Bitfarms Ltd. (NASDAQ: BITF//TSX: BITF), a global vertically

integrated Bitcoin mining company, provides an update for the month

and year ended December 31, 2023.

“In 2023, we executed our growth plan and laid

the groundwork for aggressive growth in 2024. We finished the year

with $118 million in liquidity, low-cost power contracts for up to

593 MW and a miner purchase agreement for up to 63,888 new Bitmain

miners in 2024,” said Geoff Morphy, CEO of Bitfarms. “Nearly 70% of

new miners will be deployed in our existing US and Canadian farms

with the remaining miners earmarked for the Paso Pe, Paraguay

expansion, which is currently running ahead of schedule. We are

well underway to achieve our Q2 2024 goals of 12 EH/s and 310 MW

operating capacity, which would represent increases of 85% and 29%,

respectively, compared to year-end 2023. Additionally, we maintain

optionality under the contract with the potential to achieve 17

EH/s and 23 w/TH fleet efficiency before the end of 2024.”

Ben Gagnon, Chief Mining Officer of Bitfarms,

said, “Strong operations and uptime in December drove our average

EH/s online up 5% to 6.2 EH/s, crystalizing another solid year of

performance for Bitfarms. Our mining operations largely kept pace

with network hashrate growth in 2023 generating a similar number of

Bitcoins YOY, while successfully executing on our core focus and

strategy to improve balance sheet strength and prepare for the 2024

halving. In 2024, we expect our core focus to be on executing our

Bitmain T21 miner fleet upgrade plan and driving rapid improvements

in hashrate and energy efficiency in H1 2024. Our proven

capabilities in building and operating facilities will be fully

utilized next year as we deploy our largest order of miners to

date, driving energy efficiency to 25 w/TH and seeking a larger

share of the Bitcoin mining network.”

Jeff Lucas, CFO of Bitfarms, said, “In 2024, we

are building on our financial foundation with a continued focus on

effectively utilizing cash flow from operations in our capital

efficient growth plan for farm expansion and fleet-wide upgrades.

Throughout 2023, we maintained a strong balance sheet during the

fourth quarter, and we increased total liquidity by $52 million to

$118 million, ending the year with $84 million in cash, $34 million

in BTC in treasury, and only $4 million in debt. Furthermore, in

December, we increased our overall BTC exposure by expanding our

Synthetic HODL™ portfolio by a total of 100 long-dated calls while

maintaining BTC held in treasury relatively constant at 804.”

Mining Review

December production of 446 BTC represented an

increase of 13.8% from November as high uptime and a surge in

transaction fees of 465% offset a network difficulty increase of

6.0% during the month. For the year ended December 31st, network

difficulty increased 103.6% while the BTC price was up

approximately 156.8%, resulting in a 61.4% improvement in YOY

production economics as measured by USD/TH/day.

|

Key Performance Indicators |

December 2023 |

November 2023 |

December 2022 |

|

Total BTC earned |

446 |

392 |

496 |

|

Month End Operating EH/s |

6.5 |

6.4 |

4.5 |

|

BTC/Avg. EH/s |

72 |

66 |

113 |

|

Operating Capacity (MW) |

240 |

240 |

188 |

|

Hydropower MW |

186 |

186 |

178 |

|

Watts/Terahash Efficiency (w/TH) |

35 |

35 |

40 |

|

BTC Sold |

444 |

350 |

1,755 |

December 2023 Select Operating Highlights

- 6.5 EH/s

online as of December 31, 2023, up 44% from December 31, 2022, and

up 2% from November 30, 2023.

- 6.2 EH/s

average online, up 5.1% from November 2023.

- 71.7

BTC/average EH/s, up 8.0% from 66.4 in November 2023.

- 446 BTC

earned, 13.8% higher than November 2023 and 10.1% lower than

December 2022.

- 14.4 BTC

earned daily on average, equal to approximately $612,000 per day

based on a BTC price of $42,500 on December 31, 2023.

- At Paso Pe,

Paraguay:

- Finalized the

amended contract for an additional 20 MW of energy to support

expansion of air-cooled warehouse operating capacity from 30 MW to

50 MW for total capacity of 70 MW.

- Completed the

manufacture of the 80 MW transformer, which is now in transit.

- Nearing

completion of the underground cable connections to the ANDE

sub-station.

- At

Baie-Comeau, Quebec:

- Cleared the

site to house the planned 11 MW H2 2024 expansion and poured the

building’s concrete footings ahead of schedule.

Bitfarms’ BTC Monthly

Production

|

Month |

BTC Earned 2023 |

BTC Earned 2022 |

|

January |

486 |

301 |

|

February |

387 |

298 |

|

March |

424 |

363 |

|

April |

379 |

405 |

|

May |

459 |

431 |

|

June |

385 |

420 |

|

July |

378 |

500 |

|

August |

383 |

534 |

|

September |

411 |

481 |

|

October |

398 |

486 |

|

November |

392 |

453 |

|

December |

446 |

496 |

|

Totals |

4,928 |

5,167 |

December 2023 Financial

Update

- Sold 444 BTC

of the 446 BTC earned, generating total proceeds of $18.9

million.

- BTC held in

treasury increased to 804, representing approximately $34.2 million

based on a BTC price of $42,500 at December 31, 2023.

- Increased

Synthetic HODL™ by 100 long-dated BTC call options to 135

long-dated BTC call options at December 31, 2023.

- Reduced total

outstanding indebtedness during the month by $2.0 million,

resulting in a remaining balance of $4.0 million at December 31,

2023, all of which is scheduled to be paid by February 2024.

- Held

approximately $84 million in cash and cash equivalents at December

31, 2023.

Conferences and Events

Bitfarms plans to attend the following upcoming

events:

- January

16-17: 26th Annual Needham Growth Conference, New York City -

management is scheduled to present at 4:30 ET on January 17th.

- January

22-24: Series of meetings in Florida hosted by Bear Creek

Capital

- January 30:

Nasdaq Bell Ringing, New York City

About Bitfarms Ltd.

Founded in 2017, Bitfarms is a global, publicly

traded (NASDAQ/TSX: BITF) Bitcoin mining company that contributes

its computational power to one or more mining pools from which it

receives payment in Bitcoin. Bitfarms develops, owns, and operates

vertically integrated mining farms with in-house management and

company-owned electrical engineering, installation service, and

multiple onsite technical repair centers. The Company’s proprietary

data analytics system delivers best-in-class operational

performance and uptime.

Bitfarms currently has 11 farms, which are

located in four countries: Canada, the United States, Paraguay, and

Argentina. Powered by predominantly environmentally friendly

hydro-electric and long-term power contracts, Bitfarms is committed

to using sustainable, locally based, and often underutilized energy

infrastructure.

To learn more about Bitfarms’ events,

developments, and online communities:

Website: www.bitfarms.com

https://www.facebook.com/bitfarms/https://twitter.com/Bitfarms_iohttps://www.instagram.com/bitfarms/https://www.linkedin.com/company/bitfarms/

Glossary of Terms

- BTC BTC/day =

Bitcoin or Bitcoin per day

- EH or EH/s =

Exahash or exahash per second

- MW or MWh =

Megawatts or megawatt hour

- PH or PH/s =

Petahash or petahash per second

- TH or TH/s =

Terahash or terahash per second

- w/TH =

Watts/Terahash efficiency (includes cost of powering supplementary

equipment

- Synthetic HODL™

= the use of instruments that create bitcoin equivalent

exposure

Cautionary Statement

Trading in the securities of the Company should

be considered highly speculative. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein. Neither the Toronto

Stock Exchange, Nasdaq, or any other securities exchange or

regulatory authority accepts responsibility for the adequacy or

accuracy of this release.

Forward-Looking Statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking information”) that are based on

expectations, estimates and projections as at the date of this news

release and are covered by safe harbors under Canadian and United

States securities laws. The statements and information in this

release regarding projected growth, target hashrate, opportunities

relating to the Company’s geographical diversification and

expansion, upgrading and deployment of miners as well as the timing

therefor, improved financial performance and balance sheet

liquidity, other growth opportunities and prospects, and other

statements regarding future growth, plans and objectives of the

Company are forward-looking information. The statements and

information in this release regarding the miner equipment

purchases, contracted delivery and proposed deployment plans,

performance of the equipment and the impact on operating capacity

including target hashrates and hashrate growth in general, energy

efficiency and cost savings, and other statements regarding future

plans and objectives of the Company are forward-looking

information. Other forward-looking information includes, but is not

limited to, information concerning: the intentions, plans and

future actions of the Company, as well as Bitfarms’ ability to

successfully mine digital currency, revenue increasing as currently

anticipated, the ability to profitably liquidate current and future

digital currency inventory, volatility of network difficulty and

digital currency prices and the potential resulting significant

negative impact on the Company’s operations, the construction and

operation of expanded blockchain infrastructure as currently

planned, and the regulatory environment for cryptocurrency in the

applicable jurisdictions.

Any statements that involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “prospects”,

“believes” or “intends” or variations of such words and phrases or

stating that certain actions, events or results “may” or “could”,

“would”, “might” or “will” be taken to occur or be achieved) are

not statements of historical fact and may be forward-looking

information and are intended to identify forward-looking

information.

This forward-looking information is based on

assumptions and estimates of management of the Company at the time

they were made, and involves known and unknown risks, uncertainties

and other factors which may cause the actual results, performance,

or achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors include, among

others, risks relating to: the availability of financing

opportunities, risks associated with economic conditions,

dependence on management and conflicts of interest, the ability to

service debt obligations and maintain flexibility in respect of

debt covenants; economic dependence on regulated terms of service

and electricity rates; the speculative and competitive nature of

the technology sector; dependency on continued growth in blockchain

and cryptocurrency usage; lawsuits and other legal proceedings and

challenges; conflict of interests with directors and management;

government regulations; the global economic climate; dilution; the

Company’s limited operating history; future capital needs and

uncertainty of additional financing, as well as capital market

conditions in general; risks relating to the strategy of

maintaining and increasing Bitcoin holdings and the impact of

depreciating Bitcoin prices on working capital; the competitive

nature of the industry; currency exchange risks; the need for the

Company to manage its planned growth and expansion; the effects of

product development and need for continued technology change; the

ability to maintain reliable and economical sources of power to run

its cryptocurrency mining assets; the impact of energy curtailment

or regulatory changes in the energy regimes in the jurisdictions in

which the Company operates; protection of proprietary rights; the

effect of government regulation and compliance on the Company and

the industry; network security risks; the ability of the Company to

maintain properly working systems; reliance on key personnel;

global economic and financial market deterioration impeding access

to capital or increasing the cost of capital; and volatile

securities markets impacting security pricing unrelated to

operating performance. In addition, particular factors that could

impact future results of the business of Bitfarms include, but are

not limited to: the construction and operation of facilities may

not occur as currently planned, or at all; expansion may not

materialize as currently anticipated, or at all; the digital

currency market; the ability to successfully mine digital currency;

revenue may not increase as currently anticipated, or at all; it

may not be possible to profitably liquidate the current digital

currency inventory, or at all; a decline in digital currency prices

may have a significant negative impact on operations; an increase

in network difficulty may have a significant negative impact on

operations; the volatility of digital currency prices; the

anticipated growth and sustainability of hydroelectricity for the

purposes of cryptocurrency mining in the applicable jurisdictions;

the inability to maintain reliable and economical sources of power

for the Company to operate cryptocurrency mining assets; the risks

of an increase in the Company’s electricity costs, cost of natural

gas, changes in currency exchange rates, energy curtailment or

regulatory changes in the energy regimes in the jurisdictions in

which the Company operates and the adverse impact on the Company’s

profitability; the ability to complete current and future

financings, any regulations or laws that will prevent Bitfarms from

operating its business; historical prices of digital currencies and

the ability to mine digital currencies that will be consistent with

historical prices; an inability to predict and counteract the

effects of COVID-19 on the business of the Company, including but

not limited to the effects of COVID-19 on the price of digital

currencies, capital market conditions, restriction on labour and

international travel and supply chains; and, the adoption or

expansion of any regulation or law that will prevent Bitfarms from

operating its business, or make it more costly to do so. For

further information concerning these and other risks and

uncertainties, refer to the Company’s filings on www.SEDAR.com

(which are also available on the website of the U.S. Securities and

Exchange Commission at www.sec.gov), including the annual

information form for the year-ended December 31, 2022, filed on

March 21, 2023. The Company has also assumed that no significant

events occur outside of Bitfarms’ normal course of business.

Although the Company has attempted to identify important factors

that could cause actual results to differ materially from those

expressed in forward-looking statements, there may be other factors

that cause results not to be as anticipated, estimated, or

intended. There can be no assurance that such statements will prove

to be accurate as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on any forward-looking

information. The Company undertakes no obligation to revise or

update any forward-looking information other than as required by

law.

Contacts:

LHA Investor RelationsDavid Barnard+1

415-433-3777Investors@bitfarms.com

Actual Agency Khushboo Chaudhary+1

646-373-9946mediarelations@bitfarms.com

Québec Media: TactLouis-Martin Leclerc+1

418-693-2425lmleclerc@tactconseil.ca

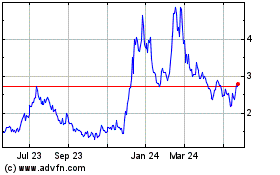

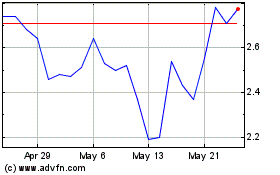

Bitfarms (TSX:BITF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Bitfarms (TSX:BITF)

Historical Stock Chart

From Feb 2024 to Feb 2025