Canacol Energy Ltd. ("Canacol" or the "Corporation") (TSX:CNE;

OTCQX:CNNEF; BVC:CNEC) comments regarding certain concerns of our

debt obligations:

As announced on March 22, 2024, during the

Corporation´s Fourth Quarter 2023 Conference Call, the Corporation

is in compliance with all of its debt covenants and there is no

indication of any possible breach. As of December 31, 2023, the

Corporation’s Consolidated Leverage Ratio was 2.85x. The 2028

Senior Notes Consolidated Leverage Ratio Covenant is 3.25x

(incurrence based) and the Revolving Credit Facility covenant is

3.50x (maintenance based), as such the Corporation is well inside

those covenant restrictions.

Any speculation that the Corporation may

not be paying its next coupon is completely false and Canacol

reaffirms its commitment to meet all its future financial

obligations.

Our recently completed corporate restructuring

will result in a significant reduction of current tax expense in

2024 and forward, providing enhanced liquidity which could be used

for debt reduction, including potential repurchasing of senior

notes should the pricing remain supressed.

The Corporation is prioritizing cash liquidity

and balance sheet preservation, and, as announced in a press

release on March 21, 2024, the Corporation has made the decision to

discontinue the quarterly dividend. Discontinuing the dividend

increases balance sheet flexibility and cash liquidity in the short

term and is in the best interest of all stakeholders. In addition,

the Corporation has access to additional sources of liquidity, if

needed, such as the sale of non-core, non-gas assets.

As previously announced in our Corporate

Guidance press release, given strong natural gas market dynamics in

Colombia, the Corporation expects to generate between $250 - $290

million in EBITDA during 2024, which is between 6% and 22% higher

than 2023’s EBITDA.

Gas scarcity in Colombia and limited options to

import gas as reported by multiple sources in recent months, is

expected to continue for the foreseeable future which is supportive

of high natural gas prices and the Corporation’s ability to

generate additional EBITDA.

The Corporation will be prepaying its 2024 tax

installments as required by Colombian regulation in the first half

of the year, however cash requirements are expected to decline in

the second half of 2024 and into 2025.

As per the Corporation’s audited reserves report

as of December 31, 2023, Canacol maintains a strong reserves base

of 295 Bcf on the proved category and 607 Bcf on the proved plus

probable category, with a Reserve Life Index “RLI” of 4.8 and 9.9

years, respectively. Also, the Corporation has 161 Bcf of Proved

Developed Not Producing ("PDNP") reserves derived from Proved

Developed Producing (“PDP”) reserves technical revisions, as

certain wells in Nelson, Clarinete, and Alboka that were producing

as of December 31, 2022 were not producing and awaiting workovers

to restart production at December 31, 2023.

The Corporation is preparing a press release

concerning its most recent gas discovery, Pomelo 1, which shall be

issued shortly.

About Canacol

Canacol is a natural gas exploration and

production company with operations focused in Colombia. The

Corporation's common stock trades on the Toronto Stock Exchange,

the OTCQX in the United States of America, and the Colombia Stock

Exchange under ticker symbol CNE, CNNEF, and CNEC,

respectively.

Forward-Looking Statements

This press release contains forward-looking

statements and forward-looking information (collectively

"forward-looking information") within the meaning of applicable

securities laws relating to the Corporation’s plans and other

aspects of our anticipated future operations, management focus,

strategies, financial, operating and production results and

business opportunities. Forward-looking information typically uses

words such as "anticipate", "believe", "continue", "trend",

"sustain", "project", "expect", "forecast", "budget", "goal",

"guidance", "plan", "objective", "strategy", "target", "intend",

"estimate", "potential", or similar words suggesting future

outcomes, statements that actions, events or conditions "may",

"would", "could" or "will" be taken or occur in the future,

including statements about our strategy, plans, focus, objectives,

priorities and position.

In particular, and without limiting the

generality of the foregoing, this press release contains

forward-looking information with respect to: the Corporation’s

future compliance with all of its debt covenants; the Corporation’s

ability to pay its next coupon; the Corporation’s ability to meet

all of its future financial obligations; the reduction of the

Corporation’s tax expense in 2024 following its corporate

restructuring; the reduced tax expense providing enhanced liquidity

for the Corporation; the potential debt reduction and repurchase

of senior notes; additional sources of liquidity; expected EBITDA

during 2024; the availability and price of gas in Colombia; the

prepayment of 2024 tax installments and the expected cash

requirements for the Corporation in 2024 and 2025; and the

Corporation’s most recent gas discovery, Pomelo 1. Statements

relating to "reserves" are also deemed to be forward-looking

statements, as they involve the implied assessment, based on

certain estimates and assumptions, that the reserves described

exist in the quantities predicted or estimated and that the

reserves can be profitably produced in the future.

The forward-looking information is based on

certain key expectations and assumptions made by our management,

including: current commodity prices and royalty regimes; timing and

amount of capital expenditures; our ability to execute our plans in

the short-term and long-term as described herein and in the

Corporation’s other disclosure documents and the impact that the

successful execution of such plans will have on the Corporation;

the price of oil, natural gas liquids and natural gas; conditions

in general economic and financial markets; the impact of rising

and/or sustained high inflation rates and interest rates; future

exchange rates; availability of drilling and related equipment;

effects of regulation by governmental agencies; recoverability of

reserves; royalty rates; future operating costs; performance of

existing and future wells; the sufficiency of budgeted capital

expenditures in carrying out planned activities; that the

Corporation will have sufficient cash flow, debt or equity sources

or other financial resources required to fund its capital and

operating expenditures and requirements as needed; that the

Corporation’s conduct and results of operations will be consistent

with its expectations; that the Corporation will have the ability

to develop its oil and gas properties in the manner currently

contemplated; that the estimates of the Corporation’s reserves

volumes and the assumptions related thereto (including commodity

prices and development costs) are accurate in all material

respects; and other matters.

Although we believe that the expectations and

assumptions on which such forward-looking information is based are

reasonable, undue reliance should not be placed on the

forward-looking information because Canacol can give no assurance

that they will prove to be correct. Since forward-looking

information addresses future events and conditions, by its very

nature it involves inherent risks and uncertainties. These include,

but are not limited to: the impact of general economic and

political conditions in Colombia; industry conditions, including

changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are

interpreted and enforced in Colombia; pandemics and epidemics;

volatility in market prices for oil, natural gas liquids and

natural gas; the risk that any of our material assumptions prove to

be materially inaccurate, including our 2024 forecast (including

for commodity prices and exchange rates); imprecision in reserve

and resource estimates; operational constraints due to debt; lack

of availability of additional financing; failure to comply with

debt covenants or deterioration in the Corporation’s credit rating;

competition; the results of exploration and development drilling

and related activities; the Corporation’s ability to recover

reserves and resources; production rates and production decline

rates; environmental risks; the production and growth potential of

our assets; obtaining required approvals of regulatory authorities

in Colombia; risks associated with negotiating with foreign

governments as well as country risk associated with conducting

international activities; risks associated with acquisitions and

dispositions; fluctuations in foreign exchange or interest rates;

changes in income tax laws or changes in tax laws and incentive

programs relating to the oil and natural gas industry; risk that

the Corporation will not be able to obtain contract extensions or

fulfill the contractual obligations required to retain its rights

to explore, develop and exploit any of its undeveloped properties;

and other factors, many of which are beyond the control of the

Corporation. Our actual results, performance or achievement could

differ materially from those expressed in, or implied by, the

forward-looking information and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

information will transpire or occur, or if any of them do so, what

benefits that we will derive therefrom. Management has included the

above summary of assumptions and risks related to forward-looking

information provided in this press release in order to provide

security holders with a more complete perspective on our future

operations and such information may not be appropriate for other

purposes.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. Additional information on these and

other factors that could affect our operations or financial results

are included in reports on file with applicable securities

regulatory authorities and may be accessed through the SEDAR+

website (www.sedarplus.ca). These forward-looking statements are

made as of the date of this press release and we disclaim any

intent or obligation to update publicly any forward-looking

information, whether as a result of new information, future events

or results or otherwise, other than as required by applicable

securities laws.

This press release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about our forecast of $250 - $290 million

in EBITDA during 2024 and our forecast about liquidity and cash

requirements; all of which are subject to the same assumptions,

risk factors, limitations, and qualifications as set forth in the

above paragraphs. The actual results of operations of Canacol and

the resulting financial results will likely vary from the amounts

set forth herein and such variation may be material. Canacol and

its management believe that the FOFI has been prepared on a

reasonable basis, reflecting management’s best estimates and

judgments. However, because this information is subjective and

subject to numerous risks, it should not be relied on as

necessarily indicative of future results. Except as required by

applicable securities laws, Canacol undertakes no obligation to

update such FOFI. FOFI contained in this press release was made as

of the date of this press release and was provided for the purpose

of providing further information about Canacol’s anticipated future

business operations. Readers are cautioned that the FOFI contained

in this press release should not be used for purposes other than

for which it is disclosed herein.

Use of Non-IFRS Financial

Measures

This press release refers to certain financial

measures that are not determined in accordance with IFRS. Measures

such as earnings before interest, tax, depreciation and

amortization (“EBITDA”) are not standard measures

under IFRS and, therefore, may not be comparable to similar

measures reported by other entities. Management believes that these

supplemental measures facilitate the understanding of the

Corporation’s results of operations and financial position. These

financial measures are considered additional IFRS or non- IFRS

financial measures. Readers are cautioned that these measures

should not be construed as an alternative to measures determined

in accordance with IFRS as an indication of the Corporation’s

performance. Readers should refer to the Corporation’s 2023 annual

financial statements and associated management discussion and

analysis filed on the SEDAR+ website (www.sedarplus.ca) for a full

discussion of the Corporation’s financial performance and a

reconciliation of these measures to their most closely related IFR

measures.

For more information please contact:

Investor Relations

South America: +571.621.1747 IR-SA@canacolenergy.com

Global: +1.403.561.1648 IR-GLOBAL@canacolenergy.com

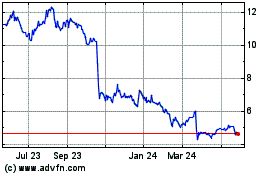

Canacol Energy (TSX:CNE)

Historical Stock Chart

From Jan 2025 to Feb 2025

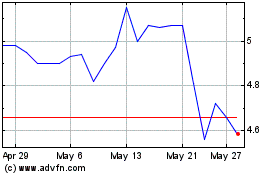

Canacol Energy (TSX:CNE)

Historical Stock Chart

From Feb 2024 to Feb 2025