Mandalay Resources Corporation ("Mandalay" or the "Company") (TSX:

MND, OTCQB: MNDJF) announces updated Mineral Reserves and Resources

for the Costerfield gold-antimony mine in Australia and the

Björkdal gold mine in Sweden as at December 31, 2024. All dollar

amounts in this press release are in U.S. dollars unless otherwise

noted.

Consolidated Highlights

-

Total Mineral Reserves of 815,000 gold equivalent ounces1, a 9%

increase net of depletion.

-

Total Mineral Measured and Indicated Resources of 1.97 million gold

equivalent ounces2, a 14% increase net of depletion.

Costerfield Highlights

-

Substantially replaced Mineral Reserves:

-

604,000 tonnes at 8.7 g/t gold and 1.8% antimony for 168,000 gold

ounces and 11,000 tonnes of antimony.

-

Equivalent to 254,000 gold equivalent ounces at a grade of 13.1

g/t1.

-

True Blue deposit experienced nearly a four times growth in gold

equivalent ounces within Inferred Resources, reinforcing its

potential as the next mineable deposit:

-

145,000 tonnes at 13.1 g/t gold and 3.1% antimony for 61,000 gold

ounces and 4,500 tonnes of antimony

-

Equivalent to 96,000 gold equivalent ounces at a grade of 22.6

g/t2.

Björkdal Highlights

-

Expansion of the extensive mineral system increased mine life to 10

years:

-

Increase of Mineral Reserves more than doubles 2024 depletion.

-

125,600 gold ounces were added at a cost of $33 per ounce.

-

Exploration success at Storheden and Norrberget with growing

Inferred Resources strengthening the pipeline of potential mineral

inventory:

-

11.7 million tonnes of combined Inferred Resources, containing

564,000 gold ounces.

_______________________________________________1 Using Mineral

Reserve metal prices (see notes of Table 2)2 Using Mineral Resource

metal prices (see notes of Table 1)

Chris Davis, Vice President of Exploration and Operational

Geology, commented:

"The exploration success at Costerfield and

Björkdal highlights the exceptional potential of our assets. The

rapid expansion of the True Blue deposit at Costerfield and the

continued Resource development at Björkdal reinforce our confidence

in the future growth of our operations. We are excited to build on

these achievements and further expand our resource base in the

coming years."

Group Mineral Resource and Mineral Reserve

Summary

Table 1: Group Mineral Resources as of December 31,

2024

|

Asset |

Resource Category |

Inventory (kt) |

Gold Grade (g/t) |

Antimony Grade (%) |

Contained Gold (koz) |

Contained Antimony (kt) |

Gold Equivalent Grade (g/t) |

Contained Gold Equivalent (koz) |

|

Costerfield |

Measured |

455 |

12.9 |

3.3 |

188 |

15.1 |

20.7 |

303 |

|

Indicated |

741 |

5.5 |

2.0 |

132 |

15.0 |

10.3 |

246 |

|

Björkdal |

Measured |

1,097 |

2.6 |

- |

91 |

- |

2.6 |

91 |

|

Indicated |

19,663 |

2.1 |

- |

1,331 |

- |

2.1 |

1,331 |

|

Group Measured and Indicated |

|

|

1,742 |

30.1 |

|

1,971 |

|

Costerfield |

Inferred |

538 |

7.5 |

1.8 |

130 |

9.7 |

11.8 |

204 |

|

Björkdal |

Inferred |

11,709 |

1.5 |

- |

564 |

- |

1.5 |

564 |

|

Group Inferred |

|

|

|

694 |

9.7 |

|

768 |

| Notes: |

|

|

1. |

The equivalency is calculated by multiplying the contained antimony

by an antimony price of $19,000/t and dividing by a gold price of

$2,500/oz. This is then added to the contained gold for a contained

gold equivalent. |

| |

2. |

The gold equivalent grade is calculated by multiplying the

contained gold equivalent by 31.1025 then dividing by the Inventory

tonnes. |

| |

3. |

Further detail can be found in tables 3 and 5. |

Table 2: Group Mineral Reserves as of December 31,

2024

|

Asset |

Reserve Category |

Inventory (kt) |

Gold Grade (g/t) |

Antimony Grade (%) |

Contained Gold (koz) |

Contained Antimony (kt) |

Gold Equivalent Grade (g/t) |

Contained Gold Equivalent (koz) |

|

Costerfield |

Proven |

350 |

10.8 |

1.9 |

121 |

6.8 |

15.4 |

173 |

|

Probable |

253 |

5.9 |

1.7 |

48 |

4.3 |

9.9 |

81 |

|

Björkdal |

Proven |

956 |

1.5 |

- |

47 |

- |

1.5 |

47 |

|

Probable |

12,727 |

1.3 |

- |

516 |

- |

1.3 |

516 |

|

Group Proven and Probable |

|

|

732 |

11.1 |

|

817 |

| Notes: |

|

|

4. |

The equivalency is calculated by multiplying the contained antimony

by an antimony price of $16,000/t and dividing by a gold price of

$2,100/oz. This is then added to the contained gold for a contained

gold equivalent. |

| |

5. |

The gold equivalent grade is calculated by multiplying the

contained gold equivalent by 31.1025 then dividing by the Inventory

tonnes. |

| |

6. |

Further detail can be found in tables 4 and 6. |

Details of the Mineral Resources and Reserves

estimates at each property are related below. Estimates were

prepared or verified by the following independent third parties:

SLR Consulting Ltd. (“SLR”) at Björkdal; and SRK Consulting.

(“SRK”) at Costerfield.

The year-end 2024 estimates of Mineral Resources

and Reserves for the Costerfield and Björkdal will be fully

documented in independent Technical Reports prepared in accordance

with National Instrument 43-101 (“NI 43-101”) to be filed

on www.sedarplus.com and the Mandalay

website www.mandalayresources.com within 45 days of this

press release.

Costerfield Mineral Resource and Mineral Reserve

Summary

During 2024, at Costerfield, Mandalay drilled a

total of 49.4 kilometres (“km”) of exploration diamond core at a

cost of $9.6 million USD. The breakdown of this significant

drilling campaign is as follows:

- 9.8 km to test extensions of the Youle, Shepherd and Kendall

ore bodies

- 26.7 km to test other near-mine targets; and

- 12.9 km to test other regional targets outside current mining

operations

The 12.9 km of regional testing included 8.9 km

drilling on the nearby True Blue deposit located approximately 2 km

north west from the current Youle workings. The Inferred Resource

at True Blue increased >300% in 2024, with the quartz-stibnite

lode extended along dip and strike. This lode is hosted in the

Costerfield siltstone (which also hosts all other current Resources

at Costerfield) and is akin to those seen in the Augusta and

Cuffley orebodies mined from 2008 to 2018. Gold is also hosted

within these veins, typically within the quartz.

In addition to drilling, 2,411 m of on-vein

development was completed dominantly on the Shepherd ore body. Rock

chip samples used in mine grade control were also included in the

geological database and used in the Mineral Resources estimation

process to improve Mineral Resources classification in areas

accessed by development.

Drill core was logged and sampled by Costerfield

geologists, who also performed mine sampling. All samples were

submitted to Onsite Laboratory Services in Bendigo, Victoria,

Australia for sample preparation and assay. Site geological and

metallurgical personnel have implemented a QA/QC process that

includes the regular submission of site specific and externally

sourced standard reference materials, duplicates and blanks with

drill and face samples submitted for assay. Site specific standard

reference materials were both produced and certified by ORE

Research and Exploration Pty Ltd. (OREAS). OREAS is an Australian

consultancy who specializes in laboratory quality control

systems.

The acQuire Geoscientific Information Management

(“GIM”) system was used to store and validate all geological data

used for the Mineral Resource Estimate. A two-dimensional (“2D”)

accumulation estimation method was used for all models. This method

is considered most applicable for the narrow veins of Costerfield.

The Datamine™ Studio RM platform supports 2D accumulation

estimation and was used to complete the Mineral Resource

Estimation. Validated drilling and mine sampling data were imported

into Datamine and composited to full intersection width. Gold

accumulation, antimony accumulation (accumulation = vein true width

x vein grade) and vein true width were estimated into a 2D block

model for each lode using ordinary kriging interpolation in zones

of high data density, and inverse distance in a limited number of

inferred, exploration areas. Gold and antimony grades were

back-calculated using the estimated accumulated data and vein true

width.

Where vein true widths are less than 1.2 m, vein

grades were diluted to a minimum mining width of 1.2 m using

dilution grades of zero g/t gold and zero percent antimony for host

lithologies. Where vein true widths are greater than or equal to

1.2 m grades were not diluted.

Mineral Resources were reported above a cut-off

of 4.3 g/t gold equivalent (“AuEq”) which was determined using

Costerfield’s 2024 production costs, and using a gold price of

$2,500/oz, and an antimony price of $19,000/t. Cut-off grade is

expressed as AuEq to allow for the inclusion and expression of the

secondary metal (Sb) in terms of the primary metal (Au). AuEq is

calculated using the formula AuEq = Au + (Sb x 2.39) where Sb is

expressed as a percentage, and Au is in grams per tonne, both based

on 1.2 m diluted grades.

Table 3: Mineral Resources at Costerfield, Inclusive of

Mineral Reserves as of December 31, 2024

|

Category |

Inventory (kt) |

Gold Grade (g/t) |

Antimony Grade (%) |

Contained Gold (koz) |

Contained Antimony (kt) |

| Measured (Underground) |

412 |

13.6 |

3.6 |

180 |

14.8 |

| Measured (Stockpile) |

43 |

5.7 |

0.8 |

8 |

0.3 |

|

Indicated |

741 |

5.5 |

2.0 |

132 |

15.0 |

|

Total Measured + Indicated |

1,197 |

8.3 |

2.5 |

320 |

30.2 |

|

Inferred (Underground) |

392 |

5.5 |

1.3 |

69 |

5.2 |

|

Inferred (True Blue) |

145 |

13.1 |

3.1 |

61 |

4.5 |

|

Total Inferred |

538 |

7.5 |

1.8 |

130 |

9.7 |

| Notes: |

|

|

7. |

The Mineral Resource is estimated as of December 31, 2024 with

depletion through to this date. |

| |

8. |

The Mineral Resource is stated according to CIM guidelines and

include Mineral Reserves. |

| |

9. |

Tonnes are rounded to the nearest thousand; contained gold (oz) is

rounded to the nearest thousand; contained antimony (t) is rounded

to nearest hundred. |

| |

10. |

Totals may appear different from the sum of their components due to

rounding. |

| |

11. |

4.3 g/t AuEq cut-off grade over a minimum mining width of 1.2 m is

applied where AuEq is calculated using the formula: AuEq = Au g/t +

2.39 * Sb % |

| |

12. |

The AuEq factor of 2.39 is calculated at a gold price of $2,500/oz,

an antimony price of $19,000/t, and recoveries of 91% for Au and

92% for Sb. |

| |

13. |

Veins were diluted to a minimum mining width of 1.2m before

applying the cut-off grade and peripheral mineralisation far from

current development was excluded to comply with the Reasonable

Prospects for Eventual Economic Extraction (RPEEE) criteria. |

| |

14. |

The Stockpile Mineral Resource is estimated based upon surveyed

volumes supplemented by production data. |

| |

15. |

Geological modelling, sample compositing and Mineral Resource

Estimation for updated models was performed by Joshua Greene,

MAusIMM, a full-time employee of Mandalay Resources. |

| |

16. |

The Mineral Resource Estimate was independently reviewed and

verified by Cael Gniel MAIG RPGeo (Mineral Resource Estimation), an

employee of SRK Consulting. Mr Gniel fulfils the requirements to be

a "Qualified Person" for the purposes of NI 43-101, and is the

Qualified Person under NI 43-101 for the Mineral Resource

Estimate. |

The Measured and Indicated categories of Mineral

Resource were used to update the mine plan using predominantly a

long-hole stoping mining method with cemented rock fill. A

sustaining cut-off grade of 5.6 g/t AuEq was determined from

Costerfield’s 2024 production costs, and minimum stoping width of

1.5 m were used, with planned and unplanned dilution at zero grade

for both Au and Sb. An incremental cut-off grade of 3.2 g/t AuEq

was applied where incremental mining conditions were met. AuEq

grade for the Mineral Reserve is calculated using commodity prices

of $2,100/oz for Au, and $16,000/t Sb. AuEq is calculated using the

formula AuEq= Au + (Sb x 1.58) where Sb is in % and Au is in grams

per tonne. Financial viability of Proven and Probable Mineral

Reserves was demonstrated at metal prices of $2,100/oz Au and

$16,000/t Sb.

Table 4: Mineral Reserves at

Costerfield as of December 31, 2024

|

Category |

Inventory (kt) |

Gold Grade (g/t) |

Antimony Grade (%) |

Contained Gold (koz) |

Contained Antimony (kt) |

| Proven

Reserve |

|

|

|

|

|

| Underground |

307 |

11.4 |

2.1 |

113 |

6.5 |

|

Stockpile |

43 |

5.7 |

0.8 |

8 |

0.3 |

|

Probable Reserve |

|

|

|

|

|

|

Underground |

253 |

5.9 |

1.7 |

48 |

4.3 |

|

Total Proven and Probable |

604 |

8.7 |

1.8 |

168 |

11.1 |

| Notes: |

|

|

1 |

The Mineral Reserve is estimated as of December 31, 2024, and

depleted for production through to December 31, 2024. |

| |

2 |

Tonnes are rounded to the nearest thousand; contained gold (oz) is

rounded to the nearest thousand; contained antimony (t) is rounded

to nearest hundred. |

| |

3 |

Totals may appear different from the sum of their components due to

rounding. |

| |

4 |

Lodes have been diluted to a minimum mining width of 1.5 m for

stoping and 1.8 m for ore development. |

| |

5 |

A sustaining cut-off grade of 5.6 g/t AuEq is applied. An

operational cut-off grade of 3.2 g/t AuEq is applied where mining

rates do not meet mill capacity and the life of the mine is not

extended. |

| |

6 |

Commodity prices applied are Au price of USD 2,100/oz, Sb price of

USD 16,000/t and exchange rate USD:AUD of 0.68. |

| |

7 |

AuEq is calculated using the formula: AuEq = Au g/t + 1.58 * Sb

%. |

| |

8 |

The Mineral Reserve is a subset, a Measured and Indicated only

schedule, of a Life of Mine plan that includes mining of Measured,

Indicated and Inferred Resources. |

| |

9 |

The Mineral Reserve Estimate was prepared by Vaughn Goyne AAusIMM,

who is a full-time employee of Mandalay Resources. The Mineral

Reserve Estimate was independently verified by Robert Urie FAusIMM

who is a full-time employee of SRK Consulting. Robert Urie fulfils

the requirements to be a “Qualified Person” for the purposes of NI

43-101, and is the Qualified Person under NI 43-101 for the Mineral

Reserve. |

The net decrease of 19,900 ounces of gold in

Proven and Probable Mineral Reserves for 2024, relative to 2023,

consists of the addition of 34,800 ounces of gold added by Mineral

Resource conversion across the Costerfield Operation and a total of

54,800 ounces of gold depleted or sterilized from the 2023 Mineral

Reserves through mining production or mining re-evaluation in 2024.

The 480 tonnes of antimony net increase in Proven and Probable

Mineral Reserves consists of 3,400 tonnes of antimony added by

Mineral Resources conversion across the Costerfield Operation and

3,110 tonnes of antimony depleted or sterilized from the 2023

Mineral Reserves through mining production or mining re-evaluation

in 2024.

Björkdal Mineral Resource and Mineral Reserve

Summary

Since the completion of the year-end 2022

Mineral Resource estimate, additional drill holes were completed

within the Bjorkdal mine focusing on the Eastern Extension area,

Aurora and a newly discovered area called North Zone Below Marble

which is a northward continuation of the Bjorkdal system.

Additional drilling was also completed at the Storheden and

Norrberget deposits which are approximately 1 km and 4 km

respectively to the east of the Bjorkdal mine. The year-end 2024

Mineral Resource estimate incorporates the results of the new

drilling information comprising 41,427 m at Bjorkdal and 16,083 m

across regional targets over the two years. In addition,

underground operations included 10,832 m of on-vein development

during 2023 and 2024, which was mapped and sampled in detail

according to the grade control protocols.

Other than the normal course updating of the

mineralization wireframes to account for new drilling and sampling

information, the workflow and estimation parameters used to prepare

the year-end 2024 Björkdal long-term block model were largely

unchanged.

The reporting cut-off grades for the Mineral

Resource and Mineral Reserve statement were modified to reflect

higher gold prices and more favourable exchange rates compared to

previous estimates. The net effect is a significantly lower cut-off

grade, which adds low-grade material to the open pit Mineral

Resources. These are detailed in the notes section of the

tables.

Updated operational costs and input parameters,

based upon Q1 to Q3 2024 actual figures and the 2025 budget, were

used in the Mineral Reserve estimation process.

The Mineral Resource estimates are presented in

Table 3. The Mineral Reserve estimates are presented in Table

4.

Table 5:

Björkdal Mineral Resource

Estimate, Inclusive of Mineral Reserves, as of December 31,

2024

|

Category |

Area |

Inventory(kt) |

Gold Grade(g/t) |

Contained Gold (koz) |

|

Measured |

|

|

|

|

| |

Björkdal Underground |

1,097 |

2.57 |

91 |

| Indicated |

|

|

|

|

| |

Björkdal Underground |

13,792 |

2.41 |

1,069 |

| |

Björkdal Open Pit |

4,130 |

1.61 |

213 |

| |

Norrberget Open Pit |

221 |

2.76 |

20 |

|

|

Stockpiles |

1,520 |

0.59 |

29 |

|

Total Measured + Indicated |

20,760 |

2.13 |

1,421 |

|

Inferred |

|

|

|

|

| |

Björkdal Underground |

3,178 |

2.11 |

216 |

| |

Storheden Underground |

1,769 |

1.74 |

99 |

| |

Björkdal Open Pit |

6,666 |

1.09 |

233 |

|

|

Norrberget Open Pit |

96 |

5.36 |

17 |

|

Total Inferred |

|

11,709 |

1.50 |

564 |

Notes:

-

Björkdal Mineral Resources are estimated using drill hole and

sample data as of September 30, 2024, and depleted for production

through December 31, 2024. Norrberget Mineral Resources are based

on a data cut-off date of September 30, 2024.

-

CIM (2014) definitions and the 2019 CIM Estimation of Mineral

Resources and Mineral Reserves Best Practice Guidelines were

followed for Mineral Resources.

-

Mineral Resources are inclusive of Mineral Reserves.

-

Mineral Resources are estimated using an average gold price of

$2,500/oz and an exchange rate of 10.35 SEK/US$.

-

Bulk density is 2.74 t/m3 for veins and host rock. Bulk density is

2.92 t/m3 for skarn ore bodies.

-

High gold assays were capped to 30 g/t Au for the Björkdal open pit

mine.

-

High gold assays for the underground mine were capped at 60 g/t Au

for the first search pass and 40 g/t Au for subsequent passes.

-

High gold assays at Norrberget were capped at 24 g/t Au.

-

Interpolation was by inverse distance cubed utilizing diamond

drill, reverse circulation, and chip channel samples.

-

Björkdal open pit Mineral Resources are estimated at a cut-off

grade of 0.17 g/t Au and constrained by a resource pit shell.

-

Norrberget open pit Mineral Resources are estimated at a cut-off

grade of 0.27 g/t Au and constrained by a resource pit shell.

-

Underground Mineral Resources are estimated at a block cut-off

grade of 0.71 g/t Au for all veins.

-

A nominal 2.5 m minimum mining width was used to interpret

veins.

-

Reported Mineral Resources are depleted for previously mined

underground development and stopes and exclude remnant

material.

-

Stockpile Mineral Resources are based upon surveyed volumes

supplemented by production data.

-

Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability.

-

Numbers may not sum due to rounding.

- The Independent Qualified Person

for the Björkdal and Norrberget Mineral Resource estimates is Reno

Pressacco, M.Sc.(A)., P.Geo., Associate Principal Geologist with

SLR, who is a Qualified Person as defined by NI 43-101.

Other than the normal course updating of the

underground development and stope wireframes and the

re-optimisation of the Björkdal and Norrberget open pits to account

for the updated resource model, the workflow and modifying factors

used to prepare the year-end 2024 Björkdal Mineral Reserves were

largely unchanged from those used during the previous year.

Table 6: Björkdal Mineral Reserve

Estimate, as of December 31, 2024

|

Category |

Area |

Inventory(kt) |

Gold Grade(g/t) |

Contained Gold(koz) |

|

Proven |

|

|

|

|

|

|

Björkdal Underground |

956 |

1.53 |

47 |

|

Total Proven |

|

956 |

1.53 |

47 |

|

Probable |

|

|

|

|

| |

Björkdal Underground |

5,721 |

1.59 |

293 |

| |

Björkdal Open Pit |

5,325 |

1.05 |

180 |

| |

Norrberget Open Pit |

161 |

2.72 |

14 |

|

|

Stockpiles |

1,520 |

0.59 |

29 |

|

Total Probable |

|

12,727 |

1.26 |

516 |

|

Total Proven & Probable |

13,683 |

1.28 |

563 |

Notes:

-

Björkdal Mineral Reserves are estimated using drill hole and sample

data as of September 30, 2024, and depleted for production through

December 31, 2024.

-

Norrberget Mineral Reserves are based on a data cut-off date of

September 30, 2024.

-

CIM (2014) definitions were followed for Mineral Reserves.

-

Open pit Mineral Reserves for Björkdal are based on mine designs

carried out on an updated resource model, applying a block dilution

of 100% at 0.0 g/t Au for blocks above 1.0 g/t and 100% at in-situ

grade for blocks below 1.0 g/t, but above a cut-off grade of 0.20

g/t Au. The application of these block dilution factors is based on

historical reconciliation data from 2018 and 2019. A marginal

cut-off grade of 0.20 g/t Au was applied to estimate open pit

Mineral Reserves.

-

Open pit Mineral Reserves for Norrberget are based on 25% dilution

at 0.0 g/t Au and a cut-off grade of 0.32 g/t Au.

-

Underground Mineral Reserves are based on mine designs carried out

on an updated resource model. Minimum mining widths of 3.1 m for

stopes (after dilution) and 4.6 m for development (after dilution)

were used. Stope dilution was applied by adding 0.25 m on each side

of stopes as well as an additional 25% sidewall over break

dilution. Dilution factors of 20% for ore drives and 10% for

capital development were applied to the development design widths.

Mining extraction was assessed at 95% for contained ounces within

stopes and 100% for development. A cut-off grade of 0.85 g/t Au was

applied to material mined within stopes. An incremental cut-off

grade of 0.20 g/t Au was used for development material.

-

Stockpile Mineral Reserves are based upon surveyed volumes

supplemented by production data as of December 31, 2024.

-

Mineral Reserves are estimated using an average long-term gold

price of US$2,100/oz for Björkdal and Norrberget, and an exchange

rate of 10.35 SEK/US$.

-

Tonnes and contained gold are rounded to the nearest thousand.

-

Numbers may not sum due to rounding.

-

The Independent Qualified Person for the Björkdal Mineral Reserve

estimate is Rick Taylor, MAusIMM (CP), Associate Principal Mining

Engineer with SLR, who is a Qualified Person as defined by NI

43-101.

A total of 125,600 ounces of gold were added to

Mineral Reserves at Björkdal during 2023 and 2024 at an exploration

cost of US$4.2 million, not including regional exploration

expenditure. The exploration cost of adding these additional

Mineral Reserves was US$33.4 per ounce of gold.

Qualified Persons

All Qualified Persons listed below have read and

approved the contents of this news release as it pertains to the

Mineral Resource and Mineral Reserve estimates disclosed in this

news release. The QPs are not aware of any mining, metallurgical,

infrastructure, permitting, or other relevant factors that could

materially affect their respective Mineral Reserve estimate. The

QPs are not aware of any environmental, permitting, legal, title,

taxation, socio-economic, marketing, political, or other relevant

factors that could materially affect their respective Mineral

Resource estimate.

-

The Mineral Resource estimates for Costerfield and True Blue were

carried out under the supervision of Cael Gniel MAIG RPGeo (Mineral

Resource Estimation), an employee of SRK Consulting and independent

of Mandalay. He is a Qualified Person for the purpose of NI

43-101.

-

The Mineral Reserve estimate for Costerfield was carried out under

the supervision of Robert Urie FAusIMM who is a full-time employee

of SRK Consulting and independent of Mandalay. He is a Qualified

Person for the purposes of NI 43-101.

-

The Mineral Resource estimates for Björkdal and Norrberget were

reviewed by Reno Pressacco, M.Sc.(A)., P.Geo., Associate Principal

Geologist, an employee of SLR and independent of Mandalay. He is a

Qualified Person for the purpose of NI 43-101.

-

The Björkdal Mineral Reserve estimate was carried out under the

supervision of Rick Taylor, CP, MAusIMM, Principal Mining Engineer,

an employee of SLR and independent of Mandalay. He is a Qualified

Person for the purposes of NI 43-101.

For Further Information

Frazer Bourchier President and Chief Executive

Officer

Edison NguyenDirector, Business Valuations and

IR

Contact: 647.258.9722

About Mandalay Resources

Corporation

Mandalay is a Canada-based natural resource

company with producing assets in Australia (the Costerfield

gold-antimony mine) and Sweden (the Björkdal gold mine). The

Company is focused on growing its production and reducing costs to

generate significant positive cash flow. Mandalay is committed to

operating safely and in an environmentally responsible manner,

while fostering strong community and employee engagement.

Mandalay’s mission is to create shareholder

value through profitable operations and successful organic

exploration at its Costerfield and Björkdal mines, while actively

evaluating accretive, and non-dilutive inorganic growth

opportunities. At Costerfield, the Company focuses on mining the

high-grade Youle and Shepherd veins, while expanding near-mine and

regional Mineral Resources & Reserves. At Björkdal, the goal is

to enhance production from the Eastern Extension area and other

higher-margin zones, such as the North Zone, to optimize

profitability in the coming years.

Forward-Looking Statements

This news release contains "forward-looking

statements" within the meaning of applicable securities laws.

Readers are cautioned not to place undue reliance on

forward-looking statements. Actual results and developments may

differ materially from those contemplated by these statements

depending on, among other things, changes in commodity prices and

general market and economic conditions. The factors identified

above are not intended to represent a complete list of the factors

that could affect Mandalay. A description of additional risks that

could result in actual results and developments differing from

those contemplated by forward-looking statements in this news

release can be found under the heading “Risk Factors” in Mandalay’s

annual information form dated March 28, 2024, a copy of which is

available under Mandalay’s profile at www.sedar.com. In addition,

there can be no assurance that any inferred resources that are

discovered as a result of additional drilling will ever be upgraded

to proven or probable reserves. Although Mandalay has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking statements.

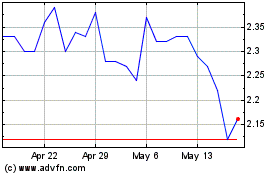

Mandalay Resources (TSX:MND)

Historical Stock Chart

From Jan 2025 to Feb 2025

Mandalay Resources (TSX:MND)

Historical Stock Chart

From Feb 2024 to Feb 2025