SeaChange International, Inc.

(OTC: SEAC)

(“SeaChange” or the “Company”), a leading provider of video

delivery, advertising, streaming platforms, and emerging Free

Ad-Supported Streaming TV services (FAST) development, has entered

into an asset purchase agreement (the “Enghouse Purchase

Agreement”) under which an affiliate of Enghouse Systems Limited

(“Enghouse”), a leading global telecommunication technology and

solutions company that provides next generation communications

solutions to communication service providers (including TV / cable

operators), media companies, defense, public safety agencies, and

utilities, will acquire substantially all of SeaChange’s assets

related to its product and services business (the “Enghouse Asset

Sale”), and will assume certain liabilities, for a total purchase

price of $39 million, less SeaChange’s cash and cash equivalents at

closing (“Closing”). The Company currently expects the transaction

will result in net proceeds to SeaChange of between $21 to $23

million upon Closing.

The Enghouse Asset Sale, which has been approved

by SeaChange’s Board of Directors (the “Board”), is subject to

various terms and closing conditions, including approval by a

majority of the shares of SeaChange’s outstanding common stock.

Subject to such closing conditions, Closing is expected to occur in

early May 2024.

“When we set out to identify a strategic partner

for SeaChange, our two key goals were to maximize stockholder value

and to find a larger home for the SeaChange assets within which the

business could scale. With Enghouse’s commitment to SeaChange and

their customer-centric vision for the business, both goals are met.

Enghouse has a remarkable track record of embedding software

businesses into their highly efficient operational framework, and

we are looking forward to seeing SeaChange thrive within the

Enghouse family,” said Chris Klimmer, CEO at SeaChange.

Similar to the Partner One Transaction (as

defined and discussed below), following Closing, the Company will

retain its cash and cash equivalents, and U.S. and state net

operating loss carryforwards (“NOLs”), which may be available to

offset future tax income. The Enghouse Purchase Agreement also

contains a termination fee payable to Enghouse in connection with

the termination of the Enghouse Purchase Agreement under certain

circumstances, such as consummation of an alternative acquisition

transaction in connection with a Superior Proposal (as defined in

the Enghouse Purchase Agreement). However, the termination fee in

the Enghouse Purchase Agreement is $1.3 million.

In addition, similar to the Partner One

Transaction, concurrently with the execution of the Enghouse

Purchase Agreement, a significant stockholder (the “Significant

Stockholder”) of the Company, that cumulatively owns approximately

30.5% of the shares of SeaChange’s outstanding common stock, has

entered into a voting agreement with Enghouse pursuant to which the

Significant Stockholder has agreed, subject to the terms and

conditions therein, to vote its shares of common stock of the

Company to approve the Enghouse Asset Sale at the SeaChange special

meeting of stockholders (the “Special Meeting”).

Termination of the Partner One Acquisition

As previously announced on March 11, April 10

and April 18, 2024, SeaChange had entered into similar agreements,

as amended (the “Partner One Agreements”), with an affiliate of

Partner One, which would acquire substantially all of SeaChange’s

assets related to its product and services business, and would

assume certain liabilities, for a total purchase price of

$34,001,000, less SeaChange’s cash and cash equivalents at closing

(the “Partner One Transaction”).

The Company received an acquisition proposal

from Enghouse, which the Board, in consultation with the Company’s

independent financial and legal advisors, determined in good faith

was a Superior Proposal (as defined in the Partner One Agreements)

compared to the Partner One Transaction. Pursuant to the Partner

One Agreements, Partner One was given three days’ prior written

notice of the Board’s intention to change its recommendation and/or

have the Company terminate the Partner One Agreements, allowing

Partner One the opportunity, if it desired, to make such

adjustments in the terms and conditions of the Partner One

Agreements, so that the new acquisition proposal ceased to

constitute a Superior Proposal.

Partner One notified SeaChange that Partner

One’s acquisition proposal in the Partner One Agreements was its

best and final offer and that Partner One would not be making

adjustments in the terms and conditions of the Partner One

Agreements. Therefore, SeaChange has exercised its right to

terminate the Partner One Agreements on April 23, 2024, and the

termination is effective immediately. Pursuant to the Partner One

Agreements, SeaChange will pay a $1.0 million termination fee to

Partner One in connection with the termination of the Partner One

Agreements upon Closing.

SeaChange Special Meeting of Stockholders and

Proxy Supplement

The Special Meeting was called to order on April

22, 2024, at 10:00 a.m., Eastern Time, and adjourned to provide

SeaChange’s stockholders adequate time to digest supplement

disclosures and the ability to reevaluate previously casts, if

applicable (after previously being similarly adjourned on April 17,

2024). The Board intends to reconvene the Special Meeting on April

26, 2024, at 9:30 a.m., Eastern Time at

www.virtualshareholdermeeting.com/SEAC2024SM to consider, among

other things, a proposal to approve the Enghouse Asset Sale

pursuant to the Enghouse Asset Purchase Agreement. The record date

for the Special Meeting remains March 18, 2024.

On or about March 22, 2024, SeaChange mailed a

proxy statement (the “Original Proxy Statement”) to consider and

vote on proposals relating to the proposed Partner One Transaction.

SeaChange posted on www.proxyvote.com (i) on or about April 11,

2024, a proxy supplement (“Proxy Supplement No.1”) regarding

certain amended terms of the Partner One transaction and (ii) on or

about April 18, 2024, a proxy supplement (“Proxy Supplement No.2”)

regarding certain further amended terms of the Partner One

transaction. Due to the termination of the Partner One Transaction

and the execution of the Enghouse Asset Purchase Agreement,

SeaChange intends to post a new proxy supplement (“Proxy Supplement

No.3” and, together with the Original Proxy Statement, Proxy

Supplement No.1, Proxy Supplement No.2, the “Proxy Statement

Materials”) on www.proxyvote.com on or about April 24, 2024 to all

SeaChange stockholders entitled to vote at the Special Meeting

regarding certain material details of the Enghouse Asset Sale that

differ from the Partner One Transaction. Please carefully read the

Proxy Statement Materials, along with the exhibits attached

thereto, but please note that applicable SeaChange stockholders

should use the proxy card that was previously sent to them with the

Original Proxy Statement. Also, SeaChange stockholders should

please note that Proposal No.1 on the proxy card now refers to the

Enghouse Asset Sale. If SeaChange stockholders have already

delivered a properly executed proxy and do not wish to change their

vote, they do not need to do anything.

Needham & Company, LLC is acting as

exclusive financial advisor to SeaChange in this transaction, and

K&L Gates LLP is acting as legal counsel to SeaChange in this

transaction.

About SeaChange International,

Inc.SeaChange International, Inc. (OTC: SEAC) provides

first-class video streaming, linear TV, and video advertising

technology for operators, content owners, and broadcasters

globally. SeaChange technology enables operators, broadcasters, and

content owners to cost- effectively launch and grow premium linear

TV and direct-to-consumer streaming services to manage, curate, and

monetize their content. SeaChange helps protect existing and

develop new and incremental advertising revenues for traditional

linear TV and streaming services with its unique advertising

technology. SeaChange enjoys a rich heritage of nearly three

decades of delivering premium video software solutions to its

global customer base.

About EnghouseEnghouse Systems

Ltd. is a Canadian publicly traded company (TSX: ENGH) that

provides vertically focused enterprise software solutions focusing

on contact centers, video communications, healthcare,

telecommunications, public safety and the transit market. Enghouse

has a two-pronged growth strategy that focuses on internal growth

and acquisitions, which are funded through operating cash flows.

The company has no external debt financing and is organized around

two business segments: the Interactive Management Group and the

Asset Management Group. For more information, please visit

www.enghouse.com.

Forward-Looking StatementsThis

press release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

In general, forward-looking statements usually may be identified

through use of words such as “may,” “believe,” “expect,”

“anticipate,” “intend,” “will,” “should,” “plan,” “estimate,”

“predict,” “continue”, and “potential,” or the negative of these

terms, or other comparable terminology, and include statements

related the amount of net proceeds SeaChange receives from the

transaction, the timing and logistics of reconvening the Special

Meeting, the timing of the posting of Proxy Supplement No.3 on

www.proxyvote.com, the ability and timing to close the Enghouse

Asset Sale, post-transaction success, and NOLs availability to

offset SeaChange’s tax income in the future. Forward-looking

statements are not historical facts and represent management’s

beliefs, based upon information available at the time the

statements are made, with regard to the matters addressed; they are

not guarantees of future performance. Actual results may prove to

be materially different from the results expressed or implied by

the forward-looking statements. Forward-looking statements are

subject to numerous assumptions, risks, and uncertainties that

change over time that could cause actual results to differ

materially from those expressed in or implied by such statements.

Many of the factors that could cause actual results to differ

materially from those expressed in or implied by forward-looking

statements are beyond the ability of the Company or Enghouse to

control or predict. Stockholders and investors should not place

undue reliance on any forward-looking statements. Any

forward-looking statements speak only as of the date of this press

release, and neither SeaChange nor Enghouse undertakes any

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events, or

otherwise, except as required by law.

Contact:SeaChange International

1.978.897.0100info@schange.com

Source: SeaChange International, Inc.

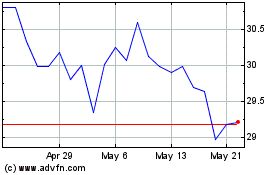

Enghouse Systems (TSX:ENGH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Enghouse Systems (TSX:ENGH)

Historical Stock Chart

From Dec 2023 to Dec 2024