law.

###

2024-042

Founded in 1901, United States Steel Corporation is a leading steel producer. With an unwavering focus on safety, the Company’s customer-centric Best for All® strategy is advancing a more secure, sustainable future for U. S. Steel and its stakeholders. With a renewed emphasis on innovation, U. S. Steel serves the automotive, construction, appliance, energy, containers, and packaging industries with high value-added steel products such as U. S. Steel’s proprietary XG3® advanced high-strength steel. The Company also maintains competitively advantaged iron ore production and has an annual raw steelmaking capability of 25.4 million net tons. U. S. Steel is headquartered in Pittsburgh, Pennsylvania, with world-class operations across the United States and in Central Europe. For more information, please visit www.ussteel.com.

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

1 EARNINGS PRESENTATION THIRD QUARTER 2024 October 31, 2024

2 FORWARD-LOOKING STATEMENTS This presentation contains information regarding the Company and Nippon Steel Corporation (“NSC”) that may constitute “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, that are subject to risks and uncertainties. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,” “may” and similar expressions or by using future dates in connection with any discussion of, among other things, statements expressing general views about future operating or financial results, operating or financial performance, trends, events or developments that we expect or anticipate will occur in the future, anticipated cost savings, potential capital and operational cash improvements and changes in the global economic environment, anticipated capital expenditures, the construction or operation of new or existing facilities or capabilities and the costs associated with such matters, statements regarding our greenhouse gas emissions reduction goals, as well as statements regarding the proposed transaction between the Company and NSC. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements include all statements that are not historical facts, but instead represent only the Company’s beliefs regarding future goals, plans and expectations about our prospects for the future and other events, many of which, by their nature, are inherently uncertain and outside of the Company’s or NSC’s control. It is possible that the Company’s or NSC’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward- looking statements. Management of the Company believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. In addition, forward looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company’s or NSC’s historical experience and our present expectations or projections. Risks and uncertainties include without limitation: the ability of the parties to consummate the proposed transaction between the Company and NSC, on a timely basis or at all; the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement and plan of merger relating to the proposed transaction (the “Merger Agreement”); the risk that the parties to the Merger Agreement may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business opportunities or strategic transactions; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the Company’s common stock; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating to the proposed transaction; the risk that the proposed transaction and its announcement could have an adverse effect on the ability of the Company or NSC to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, stockholders and other business relationships and on its operating results and business generally; and the risk the pending proposed transaction could distract management of the Company. The Company directs readers to its Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, and the other documents it files with the SEC for other risks associated with the Company’s future performance. These documents contain and identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements. All information in this presentation is as of the date above. The Company does not undertake any duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations whether as a result of new information, future events or otherwise, except as required by law.

3 EXPLANATION OF USE OF NON-GAAP MEASURES We present adjusted net earnings, adjusted net earnings margin, adjusted net earnings per diluted share, earnings before interest, income taxes, depreciation and amortization (EBITDA), adjusted EBITDA, adjusted EBITDA margin and adjusted profit margin, which are non-GAAP measures, as additional measurements to enhance the understanding of our operating performance. We believe that EBITDA, considered along with net earnings, is a relevant indicator of trends relating to our operating performance and provides management and investors with additional information for comparison of our operating results to the operating results of other companies. Adjusted net earnings and adjusted net earnings per diluted share are non-GAAP measures that exclude the effects of items that include: asset impairment charges, restructuring and other charges, stock-based compensation expense, VEBA asset surplus adjustment, environmental remediation charges, strategic alternatives review process costs, Granite City idling costs, tax impact of adjusted items and other changes, net (Adjustment Items). Adjusted EBITDA and adjusted EBITDA margin are also non- GAAP measures that exclude the effects of certain Adjustment Items. We present adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, adjusted EBITDA margin and adjusted profit margin to enhance the understanding of our ongoing operating performance and established trends affecting our core operations by excluding the effects of events that can obscure underlying trends. U. S. Steel's management considers adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, adjusted EBITDA margin and adjusted profit margin as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, adjusted EBITDA margin and adjusted profit margin useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, adjusted EBITDA margin and adjusted profit margin provides insight into management’s view and assessment of the Company’s ongoing operating performance because management does not consider the Adjustment Items when evaluating the Company’s financial performance. Adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, adjusted EBITDA margin and adjusted profit margin should not be considered a substitute for net earnings or other financial measures as computed in accordance with U.S. GAAP and are not necessarily comparable to similarly titled measures used by other companies. We also present net debt, a non-GAAP measure calculated as total debt less cash and cash equivalents. We believe net debt is a useful measure in calculating enterprise value.

4 SUMMARY: ADVANCING TOWARDS OUR BEST FOR ALL® FUTURE Current Landscape Progressing towards closing of the transaction with Nippon Steel Corporation (NSC) by the end of the year The first coil at Big River 2 (BR2) was successfully produced on October 31, 2024 Challenges Successfully navigating a dynamic steel industry backdrop Solution Progressing towards becoming the ‘Best Steelmaker with World- leading Capabilities’ Moving closer to fully ramping up our in-flight capital projects Path Forward Closing the NSC transaction at $55 per share Creating a global steel leader in value and innovation

5 NSC & U. S. STEEL: PROGRESSING TOWARDS DEAL CLOSING Board of Arbitration rules in favor of U. S. Steel Working towards regulatory approval Confirmed that the successorship clause has been satisfied by U. S. Steel Receipt of all non-U.S. regulatory approvals Both U.S. antitrust and CFIUS reviews progressing Working towards closing by year- end Advancing towards creating the “Best Steelmaker with World-leading Capabilities”

6 NSC & U. S. STEEL: BOARD OF ARBITRATION RULES IN FAVOR OF U. S. STEEL U. S. Steel has satisfied the successorship obligations in the Basic Labor Agreement (BLA) with the United Steelworkers (USW) All BLA issues between U. S. Steel and USW related to the transaction are now resolved No further action under the BLA is required for Nippon Steel to acquire U. S. Steel and assume all USW agreements in line with its commitments On September 25, 2024, the Board of Arbitration determined that the successorship clause has been satisfied and that, as required by the BLA, Nippon Steel has: • Recognized the USW as the bargaining representative for USW-represented employees at U. S. Steel; • Provided reasonable assurances that it has both the willingness and financial wherewithal to honor the commitments in the agreements between U. S. Steel and the USW applicable to USW-represented employees; and • Assumed all USW agreements that are applicable to USW-represented employees at U. S. Steel.

7 NSC: ADDITIONAL COMMITMENTS TO STRENGTHEN U. S. STEEL TRANSACTION Mon Valley Works: To replace and/or upgrade the existing hot strip mill and other facilities with an investment of at least $1B. To improve yield, energy efficiency, product quality, operating effectiveness and expand the markets and customers it currently serves. Gary Works: To revamp Blast Furnace #14 with an investment of approximately $300M. To realize operational benefits, as well as benefits for our workers, customers and communities to benefit from environmentally friendly production of automotive flat steel. Nippon Steel has announced further commitments that support the closing of the transaction: • Additional $1.3 billion of growth capital to extend the production life of two blast furnace assets and secure jobs for generations to come; and, • A post-closing governance policy whereby the Board of Directors and senior management team of U. S. Steel will consist of primarily of U.S. citizens; and • Transfer of all of Nippon Steel’s interest in the AM/NS Calvert LLC to ArcelorMIttal upon closing of the transaction with U. S. Steel. ADDITIONAL $1.3B OF CAPITAL COMMITMENTS, RESULTING IN A TOTAL COMMITMENT OF $2.7B:

8 NSC & U. S. STEEL: BEST STEELMAKER WITH WORLD-LEADING CAPABILITIES BEST FOR EMPLOYEES BEST FOR COMMUNITIES BEST FOR INVESTORS + BEST FOR CUSTOMERS

9 Big River 2 First Coil The U. S. Steel Competitive Edge: Creating a capability edge to produce wider and thinner steels with Endless Casting & Rolling Technology Creating a customer edge by building a suite of finishing assets for broader customer reach into value-added products Creating a sustainability edge by expanding value-add offerings through EAF production BR2: FIRST COIL ACHIEVED - A WORLD-CLASS MINI MILL

10 Then November 2022 – Construction Begins Now October 2024 – First Coil Achieved BR2: NORTH AMERICA'S MOST TECHNOLOGICALLY ADVANCED STEEL MILL

11 Mini Mill Facilities: F A C I L I T Y H I G H L I G H T S I N D U S T R Y - L E A D I N G P R O D U C T I V I T Y C A R B O N I M P A C T 3.0 MNT capability per year two EAFs3.3 MNT capability per year two EAFs 1 Endless casting & rolling line Light gauge / wide; ideal for auto end-market Best-in-class finishing lines ~1M ton Galvanizing (2 lines) 1 RH Degasser Only North American mill to connect an EAF with a RH degasser for cleaner, more formable steels Best-in-class finishing lines ~525k ton Galvanizing (1 line) ~200k ton NGO (1 line) ~325k ton Galv/Galvalume (1 line) ~165k ton paint line ~3,700 Tons per employee (~1,700 employees) <0.4 GHG Emissions Intensity (metric tons of CO2e per metric ton of raw steel produced; scope 1 & 2 emissions) BR2: UNIQUE CAPABILITIES • Advanced high strength steel HDG / CAL combo line • Heavy gauge HR / Pickle HDG line Hot Roll Capabilities 36” to 76” width 0.0550” to 1.0000” thickness Hot Roll (ESP) Capabilities 45” to 77” width 0.0315” to 0.5000” thickness

12 Product mix 3rd party shipments Coated 25% 60% 25% 15% Hot rolled coil Cold rolled coil 2 0 2 3 Coated 40% 15% 40% Hot rolled coil Cold rolled coil F U T U R E P R O D U C T M I X NGO 5% Higher through- cycle margin product mix Enhancing our earnings profile Increasing mix of value- added products to drive through-cycle performance BR2: ENHANCING THE MINI MILL SEGMENT’S EARNINGS PROFILE

13 FINANCIAL PERFORMANCE

14 Q3 2024 FINANCIAL PERFORMANCE: SUMMARY $319M Adjusted EBITDA ~8% adjusted EBITDA margin Third quarter performance $119M Reported Net Earnings $0.48 per diluted share Note: For reconciliation of non-GAAP amounts, see Appendix. $140M Adjusted Net Earnings $0.56 per diluted share $4.1B Liquidity Including $1.8B cash

15 Q3 2024 FINANCIAL PERFORMANCE: POSITIVE EBITDA ACROSS EACH SEGMENT Resilience in our business model offsets weaker market environment Million Adjusted EBITDA $319 North American Flat-Rolled Segment Resilient average selling prices and volumes reflect a strong commercial strategy and a diverse product mix; managing costs to keep earnings strong Mini Mill Segment Weaker spot selling prices and $40 million of one-time start- up costs across strategic growth projects; Mini Mill adjusted EBITDA margin for Q3 2024 was 11% excluding these one- time costs U. S. Steel Europe Segment Benefitted from one-time favorable adjustment related to the reserve for CO2 emissions which offset pressures from a challenging demand environment in Europe Tubular Segment Challenging price environment despite an enhanced suite of proprietary connections and seamless pipe products serving a diverse oil and gas customer base Note: For reconciliation of non-GAAP amounts, see Appendix.

16 Q4 2024 OUTLOOK: $225 TO $275 MILLION ADJUSTED EBITDA North American Flat-Rolled Mini Mill1 U. S. Steel Europe Tubular Raw Materials Unfavorable raw material pricing expected Operating Costs No material change expected Commercial Unfavorable impact expected from lower average selling prices Raw Materials Slightly higher raw material costs expected Operating Costs Unfavorable impact expected as a result of BR2 ramp inefficiencies Commercial Favorable impact expected due to higher average selling prices and incremental volumes from BR2 ramp Raw Materials Favorable impact expected from inventory adjustments, partially offset by the absence of the favorable adjustment related to the CO2 emissions reserve Operating Costs Unfavorable impact expected from volume inefficiencies, higher energy costs and repair costs related to unplanned downtime at the #1 Caster. Commercial Unfavorable impact expected from weak demand resulting in lower volumes and lower average selling prices Raw Materials No material change expected Operating Costs Favorable impact expected from efficiencies due to absence of outage Commercial Favorable impact expected from increased volumes due to the absence of outage Note: Commentary reflects the expected change versus Q3 2024. 1 Q4 2024 Mini Mill segment EBITDA is expected to include the impact of ~$25 million in construction and related start-up costs vs. ~$40 million in Q3 2024.

17 RESILIENT PERFORMANCE DESPITE A CHALLENGING MARKET ENVIRONMENT 2024E Outlook from Q3 2023 Earnings Presentation1 Commercial Strategic Investments All Other Latest 2024E Expectations ~$2B (~$1.0B) (~$0.2B) ~$0.7B ~$1.4 - $1.5B • Timing of BR2 startup • Extended qualification period for automotive NGO customers • Favorable raw material and operational impacts • Gary Works pig iron machine at run-rate • Dual coating line ramping ahead of schedule • 2024 steel prices in N. America and Europe lower than expected • Weaker-than- expected 2024 demand 1 As published on October 27, 2023 in Form 8-K

18 STRATEGIC GROWTH CAPITAL CYCLE APPROACHING END Capital Expenditure by Year Capex is stepping down following completion of strategic growth spend ~$0.7B ~$0.2B 2021 ~$0.6B ~$1.2B 2022 ~$0.6B ~$2.0B 2023 ~$0.7B ~$1.6B 2024E ~$0.7B ~$0.2B ~$0.1B 2025E1 Expected Future State ~$0.9B ~$1.8B ~$2.6B ~$2.3B ~$1.0B ~$0.6 - 0.7B 2024 capex is now ~$2.3B; Significant free cash flow expected in 2025 as strategic capex rolls off Sustaining Strategic Regulatory and Innovation Additional details on next slide 1 2025E strategic growth capital includes NAFR blast furnace investments, CarbonFreeTM investment, Great Lakes pickle welder, Tubular investments and Mini Mill investments.

19 HIGHER CAPITAL REQUIRED TO FINISH STRATEGIC PROJECTS BY 2024 2024 Capital Expenditure Evolution … How did we get here? 2024 capex is now ~$2.3B; BR2 capex now $3.6 billion Previous Budget BR2 2025 Growth Capex Pull Forward Latest Budget ~$1.9B ~$0.2B ~$0.2B ~$2.3B Primarily related to labor cost increases (i.e. higher contractor headcount, night shifts) due to electrical equipment delivery delays. Pull forward of 2025 Big River Steel Works capex, including the 165 kton paint line at BRS.

20 2024 T H I R D Q U A R T E R U P D A T E

21 FINANCIAL UPDATES Reported Net Earnings (Loss) Adjusted Net Earnings Segment EBIT2 Adjusted EBITDA3 Profit Margin: 7% (2%) 4% 4% 3% $ Millions $ Millions $ Millions $ Millions 8% 4% 5% 5% 8% 2% 5% 5% Adjusted EBITDA Margin:3 13% 8% 10% 11%Segment EBIT Margin:2 Note: For reconciliation of non-GAAP amounts, see Appendix. 1 Earnings (loss) excluding adjustment items. 2 Earnings (loss) before interest and income taxes. 3 Earnings (loss) before interest, income taxes, depreciation and amortization, and excluding adjustment items. Adjusted Profit Margin1: $299 -$80 $171 $183 $119 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 $350 $167 $206 $211 $140 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 $348 $89 $204 $226 $84 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 $578 $330 $414 $443 $319 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 4% 2% 8%

22 KEY OPERATING STATISTICS TRENDS BY SEGMENT Flat-Rolled Operating Statistics Mini Mill Operating Statistics U. S. Steel Europe (USSE) Operating Statistics Tubular Operating Statistics1 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price: $ / net ton Q3 2023 2,390 2,159 $1,036 Q4 2023 2,087 2,034 $978 Q1 2024 2,111 2,049 $1,054 Q2 2024 2,072 2,045 $1,051 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price: $ / net ton Q3 2023 693 561 $901 Q4 2023 752 617 $807 Q1 2024 717 568 $977 Q2 2024 725 562 $869 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price: $ / net ton Q3 2023 990 958 $852 Q4 2023 1,100 1,024 $770 Q1 2024 1,079 1,072 $830 Q2 2024 980 875 $821 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price: $ / net ton Q3 2023 111 104 $2,927 Q4 2023 157 132 $2,390 Q1 2024 146 114 $2,267 Q2 2024 117 109 $2,108 Q3 2024 2,107 1,905 $993 Q3 2024 970 899 $802 Q3 2024 732 602 $800 Q3 2024 159 110 $1,805 1 2024 shipments include immaterial billet shipments in Q1 and Q2 and 6 thousand of billet shipments in Q3. Tubular Segment shipments and average selling price in Q3 2024, exclusive of billet sales, was 104 thousand tons and $1,871 per ton, respectively

23 EBITDA TRENDS BY SEGMENT EBITDA Margin: 13% 5% 6% 12% 13% 12% 21% 12% 1% 0% 5% 3% EBITDA Margin: 32% 38% 25% 17%EBITDA Margin: Note: For reconciliation of non-GAAP amounts, see Appendix. 1 Q4 2023 North American Flat-Rolled segment includes the impact of construction and related start-up costs of approximately $10 million related to the DR-grade pellet strategic project. 2 Mini Mill segment EBITDA includes the impact of construction and related start-up costs of ~$17M in Q3 2023, ~$12M in Q4 2023, ~$20M in Q1 2024, ~$30M in Q2 2024, and ~$40M in Q3 2024 EBITDA Margin: $378 $128 $156 $310 $246 Q3 2023 Q4 20231 Q1 2024 Q2 2024 Q3 2024 $84 $74 $145 $74 $22 Q3 20232 Q4 20232 Q1 20242 Q2 20242 Q3 20242 $10 $3 $46 $21 $39 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 $99 $126 $69 $42 $9 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Flat-Rolled Segment EBITDA Mini Mill Segment EBITDA$ Millions $ Millions USSE Segment EBITDA Tubular Segment EBITDA$ Millions $ Millions 11% EBITDA margin excluding ~$40M of Q3 2024 construction and related start-up costs 5% 10% 4% 4%

24 $ Millions, Q2 2024 vs. Q3 2024 FLAT-ROLLED SEGMENT EBITDA CHANGE ANALYSIS Commercial The unfavorable impact is primarily the result of lower shipment volumes and lower average realized prices. Raw Materials The change is not material. Operating Costs The unfavorable impact is primarily the result of higher labor costs and increased costs for purchased products and services. $378 $246 $74 Q3 2023 ($182) Commercial Raw Materials ($25) Operating Costs Other Q3 2024 $1 Other The favorable impact is primarily the result of lower energy cost and profit-based payments. Commercial The unfavorable impact is primarily the result of lower shipment volumes and lower average realized prices. Raw Materials The change is not material. Operating Costs The favorable impact is primarily the result of outage timing. Other The favorable impact is primarily the result of lower profit-based payments. $ Millions, Q3 2023 vs. Q3 2024 $310 $246 $43 $29 Q2 2024 ($140) Commercial $4 Raw Materials Operating Costs Other Q3 2024

25 $ Millions, Q2 2024 vs. Q3 2024 MINI MILL SEGMENT EBITDA CHANGE ANALYSIS $84 $22 $29 $5 Q3 2023 ($68) Commercial Raw Materials Operating Costs ($28) Other Q3 2024 $ Millions, Q3 2023 vs. Q3 2024 $74 $22 $12 Q2 2024 ($44) Commercial Raw Materials ($3) Operating Costs ($17) Other Q3 2024 Note: Q3 2024, Q2 2024, and Q3 2023 Mini Mill segment EBITDA includes the impact of ~$40 million, ~$30 million, and ~$17 million in construction and related start-up costs, respectively. Commercial The unfavorable impact is primarily the result of lower average realized prices partially offset by higher volume. Raw Materials The favorable impact is primarily the result of lower metallics costs. Operating Costs The favorable impact is primarily the result of lower spending. Other The unfavorable impact is primarily the result of higher construction and related start-up costs associated with strategic projects. Commercial The unfavorable impact is primarily the result of lower average realized prices partially offset by higher volume. Raw Materials The favorable impact is primarily the result of lower metallics costs. Operating Costs The change is not material. Other The unfavorable impact is primarily the result of higher construction and related start-up costs associated with strategic projects.

26 $21 $30 $39 $3 $6 Q2 2024 ($21) Commercial Raw Materials Operating Costs Other Q3 2024 $ Millions, Q2 2024 vs. Q3 2024 U. S. STEEL EUROPE SEGMENT EBITDA CHANGE ANALYSIS $10 $39 $18 Q3 2023 ($44) Commercial $57 Raw Materials ($2) Operating Costs Other Q3 2024 $ Millions, Q3 2023 vs. Q3 2024 Commercial The unfavorable impact is primarily the result of lower average realized prices and lower shipment volumes. Raw Materials The favorable impact is primarily the result of a one- time favorable adjustment related to the reserve for CO2 emissions and lower coal, PCI, and iron ore costs. Operating Costs The change is not material. Other The favorable impact is primarily the result of lower energy cost and favorable foreign exchange impact. Commercial The unfavorable impact is primarily the result of lower average realized prices. Raw Materials The favorable impact is primarily the result of a one- time favorable adjustment related to the reserve for CO2 emissions and lower coal and iron ore costs. Operating Costs The change is not material. Other The favorable impact is primarily the result of timing of accounting accruals.

27 $ Millions, Q2 2024 vs. Q3 2024 TUBULAR SEGMENT EBITDA CHANGE ANALYSIS $99 $7 $9 Q3 2023 ($99) Commercial Raw Materials ($1) Operating Costs $3 Other Q3 2024 $ Millions, Q3 2023 vs. Q3 2024 $42 $9 $2 Q2 2024 ($27) Commercial Raw Materials ($4) Operating Costs ($4) Other Q3 2024 Commercial The unfavorable impact is primarily the result of lower average realized prices. Raw Materials The favorable impact is primarily the result of lower outside purchased scrap costs. Operating Costs The change is not material. Other The change is not material. Commercial The unfavorable impact is primarily the result of lower average realized prices. Raw Materials The change is not material. Operating Costs The change is not material. Other The change is not material.

28 Minntac M I N I M I L L T U B U L A R Clairton Keetac BF #4 BF #6 BF #8 BF #14 BF ‘A’ BF ‘B’ N O R T H A M E R I C A N F L A T - R O L L E D BF #1 BF #3 EAF #1 EAF #2 BF #1 BF #3BF #2 Seamless Pipe #1 ERW #2 ERW EAF Steelmaking / Seamless Pipe Indefinitely IdledOperating 1 Raw steel capability, except at Minntac and Keetac (DR-grade / blast furnace pellet capability), Clairton (coke capability), Gary pig (pig iron) Lorain, and Lone Star (pipe capability). 2 Keetac’s DR-grade pellets investment is ramping up in 2024. Keetac can flex its capacity to produce either 6 million tons of blast furnace iron ore pellets or 4 million tons of DR-grade pellets. 3 If Keetac produces 4 million tons of DR-grade pellets and zero tons of blast furnace iron ore pellets, total iron ore production capacity would be 16.4 million. 4 BR2 currently progressing through phased startup in Q4 2024. 22.43 3.6 7.5 2.8 2.9 - - - 2.8 - 0.90 0.38 0.79 - 0.38 0.79 5.01.6 3.3- Iron Ore Pellets2 Cokemaking Gary Granite City Mon Valley Big River Steel Košice Lorain Lone Star Fairfield E U R O P E Idled Total Capability1 GLOBAL OPERATING FOOTPRINT Temporarily Idled GaryPig Iron - 0.5 Keetac 4.0-DR-grade Pellets2 All amounts shown in millions BF#1 at USSE remains offline following planned 30-day outage in August reflecting weak demandEAF #3 EAF #4 3.0-Big River Steel 24

29 CASH AND LIQUIDITY Note: For reconciliation of non-GAAP amounts, see Appendix. 1 TTM = Trailing twelve months $138 $4,090 $3,505 $2,100 $1,100 FY 2020 FY 2021 FY 2022 FY 2023 TTM Q3 20241 $1,985 $2,522 $3,504 $2,948 $1,773 FY 2020 FY 2021 FY 2022 FY 2023 Q3 2024 $3,153 $4,971 $5,925 $5,174 $4,052 FY 2020 FY 2021 FY 2022 FY 2023 Q3 2024 $2,902 $1,369 $473 $1,274 2,458 FY 2020 FY 2021 FY 2022 FY 2023 Q3 2024 Cash from Operations Cash and Cash Equivalents$ Millions $ Millions Total Estimated Liquidity Net Debt$ Millions $ Millions

30 APPENDIX

31 SUPPLEMENTAL INFORMATION HRC (30%) CRC (40%) Coated (25%) Tin (5%) HRC (60%) CRC (15%) Coated (25%) HRC (60%) CRC (10%) Coated (20%) Other (10%) Seamless (100%) Flat-Rolled Mini Mill1 U. S. Steel Europe Tubular2023 Shipments by product mix 1 Mini Mill segment product mix, once Big River 2 (BR2) is fully ramped by 2026, is expected to be ~40% hot rolled coil (HRC) / ~15% cold rolled coil (CRC) / ~40% Coated / ~5% Non-grain oriented electrical steel.

32 SUPPLEMENTAL INFORMATION HRC (20%) CRC (40%) Coated (30%) Other (5%) HRC (55%) CRC (15%) Coated (30%) HRC (45%) CRC (10%) Coated (35%) Other (5%) Tubular Product (100%) Flat-Rolled Mini Mill U. S. Steel Europe Tubular2023 Revenue by product mix Semi-finished (5%) Semi-finished (5%)

33 SUPPLEMENTAL INFORMATION Service Centers (17%) Converters (25%) Auto (33%) Construction (10%) Oil & Gas (94%) Flat-Rolled Mini Mill U. S. Steel Europe Tubular2023 Shipments by major market Packaging (7%) Appliance & Electrical (5%) Other (3%) Service Centers (46%) Converters (30%) Auto (1%) Construction (20%) Appliance & Electrical (3%) Service Centers (22%) Converters (8%) Auto (16%) Construction (34%) Packaging (8%) Appliance & Electrical (4%) Other (8%) Construction (6%)

34 SUPPLEMENTAL INFORMATION Firm (23%) Market based quarterly (29%) Market based monthly (15%) Spot (33%) Firm (6%) Cost based (9%) Market based quarterly (5%) Market based monthly (38%) Spot (42%) Firm (31%) Cost based (2%) Market based quarterly (2%) Market based monthly (10%) Spot (55%) Program (78%) Spot (22%) Flat-Rolled Mini Mill U. S. Steel Europe Tubular2023 Contract / spot mix by segment Note: Excludes intersegment shipments.

35 SUPPLEMENTAL INFORMATION Cost structure: Blast furnace steelmaking illustrative Coke (~35%) Natural Gas (~5%) Scrap (~30%) Raw Material Costs1 Iron ore (~30%) Key Inputs Ratio1 Pricing Convention Iron Ore 1.3 tons of pellets / ton of raw steel x raw steel volume (million tons) x iron ore price assumption ($/nt) NAFR: Vertically integrated USSE: Prices determined in long-term contracts with strategic suppliers or as spot prices negotiated monthly or quarterly Coke Scrap Natural Gas2 1.4 tons of met coal / ton of coke x met coal price assumption ($/nt) + $75 - $100 / ton conversion cost x 0.3 ton of coke / ton of raw steel 0.3 tons of scrap / ton of raw steel x raw steel volume (million tons) x scrap price assumption ($/nt) 6 mmbtus of nat gas / ton of raw steel x raw steel volume (million tons) x nat gas price assumption ($/nt) Labor 2 hours labor / ton of raw steel x raw steel volume (million tons) x hourly labor rate ($/hr) Other Variable Costs ~$150 - $300 / ton dependent on level of raw steel pricing, product mix, and maintenance activity USSE: Includes CO2 costs Miscellaneous: includes maintenance and services, tool, other fuel and energy, and alloy costs NAFR: Primarily annual met coal contracts USSE: Prices for European met coal contracts negotiated quarterly, annually or determined as index-based prices. NAFR & USSE: 60% generated internally; 40% purchased at market prices NAFR: 70% based on bids solicited monthly from various vendors; remainder daily or with term agreements USSE: Based on bids solicited primarily on a quarterly or monthly basis; remainder balanced on a daily basis 1 Raw material costs and ratios assume a blast furnace within the North American flat-rolled segment. 2 6 mmbtus per ton of raw steel production; 4 mmbtus per ton consumed for further process (primarily at the hot strip mill).

36 SUPPLEMENTAL INFORMATION Cost structure: Electric arc furnace steelmaking illustrative Prime Scrap (~30%) Pig Iron (~25%) HBI / DRI (~10%) Raw Material Costs Obsolete Scrap (~35%) Key Inputs Ratio Pricing Convention Scrap 0.8 tons of scrap / ton of raw steel x raw steel volume (million tons) x scrap price assumption ($/nt) Volumes secured annually; priced on a monthly or quarterly basis Pig Iron HBI Electricity 0.3 tons of pig iron / ton of raw steel x raw steel volume (million tons) x pig iron price assumption ($/nt) 0.1 tons of HBI / ton of raw steel x raw steel volume (million tons) x HBI price assumption ($/nt) 0.6 MKWH of electricity / ton of raw steel x raw steel volume (million tons) x electricity price assumption ($/nt) Internal pig iron transferred from the N. American Flat-rolled segment at a discounted market rate; 3rd party pig volumes secured annually; priced on a monthly or quarterly basis Volumes secured annually; priced on a monthly or quarterly basis based on a blended basket of external HBI production inputs and HBI/DRI substitutes Volume-discounted negotiated base price; adjusted quarterly based on regional electricity price fluctuations Labor 0.14 hours labor / ton of raw steel x raw steel volume (million tons) x hourly labor rate ($/hr)

37 RECONCILIATION TABLE Flat-Rolled ($ millions) Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Segment earnings (loss) before interest and income taxes $225 ($31) $34 $183 $106 Depreciation 153 159 122 127 140 Flat-Rolled Segment EBITDA $378 $128 $156 $310 $246 Segment EBIT Margin1 8% (1%) 1% 7% 4% Segment EBITDA Margin1 13% 5% 6% 12% 10% Tubular ($ millions) Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Segment earnings (loss) before interest and income taxes $87 $113 $57 $29 ($4) Depreciation 12 13 12 12 13 Tubular Segment EBITDA $99 $126 $69 $42 $9 Segment EBIT Margin1 28% 34% 21% 12% (2%) Segment EBITDA Margin1 32% 38% 25% 17% 4% Other ($ millions) Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Segment earnings (loss) before interest and income taxes $7 ($1) ($2) ($4) $3 Depreciation 0 0 0 0 0 Other Segment EBITDA $7 ($1) ($2) ($4) $3 Mini Mill ($ millions) Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Segment earnings (loss) before interest and income taxes $42 $29 $99 $28 ($28) Depreciation 42 45 46 47 50 Mini Mill Segment EBITDA $84 $74 $145 $74 $22 Segment EBIT Margin1 6% 5% 14% 5% (5%) Segment EBITDA Margin1 13% 12% 21% 12% 4% Segment EBITDA U. S. Steel Europe ($ millions) Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Segment earnings (loss) before interest and income taxes ($13) ($21) $16 ($10) $7 Depreciation 23 24 30 31 32 U. S. Steel Europe Segment EBITDA $10 $3 $46 $21 $39 Segment EBIT Margin1 (2%) (3%) 2% (1%) 1% Segment EBITDA Margin1 1% 0% 5% 3% 5% 1 The segment EBIT and segment EBITDA margins represent EBIT or EBITDA divided by net sales.

38 SUPPLEMENTAL INFORMATION Big River Steel LLC1 Summary Table Customer Sales Intersegment Sales Net Sales EBIT2 $508M $93M $601M $13M Income Statement $ Millions Q3 2024 Cash and cash equivalents Total Assets 2029 Senior secured notes Environmental revenue bonds Financial leases and all other obligations Fair value step up3 Total Debt3 $90M $3,664M $720M $752M $22M $104M $1,598M Balance Sheet Depreciation and Amortization Capital Expenditures4 $44M $57M Cash Flow 1 Unless otherwise noted, amounts shown are reflected in Big River Steel LLC, the operating unit of the Big River Steel companies that reside within the Mini Mill segment. 2 Earnings before interest and income taxes. 3 The debt amounts reflect aggregate principal amounts. The fair value step up represents the excess of fair value over book value when Big River Steel was purchased. The fair value step-up is recorded in Big River Steel Holdings LLC. The fair value step up is shown as it is related to the debt amounts in Big River Steel LLC. 4 Excludes capital expenditures for BR2 and air separation unit.

39 RECONCILIATION TABLE Short-term debt and current maturities of long-term debt Long-term debt, less unamortized discount and debt issuance costs Net Debt $ millions YE 2023YE 2022YE 2021YE 2020 $192 $4,695 $28 $3,863 $63 $3,914 $142 $4,080 Total Debt $4,222$3,977$3,891$4,887 Less: Cash and cash equivalents 1,985 2,522 3,504 2,948 Net Debt $1,274$473$1,369$2,902 Net Debt Q3 2024 $163 4,068 $4,231 1,773 $2,458

40 RECONCILIATION TABLE Adjusted Net Earnings 1 The tax impact of the adjusted items in 2024 is calculated using a blended tax rate of 24%. The tax impact of adjusted items in 2023 is calculated for U.S. domestic items using a blended tax rate of 24% and for USSE items 21%. $167$350 Reported net earnings attributable to U. S. Steel Asset impairment charges Restructuring and other charges Stock-based compensation expense VEBA asset surplus adjustment Environmental remediation charges Strategic alternatives review process costs Granite City idling costs Other charges, net Tax impact of adjusted items1 $299 - 18 14 (6) 9 16 14 1 (15) ($80) 123 15 14 (7) - 63 107 10 (78) Net Earnings Net earnings (loss) margin2 Adjusted net earnings margin2 7% 8% (2%) 4% 2 The net earnings and adjusted net earnings margins represent net earnings or adjusted net earnings divided by net sales. Q1 2024 $206 4% 5% Q4 2023Q3 2023$ Millions $171 7 6 11 (4) 2 23 - 1 (11) Q3 2024 $140 3% 4% $119 - 5 10 (9) 1 18 - 2 (6) Q2 2024 $211 4% 5% $183 12 - 16 (8) 1 18 - (2) (9)

41 RECONCILIATION TABLE $ Millions Adjusted EBITDA Adjusted EBITDA Q4 2023Q3 2023 $330$578 Reported net earnings attributable to U. S. Steel Income tax expense Net interest and other financial costs Reported earning before interest and income taxes Depreciation, depletion and amortization expense EBITDA Asset impairment charges Restructuring and other charges Stock-based compensation expense Environmental remediation charges Strategic alternatives review process costs Granite City idling costs Other charges, net $299 42 (64) $277 230 $507 - 18 14 9 16 14 - ($80) (85) (66) ($231) 241 $10 123 15 14 - 63 107 (2) Net earnings margin1 Reported EBIT margin1 Adjusted EBITDA margin1 7% 6% 13% (2%) (6%) 8% 1 The net earnings, reported EBIT and adjusted EBITDA margins represent net earnings or EBITDA divided by net sales. Q1 2024 $414 $171 38 (55) $154 210 $364 7 6 11 2 23 - 1 4% 4% 10% Q2 2024 $443 $183 56 (58) $181 217 $398 12 - 16 1 18 - (2) 4% 4% 11% Q3 2024 $319 $119 (10) (61) $48 235 $283 - 5 10 1 18 - 2 3% 1% 8%

42 Emily Chieng Investor Relations Officer ecchieng@uss.com 412-618-9554 Alana Blatz Manager – Investor Relations agblatz@uss.com 412-303-6521 INVESTOR RELATIONS

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |