Freehold Royalties Announces Closing of Strategic Midland Basin Acquisition, Credit Facility Increase and Declares Dividend for December 2024

December 13 2024 - 11:43AM

Freehold Royalties Ltd. (Freehold or the Company) (TSX:FRU) is

pleased to announce that it has closed its previously announced

transaction to acquire mineral title and royalty interests in the

core of the Midland Basin in Texas (the Acquisition or the Acquired

Assets) for approximately $259 million, net of estimates for

exchange rate, expenses and customary closing adjustments.

Acquisition Highlights:

- 1,500 – 1,600 boe/d of premium

priced, light oil weighted production (~950 bbls/d oil)

- Approximately $37 million in 2025E

net royalty revenue (net of production and ad valorem taxes and

assuming US$70/bbl WTI)

- Provides immediate and expected

increasing future accretion on funds flow per share, free cash flow

per share and total production and oil production per share

Dividend Announcement

The board of directors of Freehold has declared

a monthly dividend of $0.09 per share to be paid on January 15,

2025, to shareholders of record on December 31, 2024. The dividend

is designated as an eligible dividend for Canadian income tax

purposes.

Credit Facility Increase

In connection with the Acquisition, Freehold

increased its credit facilities by $50 million to $450 million. The

committed revolving credit facility increased from $380 million to

$430 million while the operating facility remained unchanged at $20

million. The agreement also carries an option to increase the

revolving facility by an additional $50 million, subject to the

consent of the lenders.

Freehold is uniquely positioned as a leading

North American energy royalty company with approximately 6.1

million gross acres in Canada and approximately 1.2 million gross

drilling acres in the United States. Freehold’s common shares trade

on the Toronto Stock Exchange in Canada under the symbol FRU.

For further information

contact

| Freehold

Royalties Ltd. |

|

Todd McBride, CPA, CMAInvestor Relationst. 403.221.0833e.

tmcbride@freeholdroyalties.comw. www.freeholdroyalties.com |

Nick Thomson, CFAInvestor Relationst. 403.221.0874e.

nthomson@freeholdroyalties.comw. www.freeholdroyalties.com |

| |

|

Forward-Looking Statements

This news release offers our assessment of

Freehold’s future plans and operations as at December 13, 2024 and

contains forward-looking information including, without limitation,

forward-looking information with regards to Freehold's estimates

for 2025 production for the Acquired Assets and net royalty revenue

(net of production and ad valorem taxes) for 2025; the expected

attributes and benefits to be derived by Freehold pursuant to the

Acquisition; and the future performance of the Acquired Assets

following the completion of the Acquisition.

This forward-looking information is provided to

allow readers to better understand our business and prospects and

may not be suitable for other purposes. By its nature,

forward-looking information is subject to numerous risks and

uncertainties, some of which are beyond our control, including the

demand for oil and natural gas, general economic conditions,

industry conditions, the impact of the Russia-Ukraine war and the

Israel-Hamas-Hezbollah conflict on the global economy and commodity

prices, volatility of commodity prices, currency fluctuations,

imprecision of reserve estimates, royalties, environmental risks,

taxation, regulation, changes in tax or other legislation,

competition from other industry participants, the lack of

availability of qualified personnel or management, stock market

volatility, our ability to access sufficient capital from internal

and external sources. Risks are described in more detail in

Freehold’s annual information form for the year ended December 31,

2023 which is available under Freehold’s profile on SEDAR+ at

www.sedarplus.ca.

With respect to forward looking information

contained in this press release including relating to the 2025

forecast production and 2025 royalty revenue from the Acquired

Assets, we have made assumptions regarding, among other things;

future oil and natural gas prices (for the purposes of the

estimates in this press release we have assumed a West Texas

Intermediate price of US$70/barrel of oil and a NYMEX natural gas

price of US$3.30/MMbtu); future exchange rates (for the purposes of

the estimates in this press release we have assumed an exchange

rate of US$1.00 for every CDN$1.40); that drilled uncompleted wells

will be completed in the short term and brought on production; that

wells that have been permitted will be drilled and completed within

a customary timeframe; expectations as to additional wells to be

permitted, drilled, completed and brought on production in 2024 and

2025 based on Freehold's review of the geology and economics of the

plays associated with the Acquired Assets; expected production

performance of wells to be drilled and/or brought on production in

2024 and 2025; the ability of our royalty payors to obtain

equipment in a timely manner to carry out development activities;

the ability and willingness of royalty payors to fund development

activities relating to the Acquired Assets; and such other

assumptions as are identified herein. You are cautioned that the

assumptions used in the preparation of such information, although

considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on

forward looking information. We can give no assurance that any of

the events anticipated will transpire or occur, or if any of them

do, what benefits we will derive from them. The forward-looking

information contained herein is expressly qualified by this

cautionary statement. To the extent any guidance or forward-looking

statements herein constitute future-oriented financial information

or financial outlook, they are included herein to provide readers

with an understanding of management's plans and assumptions for

budgeting purposes and readers are cautioned that the information

may not be appropriate for other purposes and is prepared as of the

date hereof. Our policy for updating forward-looking statements is

to update our key operating assumptions quarterly and, except as

required by law, we do not undertake to update any other

forward-looking statements. You are further cautioned that the

preparation of financial statements in accordance with

International Financial Reporting Standards requires management to

make certain judgments and estimates that affect the reported

amounts of assets, liabilities, revenues, and expenses. These

estimates may change, having either a positive or negative effect

on net income, as further information becomes available and as the

economic environment changes.

Currency

All references in this press release to dollar

amounts are to Canadian dollars unless otherwise indicated.

Conversion of Natural Gas to Barrels of

Oil Equivalent (BOE)

To provide a single unit of production for

analytical purposes, natural gas production and reserves volumes

are converted mathematically to equivalent barrels of oil (boe). We

use the industry-accepted standard conversion of six thousand cubic

feet of natural gas to one barrel of oil (6 Mcf = 1 bbl). The 6:1

boe ratio is based on an energy equivalency conversion method

primarily applicable at the burner tip. It does not represent a

value equivalency at the wellhead and is not based on either energy

content or current prices. While the boe ratio is useful for

comparative measures and observing trends, it does not accurately

reflect individual product values and might be misleading,

particularly if used in isolation. As well, given that the value

ratio, based on the current price of crude oil to natural gas, is

significantly different from the 6:1 energy equivalency ratio,

using a 6:1 conversion ratio may be misleading as an indication of

value.

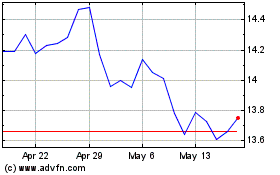

Freehold Royalties (TSX:FRU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Freehold Royalties (TSX:FRU)

Historical Stock Chart

From Dec 2023 to Dec 2024