BAYTEX RECEIVES NYSE LISTING NOTIFICATION

March 25 2020 - 4:00PM

Baytex Energy Corp. (“Baytex”) (TSX, NYSE: BTE) announced that it

received notification on March 24, 2020 from the New York Stock

Exchange (“NYSE”) that Baytex is no longer in compliance with one

of the NYSE’s continued listing standards because the average

closing price of Baytex’s common shares was less than US$1.00 per

share over a consecutive 30 trading period. The issuance of the

notification is not discretionary and is sent automatically when a

listed company’s share price falls below the NYSE’s minimum price

listing standard.

Under the NYSE’s rules, Baytex can avoid

delisting if, within six months from the date of the NYSE

notification, its common shares have a closing price on the last

trading day of any calendar month and a concurrent 30 trading day

average closing price of at least US$1.00 per share. If

at the expiration of the applicable six month cure period Baytex

has not regained compliance, the NYSE will commence suspension and

delisting procedures. The NYSE can also commence accelerated

delisting action in the event Baytex’s common shares trade at

levels viewed by the NYSE to be abnormally low, which the NYSE has

advised is typically below US$0.16 per share. At this time, Baytex

does not expect to propose a share consolidation as a means of

curing the deficiency.

Non-compliance with the NYSE’s price listing

standard does not affect Baytex’s business operations or its

reporting requirements to the U.S. Securities and Exchange

Commission (the “SEC“), nor does it affect the continued listing

and trading of Baytex’s common shares on the Toronto Stock Exchange

(the “TSX“).

Baytex’s common shares will continue to be

listed and traded on the NYSE during the applicable cure period,

subject to continued compliance with the NYSE’s other continued

listing standards, under the symbol “BTE”, but the NYSE will assign

a “.BC” indicator to the symbol to denote that Baytex is below the

NYSE’s price listing standard. This indicator will be removed at

such time as Baytex is deemed compliant with the NYSE’s price

listing standard.

Advisory Regarding Forward-Looking

Statements

In the interest of providing Baytex's

shareholders and potential investors with information regarding

Baytex, including management's assessment of Baytex's future plans

and operations, certain statements in this press release are

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian securities legislation (collectively, "forward-looking

statements"). In some cases, forward-looking statements can

be identified by terminology such as “ continue", "could",

"estimate", "expect", "forecast", "intend", "may", "ongoing",

"outlook", "potential", "should", "target", "would", "will" or

similar words suggesting future outcomes, events or

performance. The forward-looking statements contained in this

press release speak only as of the date thereof and are expressly

qualified by this cautionary statement.

Specifically, this press release contains

forward-looking statements relating to but not limited to: that if

at the expiration of the applicable cure period Baytex has not

regained compliance or if Baytex shares trade at abnormally low

levels, the NYSE will commence suspension and delisting procedures;

Baytex’s expectation that it will not pursue a share consolidation;

that non-compliance with the NYSE’s price listing standard does not

affect Baytex’s business operations, its reporting requirements to

the SEC or the continued listing and trading of Baytex’s common

shares on the TSX.

The forward-looking statements provided in this

press release are based on management's current beliefs, based on

currently available information, as to the outcome and timing of

future events. Baytex cautions that its forward-looking statements

relating to Baytex are subject to all of the risks and

uncertainties normally incident to such endeavors and to Baytex's

business of exploring for, developing, producing and selling oil

and natural gas. Important factors that could cause actual results

and events to differ from those described in the forward-looking

statements can be found in our public filings (including our Annual

Information Form) available in Canada at www.sedar.com and in the

United States at www.sec.gov.

There is no representation by Baytex that actual

results achieved will be the same in whole or in part as those

referenced in such forward-looking statements and Baytex does not

undertake any obligation to update publicly or to revise any of the

included forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities laws.

Baytex Energy Corp.

Baytex Energy Corp. is an oil and gas

corporation based in Calgary, Alberta. The company is engaged in

the acquisition, development and production of crude oil and

natural gas in the Western Canadian Sedimentary Basin and in the

Eagle Ford in the United States. Approximately 83% of Baytex’s

production is weighted toward crude oil and natural gas liquids.

Baytex’s common shares trade on the Toronto Stock Exchange and the

New York Stock Exchange under the symbol BTE.

For further information about Baytex, please

visit our website at www.baytexenergy.com or contact:

Brian Ector, Vice President, Capital

Markets

Toll Free Number: 1-800-524-5521Email:

investor@baytexenergy.com

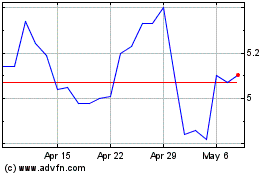

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Feb 2024 to Feb 2025