Demand recovery and operational strength

drives record results for the year

Algoma Central Corporation (TSX: ALC) today reported its results

for the year ended December 31, 2021. Algoma delivered record

fiscal 2021 results with revenues of $598,873, a 10% increase

compared to 2020. The Company reported a 79% increase in net

earnings and a 9% increase in EBITDA(1). All amounts reported below

are in thousands of Canadian dollars, except for per share data and

where the context dictates otherwise.

"Our business demonstrated true strength this year and as a

result, we achieved a record year," said Gregg Ruhl, President and

CEO of Algoma Central Corporation. "I am extremely proud of our

team members as they continue to move us forward and meet demand

while navigating through the challenges of this pandemic. We also

had a record year in safety and reported the lowest number of lost

time injuries in our history," Mr. Ruhl continued. "Recovery was a

key theme this year as we saw the economy here in Canada and around

the world steadily improve throughout 2021. Although we did not

experience the same surge in grain cargoes this year, export iron

ore and North American steel demand drove increased cargoes and

higher average freight rates in our Domestic Dry-Bulk segment. In

our Global Short Sea joint ventures, we saw significant market

improvements after a tough downturn last year and our cement and

mini-bulker fleets are performing well and generating excellent

returns. Looking into 2022, Algoma is well-positioned for the

upcoming navigation season as we anticipate growth in most sectors.

We are prepared to strategically deploy capacity to mitigate the

impact of lower grain cargoes caused by the drought in western

Canada. As always, we will stay focused on providing stakeholder

value by continuing to deliver long-term sustainable shipping

solutions through investment in fleet renewal and innovative

technologies that will maintain our position as Your Marine Carrier

of ChoiceTM now and into the future." Mr. Ruhl concluded.

Financial Highlights: Full-year 2021 Compared to 2020

- Net earnings increase of 79% to $82,170 compared to $45,850.

Basic earnings per share were $2.17 compared to $1.21 and diluted

earnings per share were $2.01 compared to $1.19.

- Domestic Dry-Bulk segment revenue increased 18% to $338,661

compared to $286,156, reflecting higher fuel cost recoveries,

significantly improved base freight rates in most sectors and a 2%

increase in overall volumes. Operating earnings increased 39% to

$64,970 compared to $46,752.

- The Global Short Sea Shipping segment net earnings increased

238% to $38,089 compared to $11,268. Revenue increased 6% to

$263,953 compared to $247,881. Driving the increase were

significant improvements in freight rates in the mini-bulker

segment and steady demand in North American cement markets.

- The Ocean Self-Unloader segment revenue increased 17% to

$156,294 compared to $134,109 as a result of a 7% increase in

revenue days mainly due to fewer dry-dockings and our pro-rata

share of the Pool being higher than normal this year. Operating

earnings increased 57% to $29,503 compared to $18,791.

- Revenue for Product Tankers decreased 17% to $94,535 compared

to $114,273. This was attributable to reductions in demand from our

major customer and consequently a 22% decrease in revenue days.

Operating earnings decreased 36% to $13,738 compared to

$21,550.

Consolidated Statement of Earnings

For the years ended December 31

2021

2020

Revenue

$

598,873

$

545,660

Operating expenses

(402,967

)

(366,693

)

Selling, general and administrative

(32,551

)

(29,727

)

Other operating items

(2,196

)

—

Depreciation and amortization

(67,852

)

(75,154

)

Operating earnings

93,307

74,086

Interest expense

(20,733

)

(19,738

)

Interest income

81

238

Gain on sale of properties

1,596

5,621

Foreign currency gains

1,326

351

75,577

60,558

Income tax expense

(11,812

)

(9,503

)

Net earnings (loss) from investments in

joint ventures

18,405

(5,205

)

Net Earnings

$

82,170

$

45,850

Basic earnings per share

$

2.17

$

1.21

Diluted earnings per share

$

2.01

$

1.19

EBITDA(1)

The Company uses EBITDA as a measure of the cash generating

capacity of its businesses. The following table provides a

reconciliation of net earnings in accordance with GAAP to the

non-GAAP EBITDA measure for the years ended December 31, 2021 and

2020 and presented herein:

For the years ended December 31

2021

2020

Net earnings

$

82,170

$

45,850

Depreciation and amortization

83,241

91,998

Impairment provision

—

9,746

Interest and taxes

35,010

32,874

Foreign exchange gain

(1,491

)

(534

)

Other operating items

(3,379

)

—

Gain on disposal of assets

—

65

Gain on sale of property

(1,596

)

(5,621

)

Gain on sale of vessels

(4,972

)

(315

)

EBITDA

$

188,983

$

174,063

Select Financial Performance by Business Segment

For the periods ended December 31

2021

2020

Domestic Dry-Bulk

Revenue

$

338,661

$

286,156

Operating earnings

64,970

46,752

Product Tankers

Revenue

94,535

114,273

Operating earnings

13,738

21,550

Ocean Self-Unloaders

Revenue

156,294

134,109

Operating earnings

29,503

18,791

Corporate and Other

Revenue

9,383

11,122

Operating loss

(14,904

)

(13,007

)

The MD&A for the year ended December 31, 2021 includes

further details. Full results for the year ended December 31, 2021

can be found on the Company’s website at

www.algonet.com/investor-relations and on SEDAR at

www.sedar.com.

2022 Business Outlook(2)

For 2022, we are expecting the demand for manufacturing and

building materials to continue to trend upwards, and steady

production and associated demand should result in salt volumes

approximating normal levels. The impact of the drought in Western

Canada will be a significant factor in our domestic trade but we

are preparing for lower volumes with plans for strategic capacity

deployment and maintaining tight control of operating costs.

The demand for petroleum products in 2022 is expected to be

similar to 2021 as our customers continue to recover from the

impact COVID-19 has had on the demand for wholesale petroleum

products. We are ready to deploy additional capacity should

restrictions ease and global travel begin to recover.

Market trends remain positive in our international segments as

we begin 2022 and we are hopeful there will be a return to more

normal aggregate volumes following the recent downturn in global

infrastructure projects. Freight rates in our Ocean Self-Unloader

segment and in our Global Short Sea joint ventures are likely to

remain strong as market demand continues to steadily increase after

COVID-19 related downturns.

Normal Course Issuer Bid

Effective March 19, 2021, the Company renewed its normal course

issuer bid with the intention to purchase, through the facilities

of the TSX, up to 1,890,457 of its Common Shares ("Shares")

representing approximately 5% of the 37,800,943 Shares which were

issued and outstanding as at the close of business on March 6, 2021

(the “NCIB”). No shares have been purchased to date under this

NCIB.

The Company intends to renew its normal course issuer bid upon

receipt of the required approvals from regulatory authorities.

Cash Dividends

The Company's Board of Directors have authorized payment of a

quarterly dividend to shareholders of $0.17 per common share. The

dividend will be paid on March 1, 2022 to shareholders of record on

February 15, 2022.

Notes

(1) Use of Non-GAAP Measures

The Company uses several financial measures to assess its

performance including earnings before interest, income taxes,

depreciation, and amortization (EBITDA), free cash flow, return on

equity, and adjusted performance measures. Some of these measures

are not calculated in accordance with Generally Accepted Accounting

Principles (GAAP), which are based on International Financial

Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB), are not defined by GAAP, and do

not have standardized meanings that would ensure consistency and

comparability among companies using these measures. From

Management’s perspective, these non-GAAP measures are useful

measures of performance as they provide readers with a better

understanding of how management assesses performance. Further

information on Non-GAAP measures please refer to page 2 in the

Company's Management's Discussion and Analysis for the year ended

December 31, 2021.

(2) Forward Looking Statements

Algoma Central Corporation’s public communications often include

written or oral forward-looking statements. Statements of this type

are included in this document and may be included in other filings

with Canadian securities regulators or in other communications. All

such statements are made pursuant to the safe harbour provisions of

any applicable Canadian securities legislation. Forward-looking

statements may involve, but are not limited to, comments with

respect to our objectives and priorities for 2022 and beyond, our

strategies or future actions, our targets, expectations for our

financial condition or share price and the results of or outlook

for our operations or for the Canadian, U.S. and global economies.

The words "may", "will", "would", "should", "could", "expects",

"plans", "intends", "trends", "indications", "anticipates",

"believes", "estimates", "predicts", "likely" or "potential" or the

negative or other variations of these words or other comparable

words or phrases, are intended to identify forward-looking

statements.

By their nature, forward-looking statements require us to make

assumptions and are subject to inherent risks and uncertainties.

There is significant risk that predictions, forecasts, conclusions

or projections will not prove to be accurate, that our assumptions

may not be correct and that actual results may differ materially

from such predictions, forecasts, conclusions or projections. We

caution readers of this document not to place undue reliance on our

forward-looking statements as a number of factors could cause

actual future results, conditions, actions or events to differ

materially from the targets, expectations, estimates or intentions

expressed in the forward-looking statements.

About Algoma Central Corporation

Algoma owns and operates the largest fleet of dry and liquid

bulk carriers operating on the Great Lakes - St. Lawrence Waterway,

including self-unloading dry-bulk carriers, gearless dry-bulk

carriers and product tankers. Since 2010 we have introduced 10 new

build vessels to our domestic dry-bulk fleet, with one under

construction and expected to arrive in 2024, making us the

youngest, most efficient and environmentally sustainable fleet on

the Great Lakes. Each new vessel reduces carbon emissions on

average by 40% versus the ship replaced. Algoma also owns ocean

self-unloading dry-bulk vessels operating in international markets

and a 50% interest in NovaAlgoma, which owns and operates a

diversified portfolio of dry-bulk fleets serving customers

internationally. Algoma truly is Your Marine Carrier of

Choice™.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220228005282/en/

Gregg A. Ruhl President & CEO 905-687-7890

Peter D. Winkley Chief Financial Officer 905-687-7897

Or visit www.algonet.com or www.sedar.com

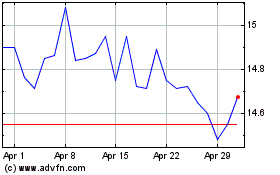

Algoma Central (TSX:ALC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Algoma Central (TSX:ALC)

Historical Stock Chart

From Feb 2024 to Feb 2025