Fairfax India Announces Intention to Make a Normal Course Issuer Bid

September 26 2024 - 6:55AM

Fairfax India Holdings Corporation (“Fairfax India”) (TSX: FIH.U)

announces that the Toronto Stock Exchange (the “TSX”) has accepted

a notice filed by Fairfax India of its intention to commence a

Normal Course Issuer Bid for its Subordinate Voting Shares through

the facilities of the TSX (or other alternative Canadian trading

systems) effective September 30, 2024. Purchases will be made in

accordance with the rules and policies of the TSX and the

Subordinate Voting Shares purchased by Fairfax India will be

cancelled and/or reserved for share based payment awards.

The notice provides that Fairfax India’s board

of directors has approved the purchase on the TSX, during the

period commencing September 30, 2024 and ending September 29, 2025,

of up to 5,585,509 Subordinate Voting Shares, representing

approximately 10% of Fairfax India’s public float of 55,855,093

Subordinate Voting Shares as at September 16, 2024. As at September

16, 2024, Fairfax India had outstanding 105,152,447 Subordinate

Voting Shares. Under the bid, Fairfax India may purchase up to

7,286 Subordinate Voting Shares on the TSX (or other alternative

Canadian trading systems) during any trading day, which represents

25% of the average daily trading volume on the TSX for the prior

six months (being 29,147 Subordinate Voting Shares), all as

calculated in accordance with the rules of the TSX. This limitation

does not apply to purchases made pursuant to block purchase

exemptions.

Fairfax India is making this Normal Course

Issuer Bid because it believes that in appropriate circumstances

its Subordinate Voting Shares represent an attractive investment

opportunity and that purchases under the bid will enhance the value

of the Subordinate Voting Shares held by the remaining

shareholders.

Pursuant to its existing Normal Course Issuer

Bid, Fairfax India sought and received approval from the TSX to

purchase up to 5,646,788 Subordinate Voting Shares, and has

purchased to date 552,848 Subordinate Voting Shares during the last

twelve months through open market purchases on the TSX and other

alternative Canadian trading systems at a volume weighted average

price per share of US$13.80.

Fairfax India also announces that it has entered

into an automatic share purchase plan (the “ASPP”) with a

designated broker to allow for the purchase of its Subordinate

Voting Shares under its Normal Course Issuer Bid at times when

Fairfax India normally would not be active in the market due to

applicable regulatory restrictions or internal trading black-out

periods. Before the commencement of any particular internal trading

black-out period, Fairfax India may, but is not required to,

instruct its designated broker to make purchases of Subordinate

Voting Shares under the Normal Course Issuer Bid during the ensuing

black-out period in accordance with the terms of the ASPP. Such

purchases will be determined by the broker in its sole discretion

based on parameters established by Fairfax India prior to

commencement of the applicable black-out period in accordance with

the terms of the ASPP and applicable TSX rules. Outside of these

black-out periods, Subordinate Voting Shares will be purchasable by

Fairfax India at its discretion under its Normal Course Issuer

Bid.

The ASPP is effective as of September 30, 2024

and will terminate on the earliest of the date on which: (a) the

maximum annual purchase limit under the Normal Course Issuer Bid

has been reached; (b) the Normal Course Issuer Bid expires; or (c)

Fairfax India terminates the ASPP in accordance with its terms. The

ASPP constitutes an “automatic securities purchase plan” under

applicable Canadian securities laws.

About Fairfax India

Fairfax India is an investment holding company

whose objective is to achieve long term capital appreciation, while

preserving capital, by investing in public and private equity

securities and debt instruments in India and Indian businesses or

other businesses with customers, suppliers or business primarily

conducted in, or dependent on, India.

|

For further information, contact: |

John Varnell, Vice President, Corporate Affairs |

|

|

(416) 367-4755 |

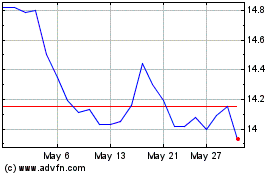

Fairfax India (TSX:FIH.U)

Historical Stock Chart

From Dec 2024 to Jan 2025

Fairfax India (TSX:FIH.U)

Historical Stock Chart

From Jan 2024 to Jan 2025