Medexus Pharmaceuticals (

Medexus) (TSX: MDP)

(OTCQX: MEDXF) today announced its operating and financial

results and provided a business update for the company’s first

fiscal quarter ended June 30, 2022. All dollar amounts in this

press release are in United States dollars unless specified

otherwise.

Financial Highlights

- Delivered record

total revenue of $23.0 million in fiscal Q1 2023, an

increase of 33% compared to $17.3 million in

fiscal Q1 2022 and an increase of 13% compared to

$20.3 million in fiscal Q4 2022. This represents the

strongest fiscal Q1 in Medexus’s history. Primary drivers for the

$5.7 million increase over fiscal Q1 2022 were an

increase in net sales of IXINITY and recognition of a portion of

revenue from Gleolan sales in the United States.

- Achieved

Adjusted EBITDA* of $1.9 million in fiscal Q1 2023

compared to $(4.9) million in fiscal Q1 2022 and

$1.1 million in fiscal Q4 2022. Organic increases in product

revenue, a reduction in research & development costs, and

recognition of a portion of revenue from Gleolan sales in the

United States were the primary drivers of the $6.8 million

increase over fiscal Q1 2022. Medexus achieved this

Adjusted EBITDA increase while continuing to maintain appropriate

investments in preparations for a commercial launch of treosulfan

in the United States.

- Yielded

operating profit of $0.0 million in fiscal Q1 2023, a

$7.2 million improvement compared to operating loss of

$7.2 million in fiscal Q1 2022.

- Produced net

loss of $1.4 million in fiscal Q1 2023, a

$5.2 million improvement compared to $6.6 million in

fiscal Q1 2022.

- Generated

Adjusted Net Loss* of $3.6 million in

fiscal Q1 2023, a $6.2 million improvement compared

to $9.8 million in fiscal Q1 2022.

- Held cash and

cash equivalents of $7.3 million (with $8.7 million of

total available liquidity) at end of fiscal Q1 2023.

* Refer to “Non-GAAP Measures” at the

end of this press release for information about Adjusted EBITDA and

Adjusted Net Income (Loss).

Ken d’Entremont, Chief Executive Officer of

Medexus, commented, “We are proud to announce the strongest fiscal

Q1 in our company’s history driven by a strong base business and

complemented by initial revenues generated through our license

agreement for Gleolan in the U.S. We anticipate completing our

transition to full commercial responsibility for Gleolan within the

current quarter and will begin to report Gleolan net sales in our

revenues starting at that time. So far Gleolan sales have performed

to our expectations, and we are excited about Gleolan’s

contribution to growing our revenues over the coming quarters.”

Mr d’Entremont continued, “We are also moving

forward with treosulfan. In July 2022, our partner medac

resubmitted the treosulfan NDA to the FDA. If the response is

considered complete by the FDA, a subsequent FDA approval will

allow for the commercial launch of treosulfan in the U.S. in the

first half of calendar year 2023. If approved, Treosulfan is

expected to significantly contribute to our sustained overall

growth in the years ahead.”

Operational Highlights

Operational highlights for the three-month

period ended June 30, 2022 and subsequent period include:

-

IXINITY: Pharmacy and wholesale customers have now

returned to normal buying patterns that are better aligned with

patient unit demand. This contributed to an increase in IXINITY

product revenue over fiscal Q1 2022. Medexus also

continues to invest in an ongoing initiative to improve the IXINITY

manufacturing process. Medexus expects the resulting operational

efficiencies to improve IXINITY gross margins over the coming

quarters.

-

Rupall: Increasingly severe allergy seasons across

Canada and successful sustained execution of sales and marketing

initiatives yielded continued strong growth in Rupall sales in

fiscal Q1 2023, with unit demand growth of 22% for the

12 months ended June 30, 2022. (Source: IQVIA CDH units –

Drugstores and hospitals purchases, MAT March 2022.) This

performance continues to position Rupall as one of the

fastest-growing antihistamines in the Canadian prescription

market.

-

Rasuvo: Unit demand increased in the

12 months ended June 30, 2022. (Source: Symphony Sub National

6/30/2022 Data & Chargebacks, PAP.) However, increasing

competition in the U.S. branded methotrexate market continue

to negatively affect Rasuvo product-level revenue. Medexus has

implemented effective unit-level price reductions to defend its

strong market position.

-

Gleolan: In March 2022, Medexus acquired the

exclusive right to commercialize Gleolan in the United States.

Gleolan sales during the ongoing transition period, including

fiscal Q1 2023, have been in line with expectations, and

Medexus recognized a portion of net sales in its revenue

accordingly. Transition of commercialization responsibility to

Medexus under the license agreement continues to go well, and

Medexus expects to complete this process in full in the current

quarter. This will result in Medexus having full responsibility for

commercializing Gleolan in the United States, which will therefore

allow Medexus to begin fully recognizing product revenue within

fiscal Q2 2023.

-

Treosulfan: In July 2022, medac, a strategic

partner of Medexus, resubmitted its NDA for treosulfan with the

FDA. The resubmission included updates to data files and supporting

information in response to the FDA’s information request received

in May 2022. The review clock for the FDA’s review of the NDA

resubmission will then start if and when the response is considered

complete by the FDA. In addition, in August 2022, Medexus and medac

signed an amendment to their February 2021 license agreement for

treosulfan. The amendment extends the payment date for regulatory

milestones triggered by an FDA approval to October 2023, which

therefore allows Medexus to launch and begin commercialization well

before these license payments must be paid.

Additional Information

Medexus’s financial statements and management’s

discussion and analysis for the first fiscal quarter ended

June 30, 2022 are available on Medexus’s corporate website at

www.medexus.com and in the company’s corporate filings on SEDAR at

www.sedar.com.

Conference Call Details

Medexus will host a conference call at 8:00 AM

Eastern Time on Tuesday, August 9, 2022, to discuss the

company’s operating and financial results and corporate updates for

fiscal Q1 2023.

To participate in the call, please dial the

following numbers:

888-506-0062 (toll-free)

for Canadian and U.S. callers+1 973-528-0011 for international

callers

Access code: 379918

A live webcast of the call will be available on

the Investors—News & Events—IR Calendar section of Medexus’s

corporate website or at the following link:

https://www.webcaster4.com/Webcast/Page/2010/46315

A replay of the call will be available

approximately one hour following the end of the call through

Tuesday, August 16, 2022. To access the replay, please dial

the following numbers:

877-481-4010 for

Canadian and U.S. callers+1 919-882-2331 for international

callers

Conference ID: 46315

A replay of the webcast will be available on the

Investors—News & Events—IR Calendar section of Medexus’s

corporate website until Wednesday, August 9, 2023.

About Medexus

Medexus is a leader in innovative rare disease

treatment solutions with a strong North American commercial

platform and a portfolio of proven best-in-class products. Our

current focus is on the therapeutic areas of hematology,

auto-immune diseases, and allergy. We continue to build a highly

differentiated company with a growing portfolio of innovative and

high-value orphan and rare disease products that will underpin our

growth for the next decade.

Our current leading products are Rasuvo™ and

Metoject®, a unique formulation of methotrexate (auto-pen and

pre-filled syringe) designed to treat rheumatoid arthritis and

other auto-immune diseases; IXINITY®, an intravenous recombinant

factor IX therapeutic for use in patients 12 years of age

or older with Hemophilia B (a hereditary bleeding disorder

characterized by a deficiency of clotting factor IX in the

blood, which is necessary to control bleeding); and Rupall®, an

innovative prescription allergy medication with a unique mode of

action. We also hold exclusive US and Canadian rights to

commercialize Gleolan™ (aminolevulinic acid hydrochloride or

ALA HCl), an FDA-approved, orphan drug designated optical

imaging agent currently indicated in patients with glioma

(suspected World Health Organization Grades III or IV on

preoperative imaging) as an adjunct for the visualization of

malignant tissue during surgery.

We have also licensed treosulfan, part of a

preparative regimen for allogeneic hematopoietic stem cell

transplantation to be used in combination with fludarabine, for

commercialization in the United States and Canada. Treosulfan was

approved by Health Canada in June 2021 and is marketed in

Canada as Trecondyv®. Treosulfan is currently the subject of a

regulatory review process with the U.S. Food and Drug

Administration.

Our mission is to provide the best healthcare

products to healthcare professionals and patients. We strive to

deliver on this mission by acting on our core values: Quality,

Innovation, Customer Service, and Collaboration.

Contacts

For more information, please contact any of the

following:

Medexus

Ken d’Entremont, Chief Executive OfficerMedexus

PharmaceuticalsTel: 905-676-0003Email:

ken.dentremont@medexus.com

Marcel Konrad, Chief Financial OfficerMedexus

PharmaceuticalsTel: 312-548-3139Email:

marcel.konrad@medexus.com

Investor Relations

Victoria RutherfordAdelaide CapitalTel:

1-480-625-5772Email: victoria@adcap.ca

Forward-Looking Statements

Certain statements made in this press release

contain forward-looking information within the meaning of

applicable securities laws (forward-looking

statements). The words “anticipates”, “believes”,

“expects”, “will”, “plans”, “potential”, and similar words or

expressions are often intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. Specific forward-looking statements

contained in this news release include, but are not limited to,

statements regarding Medexus’s business strategy or outlook and

future growth plans, expectations regarding future financial or

operating performance (including with respect to the expected

benefits of improvements made to the IXINITY manufacturing process

and expected results from sales of Gleolan in the United States),

ability to obtain FDA approval for treosulfan, the timing of

treosulfan launch in the United States, and competitive position of

and anticipated trends and challenges in the company’s business and

the markets in which it operates. These statements are based on

factors or assumptions that were applied in drawing a conclusion or

making a forecast or projection, including assumptions based on

historical trends, current conditions and expected future

developments. Since forward-looking statements relate to future

events and conditions, by their very nature they require making

assumptions and involve inherent risks and uncertainties. Medexus

cautions that although it is believed that the assumptions are

reasonable in the circumstances, these risks and uncertainties give

rise to the possibility that actual results may differ materially

from the expectations set out in the forward-looking statements.

Material risk factors include those set out in Medexus’s materials

filed with the Canadian securities regulatory authorities from time

to time, including Medexus’s most recent annual information form

and management’s discussion and analysis; future capital

requirements and dilution; intellectual property protection and

infringement risks; competition (including potential for generic

competition); reliance on key management personnel; Medexus’s

ability to implement its business plan; Medexus’s ability to

leverage its U.S. and Canadian infrastructure to promote additional

growth; regulatory approval by relevant health authorities,

including the FDA; product reimbursement by third party payers;

litigation or expiry with respect to patents or other intellectual

property rights; litigation risk; stock price volatility;

government regulation; and potential third party claims. Given

these risks, undue reliance should not be placed on these

forward-looking statements, which are made only as of the date

hereof. Other than as specifically required by law, Medexus

undertakes no obligation to update any forward-looking statements

to reflect new information, subsequent or otherwise.

Trademarks and trade names

This press release contains references to

trademarks and service marks, including those belonging to other

companies, persons, or entities. Solely for convenience, trademarks

and trade names referred to in this document may appear without the

“®” or “™” symbols. Each such reference should be read as though it

appears with the relevant symbol. Any such references are not

intended to indicate, in any way, that the holder or holders of the

relevant intellectual property rights will not assert, to the

fullest extent under applicable law, its rights to these trademarks

and trade names.

Non-GAAP measures

Company management uses, and this press release

refers to, financial measures that are not recognized under IFRS

and do not have a standard meaning prescribed by generally accepted

accounting principles (GAAP) in accordance with

IFRS or other financial or accounting authorities (non-GAAP

measures). These non-GAAP measures may include “non-GAAP

financial measures” and “non-GAAP ratios” (each defined in National

Instrument 52-112, Non-GAAP and Other Financial Measures

Disclosure). Medexus’s method for calculating these measures may

differ from methods used by other companies and therefore these

measures are unlikely to be comparable to similarly-designated

measures used or presented by other companies.

In particular, management uses Adjusted Net

Income (Loss) and Adjusted EBITDA as measures of Medexus’s

performance. Adjusted Net Income (Loss), EBITDA (earnings before

interest, taxes, depreciation, and amortization) and Adjusted

EBITDA are non-GAAP financial measures. In addition, Adjusted Net

Income (Loss) may be presented on a per share basis.

An explanation and discussion of each of these

non-GAAP measures, including their limitations, is set out under

the heading “Preliminary Notes—Non-GAAP measures” in Medexus’s most

recent management’s discussion and analysis. A reconciliation of

each of these non-GAAP measures to the most directly comparable

IFRS measure can be found under the heading “Reconciliation of

Adjusted Net Income (Loss) and Adjusted EBITDA to Net Income

(Loss)” below.

Reconciliation of Adjusted Net Income

(Loss) and Adjusted EBITDA to Net Income (Loss)

The following tables are derived from and should

be read together with Medexus’s consolidated statement of

operations for the three-month period ended June 30, 2022. This

supplementary disclosure is intended to more fully explain

disclosures related to Adjusted Net Income (Loss) and Adjusted

EBITDA and provides additional information related to Medexus’s

operating performance. However, Medexus’s non-GAAP measures have

limitations as analytical tools and should not be considered in

isolation or as a substitute for analysis of Medexus’s financial

information as reported under IFRS.

|

(Amounts in $ ’000s) |

|

|

|

For the three-month period ended June 30 |

2022 |

|

2021 |

|

|

Net loss |

(1,398 |

) |

(6,587 |

) |

|

Add back: |

|

|

|

Unrealized gain on fair value of derivatives |

(2,239 |

) |

(3,246 |

) |

|

Adjusted net income (loss) |

(3,637 |

) |

(9,833 |

) |

|

(Amounts in $ ’000s) |

|

|

For the three-month period ended June 30 |

2022 |

|

2021 |

|

|

Net loss |

(1,398 |

) |

(6,587 |

) |

|

Add back: |

|

|

|

Depreciation and amortization (property, equipment, intangible

assets) |

1,542 |

|

1,579 |

|

|

Interest expense |

3,149 |

|

2,884 |

|

|

Income tax recovery |

(154 |

) |

- |

|

|

EBITDA |

3,139 |

|

(2,124 |

) |

|

Add back: |

|

|

|

Share-based compensation |

303 |

|

671 |

|

|

Transaction fees |

28 |

|

- |

|

|

Foreign exchange loss (gain) |

675 |

|

(213 |

) |

|

Unrealized loss (gain) on fair value of derivatives |

(2,239 |

) |

(3,246 |

) |

|

Adjusted EBITDA |

1,906 |

|

(4,912 |

) |

|

|

|

|

|

|

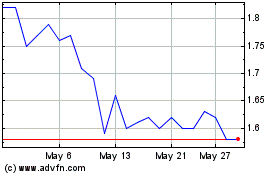

Medexus Pharmaceuticals (TSX:MDP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Medexus Pharmaceuticals (TSX:MDP)

Historical Stock Chart

From Jan 2024 to Jan 2025