Aberdeen Closes Private Placement Financing

July 31 2020 - 8:13AM

ABERDEEN INTERNATIONAL INC. (“Aberdeen” or

the “Company”) (TSX: AAB) announces it has completed a

fully-subscribed non-brokered private placement financing of

16,000,000 units of the Company (the “Units”) at a price of $0.05

per Unit for gross proceeds of $800,000 (the “Offering”). Each Unit

consists of one common share of the Company (each a “Common Share”)

and one-half of one common share purchase warrant (each whole

warrant, a “Warrant”) entitling the holder to acquire a Common

Share at a price of $0.07 for a period of two years from the date

of issuance, subject to an acceleration provision whereby in the

event that at any time after the expiry of the statutory hold

period, the Common Shares trade at $0.20 or higher on the TSX

Venture Exchange for a period of 30 consecutive days, the Company

shall have the right to accelerate the expiry date of the Warrants

to the date that is 30 days after the Company issues a news release

announcing that it has elected to exercise the acceleration right.

The Company intends to use the net proceeds of

the Offering for working capital and general corporate purposes.

The Common Shares, Warrants and common shares underlying the

Warrants are subject to a four month and one day statutory hold

period which expires on December 1, 2020. Closing of the Offering

remains subject to receipt of all regulatory approvals, including

the approval of the Toronto Stock Exchange.

ABOUT ABERDEEN INTERNATIONAL

INC.

Aberdeen International is a global resource

investment company and merchant bank focused on small

capitalization companies in the mining and metals sector.

For additional information, please visit our

website at www.aberdeeninternational.ca.

For further information, please

contact:

Ryan PtolemyChief Financial OfficerAberdeen

International Inc.ryanp@fmfinancialgroup.com+1 416-861-5882

Cautionary Notes

This press release contains "forward looking

information" within the meaning of applicable Canadian securities

legislation. Forward looking information includes, but is not

limited to, statements with respect to the future financial or

operating performance of the Company, Aberdeen’s possible future

trading and intentions, valuations of investments, the completion

of the Offering, the use of proceeds of the Offering, proposed

transactions and investments, investment philosophy and liabilities

and commitments. Generally, forward looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: financing not being available at desired prices;

general business, economic, competitive, political and social

uncertainties; and other general risks of the mining and investment

industries. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward looking information. The Company does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act") or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.

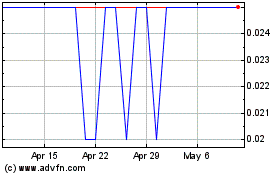

Aberdeen (TSX:AAB)

Historical Stock Chart

From Feb 2025 to Mar 2025

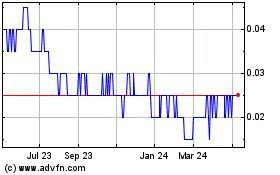

Aberdeen (TSX:AAB)

Historical Stock Chart

From Mar 2024 to Mar 2025