Fairfax India Shareholders Approve One-Time Deviation From Investment Concentration Restriction

January 28 2025 - 4:05PM

Fairfax India Holdings Corporation (“Fairfax India” or the

“Company”) (TSX: FIH.U) is pleased to announce the voting results

from its special meeting of shareholders held on January 28, 2025

(the “

Special Meeting”) in connection with a

proposed one-time deviation from the Company’s investment

concentration restriction set forth in its by-laws (the

“

Investment Concentration Restriction”) in order

to complete the previously announced acquisition of an additional

10% equity interest in Bangalore International Airport Limited (the

“

Additional BIAL Investment”).

The special resolution to approve the one-time

deviation from the Investment Concentration Restriction required

the approval of the holders of multiple voting shares and

subordinate voting shares of the Company, each voting separately as

a class. At the Special Meeting, the special resolution was

approved by (i) 100% of the votes cast by holders of multiple

voting shares, and (ii) approximately 99% of the votes cast by

holders of subordinate voting shares.

Completion of the Additional BIAL Investment

remains subject to receipt of applicable third party consents and

other customary closing conditions. Assuming that the remaining

conditions to closing are satisfied, it is expected that the

Additional BIAL Investment will close in Q1 2025.

About Fairfax India

Fairfax India is an investment holding company

whose objective is to achieve long-term capital appreciation, while

preserving capital, by investing in public and private equity

securities and debt instruments in India and Indian businesses or

other businesses with customers, suppliers or business primarily

conducted in, or dependent on, India.

| For further

information, contact: |

John Varnell,

Vice President, Corporate Affairs |

| |

(416) 367-4755 |

| |

|

This press release may contain forward-looking

statements within the meaning of applicable securities legislation.

Forward-looking statements may relate to the Company’s or an Indian

Investment’s future outlook and anticipated events or results and

may include statements regarding the financial position, business

strategy, growth strategy, budgets, operations, financial results,

taxes, dividends, plans and objectives of the Company.

Particularly, statements regarding future results, performance,

achievements, prospects or opportunities of the Company, an Indian

Investment, or the Indian market are forward-looking statements. In

some cases, forward-looking statements can be identified by the use

of forward-looking terminology such as “plans”, “expects” or “does

not expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates” or “does not anticipate” or

“believes”, or variations of such words and phrases or state that

certain actions, events or results “may”, “could”, “would”,

“might”, “will” or “will be taken”, “occur” or “be achieved”.

Forward-looking statements are based on our

opinions and estimates as of the date of this press release, and

they are subject to known and unknown risks, uncertainties,

assumptions and other factors that may cause the actual results,

level of activity, performance or achievements to be materially

different from those expressed or implied by such forward-looking

statements, including but not limited to the following factors: oil

price risk; geographic concentration of investments; foreign

currency fluctuation; volatility of the Indian securities markets;

investments may be made in foreign private businesses where

information is unreliable or unavailable; valuation methodologies

involve subjective judgments; financial market fluctuations; pace

of completing investments; minority investments; reliance on key

personnel and risks associated with the Investment Advisory

Agreement; disruption of the Company’s information technology

systems; lawsuits; use of leverage; significant ownership by

Fairfax may adversely affect the market price of the subordinate

voting shares; weather risk; taxation risks; emerging markets; MLI;

economic risk; trading price of subordinate voting shares relative

to book value per share risk; and economic disruptions from the

after-effects of the COVID-19 pandemic and the conflicts in Ukraine

and the Middle East. Additional risks and uncertainties are

described in the Company’s annual information form dated March 8,

2024 which is available on SEDAR+ at www.sedarplus.ca and on the

Company’s website at www.fairfaxindia.ca. These factors and

assumptions are not intended to represent a complete list of the

factors and assumptions that could affect the Company. These

factors and assumptions, however, should be considered

carefully.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The Company does not

undertake to update any forward-looking statements contained

herein, except as required by applicable securities laws.

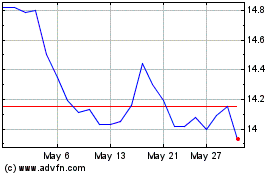

Fairfax India (TSX:FIH.U)

Historical Stock Chart

From Jan 2025 to Feb 2025

Fairfax India (TSX:FIH.U)

Historical Stock Chart

From Feb 2024 to Feb 2025