NOVAGOLD RESOURCES INC. (“NOVAGOLD” or “the

Company” (NYSE American, TSX: NG) today released its 2023 first

quarter financial results and an update on its Tier One1 gold

development project, Donlin Gold, which NOVAGOLD owns equally with

Barrick Gold Corporation (“Barrick”).

Details of the financial results for the quarter ended February

28, 2023 are presented in the consolidated financial statements and

quarterly report filed on Form 10-Q on April 4, 2023 that is

available on the Company’s website at www.novagold.com, on SEDAR at

www.sedar.com, and on EDGAR at www.sec.gov. All amounts are in U.S.

dollars unless otherwise stated.

In the first quarter of 2023, the following milestones

were achieved at Donlin Gold:

- The Donlin Gold

project camp re-opened in February 2023 to prepare for the field

program with a total workforce of 44 direct hire employees, 63%

being from the Yukon-Kuskokwim (Y-K) region.

- To support mine

planning and mine design, Donlin Gold also advanced onsite

hydrological drilling to further define the depth and flow of

groundwater in the areas of the planned Donlin Gold project pit and

surrounding infrastructure.

- As a federally

permitted project on private Alaska Native Corporation land

designated by law for mining and with key State permits in hand,

several activities continued to keep our current permits in good

standing and to advance the remaining permits needed, including the

following highlights:

- Commencement of additional fieldwork and geotechnical drilling

to collect data required to advance the Alaska Dam Safety

certificates for water diversion and water retention structures

including the proposed tailings storage facility. All necessary

fieldwork for the certificates is planned to be completed this

year;

- Application for a new air quality permit from the Alaska

Department of Environmental Conservation (ADEC). A draft permit was

issued for public comment in December 2022;

- Submission to ADEC of the application for the regularly

scheduled re-issuance of the project’s Alaska Pollutant Discharge

Elimination System permit (APDES); ADEC extended the permit to

remain in effect until the State completes the re-issuance.

- Following the easing

of COVID-19 restrictions, community engagement efforts increased

significantly, which allowed the project team to participate in

more in-person events. Critical assistance was provided to local

communities through the funding of, and participation in,

initiatives related to health and safety, infrastructure

development, environmental management, training and education, and

support of the indigenous culture in the Y-K region. Notable

outcomes include:

- Supported intensive academic, career and educational workshops

for rural youth and young adults of the Y-K region in partnership

with Alaska EXCEL;

- Partnered with Covenant House Alaska and Bethel Community

Services to address chronic food insecurity and homelessness in the

Y-K region;

- Collaborated with the Bethel Community Services Foundation and

the Aruqutet Project to address ongoing food distribution

challenges throughout Bethel;

- Provided continued financial assistance to construct and

maintain the 300-mile-long ice road that connects remote Kuskokwim

River communities;

- Supported Alaska Safe Riders program by sponsoring the McGrath

Iron Dog Race, in which residents participated in All-Terrain

Vehicle and Off-Road Vehicle safety presentations.

- Calista Corporation

(“Calista”) and Donlin Gold continued their proactive, bipartisan

outreach to Alaska Governor Dunleavy’s Administration and the new

legislature in Alaska, as well as with the Biden Administration and

United States Congress in Washington, D.C., to highlight the

thoroughness of the project’s environmental review and permitting

processes, in addition to the considerable benefits it would

deliver to all Alaska Natives.

_______________________________1 NOVAGOLD defines a Tier One

gold development project as one with a projected production life of

at least 10 years, annual projected production of at least 500,000

ounces of gold, and average projected cash costs over the

production life that are in the lower half of the industry cost

curve.

President’s Message

Steadily and Surely Advancing Up the Value Chain the

Donlin Gold Project – the leading Tier 1 Gold Development Project

in Alaska, One of the Only Remaining Tier 1

Jurisdictions

All of us at NOVAGOLD take great pride in the fact that we have

been laser-focused – as well as highly successful – in executing

the explicit strategy that was set forth by our Chairman and me

more than a decade ago: namely, to unlock the value of NOVAGOLD’s

high-quality assets for our shareholders and to dedicate our entire

energy toward creating the maximum leverage from a pure play on the

singularly brilliant endowment that is the Donlin Gold project. And

to accomplish all this while safeguarding the Company’s robust

treasury to allow us to accomplish our work without needing to go

back to the financial markets.

As we have stated on numerous occasions, our Board and

management believe that the Donlin Gold project is truly

best-in-class in its combination of attributes and hence that

NOVAGOLD constitutes the most perfectly suited “go-to” equity to

benefit from the next wave in the bull market in gold. Possessing

the unique combination of industry-leading size, grade, and

excellent exploration upside with which to move the needle in the

gold industry, our project’s location in Alaska – a safe and

time-tested jurisdiction in which to develop, build and operate a

mine for generations to come – makes it the ultimate company-maker.

For our part, we believe to have been responsible stewards of this

remarkable asset in its progression up the value chain. Yet our

greatest accomplishments have been reached by providing

wide-ranging support to the Donlin Gold project team in advancing

its various activities in the areas of permitting, engineering, as

well as environmental, social and governmental engagement, in

addition to our pivotal collaboration with Calista and The

Kuskokwim Corporation (TKC) – the Alaska Native Corporation

partners and landowners.

The value enhancement work continues apace. The Donlin Gold

project camp re-opened in the first quarter of 2023 to continue

fieldwork to collect geotechnical and hydrological information

needed to advance the design documentation required for the Alaska

Dam Safety certificates applications, with formal issuance of the

certificates of approval to construct expected in 2026.

The safety program currently in effect at the Donlin Gold

project site is well advanced for a project at this stage of

development – with experienced safety coordinators on-site 24/7, an

established and widely shared culture of awareness, and team spirit

characterized by employees looking out for one another. With the

latest field program, Donlin Gold’s project site seasoned

environmental team, including field staff, ensures that all permit

requirements are met and daily procedures are followed. All project

staff are properly trained to ensure they recognize that the

protection of water, land, and biological resources is of the

highest priority in Donlin Gold’s operations.

Off-site, our current focus at Donlin Gold lies in updating the

geologic and resource models with the data derived from the

extensive drill programs that took place over the last three years;

reviewing key project assumptions, inputs, and design components

for optimization (mine engineering, metallurgy, hydrology, and

infrastructure); advancing remaining permits through the regulatory

process and supporting the State in maintaining the existing

permits; and, through continued engagement, sustaining and

expanding project support in the Y-K region.

Ultimately, subject to a formal decision by the Donlin Gold LLC

board, the comprehensive work we are completing should lead to the

update of the Donlin Gold project feasibility study which, in turn,

would initiate the detailed engineering work necessary to advance

the project design before reaching a construction decision.

Diligently Maintaining Permits in Good Standing and

Working to Secure the Remaining State-Level Permits

Donlin Gold, its owners, and its partners Calista and TKC are

intimately familiar with the permitting and regulatory processes

applicable to the project and will continue to support the State in

this important work. Together, we pursue our efforts to secure the

various remaining state-level permits and certificates required for

the project. This includes the current fieldwork related to the

issuance of the Alaska Dam Safety certificates – which is targeted

for completion in 2023, with formal issuance of the certificates of

approval to construct expected in 2026.

In 2022, Donlin Gold applied for a new air quality permit based

on updated air quality modeling and emissions controls information,

and the regularly scheduled re-issuance of its APDES permit from

ADEC. The new air quality permit is expected to be issued by June

30, 2023, which corresponds to the expiration date of the current

permit. ADEC has extended the existing APDES permit indefinitely

until a new permit is finalized. Donlin Gold continues to support

ADEC in its due diligence regarding the State’s Clean Water Act

(CWA) Section 401 certification (the “401 Certification”) of the

Federal CWA Section 404 permit. On July 14, 2022, the ADEC

Commissioner granted the request for an adjudicatory hearing review

related to potential water temperature effects in Crooked Creek.

The briefing process in this administrative appeal of the 401

Certification has now been completed and a decision is expected in

the first half of 2023.

Owning a federally permitted project on private land already

designated by law for mining has tremendous inherent value in

today’s world. We have always prepared and organized ourselves for

potential challenges to the Federal and State permitting processes.

Our project leadership and litigation teams bring longstanding

experience with the processes that need to be followed. Donlin Gold

and its owners, alongside the steadfast advocacy of Calista and

TKC, continue to support the State and Federal government in the

defense of these permits which reflect a diligent, thorough,

transparent, and inclusive process for all involved – including

stakeholders from the Y-K region.

It is also worth noting that all appeals challenging Donlin

Gold’s permits to date have proved unsuccessful, often multiple

times. Nevertheless, objections to mining activity are common. The

Alaska Superior Court briefings on the Right-of-Way (ROW) lease for

the portions of the natural gas pipeline on State lands were

completed with oral arguments held in January 2023. We anticipate

decisions to be issued by the end of 2023. The State of Alaska’s

issuance of water rights for the mine and transportation facilities

was appealed to the Commissioner of the Alaska Department of

Natural Resources (ADNR). ADNR and Donlin Gold submitted their

response briefs on March 8, 2023, and the appellants are preparing

their final brief. A decision is expected within the next year.

Actively Engaging with Community Stakeholders and

Government

At Donlin Gold, we are extremely fortunate to enjoy time-tested

partnerships with our Alaska Native Corporation partners Calista

and TKC. The Donlin Gold team continues to closely collaborate with

them in all aspects of our considerable outreach and engagement

activities throughout the Y-K region. An extension of these efforts

are the newly-established community liaison positions that were

recently filled by former project site employees residing in five

Y-K villages.

Crooked Creek, the village closest to the Donlin Gold project

site in the Y-K region, wrote a letter in support of the Donlin

Gold project in December 2022. The village has been struggling with

access to reliable power and water in recent months, which also led

to the shutdown of its school, clinic, and post office. In

response, Donlin Gold, Calista and TKC provided support to Crooked

Creek by purchasing and delivering a generator, alerting the State

of Alaska’s emergency response team for additional assistance, and

helping the local authorities identify a longer-term solution for

their infrastructure needs as well as assisting with access to

available government funding.

Alaska’s U.S. Senators and Governor have consistently expressed

their long-term support of the Donlin Gold project – votes of

confidence for which we are enormously grateful. In close

coordination with NOVAGOLD and Barrick, Calista and Donlin Gold

co-lead our government relations work, which over time has

represented an important part of advancing the Donlin Gold project

through permitting and beyond. In 2023, Calista and Donlin Gold

will carry on their proactive, bipartisan outreach to the State

Administration and the new legislature in Alaska, as well as with

the Biden Administration and the United States Congress in

Washington, D.C., to highlight the thoroughness of the project’s

environmental review and permitting processes, in addition to the

considerable benefits that the project would deliver to all Alaska

Natives through the revenue sharing provisions of the Alaska Native

Claims Settlement Act of 1971.

Consistent Investment in Environmental and Social

Initiatives

Assisting and partnering with local communities of the Y-K

region has been a constant focus for NOVAGOLD. To that end, Donlin

Gold works in close concert with Calista and TKC, as well as other

key representatives of local communities, to provide critical

support to the Y-K region today and ultimately ensure the

sustainable and profitable development of the Donlin Gold project

in the years to come.

Donlin Gold was the premier sponsor of the McGrath Iron Dog Race

community safety presentation promoting safety in operating

snowmachines, all-terrain vehicles and recreational off-road

vehicles, as part of the Alaska Safe Riders program – a non-profit

organization dedicated to reducing deaths and injuries from tragic

accidents. In addition, Donlin Gold, in collaboration with Covenant

House Alaska and Bethel Community Services, is developing an action

plan to help address chronic and ongoing youth food insecurity in

the Y-K region. To date, the three entities have successfully

leased space from Bethel Winter House toward establishing a housing

and service hub for youth aged 18 to 24. Furthermore, Donlin Gold

partnered with the Bethel Community Services Foundation and the

Aruqutet Project on a regional program to address food insecurity

throughout the Bethel community. Over 550 local households are

enrolled in the program to date, with approximately 200 of them

receiving food during any given month. As with all of our other

initiatives, employing local staff and committed volunteers has

proven critical to the program’s success.

In partnership with the Alaska Native Tribal Health Consortium,

Donlin Gold is advancing efforts to improve the overall health and

safety standards of water and sewer services in the Middle

Kuskokwim area communities through the TKC Fishwheel initiative.

Furthermore, in collaboration with TKC, the village of Crooked

Creek, the Akiak Native Community and the Napaimute Tribe, Donlin

Gold provided financial support for the construction and

maintenance of the ice roads that allow for winter travel between

the remote Kuskokwim River communities – which, in turn, led to

increased participation in community events, cultural activities,

sports, and provided access for emergency services, law enforcement

and travel. On average, a total of 300 miles of ice road is

constructed and maintained annually thanks to this program.

Advancing educational opportunities in Alaska constitutes yet

another high priority for the Company. NOVAGOLD recently awarded

its first University of Alaska scholarship to an undergraduate

student in mining or geological engineering. In addition, Donlin

Gold supports the Alaska EXCEL program – a non-profit providing

supplemental academic, career and technical education for rural

youth and young adults across the Y-K region. Numerous student

interview preparation sessions took place in the first quarter,

with four more planned over the next two quarters. Through this

rigorous process, the students receive high school credits toward

graduation as well as concurrent college credits.

Strong Treasury to Advance Donlin Gold and Create

Value

It is quite remarkable that, ever since the last fundraising

round of January 2012, there has been no need to issue further

equity to execute our strategy. And yet, NOVAGOLD’s treasury

remains robust with $116.2 million in cash and term deposits as of

February 28, 2023. Moreover, with $25 million due in July 2023 from

Newmont and an additional contingent payment of $75 million upon

approval of the Galore Creek project construction plan by its

owners, the Company enjoys a healthy financial position.

In closing, I wish to extend my sincere gratitude to the

experienced team of professionals at NOVAGOLD, Donlin Gold and

Barrick, as well as to the entire project site workforce and

community engagement teams. We pride ourselves in our steadfast

commitment to health and safety and are profoundly grateful for the

extraordinary mutual respect that characterizes relations with our

Alaska Native Corporation partners. Indeed, working in Alaska is a

distinct pleasure and we are thankful for the State agencies’

diligent approach and adherence to established regulatory

procedures.

In terms of governance, our management team has the privilege of

working with an incredible Board whose members provide exceptional

strategic guidance and are committed to best practices in all

aspects of the business. Their unwavering dedication and engagement

are greatly appreciated.

Of paramount importance, NOVAGOLD has been blessed with

long-term and supportive shareholders – comprising many of the most

honored names in the investment world – whose presence and counsel

simply have been invaluable. We are grateful for their decision to

invest in our Company and for their continued interest and

engagement. We reaffirm to all of them that, as stewards of the

Company, we continue to be focused on delivering on our strategy

and enhancing the value of the Donlin Gold project increasing both

shareholder and stakeholder wealth in a safe and socially

responsible manner.

As we position the Company to enjoy the fruits of its unique

leverage on what we believe constitutes the best positioned gold

development story in the marketplace, I look forward to continuing

to deliver on our promises and to keeping an open line of

communication between us as we reach even more milestones together

in 2023.

Sincerely,

Gregory A. LangPresident & CEO

Financial Resultsin thousands of U.S. dollars,

except for per share amounts

|

|

Three months endedFebruary 28, 2023$ |

|

Three months endedFebruary 28, 2022$ |

|

|

General and administrative expense(1) |

5,607 |

|

5,177 |

|

|

Share of losses – Donlin Gold |

4,475 |

|

4,040 |

|

|

Total operating expenses |

10,082 |

|

9,217 |

|

|

|

|

|

|

|

|

Loss from operations |

(10,082 |

) |

(9,217 |

) |

|

Interest expense on promissory note |

(2,944 |

) |

(1,512 |

) |

|

Accretion of notes receivable |

217 |

|

210 |

|

|

Other income (expense), net |

2,225 |

|

524 |

|

|

Loss before income taxes |

(10,584 |

) |

(9,995 |

) |

|

Income tax expense |

(75 |

) |

|

|

|

Net Loss |

(10,659 |

) |

(9,995 |

) |

|

|

|

|

|

|

|

Net loss per common share, basic and diluted |

(0.03 |

) |

(0.03 |

) |

|

|

AtFebruary 28, 2023$ |

|

AtNovember 30,

2022$ |

|

|

Cash and term deposits |

116,161 |

|

125,882 |

|

|

Total assets |

151,361 |

|

159,189 |

|

|

Total liabilities |

130,057 |

|

129,286 |

|

(1) Includes share-based compensation expense of $2,161 and

$2,091 for the first quarter-ended February 28, 2023, and quarter

ended February 28, 2022, respectively.

During the first quarter of 2023, we incurred a net loss of

$10.7 million compared to a net loss of $10.0 million for the

comparable period in 2022. The increase in net loss is primarily

due to an increase in interest expense on the promissory note,

increased permitting costs at the Donlin Gold project and higher

corporate legal expenses, partially offset by increased interest

income and other income related to the 2021 sale of the Company’s

interest in the San Roque mineral property.

Liquidity and Capital Resources

In the first quarter of 2023, cash and cash equivalents

decreased by $9.7 million, primarily to fund our share of the

Donlin Gold project and for corporate administrative expenses. The

$4.3 million decrease in cash used in the first quarter of 2023

compared to 2022 was due to the timing of corporate liability

insurance payments in 2022, withholding tax paid on share-based

compensation in 2022 (no Performance Share Units vested in 2023)

and proceeds received from the sale of the San Roque mineral

property.

At the end of the first quarter, cash and term deposits were

$116.2 million (cash $54.2 million, term deposits $62.0 million).

An additional payment from Newmont of $25 million comes due in July

2023 related to the sale of NOVAGOLD’s 50% interest in the Galore

Creek project in 2018, along with a note for $75 million contingent

upon approval of a Galore Creek project construction plan by its

owners. At present, we believe the Company has sufficient working

capital available to cover anticipated funding of the Donlin Gold

project and corporate general and administrative costs through

completion of an updated Donlin Gold project feasibility study.

Further, we believe we have sufficient working capital available to

cover anticipated costs and expenses for at least the next three

years. Substantial additional capital will be required once a

decision to commence engineering and construction is reached by the

Donlin Gold board for the Donlin Gold project.

2023 Outlook

We anticipate spending approximately $31 million, which

includes, $13 million for corporate general and administrative

costs, $1 million for working capital and $17 million to fund our

share of expenditures at the Donlin Gold project, including:

- $8 million for external affairs, permitting, environmental,

land, and legal activities, and

- $9 million for project planning and fieldwork (dam and water

structures, metallurgical testing, mining studies, hydrogeology and

geochemistry, and infrastructure planning).

NOVAGOLD’s primary goals in 2023 are to continue to advance the

Donlin Gold project toward a construction decision; maintaining

support for Donlin Gold among the project’s stakeholders; promoting

a strong safety, sustainability, and environmental culture;

maintaining a favorable reputation of NOVAGOLD; and preserving a

healthy balance sheet. Our operations primarily relate to the

delivery of project milestones, including the achievement of

various technical, environmental, sustainable development, economic

and legal objectives, obtaining necessary permits, completion of

pre-feasibility and feasibility studies, preparation of engineering

designs and the financing to fund these objectives.

Conference Call & Webcast Details

NOVAGOLD’s conference call and webcast to discuss these results

will take place on April 5, 2023, at 8:00 am PT (11:00 am ET). The

webcast and conference call-in details are provided below.

Video Webcast:

http://www.novagold.com/investors/events North American callers:

1-800-319-4610International callers:

1-604-638-5340

NOVAGOLD’s quarterly reporting schedule for the

remainder of 2023 will be as follows:

- Q1 2023 – A conference call and

webcast will be held on Wednesday, April 5, 2023 at 11 a.m. ET / 8

a.m. PT to discuss Q1 2023 financial results.

- Annual Meeting of Shareholders –

Thursday, May 18, 2023; the meeting will be held at 4 p.m. ET / 1

p.m. PT

- Q2 2023 – Tuesday, June 27, 2023;

financial statements and a Donlin Gold project update will be

released after market close. A conference call and webcast will be

held on Wednesday, June 28, 2023 at 11 a.m. ET / 8 a.m. PT to

discuss Q2 financial results.

- Q3 2023 – Tuesday, October 3, 2023;

financial statements and a Donlin Gold project update will be

released after market close. A conference call and webcast will be

held on Wednesday, October 4, 2023 at 11 a.m. ET / 8 a.m. ET to

discuss Q3 financial results.

About NOVAGOLD

NOVAGOLD is a well-financed precious metals company focused on

the development of its 50%-owned Donlin Gold project in Alaska, one

of the safest mining jurisdictions in the world. With approximately

39 million ounces of gold in the Measured and Indicated Mineral

Resource categories, inclusive of Proven and Probable Mineral

Reserves (541 million tonnes at an average grade of approximately

2.24 grams per tonne, in the Measured and Indicated Resource

categories on a 100% basis) 2, the Donlin Gold project is regarded

to be one of the largest, highest-grade, and most prospective known

open-pit gold deposits in the world. According to the 2021

Technical Report and the S-K 1300 Report (both as defined below),

once in production, the Donlin Gold project is expected to produce

an average of more than one million ounces per year over a 27-year

mine life on a 100% basis. The Donlin Gold project has substantial

exploration potential beyond the designed footprint of the open pit

which currently covers three kilometers of an approximately

eight-kilometer-long gold-bearing trend. Current activities at the

Donlin Gold project are focused on State permitting, engineering

studies, community outreach, and workforce development in

preparation for the eventual construction and operation of this

project. With a strong balance sheet, NOVAGOLD is well-positioned

to fund its share of permitting and advancement efforts at the

Donlin Gold project.

Scientific and Technical Information

Certain scientific and technical information contained herein

with respect to the Donlin Gold project is derived from the 2021

Technical Report and the S-K 1300 Report3. Henry Kim, P.Geo.,

Senior Resource Geologist, Wood Canada Limited (“Wood”); Mike

Woloschuk, P.Eng., VP Global Business Development & Consulting,

Wood Group USA, Inc.; and Kirk Hanson, MBA, P.E., Technical

Director, Open Pit Mining, Wood Group USA, Inc. are the Qualified

Persons responsible for the preparation of the 2021 Technical

Report, and each is an independent Qualified Person as defined by

National Instrument 43-101 (“NI 43-101”). Wood prepared the S-K

1300 Report. Paul Chilson, P.E., who is the Manager, Mine

Engineering for NOVAGOLD and a Qualified Person under NI 43-101 and

under S-K 1300, has approved and verified the scientific and

technical information related to the 2022 Donlin Gold project drill

program, the 2021 Technical Report and the S-K 1300 Report

contained in this media release.

NOVAGOLD Contacts:Mélanie Hennessey Vice

President, Corporate Communications 604-669-6227 or

1-866-669-6227

Cautionary Note Regarding Forward-Looking

Statements

This media release includes certain “forward-looking

information” and “forward-looking statements” (collectively

“forward-looking statements”) within the meaning of applicable

securities legislation, including the United States Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are frequently, but not always, identified by words such

as “expects”, “anticipates”, “believes”, “intends”, “estimates”,

“potential”, “possible”, and similar expressions, or statements

that events, conditions, or results “will”, “may”, “could”, “would”

or “should” occur or be achieved. Forward-looking statements are

necessarily based on several opinions, estimates and assumptions

that management of NOVAGOLD considered appropriate and reasonable

as of the date such statements are made, are subject to known and

unknown risks, uncertainties, assumptions, and other factors that

may cause the actual results, activity, performance, or

achievements to be materially different from those expressed or

implied by such forward-looking statements. All statements, other

than statements of historical fact, included herein are

forward-looking statements. These forward-looking statements

include statements regarding the anticipated timing of certain

judicial and/or administrative decisions; the 2023 outlook; the

timing and potential for a new feasibility study on the Donlin Gold

project; our goals and planned expenditures for the remainder of

2023; ongoing support provided to key stakeholders including Native

Corporation partners; Donlin Gold’s continued support for the State

permitting process; the potential development and construction of

the Donlin Gold project; the sufficiency of funds to continue to

advance development of Donlin Gold, including to a construction

decision; perceived merit of properties; mineral reserve and

mineral resource estimates; Donlin Gold’s ability to secure the

permits needed to construct and operate the Donlin Gold project in

a timely manner, if at all; legal challenges to Donlin Gold’s

existing permits and the timing of decisions in those challenges;

whether the Donlin Gold LLC Board will continue to advance the

Donlin Gold project up the value chain; the success of the

strategic mine plan for the Donlin Gold project; the success of the

Donlin Gold community relations plan; the outcome of exploration

drilling at the Donlin Gold project and the timing thereof; and the

conversion of Galore Creek into a mine and the receipt of $25

million due in July 2023 from Newmont and the $75 million

contingent payment from Newmont. In addition, any statements that

refer to expectations, intentions, projections or other

characterizations of future events or circumstances are

forward-looking statements. Forward-looking statements are not

historical facts but instead represent the expectations of NOVAGOLD

management’s estimates and projections regarding future events or

circumstances on the date the statements are made. Important

factors that could cause actual results to differ materially from

expectations include the need to obtain additional permits and

governmental approvals; the timing and likelihood of obtaining and

maintaining permits necessary to construct and operate; the need

for additional financing to explore and develop properties and

availability of financing in the debt and capital markets; the

coronavirus global pandemic (COVID-19); uncertainties involved in

the interpretation of drill results and geological tests and the

estimation of reserves and resources; changes in mineral production

performance, exploitation and exploration successes; changes in

national and local government legislation, taxation, controls or

regulations and/or changes in the administration of laws, policies

and practices, expropriation or nationalization of property and

political or economic developments in the United States or Canada;

the need for continued cooperation between Barrick and NOVAGOLD for

the continued exploration, development and eventual construction of

the Donlin Gold property; the need for cooperation of government

agencies and Native groups in the development and operation of

properties; risks of construction and mining projects such as

accidents, equipment breakdowns, bad weather, disease pandemics,

non-compliance with environmental and permit requirements,

unanticipated variation in geological structures, ore grades or

recovery rates; unexpected cost increases, which could include

significant increases in estimated capital and operating costs;

fluctuations in metal prices and currency exchange rates; whether

or when a positive construction decision will be made regarding the

Donlin Gold project; and other risks and uncertainties disclosed in

NOVAGOLD’s most recent reports on Forms 10-K and 10-Q, particularly

the "Risk Factors" sections of those reports and other documents

filed by NOVAGOLD with applicable securities regulatory authorities

from time to time. Copies of these filings may be obtained by

visiting NOVAGOLD’s website at www.novagold.com, or the SEC's

website at www.sec.gov, or at www.sedar.com. The forward-looking

statements contained herein reflect the beliefs, opinions and

projections of NOVAGOLD on the date the statements are made.

NOVAGOLD assumes no obligation to update the forward-looking

statements of beliefs, opinions, projections, or other factors,

should they change, except as required by law.

_______________________________

2 Donlin Gold data as per the 2021 Technical Report and the S-K

1300 Report, as defined below. Donlin Gold possesses Measured

Resources of approximately 8 Mt grading 2.52 g/t and Indicated

Resources of approximately 534 Mt grading 2.24 g/t, each on a 100%

basis and inclusive of Mineral Reserves, of which approximately 4

Mt of Measured Resources and approximately 267 Mt of Indicated

Resources inclusive of Reserves is attributable to NOVAGOLD through

its 50% ownership interest in Donlin Gold LLC. Exclusive of Mineral

Reserves, Donlin Gold possesses Measured Resources of approximately

1 Mt grading 2.23 g/t and Indicated Resources of approximately 69

Mt grading 2.44 g/t, of which approximately 0.5 Mt of Measured

Resources and approximately 35 Mt of Indicated Resources exclusive

of Mineral Reserves is attributable to NOVAGOLD. Donlin Gold

possesses Proven Reserves of approximately 8 Mt grading 2.32 g/t

and Probable Reserves of approximately 497 Mt grading 2.08 g/t,

each on a 100% basis, of which approximately 4 Mt of Proven

Reserves and approximately 249 Mt of Probable Reserves is

attributable to NOVAGOLD. Mineral Reserves and Resources have been

estimated in accordance with NI 43-101 and S-K 1300. 3 The Company

retained Wood Canada Limited (“Wood”) in 2020 to update content in

its previously filed “Donlin Creek Gold Project, Alaska, USA, NI

43-101 Technical Report on the Second Updated Feasibility Study,”

effective November 18, 2011, and amended January 20, 2012. This

update resulted in a report titled “NI 43-101 Technical Report on

the Donlin Gold Project, Alaska, USA” with an effective date of

June 1, 2021 (the “2021 Technical Report”) and was filed on August

31, 2021. The Company is a registrant with the SEC and is reporting

its exploration results, Mineral Resources, and Mineral Reserves in

accordance with Subpart 229.1300 of Regulation S-K – Disclosure by

Registrants Engaged in Mining Operations (“S-K 1300”) as of

November 30, 2021. While the S-K 1300 rules are similar to National

Instrument 43-101 Standards of Disclosure for Mineral Projects

rules in Canada, they are not identical and therefore two reports

have been produced for the Donlin Gold project. The Company

requested that Wood prepare a Technical Report Summary of the

Donlin Gold project, Alaska, USA using the standards of S-K 1300

and it is titled “S-K 1300 Technical Report Summary on the Donlin

Gold Project, Alaska, USA” (“S-K 1300 Report”), current as of

November 30, 2021. Wood incorporated 2020 costs and new gold price

guidance to meet the Company’s reporting requirements. The

resultant 2021 Technical Report and S-K 1300 Report showed no

material change to the previously reported mineral resources or

mineral reserves.

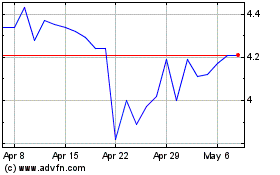

NovaGold Resources (TSX:NG)

Historical Stock Chart

From Nov 2024 to Dec 2024

NovaGold Resources (TSX:NG)

Historical Stock Chart

From Dec 2023 to Dec 2024