Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”)

reported its operating and consolidated financial results for the

three months ending September 30, 2020.

The third quarter demonstrated the significance

of Athabasca’s swift response to the COVID-19 pandemic. The Company

has focused on maximizing corporate funds flow and maintaining

corporate liquidity. Its Leismer asset underpinned a low corporate

decline rate with significant cash flow generation. The recent

improvement in commodity prices allowed the Company to successfully

restart its Hangingstone asset and also implement price protection

through hedges over the winter season. The Light Oil division

generated strong margins and has helped insulate the Company during

these periods of pricing volatility.

Q3

Operating &

Financial Highlights

-

Q3 Production:

32,061 boe/d (86% liquids), including 20,231 bbl/d from Thermal Oil

and 11,830 boe/d (62% liquids) from Light Oil.

-

Free Cash Flow: Adjusted funds flow of $14.6

million and capital expenditures of $12.4 million resulting in free

cash flow of $2.2 million.

-

Balance Sheet: Maintained strong liquidity with

$152 million of unrestricted cash.

-

Leismer: Production of 18,434 bbl/d, following

voluntary price-driven curtailments in Q2. The asset generated $29

million of operating income with an operating netback of

$16.46/bbl.

-

Hangingstone: Operations resumed in September,

after a successful planned turnaround during curtailment, with

current production of ~7,000 bbl/d. The asset will ramp up into

2021.

-

Light Oil: Industry leading operating netback of

$21.43/boe. Ten new wells resumed production in July in Placid

Montney. Kaybob Duvernay recent well results continue to screen as

top producers with IP90s of 1,125 boe/d (84% liquids) at Kaybob

East and 900 bbl/d at Two Creeks.

Outlook

-

Production

Guidance. Q4 2020 guidance is

maintained at 32,000 – 34,000 boe/d.

-

Capital: No changes to previous

capital guidance of $85 million for 2020. The Company is preparing

for the option of a winter drilling season at its Leismer asset,

aimed at sustaining production and profitability. Minimal activity

in Light Oil is planned for the balance of the winter.

-

Hedging: The Company has realized hedging gains of

$39 million year-to-date. ~55% of Thermal Oil dilbit volumes are

hedged through Q4 2020 and the Company has commenced its 2021 risk

management program aimed at protecting cashflow for a minimal

maintenance capital program.

Athabasca’s strong liquidity position, coupled

with its low decline, long reserve life assets, positions it well

to withstand the current economic environment. The Company has

differentiated exposure to expanded market egress on the horizon

and an ultimate recovery in commodity prices.

Business Environment and the Impact of

COVID-19

In March 2020, the COVID-19 outbreak was

declared a pandemic by the World Health Organization. Global

commodity prices declined significantly as countries around the

world enacted emergency measures to combat the spread of the virus.

The decrease in oil demand has been unprecedented however since

April, global demand has improved while OPEC and North American

producers have cut production. Global inventories have begun to

moderate with economies reopening and leading towards a partial

recovery and stabilization in oil prices. Despite this, the path

towards a full recovery is expected to be volatile.

In Alberta, physical markets and regional

benchmark prices (e.g. Western Canadian Select “WCS” heavy oil)

have strengthened with WTI prices and tighter differentials as a

result of curtailed volumes and falling inventories. Alberta

inventories are currently at multi-year lows and have retreated to

~20 mmbbl, down from a peak of 35 – 40 mmbbl during prior

constrained periods (Genscape). Athabasca expects current WCS

differentials to remain supported by muted industry growth

projects, strong demand for heavy oil from US Gulf Coast refineries

as they face structural declines in global heavy supply (Venezuela

and Mexico) and improving basin egress (including Enbridge Line 3

replacement H2 2021).

Corporate Response to

COVID-19

The Company has implemented business procedures

that comply with Alberta Health Guidelines. Athabasca is committed

to ensuring the health and safety of all its personnel and has

successfully transitioned its office staff back to the office on a

full-time basis and the field sites continue to take site specific

pre-cautionary measures related to COVID-19. The Company has not

experienced any COVID-19 cases in the Calgary office or at its

field sites.

The Company took swift action in response to the

pandemic and economic crisis. Major initiatives include a reduction

to the 2020 capital program, significant temporary production

curtailments, partnering with service companies to reduce operating

costs and reducing future financial commitments on the Keystone XL

pipeline. Finally, the Company bolstered its liquidity by $70

million through an upsized Contingent Bitumen Royalty.

Athabasca is well positioned to navigate the

current challenging environment with $152 million in unrestricted

cash. The Company remains focused on safe and reliable operations

while maximizing corporate funds flow and strong liquidity.

Approximately 55% of Thermal Oil dilbit volumes are hedged through

Q4 2020 and the Company has commenced its 2021 risk management

program aimed at protecting cashflow for a minimal maintenance

capital program.

|

Hedging Summary¹ |

|

|

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

| WCS

Differentials |

19,900 |

18,000 |

7,500 |

7,500 |

- |

| Average

Price |

$16.92 |

$14.44 |

$11.98 |

$11.98 |

- |

|

|

|

|

|

|

|

| WTI² |

17,900 |

11,000 |

- |

- |

- |

|

Average Price³ |

~$43 |

~$40 |

- |

- |

- |

|

Notes: |

|

|

|

|

|

|

1. Details of hedging contracts provided in the Q3 2020

MD&A. |

|

2. WTI hedges include a combination of fixed price swaps, collars,

and 3-way contracts. |

|

3. Average pricing reflects strip commodity pricing as at Nov. 2,

2020 and does include upside pricing potential on collar

instruments. |

Financial and Operational Highlights

|

|

|

Three months

endedSeptember 30, |

|

Nine months

endedSeptember 30, |

|

($ Thousands, unless otherwise noted) |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

CONSOLIDATED |

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum and natural gas production (boe/d) |

|

|

32,061 |

|

|

|

35,257 |

|

|

|

31,896 |

|

|

|

36,126 |

|

|

Operating Income (Loss)(1)(2) |

|

$ |

42,812 |

|

|

$ |

64,614 |

|

|

$ |

50,076 |

|

|

$ |

190,338 |

|

|

Operating Netback(1)(2) ($/boe) |

|

$ |

14.67 |

|

|

$ |

19.10 |

|

|

$ |

5.61 |

|

|

$ |

19.24 |

|

|

Capital expenditures |

|

$ |

12,381 |

|

|

$ |

42,664 |

|

|

$ |

94,438 |

|

|

$ |

129,345 |

|

|

Capital Expenditures Net of Capital-Carry(1) |

|

$ |

12,381 |

|

|

$ |

35,304 |

|

|

$ |

71,698 |

|

|

$ |

93,948 |

|

|

LIGHT OIL DIVISION |

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum and natural gas production (boe/d) |

|

|

11,830 |

|

|

|

10,023 |

|

|

|

9,853 |

|

|

|

10,642 |

|

|

Percentage liquids (%) |

|

62 |

% |

|

55 |

% |

|

61 |

% |

|

54 |

% |

|

Operating Income (Loss)(1) |

|

$ |

23,327 |

|

|

$ |

21,800 |

|

|

$ |

42,460 |

|

|

$ |

78,717 |

|

|

Operating Netback(1) ($/boe) |

|

$ |

21.43 |

|

|

$ |

23.64 |

|

|

$ |

15.73 |

|

|

$ |

27.09 |

|

|

Capital expenditures |

|

$ |

1,917 |

|

|

$ |

21,501 |

|

|

$ |

61,534 |

|

|

$ |

63,214 |

|

|

Capital Expenditures Net of Capital-Carry(1) |

|

$ |

1,917 |

|

|

$ |

14,141 |

|

|

$ |

38,794 |

|

|

$ |

27,817 |

|

|

THERMAL OIL DIVISION |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bitumen production (bbl/d) |

|

|

20,231 |

|

|

|

25,234 |

|

|

|

22,043 |

|

|

|

25,484 |

|

|

Operating Income (Loss)(1) |

|

$ |

26,844 |

|

|

$ |

51,888 |

|

|

$ |

(30,886 |

) |

|

$ |

153,538 |

|

|

Operating Netback(1) ($/bbl) |

|

$ |

14.66 |

|

|

$ |

21.09 |

|

|

$ |

(4.98 |

) |

|

$ |

21.95 |

|

|

Capital expenditures |

|

$ |

10,454 |

|

|

$ |

21,146 |

|

|

$ |

32,872 |

|

|

$ |

66,114 |

|

|

CASH FLOW AND FUNDS FLOW |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from operating activities |

|

$ |

(4,782 |

) |

|

$ |

16,741 |

|

|

$ |

(38,989 |

) |

|

$ |

59,657 |

|

|

per share - basic |

|

$ |

(0.01 |

) |

|

$ |

0.03 |

|

|

$ |

(0.07 |

) |

|

$ |

0.11 |

|

|

Adjusted Funds Flow(1) |

|

$ |

14,617 |

|

|

$ |

43,906 |

|

|

$ |

(29,480 |

) |

|

$ |

133,282 |

|

|

per share - basic |

|

$ |

0.03 |

|

|

$ |

0.08 |

|

|

$ |

(0.06 |

) |

|

$ |

0.26 |

|

|

NET INCOME & COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) & comprehensive income (loss) |

|

|

(18,818 |

) |

|

|

(8,265 |

) |

|

|

(600,634 |

) |

|

|

255,622 |

|

|

per share - basic |

|

$ |

(0.04 |

) |

|

$ |

(0.02 |

) |

|

$ |

(1.14 |

) |

|

$ |

0.49 |

|

|

per share - diluted |

|

$ |

(0.04 |

) |

|

$ |

(0.02 |

) |

|

$ |

(1.14 |

) |

|

$ |

0.49 |

|

|

COMMON SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

|

530,675,391 |

|

|

|

523,263,183 |

|

|

|

528,220,593 |

|

|

|

520,604,599 |

|

|

Weighted average shares outstanding - diluted |

|

|

530,675,391 |

|

|

|

523,263,183 |

|

|

|

528,220,593 |

|

|

|

525,461,794 |

|

|

|

|

Sept.

30, |

|

|

Dec. 31, |

|

|

As at ($ Thousands) |

|

2020 |

|

|

2019 |

|

|

BALANCE SHEET |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

151,730 |

|

|

$ |

254,389 |

|

|

Restricted cash (current and long-term) |

|

$ |

150,887 |

|

|

$ |

110,609 |

|

|

Face value of long-term debt(3) |

|

$ |

600,255 |

|

|

$ |

583,425 |

|

|

(1) Refer to the “Advisories and Other Guidance” section within the

Company’s Q3 2020 MD&A for additional information on Non-GAAP

Financial Measures. |

|

(2) Includes realized commodity risk management loss of $7.4

million and gain of $38.5 million for the three and nine months

ended September 30, 2020, respectively (three and nine months ended

September 30, 2019 - $9.1 million loss and $41.9 million

loss). |

|

(3) The face value of the 2022 Notes is US$450 million. The 2022

Notes were translated into Canadian dollars at the September 30,

2020 exchange rate of US$1.00 = C$1.3339. |

Operations

Update

Thermal Oil

In Q3 2020, consolidated thermal production

averaged 20,231 bbl/d with $27 million of operating income. Capital

expenditures of $10 million were limited to routine maintenance

activity.

At Leismer, production averaged 18,434 bbl/d

during the quarter. Production returned to operational capacity

following voluntary curtailments in the second quarter in response

to extreme low pricing. The asset’s steam oil ratio averaged 3.3x

and has trended lower as a result of continued success of the

non-condensable gas (NCG) co-injection across the field. A low

operating expense of $10.73/bbl underpinned Leismer’s netback of

$16.46/bbl. The asset has demonstrated significant cost

improvements over the last year, ensuring it contributes

significant cash flow to the Company. Leismer has an estimated

operating breakeven of US$23/bbl WCS (assuming US$12.50/bbl

differential).

At Hangingstone, operations were suspended in

April 2020 due to low commodity prices. During the second and third

quarter, the organization successfully completed Hangingstone’s

first major scheduled plant turnaround. The Company strategically

extended the duration of the turnaround to manage costs and to

enhance the safety of the personnel on site in response to

COVID-19. Operations resumed on September 1 with October production

of approximately 7,000 bbl/d. The asset is expected to ramp-up

to previous rates of 9,000 – 9,500 bbl/d over the next 12 months.

In the third quarter, the Company received approval from the

Alberta Energy Regulator to implement NCG co-injection at the

project which is expected to provide pressure maintenance and

reduce the asset’s energy intensity. To protect against future

commodity price volatility the Company has hedged the Hangingstone

production profile through the winter utilizing a collar hedge

structure with a minimum WCS floor price of ~US$25/bbl with upside

potential to ~US$31/bbl WCS (Q4 2020 – Q1 2021).

Light Oil

In Q3 2020, production averaged 11,830 boe/d

(62% liquids) with $23 million of operating income ($21.43/boe

netback). Capital expenditures were $2 million with minimal field

activity planned in the Montney and the Duvernay for the balance of

the winter season.

At Greater Placid, production resumed from 10

new Montney development wells supporting a top tier netback of

$19.33/boe. Placid is positioned for flexible future development

with no near-term land retention requirements.

In the Greater Kaybob Duvernay, 16 new wells

have been brought on-stream year-to-date. In the oil window,

production results have been consistently strong with wells

screening as top liquids producers in the basin. Recent results

include a two well pad at Kaybob East (15-19-64-17W5) which had an

IP30 of 1,400 boe/d per well (87% liquids) and an IP90 of 1,125

boe/d per well (84% liquids), and a single well at Two Creeks

(13-31-64-15W5) which had an IP30 of 1,300 bbl/d (100% liquids) and

an IP90 of 900 bbl/d (100% liquids). Greater Kaybob is positioned

for flexible future development with an inventory of approximately

700 locations, established infrastructure and no near-term land

retention requirements. The joint development agreement (“JDA”)

protects the Company’s interests and minimal activity is currently

planned for the balance of 2020 and 2021. Future changes to the JDA

requires approval from both parties and preserves optionality to

increase spending in a more robust macro environment.

About Athabasca Oil Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s common shares

trade on the TSX under the symbol “ATH”. For more information,

visit www.atha.com.

For more information, please contact:

Matthew TaylorChief Financial

Officer1-403-817-9104mtaylor@atha.com

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. All information other than statements of historical fact

is forward-looking information. The use of any of the words

“anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”,

“will”, “project”, “believe”, “view”, ”contemplate”, “target”,

“potential” and similar expressions are intended to identify

forward-looking information. The forward-looking information is not

historical fact, but rather is based on the Company’s current

plans, objectives, goals, strategies, estimates, assumptions and

projections about the Company’s industry, business and future

operating and financial results. This information involves known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking information. No assurance can

be given that these expectations will prove to be correct and such

forward-looking information included in this News Release should

not be unduly relied upon. This information speaks only as of the

date of this News Release. In particular, this News Release

contains forward-looking information pertaining to, but not limited

to, the following: our strategic plans and growth strategies;

restoring production following curtailments and the Hangingstone

suspension; the Company’s 2020 capital budget; expectations on

global oil fundamentals; and other matters.With respect to

forward-looking information contained in this News Release,

assumptions have been made regarding, among other things: commodity

outlook; the regulatory framework in the jurisdictions in which the

Company conducts business; the Company’s financial and operational

flexibility; the Company’s capital expenditure outlook, financial

sustainability and ability to access sources of funding; geological

and engineering estimates in respect of Athabasca’s reserves and

resources; and other matters. Actual results could differ

materially from those anticipated in this forward-looking

information as a result of the risk factors set forth in the

Company’s Annual Information Form (“AIF”) dated March 4, 2020

available on SEDAR at www.sedar.com, including, but not limited to:

fluctuations in commodity prices, foreign exchange and interest

rates; political and general economic, market and business

conditions in Alberta, Canada, the United States and globally;

changes to royalty regimes, environmental risks and hazards; the

potential for management estimates and assumptions to be

inaccurate; the dependence on Murphy as the operator of the

Company’s Duvernay assets; the capital requirements of Athabasca’s

projects and the ability to obtain financing; operational and

business interruption risks, including those that may be related to

the COVID-19 pandemic; failure by counterparties to make payments

or perform their operational or other obligations to Athabasca in

compliance with the terms of contractual arrangements; aboriginal

claims; failure to obtain regulatory approvals or maintain

compliance with regulatory requirements; uncertainties inherent in

estimating quantities of reserves and resources; litigation risk;

environmental risks and hazards; reliance on third party

infrastructure; hedging risks; insurance risks; claims made in

respect of Athabasca’s operations, properties or assets; risks

related to Athabasca’s amended credit facilities and senior secured

notes; and risks related to Athabasca’s common shares.The risks and

uncertainties referred to above are described in more detail in

Athabasca’s most recent AIF, which is available on the Company’s

SEDAR profile at www.sedar.com. Readers are cautioned that the

foregoing list of risk factors should not be construed as

exhaustive. The forward-looking information included in this News

Release is expressly qualified by this cautionary statement and is

made as of the date of this News Release. The Company does not

undertake any obligation to publicly update or revise any

forward-looking information except as required by applicable

securities laws. Oil and Gas Information“BOEs" may

be misleading, particularly if used in isolation. A BOE conversion

ratio of six thousand cubic feet of natural gas to one barrel of

oil equivalent (6 Mcf: 1 bbl) is based on an energy equivalency

conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. As the value

ratio between natural gas and crude oil based on the current prices

of natural gas and crude oil is significantly different from the

energy equivalency of 6:1, utilizing a conversion on a 6:1 basis

may be misleading as an indication of value.Operating break‐even

reflects the estimated WCS oil price per barrel required to

generate an asset level operating income of Cdn $0. Break‐even is

used to assess the impact of changes in WCS oil prices on operating

income of an asset and could impact future investment decisions.

Break‐even does not have any standardized meaning and therefore

should not be used to make comparisons to similar measures

presented by other issuers.The initial production rates provided in

this News Release should be considered to be preliminary. Initial

production rates disclosed herein may not necessarily be indicative

of long-term performance or of ultimate recovery.Non-GAAP

Financial MeasuresThe "Adjusted Funds Flow”, "Light Oil

Operating Income", “Light Oil Operating Netback”, “Light Oil

Capital Expenditures Net of Capital‐Carry”, "Thermal Oil Operating

Income (Loss)", "Thermal Oil Operating Netback", “Consolidated

Operating Income”, “Consolidated Operating Netback”, and

“Consolidated Capital Expenditures Net of Capital‐Carry” financial

measures contained in this News Release do not have standardized

meanings which are prescribed by IFRS and they are considered to be

non‐GAAP measures. These measures may not be comparable to similar

measures presented by other issuers and should not be considered in

isolation with measures that are prepared in accordance with

IFRS.Adjusted Funds Flow is not intended to represent cash flow

from operating activities, net earnings or other measures of

financial performance calculated in accordance with IFRS. Adjusted

Funds Flow is calculated by adjusting for changes in non-cash

working capital, restructuring expenses and settlement of

provisions from cash flow from operating activities. The Adjusted

Funds Flow measure allows management and others to evaluate the

Company’s ability to fund its capital programs and meet its ongoing

financial obligations using cash flow internally generated from

ongoing operating related activities. Adjusted Funds Flow per share

is calculated as Adjusted Funds Flow divided by the applicable

number of weighted average shares outstanding.The Light Oil

Operating Income measure in this News Release is calculated by

subtracting royalties, operating expenses and transportation &

marketing expenses from petroleum and natural gas sales. The Light

Oil Operating Netback measure is calculated by dividing the Light

Oil Operating Income by the Light Oil production and is presented

on a per boe basis. The Light Oil Operating Income and the Light

Oil Operating Netback measures allow management and others to

evaluate the production results from the Company’s Light Oil

assets. The Thermal Oil Operating Income (Loss) measure in this

News Release with respect to the Leismer Project and Hangingstone

Project is calculated by subtracting the cost of diluent blending,

royalties, operating expenses and transportation & marketing

expenses from blended bitumen sales. The Thermal Oil Operating

Netback measure is calculated by dividing the respective projects

Operating Income (Loss) by its respective bitumen sales volumes and

is presented on a per barrel basis. The Thermal Oil Operating

Income (Loss) and the Thermal Oil Operating Netback measures allow

management and others to evaluate the production results from the

Company’s Thermal Oil assets. The Consolidated Operating Income

(Loss) measure in this News Release is calculated by adding or

subtracting realized gains (losses) on commodity risk management

contracts, royalties, the cost of diluent blending, operating

expenses and transportation & marketing expenses from petroleum

and natural gas sales. The Consolidated Operating Netback measure

is calculated by dividing Consolidated Operating Income (Loss) by

the total sales volumes and is presented on a per boe basis. The

Consolidated Operating Income (Loss) and the Consolidated Operating

Netback measures allow management and others to evaluate the

production results from the Company’s Light Oil and Thermal Oil

assets combined together including the impact of realized commodity

risk management gains or losses. The Consolidated Capital

Expenditures Net of Capital-Carry and Light Oil Capital

Expenditures Net of Capital-Carry measures in this News Release are

outlined in the Company’s Q3 2020 MD&A. These measures allow

management and others to evaluate the true net cash outflow related

to Athabasca's capital expenditures.The Free Cash Flow measure in

this News Release is calculated by subtracting Capital Expenditures

from Adjusted Funds Flow. This measure allows management and others

to evaluate Athabasca’s ability to generate funds to finance

operations and capital expenditures.

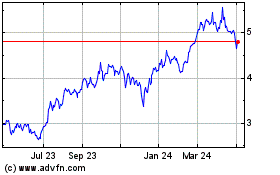

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Oct 2024 to Nov 2024

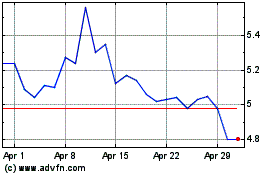

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Nov 2023 to Nov 2024