Black Iron Signs MOU With Glencore for Funding Construction of the Shymanivske Iron Ore Project

February 20 2019 - 7:30AM

Black Iron Signs MOU With Glencore for Funding Construction of the

Shymanivske Iron Ore Project

via NetworkWire -- Black Iron Inc. (“Black Iron”) (TSX: BKI; OTC:

BKIRF; FRANKFURT: BIN) is pleased to announce the signing of a

non-binding Memorandum of Understanding (the “MOU”) with a

subsidiary of Glencore plc (“Glencore”), pursuant to which the

parties agree to engage in formal negotiations to finance the

construction of the Shymanivske Iron Ore Project (the

“Project”).

The MOU contemplates Glencore making an

investment to help fund construction of the Project in exchange for

securing the offtake of up to the full phase one planned annual

production of four million tonnes with the terms and amount still

to be negotiated. Additionally, the MOU outlines cooperation

between Black Iron and Glencore to leverage their relationships to

source the balance of funds required to construct the Project.

The MOU also allows for allocation of offtake to

other equity investors subject to the investment terms offered

being equal or superior to those proposed by Glencore. Black Iron

is currently in discussion with other companies that have expressed

strong interest in securing supply of the ultra high-grade iron ore

concentrate expected to be produced from the Project in exchange

for providing construction financing.

Matt Simpson, Black Iron’s CEO, commented: “I am

excited to welcome Glencore as an offtake investor for construction

of the Shymanivske Project as well as their agreement to work with

us to help secure additional financing. Glencore’s

involvement significantly strengthens our capability and draws on

their extensive international network, experience and market

knowledge.”

Securing the complete finance package in

addition to the required surface rights are the two main areas of

focus for Black Iron management. As previously indicated,

debt finance discussions are ongoing with international finance

institutions and European based banks who really like the projected

robust economics of the Project due to its low operating cost and

construction capital intensity.

The Project is located in Kryvyi Rih, Ukraine, a

highly developed iron ore mining region with well-established

infrastructure located well away from the conflict zones. The

Project’s proximity and access to major infrastructure including

paved roads, railway, powerlines and port as well as highly skilled

low-cost labour force allow for a phased development approach at

significantly reduced initial capital requirements and operating

costs.

Black Iron plans to produce a 68% iron content

pellet feed concentrate with very low levels of trace elements that

can be used to produce high-quality iron ore blast furnace pellets

or premium direct reduction grade pellets. It can also be

used as a sweetener in the feed for sinter production which is then

processed to iron in blast furnaces.

About Black IronBlack Iron is

an iron ore exploration and development company, advancing its 100%

owned Shymanivske project located in Kryvyi Rih, Ukraine. The

Shymanivske project contains a NI 43-101 compliant resource

estimated to be 646 Mt Measured and Indicated mineral resources,

consisting of 355 Mt Measured mineral resources grading 31.6% total

iron and 18.8% magnetic iron, and Indicated mineral resources of

290 Mt grading 31.1% total iron and 17.9% magnetic iron, using a

cut-off grade of 10% magnetic iron. Additionally, the Shymanivske

project contains 188 Mt of Inferred mineral resources grading 30.1%

total iron and 18.4% magnetic iron. Full mineral resource details

can be found in the NI 43-101 compliant technical report entitled

“Preliminary Economic Assessment of the Re-scoped Shymanivske Iron

Ore Deposit” effective November 21, 2017 under the Company's

profile on SEDAR at www.sedar.com. The Shymanivske project is

surrounded by five other operating mines, including ArcelorMittal's

iron ore complex. Please visit the Company's website at

www.blackiron.com for more information.

The technical and scientific contents of this

press release have been prepared under the supervision of and have

been reviewed and approved by Matt Simpson, P.Eng., CEO of Black

Iron, who is a Qualified Person as defined by NI 43-101.

Cautionary StatementThe PEA is

preliminary in nature, and it includes inferred mineral resources

that are considered too speculative geologically to have the

economic considerations applied to them that would enable them to

be categorized as mineral reserves. There is no certainty that the

PEA will be realized.

For more information, please contact:

Black Iron Inc.,Matt

Simpson Chief Executive OfficerTel: +1 (416) 309-2138

info@blackiron.com

Forward-Looking InformationThis

press release contains forward-looking information. Forward-looking

information is based on what management believes to be reasonable

assumptions, opinions and estimates of the date such statements are

made based on information available to them at that time, including

those factors discussed in the section entitled ‘‘Risk Factors’’ in

the Company’s annual information form for the year ended December

31, 2017 or as may be identified in the Company’s public disclosure

from time to time, as filed under the Company’s profile on SEDAR at

www.sedar.com. Forward-looking information may include, but

is not limited to, statements with respect to the Project, the MOU

and the transactions contemplated therein, the relationship between

Glencore and the Company, the mineralization of the Project, the

results of the PEA, the realization of the PEA, and future plans

for the Company’s development. Generally, forward looking

information can be identified by the use of forward-looking

terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or state that certain

actions, events or results "may", "could", "would", "might" or

"will be taken", "occur" or "be achieved". Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information, including but not limited to: general

business, economic, competitive, geopolitical and social

uncertainties; the actual results of current exploration

activities; other risks of the mining industry and the risks

described in the annual information form of the Company. Although

the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward looking information. The Company

does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

Corporate Communications:

NetworkWire (NW) New York, New Yorkwww.NetworkNewsWire.com

212.418.1217 OfficeEditor@NetworkWire.com

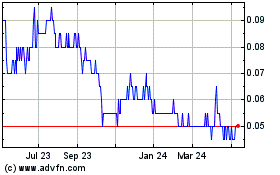

Black Iron (TSX:BKI)

Historical Stock Chart

From Feb 2025 to Mar 2025

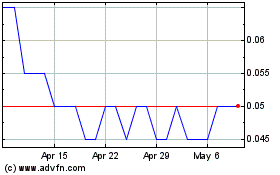

Black Iron (TSX:BKI)

Historical Stock Chart

From Mar 2024 to Mar 2025